Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d671902d8k.htm |

Third Quarter FY14

Earnings Presentation

Bristow Group Inc.

February 7, 2014

Exhibit 99.1 |

2

Third quarter earnings call agenda

Introduction

CEO remarks and operational highlights

Current and future financial performance

Closing remarks

Questions and answers

Linda McNeill, Director Investor Relations

Bill Chiles, President and CEO

Jonathan Baliff, SVP and CFO

Bill Chiles, President and CEO |

3

Forward-looking statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

include

statements

about

our

future

business,

operations,

capital

expenditures,

fleet

composition,

capabilities

and

results;

modeling

information,

earnings

and

adjusted

earnings

growth

guidance,

expected

operating

margins,

cash

flow

stability

and

other

financial

projections;

future

dividends,

share

repurchases

and

other

uses

of

excess

cash;

plans,

strategies

and

objectives

of

our

management,

including

our

plans

and

strategies

to

grow

earnings

and

our

business,

our

general

strategy

going

forward,

our

business

model

and

our

operational

excellence

initiative;

expected

actions

by

us

and

by

third

parties,

including

our

customers,

competitors

and

regulators;

impact

of

grounding

and

the

effects

thereof;

the

valuation

of

our

company

and

its

valuation

relative

to

relevant

financial

indices;

assumptions

underlying

or

relating

to

any

of

the

foregoing,

including

assumptions

regarding

factors

impacting

our

business,

financial

results

and

industry;

expected

input

of

our

investment

in

Eastern

Airways;

and

other

matters.

Our

forward-looking

statements

reflect

our

views

and

assumptions

on

the

date

of

this

presentation

regarding

future

events

and

operating

performance.

They

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

many

of

which

may

be

beyond

our

control,

that

may

cause

actual

results

to

differ

materially

from

any

future

results,

performance

or

achievements

expressed

or

implied

by

the

forward-looking

statements.

These

risks,

uncertainties

and

other

factors

include

fluctuations

in

the

demand

for

our

services;

fluctuations

in

worldwide

prices

of

and

demand

for

natural

gas

and

oil;

fluctuations

in

levels

of

natural

gas

and

oil

exploration

and

development

activities;

the

impact

of

competition;

actions

by

customers;

the

risk

of

reductions

in

spending

on

helicopter

services

by

governmental

agencies;

changes

in

tax

and

other

laws

and

regulations;

changes

in

foreign

exchange

rates

and

controls;

risks

associated

with

international

operations;

operating

risks

inherent

in

our

business,

including

the

possibility

of

declining

safety

performance;

general

economic

conditions

including

the

capital

and

credit

markets;

our

ability

to

obtain

financing;

the

risk

of

grounding

of

segments

of

our

fleet

for

extended

periods

of

time

or

indefinitely;

our

ability

to

re-deploy

our

aircraft

to

regions

with

greater

demand;

our

ability

to

acquire

additional

aircraft

and

dispose

of

older

aircraft

through

sales

into

the

aftermarket;

the

possibility

that

we

do

not

achieve

the

anticipated

benefit

of

our

fleet

investment

program;

availability

of

employees;

political

instability,

war

or

acts

of

terrorism

in

any

of

the

countries

where

we

operate;

and

those

discussed

under

the

captions

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

in

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

March

31,

2013

and

our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

December

31,

2013.

We

do

not

undertake

any

obligation,

other

than

as

required

by

law,

to

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise. |

4

Chief Executive Officer comments

Bill

Chiles,

President

and

CEO |

Operational safety review

* Includes consolidated commercial operations only

Total Recordable Injury Rate* per 200,000

man hours (cumulative)

Lost Work Case Rate

*

per 200,000

man hours (cumulative)

Commercial Air Accident Rate

*

per 100,000

flight hours (fiscal year)

FY13

FY14

FY13

FY14

5 |

6

Q3 FY14 highlights

*

Adjusted

EPS

and

adjusted

EBITDAR

amounts

exclude

gains

and

losses

on

dispositions

of

assets

and

any

special

items

during

the

period.

See

reconciliation

of

these

items

to

GAAP

measures

in

the

appendix

hereto

and

in

our

earnings

release

for

the

quarter

ended

December

31,

2013.

** Please see our earnings release for more information regarding earnings

guidance. •

Q3 operating revenue of $373.6M (7.8% increase from Q3 FY13, 1.3% decrease from Q2

FY14) •

Q3

GAAP

EPS

of

$0.51

(49%

decrease

from

Q3

FY13,

83.1%

decrease

from

Q2

FY14)

•

Q3

adjusted

EPS*

of

$0.85

(27.4%

decrease

from

Q3

FY13,

33.1%

decrease

from

Q2

FY14)

•

Q3

adjusted

EBITDAR*

of

$100.7M

(7.8%

decrease

from

Q3

FY13,

7.2%

decrease

from

Q2

FY14)

•

Good top-line growth in Q3 FY14 with a decrease in adjusted EBITDAR and adjusted

EPS driven by contract start up timing, increases in maintenance

and other expenses

•

GAAP EPS of $0.51 includes the impact of a tax payment Líder made to the

Brazilian government equal to $0.34 per share; adjusted EPS is $0.85

•

Total liquidity was $617.2 million even after year-to-date ~$526.0 million

capex •

Adjusted EPS guidance for full FY14 is reaffirmed at $4.25 -

$4.55** with costs incurred

in Q3 expected to be recovered in Q4 FY14 as several a/c begin revenue service

|

7

•

Europe contributed 44% of Bristow operating revenue

and 48% of adjusted EBITDAR* in Q3 FY14

•

Operating revenue increased to $158.5M in Q3 FY14

from $124.4M in Q3 FY13 with the net addition of

eight

LACE and an overall increase in activity under

new contracts over the comparable quarter

•

Adjusted EBITDAR increased to $56.0M in Q3 FY14

from $49.1M in Q3 FY13 but adjusted EBITDAR

margin decreased to 35.3% in Q3 FY14 from 39.5%

in Q3 FY13 due to higher maintenance and salary

costs

Outlook:

