Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - ORAMED PHARMACEUTICALS INC. | f10q0216ex32i_oramed.htm |

| EX-31.1 - CERTIFICATION - ORAMED PHARMACEUTICALS INC. | f10q0216ex31i_oramed.htm |

| EX-31.2 - CERTIFICATION - ORAMED PHARMACEUTICALS INC. | f10q0216ex31ii_oramed.htm |

| EX-32.2 - CERTIFICATION - ORAMED PHARMACEUTICALS INC. | f10q0216ex32ii_oramed.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended February 29, 2016

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-50298

ORAMED PHARMACEUTICALS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 98-0376008 | |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S.

Employer Identification No.) |

Hi-Tech Park 2/4 Givat Ram PO Box 39098 Jerusalem, Israel |

91390 | |

| (Address of Principal Executive Offices) | (Zip Code) |

+ 972-2-566-0001

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of April 5, 2016, there were 13,115,991 shares of the issuer’s common stock, $0.012 par value per share, outstanding.

ORAMED PHARMACEUTICALS INC.

FORM 10-Q

TABLE OF CONTENTS

| PART I – FINANCIAL INFORMATION | 1 |

| ITEM 1 - FINANCIAL STATEMENTS | 1 |

| ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 15 |

| ITEM 3 – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 22 |

| ITEM 4 - CONTROLS AND PROCEDURES | 22 |

| PART II - OTHER INFORMATION | 22 |

| ITEM 2 – UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 22 |

| ITEM 6 - EXHIBITS | 22 |

As used in this Quarterly Report on Form 10-Q, the terms “we,” “us,” “our” and the “Company” mean Oramed Pharmaceuticals Inc. and our wholly-owned Israeli subsidiary, Oramed Ltd., unless otherwise indicated. All dollar amounts refer to U.S. Dollars unless otherwise indicated.

On February 29, 2016, the exchange rate between the New Israeli Shekel, or NIS, and the dollar, as quoted by the Bank of Israel, was NIS 3.91 to $1.00. Unless indicated otherwise by the context, statements in this Quarterly Report on Form 10-Q that provide the dollar equivalent of NIS amounts or provide the NIS equivalent of dollar amounts are based on such exchange rate.

PART I – FINANCIAL INFORMATION

ITEM 1 - FINANCIAL STATEMENTS

ORAMED PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF FEBRUARY 29, 2016

TABLE OF CONTENTS

| Page | |

| CONDENSED CONSOLIDATED FINANCIAL STATEMENTS: | |

| Balance sheets | 2 |

| Statements of comprehensive loss | 3 |

| Statement of changes in stockholders’ equity | 4 |

| Statements of cash flows | 5 |

| Notes to financial statements | 6-15 |

| 1 |

ORAMED PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

| February 29, | August 31, | |||||||

| 2016 | 2015 | |||||||

| Assets | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | $ | 3,230 | $ | 3,213 | ||||

| Short-term deposits | 20,291 | 11,928 | ||||||

| Marketable securities | 2,081 | 2,088 | ||||||

| Restricted cash | 16 | 16 | ||||||

| Prepaid expenses and other current assets | 417 | 127 | ||||||

| Total current assets | 26,035 | 17,372 | ||||||

| LONG-TERM ASSETS: | ||||||||

| Long-term deposits and investment | 10,555 | 8,022 | ||||||

| Marketable securities | 1,762 | 940 | ||||||

| Amounts funded in respect of employee rights upon retirement | 9 | 9 | ||||||

| Property and equipment, net | 11 | 11 | ||||||

| Total long-term assets | 12,337 | 8,982 | ||||||

| Total assets | $ | 38,372 | $ | 26,354 | ||||

| Liabilities and stockholders' equity | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable and accrued expenses | $ | 829 | $ | 953 | ||||

| Deferred revenues (note 1a1) | 649 | 500 | ||||||

| Related parties | 41 | 36 | ||||||

| Total current liabilities | 1,519 | 1,489 | ||||||

| LONG-TERM LIABILITIES: | ||||||||

| Deferred revenues (note 1a1) | 4,109 | - | ||||||

| Employee rights upon retirement | 13 | 11 | ||||||

| Provision for uncertain tax position | 26 | 26 | ||||||

| 4,148 | 37 | |||||||

| COMMITMENTS (note 2) | ||||||||

| STOCKHOLDERS' EQUITY: | ||||||||

| Common stock, $0.012 par value (30,000,000 authorized shares; 13,109,789 and 11,563,077 shares issued and outstanding as of February 29, 2016 and August 31, 2015, respectively) | 157 | 138 | ||||||

| Additional paid-in capital | 71,578 | 59,184 | ||||||

| Accumulated other comprehensive income | 230 | 558 | ||||||

| Accumulated loss | (39,260 | ) | (35,052 | ) | ||||

| Total stockholders' equity | 32,705 | 24,828 | ||||||

| Total liabilities and stockholders' equity | $ | 38,372 | $ | 26,354 | ||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 2 |

