Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CVR ENERGY INC | cvi8-kxq42013earningsprese.htm |

0 4th Quarter 2013 Earnings Report February 20, 2014

1 Forward Looking Statements This presentation should be reviewed in conjunction with CVR Energy, Inc.’s Fourth Quarter earnings conference call held on February 20, 2014. The following information contains forward-looking statements based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors. You are cautioned not to put undue reliance on such forward-looking statements (including forecasts and projections regarding our future performance) because actual results may vary materially from those expressed or implied as a result of various factors, including, but not limited to (i) those set forth under “Risk Factors” in CVR Energy, Inc.’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Energy, Inc. makes with the Securities and Exchange Commission, (ii) those set forth under “Risk Factors” in CVR Refining, LP’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Refining, LP makes with the Securities and Exchange Commission, and (iii) those set forth under “Risk Factors” in the CVR Partners, LP Annual Report on form 10-K, Quarterly Reports on form 10-Q and any other filings CVR Partners, LP makes with the Securities and Exchange Commission. CVR Energy, Inc. assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

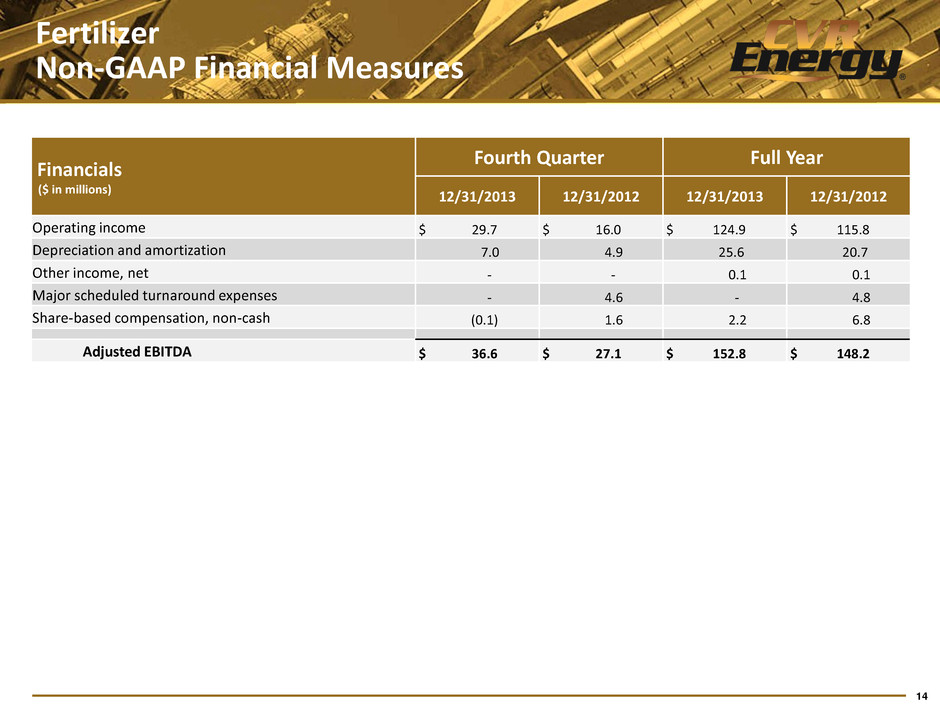

2 Consolidated Results Note: Adjusted EBITDA for the fourth quarter 2013 and 2012 excludes turnaround expenses of $0.0mm and $93.7mm, respectively and for full year 2013 and 2012 excludes turnaround expenses of $0.0mm and $128.5mm, respectively (1) Non-GAAP reconciliation on slide 10 for fourth quarter and slide 11 for full year (2) Non-GAAP reconciliation on slide 12 for fourth quarter and slide 13 for full year (3) Non-GAAP reconciliation on slide 14 (4) Non-GAAP reconciliation on slide 15 Fourth Quarter Full Year (In millions, except for EPS/ EPU/Distributions) Q4 2013 Q4 2012 Percent Change 2013 2012 Percent Change Adjusted EBITDA(1) $ 110.0 $ 210.3 -48% $ 659.7 $ 1,264.5 -48% Adjusted net income per diluted share(2) $ 0.71 $ 1.20 -41% $ 4.01 $ 7.55 -47% Fertilizer Adjusted EBITDA(3) $ 36.6 $ 27.1 35% $ 152.8 $ 148.2 3% CVR Partners Distributions $ 0.43 $ 0.19 129% $ 1.98 $ 1.81 10% Petroleum Adjusted EBITDA(4) $ 117.5 $ 198.2 -41% $ 712.0 $ 1,178.9 -40% CVR Refining Distributions $ 0.45 n/a n/a $ 3.68 n/a n/a