New oil and gas presence in Sumburgh positions us

for new growth opportunities west of Shetlands

Tenders for four LACE are ongoing in the UK and

two new technology SAR a/c in the Netherlands

expected in FY15

Industry-wide UK Parliamentary inquiry on

helicopter safety is ongoing

FY14 adjusted EBITDAR margin expected

to be ~ mid thirties

Europe (EBU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other |

8

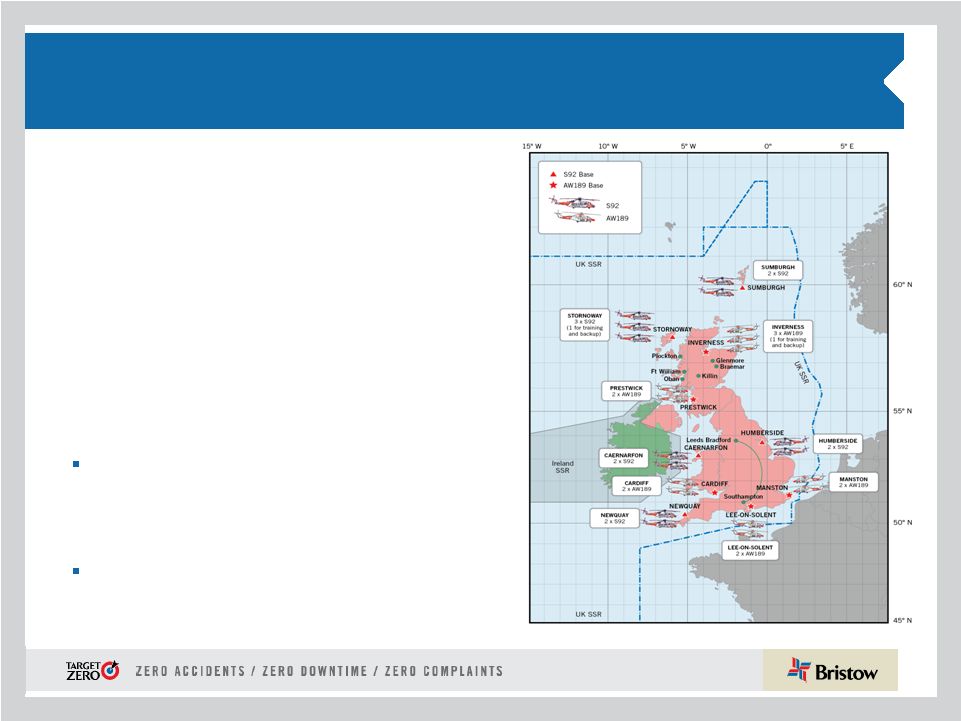

UK SAR update

•

From the start of the GAP SAR contract in

June 1, 2013 through December 31, 2013, we

have conducted 169 missions and rescued

and/or assisted 151 persons

•

Sumburgh and Stornoway bases generated

$12.1M of revenue in Q3 FY14 and $25.1M

since the beginning of the contract

•

Construction of first two UK SAR bases in

Inverness and Humberside to commence

in Q4 FY14

Outlook:

Assigned purchase contract for seven SAR

S-92s this quarter as part of completing the

leases for all 11 S-92s expected in

Q4 FY14

Expect to complete lease financing of the

remaining seven SAR a/c by Q4 FY15 |

9

CHANGE:

Bristow

Helicopters

is

making

an

investment

in

Eastern

Airways,

a UK regional fixed-wing oil and gas focused transport company

•

Bristow Helicopters Limited (Bristow Helicopters)

purchased a 60% interest in the privately owned

Eastern Airways International Limited (Eastern

Airways)

•

Eastern Airways is a regional fixed-wing operator

with both charter and scheduled flights servicing

UK oil and gas industry transport from its main

operational hub in Aberdeen

•

Bristow Helicopters investment is £27M with a

possible £6M earn out over three years and

includes:

A 60% interest in Eastern Airways with

proportional voting and economic rights, with

the existing owners retaining the remaining

40%

30 fixed-wing aircraft

Financial results from Eastern Airways will be

consolidated within Bristow’s EBU

This investment will strengthen our ability to provide a complete suite of

point- to-point transportation services for our existing European based

passengers |

10

Charter services

Scheduled services

Eastern Airways provides scale, stability and positive financial

impact (with less capital) for EBU

This investment expands helicopter services in certain areas like the Shetland

Islands and will create a more integrated logistics solution for our global

clients •

Bristow Helicopters and Eastern Airways are

culturally

aligned

with

shared

core

values

of

safety,

quality

and

service

•

Bristow Helicopters and Eastern Airways have a

long

standing

relationship

working

together

on

several

contracts,

including

the

IAC

Scatsta

contract

•

Bristow Helicopters and Eastern Airways

together

are

positioned

to

facilitate

and

expand

passengers’

transport

experience

from

home

to

offshore

bases,

a

market

niche

underserved

by

major

airlines

•

Eastern Airways has recently been awarded

a contract by a major oil company to provide fixed

wing services to Sumburgh to be combined with

separately awarded Bristow Helicopters contract

•

Financially

relatively

small

investment

with

expected

positive

EBITDAR,

BVA

and

EPS

impact

See

10-Q

Note

2

“Variable

interest

entities

and

other

investments

in

significant

affiliates”

for

more

information |

11

West Africa (WASBU)

