Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ORAMED PHARMACEUTICALS INC. | zk1414375.htm |

| EX-99 - EXHIBIT 99.2 - ORAMED PHARMACEUTICALS INC. | exhibit_99-2.htm |

Exhibit 99.1

Breakthrough

Technology

for a

for a

Brighter Future

1

February 2014

2

Safe Harbor

Certain statements contained in this material are forward-looking statements. These forward-looking statements

are based on the current expectations of the management of Oramed only, and are subject to a number of

factors and uncertainties that could cause actual results to differ materially from those described in the forward-

looking statements, including the risks and uncertainties related to the progress, timing, cost, and results of

clinical trials and product development programs; difficulties or delays in obtaining regulatory approval or patent

protection for our product candidates; competition from other pharmaceutical or biotechnology companies; and

our ability to obtain additional funding required to conduct our research, development and commercialization

activities, and others, all of which could cause the actual results or performance of Oramed to differ materially

from those contemplated in such forward-looking statements. Except as otherwise required by law, Oramed

undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of unanticipated events. For a more detailed

description of the risks and uncertainties affecting Oramed, reference is made to Oramed's reports filed from time

to time with the Securities and Exchange Commission. which involve known and unknown risks, uncertainties

and other factors which may cause the actual results, performance or achievements of the company, or industry

results, to be materially different from any future results, performance or achievements expressed or implied by

such forward-looking statements. Please refer to the company's filings with the Securities and Exchange

Commission for a comprehensive list of risk factors that could cause actual results, performance or achievements

of the company to differ materially from those expressed or implied in such forward-looking statements. Oramed

undertakes no obligation to update or revise any forward-looking statements.

are based on the current expectations of the management of Oramed only, and are subject to a number of

factors and uncertainties that could cause actual results to differ materially from those described in the forward-

looking statements, including the risks and uncertainties related to the progress, timing, cost, and results of

clinical trials and product development programs; difficulties or delays in obtaining regulatory approval or patent

protection for our product candidates; competition from other pharmaceutical or biotechnology companies; and

our ability to obtain additional funding required to conduct our research, development and commercialization

activities, and others, all of which could cause the actual results or performance of Oramed to differ materially

from those contemplated in such forward-looking statements. Except as otherwise required by law, Oramed

undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of unanticipated events. For a more detailed

description of the risks and uncertainties affecting Oramed, reference is made to Oramed's reports filed from time

to time with the Securities and Exchange Commission. which involve known and unknown risks, uncertainties

and other factors which may cause the actual results, performance or achievements of the company, or industry

results, to be materially different from any future results, performance or achievements expressed or implied by

such forward-looking statements. Please refer to the company's filings with the Securities and Exchange

Commission for a comprehensive list of risk factors that could cause actual results, performance or achievements

of the company to differ materially from those expressed or implied in such forward-looking statements. Oramed

undertakes no obligation to update or revise any forward-looking statements.

3

Oramed Overview

Proprietary Protein Oral Delivery (POD™) platform technology

For the oral delivery of drugs that are currently only available via injection

Product

Pipeline

Proof of Concept established in preclinical and clinical trials

Publicly traded - NASDAQCM:ORMP

Founded in 2006 by its scientific inventors after more than two

decades of research

§ Oral Insulin (ORMD-0801)

o Type 2 diabetes

o Type 1 diabetes

§ Oral GLP-1 Analog (ORMD-0901)

§ Combination Therapy (ORMD 0801 + 0901)

4

Agenda Overview

Oral Administration

Diabetes

Oramed Pipeline

Corporate Overview

The Challenge

The Oramed Solution

Statistics and Market

Oral Insulin

Oral GLP-1 Analog

Management Team

Scientific Advisory Board

Intellectual Property

Financials

5

Oramed

An Oral Solution

An Oral Solution

Harsh pH

Protease

threat

Mechanical

challenges

Absorption

barrier

6

Fate of proteins/peptides in GIT

Leads to protein breakdown and lack of absorption

Oramed POD™ Technology:

The Solution

7

Oramed’s delivery platform protects proteins and enhances their

absorption, allowing them to reach the bloodstream via the portal

vein, thereby establishing a more physiologic protein gradient

when compared to other delivery systems.

absorption, allowing them to reach the bloodstream via the portal

vein, thereby establishing a more physiologic protein gradient

when compared to other delivery systems.