ORAMED PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

| Six months ended | Three months ended | |||||||||||||||

| February 29, | February 28, | February 29, | February 28, | |||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| REVENUES | $ | 125 | $ | - | $ | 125 | $ | - | ||||||||

| RESEARCH AND DEVELOPMENT EXPENSES, NET | 3,208 | 2,438 | 1,307 | 1,136 | ||||||||||||

| GENERAL AND ADMINISTRATIVE EXPENSES | 1,278 | 1,138 | 730 | 538 | ||||||||||||

| OPERATING LOSS | 4,361 | 3,576 | 1,912 | 1,674 | ||||||||||||

| FINANCIAL INCOME | (193 | ) | (65 | ) | (128 | ) | (38 | ) | ||||||||

| FINANCIAL EXPENSES | 40 | 22 | 34 | 1 | ||||||||||||

| NET LOSS FOR THE PERIOD | 4,208 | 3,533 | 1,818 | 1,637 | ||||||||||||

| UNREALIZED LOSS (GAIN) ON AVAILABLE FOR SALE SECURITIES | 328 | 352 | (78 | ) | (7 | ) | ||||||||||

| TOTAL OTHER COMPREHENSIVE LOSS (INCOME) | 328 | 352 | (78 | ) | (7 | ) | ||||||||||

| TOTAL COMPREHENSIVE LOSS FOR THE PERIOD | $ | 4,536 | $ | 3,885 | $ | 1,740 | $ | 1,630 | ||||||||

| LOSS PER COMMON SHARE: | ||||||||||||||||

| BASIC AND DILUTED LOSS PER COMMON SHARE | $ | 0.35 | $ | 0.34 | $ | 0.14 | $ | 0.15 | ||||||||

| WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK USED IN COMPUTING BASIC AND DILUTED LOSS PER COMMON STOCK | 12,112,771 | 10,482,190 | 12,652,733 | 10,826,146 | ||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 3 |

ORAMED PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY

U.S. Dollars in thousands (except for share data)

(UNAUDITED)

| Accumulated | ||||||||||||||||||||||||

| Additional | other | Total | ||||||||||||||||||||||

| Common Stock | paid-in | comprehensive | Accumulated | stockholders' | ||||||||||||||||||||

| Shares | $ | capital | income | loss | equity | |||||||||||||||||||

| In thousands | ||||||||||||||||||||||||

| BALANCE AS OF AUGUST 31, 2015 | 11,563 | $ | 138 | $ | 59,184 | $ | 558 | $ | (35,052 | ) | $ | 24,828 | ||||||||||||

| CHANGES DURING THE SIX-MONTH PERIOD ENDED FEBRUARY 29, 2016: | ||||||||||||||||||||||||

| SHARES ISSUED FOR SERVICES | 8 | * | 48 | - | - | 48 | ||||||||||||||||||

| ISSUANCE OF COMMON STOCK | 1,155 | 14 | 10,580 | - | - | 10,594 | ||||||||||||||||||

| EXERCISE OF WARRANTS | 323 | 4 | 1,282 | - | - | 1,286 | ||||||||||||||||||

| STOCK BASED COMPENSATION | 61 | 1 | 484 | - | - | 485 | ||||||||||||||||||

| NET LOSS | - | - | - | - | (4,208 | ) | (4,208 | ) | ||||||||||||||||

| OTHER COMPREHENSIVE LOSS | - | - | - | (328 | ) | - | (328 | ) | ||||||||||||||||

| BALANCE AS OF FEBRUARY 29, 2016 | 13,110 | $ | 157 | $ | 71,578 | $ | 230 | $ | (39,260 | ) | $ | 32,705 | ||||||||||||

| * | Represents an amount of less than $1. |

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 4 |

ORAMED PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

(UNAUDITED)

| Six months ended | ||||||||

| February 29, | February 28, | |||||||

| 2016 | 2015 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (4,208 | ) | $ | (3,533 | ) | ||

| Adjustments required to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Depreciation | 2 | 3 | ||||||

| Exchange differences and interest on deposits | (101 | ) | (36 | ) | ||||

| Stock-based compensation | 485 | 564 | ||||||

| Common stock issued for services | 48 | 26 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | (290 | ) | 341 | |||||

| Accounts payable, accrued expenses and related parties | (119 | ) | (368 | ) | ||||

| Deferred revenue | 4,258 | - | ||||||

| Liability for employee rights upon retirement | 2 | - | ||||||

| Total net cash provided by (used in) operating activities | 77 | (3,003 | ) | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | (2 | ) | (2 | ) | ||||

| Purchase of short-term and long-term deposits | (13,385 | ) | (6,225 | ) | ||||

| Proceeds from sale of short-term deposits | 2,620 | 3,750 | ||||||

| Purchase of held to maturity securities | (1,775 | ) | - | |||||

| Proceeds from maturity of held to maturity securities | 600 | - | ||||||

| Total net cash used in investing activities | (11,942 | ) | (2,477 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from issuance of common stock and vested restricted stock units net of issuance expenses | 10,594 | 4,833 | ||||||

| Proceeds from exercise of warrants and options | 1,286 | 8 | ||||||

| Net cash provided by financing activities | 11,880 | 4,841 | ||||||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | 2 | (21 | ) | |||||

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 17 | (660 | ) | |||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 3,213 | 1,762 | ||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 3,230 | $ | 1,102 | ||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 5 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES:

| a. | General: |

| 1) | Incorporation and operations |

Oramed Pharmaceuticals Inc. (the “Company”) was incorporated on April 12, 2002, under the laws of the State of Nevada. From incorporation until March 3, 2006, the Company was an exploration stage company engaged in the acquisition and exploration of mineral properties. On February 17, 2006, the Company entered into an agreement with Hadasit Medical Services and Development Ltd (“Hadasit”) to acquire the provisional patent related to orally ingestible insulin capsule to be used for the treatment of individuals with diabetes.

On May 14, 2007, the Company incorporated a wholly-owned subsidiary in Israel, Oramed Ltd. (the “Subsidiary”), which is engaged in research and development. Unless the context indicates otherwise, the term “Group” refers to Oramed Pharmaceuticals Inc. and its Subsidiary.

On March 11, 2011, the Company was reincorporated from the State of Nevada to the State of Delaware.