•

Nigeria contributed 22% of Bristow operating

revenue and 23% of adjusted EBITDAR* in

Q3 FY14

•

Operating revenue increased by 3.8% to $79.4M in

Q3 FY14 from $76.5M in Q3 FY13 due to improved

pricing, ad hoc flying and increased activity

•

Adjusted EBITDAR decreased slightly to $26.6M in

Q3 FY14 from $26.8M in Q3 FY13 and adjusted

EBITDAR margin decreased to 33.5% in Q3 FY14

vs. 35.0% in Q3 FY13 due to an increase in salaries

and benefits

Outlook:

New projects still on hold pending the clarification

of the Petroleum Industry Bill

Continued renewal of existing contracts

Tenders for new a/c are expected to be issued in

Q1 FY15

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other FY14 adjusted EBITDAR margin

expected to be ~ low thirties |

12

•

North America contributed 15% of Bristow operating

revenue and 16% of adjusted EBITDAR* in Q3 FY14

•

Operating revenue decreased to $54.9M in Q3 FY14

from $59.3M in Q3 FY13 primarily due to a decline in

the number of small a/c on contract

•

Adjusted EBITDAR increased 5% to $18.2M in

Q3 FY14 vs. $17.3M in Q3 FY13 and adjusted

EBITDAR margin increased to 33.1% vs. 29.1% in

Q3 FY13 due to higher equity earnings from our

investment in Cougar

Outlook:

Expecting to exit completely out of our non-core

business in Alaska by Q2 FY15

We continue to divest small a/c as part of our

restructuring to serve clients’

deep water needs

Tender issued by major IOC for a long term

contract of two to three LACE with a start date in

Q4 FY15

FY14 adjusted EBITDAR margin

expected to be ~ low thirties

North America (NABU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other Bristow operated bases

Cougar operated bases |

13

Australia (AUSBU)

•

Australia contributed 10% of Bristow operating

revenue and 4% of adjusted EBITDAR* in

Q3 FY14

•

Operating revenue decreased to $34.6M in

Q3 FY14 from $41.6M in Q3 FY13 due to the

ending of short term contracts and the negative

impact of foreign currency exchange rates

•

Adjusted EBITDAR decreased to $5.2M in

Q3 FY14 from $11.4M in Q3 FY13 and adjusted

EBITDAR margin decreased to 15.0% in Q3 FY14

from 27.3% in Q3 FY13 due to costs incurred in

anticipation of contracts that are due to start in

Q4 FY14 and FY15, including INPEX

Outlook:

Two LACE arrived in the region and have

started new work

New oil and gas SAR opportunities

Awaiting award decision for three LACE for

exploration opportunity in the Great Australian

Bight starting in January 2016

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other Great

Australian

Bight

FY14 adjusted EBITDAR margin

expected to be ~ low twenties |

14

Other International (OIBU)

Other International (OIBU)

•

Other International contributed 9% of Bristow operating

revenue and 9% of adjusted EBITDAR* in Q3 FY14

•

Operating revenue decreased to $30.8M in Q3 FY14 vs.

$32.0M in Q3 FY13 due to a decline in aircraft on contract

in Malaysia

•

Adjusted EBITDAR decreased to $10.2M in Q3 FY14 from

$17.8M in Q3 FY13 and adjusted EBITDAR margin

decreased to 33.2% in Q3 FY14 from 55.7% in Q3 FY13

due to a decline in aircraft on contract in Malaysia, a change

in the Líder equity pickup and costs incurred in Tanzania

mobilization that will be recovered in the future periods

•

A loss in unconsolidated earnings from Líder of $17.1M in

Q3 FY14 vs. $4.2M earnings in Q3 FY13 due to a $19.3M

reduction in earnings resulting from a tax payment Líder

made to the Brazilian government

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other Consolidated in OIBU

Unconsolidated Affiliate

Outlook:

FY14 adjusted EBITDAR margin expected to be ~ low to mid forties

Additional new opportunities in North and East African markets

and Russia

Two additional AW139 a/c are being deployed to Trinidad as part of the fleet

renewal Petrobras

is

expected

to

issue

a

bid

for

two

to

four

LACE

SAR

starting

in

CY15

–

CY16

Opportunities

for

oil

and

gas

and

SAR

in

the

Falkland

Islands

starting

in

CY15

–

CY16 |

15

Financial discussion

Jonathan

Baliff,

SVP

and

CFO |

16

$109.2

$100.7

$3.2

$1.8

$3.5

Q3 FY13

Operations

Corporate and Other

FX Changes

Q3 FY14

Financial highlights Q3:

Adjusted EPS and adjusted EBITDAR summary

Q3 FY13 to Q3 FY14 adjusted EPS bridge

Q3 FY13 to Q3 FY14 adjusted EBITDAR bridge (in millions)

$1.17

$0.85

$0.01

$0.25

$0.08

Q3 FY13

Operations

Corporate and Other

FX Changes

Q3 FY14

* Adjusted EPS and EBITDAR amounts exclude gains and losses on dispositions of

assets and any special items during the quarter. See reconciliation of these

items to GAAP in the appendix hereto and in our earnings release for the

quarter ended December 31, 2013. |

17

$278.0

$311.0

$33.0

$5.2

$5.2

YTD FY13

Operations

Corporate and Other

FX Changes

YTD FY14

$2.77

$3.11

$0.33

$0.11

$0.10

YTD FY13

Operations

Corporate and Other

FX Changes

YTD FY14

Financial highlights YTD:

Adjusted EPS and adjusted EBITDAR summary

YTD FY13 to YTD FY14 adjusted EPS bridge

YTD FY13 to YTD FY14 adjusted EBITDAR bridge (in millions)

* Adjusted EPS and EBITDAR amounts exclude gains and losses on dispositions of

assets and any special items during the nine months ended December 31, 2013 and 2012. See reconciliation of these items to GAAP in the appendix

hereto and in our earnings release for the quarter ended December 31, 2013.

|

18

LACE and LACE rate continue to increase led by

new technology a/c and improved utilization/terms

FY14

average

LACE

guidance

of

160

-

164

and

average

LACE

rate

guidance

of

$8.95

-

$9.25

are

reaffirmed

* See appendix hereto for more information on LACE and LACE rate.