3 Financial Results Note: Adjusted EBITDA for the fourth quarter 2013 and 2012 excludes turnaround expenses of $0.0mm and $93.7mm, respectively and for full year 2013 and 2012 excludes turnaround expenses of $0.0mm and $128.5mm, respectively (1) Non-GAAP reconciliation on slide 10 for fourth quarter and slide 11 for full year (2) Non-GAAP reconciliation on slide 10 for fourth quarter and slide 11 for full year (3) Non-GAAP reconciliation on slide 12 for fourth quarter and slide 13 for full year Fourth Quarter Full Year (In millions, except for EPS) Q4 2013 Q4 2012 2013 2012 Net earnings (loss) attributable to CVR Energy stockholders $ (21.7) $ 40.2 $ 370.7 $ 378.6 Earnings (loss) per diluted share $ (0.25) $ 0.46 $ 4.27 $ 4.33 EBITDA(1) $ (28.0) $ 105.7 $ 696.4 $ 801.3 Adjusted EBITDA(2) $ 110.0 $ 210.3 $ 659.7 $ 1,264.5 Adjusted net income per diluted share(3) $ 0.71 $ 1.20 $ 4.01 $ 7.55

4 Debt Metrics Note: Refer to slide 8 for metrics used in calculations Financial Metrics 2008 2009 2010 2011 2012 2013 Debt to Capital 46% 43% 41% 43% 37% 36% Debt to Adj. EBITDA 2.3 2.4 2.5 1.2 0.7 1.0 Consolidated Net Debt (Cash) ($s in millions) 487.0 454.4 277.0 475.5 2.2 (165.9) ($200) ($100) $0 $100 $200 $300 $400 $500 $600 2008 2009 2010 2011 2012 2013

Appendix

6 Non-GAAP Financials Measures To supplement the actual results in accordance with GAAP for the applicable periods, the Company also uses non- GAAP measures as discussed below, which are reconciled to GAAP-based results. These non-GAAP financial measures should not be considered an alternative for GAAP results. The adjustments are provided to enhance an overall understanding of the Company’s financial performance for the applicable periods and are indicators management believes are relevant and useful for planning and forecasting future periods.

