Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Allergan plc | d679339d8k.htm |

| EX-99.1 - EX-99.1 - Allergan plc | d679339dex991.htm |

Creating a New Model

in Specialty Pharmaceutical Leadership Exhibit 99.2 |

Important Information

For Investors and Shareholders 2

This communication does not constitute an offer to sell or the solicitation of an offer to buy any

securities or a solicitation of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed

merger between Actavis and Forest, Actavis will file with the Securities and Exchange Commission (the

“SEC”) a registration statement on Form S-4 that will include a joint proxy

statement of Actavis and Forest that also constitutes a prospectus of Actavis.

The

definitive

joint

proxy

statement/prospectus

will

be

delivered

to

shareholders

of

Actavis

and

Forest.

INVESTORS

AND

SECURITY

HOLDERS

OF

ACTAVIS

AND

FOREST

ARE

URGED

TO

READ

THE

DEFINITIVE

JOINT

PROXY

STATEMENT/PROSPECTUS

AND

OTHER

DOCUMENTS

THAT

WILL

BE

FILED

WITH

THE

SEC

CAREFULLY

AND

IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors and security holders will be able to obtain free copies of the registration statement and

the definitive joint proxy statement/prospectus (when available) and other documents filed with

the SEC by Actavis and Forest through the website maintained

by

the

SEC

at

http://www.sec.gov.

Copies

of

the

documents

filed

with

the

SEC

by

Actavis

will

be

available

free

of

charge

on

Actavis’

internet

website

at

www.actavis.com

or

by

contacting

Actavis’

Investor

Relations

Department

at

(862)

261-

7488. Copies of the documents filed with the SEC by Forest will be available free of charge on

Forest’s internet website at www.frx.com or by contacting Forest’s Investor Relations

Department at (212) 224-6713. Participants in the Merger Solicitation

Actavis,

Forest,

their

respective

directors

and

certain

of

their

executive

officers

and

employees

may

be

considered

participants

in the solicitation of proxies in connection with the proposed transaction. Information regarding the

persons who may, under the rules of the SEC, be deemed participants in the solicitation of the

Actavis and Forest shareholders in connection with the proposed merger will be set forth in the

joint proxy statement/prospectus when it is filed with the SEC. Information about the directors

and executive officers of Forest is set forth in its proxy statement for its 2013 annual meeting of stockholders, which

was filed with the SEC on July 8, 2013 and certain of its Current Reports on Form 8-K. Information

about the directors and executive officers of Actavis is set forth in its proxy statement for

its 2013 annual meeting of stockholders, which was filed with the SEC on March 29, 2013 and

certain of its Current Reports on Form 8-K. Additional information regarding the participants in

the proxy solicitations and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the joint proxy statement/prospectus filed with the

above-referenced registration statement on Form S-4 and other relevant materials to be

filed with the SEC when they become available. |

Actavis Cautionary

Statement Regarding Forward-Looking Statements 3

Statements contained in this communication that refer to Actavis’ estimated or anticipated

future results, including estimated synergies, or other non-historical facts are

forward-looking statements that reflect Actavis’ current perspective of existing trends and information as of the date of this

communication. Forward looking statements generally will be accompanied by words such as

“anticipate,” “believe,” “plan,” “could,” “should,”

“estimate,” “expect,” “forecast,” “outlook,”

“guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,” “predict,” “project,” or other similar words,

phrases or expressions. Such forward-looking statements include, but are not limited to,

statements about the benefits of the Forest acquisition, including future financial and

operating results, Actavis’ or Forest’s plans, objectives, expectations and intentions and the expected timing of

completion of the transaction. It is important to note that Actavis’ goals and expectations are

not predictions of actual performance. Actual results may differ materially from Actavis’

current expectations depending upon a number of factors affecting Actavis’ business, Forest’s business and risks

associated with acquisition transactions. These factors include, among others, the inherent

uncertainty associated with financial projections; restructuring in connection with, and

successful closing of, the Forest acquisition; subsequent integration of the Forest acquisition and the ability to

recognize the anticipated synergies and benefits of the Forest acquisition; the ability to obtain

required regulatory approvals for the transaction (including the approval of antitrust

authorities necessary to complete the acquisition), the timing of obtaining such approvals and the risk that such

approvals may result in the imposition of conditions that could adversely affect the combined company

or the expected benefits of the transaction; the ability to obtain the requisite Forest and