Consolidated commercial aircraft, LACE and LACE rate exclude Bristow Academy, affiliate a/c, aircraft

held for sale, a/c construction in progress, and reimbursable revenue.

|

19

Combination of revenue growth and capital efficiency

drives quarterly BVA improvement

* Bristow Value Added (BVA) is calculated by taking gross cash flow less the

product of gross operating assets times a capital charge of 10.5%. Example calculation for

Q3 FY14, Q2 FY14, Q3 FY13 and Q2 FY13 can be found in the appendix hereto.

Absolute BVA* Q3 FY12 –

Q3 FY14

•

Q3 FY14 BVA is positive $12.1M, an improvement of $2.8M over Q3 FY13

•

YTD FY14 consolidated BVA is positive $36.0M, a $22.7M increase from YTD

FY13 •

Year-over-year change in BVA is driven by:

Margin improvement due to strong performance from Europe and West Africa

Benefit from FBH sale

Lider contributed $14.4M to the YTD BVA |

20

Our progress on BVA yields stronger liquidity for

growth . . .

Net cash provided by operating activities*

*

See

10-Q

for

more

information

on

cash

flow

provided

by

operating

activities

Total liquidity

178 |

21

…

with FY14 guidance reaffirmed

•

FY14

adjusted

EPS

guidance

reaffirmed

to

$4.25

-

$4.55,

excluding special items and a/c sales. Other specific items

include:

* Assuming FY14 revenue earned in same regions and same mix as in FY13

Long term adjusted EPS growth of 10 -

15% combined with a 20 -

30%

dividend payout policy reflects management’s commitment to deliver a

more stable, growing and predictable total return for shareholders

Average LACE

~160 - 164

Interest expense

~ $30 - $35M

Average LACE rate

~ $8.95 - $9.25M

Rent expense (a/c only)

~$85 - $90M

G & A expense (all inclusive)

~ $175 - $185M

Tax rate*

~ 20 - 24%

Depreciation expense

~ $90 - $95M

Adj. EPS guidance

$4.25 - $4.55

FY14 guidance |

22

5 Fleet

Types

Moving forward with Operational Excellence:

The efforts have been ongoing at Bristow since 2012

•

Since

February

2012,

we

have

focused

on

an

integrated

company-wide

project

to

move

Bristow

towards

Operational

Excellence

through

standardization

and

simplification.

Our

first

efforts

include:

eFlight (Flight Operations Applications)

SAP (Business Management Applications) will replace a much older

application (IFS)

Applications integrate with our clients and original equipment manufacturers

•

These

efforts

are

primarily

meant

to

reduce

risk

and

reinforce

our

long

term

10-15%

adjusted

EPS

growth

through BVA and EPS accretion

•

Significant business transformation work is also underway

Integrated operations planning

Inventory optimization

•

Fleet rationalization and simplification:

Today

In ~ 5 Years

In ~ 10 Years

28 Fleet

Types

8 Fleet

Types |

23

Conclusions

•

Safety continues to be our #1 core value as we strive to achieve

Target Zero and participate in industry efforts to share best

practices

•

Revenue growth continues as clients turn to Bristow as their

provider of choice due to our global reach, financial strength, and

ongoing Operational Excellence performance

•

Although the third quarter results were lower year-over-year and

sequentially, some of this was expected, which is why we have

confidence in annualized FY14 results within our guidance range

•

Bristow Helicopters’

