Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OVERSEAS SHIPHOLDING GROUP INC | v368398_8k.htm |

Exhibit 99.1

Bondholder Term Sheet Proposal Sources & Uses January 16, 2014 CONFIDENTIAL Subject to change as the debtors complete their analysis Prepared at the Request of Counsel and Subject to FRE 408 and All Similar Rules

DISCLAIMER This presentation and any accompanying oral communications by Overseas Shipholding Group, Inc. (together with its subsidiaries and affiliates, collectively, "OSG" or the "Company") or the Company's advisors may include certain statements, estimates and projections with respect to anticipated, past, present and future performance of the Company. Such estimates and projections reflect various assumptions by OSG concerning its past, present and future results and have been included solely for illustrative purposes. Statements, estimates and projections as to future performance are subject to a high degree of risk and uncertainty. No representations or warranties are made or should be implied as to the accuracy of such statements, estimates or projections or with respect to any other materials herein. Actual results may vary materially from the estimated or projected results contained herein. This presentation is subject to the terms of the Non-Disclosure Agreements (“NDAs”) Company and each recipient of this presentation. Pursuant to the terms of the NDAs, the recipients of this presentation (and any accompanying oral communications) hereby agree to treat this presentation (and oral disclosures) in a confidential manner. By accepting these materials, each recipient agrees that (i) neither it nor its agents, representatives, directors or employees shall reproduce, disclose or distribute this presentation (and oral disclosures) to others, in whole or in part, at any time without the prior written consent of the Company unless otherwise provided by the applicable NDAs and (ii) the recipient shall keep confidential such information in accordance with the terms of the applicable NDAs. Subject to change and refinement as the debtors complete their analysis. Privileged & Confidential Prepared at the Request of Counsel; Subject to FRE 408 and All Similar Rules; Principal Information page 2

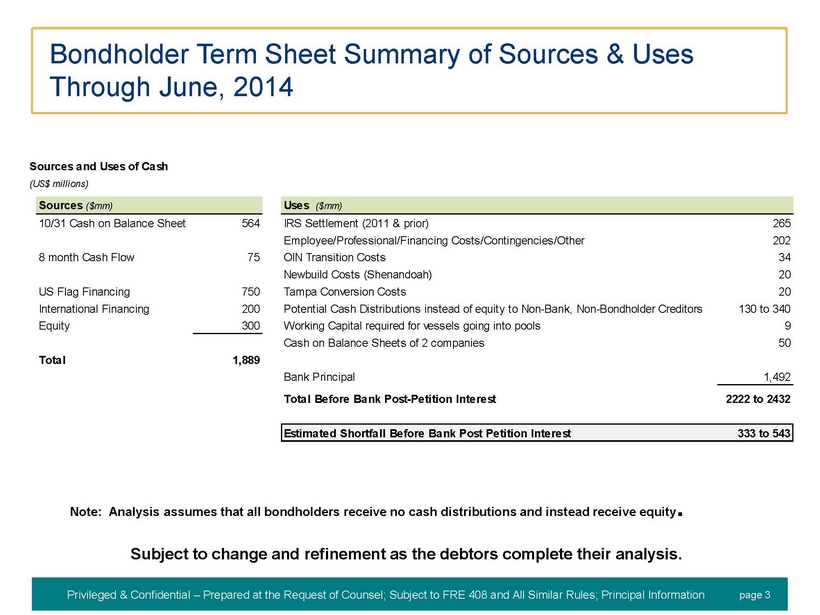

Bondholder Term Sheet Summary of Sources & Uses Through June, 2014 Sources and Uses of Cash (US$ millions) Sources ($mm) Uses ($mm) 10/31 Cash on Balance Sheet 564 IRS Settlement (2011 & prior) 265 Employee/Professional/Financing Costs/Contingencies/Other 202 8 month Cash Flow 75 OIN Transition Costs 34 Newbuild Costs (Shenandoah) 20 US Flag Financing 750 Tampa Conversion Costs 20 International Financing 200 Potential Cash Distributions instead of equity to Non-Bank, Non-Bondholder Creditors 130 to 340 Equity 300 Working Capital required for vessels going into pools 9 Cash on Balance Sheets of 2 companies 50 Total 1,889 Bank Principal 1,492 Total Before Bank Post-Petition Interest 2222 to 2432 Estimated Shortfall Before Bank Post Petition Interest 333 to 543 Note: Analysis assumes that all bondholders receive no cash distributions and instead receive equity. Subject to change and refinement as the debtors complete their analysis. Privileged & Confidential Prepared at the Request of Counsel; Subject to FRE 408 and All Similar Rules; Principal Information page 3