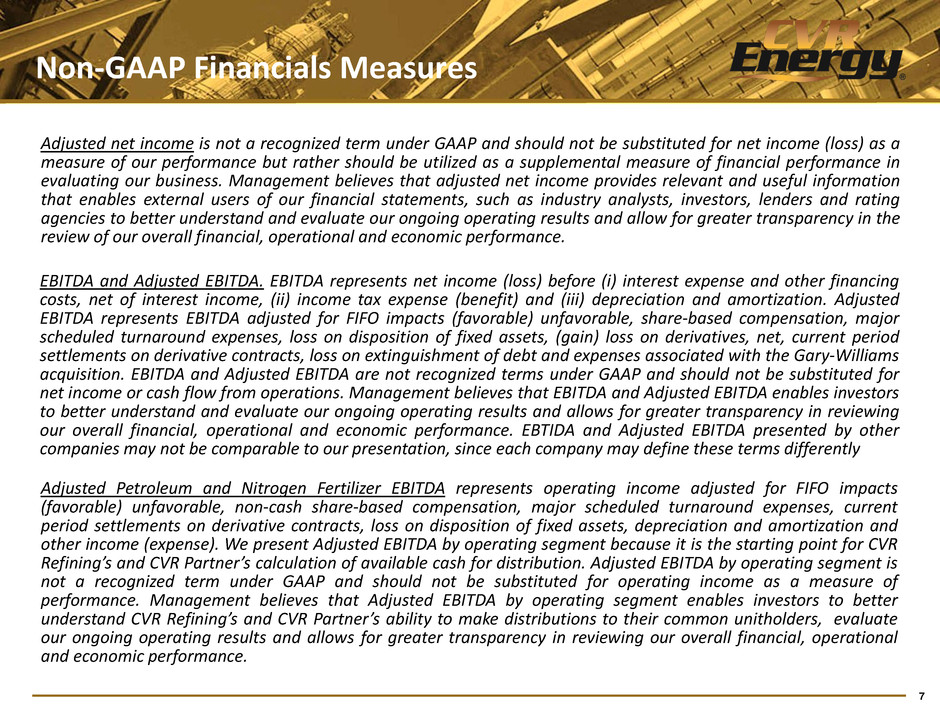

7 Non-GAAP Financials Measures EBITDA and Adjusted EBITDA. EBITDA represents net income (loss) before (i) interest expense and other financing costs, net of interest income, (ii) income tax expense (benefit) and (iii) depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted for FIFO impacts (favorable) unfavorable, share-based compensation, major scheduled turnaround expenses, loss on disposition of fixed assets, (gain) loss on derivatives, net, current period settlements on derivative contracts, loss on extinguishment of debt and expenses associated with the Gary-Williams acquisition. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be substituted for net income or cash flow from operations. Management believes that EBITDA and Adjusted EBITDA enables investors to better understand and evaluate our ongoing operating results and allows for greater transparency in reviewing our overall financial, operational and economic performance. EBTIDA and Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define these terms differently Adjusted Petroleum and Nitrogen Fertilizer EBITDA represents operating income adjusted for FIFO impacts (favorable) unfavorable, non-cash share-based compensation, major scheduled turnaround expenses, current period settlements on derivative contracts, loss on disposition of fixed assets, depreciation and amortization and other income (expense). We present Adjusted EBITDA by operating segment because it is the starting point for CVR Refining’s and CVR Partner’s calculation of available cash for distribution. Adjusted EBITDA by operating segment is not a recognized term under GAAP and should not be substituted for operating income as a measure of performance. Management believes that Adjusted EBITDA by operating segment enables investors to better understand CVR Refining’s and CVR Partner’s ability to make distributions to their common unitholders, evaluate our ongoing operating results and allows for greater transparency in reviewing our overall financial, operational and economic performance. Adjusted net income is not a recognized term under GAAP and should not be substituted for net income (loss) as a measure of our performance but rather should be utilized as a supplemental measure of financial performance in evaluating our business. Management believes that adjusted net income provides relevant and useful information that enables external users of our financial statements, such as industry analysts, investors, lenders and rating agencies to better understand and evaluate our ongoing operating results and allow for greater transparency in the review of our overall financial, operational and economic performance.

8 Capital Structure* Note: 2011 includes debt related to acquisition of Gary Williams but only 16 days of EBITDA contribution * Includes cash and debt of CVR Partners LP and CVR Refining LP (1) Adjusted for FIFO, turnaround expenses, SBC, financing costs, gains/losses on derivatives, net, current period settlements on derivative contracts, asset dispositions, loss on extinguishment of debt, Gary Williams acquisition and integration costs, and bridge loan expenses (2) Non-GAAP reconciliation on slide 9 Financials ($ in millions) Full Year 2008 2009 2010 2011 2012 2013 Cash $ 8.9 $ 36.9 $ 200.0 $ 388.3 $ 896.0 $ 842.1 Total Debt, including current portion 495.9 491.3 477.0 863.8 898.2 676.2 Net Debt (Cash) 487.0 454.4 277.0 475.5 2.2 (165.9) CVR Stockholder’s Equity 579.5 653.8 689.6 1,151.6 1,525.1 1,188.6 Adjusted EBITDA(1)(2) $ 218.1 $ 206.8 $ 192.0 $ 691.3 $ 1,264.5 $ 659.7

9 Consolidated Non-GAAP Financial Measures Financials ($ in millions) Full Year 2008 2009 2010 2011 2012 2013 Net income attributable to CVR Energy stockholders $ 163.9 $ 69.4 $ 14.3 $ 345.8 $ 378.6 $ 370.7 Interest expense and other financing costs, net of interest income 37.6 42.5 48.1 55.3 74.5 49.3 Depreciation and amortization 82.2 84.9 86.8 90.3 130.0 142.8 Income tax expense 63.9 29.2 13.8 209.5 225.6 183.7 FIFO impacts, (favorable) unfavorable 102.5 (67.9) (31.7) (25.6) 58.4 (21.3) Goodwill impairment 42.8 - - - - - (Gain) loss on derivatives, net (125.3) 65.3 1.5 (78.1) 285.6 (57.1) Current period settlements on derivative contracts(1) (122.6) (27.5) (2.1) (7.2) (137.6) 6.4 Share-based compensation (42.5) 8.8 37.2 27.2 39.1 18.4 Loss on disposal of fixed assets 2.3 - 2.7 2.5 - - Loss on extinguishment of debt 10.0 2.1 16.6 2.1 37.5 26.1 Major scheduled turnaround expenses 3.3 - 4.8 66.4 128.5 - Expenses associated with proxy matter - - - - 44.2 - Expenses associated with the acquisition of Gary-Williams(2) - - - 9.1 11.0 - Adjusted EBITDA and EBITDA expenses related to non- controlling interest - - - (6.0) (10.9) (59.3) Adjusted EBITDA $ 218.1 $ 206.8 $ 192.0 $ 691.3 $ 1,264.5 $ 659.7 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. (2) Legal, professional and integration expenses related to the December 2011 acquisition