investment in Eastern Airways expands

services in certain areas like the Shetland Islands and creates a

more integrated logistics solution for our global clients

|

24

Appendix |

25

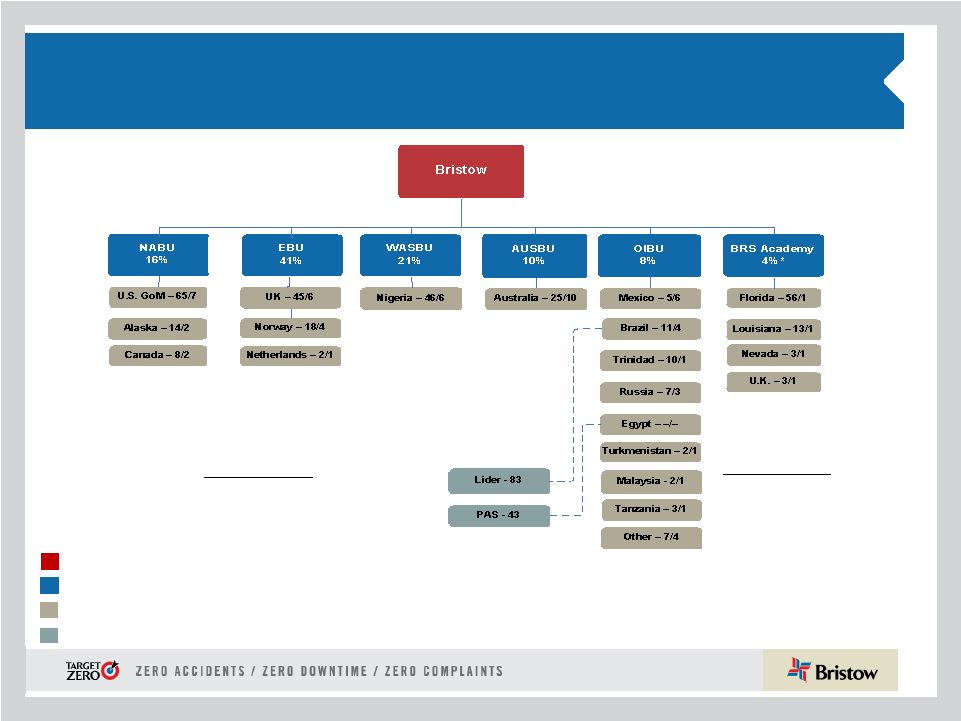

Organizational chart -

as of December 31, 2013

Business

Unit

(%

of

Q3

FY14

operating

revenue)

Corporate

Region

(

#

of

a/c

/

#

of

Locations)

Joint

Venture

(#

of

a/c)

Key

Operated Aircraft

Bristow owned and/or operated 345

aircraft as of December 31, 2013

Affiliated Aircraft

Bristow affiliates and joint

ventures operated 126 aircraft

as of December 31, 2013

* Includes corporate and other |

26

Aircraft Fleet –

medium and large

as of December 31, 2013

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 16-25 passengers

Mature Aircraft

Fair

market

value

of

our

owned

fleet

is

~$1.9

billion

and

leased

fleet

is

~$900

million

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332 L Super Puma

18

Twin Turbine

19

-

19

-

AW189

16

Twin Turbine

-

-

-

17

EC175

16

Twin Turbine

-

-

-

5

EC225

19

Twin Turbine

20

-

20

3

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

56

7

63

10

104

7

111

35

LACE

102

Medium Helicopters

AW139

12

Twin Turbine

14

2

16

4

Bell 212

12

Twin Turbine

-

14

14

-

Bell 412

13

Twin Turbine

28

17

45

-

EC155

13

Twin Turbine

1

-

1

-

Sikorsky S-76A/A++

12

Twin Turbine

4

5

9

-

Sikorsky S-76C/C++

12

Twin Turbine

51

34

85

-

Sikorsky S-76D

12

Twin Turbine

2

-

2

8

100

72

172

12

LACE

48 |

27

Aircraft Fleet –

small, training and fixed

as of December 31, 2013 (continued)

Mature Aircraft

Small capacity 4-7 passengers

Training capacity 2-6 passengers

* LACE does not include held for sale, training helicopters and fixed wing

Next Generation Aircraft

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

AS350BB

4

Turbine

-

2

2

-

Bell 206B

4

Turbine

1

2

3

-

Bell 206 L Series

6

Turbine

19

6

25

-

Bell 407

6

Turbine

36

-

36

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

3

3

6

-

63

13

76

-

LACE

13

Training Helicopters

AS 355

5

Twin turbine

3

-

3

-

Bell 206B

4

Single Engine

12

-

12

-

Robinson R22

2

Piston

10

-

10

-

Robinson R44

4

Piston

5

-

5

-

Sikorsky 300CB/CBi

2

Piston

44

-

44

-

Fixed Wing

1

-

1

-

75

-

75

-

Fixed Wing

3

34

37

-

Total

345

126

471

47

TOTAL LACE (Large Aircraft Equivalent)*

162 |

28

Operating lease strategy: lowering the cost and amount of

capital needed to grow

•

Of the 81 a/c currently leased in our fleet, 52 are commercial (39 LACE) and 29

are training

•

39 LACE a/c represent approximately 24% of our commercial fleet

•

Our

goal

is

for

commercial

fleet

operating

leases

to

account

for

approximately

30-35% of our LACE

Leased aircraft as of December 31, 2013

* The percentage of LACE leased is calculated by taking the total LACE for leased

aircraft divided by the total LACE for all aircraft we operate, including both owned and leased aircraft.

See

10-Q

Note

5

“Commitments

and

contingencies”

for

more

information

provided

on

operating

leases.

Small

Medium

Large

Total

Leased LACE

Total LACE

% Leased

EBU

-

1

21

22

22

59

37%

WASBU

-

1

1

2

2

22

7%

NABU

4

13

3

20

11

34

31%

AUSBU

2

2

4

8

6

20

28%

OIBU

-

-

-

-

-

28

-

Total

6

17

29

52

39

162

24%

* |

29

Consolidated fleet changes and aircraft sales for

Q3 FY14

See

10-Q

Note

5

“Commitments

and

contingencies”

for

more

information

provided

on

operating

leases.

Additionally, during Q3 FY14 we sold six aircraft for $72.4M, which we subsequently

leased back. Leased aircraft in consolidated fleet

Small

Medium

Large

Training

Total

EBU

-

1

21

-

22

WASBU

-

1

1

-

2

NABU

4

13

3

-

20

AUSBU

2

2

4

-

8

OIBU

-

-

-

-

-

Academy

-

-

-

29

29

Total

6

17

29

29

81

Q1 FY14

Q2 FY14

Q3 FY14

YTD

Fleet Count Beginning

351

353

350

351

Delivered

Large

3

2

4

9

Medium

2

3

3

8

Total Delivered

5

5

7

17

Removed

Sales

(4)

(4)

(11)

(19)

Other*

1

(4)

(1)

(4)

Total Removed

(3)

(8)

(12)

(23)