Actavis shareholder approvals; the risk that a condition to closing of the Forest acquisition may not be

satisfied on a timely basis or at all; the failure of the proposed transaction to close for any other

reason; risks relating to the value of the Actavis shares to be issued in the transaction; the

anticipated size of the markets and continued demand for Actavis’ and Forest’s products; the impact of

competitive products and pricing; access to available financing (including financing for the

acquisition or refinancing of Actavis or Forest debt) on a timely basis and on reasonable

terms; the risks of fluctuations in foreign currency exchange rates; the risks and uncertainties normally incident to

the pharmaceutical industry, including product liability claims and the availability of product

liability insurance on reasonable terms; the difficulty of predicting the timing or outcome of

pending or future litigation or government investigations; periodic dependence on a small number of products for

a material source of net revenue or income; variability of trade buying patterns; changes in

generally accepted accounting principles; risks that the carrying values of assets may be

negatively impacted by future events and circumstances; the timing and success of product launches; the difficulty

of predicting the timing or outcome of product development efforts and regulatory agency approvals or

actions, if any; market acceptance of and continued demand for Actavis’ and Forest’s

products; costs and efforts to defend or enforce intellectual property rights; difficulties or delays in

manufacturing; the availability and pricing of third party sourced products and materials; successful

compliance with governmental regulations applicable to Actavis’ and Forest’s

facilities, products and/or businesses; changes in the laws and regulations affecting, among other things, pricing

and reimbursement of pharmaceutical products; changes in tax laws or interpretations that could

increase Actavis’ consolidated tax liabilities; the loss of key senior management or

scientific staff; and such other risks and uncertainties detailed in Actavis’ periodic public filings with the Securities

and Exchange Commission, including but not limited to Actavis’ Annual Report on form 10-K

for the year ended December 31, 2012 and from time to time in Actavis’ other investor

communications. Except as expressly required by law, Actavis disclaims any intent or obligation to update or revise

these forward-looking statements. |

Forest Cautionary Statement Regarding Forward-Looking Statements

4

This release contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements include, but are not

limited to, statements about the benefits of the acquisition of Forest by Actavis, including

future financial and operating results, Forest’s or Actavis’ plans, objectives,

expectations and intentions and the expected timing of completion of the transaction. It is

important to note that Forest’s goals and expectations are not predictions of actual

performance. Actual results may differ materially from Forest’s current expectations depending

upon a number of factors affecting Forest’s business, Actavis’ business and risks associated

with acquisition transactions. These factors include, among others, the inherent uncertainty

associated with financial projections; restructuring in connection with, and successful closing

of, the acquisition; subsequent integration of the companies and the ability to recognize the

anticipated synergies and benefits of the acquisition; the ability to obtain required

regulatory approvals for the transaction (including the approval of antitrust authorities

necessary to complete the acquisition), the timing of obtaining such approvals and the risk

that such approvals may result in the imposition of conditions that could adversely affect the

combined company or the expected benefits of the transaction; the ability to obtain the

requisite Forest and Actavis shareholder approvals; the risk that a condition to closing of the

acquisition may not be satisfied on a timely basis or at all; the failure of the proposed transaction

to close for any other reason; risks relating to the value of the Actavis shares to be issued in

the transaction; access to available financing (including financing for the acquisition or

refinancing of Forest or Actavis debt) on a timely basis and on reasonable terms; the

difficulty of predicting FDA approvals, the acceptance and demand for new pharmaceutical

products, the impact of competitive products and pricing, the timely development and launch of

new products, and the risk factors listed from time to time in Forest Laboratories’ Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and any subsequent SEC

filings. Forest assumes no obligation to update forward-looking statements contained

in this release to reflect new information or future events or developments. |

Presentation

Overview •

Transaction Overview

•

An Innovative New Model in Specialty Pharmaceutical

Leadership

•

Forest Overview

•

Summary

5 |

Proposed Transaction

Terms •

Equity and Cash transaction valued at approximately $25 B

-

25% Premium to Forest closing price as of 2/14/2014

-

70/30 equity and cash split

-

$26.04 in cash + 0.3306 share of ACT/share of FRX

•

Pro Forma Forest ownership of ~35% shares of Actavis

•

Cash portion funded through existing cash and new debt

•

Anticipated to close by mid-year 2014 subject to:

-

Subject to approval of both Actavis and Forest shareholders

-

Customary conditions including legal and regulatory approval (HSR)