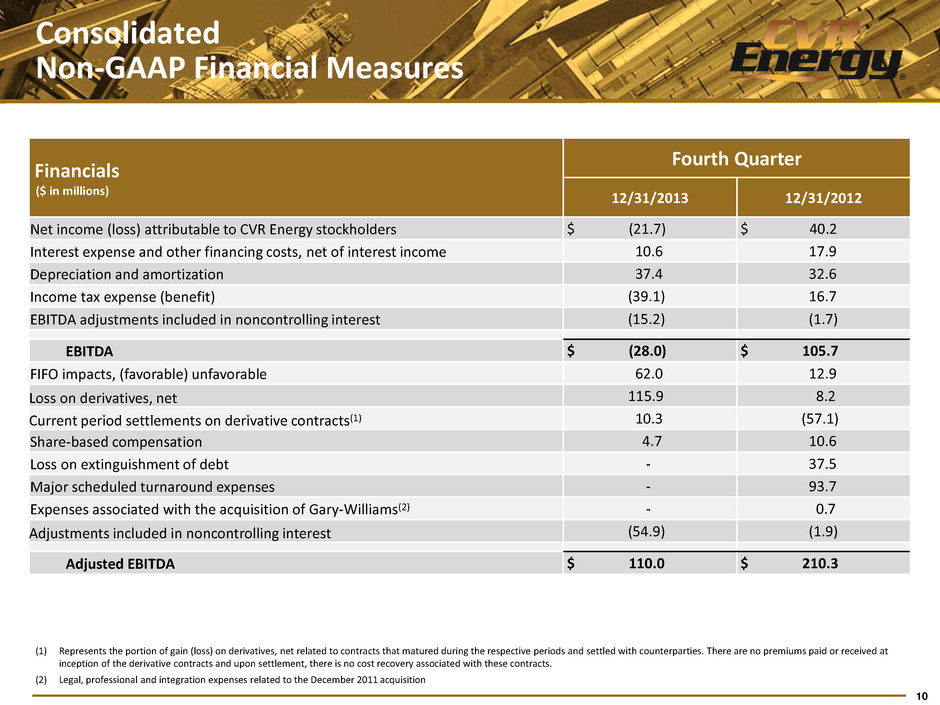

10 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. (2) Legal, professional and integration expenses related to the December 2011 acquisition Consolidated Non-GAAP Financial Measures Financials ($ in millions) Fourth Quarter 12/31/2013 12/31/2012 Net income (loss) attributable to CVR Energy stockholders $ (21.7) $ 40.2 Interest expense and other financing costs, net of interest income 10.6 17.9 Depreciation and amortization 37.4 32.6 Income tax expense (benefit) (39.1) 16.7 EBITDA adjustments included in noncontrolling interest (15.2) (1.7) EBITDA $ (28.0) $ 105.7 FIFO impacts, (favorable) unfavorable 62.0 12.9 Loss on derivatives, net 115.9 8.2 Current period settlements on derivative contracts(1) 10.3 (57.1) Share-based compensation 4.7 10.6 Loss on extinguishment of debt - 37.5 Major scheduled turnaround expenses - 93.7 Expenses associated with the acquisition of Gary-Williams(2) - 0.7 Adjustments included in noncontrolling interest (54.9) (1.9) Adjusted EBITDA $ 110.0 $ 210.3