On November 30, 2015, the Company and the Subsidiary entered into a Technology License Agreement with Hefei Tianhui Incubation of Technologies Co. Ltd. (“HTIT”) and on December 21, 2015 the parties entered into an Amended and Restated Technology License Agreement (the “License Agreement”). According to the License Agreement, the Company will grant HTIT an exclusive commercialization license in the territory of the Peoples Republic of China, Macau and Hong Kong (the “Territory”), related to the Company’s oral insulin capsule, ORMD-0801. Pursuant to the License Agreement, HTIT will conduct, at its own expense, certain pre-commercialization and regulatory activities with respect to the Company’s technology and ORMD-0801 capsule, and will pay to the Company (i) royalties of 10% on net sales of the related commercialized products to be sold by HTIT in the Territory (“Royalties”), and (ii) an aggregate of $37,500, of which $3,000 is payable immediately, $8,000 will be paid subject to the Company entering into certain agreements with certain third parties, and $26,500 will be payable upon achievement of certain milestones and conditions. In the event that the Company does not meet certain conditions, the Royalties rate may be reduced to a minimum of 8%. Following the expiration of the Company's patents covering the technology in the Territory (the “Patents”), the Royalties rate may be reduced, under certain circumstances, to 5%.

The Royalties term will commence upon the commercialization of the product and will end upon the later of the expiration of the Patents or fifteen years after the first commercialization of the product in the Territory.

The initial payment of $3,000 was received in January 2016.

Among others, the Company's involvement through the product submission date will include consultancy for the pre-commercialization activities in the Territory, as well as providing advice to HTIT on an ongoing basis.

| 6 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES (continued):

The closing of the License Agreement was conditioned upon the approval of the Israeli Chief Scientist, which was received on December 21, 2015.

In July 2015, according to the letter of intent signed between the parties or their affiliates, HTIT's affiliate paid the Subsidiary a non-refundable amount of $500 as a no-shop fee. The no-shop fee was deferred and the related revenue is recognized over the estimated term of the License Agreement (see below).

In addition, on November 30, 2015, the Company entered into a Stock Purchase Agreement (“SPA”) with HTIT. According to the SPA, the Company issued 1,155,367 shares of common stock to HTIT. The transaction was closed on December 28, 2015.

The License Agreement and the SPA were considered a single arrangement with multiple deliverables. The Company allocated the total consideration of $49,500 between the License Agreement and the SPA according to their fair value, as follows: $10,617 was allocated to the issuance of shares (less of issuance expenses of $23), based on the quoted price of the Company's share on the closing date of the SPA at December 28, 2015, and $38,883 to the License Agreement. Given the Company's continuing involvement through the expected product submission (June 2023), amounts received relating to the License Agreement are recognized over the period from which the Company is entitled to the respective payment, and the expected product submission date.

As a result, out of total of $4,883 which was allocated to the License Agreement, revenues in the amount of $125 were recognized in the three month period ended February 29, 2016 and $4,758 was deferred.

| 2) | Development and liquidity risks |

The Group is engaged in research and development in the biotechnology field for innovative pharmaceutical solutions, including an orally ingestible insulin capsule to be used for the treatment of individuals with diabetes, and the use of orally ingestible capsules for delivery of other polypeptides, and has not generated significant revenues from its operations. Continued operation of the Company is contingent upon obtaining sufficient funding until it becomes profitable.

| 7 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES (continued):

Successful completion of the Company’s development programs and its transition to normal operations is dependent upon obtaining necessary regulatory approvals from the U.S. Food and Drug Administration prior to selling its products within the United States, and foreign regulatory approvals must be obtained to sell its products internationally. There can be no assurance that the Company will receive regulatory approval of any of its product candidates, and a substantial amount of time may pass before the Company achieves a level of revenues adequate to support its operations, if at all. The Company also expects to incur substantial expenditures in connection with the regulatory approval process for each of its product candidates during their respective developmental periods. Obtaining marketing approval will be directly dependent on the Company’s ability to implement the necessary regulatory steps required to obtain marketing approval in the United States and in other countries. The Company cannot predict the outcome of these activities.

Based on its current cash resources and commitments, and cash received in private and public offerings in the six month period ended February 29, 2016 and in the year ended August 31, 2015, as well as the investment made by HTIT, the Company believes it will be able to maintain its current planned development activities and the corresponding level of expenditures for at least the next 12 months beyond the date that the financial statements are issued, although no assurance can be given that it will not need additional funds prior to such time. If there are unexpected increases in general and administrative expenses or research and development expenses, the Company may need to seek additional financing during the next 12 months.

| b. | Loss per common share |

Basic and diluted net loss per common share are computed by dividing the net loss for the period by the weighted average number of shares of common stock outstanding. Outstanding stock options, warrants and restricted stock units have been excluded from the calculation of the diluted loss per share because all such securities are anti-dilutive for all periods presented. The total number of common stock options, warrants and restricted stock units excluded from the calculation of diluted net loss was 2,592,117 and 2,237,422 for the six month periods ended February 29, 2016 and February 28, 2015, respectively.

| c. | Revenue recognition |

Revenue is recognized when delivery has occurred, evidence of an arrangement exists, title and risks and rewards for the products are transferred to the customer, collection is reasonably assured and product returns can be reliably estimated.

