Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mondelez International, Inc. | d680016d8k.htm |

| EX-99.1 - EX-99.1 - Mondelez International, Inc. | d680016dex991.htm |

CAGNY Conference

February 18, 2014

Exhibit 99.2

Mondelez

International |

Irene Rosenfeld Chairman and CEO

|

Forward-looking statements

3

This slide presentation contains a number of forward-looking statements. Words, and variations of

words, such as “will,” “expect,” “may,” “should,”

“likely,” “believe,” “deliver,” “guidance” and similar expressions

are intended to identify our forward-looking statements. Examples of forward-looking

statements include, but are not limited to, statements we make about our future performance,

including future revenue growth, earnings per share, operating income, margins, taxes, cash

flow, market shares and shareholder returns; the drivers of our future performance, including

investments, productivity improvements and cost reductions; and dividends, share repurchases

and uses of cash. These forward-looking statements are subject to a number of risks and

uncertainties, many of which are beyond our control, which could cause our actual results to

differ materially from those indicated in our forward-looking statements. Such factors

include, but are not limited to, risks from operating globally and in emerging markets, continued

consumer weakness, continued volatility of commodity and other input costs, pricing actions,

continued weakness in economic conditions, business disruptions, increased competition and tax

law changes. For additional information on these and other factors that could affect our

forward-looking statements, see our risk factors, as they may be amended from time to time,

set forth in our filings with the SEC, including our most recently filed Annual Report on Form

10-K. We disclaim and do not undertake any obligation to update or revise any

forward-looking statement in this slide presentation, except as required by applicable law

or regulation. |

|

Agenda

Long-term growth algorithm and targets

Margin improvement and capital allocation

Sustaining growth and margin expansion in

North America

5 |

A

global snacks powerhouse $35 billion revenues in 2013

75% in fast-growing snacks

Category leadership

Favorite snacks brands

Proven innovation platforms

Advantaged geographic footprint

6 |

Snacking is a $1.2 trillion global market

7

In between

meals

As a replacement for

a meal

Source: Euromonitor |

Three

broad reasons why people snack 8

% of MDLZ

Portfolio

~25%

~60%

~15%

MY MIND

& REFRESH |

Snacks

are growth categories around the world 9

Well-aligned with consumer trends

Expandable consumption

Growth with GDP in emerging markets

Higher margins |

Near-term global category growth rates have slowed,

but expected to return to historical levels

Category

2011

2012

2013

Biscuits

7.3%

7.4%

5.5%

Chocolate

5.9%

6.0%

5.3%

Gum

2.0%

0.1%

0.7%

6.4%

6.2%

4.5%

Total Snacks

6.1%

5.9%

4.7%

Powdered Beverages

9.7%

11.5%

10.6%

Coffee

12.3%

7.2%

(1.9)%

Total Global Category Growth*

6.8%

6.1%

3.8%

10

Source: ACNielsen

* Total Global Category Growth includes biscuits, chocolate, gum, candy, coffee,

powdered beverages and cream cheese categories in key markets. Candy

|

#1

#1

#1

#1

#1

#1

#1

#2

#1

#1

#1

#1

#3

#2

--

--

#3

#2

#2

--

--

--

--

#1

#3

#3

#3

#1

#1

#3

#2

#2

#2

#2

#2

#2

#1

#2

#1

#2

#1

#1

18%

15%

30%

7%

11%

16%

Source: Euromonitor market share

North

North

America

America

Europe

Europe

Global

Global

Market

Market

Share

Share

Latin

Latin

America

America

Asia

Asia

Pacific

Pacific

Eastern

Eastern

Europe

Europe

Middle East

Middle East

& Africa

& Africa

We are a leader in our categories

Biscuits

Chocolate

Gum

Candy

Coffee

Powdered

Beverages

11 |

Driving market share gains across our portfolio

% Revenues Gaining or Holding Share

(1)

2013

by

Category

Chocolate

~80%

Biscuits

~70%

Gum & Candy

~50%

Beverages,

~65%

Cheese & Grocery

12

(1)

Defined

as

percentage

of

revenues

in

key

markets

for

the

category

with

share

either

increasing

or

flat

versus

the

same

prior

year

period.