Protease Inhibitors

Enteric Coating

Versatile

Supports a wide

range of protein

sizes and doses

range of protein

sizes and doses

Simple

Simple blend of

ingredients

ingredients

Versatile

Simple

Competent

Regulatory competence

No NCEs;

widely applied pharmacopoeia

8

Oramed POD™ Technology

Insulin

GLP-1

Analog

Analog

Other

9

Potential Oramed Technology Applications:

Opportunities & Market

Opportunities & Market

$15+ billion 2012 global insulin market

$32 billion projected market for 2018

$2+ billion 2012 global GLP-1 market

Many patients stop treatment as a result of

injection-related side effects

injection-related side effects

Vaccines: $24 billion in 2013 - grew from $5

billion in 2000

billion in 2000

Flu vaccine estimated at $2.9 billion in

2011 to $3.8 billion in 2018

2011 to $3.8 billion in 2018

Interferon: $6.3 billion, 2011 global market

Diabetes:

A Global Epidemic

A Global Epidemic

POPULATION

• 371 million: Number of diabetics worldwide

• 25.8 million in the US - projected to 44.1 million by 2034

• Type 2 diabetes accounts for about 90% of diabetes cases

COST

• $471 billion: estimated annual global economic burden - includes

direct medical costs, disability, reduced productivity

direct medical costs, disability, reduced productivity

• America: approx. $176 billion in direct medical costs and $69 billion in

reduced productivity

reduced productivity

• Projected American economic burden for direct medical costs alone by

2034 - $336 billion (based on current obesity levels, Diabetes Care, 2009).

2034 - $336 billion (based on current obesity levels, Diabetes Care, 2009).

11

Oramed Pipeline

ORMD-0801

Oral Insulin

Oral Insulin

50

37

As of Nov 12, 2013

Total number of

study subjects:

153

Total number of

human doses:

human doses:

1632

15

Portal insulin delivery is physiologic.

Systemic insulin delivery is not.

Systemic insulin delivery is not.

l Blood glucose - insulin secretion

system forms a 'closed-loop'

system forms a 'closed-loop'

l Peripheral insulin promotes glucose

uptake in fat and muscle

uptake in fat and muscle

l First-pass hepatic metabolism

extracts 80% of secreted insulin

extracts 80% of secreted insulin

l Systemic exposure is minimized

portal vein

liver

small intestine

stomach

To systemic

circulation

ORMD-0801

Type 2 Diabetes

(T2DM)

Type 2 Diabetes

(T2DM)

17

Initial Treatment:

• Lifestyle Modification

• Diet & Exercise

Single & Combination Oral

Therapies:

Therapies:

• Reduce insulin resistance

• Stimulate insulin secretion

Final Treatment:

• Insulin Replacement

(injections)

ORMD-0801 is not a substitute for

insulin injections, but rather a

new earlier treatment option

insulin injections, but rather a

new earlier treatment option

Criteria for advancing to next stage:

AIC not at target < 7.0%

Type 2 Diabetes:

Stages & Treatment Options

0

25

50

75

100

IGT

Post-

prandial

hyper-

glycemia

T2DM

phase I

T2DM

phase II

T2DM

18

Fasting Blood Glucose (FBG):

• Measurement of blood glucose levels after a fast (e.g. first thing in the morning)

• Effected by liver regulation of glucose and insulin levels in the body during a fast

Elevated FBG

• Elevated FBG levels are a major issue in T2DM

• Main cause: excessive nocturnal glucose production from liver

• Current treatments for correction of elevated FBG are suboptimal

FBG: Stats

• Approximately 70% of individuals with impaired FBG develop T2DM

• An estimated > 80% of T2DM patients exhibit abnormal FBG and fail to achieve glycemic

control with Metformin or thiazolidinediones (TZDs) preparations

control with Metformin or thiazolidinediones (TZDs) preparations

ORMD-0801: Unique Indication

• Nighttime dose

T2DM

0

20

40

60

80

0

60

120

180

Time (min)

n=4

8 mg

insulin

ORMD-0801: Preclinical - Dogs

• Healthy, non-diabetic, cannulated beagle dogs showed a 60-75% drop in blood

glucose levels within 30-100 minutes of treatment

glucose levels within 30-100 minutes of treatment

• No hypoglycemia or adverse events were observed over the three years of

testing

testing

T2DM

ORMD-0801 (C)

ORMD-0801 (A)

1.5 U NovoRapid

8 mg insulin, no additives

20

40

60

80

-

0

30

60

90

120

NC

0

100

-

10

150

Time (min)

NC; 4 independent test sessions

ORMD-0801; 10 independent sessions

Fasting

n=2

Pre-prandial

0

20

40

60

80

100

120

140

0

50

100

150

Time (min)