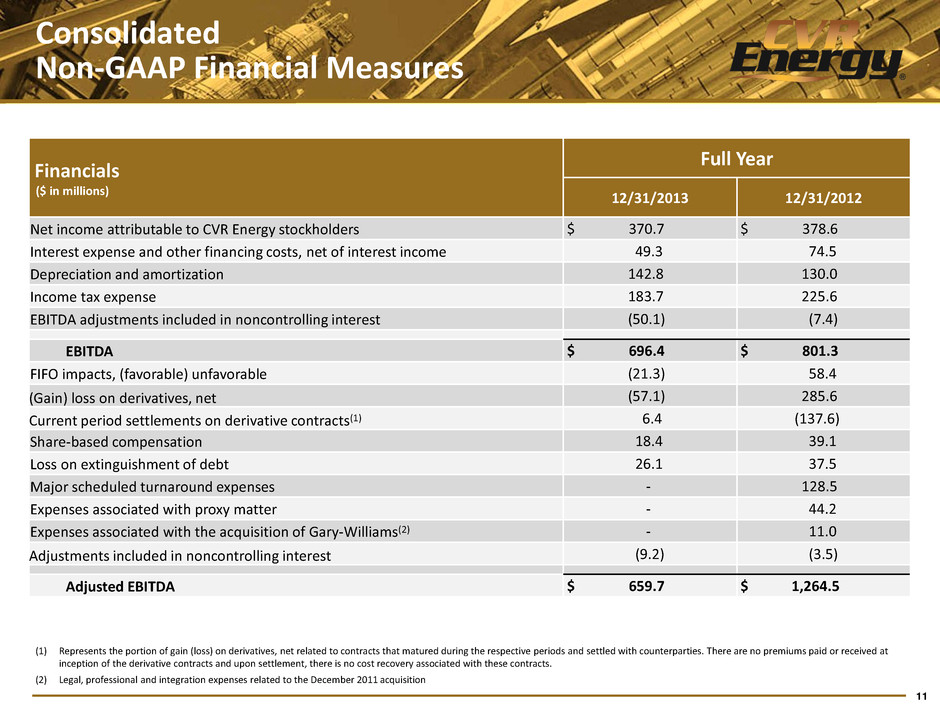

11 Consolidated Non-GAAP Financial Measures Financials ($ in millions) Full Year 12/31/2013 12/31/2012 Net income attributable to CVR Energy stockholders $ 370.7 $ 378.6 Interest expense and other financing costs, net of interest income 49.3 74.5 Depreciation and amortization 142.8 130.0 Income tax expense 183.7 225.6 EBITDA adjustments included in noncontrolling interest (50.1) (7.4) EBITDA $ 696.4 $ 801.3 FIFO impacts, (favorable) unfavorable (21.3) 58.4 (Gain) loss on derivatives, net (57.1) 285.6 Current period settlements on derivative contracts(1) 6.4 (137.6) Share-based compensation 18.4 39.1 Loss on extinguishment of debt 26.1 37.5 Major scheduled turnaround expenses - 128.5 Expenses associated with proxy matter - 44.2 Expenses associated with the acquisition of Gary-Williams(2) - 11.0 Adjustments included in noncontrolling interest (9.2) (3.5) Adjusted EBITDA $ 659.7 $ 1,264.5 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. (2) Legal, professional and integration expenses related to the December 2011 acquisition

12 Consolidated Non-GAAP Financial Measures Financials ($ in millions) Fourth Quarter 12/31/2013 12/31/2012 Income (loss) before income tax expense (benefit) $ (79.7) $ 61.5 FIFO impact (favorable) unfavorable 62.0 12.9 Share-based compensation 4.7 10.6 Loss on extinguishment of debt - 37.5 Major scheduled turnaround expenses - 93.7 Loss on derivatives, net 115.9 8.2 Current period settlements on derivative contracts(1) 10.3 (57.1) Expenses associated with the acquisition of Gary-Williams(2) - 0.7 Adjusted income before income tax expense (benefit) and noncontrolling interest $ 113.2 $ 168.0 Adjusted net income attributed to noncontrolling interest (36.0) (6.5) Income tax expense, as adjusted (15.5) (57.7) Adjusted net income attributable to CVR Energy stockholders $ 61.7 $ 103.8 Adjusted Net Income per diluted share $ 0.71 $ 1.20 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. (2) Legal, professional and integration expenses related to the December 2011 acquisition