Given the Company's continuing involvement through the expected product submission (June 2023), revenue from the License Agreement is recognized over the periods from which the Company is entitled to the respective payments (including milestones), and through the expected product submission date.

| 8 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES (continued):

| d. | Newly issued and recently adopted Accounting Pronouncements |

| 2) | In January 2016, the FASB issued guidance on recognition and measurement of financial assets and financial liabilities (Accounting Standards Update No. 2016-01) that will supersede most current guidance. Changes to the current United States generally accepted accounting principles (“U.S. GAAP”) model primarily affect the accounting for equity investments, financial liabilities under the fair value option and the presentation and disclosure requirements for financial instruments. In addition, the FASB clarified guidance related to the valuation allowance assessment when recognizing deferred tax assets resulting from unrealized losses on available-for-sale debt securities. |

The accounting for other financial instruments, such as loans, investments in debt securities, and financial liabilities, is largely unchanged. The classification and measurement guidance will be effective in fiscal years beginning after December 15, 2017, including interim periods within those fiscal years (early adoption of the provision to record fair value changes for financial liabilities under the fair value option resulting from instrument-specific credit risk in other comprehensive income is permitted). The Company is currently evaluating the impact of the guidance on its consolidated financial statements.

| 3) | In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) (“ASU 2016-02”), which supersedes the existing guidance for lease accounting, Leases (Topic 840). ASU 2016-02 requires lessees to recognize leases on their balance sheets, and leaves lessor accounting largely unchanged. The amendments in ASU 2016-02 are effective for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. Early application is permitted for all entities. ASU 2016-02 requires a modified retrospective approach for all leases existing at, or entered into after, the date of initial application, with an option to elect to use certain transition relief. The Company is currently evaluating the impact of this new standard on its consolidated financial statements. |

| e. | Condensed Consolidated Financial Statements Preparation |

The condensed consolidated financial statements included herein have been prepared in accordance with U.S. GAAP and on the same basis as the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2015 (the “2015 Form 10-K”). These condensed consolidated financial statements reflect all adjustments that are of a normal recurring nature and that are considered necessary for a fair statement of the results of the periods presented. Certain information and disclosures normally included in annual consolidated financial statements have been omitted in this interim period report pursuant to the rules and regulations of the Securities and Exchange Commission. Because the condensed consolidated interim financial statements do not include all of the information and disclosures required by U.S. GAAP for annual financial statements, they should be read in conjunction with the audited consolidated financial statements and notes included in the 2015 Form 10-K. The results for interim periods are not necessarily indicative of a full fiscal year’s results.

| 9 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 2 - COMMITMENTS:

| a. | In March 2011, the Subsidiary sold shares of its investee company, Entera Bio Ltd (“Entera”) to D.N.A Biomedical Solutions Ltd (“D.N.A”) (see also note 4), retaining a 3% interest as of March 2011, which is accounted for as a cost method investment (amounting to $1). In consideration for the shares sold to D.N.A, the Company received, among other payments, 8,404,667 ordinary shares of D.N.A. |

As part of this agreement, the Subsidiary entered into a patent transfer agreement according to which, the Subsidiary assigned to Entera all of its right, title and interest in and to the patent application that it has licensed to Entera since August 2010. Under this agreement, the Subsidiary is entitled to receive from Entera royalties of 3% of Entera’s net revenues (as defined in the agreement) and a license back of that patent application for use in respect of diabetes and influenza. As of February 29, 2016, Entera had not yet realized any revenues and had not paid any royalties to the Subsidiary.

In addition, as part of a consulting agreement with a third party, dated February 15, 2011, the Subsidiary is obliged to pay this third party royalties of 8% of the net royalties actually received by the Subsidiary in respect of the patent that was sold to Entera in March 2011.

| b. | On April 28, 2013, the Subsidiary entered into a lease agreement for its office facilities in Israel. The lease agreement is for a period of 36 months commencing November 4, 2013. |

The annual lease payment will be New Israeli Shekel 89 thousands from 2014 through 2016, and will be linked to the increase in the Israeli consumer price index (“CPI”) (as of February 29, 2016, the future annual lease payments under the agreement will be $23, based on the exchange rate as of February 29, 2016).

As security for its obligation under this lease agreement the Company provided a bank guarantee in an amount equal to three monthly lease payments.

| 10 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 2 - COMMITMENTS (continued):

| d. | Grants from the Bio-Jerusalem Fund (“Bio-Jerusalem”) |

The Subsidiary is committed to pay royalties to Bio-Jerusalem on proceeds from future sales at a rate of 4% and up to 100% of the amount of the grant received by the Company (Israeli CPI linked) at the total amount of $65.

During the six month period ended February 29, 2016, the Company received no grants from Bio-Jerusalem.

As of February 29, 2016, the Subsidiary had realized revenues from the said project in the amount of $53 and incurred a liability to pay royalties of $2.

| e. | Grants from the Office of Chief Scientist (“OCS”) |

Under the terms of the Company’s funding from the OCS, royalties of 3.5% are payable on sales of products developed from a project so funded, up to a maximum amount equaling 100%-150% of the grants received by the Company (dollar linked) with the addition of annual interest at a rate based on LIBOR.

At the time the grants were received, successful development of the related projects was not assured. In case of failure of a project that was partly financed as above, the Company is not obligated to pay any such royalties.

The total amount that was received through February 29, 2016 was $2,194.

Royalty expenses amounted to $2 during the six month period ended February 29, 2016 and included in research and development expenses.

As of February 29, 2016, the Subsidiary had realized revenues from the said project in the amount of $53 and incurred a liability to pay royalties of $2.

| 11 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 3 - FAIR VALUE:

The Company measures fair value and discloses fair value measurements for financial assets and liabilities. Fair value is based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. In order to increase consistency and comparability in fair value measurements, the guidance establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three broad levels, which are described as follows:

| Level 1: | Quoted prices (unadjusted) in active markets that are accessible at the measurement date for assets or liabilities. The fair value hierarchy gives the highest priority to Level 1 inputs. |

| Level 2: | Observable prices that are based on inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. |

| Level 3: | Unobservable inputs are used when little or no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs. |

As of February 29, 2016, the assets or liabilities measured at fair value are comprised of available for sale equity securities (level 1).

In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible.

As of February 29, 2016, the carrying amount of cash and cash equivalents, short-term deposits, prepaid expenses and other current assets and accounts payable and accrued expenses approximate their fair values due to the short-term maturities of these instruments.