353

350

345

345

* Includes lease returns and commencements

Fleet changes

Held for sale aircraft in consolidated fleet

Small

Medium

Large

Training

Total

EBU

-

-

2

-

2

WASBU

-

2

-

-

2

NABU

11

-

-

-

11

AUSBU

-

-

-

-

-

OIBU

1

3

-

-

4

Academy

-

-

-

2

2

Total

12

5

2

2

21

# of a/c Sold

Cash

received*

Q1 FY14

4

2.0

$

Q2 FY14

4

7.9

Q3 FY14

11

14.3

Total

19

24.2

$

* Amounts stated in millions |

30

Op revenue

1

LACE

LACE rate

2,3

EBU

$452

59

$10.30

WASBU

231

22

14.17

NABU

174

34

6.75

AUSBU

108

20

7.21

OIBU

95

28

4.58

Total

$1,091

162

$8.97

Operating Revenue, LACE, and LACE rate by BU

as of December 31, 2013

Operating revenue, LACE and LACE rate by BU

4

1)

$ in millions

2)

LACE rate is annualized

3)

$ in millions per LACE

4)

Excludes Bristow Academy |

31

Historical LACE by BU

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

EBU

45

45

45

42

42

43

48

46

44

46

46

45

WASBU

23

23

24

25

24

24

21

22

23

22

22

22

NABU

39

36

36

36

39

35

34

29

30

29

30

30

AUSBU

20

20

22

22

20

23

24

20

19

20

20

19

OIBU

36

34

34

35

33

33

33

38

39

38

38

34

Consolidated

163

158

161

160

157

158

159

154

154

154

155

149

Q1

Q2

Q3

Q4

Q1

Q2

Q3

EBU

47

45

51

55

57

59

59

WASBU

22

22

20

21

21

21

22

NABU

30

31

39

37

37

33

34

AUSBU

18

17

17

19

19

19

20

OIBU

32

28

27

27

27

28

28

Consolidated

147

142

154

158

161

160

162

LACE

FY11

FY12

FY10

FY13

FY14 |

32

Historical LACE rate by BU

1) $ in millions

2) LACE rate is annualized

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

EBU

$8.36

$8.28

$8.40

$8.76

$8.20

$8.50

$7.90

$8.40

$9.80

$9.60

$9.63

$10.09

WASBU

9.08

8.81

8.66

8.34

9.70

9.40

10.70

9.90

9.10

10.30

11.17

11.46

NABU

5.05

5.44

5.26

5.23

5.40

6.10

6.00

6.60

5.80

6.30

5.89

5.79

AUSBU

5.38

5.56

5.59

5.67

6.80

6.00

6.00

7.50

8.60

7.10

6.96

7.78

OIBU

3.66

4.09

4.06

3.78

3.90

4.10

4.40

3.90

3.50

3.70

3.78

4.22

Consolidated

$6.31

$6.52

$6.49

$6.45

$6.70

$6.90

$6.90

$7.10

$7.30

$7.40

$7.43

$7.89

Q1

Q2

Q3

Q4

Q1

Q2

Q3

EBU

$10.60

$11.03

$9.74

$9.13

$9.63

$9.95

$10.30

WASBU

12.35

12.24

13.71

13.28

14.26

14.62

14.17

NABU

7.05

7.11

5.84

6.12

6.34

7.13

6.75

AUSBU

8.48

9.29

9.55

8.58

8.04

7.74

7.21

OIBU

4.22

4.62

4.76

4.94

4.97

4.73

4.58

Consolidated

$8.55

$8.95

$8.49

$8.35

$8.78

$9.07

$8.97

LACE rate

1,2

FY10

FY11

FY12

FY13

FY14 |

33

Order and options book as of December 31, 2013

1)

22 large a/c on order and 13 large a/c on option are subject to the

successful development and certification of the aircraft 2)

One oil and gas full SAR /c is under contract

ORDER BOOK¹

#

Helicopter

Class

Delivery Date

Location

Contracted

1

Medium

March 2014

OIBU

1 of 1

1

Medium

March 2014

NABU

2

Large

March 2014

EBU

1 of 2

3

Medium

June 2014

OIBU

1 of 3

2

Large

June 2014

AUSBU

1 of 2

1

Large

June 2014

OIBU

1

Large

June 2014

WASBU

6

Medium

September 2014

WASBU

1

Medium

September 2014

NABU

3

Large

September 2014

EBU

2 of 3

2

1

Large

September 2014

AUSBU

1 of 1

1

Large

December 2014

EBU

1

Large

March 2015

OIBU

1

Large

March 2015

NABU

1 of 1

1

Large

March 2015

AUSBU

1

Large

March 2015

EBU

1

Large

June 2015

EBU

1

Large

June 2015

AUSBU

1

Large

September 2015

NABU

1

Large

December 2015

NABU

1

Large

March 2016

EBU

2

Large

March 2016

NABU

1

Large

June 2016

NABU

1

Large

June 2016

EBU

36

8 of 36

OPTIONS BOOK

#

Helicopter

Class

Delivery Date

2

Medium

March 2015

1

Large

June 2015

3

Medium

June 2015

3

Large

September 2015

2

Medium

September 2015

3

Large

December 2015

2

Medium

December 2015

2

Large

March 2016

3

Medium

March 2016

3

Large

June 2016

3

Medium

June 2016

4

Large

September 2016

2

Medium

September 2016

5

Large

December 2016

1

Medium

December 2016

3

Large

March 2017

1

Medium

March 2017

3

Large

June 2017

1

Medium

June 2017

3

Large

September 2017

1

Medium

September 2017

4

Large

December 2017

1

Medium

December 2017

1

Large

March 2018

57 |

34

Order and options book as of December 31, 2013

(continued)

