Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CatchMark Timber Trust, Inc. | d677129d8k.htm |

RISI

Timberland Conference February 2014

Exhibit 99.1 |

1

Forward Looking Statements

This presentation contains certain forward-looking statements within the meaning of the federal

securities laws. These forward-looking statements are based on certain assumptions, discuss

future expectations, describe future plans and strategies, contain financial and operating

projections or state other forward- looking information. The Company’s ability to

predict results or the actual effect of future events, actions, plans or strategies is

inherently uncertain. Although the Company believes that the expectations reflected in such

forward-looking statements are based on reasonable assumptions, the Company’s actual results

and performance could differ materially from those set forth in, or implied by, the

forward-looking statements as a result of risks and uncertainties, including those

described in the Company’s filings with the Securities and Exchange Commission. You are

cautioned not to place undue reliance on any of these forward-looking statements, which

reflect the Company’s views on this date. Furthermore, except as required by law,

the Company is under no duty to, and does not intend to, update any of our forward- looking

statements after this date, whether as a result of new information, future events or otherwise. |

2

Annual Housing Starts vs. Real Sawtimber Prices

(starts in 000s / US$ per ton)

It’s All About Housing

Housing starts drive sawtimber prices: 1.5mm starts = $40+ sawtimber (vs. $23

today). Source: Forest Economic Advisors.

Projected Housing Starts

Projected Lumber Consumption

(starts in millions)

(BBF)

Source:

Timber Mart-South South-wide Average Sawtimber Prices.

Note:

Prices are adjusted for inflation and converted to 2013 dollars based on the

Producer Price Index (PPI).

0.8

0.9

1.2

1.4

1.6

1.8

0.5

1.0

1.5

2.0

12

13

14

15

16

17

$20

$30

$40

$50

$60

500

1,000

1,500

2,000

2,500

Total Housing Starts

Pine Sawtimber

44.4

48.5

53.2

57.7

63.0

67.3

30

40

50

60

70

80

12

13

14

15

16

17 |

3

Mountain Pine Beetle Impact Will Be Pronounced

U.S. Housing Starts vs. B.C. Interior Annual Allowable Cut

MPB epidemic is projected to lead to reduced lumber production of 20% in B.C.

Inventory of Available Live and Dead Lodgepole Pine By Years Since Attack

(Mil m³)

(starts in MMs / AAC in Mil m³)

Poor Grade of

Lumber

Lower Log

Recovery

Longer Haul

Distances

Higher Costs &

Lower Production

from B.C.

~20% Decline in B.C. Supply

~5% Decline in N. American Supply

Economic Shelf Life = 8-12 years

Source: Forest Economic Advisors.

2.1

0.6

1.5

64.1

66.9

50.7

2005

2009

Trend

Housing Starts

B.C. Interior AAC

-

200

400

600

800

1,000

1,200

1,400

1,600

99

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14

15

16

17

18

19

20

Live

<8 yrs

9-10 yrs

11-12 yrs

>12 yrs

Year |

4

17.0

13.8

-

4.0

8.0

12.0

16.0

20.0

2005

2016

Lumber Production

Eastern Canada Producers Have Multiple Challenges

Eastern Canada Lumber Production

Increased harvest restrictions and large-scale paper mill closures are projected

to lead to reduced lumber production of 20% in Eastern Canada.

Unsustainable

Harvest Levels

Higher Costs & Lower Production from

Eastern Canada

Issue

Government

Mandated Harvest

Reductions

Result

Closure of Pulp and

Paper Mills

Severely Impacted

Sawmill Economics

Net Impact

Source: Forest Economic Advisors.

~20% Decline in E. Canada Supply

~5% Decline in N. American Supply |

5

Log and Lumber Export Volume Has Surged

China has driven exponential growth in log and lumber exports from the Pacific

Northwest and British Columbia, respectively.

U.S. Pacific Northwest Log Exports

British Columbia Lumber Exports (excl. U.S.)

(BBF)

(BBF)

Source: Forest Economic Advisors.

Source: Forest Economic Advisors.