As of February 29, 2016, the carrying amount of long-term deposits approximates their fair values due to the stated interest rates which approximate market rates.

The amounts funded in respect of employee rights are stated at cash surrender value which approximates its fair value.

| 12 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 4 - MARKETABLE SECURITIES:

The Group's marketable securities include investments in equity securities of D.N.A and in held to maturity bonds.

| a. | Composition: |

| February 29, 2016 | August 31, 2015 | ||||||||

| Short-term: | |||||||||

| D.N.A (see b below) | $ | 825 | $ | 1,153 | |||||

| Held to maturity bonds (see c below) | 1,256 | 935 | |||||||

| $ | 2,081 | $ | 2,088 | ||||||

| Long-term: | |||||||||

| Held to maturity bonds (see c below) | $ | 1,762 | $ | 940 | |||||

| b. | D.N.A |

The investment in D.N.A is reported at fair value, with unrealized gains and losses, recorded as a separate component of other comprehensive income in equity until realized. Unrealized losses that are considered to be other-than-temporary are charged to statement of operations as an impairment charge and are included in the consolidated statement of operations under impairment of available-for-sale securities.

The D.N.A ordinary shares are traded on the Tel Aviv Stock Exchange and have a quoted price. The fair value of those securities is measured at the quoted prices of the securities on the measurement date.

During the six month periods ended February 29, 2016 and February 28, 2015, the Group did not sell any of the D.N.A ordinary shares.

As of February 29, 2016, the Group owns approximately 8.7% of D.N.A’s outstanding ordinary shares.

The cost of the securities as of February 29, 2016 and August 31, 2015 is $590.

| 13 |

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 4 - MARKETABLE SECURITIES (continued):

| c. | Held to maturity bonds |

The amortized cost and estimated fair value of held-to-maturity securities at February 29, 2016, are as follows:

| February 29, 2016 | |||||||||||||

| Amortized cost | Gross unrealized losses |

Estimated fair value | |||||||||||

| Short-term: | |||||||||||||

| Commercial bonds | $ | 1,219 | $ | (1 | ) | $ | 1,218 | ||||||

| Accrued interest | 37 | - | 37 | ||||||||||

| Long-term | 1,762 | (6 | ) | 1,756 | |||||||||

| $ | 3,018 | $ | (7 | ) | $ | 3,011 | |||||||

As of February 29, 2016, the contractual maturities of debt securities classified as held-to-maturity are as follows: after one year through two years, $1,762, and the yield to maturity rates vary between 0.84% to 1.8%.

NOTE 5 - STOCK HOLDERS’ EQUITY

| a. | On December 28, 2015, the Company completed a private placement of 1,155,367 shares of the Company's common stock to HTIT. See also note 1. |

| b. | On January 4, 2016, the Company’s President, Chief Executive Officer and director (the “CEO”), in his personal capacity as a shareholder of the Company, and a leading investor of the Company, terminated a letter agreement dated November 29, 2012, between the parties, which entitled the leading investor to certain stock compensation from the CEO under certain conditions. |

NOTE 6 - STOCK-BASED COMPENSATION

On November 19, 2015, options to purchase an aggregate of 22,000 of the Company’s shares of common stock were granted to two consultants at an exercise price of $7.36 per share (equivalent to the traded market price on the date of grant). 10,000 of the options vested in one installment on December 1, 2015, and the remaining 12,000 options vest in twelve equal quarterly installments, commencing January 1, 2016. All the options will expire on November 19, 2025. The fair value of the remaining 12,000 options as of February 29, 2016 was $68, using the following assumptions: dividend yield of 0%; expected term of 9.73 years; expected volatility of 79.74%; and risk-free interest rate of 1.74%. The fair value of the unvested options is remeasured at each balance sheet reporting date and is recognized over the related service period using the straight-line method.

| 14 |

ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the condensed consolidated financial statements and the related notes included elsewhere herein and in our consolidated financial statements, accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report (as defined below).

Forward-Looking Statements

The statements contained in this Quarterly Report on Form 10-Q that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “planned expenditures,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Quarterly Report on Form 10-Q. Additionally, statements concerning future matters are forward-looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements, or industry results, expressed or implied by such forward-looking statements. Such forward-looking statements include, among other statements, statements regarding the following:

| ● | the expected development and potential benefits from our products in treating diabetes; |

| ● | our research and development plans, including pre-clinical and clinical trials plans, the timing of conclusion of trials and trials’ results; |

| ● | our expectations regarding our short- and long-term capital requirements; |

| ● | our outlook for the coming months and future periods, including but not limited to our expectations regarding future revenue and expenses; and |

| ● | information with respect to any other plans and strategies for our business. |

Although forward-looking statements in this Quarterly Report on Form 10-Q reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended August 31, 2015, or our Annual Report, as filed with the Securities and Exchange Commission, or the SEC, on November 25, 2015, as well as those discussed elsewhere in our Annual Report and in this Quarterly Report on Form 10-Q. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Quarterly Report on Form 10-Q. Except as required by law, we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Quarterly Report on Form 10-Q. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Quarterly Report on Form 10-Q which attempts to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| 15 |

Overview of Operations

We are a pharmaceutical company currently engaged in the research and development of innovative pharmaceutical solutions, including an oral insulin capsule to be used for the treatment of individuals with diabetes, and the use of orally ingestible capsules or pills for delivery of other polypeptides.