6 |

Creating an Innovative

New Model in Specialty Pharmaceutical Leadership

Enhanced size and scale

Broad & diverse portfolio with multiple blockbuster

therapeutic franchises

Balanced portfolio of branded and generic pharmaceuticals

Exceptionally strong global commercial capabilities create

high value to customers

More than $1 billion investment in R&D driving strong

organic growth

Strong free cash flow generation

Efficient tax structure and solid balance sheet

Drive robust organic growth accelerated

by smart business development

7 |

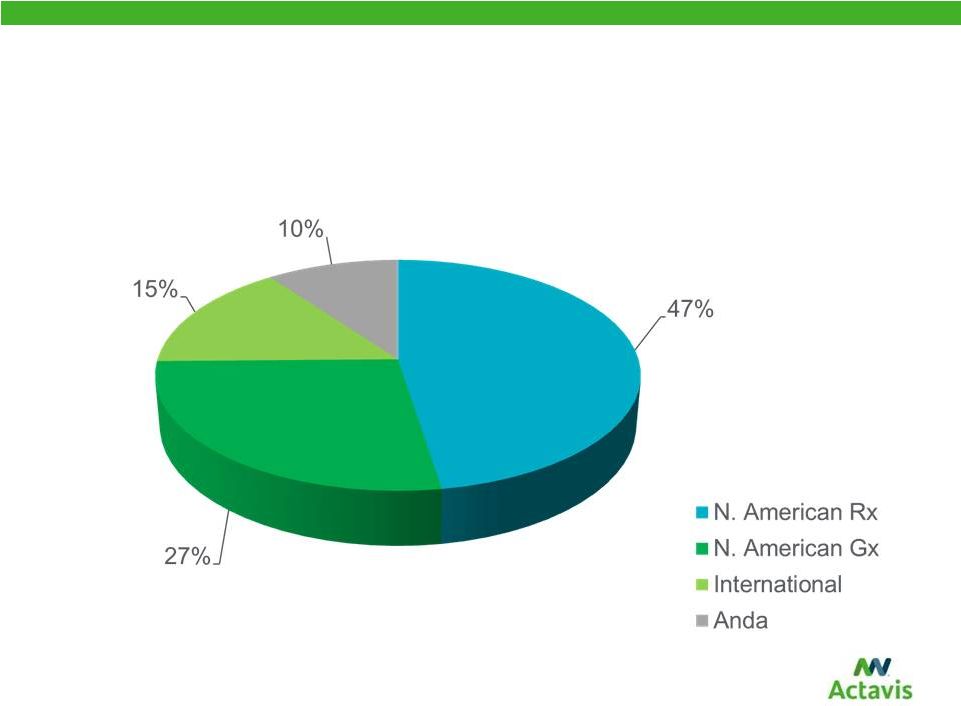

Balanced Revenue

Portfolio of North American Brand, North American Generic, International and Distribution