#

Helicopter

Class

Delivery Date

Location

Contracted

3

Large

September 2014

EBU

3 of 3

2

Large

March 2015

EBU

2 of 2

2

Large

June 2015

EBU

2 of 2

2

Large

September 2015

EBU

2 of 2

2

Large

December 2015

EBU

2 of 2

11

11 of 11

UK SAR CONFIGURED ORDER BOOK |

35

Adjusted EBITDAR margin* trend

*

Adjusted

EBITDAR

excludes

special

items

and

asset

dispositions

and

margin

is

calculated

by

taking

adjusted

EBITDAR

divided

by

operating

revenue

FY11

FY12

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

EBU

29.8%

31.5%

34.6%

34.4%

32.7%

33.0%

31.4%

30.7%

36.1%

32.9%

WASBU

33.7%

36.9%

35.8%

34.3%

35.2%

29.5%

35.5%

37.2%

36.6%

35.0%

NABU

20.8%

25.8%

15.9%

8.5%

18.5%

14.3%

20.6%

14.8%

19.4%

17.3%

AUSBU

33.2%

26.1%

27.0%

31.1%

29.3%

20.2%

14.4%

23.5%

35.6%

24.3%

OIBU

18.3%

40.2%

37.4%

59.4%

39.3%

48.1%

19.1%

47.8%

42.9%

39.5%

Consolidated

23.8%

27.5%

25.9%

29.6%

26.7%

23.4%

24.0%

27.6%

31.2%

26.6%

FY13

FY14

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

EBU

32.2%

34.6%

39.5%

38.3%

36.2%

30.3%

35.3%

35.3%

WASBU

31.9%

26.5%

35.0%

31.8%

31.5%

31.3%

30.4%

33.5%

NABU

23.2%

20.7%

29.1%

29.5%

25.7%

29.2%

31.0%

33.1%

AUSBU

27.0%

28.0%

27.3%

26.0%

27.1%

17.7%

21.0%

15.0%

OIBU

36.2%

44.2%

55.7%

51.6%

46.6%

67.4%

39.3%

33.2%

Consolidated

26.3%

26.1%

31.5%

29.4%

28.3%

28.5%

28.7%

27.0% |

36

Adjusted EBITDAR* reconciliation

* Adjusted EBITDAR excludes special items and asset dispositions

Fiscal year ended,

3/31/2011

3/31/2012

($ in millions)

Q1

Q2

Q3

Q4 Full Year

Q1

Q2

Q3

Q4

Full Year

Net income

$20.9

$38.8

$42.3

$31.2

$133.3

$21.2

$3.0

$26.5

$14.6

$65.2

Income tax expense

8.5

3.3

-11.8

7.1

7.1

6.6

-1.9

7.1

2.4

14.2

Interest expense

11.1

11.5

13.8

9.9

46.2

9.0

9.5

9.8

10.0

38.1

Gain on disposal of assets

-1.7

-1.9

0.0

-5.1

-8.7

-1.4

1.6

2.9

28.6

31.7

Depreciation and amortization

19.3

21.0

21.3

27.7

89.4

22.7

25.4

22.7

25.3

96.1

Special items

0.0

0.0

-1.2

2.4

1.2

0.0

24.6

0.0

3.4

28.1

EBITDA Subtotal

58.1

72.7

64.4

73.3

268.5

58.1

62.1

68.9

84.3

273.4

Rental expense

6.6

6.1

8.7

7.7

29.2

9.0

9.1

12.8

15.1

46.0

Adjusted EBITDAR

$64.7

$78.8

$73.1

$81.1

$297.7

$67.0

$71.2

$81.8

$99.5

$319.5

3/31/2013

3/31/2014

($ in millions)

Q1

Q2

Q3

Q4 Full Year

Q1

Q2

Q3

Net income

$24.2

$30.4

$36.7

$40.4

$131.7

$26.9

$109.9

$19.0

Income tax expense

6.2

8.3

7.8

12.7

35.0

7.6

41.1

2.9

Interest expense

8.8

8.6

14.7

10.3

42.4

20.4

9.1

7.3

Gain on disposal of assets

5.3

1.3

-7.4

-7.2

-8.1

1.7

3.1

-4.0

Depreciation and amortization

21.4

23.3

24.9

26.7

96.3

22.8

23.9

23.7

Special items

2.2

-2.8

14.9

1.9

16.2

0.0

-101.8

23.5

EBITDA Subtotal

68.0

69.2

91.6

84.8

313.5

79.4

85.2

72.4

Rental expense

16.3

15.3

17.6

18.3

67.4

23.1

23.3

28.3

Adjusted EBITDAR

$84.3

$84.5

$109.2

$103.0

$381.0

$102.5

$108.5

$100.7 |

37

Bristow stock price reflects improved operational

performance and increasing shareholder returns

Note: The net asset FMV per share does not include our UK SAR aircraft

|

38

Net asset fair market value (FMV) per share

calculation as of December 31, 2013

(in millions)

(+) FMV of a/c

1,949

$

(+) FMV of leased a/c

873

(+) NBV of PPE w/o a/c

540

(+) Working capital

481

(-) LT debt

(833)

(-) Leased imputed debt

(394)

(-) Pension liability

(125)

Net asset FMV

2,492

$

# of common shares

37

Net asset FMV per share

67.71

$ |

39

Bristow Value Added (BVA)

Sample calculation for Q2 FY14 and Q2 FY13

Bristow Value Added = Gross Cash Flow –

(Gross Operating Assets X Capital Charge)

BVA

=

GCF

-

(

GOA

X

10.5%**

)

Bristow Value Added calculation for Q2 FY14

$22.4

=

$109.2*

-

(

$3,309*

X

2.625%**)

Bristow Value Added calculation for Q2 FY13

$2.1

=

$78.8*

-

(

$2,922*

X

2.625%**)