Recent business developments

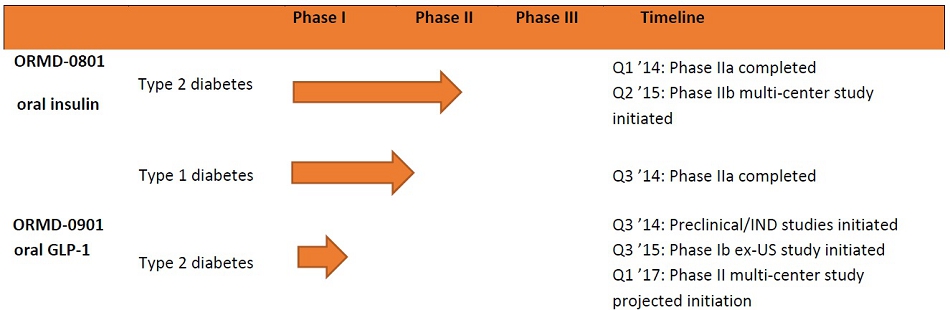

Product Candidates

We initiated a Phase IIb clinical trial on approximately 180 type 2 diabetic patients in approximately 30 sites in the United States, beginning in June 2015. This double-blind, randomized, 28-day study clinical trial is conducted under an Investigational New Drug application, or IND, with the U.S. Food and Drug Administration, or FDA. The clinical trial, designed to assess the safety and efficacy of ORMD-0801, will investigate ORMD-0801 over a longer treatment period and will have statistical power to give us greater insight into the drug’s efficacy. During April 2016, all follow-up visits of this study have been completed and we expect to report top-line results during the second quarter of calendar year 2016.

We are also conducting a glucose clamp study of our oral insulin capsule on type 2 diabetic volunteers that is performed at The University of Texas Health Science Center at San Antonio and University Health System’s Texas Diabetes Institute. The glucose clamp is a method for quantifying insulin absorption in order to measure a patient’s insulin sensitivity and how well a patient metabolizes glucose. We anticipate completing the study in the third quarter of calendar year 2016.

In September 2013, we submitted a pre-IND package to the FDA for ORMD-0901, our oral exenatide capsule, for a Phase II clinical trial on healthy volunteers and type 2 diabetic patients. We began pre-clinical studies in September 2014 and expect to begin IND-enabling studies in the first quarter of calendar year 2017. We then intend to file an IND and move immediately and directly into a large Phase II multi-center trial in the United States. In August 2015, we began a non-FDA approved clinical trial on type 2 diabetic patients, and we anticipate it will be completed during the second quarter of calendar year 2016.

| 16 |

The table below gives an overview of our product pipeline (calendar quarters):

Out-Licensed Technology

On November 30, 2015, we, our Israeli subsidiary and Hefei Tianhui Incubation of Technologies Co. Ltd., or HTIT, entered into a Technology License Agreement, and on December 21, 2015 these parties entered into an Amended and Restated Technology License Agreement, or the License Agreement. According to the License Agreement, we will grant HTIT an exclusive commercialization license in the territory of the Peoples Republic of China, Macau and Hong Kong, or the Territory, related to our oral insulin capsule, ORMD-0801. Pursuant to the License Agreement, HTIT will conduct, at its own expense, certain pre-commercialization and regulatory activities with respect to our technology and ORMD-0801 capsule, and will pay (i) royalties of 10% on net sales of the related commercialized products to be sold by HTIT in the Territory, or Royalties, and (ii) an aggregate of approximately $37.5 million, of which $3 million is payable immediately, $8 million will be paid in near term installments subject to our entry into certain agreements with certain third parties, and $26.5 million will be payable upon achievement of certain milestones and conditions. In the event that we will not meet certain conditions, the Royalties rate may be reduced to a minimum of 8%. Following the expiration of our patents covering the technology in the Territory, the Royalties rate may be reduced, under certain circumstances, to 5%. The initial payment of $3 million was received in January 2016. We also entered into a separate securities purchase agreement with HTIT, or the SPA, pursuant to which HTIT invested $12 million in us in December 2015 (see – “Liquidity and capital resources” below). In connection with the License Agreement and the SPA, we received a non-refundable payment of $500,000 as a no-shop fee.

The License Agreement and the SPA were considered a single arrangement with multiple deliverables. We allocated the total consideration of $49,500,000 between the License Agreement and the SPA according to their fair value, as follows: $10,617,000 was allocated to the issuance of shares (less of issuance expenses), based on the quoted price of our common stock on the closing date of the SPA at December 28, 2015, and $38,883,000 to the License Agreement. Amounts received relating to the License Agreement are recognized over the period from which we are entitled to the respective payment, and the expected product submission date (June 2023).

| 17 |

Results of Operations

Comparison of six and three month periods ended February 29, 2016 and February 28, 2015

The following table summarizes certain statements of operations data for the Company for the six and three month periods ended February 29, 2016 and February 28, 2015 (in thousands of dollars except share and per share data):

| Six months ended | Three months ended | |||||||||||||||

| February 29, 2016 | February 28, 2015 | February 29, 2016 | February 28, 2015 | |||||||||||||

| Revenues | $ | 125 | $ | - | $ | 125 | $ | - | ||||||||

| Research and development expenses, net | 3,208 | 2,438 | 1,307 | 1,136 | ||||||||||||

| General and administrative expenses | 1,278 | 1,138 | 730 | 538 | ||||||||||||

| Financial income, net | (153 | ) | (43 | ) | (94 | ) | (37 | ) | ||||||||

| Net loss for the period | $ | 4,208 | $ | 3,533 | $ | 1,818 | $ | 1,637 | ||||||||

| Loss per common share – basic and diluted | $ | (0.35 | ) | $ | (0.34 | ) | $ | (0.14 | ) | $ | (0.15 | ) | ||||

| Weighted average common shares outstanding | 12,112,771 | 10,482,190 | 12,652,733 | 10,826,146 | ||||||||||||

Revenues

Revenues consist of proceeds related to the License Agreement with HTIT that are recognized over the term of the License Agreement through June 2023.