-20

n=3

NC; 6 independent test sessions

ORMD-0801; 5 independent sessions

8 mg

insulin

ORMD-0801: Preclinical - Pigs

No hypoglycemia or adverse events were observed

T2DM

ORMD-0801 Trial Results:

A Summary

A Summary

21

• Healthy, non-diabetic, cannulated beagle dogs

showed a 60-75% drop in blood glucose levels

within 30-100 minutes of treatment

• No hypoglycemia or adverse events were

observed over the three years of testing (in dogs)

• Randomized, double-blind, multi-center study

on 29 patients - 21 dosed, 8 placebo,

6 weeks of monitoring

• Showed relevant clinical impact

• Good safety profile

• Safe and well tolerated by all patients

• No SAEs

T2DM Patients

Pre-clinical

T2DM

ORA-D-004

Insulin

CRP

ORMD-0801

placebo

-4

-2

0

2

4

6

8

ORMD-0801

Phase 2a Results

ORMD-0801: Phase 2a FDA Study

Overview:

•30 T2DM patients

•US site

•In-patient setting

•Double blind

•Randomized

•1 week of treatment

23

T2DM

End Points:

•Primary end point:

• Safety and tolerability

•Secondary end points:

• Pharmacodynamic effects on mean night time

glucose

glucose

• Pharmacokinetics on AUC, Cmax, Tmax, T½

• Changes from baseline in FBG, morning fasting

insulin, C-peptide

insulin, C-peptide

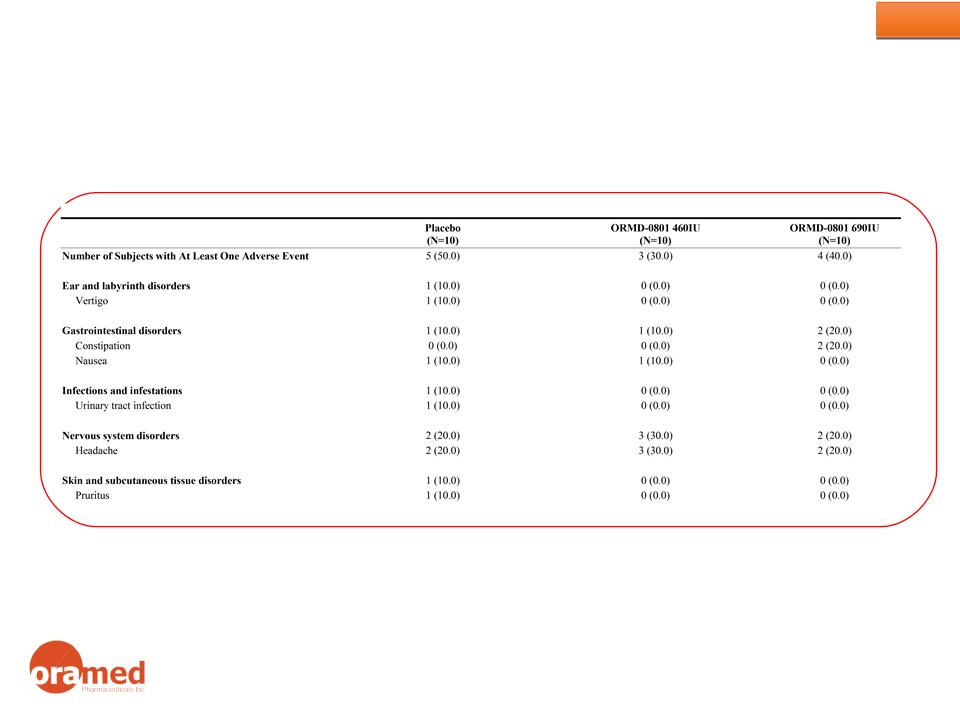

Phase 2a Results: Safety

24

T2DM

No Serious Adverse Events

The study clearly shows that ORMD-0801 is safe and well tolerated

ORMD-0801

Type 1 Diabetes

(T1DM)

Type 1 Diabetes

(T1DM)

25

26

T1DM

50.75

38

49.7

DAY

NIGHT

pretreatment

treatment

Frequency glucose >200mg/dL

20

30

40

50

60

06:00

-

08:59

09:00

-

11:59

12:00

-

13:59

14:00

-

18:59

19:00

-

20:59

21:00

-

23:59

00:00

-

05:59

Time

Design: 8 T1DM, monitor glycemic stability of orally administered ORMD-0801 (1

capsule (8 mg insulin) before meals, three times daily). Glucose monitored with

continuous, blinded glucose monitor

capsule (8 mg insulin) before meals, three times daily). Glucose monitored with

continuous, blinded glucose monitor

27

ORMD-0801: T1DM

DAY

NIGHT

180

200

220

240

260

280

300

pretreatment

treatment

Mean glucose n=8

ê 11.5%

Results: Safe, well tolerated,

reduced glycemia.

reduced glycemia.