* Reconciliation for these items follows right after this

slide ** Quarterly capital charge of 2.625% is based on annual

capital charge of 10.5% |

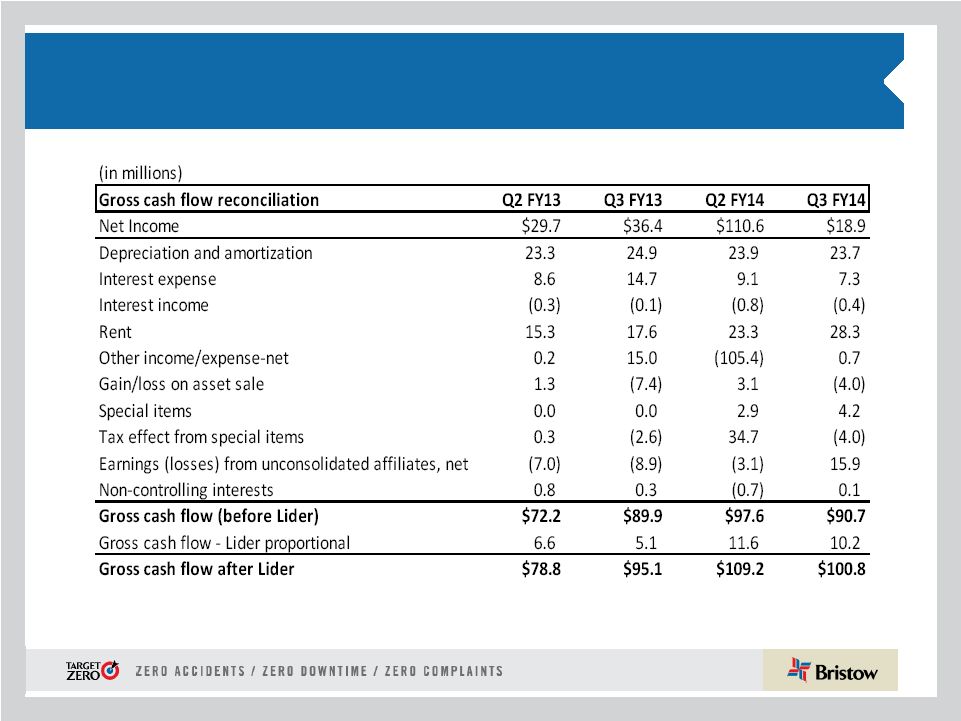

40

Bristow Value Added (BVA)

Sample calculation for Q3 FY14 and Q3 FY13

Bristow Value Added = Gross Cash Flow –

(Gross Operating Assets X Capital Charge)

BVA

=

GCF

-

(

GOA

X

10.5%**

)

Bristow Value Added calculation for Q3 FY14

$12.1

=

$100.8*

-

(

$3,378*

X

2.625%**)

Bristow Value Added calculation for Q3 FY13

$9.3

=

$95.1*

-

(

$3,269*

X

2.625%**)

* Reconciliation for these items follows right after this

slide ** Quarterly capital charge of 2.625% is based on annual

capital charge of 10.5% |

41

Gross cash flow reconciliation |

42

Adjusted gross operating assets reconciliation

(in millions)

Adjusted gross operating assets reconciliation

Q2 FY13

Q3 FY13

Q2 FY14

Q3 FY14

Total assets

$2,785

$3,051

$3,166

$3,277

Accumulated depreciation

464

480

518

530

Capitalized operating leases

225

244

373

419

Cash and cash equivalents

(348)

(232)

(314)

(323)

Investment in unconsolidated entities

(215)

(267)

(272)

(255)

Goodwill

(30)

(30)

(30)

(30)

Intangibles

(4)

(4)

(2)

(2)

Assets held for sale: net

(20)

(15)

(27)

(22)

Assets held for sale: gross

83

76

56

48

Adj. for gains and losses on assets sales

120

108

(8)

(5)

Accounts payable

(56)

(63)

(70)

(60)

Accrued maintenance and repairs

(19)

(18)

(17)

(17)

Other accrued taxes

(8)

(8)

(10)

(8)

Accrued wages, benefits and related taxes

(45)

(51)

(49)

(67)

Other accrued liabilities

(27)

(27)

(24)

(145)

Income taxes payable

(13)

(13)

(33)

(20)

Deferred revenue

(13)

(20)

(21)

(23)

ST deferred taxes

(15)

(12)

(2)

(2)

LT deferred taxes

(144)

(147)

(155)

(146)

Adjusted gross operating assets before Lider

$2,723

$3,053

$3,079

$3,150

Adjusted gross operating assets-Lider proportional

199

216

230

228

Adjusted gross operating assets after Lider

$2,922

$3,269

$3,309

$3,378 |

43

GAAP reconciliation

(i) See information about special items in 10-Q or earnings release for Q3

FY14 (ii)

These amounts are presented after applying the appropriate tax effect to each item

and dividing by the weighted average shares outstanding during the related period to calculate the earnings per share impact |

44

Leverage reconciliation

*Adjusted EBITDAR excludes gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of December 31, 2013

$

841.6

$ 1,762.9

$ 2,604.5

32.3%

Adjust for:

Unfunded Pension Liability

125.0

125.0

NPV of Lease Obligations

393.6

393.6

Letters of credit

2.4

2.4

Adjusted

$

1,362.6

(d)

$ 1,762.9

$ 3,125.5

43.6%

Calculation of debt to adjusted EBITDAR multiple

TTM Adjusted EBITDAR*:

FY 2014

$

414.0

(e)

= (d) / (e)

3.29:1 |

45

Bristow Group Inc. (NYSE: BRS)

2103 City West Blvd., 4

th

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us |