Revenues for the six and three month periods ended February 29, 2016 totaled $125,000 following the meeting of the License Agreement's closing conditions during December 2015. No revenues were recorded in the six and three month periods ended February 28, 2015.

Research and development expenses

Research and development expenses include costs directly attributable to the conduct of research and development programs, including the cost of salaries, payroll taxes, employee benefits, costs of materials, supplies, the cost of services provided by outside contractors, including services related to our clinical trials, clinical trial expenses, the full cost of manufacturing drugs for use in research, and preclinical development. All costs associated with research and development are expensed as incurred.

Clinical trial costs are a significant component of research and development expenses and include costs associated with third-party contractors. We outsource a substantial portion of our clinical trial activities, utilizing external entities such as contract research organizations, or CROs, independent clinical investigators, and other third-party service providers to assist us with the execution of our clinical studies.

Clinical activities which relate principally to clinical sites and other administrative functions to manage our clinical trials are performed primarily by CROs. CROs typically perform most of the start-up activities for our trials, including document preparation, site identification, screening and preparation, pre-study visits, training, and program management.

Clinical trial and pre-clinical trial expenses include regulatory and scientific consultants’ compensation and fees, research expenses, purchase of materials, cost of manufacturing of the oral insulin capsules, payments for patient recruitment and treatment, as well as salaries and related expenses of research and development staff.

| 18 |

Research and development expenses for the six months ended February 29, 2016 increased by 32% to $3,208,000 from $2,438,000 for the six months ended February 28, 2015. The increase is mainly attributable to expenses related to clinical trials and mainly our Phase IIb clinical trial. Stock-based compensation costs for the six months ended February 29, 2016 totaled $250,000, as compared to $293,000 during the six months ended February 28, 2015.

Research and development expenses for the three months ended February 29, 2016 increased by 15% to $1,307,000, from $1,136,000 for the three months ended February 28, 2015. The increase is mainly attributable to expenses related to clinical trials and mainly our Phase IIb clinical trial. Stock-based compensation costs for the three months ended February 29, 2016 totaled $66,000, as compared to $129,000 during the three months ended February 28, 2015.

Government grants

In the six and three month periods ended February 29, 2016, we did not recognize any research and development grants, and in the six and three month periods ended February 28, 2015, we recognized research and development grants in an amount of $17,000 and $1,000, respectively. As of February 29, 2016, we had contingent liabilities to pay royalties to the Office of the Chief Scientist of the Ministry of Economy of Israel, or OCS, of $2,000. For further details see note 2 to the condensed financial statements.

General and administrative expenses

General and administrative expenses include the salaries and related expenses of our management, consulting costs, legal and professional fees, traveling, business development costs, insurance expenses and other general costs.

General and administrative expenses for the six months ended February 29, 2016 increased by 12% to $1,278,000 from $1,138,000 for the six months ended February 28, 2015. The increase in costs related to general and administrative activities during the six months ended February 29, 2016 reflects an increase in salaries and consulting expenses resulting from cash bonuses to employees and consultants for the Company's 2015 achievements. This increase was partially offset by a decrease in stock-based compensation costs and a decrease in public relations expenses. Stock-based compensation costs for the six months ended February 29, 2016 totaled $235,000, as compared to $272,000 during the six months ended February 28, 2015.

General and administrative expenses for the three months ended February 29, 2016 increased by 36% to $730,000 from $538,000 for the three months ended February 28, 2015. The increase in costs related to general and administrative activities during the three months ended February 29, 2016 derives from the same reasons described above. Stock-based compensation costs for the three months ended February 29, 2016 totaled $99,000, as compared to $136,000 during the three months ended February 28, 2015.

Financial income, net

Net financial income increased by 256% from net income of $43,000 for the six months ended February 28, 2015 to net income of $153,000 for the six months ended February 29, 2016. The increase is mainly due to an increase in income from bank deposits and held to maturity bonds.

During the three months ended February 29, 2016, net financial income increased by 154% to $94,000 from $37,000 for the three months ended February 28, 2015. This increase is mainly attributable to an increase in income from bank deposits and held to maturity bonds.

| 19 |

Other comprehensive income

Unrealized losses on available for sale securities for the six months ended February 29, 2016 and February 28, 2015 of $328,000 and $352,000, respectively, resulted from the decrease in fair value of the ordinary shares of D.N.A Biomedical Solutions Ltd., or D.N.A, that we hold.

Unrealized gains on available for sale securities for the three months ended February 29, 2016 and February 28, 2015 of $78,000 and $7,000, respectively, resulted from the increase in fair value of our D.N.A ordinary shares.

Liquidity and capital resources

From inception through February 29, 2016, we have incurred losses in an aggregate amount of $39,260,000. During that period we have financed our operations through several private placements of our common stock, as well as public offerings of our common stock, raising a total of $56,054,000, net of transaction costs. During that period, we also received cash consideration of $3,156,000 from the exercise of warrants and options. We will seek to obtain additional financing through similar sources in the future as needed. As of February 29, 2016, we had $3,230,000 of available cash, $30,846,000 of short-term and long-term bank deposits and $3,843,000 of marketable securities. We anticipate that we will require approximately $14.6 million to finance our activities during the 12 months following February 29, 2016.

On November 30, 2015, we entered into the SPA with HTIT, pursuant to which HTIT agreed to buy and we agreed to sell 1,155,367 shares of our common stock at a price of approximately $10.39 per share, for the aggregate amount of $12 million. The transaction closed on December 28, 2015.

Management continues to evaluate various financing alternatives for funding future research and development activities and general and administrative expenses through fundraising in the public or private equity markets. Although there is no assurance that we will be successful with those initiatives, management believes that it will be able to secure the necessary financing as a result of future third party investments. Based on our current cash resources, including the recent investment by HTIT, and commitments, we believe we will be able to maintain our current planned development activities and the corresponding level of expenditures for at least the next 12 months and beyond.