T1DM

ORMD-0901

Oral GLP-1

Analog (T2DM)

Oral GLP-1

Analog (T2DM)

Oral GLP-1 Analog (Exenatide)

GLP-1: Hormone Facts

• Secreted by the intestine

• Has effect on the satiety center in the brain

• Has effect on pancreatic β-cells

GLP-1 Analog: Drug Facts

• Good safety profile

• Mimics the natural hormone in the body

• Decreases blood glucose levels - aids in

blood sugar balance

blood sugar balance

• Does not cause hypoglycemia

• Effectively reduces HbA1c

• Preserves beta cell function

• Promotes weight loss

• Current therapy is via injection only

29

• Pre-IND package submitted to

the US FDA Q3 2013

the US FDA Q3 2013

• IND enabling tox studies Q2,

2014

2014

• P1b ex-US study Q2, 2014

ORMD-0901

Oral GLP-1

Oral GLP-1 - ORMD-0901

Blunting of glucose excursions in dogs

Blunting of glucose excursions in dogs

0

20

40

60

80

100

120

S.C.

AG

4

AG

3

-

+

+

+

+

Exenatide

*

*

*

Glucose

Results: Subcutaneous exenatide delivery amounted to a 51% reduction in mean glucose

AUC0-150, while formulations AG4 and AG3 prompted 43% and 29% reductions, respectively

(* p = 0.068, demonstrating a treatment-related trend for the sample size).

ORMD-0901 formulations preserved the biological activity of orally

delivered exenatide. ORMD-0901 successfully curbed blood sugar

excursions following glucose challenge.

delivered exenatide. ORMD-0901 successfully curbed blood sugar

excursions following glucose challenge.

Methods:

Ø Healthy, fasting, cannulated

dogs

Ø Single dose ORMD-0901

formulation

Ø Administered 30 minutes

pre-glucose challenge

Ø Blood samples collected every

15 minutes

30

Mean AUC

Placebo:

148.5±30.5

No Nausea

Insulin:

180.3±106.3

21%

150 mg

exenatide

0

40

60

80

100

120

140

Time (min)

-50

0

100

150

n=4

ORMD-0901

placebo

31

ORMD-0901 - T2DM

Study

•First in Human

•4 healthy volunteers

•Placebo controlled

•Pre-prandial

Pipeline Overview

32

|

Therapy

|

Indication

|

Phase I

|

Phase II

|

Phase III/

Market |

Timeline

|

|

ORMD -

0801 Oral Insulin

|

T2DM

|

|

|

Q4, ‘13: Phase 2a completed

Q2/3, ’14: Phase 2b multi-center study

projected initiation |

|

|

T1DM

|

|

|

|

Q1, ’14: Phase 2a projected initiation

Q1, ’15: Phase 2b multi-center study projected

initiation |

|

|

ORMD-0901

Oral GLP-1

|

T2DM

|

|

|

|

Q2, ’14: Preclinical/IND studies projected

initiation Q2, ’14: Phase 1b ex-US study projected

initiation Q2, ’15: Phase 2 multi-center study projected

initiation |

Corporate

Overview

Overview

Management

34

Nadav Kidron, Esq, MBA

CEO & Director

Experience in various industries, including corporate law and

technology

technology

Miriam Kidron, PhD - CSO & Director

Senior Researcher at the Diabetes Unit of Hadassah Medical

Center for more than 25 years

Center for more than 25 years

Josh Hexter - COO, VP Bus. Dev.