Based

on

Global

Nielsen

data

for

measured

channels

for

available

periods

in

2011,

2012

and

2013.

68%

49%

69%

2011

2012

2013 |

Power

Brands and innovation platforms driving growth 13

Power Brands growing

~2x company rate

–

Significantly higher

gross margins

~13% of total revenue

from new products

Based on 2013 Revenue

Power

Brands

59%

Other

Brands

41% |

Large,

growing emerging markets footprint 14

Revenue +9% in 2013

Expected to comprise

~45% of total revenue

by 2016

Based on 2013 Revenue

Emerging

Markets

39%

Developed

Markets

61% |

Well-positioned for growth and value creation

15

Long-Term

Targets

Fast growing categories

Category leadership

Power Brands & innovation platforms

Emerging markets footprint

Targeting 14%-16% Adj. OI Margin by 2016

Supply chain reinvention

Fit for Purpose overheads

Modest increases in debt / interest

Share repurchases

Organic Net Revenue Growth:

At or Above Category Growth

Adjusted Operating Income

Growth: High Single Digit

Adjusted EPS Growth:

Double Digit |

Dave

Brearton CFO

|

Supply

Chain Reinvention driving gross margin improvement

Step change leadership talent

& capabilities

Transform global manufacturing

platforms

Redesign the supply chain

network

Drive productivity programs to

fuel growth

Improve cash management

17

$3B Gross Productivity

Cost Savings

(~$1B/per year; ~4.5% of COGS)

$1.5B Net Productivity

Cost Savings

(~$0.5B/per year; ~2.3% of COGS)

$1B Cash Flow

1

2

3

4

5

Priorities

3 Year Financial Goals |

Making

significant progress in SCR initiative 18

Talent & Capabilities

Changed 40 of 115 key roles

Strengthened L6S capabilities

1

Gross Productivity of 4.5%

Net Productivity of 2.5%

Productivity

4

Significantly reduced cash cycle

Cash Management

5

Manufacturing Platforms

New biscuit, chocolate and gum

platforms on track

Lead lines installed or on order

2

Network Redesign

30 plants restructured

Reduced 3,000+ FTEs

Greenfield & major expansions

underway across globe

3 |

Targeting “Fit for Purpose”

overheads

19

(1)

Reported SG&A as a % of net revenues was 24.6% in FY 2013. See GAAP to

Non-GAAP reconciliation at the end of this presentation 2013 SMG&A

Expense as % of Net Revenue R&D

9.2%

1.3%

2013 Adjusted SG&A was 24.8% of Revenue

(1)

Advertising

& Consumer

Promotions

Corporate

13.6%

0.6%

Selling

MG&A

& Other

Invest for Growth

Fit for Purpose |

Zero-Based Budgeting will accelerate cost reductions

Savings will drive margin improvement and fuel growth

investments

Using to identify and capture sustainable cost savings

opportunities

–

–

Retain

balance

between

top-

and

bottom-line

goals

–

–

Improve efficiency and effectiveness

Aligned leadership, internal teams and external resources

Quick wins to build momentum, create more cost-focused

culture

20 |

Driving double-digit Adjusted EPS growth

Primarily driven by high single-digit Adjusted Operating

Income growth

Modest increases in absolute debt and interest expense

Tax rate of ~20% for the next few years, gradually

increasing to mid-20s

21 |

Strong Free Cash

Flow ($ in billions)

Net Cash Provided by Operating Activities

excluding items and Restructuring Program

(1)

$4.1

(3)

Capital Expenditures (ex Restructuring Program)

(1.5)

% of Net Revenues

4.4%

2012-14 Restructuring Program

(0.3)

$2.3

(3)

FY 13

FY 14E

Combined

2013

& 2014

22

$4.1+

~(2.0)

5%+

~(0.7)

$1.4+

$8.2+

~(3.5)

~(1.0)

$3.7+

Free Cash Flow excluding items

(2)

(1)

Net cash provided by operating activities excluding items and restructuring program excludes the

following: net cash received due to the resolution of the Starbucks arbitration, cash payments

made for accrued interest and other related fees associated with the debt tendered on December 18,

2013 and cash payment made for the 2012-2014 Restructuring Program.