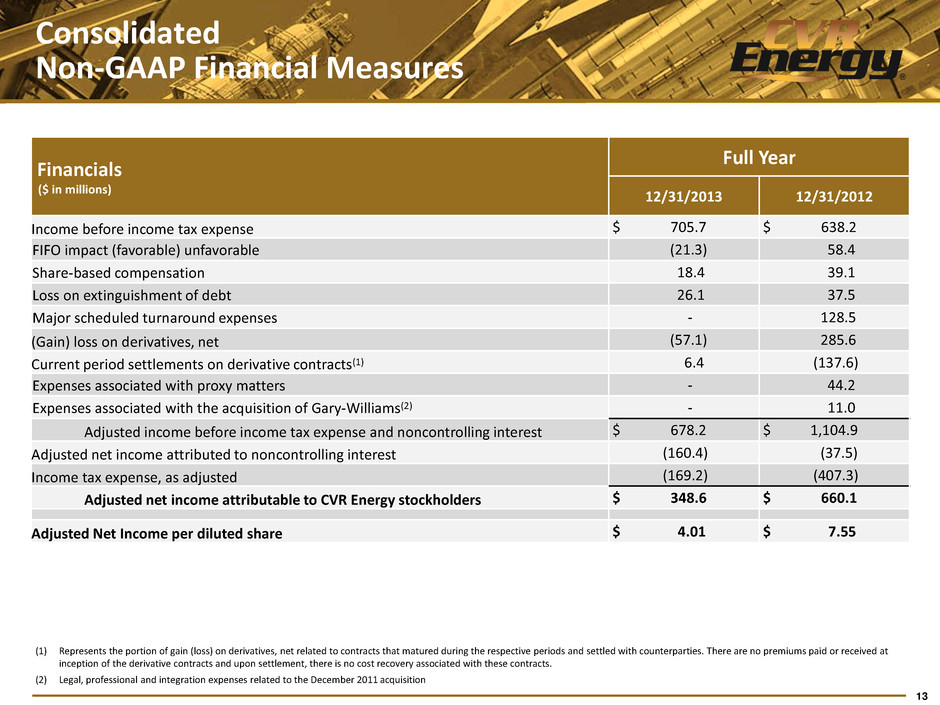

13 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. (2) Legal, professional and integration expenses related to the December 2011 acquisition Consolidated Non-GAAP Financial Measures Financials ($ in millions) Full Year 12/31/2013 12/31/2012 Income before income tax expense $ 705.7 $ 638.2 FIFO impact (favorable) unfavorable (21.3) 58.4 Share-based compensation 18.4 39.1 Loss on extinguishment of debt 26.1 37.5 Major scheduled turnaround expenses - 128.5 (Gain) loss on derivatives, net (57.1) 285.6 Current period settlements on derivative contracts(1) 6.4 (137.6) Expenses associated with proxy matters - 44.2 Expenses associated with the acquisition of Gary-Williams(2) - 11.0 Adjusted income before income tax expense and noncontrolling interest $ 678.2 $ 1,104.9 Adjusted net income attributed to noncontrolling interest (160.4) (37.5) Income tax expense, as adjusted (169.2) (407.3) Adjusted net income attributable to CVR Energy stockholders $ 348.6 $ 660.1 Adjusted Net Income per diluted share $ 4.01 $ 7.55

14 Fertilizer Non-GAAP Financial Measures Financials ($ in millions) Fourth Quarter Full Year 12/31/2013 12/31/2012 12/31/2013 12/31/2012 Operating income $ 29.7 $ 16.0 $ 124.9 $ 115.8 Depreciation and amortization 7.0 4.9 25.6 20.7 Other income, net - - 0.1 0.1 Major scheduled turnaround expenses - 4.6 - 4.8 Share-based compensation, non-cash (0.1) 1.6 2.2 6.8 Adjusted EBITDA $ 36.6 $ 27.1 $ 152.8 $ 148.2

15 Petroleum Non-GAAP Financial Measures Financials ($ in millions) Fourth Quarter Full Year 12/31/2013 12/31/2012 12/31/2013 12/31/2012 Operating income $ 14.9 $ 121.3 $ 603.0 $ 1,012.5 FIFO impacts (favorable) unfavorable 62.0 12.9 (21.3) 58.4 Share-based compensation, non-cash 1.2 4.7 9.5 13.5 Major scheduled turnaround expenses - 89.1 - 123.7 Current period settlements on derivative contracts(1) 10.3 (57.1) 6.4 (137.6) Depreciation and amortization 29.1 27.3 114.3 107.6 Other income, net - - 0.1 0.8 Adjusted EBITDA $ 117.5 $ 198.2 $ 712.0 $ 1,178.9 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts.