Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mattersight Corp | d677688d8k.htm |

| EX-99.1 - EX-99.1 - Mattersight Corp | d677688dex991.htm |

Mattersight

Q4 2013 February 12, 2014

Earnings Webinar

Exhibit 99.2 |

Confidential

& Restricted © 2014 Mattersight Corporation

Safe Harbor Language

During today’s call we will be making both historical and

forward-looking statements in order to help you better

understand our business. These forward-looking statements

include references to our plans, intentions, expectations,

beliefs, strategies and objectives. Any forward-looking

statements speak only as of today’s date. In addition, these

forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ

materially from those stated or implied by the forward-looking

statements. The risks and uncertainties associated with our

business are highlighted in our filings with the SEC, including

our Annual Report filed on Form 10-K for the year ended

December 31, 2012, our quarterly reports on Form 10-Q, as

well as our press release issued earlier today.

Mattersight Corporation undertakes no obligation to publicly

update or revise any forward-looking statements in this call.

Also, be advised that this call is being recorded and is

copyrighted by Mattersight Corporation.

2 |

Confidential

& Restricted © 2014 Mattersight Corporation

Summary

•

Very strong Q4 financial performance

•

Continued strong growth in routing/behavioral pairing

application

•

Strengthened our Balance Sheet

•

Added Richard Dresden, a highly regarded sales executive

•

Disappointing outcome with GDIT

•

Near term focus is on growing and converting routing/pilot

pipeline

3 |

Confidential

& Restricted © 2014 Mattersight Corporation

Continued Progress in Q4

•

Bookings

-

Booked $2.0M in incremental ACV

•

Revenues

-

Recognized a record $9.2M in revenue

-

Up 7% sequentially overall

-

Up 11% sequentially for subscription revenue

•

P&L

-

Achieved a record $0.8M of positive AEBITDA

-

Achieved record gross margins of 75%, up 800 bps sequentially

•

Balance Sheet

-

Raised $6M via a PIPE; paid off all debt

-

Ended the quarter with $13.4M in cash

•

Pilots

-

Closed a record 25 new pilots, including a record 22 new PBR pilots

-

Ending pilots grew 64% sequentially to a record of 54

4 |

Confidential

& Restricted © 2014 Mattersight Corporation

2013 Financial Performance

5

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2013

2012

Yr/Yr

Change

Revenues

8,516

7,915

8,609

9,171

34,211

33,452

759

Subscription Revenues

7,189

6,442

6,802

7,572

28,004

27,256

748

Gross Margin

66%

66%

67%

75%

69%

61%

8%

AEBITDA

(1,494)

(407)

295

821

(786)

(7,128)

6,342

Ending Cash

12,480

10,875

13,740

13,392

Seq. Revenue Growth

-1%

-7%

9%

7%

Seq. Subscription Growth

4%

-10%

6%

11% |

Confidential

& Restricted © 2014 Mattersight Corporation

2013 Bookings Performance

6

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2013

2012

Yr/Yr

Change

Incremental ACV Bookings

2.4

3.7

3.8

2.0

11.9

6.5

83%

Routing Pilots

-

5

17

22

44

3

1367%

Total Pilots

3

7

17

25

52

18

189%

Converted Pilots

2

2

2

1

7

4

75%

Ending Pilots

19

22

33

54

54

18

200%

Pilot Follow On ACV

9.5

11.8

21.0

28.2

28.2

10.7

164%

New Logos

1

6

9

15

31

7

343% |

Confidential

& Restricted © 2014 Mattersight Corporation

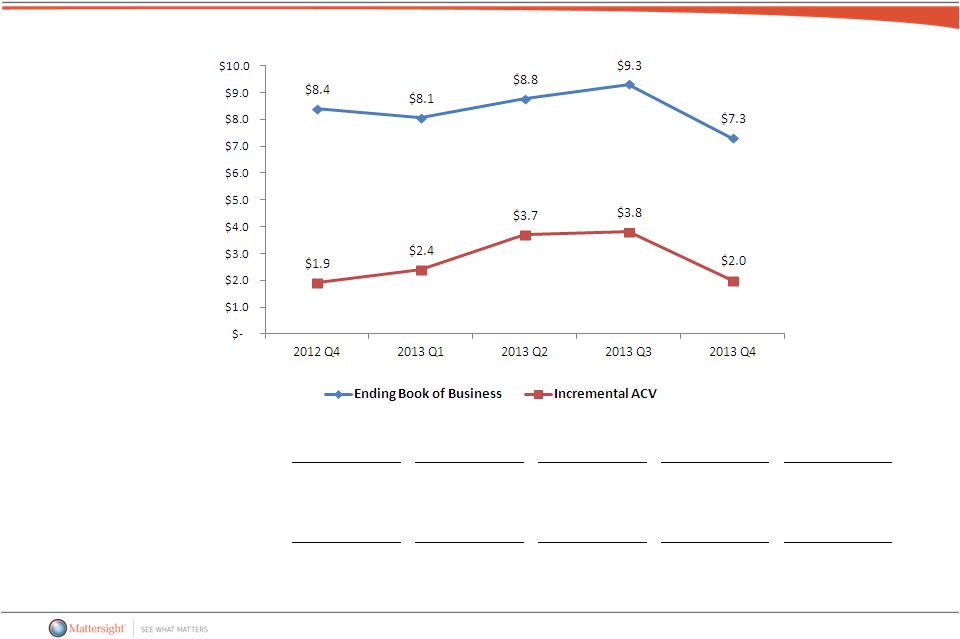

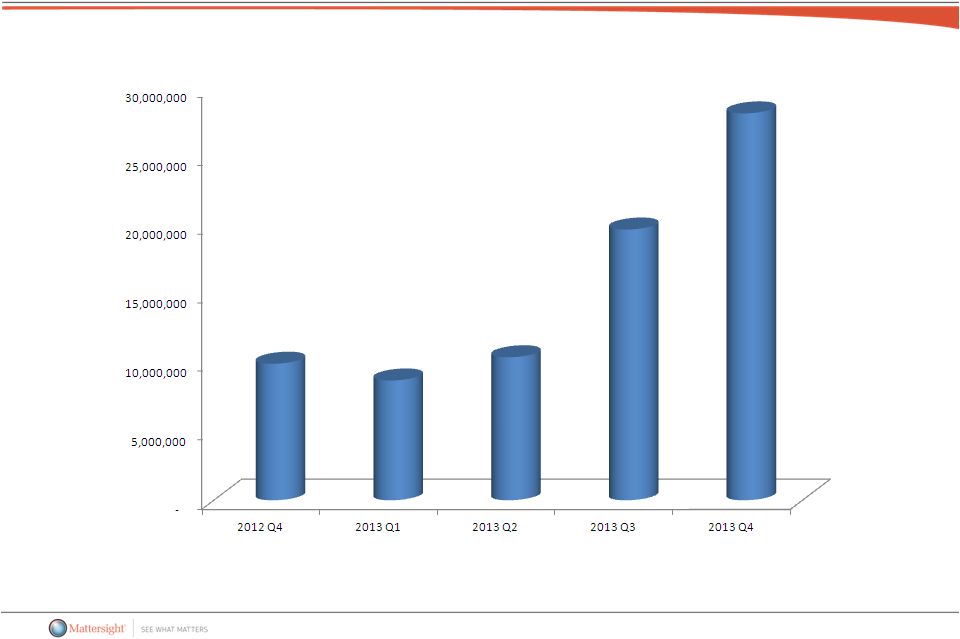

Incremental ACV / Ending Quarter Book of Business

7

2012 Q4

2013 Q1

2013 Q2

2013 Q3

2013 Q4

Starting Book of Business

8,693

8,392

8,065

8,774

9,304

Incremental ACV

465

602

933

945

501

Deployment/Cons Run Off

(543)

(340)

(201)

(277)

(825)

Subscription ACV Adj

(223)

(589)

(23)

(138)

(1,657)

Ending Book of Business

8,392

8,065

8,774

9,304

7,323 |

Confidential

& Restricted © 2014 Mattersight Corporation

Pilot Follow On ACV

8 |

Confidential

& Restricted © 2014 Mattersight Corporation

Impact Analysis Trends

9 |

Confidential

& Restricted © 2014 Mattersight Corporation

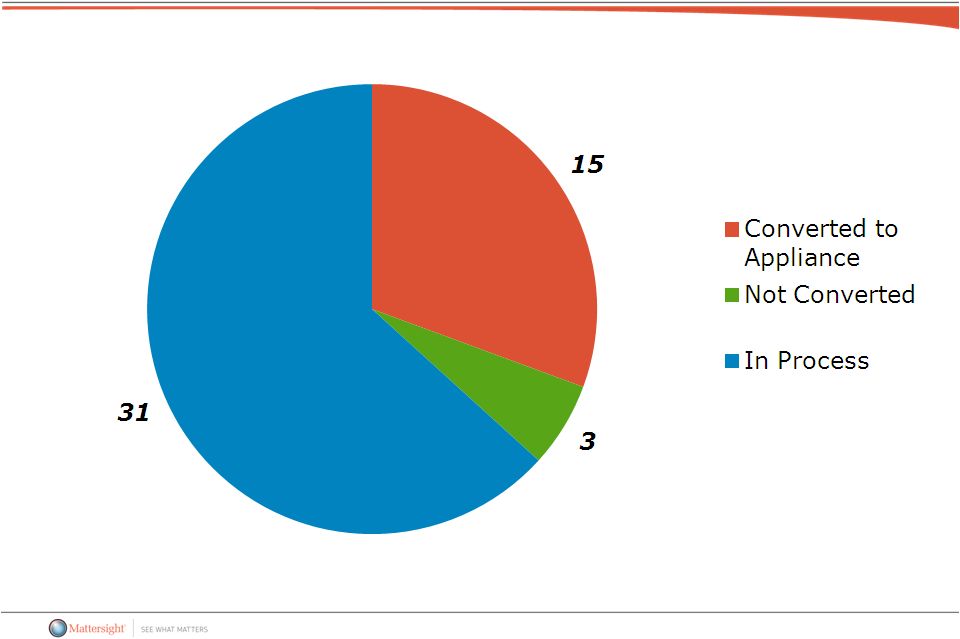

Impact Analysis Outcome Trends

10

Converted Impact Analyses include 13 direct to appliance deals |

Confidential

& Restricted © 2014 Mattersight Corporation

Appliance Deals In Process

11 |

Confidential

& Restricted © 2014 Mattersight Corporation

Introducing Richard Dresden

12

•

Following an extensive retained search, we are pleased to

announce Richard Dresden as our new EVP of Sales

•

Background Summary

-

Ran the $320M Financial Services Vertical for Savvis, where he

managed a team of 50+ sales personnel

-

At Savvis he sold large, complex solutions, including several of

the largest transactions in the company’s history

-

Strong track record as sales person and sales manager

-

The personal characteristics we wanted: keen intellect; analytical;

team values; and highly motivated to win

-

Excellent educational pedigree

•

Near Term Focus

-

In Q1 continue to build pilot pipeline

-

In Q2 begin to accelerate pilot harvest

-

Build vertical go-to-market approach for large accounts

-

Continue to grow partner channel |

Confidential

& Restricted © 2014 Mattersight Corporation

Key Metrics Going Forward

13

Metric

2014 Target

Total Rev Growth ex GDIT

25%-30%+

Subscription Growth ex GDIT

30%-35%+

Total Routing/Other Pilots

100+

Gross Margin

~70%

Routing Conversion Model

TBD |

Confidential

& Restricted © 2014 Mattersight Corporation

Business Outlook

•

Pipeline for current products remains solid

•

Very strong interest in routing

•

Q1 / Q2 Focus

-

Continued pilot / follow-on ACV growth

-

Conversions

•

FY Outlook

-

Expect GAAP revenue growth to be in the 2% -

5% range;

•

Net of GDIT expect revenue growth to be in the 25%-30%+ range

-

Will discuss any changes in expectations on a quarterly basis

-

Near term revenues will be impacted by loss of GDIT contract

14 |

Confidential

& Restricted © 2014 Mattersight Corporation

Summary

•

Very strong Q4 financial performance

•

Continued strong growth in routing/behavioral pairing

application

•

Strengthened our Balance Sheet

•

Added Richard Dresden, a highly regarded sales executive

•

Disappointing outcome with GDIT

•

Near term focus is on growing and converting routing/pilot

pipeline

15 |

Confidential

& Restricted © 2014 Mattersight Corporation

Thank You

•

Kelly Conway

-

847.582.7200

-

kelly.conway@mattersight.com

•

Mark Iserloth

-

312.454.3613

-

mark.iserloth@mattersight.com

16 |