(2)

Free Cash Flow excluding items is defined as Free Cash Flow (net cash provided by operating activities

less capital expenditures) excluding the following: net cash received due to the

resolution of the Starbucks arbitration, and cash payments made for accrued interest and other related fees associated with the debt tendered on December 18, 2013

(3)

Net cash provided by operating activities was $6.4 billion for FY 2013. See GAAP to Non-GAAP

reconciliations at the end of this presentation. |

Disciplined capital deployment based on returns

Reinvest in the business to drive top-tier growth

Capex

~5%

of

Net

Revenue

Route-to-Market/A&C investments in emerging markets

Tack-on M&A, especially in emerging markets

Return of capital to shareholders

Dividend increased 8% in 2013

$7.7B share buyback program through 2016; $2.7B in 2013

Pay down debt to preserve balance sheet flexibility

Committed to investment grade rating, access to Tier 2 CP

23 |

Well-positioned for growth and value creation

24

Long-Term

Targets

Fast growing categories

Category leadership

Power Brands & innovation platforms

Emerging markets footprint

Targeting 14%-16% Adj. OI Margin by 2016

Supply chain reinvention

Fit for Purpose overheads

Modest increases in debt / interest

Share repurchases

Organic Net Revenue Growth:

At or Above Category Growth

Adjusted Operating Income

Growth: High Single Digit

Adjusted EPS Growth:

Double Digit |

Mark

Clouse President, North America |

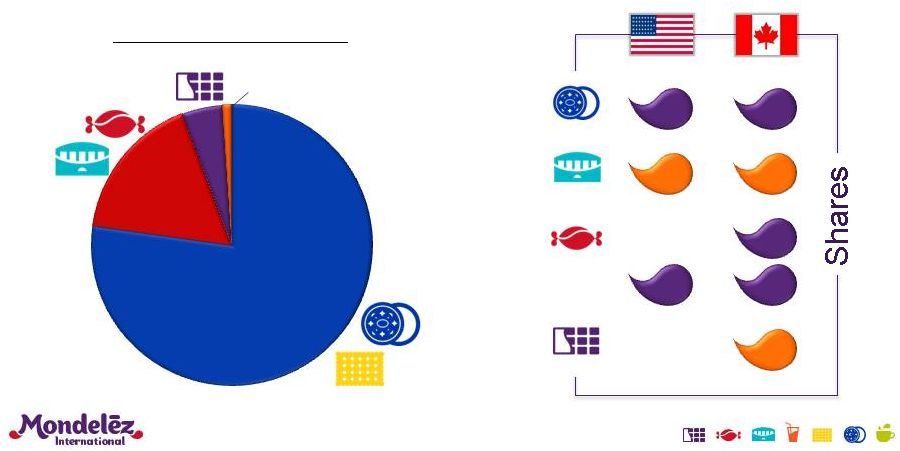

A

North American snacks powerhouse ~$6B

~$1B

#1

#2

#1

--

#3

#1

#2

#1

#1

#2

2013 Net Revenue: $7B

26

77%

17%

5%

Other 1%

Source: ACNielsen

Chocolate

Candy

&

Cough

Biscuits

Gum |

Significant progress towards goals, roadmap in place

27

Objective

Goal

2013 Results

Roadmap

Power Brands & Platforms

Sales Execution & DSD

Sustainable

Revenue Growth

“At or Above

Category”

