Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LYDALL INC /DE/ | v368991_8k.htm |

| EX-10.1 - EXHIBIT 10.1 - LYDALL INC /DE/ | v368991_ex10-1.htm |

| EX-10.2 - EXHIBIT 10.2 - LYDALL INC /DE/ | v368991_ex10-2.htm |

| EX-10.4 - EXHIBIT 10.4 - LYDALL INC /DE/ | v368991_ex10-4.htm |

| EX-10.7 - EXHIBIT 10.7 - LYDALL INC /DE/ | v368991_ex10-7.htm |

| EX-10.5 - EXHIBIT 10.5 - LYDALL INC /DE/ | v368991_ex10-5.htm |

| EX-10.3 - EXHIBIT 10.3 - LYDALL INC /DE/ | v368991_ex10-3.htm |

| EX-10.6 - EXHIBIT 10.6 - LYDALL INC /DE/ | v368991_ex10-6.htm |

specialty engineered products and materials AUTOMOTIVE FILTRATION & ENGINEERED MATERIALS LIFE SCIENCES Thermal/Acoustical Metals Thermal/Acoustical Fibers Performance Materials Vital Fluids SPECIALTY ENGINEERED PRODUCTS AND MATERIALS Industrial Filtration THIS DOCUMENT, OR AN EMBODIMENT OF IT IN ANY MEDIA, DISCLOSES INFORMATION WHICH IS PROPRIETARY, IS THE PROPERTY OF LYDALL, INC . AND/OR ITS AFFILIATE (COLLECTIVELY, “LYDALL”), IS AN UNPUBLISHED WORK PROTECTED UNDER APPLICABLE COPYRIGHT LAWS AND IS DELIVERED ON THE EXPRESS CONDITION THAT IT IS NOT TO BE USED, DISCLOSED, OR REPRODUCED, IN WHOLE OR IN PART (INCLUDING REPRODUCTION AS A DERIVATIVE WORK), OR USED FOR MANUFACTURE FOR ANYONE OTHER THAN LYDALL WITHOUT ITS WRITTEN CONSENT . NO RIGHT IS GRANTED TO DISCLOSE OR SO USE ANY INFORMATION CONTAINED HEREIN . ALL RIGHTS RESERVED . © LYDALL, INC . Investor Conference Call Acquisition of Andrew Filtration February 21, 2014

USE OR DISCLOSURE OF INFORMATION CONTAINED ON THIS SHEET IS SUBJECT TO THE RESTRICTIONS ON THE TITLE SLIDE. 2 Forward - looking Statements This presentation contains “forward - looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact, including statements regarding margin and working capital improvement results from application of Six Sigma principles, statements regarding anticipated cost synergies by 2016, statements regarding anticipated transaction expenses, and statements about the expected impact of the acquisition on Lydall’s future financial and operational performance and positioning may be deemed to be forward - looking statements . All such forward - looking statements are intended to provide management’s current expectations for the future operating and financial performance of the Company based on current expectations and assumptions relating to the Company’s business, the economy and other future conditions. Forward - looking statements generally can be identified through the use of the words such as: “believes ,” “anticipates,” “may,” “should,” “will,” “plans ,” “projects,” “expects,” “estimates,” “forecasts,” “signs,” “predicts ,” “targets,” “prospects ,” “ strategy,” “signs,” and other words of similar meaning in connection with the discussion of future operating or financial performance. Because forward - looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Such risks and uncertainties include, among others, worldwide economic cycles that affect the markets which the businesses serve which could have an effect on demand for the Company’s products and impact the Company’s profitability; challenges encountered by Lydall in the integration of the acquired business; disruptions in the global credit and financial markets, including diminished liquidity and credit availability; swings in consumer confidence and spending; unstable economic growth; raw material pricing and supply issues; fluctuations in unemployment rates; and increases in fuel prices, which could cause economic instability and could have a negative impact on the Company’s results of operations and financial condition. Accordingly , the Company’s actual results may differ materially from those contemplated by these forward - looking statements. Investors, therefore, are cautioned against relying on any of these forward - looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Additional information regarding the factors that may cause actual results to differ materially from these forward - looking statements is available in our filings with the Securities and Exchange Commission, including the risks and uncertainties identified in Part I, Item 1A - Risk Factors of Lydall’s Annual Report on Form 10 - K for the year ended December 31, 2012. These forward - looking statements speak only as of the date of this presentation, and Lydall does not assume any obligation to update or revise any forward - looking statement made in this presentation or that may, from time to time, be made by or on behalf of the Company.

USE OR DISCLOSURE OF INFORMATION CONTAINED ON THIS SHEET IS SUBJECT TO THE RESTRICTIONS ON THE TITLE SLIDE. Transaction Details ▪ Industrial filtration businesses (Andrew Filtration) of Andrew Industries Limited, acquired for $83 million in cash ▪ Business performance of Andrew Filtration for the 12 months ended December 31, 2013: Revenue ~$ 127 million, EBITDA ~$ 14 million, excluding non - recurring items 1 ▪ Lydall expects to leverage its operating discipline and support functions to generate anticipated annual cost savings of approximately $4 million by 2016 ▪ Lydall’s financial results for the Fourth Quarter 2013 will include approximately $1 million of transaction expenses and it is estimated that approximately $3 million of transaction expenses will be incurred in the First Quarter 2014 ▪ Transaction was financed through a combination of cash - on - hand and $60 million of borrowings from the Company’s recently expanded $100 million revolving credit facility ▪ New facility offers lower borrowing rates, more favorable financial covenants, and a $50 million accordion 3 Acquisition is expected to be accretive to Lydall’s 2014 full - year earnings and free cash flow, inclusive of transaction expenses, the effect of inventory step - up and incremental amortization of intangible assets 1 Amounts are unaudited, excluded non - recurring EBITDA items include management and royalty fees and income from insurance recover y