-

0.5

1.0

1.5

2.0

02

03

04

05

06

07

08

09

10

11

12

13

China

Rest of World

Year

-

2.0

4.0

6.0

8.0

02

03

04

05

06

07

08

09

10

11

12

13

China

Rest of World

Year |

6

Aggregate Supply-Demand Impact Will Be Unprecedented

These supply-demand factors equate to +1.7 million housing start

equivalents. Mountain Pine Beetle Epidemic in

British Columbia

Significant Increase in Lumber and

Log Exports to China

Major Timber Supply Contractions

in Eastern Canada

Recent Upturn in U.S. Residential

Construction

Annual Supply Impact

(Housing Start Equivalents)

Annual Demand Impact

(Housing Start Equivalents)

(220,000)

(175,000)

+450,000

+890,000

Aggregate Impact on Lumber

Supply-Demand Balance

~1.74 million

Versus 2013 Starts of ~950k

Source: Forest Economic Advisors. |

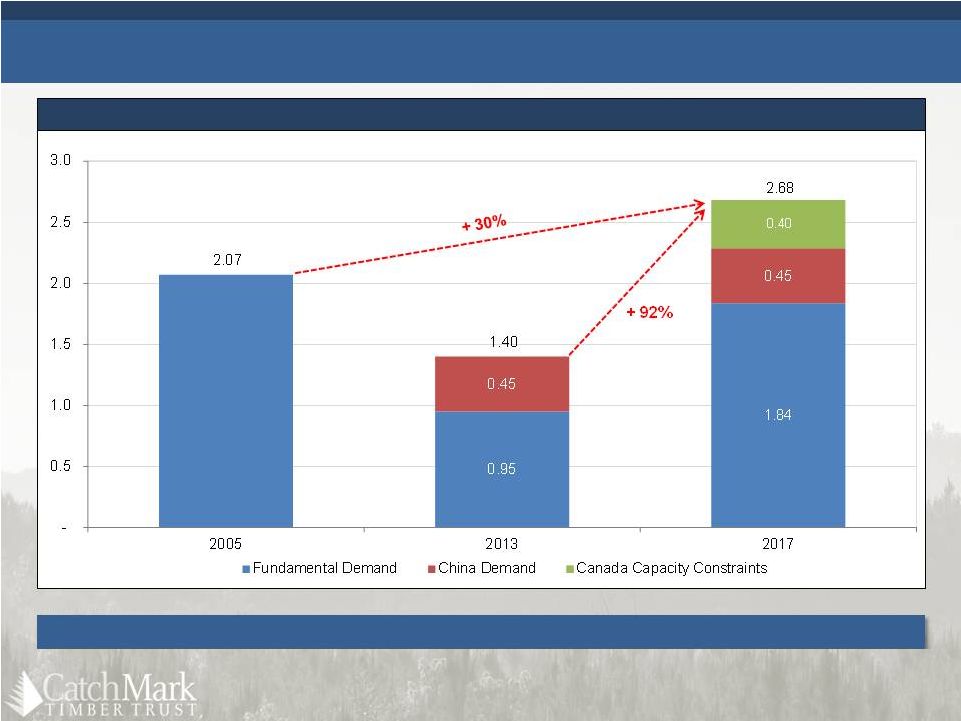

7

“Super-Cycle”

Creates New Peak

2005 vs. 2013 vs. 2017 Housing Start Equivalents

(starts in millions)

Source: Forest Economic Advisors.

New “super-cycle” peak (+30% vs. 2005) should drive significantly higher sawtimber

prices. |

8

Non-correlated asset class with inflation protection

Industry leveraged to timber “super-cycle”

Clearing house for mid-sized forests

Substantial pipeline of finite life institutional timberland portfolios

High demand fiber basket with diverse mill customers

Very strong pulpwood market

Only publicly-traded REIT invested exclusively in timberlands

Largest U.S. timber market with strong fundamentals

Significant experience in timberland investment and operations

Strong

track

record

at

TimberStar

–

acquired

$1.4

billion

of

timberlands and exited at 2.0x equity multiple within 4 years

Strategically Located Portfolio

Opportune Acquisition

Environment

CatchMark Highlights

Experienced Management

Team

“Pure Play”

U.S. South Timber

REIT

Attractive Asset Class |

Overview of CatchMark Timber Trust Holdings

280,000 acres of commercial

timberlands

247,200 fee acres

32,800 leased acres

Approximately 10.7mm tons of

merchantable timber (as of

12/31/13)

50+ mills within 100-mile radius

Delivers approximately 750

truckloads weekly

Planted 13.9mm trees since

2007 acquisition

Well-diversified species and

product mix

75% pine / 25% hardwood

by acreage

41% sawtimber / 59%

pulpwood by volume

SFI-certified

Forest Product Mills within

100-mile radius

Counties with CatchMark

Ownership

Alabama

Georgia

Note: Colors on U.S. map denote major timberland markets.