Organic NR

+2.9%

(1)

(1)

Reported net revenues increased 1.3% for FY 2013. See GAAP to Non-GAAP

reconciliation at the end of this presentation. (2)

Reported Segment Operating Income margin was 12.7% in FY 2013. See GAAP to

Non-GAAP reconciliation at the end of this presentation. Transform

Margins

+500 bps to

~19% by 2016

Adj. SOI Margin

14.9%

(2)

, +110 bps

Supply Chain Reinvention

World Class

Team

“Fit for

Purpose”

Category Model

In Place

Fit for Purpose Organization |

Power

Brands focused on snacking needs 28 |

Power

Brand focus driving acceleration and turnaround 29

|

Innovation is creating incremental usage

30

MY MIND

& REFRESH |

Right Pricing

& Promotion

Right

Assortment

Right

Space

Right

Category

Configuration

Right

Location for

Products

Right

Displays &

Shopper

Solutions

Sales strength pulls it all together

31 |

DSD is

critical to winning in store 32

Displays are the best source of incremental sales

Multiple touch points drive impulse purchases |

Significant margin opportunity in supply chain

Manufacturing

Majority of existing production lines are 60+ years old

Many existing bakeries are sub-scale

Logistics

Too many distribution centers

Sub-optimal locations

33 |

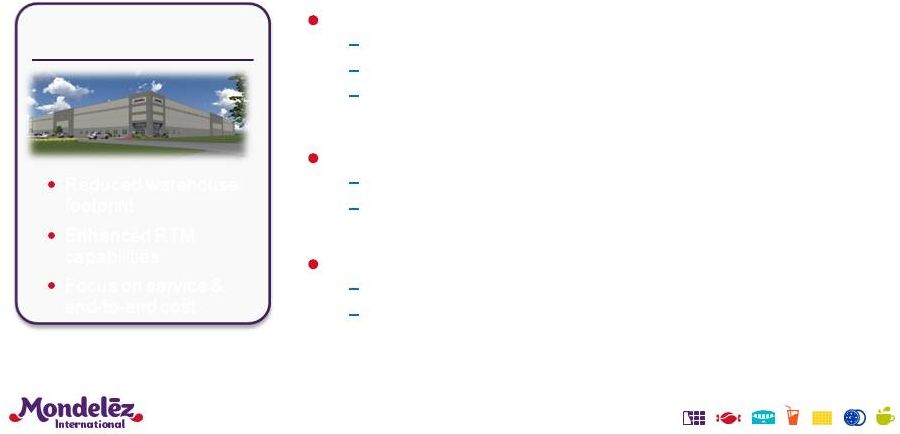

OPTIMIZED

DISTRIBUTION MODEL

34

Network redesign underway

STREAMLINE

& REINVEST

GROWTH PLANT

FOR AMERICAS |

Salinas on track for “Doors Open”