USE OR DISCLOSURE OF INFORMATION CONTAINED ON THIS SHEET IS SUBJECT TO THE RESTRICTIONS ON THE TITLE SLIDE. Overview of Andrew Filtration 4 Leading Brands Company Overview ▪ Leading global manufacturer and supplier of high quality non - woven felt filtration media and filter bags used primarily in industrial air filtration applications ▪ Manufacturing operations located in: - United States (2 locations) - United Kingdom (4 locations) - China (3 locations) ▪ Approximately 500 employees Asia 24% Europe 22% North America 54% Sales Distribution by Geography Products Industrial air filter bags & needle felts ~$127 million Industrial air filter bags

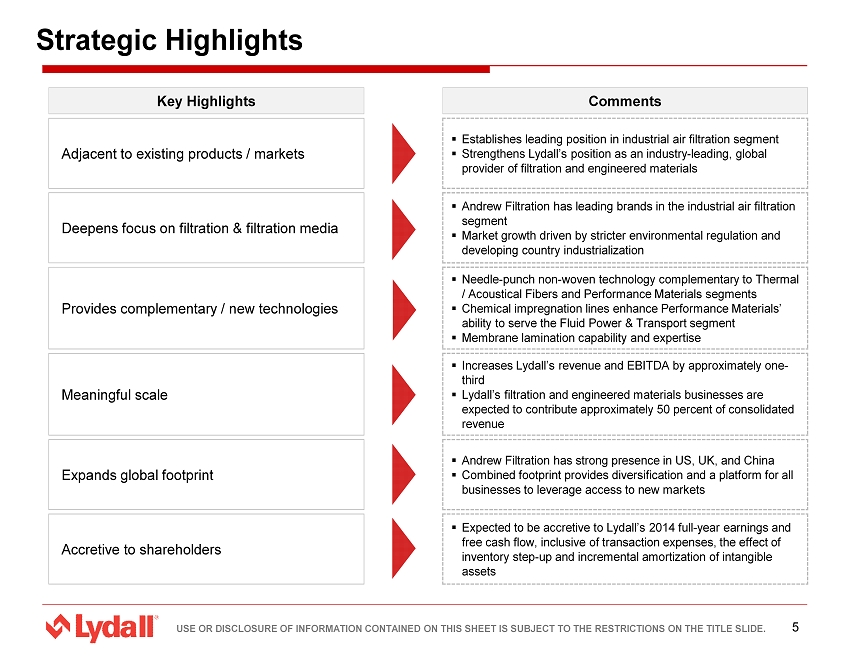

USE OR DISCLOSURE OF INFORMATION CONTAINED ON THIS SHEET IS SUBJECT TO THE RESTRICTIONS ON THE TITLE SLIDE. Strategic Highlights 5 Key Highlights Comments Adjacent to existing products / markets ▪ Establishes leading position in industrial air filtration segment ▪ Strengthens Lydall’s position as an industry - leading, global provider of filtration and engineered materials Deepens f ocus on filtration & filtration media ▪ Andrew Filtration has leading brands in the industrial air filtration segment ▪ Market growth driven by stricter environmental regulation and developing country industrialization Provides complementary / new technologies ▪ Needle - punch non - woven technology complementary to Thermal / Acoustical Fibers and Performance Materials segments ▪ Chemical impregnation lines enhance Performance Materials’ ability to serve the Fluid Power & Transport segment ▪ Membrane lamination capability and expertise Meaningful scale ▪ Increases Lydall’s revenue and EBITDA by approximately one - third ▪ Lydall’s filtration and engineered materials businesses are expected to contribute approximately 50 percent of consolidated revenue Expands global footprint ▪ Andrew Filtration has s trong presence in US, UK, and China ▪ Combined footprint provides diversification and a platform for all businesses to leverage access to new markets Accretive to shareholders ▪ Expected to be accretive to Lydall’s 2014 full - year earnings and free cash flow, inclusive of transaction expenses, the effect of inventory step - up and incremental amortization of intangible assets

USE OR DISCLOSURE OF INFORMATION CONTAINED ON THIS SHEET IS SUBJECT TO THE RESTRICTIONS ON THE TITLE SLIDE. New Segment Reporting Structure Thermal/Acoustical Metals Fabricated thermal barriers for vehicles Global Automotive Life Sciences Thermal/Acoustical Fibers Fabricated acoustical barriers for vehicles Primarily North America Global Primarily North America Global Performance Materials Life Sciences Vital Fluids Industrial Filtration Filtration and insulation media, Life sciences filtration media Industrial air filtration media and products Blood filtration, Blood transfusion, Cell therapy and Bio/ Pharma products Filtration & Engineered Materials New reporting segment Acquisition will be reported in separate reporting segment named Industrial Filtration 6

USE OR DISCLOSURE OF INFORMATION CONTAINED ON THIS SHEET IS SUBJECT TO THE RESTRICTIONS ON THE TITLE SLIDE. Closing Remarks and Q&A 7 For further information: David D. Glenn Director of Business Development and Investor Relations Telephone 860 - 646 - 1233 Facsimile 860 - 646 - 4917 info@lydall.com www.lydall.com