As of February 29, 2016, our total current assets were $26,035,000 and our total current liabilities were $1,519,000. On February 29, 2016, we had a working capital surplus of $24,519,000 and an accumulated loss of $39,260,000. As of August 31, 2015, our total current assets were $17,372,000 and our total current liabilities were $1,489,000. On August 31, 2015, we had a working capital surplus of $15,883,000 and an accumulated loss of $35,052,000. The increase in working capital from August 31, 2015 to February 29, 2016 was primarily due to proceeds from our private placement to HTIT completed in December 2015.

During the six month period ended February 29, 2016, cash and cash equivalents increased to $3,230,000 from the $3,213,000 reported as of August 31, 2015, which is due to the reasons described below.

Operating activities provided cash of $77,000 in the six month period ended February 29, 2016, as compared to $3,003,000 used in the six months ended February 28, 2015. Cash provided by operating activities in the six months ended February 29, 2016 primarily consisted of deferred revenues and stock-based compensation amounts, partially offset by net loss resulting from research and development and general and administrative expenses, while cash used for operating activities in the six months ended February 28, 2015 primarily consisted of net loss resulting from research and development and general and administrative expenses, partially offset by stock-based compensation expenses.

| 20 |

During the six month period ended February 29, 2016, we received no grants from the OCS. During the six month period ended February 28, 2015, we received $93,000 in OCS grants towards our research and development expenses, while we recognized the amount of $17,000 during such period. The amounts that were received but not recognized during the six month period ended February 28, 2015, were recognized during fiscal year 2014. The OCS supported our activity until December 2014.

Investing activities used cash of $11,942,000 in the six month period ended February 29, 2016, as compared to $2,477,000 that were used in the six month period ended February 28, 2015. Cash used for investing activities in the six months ended February 29, 2016 consisted primarily of the purchase of short-term and long-term bank deposits, as well as the purchase of marketable securities, while cash used for investing activities in the six months ended February 28, 2015 consisted primarily of the investment in short-term and long-term bank deposits.

Financing activities provided cash of $11,880,000 in the six month period ended February 29, 2016, as compared to $4,841,000 that were provided in the six month period ended February 28, 2015. Financing activities in the six month period ended February 29, 2016 and February 28, 2015 consisted of proceeds from our issuance of common stock and proceeds from exercise of warrants and options.

Off-balance sheet arrangements

As of February 29, 2016, we had no off balance sheet arrangements that have had or that we expect would be reasonably likely to have a future material effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

Our significant accounting policies are described in the notes to the consolidated financial statements as of August 31, 2015. The significant accounting policy regarding the License Agreement is described in the notes to the condensed financial statements as of February 29, 2016.

Planned Expenditures

The estimated expenses referenced herein are in accordance with our business plan. Since our technology is still in the development stage, it can be expected that there will be changes in some budgetary items. Our planned expenditures for the twelve months beginning March 1, 2016 are as follows (in thousands):

| Category | Amount | |||

| Research and development | $ | 12,670 | ||

| General and administrative expenses | 2,080 | |||

| Financial income, net | (160 | ) | ||

| Total | $ | 14,590 | ||

In June 2015, we initiated a Phase IIb clinical trial for our orally ingested insulin and we are conducting, or planning to conduct, further clinical studies, including those with regard to our oral exenatide capsule. Our ability to complete these expected activities is dependent on several major factors including the ability to attract sufficient financing on terms acceptable to us.

| 21 |

ITEM 3 - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

There has been no significant change in our exposure to market risk during the three months ended February 29, 2016. For a discussion of our exposure to market risk, refer to Part II, Item 7A, “Quantitative and Qualitative Disclosures About Market Risk,” contained in our Annual Report.

ITEM 4 - CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Our management, including our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures as of February 29, 2016. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures are effective.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the quarter ended February 29, 2016 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

ITEM 2 - UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

On February 1, 2016, we issued 3,750 shares of our common stock to Corporate Profile, LLC, or Corporate Profile, in payment of a portion of the consulting fee for investor relations services owed to Corporate Profile pursuant to a Letter Agreement, dated July 1, 2015, between us and Corporate Profile and a Stock Purchase Agreement, dated July 1, 2015, between us and Corporate Profile. We issued these shares pursuant to an exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended.

ITEM 6 - EXHIBITS

| Number | Exhibit | |

| 31.1* | Certification of Principal Executive Officer pursuant to Rule 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended. | |

| 31.2* | Certification of Principal Financial Officer pursuant to Rule 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended. | |

| 32.1** | Certification of Principal Executive Officer pursuant to 18 U.S.C. Section 1350. | |

| 32.2** | Certification of Principal Financial Officer pursuant to 18 U.S.C. Section 1350. | |

| 101.1* | The following financial statements from the Company’s Quarterly Report on Form 10-Q for the quarter ended February 29, 2016, formatted in XBRL: (i) Condensed Consolidated Balance Sheets, (ii) Condensed Consolidated Statements of Comprehensive Loss, (iii) Condensed Consolidated Statements of Changes in Stockholders’ Equity, (iv) Condensed Consolidated Statements of Cash Flows and (v) the Notes to Condensed Consolidated Financial Statements. |

| * | Filed herewith |

| ** | Furnished herewith |

| 22 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| ORAMED PHARMACEUTICALS INC. | ||

| Date: April 6, 2016 | By: | /s/ Nadav Kidron |

| Nadav Kidron | ||

| President and Chief Executive Officer | ||

| Date: April 6, 2016 | By: | /s/ Yifat Zommer |

| Yifat Zommer | ||

| Chief Financial Officer | ||

| (principal financial and accounting officer) | ||

23