in Q4 2014

35

GROWTH PLANT

FOR AMERICAS

New capacity for

Power Brands

Advantaged assets at

advantaged costs

Fully integrated site

To open with 5 lines; expandable to 14 lines

World-class technology

Logistic optimization for Mexico hub |

Streamlining current footprint

36

Completed closure of Lakeshore Bakery, Toronto

550 positions affected

Announced closure of Philadelphia Bakery

350 positions affected with closure by early

2015 Upgrading North American asset base

Installing 16 new lines

Streamline subscale

facilities

Upgrading assets and

simplifying portfolio

STREAMLINE

& REINVEST |

Optimizing distribution infrastructure

37

Eliminating 4 distribution centers by Q3 2014

Enables inventory reductions and service improvements

3 already exited

5% reduction in warehouse costs

Transportation efficiencies & effectiveness

Improved geographic footprint

Ship direct to branches

Service improvements

Case fill improved ~5 pp over the last 2 years

On-time delivery improved 10+ pp in 2013

OPTIMIZED

DISTRIBUTION MODEL

Reduced warehouse

footprint

Enhanced RTM

capabilities

Focus on service &

end-to-end cost |

Creating a Fit for Purpose organization

38

Streamline category responsibility

Integrate Canada, eliminate redundancy

Focus P&L on categories

Harmonize & simplify portfolio

Lower cost structure and mindset

Zero-Based Budgeting

Embed sustainable cost leadership into culture

Aggressively build capabilities to strengthen execution

Streamline &

Simplify

Cost Savings

& Culture

Prioritized

Capability

Development |

Plans in place to deliver

margin goal 39

Adjusted Segment Operating Income Margin

(1)

13.8%

14.9%

18% to

21%

(1)

Reported Segment Operating Income margin was 11.3% in FY 2012 and 12.7% in FY 2013.

See GAAP to Non-GAAP reconciliation at the end of this presentation.

2012

2013

2016 |

Well-positioned for growth and value creation

Sustainable revenue growth

Significant margin improvement

Double-digit Adjusted EPS growth

Strong cash flow

Consistent top-tier financial performance over the long term

40 |

|

GAAP to Non-GAAP

Reconciliation 42

As

Reported/

Revised

(GAAP)

Impact of

Divestitures

(1)

Impact of

Currency

Organic

(Non-GAAP)

North America

2013

6,991

$

(39)

$

35

$

6,987

$

2012

6,903

$

(110)

$

-

$

6,793

$

% Change

1.3%

1.0

pp

0.6pp

2.9%

(1)

Net Revenues to Organic Net Revenues

For the Twelve Months Ended December 31,

($ in millions) (Unaudited)

Includes the exit of a product line upon the execution of a licensing agreement in 2013;

and a divestiture in 2012 |

GAAP

to Non-GAAP Reconciliation 43

As

Reported/

Revised

(GAAP)

Integration

Program and other

Acquisition

Integration costs

(1)

Spin-Off Costs

and Related

Adjustments

(2)

2012-2014

Restructuring

Program

Costs

(3)

Benefit from

Indemnification

Resolution

(4)

Operating

Income from

Divestitures

Gains on

Acquisition and

Divestitures,

net

(5)

Acquisition-

related costs

As Adjusted

(Non-GAAP)

Mondelez International

2013

Operating Income

3,971

$

220

$

62

$

330

$

(336)

$

(6)

$

(30)

$

2

$

4,213

$

Operating Income margin

11.2%

12.0%

2012

Operating Income

3,637

$

140

$

512

$

110

$

-

$

(79)

$

(107)

$

1

$

4,214

$

Operating Income margin

10.4%

12.2%

North America

2013

Segment Operating Income

889

$

1

$

-

$

160

$

-

$

(11)

$

-

$

-

$

1,039

$

Segment Operating Income margin

12.7%

14.9%

2012

Segment Operating Income

781

$

6

$

77

$

98

$

-

$

(26)

$

-

$

-

$

936

$

Segment Operating Income margin

11.3%

13.8%

Europe

2013

Segment Operating Income

1,699

$

88

$

-

$

131

$

-

$

(2)

$

-

$

-

$

1,916

$

Segment Operating Income margin

12.1%

13.6%

2012

Segment Operating Income

1,762

$

47

$

1

$

6

$

-

$

(53)

$

-

$

-

$

1,763

$

Segment Operating Income margin

12.8%

13.0%

(1)

(2)

(3)

(4)

(5)

Restructuring Program costs represent restructuring and related implementation

costs reflecting primarily severance, asset disposals and other manufacturing-related costs.