More than 15 years of prominent leadership roles in

biotech and pharma

Yifat Zommer, CPA, MBA - CFO

Extensive experience in corporate financial management

Michael Berelowitz, MD

• Chairman of Oramed SAB

• SVP Clinical Development &

Medical Affairs, Pfizer (former)

Medical Affairs, Pfizer (former)

Harold Jacob, MD

• Chief Medical Officer, Given

Imaging (former)

Imaging (former)

Gerald Ostrov

• CEO, Bausch&Lomb (former)

• Senior level Executive J&J (former)

Leonard Sank

• Entrepreneur and businessman

Board of Directors

36

37

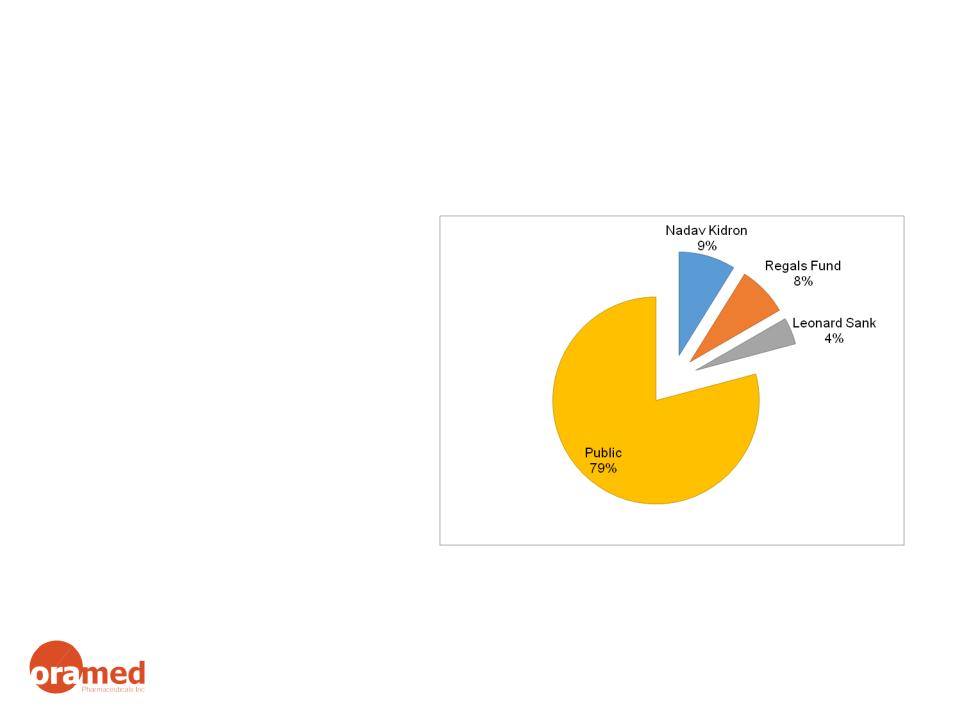

Financial Overview*

Ticker: NASDAQ: ORMP

• $43M raised to date **

• No Debt

• Cash and investments: $23.8M

• Shares Issued: 9.7M

• Fully diluted: 11.9M ***

37

* As of January 14, 2014

** Including the shares of D.N.A Biomedical Solutions Ltd.

*** Including outstanding 0.9M options and 1.5M warrants

ORMD-0801

Oral Insulin

ORMD-0901

Oral GLP-1Analog

Anticipated Milestones 2014-2015

•Initiation & Completion of IND-enabling studies

•Initiation & Completion of Phase 1b ex-US study

•Initiation of Phase 2 multi-site study under US IND

T2DM

• Completion of Phase 2a FDA study

• Initiation & Completion of Phase 2b multi-site study

under US IND

under US IND

T1DM

• Initiation & Completion of Phase 2a FDA study

• Initiation & Completion of Phase 2b multi-site study

under US IND

under US IND

Analyst Coverage

39

Oramed is followed by the analysts listed below:

Please note that any opinions, estimates or forecasts regarding Oramed's performance made by

these analysts are theirs alone and do not represent opinions, forecasts or predictions of Oramed

or its management. Oramed does not by its reference above or distribution imply its

endorsement of or concurrence with such information, conclusions or recommendations.

these analysts are theirs alone and do not represent opinions, forecasts or predictions of Oramed

or its management. Oramed does not by its reference above or distribution imply its

endorsement of or concurrence with such information, conclusions or recommendations.

|

Analyst

|

Firm

|

|

Raghuram Selvaraju

|

Aegis Capital Corp.

|

|

Graig Suvannavejh

|

MLV & Co.

|

In Summary

•Product pipeline with the potential to expand to other

indications

•Proprietary technology platform (POD™) for oral

delivery of peptides

•Clear proof of concept

•Strong IP

•Orally ingestible insulin capsule in Phase 2

clinical development under the US FDA

•Significant market opportunity

•World-leading scientific team

•Experienced management team

Breakthrough Technology

for a Brighter Future

Contact :

Nadav Kidron

CEO

nadav@oramed.com

Josh Hexter

COO

josh@oramed.com

41