Based on 2014 proforma combined revenue

8 |

Financially Compelling Combination

•

Approximately $15 billion annual revenue generation

—

Approximately 50/50 brand/generic

•

Expected double-digit accretion to non-GAAP earnings,

including synergies, in 2015 and 2016

•

Greater than $4 billion annual free cash flow in 2015

—

Expect to maintain investment grade credit ratings

•

Estimated ~$1 billion in annual pre-tax operational and tax

synergies within three years of transaction close

9

•

Strong cash flow drives rapid deleveraging to under 3.5x debt

to pro forma adjusted EBITDA by the end of 2014 |

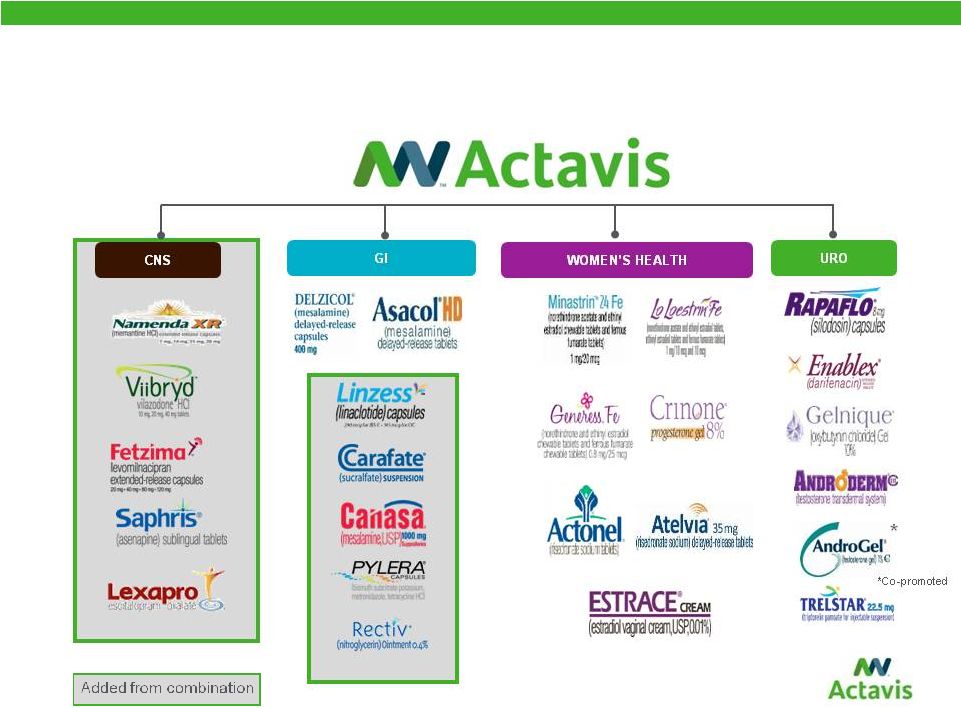

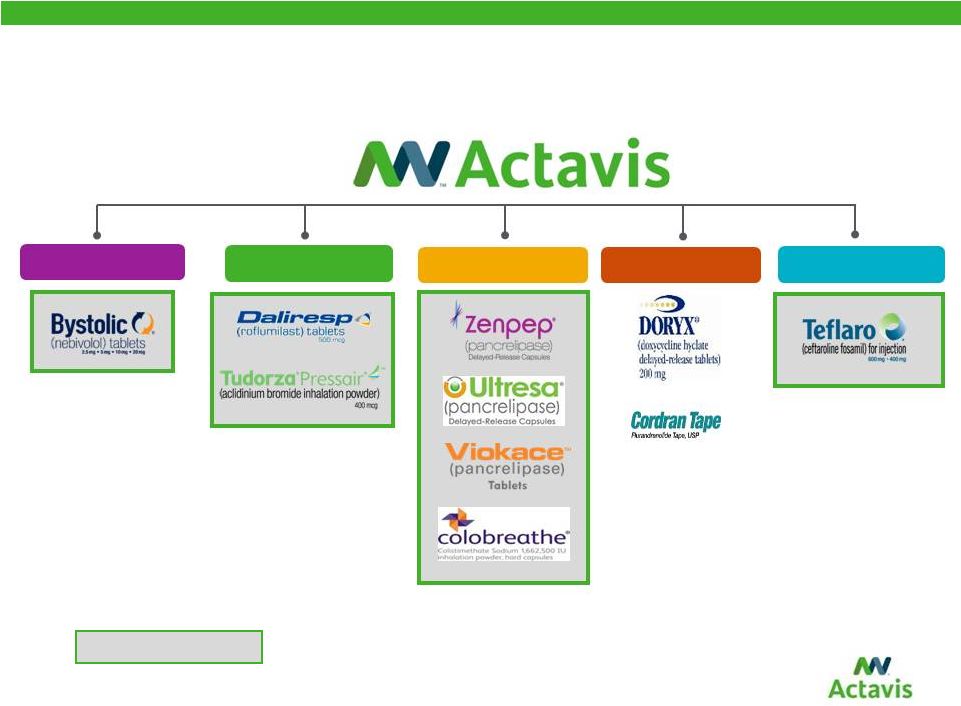

Broad & Diverse Portfolio with

Multiple Blockbuster Therapeutic Franchises

10 |

Emerging and Sustainable Portfolios in New Categories

CARDIOVASCULAR

DERM

INFECTIOUS DISEASE

RESPIRATORY

Added from combination

11

CYSTIC FIBROSIS |

Exceptionally Strong

Commercial Capabilities Create High Value to Customers

•

Enhanced profile: size, scale and product diversification

bring high value to customers

–

physicians, hospitals, health plans and distribution channels

12

•

World-class global commercial organization competing

across multiple market segments

–

Brands, generics, biosimilars, and OTCs

•

Better positioned with Forest’s strong primary care sales

force to drive increased sales of Actavis Specialty Brands

•

Strong global operations providing high-quality reliable

supply |

Continued Strong

Investment in R&D with over $1 Billion Expected in Year One

•

Continued investment in strong pipeline assets across all

therapeutic categories

•

Continued strong investment in generic R&D to maintain

strong global pipeline

-

Continue to invest in differentiated products including respiratory,

injectables and ophthalmics for all markets

-

Continued focus on important FTF assets in the US

-

Continued commitment to the development of biosimilars

•

Forest will add more than a half dozen near-

and mid-term

R&D products to Actavis’

robust development portfolio.