9 |

10

CatchMark is a Pure-Play Timber REIT

2012 EBITDA from Non-Timber Businesses

CatchMark will be the only pure-play, publicly-traded timber REIT with a

focus on recurring harvest cash flow.

%

of

Average

Timberland

Adjusted

EBITDA

from

Land

Sales

(1)

(1)

Data

based

on

5-year

average

data

(2008

–

2012); Timberland Adjusted EBITDA includes timber harvest EBITDA, land sales

EBITDA and non-cash basis of land sales. (2)

Weyerhaeuser does not provide disclosure on land sales.

52%

9%

63%

11%

25%

0%

0%

20%

40%

60%

80%

100%

WY

PCL

RYN

PCH

DEL

CatchMark

% of Total EBITDA

NA

64%

43%

44%

24%

25%

0%

10%

20%

30%

40%

50%

60%

70%

80%

WY

PCL

RYN

PCH

DEL

CatchMark

% of Timberland Adj. EBITDA

(2) |

11

(1)

Gross proceeds of $163 million less fees and expenses of $14.4 million.

(2)

Based on price as of 2/6/2014.

(3)

Based on debt divided by (debt plus equity market cap).

$150mm committed, multi-draw acquisition

facility with accordion up to $225mm

Grid pricing overview:

LOC / Term Loan: L+150 to L+275

Acquisition Facility: L+175 to L+300

+ 20 to 35 bps commitment fee

$15mm revolver (undrawn)

Debt remaining post-IPO converted to term

loan

Conservative Capital Structure with Embedded Growth Capacity

CatchMark has low leverage with over $200 million of embedded leverage / acquisition

capacity.

($ in 000s)

9/30/2013

Pro Forma

(1)

New Credit Facility Overview

Cash & Cash Equivalents

$12,467

Total Debt

32,254

Net Debt

$19,787

Preferred Stock

–

Stockholders' Equity

303,794

Equity Market Cap.

(2)

$337,242

Debt to Total Market Cap.

(3)

8.7% |

12

Historical Timberland Transaction Volume

($ in millions)

Timberland M&A Activity Is Picking Up

Significant TIMO owned portfolios acquired in 2003 –

2008 expected to re-enter the market.

Source: Forest Economic Advisors.

2003 –

2008 Volume = $35 billion

$680

$1,634

$2,032

$3,767

$3,074

$6,130

$8,458

$8,391

$4,901

$1,949

$1,060

$1,337

$3,404

$3,853

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013 |

Timely Growth Opportunity

Cyclical buying opportunities in timberland

Significant upside potential from improving market dynamics

Substantial pipeline of finite life institutional timberland

portfolios

Focus on key U.S. South and Pacific Northwest regions

Target well-stocked properties capable of generating stable cash flow

Utilize attractive cost of capital

Senior team with deep and proven timber investing experience

Strong management track record and historical investor returns

$1.4 billion capital invested, 1.4x capital returned, 2.0x equity returned

Opportunity / Timing

Strategy

Track Record

CatchMark is well-positioned to execute its growth strategy and leverage the

anticipated sector recovery.

13 |

14

Conclusion / Key Takeaways

Proactive asset management philosophy and value maximization mindset

Significant experience investing in and operating timberlands

Track record of delivering strong investor returns

Non-correlated asset class, inflation protection, direct play on housing

recovery Stable and predictable cash flows with significant upside

potential Excellent anchor asset located in competitive fiber basket

Pure-play timber REIT focused on timberland operations

Balance sheet capacity and pipeline to grow accretively

Strong governance structure with industry best practices

Valuation at discount to recent private market transaction precedents

Represents attractive entry point with significant upside from industry

“super-cycle” Asset

Team

Platform

CatchMark represents a compelling opportunity.

Valuation |

|