As part of our 2010 Cadbury acquisition, the company became the responsible party

for tax matters under the Cadbury Schweppes Plc and Dr Pepper Snapple Group, Inc. (“DPSG”) Tax Sharing and

Indemnification Agreement dated May 1, 2008 (“Tax Indemnity”) for certain

2007 and 2008 transactions relating to the demerger of Cadbury’s Americas Beverage business. A U.S. federal tax audit of

DPSG for the 2006-2008 tax years was concluded with the IRS in August 2013. As

a result, the company recorded a favorable impact of $363 million due to the reversal of the accrued liability in

excess of the amount paid to DPSG under the Tax Indemnity. The company recorded

$336 million in selling, general and administrative expenses and $49 million in interest and other expense, net,

partially offset by $22 million of tax expense for an impact of $0.20 per diluted

share. On February 22, 2013, the company acquired the remaining interest in a

biscuit operation in Morocco, which is now a wholly-owned subsidiary within the EEMEA segment. A pre-tax gain of $22

million was recorded in connection with the acquisition. In addition, during

the twelve months ended December 31, 2013, the company divested a salty snack business in Turkey, a confectionery

business in South Africa and a chocolate business in Spain. A pre-tax

gain of $8 million was recorded in connection with these divestitures.

Operating Income To Adjusted Operating Income

($ in millions, except percentages) (Unaudited)

For the Twelve Months Ended December 31,

Integration

Program

costs

are

defined

as

the

costs

associated

with

combining

the

Mondelez

International

and

Cadbury

businesses,

and

are

separate

from

those

costs

associated

with

the

acquisition.

Spin-Off

Costs

represent

transaction

and

transition

costs associated

with

preparing

the

businesses

for

independent

operations

consisting

primarily

of

financial

advisory

fees,

legal

fees,

accounting

fees,

tax

services

and

information

systems

infrastructure duplication,

and

financing

and

related

costs

to

redistribute

debt

and

secure

investment

grade

ratings

for

both

the

Kraft

Foods

Group

business

and

the

Mondelez

International

business.

Spin-Off

related

adjustments

include

the

pension

adjustment

defined

as

the

estimated

benefit

plan expense associated

with

certain

benefit

plan

obligations

transferred

to Kraft Foods Group in the Spin-Off.

-

-

- |

GAAP

to Non-GAAP Reconciliation 44

As

Reported/

Recorded

(GAAP)

Integration Program

and other

Acquisition

Integration costs

(3)

Spin-Off Costs

and Related

Adjustments

(4)

2012-2014

Restructuring

Program Costs

(5)

Benefit from

Indemnification

Resolution

(6)

Impact from

Divestitures

Acquisition-

related costs

As Adjusted

(Non-GAAP)

Net Revenues

35,299

$

-

$

-

$

-

$

-

$

(70)

$

-

$

35,229

$

Advertising and Consumer Promotion

3,234

$

-

$

-

$

-

$

-

$

(4)

$

-

$

3,230

$

Selling, Marketing, G & A and Other/Income & Expense

5,025

(160)

(55)

(4)

-

4,806

Research and Development

471

1

-

-

-

-

-

472

General corporate expense

(1)

283

(1)

(62)

2

-

-

222

Other

(2)

(334)

-

-

-

336

-

(2)

-

Selling, General and Administrative expenses

8,679

$

(160)

$

(62)

$

(53)

$

336

$

(8)

$

(2)

$

8,730

$

Advertising and Consumer Promotion

9.2%

9.2%

Selling, Marketing, G & A and Other/Income & Expense

14.2%

13.7%

Research and Development

1.3%

1.3%

General corporate expense

(1)

0.8%

0.6%

Other

(2)

(0.9)%

0.0%

Selling, General and Administrative expenses

24.6%

24.8%

(1)

(2)

(3)

(4)

(5)

(6)

Spin-Off

Costs

represent

transaction

and

transition

costs

associated

with

preparing

the

businesses

for

independent

operations

consisting

primarily

of

financial

advisory

fees,

legal

fees,

accounting

fees,

tax

services

and

information

systems

infrastructure

duplication,

and

financing

and

related

costs

to

redistribute

debt

and

secure

investment

grade

ratings

for

both

the

Kraft

Foods

Group

business

and

the

Mondelez

International

business.