-

Five products at the NDA stage of development, including treatments for

Alzheimer’s disease, cardiovascular disease, infectious disease, as well

as Schizophrenia and bipolar disorders and, and treatments for COPD

13 |

Combined Specialty Brands Pipeline

Actavis

Biologic

Forest

Colvir

Albaconazole

VVC

Esmya®-Fibroids

(US)

Diafert™

WC3011

E2 Vaginal Cream

Metronidazole 1.3%

Vaginal Gel

E4/Progestin OC

Levosert™

Contraception

Progestin Only Patch

Amg/Act

Herceptin®

WC3043

Udenafil ED

WC3055

Udenafil BPH

Rapaflo®

NextGen

WC3035

Sarecycline

WC2055

Doxycycline NextGen

Oxybutynin

Hyperhidrosis

Albaconazole

Onychomycosis

WC3079

Delzicol®

NextGen

WC3046

Delzicol®

800mg

Cariprazine

(Bipolar Depression)

Cebranopadol

(Pain Management)

TRV027

(Acute Heart Failure)

TUDORZA®-formoterol

(COPD)

Ceftazidime-avibactam

(Infectious Disease)

BYSTOLIC®-valsartan

(Hypertension)

NAMENDA XR®-donepezil

(Alzheimer's Disease)

Cariprazine (CRL)

(Schizophrenia, BP Mania)

Amg/Act

Avastin®

rFSH

VIIBRYD®

(GAD)

NOTE: Additional important

products in preclinical

development including

biosimilars to Rituxin

®

and

Erbitux

®

through Actavis

collaboration with Amgen

14 |

Overview

15 |

BUSINESS

development

DRUG

Marketed Drugs

NDA

EXECUTION

AN

EXCEPTIONAL

COMPANY

ENGINE

commercial

Specialty pharmaceutical company focused on large primary care and subspecialty

markets

Key strategy building blockbuster therapeutic line calls to create economies and

relevance

16

Forest –

Overview and Strategy

development |

Recent Strategic Initiatives Have Rejuvenated Forest

Commenced Project Rejuvenate to achieve $500 M in cost reductions

Acquired Saphris for $240 M

Leveraged balance sheet with $1.2 B in first ever bond offering

in December and $1.8 B offering

in January for Aptalis acquisition Achieved NAMENDA XR

®

Coverage at 9 of Top 10 Part D Plans

Launched FETZIMA™

for Depression

Filed NAMENDA

®

Pediatric Written Request (PWR)

Completed $2.9 B acquisition of Aptalis

Notified FDA of intent to discontinue NAMENDA

®

, Focus on NAMENDA

17

XR

® |

Forest Has Strong Drug Development Capabilities and is

Focused on Commercial Execution

•

Next 9 strategy executed well

•

7 regulatory approvals since 2009

•

History of first cycle approvals

•

New products contributed 44% of sales and grew 59% year-

over-year in most recent quarter

18 |

Recent Acquisition of Aptalis

•

Aptalis is an excellent strategic fit

Diversifies Forest offerings in key therapeutic areas

GI franchise in

the

US

complements

Linzess

business

CF franchise in Europe complements Colobreathe business

Significantly improves Forest profitability in Canada

•

Aptalis products are growing and expected to contribute ~$700 M to

Forest sales

•

Forest expects to realize significant synergies

–

$125 million in pre-tax synergies

•

Deal closed January 31, 2014

19

•

Deal is immediately & highly accretive to Forest non-GAAP EPS

|

Summary of a

Transformational Combination 20 |

~$1 Billion in Annual

Synergies •

~$1 Billion Pre-Tax Operational and Tax Synergies

•

Majority of the synergies are expected to take place in first 12

months following close

–

Total synergies realized in first 3 years after acquisition

close

•

Excludes any manufacturing and revenue synergies

•

Tax synergies approximately 10% of total

•

Pro forma combined tax rate is expected to be slightly below

16% for 2015

21 |

Next Steps

•

Successful Completion of Transaction Requires:

–

Approval by shareholders of both companies

–

Regulatory review and approval including Hart-Scott-

Rodino review

22

•

Anticipated close mid-year 2014

•

Management teams from both companies to immediately

begin pre-integration activities to maximize potential at close

|

23 |