Restructuring Program costs represent related implementation costs included in

SG&A reflecting primarily severance and asset disposal costs. As part of

our 2010 Cadbury acquisition, the company became the responsible party for tax matters under the Cadbury Schweppes Plc and Dr Pepper Snapple Group, Inc. (“DPSG”) Tax Sharing and Indemnification Agreement

dated May 1, 2008 (“Tax Indemnity”) for certain 2007 and 2008 transactions

relating to the demerger of Cadbury’s Americas Beverage business. A U.S. federal tax audit of DPSG for the 2006-2008 tax years was concluded with

the IRS in August 2013. As a result, the company recorded a favorable impact of $363

million due to the reversal of the accrued liability in excess of the amount paid to DPSG under the Tax Indemnity. The company recorded

$336

million

in

selling,

general

and

administrative

expenses

and

$49

million

in

interest

and

other

expense,

net,

partially

offset

by

$22

million

of

tax

expense

for

an

impact

of

$0.20

per

diluted

share.

SG&A Expense To Adjusted SG&A Expense

For the Twelve Months Ended December 31, 2013

($ in millions, except percentages) (Unaudited)

Excludes asset impairment costs recorded within general corporate expenses.

Includes

benefit

from

indemnification

resolution,

and

acquisition-related

costs.

Integration

Program

costs

are

defined

as

the

costs

associated

with

combining

the

Mondelez

International

and

Cadbury

businesses,

and

are

separate

from

those

costs

associated

with

the

acquisition.

-

- |

GAAP

to Non-GAAP Reconciliation 45

Net Cash Provided by Operating Activities (GAAP)

6,410

$

Items

Cash impact of the resolution of the Starbucks arbitration

(1)

(2,616)

Cash payments for accrued interest and other related fees associated with

debt tendered as of December 18, 2013.

(2)

81

Restructuring Program

Cash payments for Restructuring Program expenses

221

Net Cash Provided by Operating Activities excluding items and

Restructuring Program (Non-GAAP)

4,096

$

Capital Expenditures (GAAP)

1,622

$

Restructuring Progam capital expenditures

(61)

Capital Expenditures excluding Restructuring Program (Non-GAAP)

1,561

$

(1)

(2)

On December 18, 2013, the company completed a $3.4 billion cash tender offer for

some of its outstanding high coupon long-term debt. The amount

above reflects the cash payments associated with accrued interest and other

related fees.

For the Twelve Months Ended December 31, 2013

Net Cash Provided by Operating Activities

and Capital Expenditures

($ in millions) (Unaudited)

During the fourth quarter of 2013, the dispute with Starbucks Coffee Company was

resolved. The amount noted above reflects the cash received from

Starbucks of $2,764 million net of $148 million attorney's fees paid. |

GAAP

to Non-GAAP Reconciliation 46

Net Cash Provided by Operating Activities (GAAP)

6,410

$

Capital Expenditures

(1,622)

Free Cash Flow (Non-GAAP)

4,788

$

Items

Cash

impact

of

the

resolution

of

the

Starbucks

arbitration

(1)

(2,616)

Cash payments for accrued interest and other related fees associated with

debt

tendered

as

of

December

18,

2013.

(2)

81

Free Cash Flow excluding items (Non-GAAP)

2,253

$

(1)

(2)

On December 18, 2013, the company completed a $3.4 billion cash tender offer for

some of its outstanding high coupon long-term debt. The amount

above reflects the cash payments associated with accrued interest and other

related fees.

For the Twelve Months Ended December 31, 2013

Net Cash Provided by Operating Activities

to Free Cash Flow excluding items

($ in millions) (Unaudited)

During the fourth quarter of 2013, the dispute with Starbucks Coffee Company was

resolved. The amount noted above reflects the cash received from

Starbucks of $2,764 million net of $148 million attorney's fees paid. |