Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LyondellBasell Industries N.V. | d668076d8k.htm |

| EX-99.1 - EX-99.1 - LyondellBasell Industries N.V. | d668076dex991.htm |

Jim

Gallogly, Chief Executive Officer Karyn Ovelmen, Chief Financial Officer

Sergey Vasnetsov, SVP -

Strategic Planning and Transactions

Doug Pike, VP -

Investor Relations

Fourth-Quarter 2013 Earnings

January 31, 2014

Exhibit 99.2 |

Cautionary Statement

The

statements

in

this

presentation

relating

to

matters

that

are

not

historical

facts

are

forward-looking

statements.

These forward-looking statements are based upon assumptions of management which

are believed to be reasonable at the time made and are subject to

significant risks and uncertainties. Actual results could differ materially based on

factors including, but not limited to, the business cyclicality of the chemical,

polymers and refining industries; the availability, cost and price

volatility of raw materials and utilities, particularly the cost of oil, natural gas, and

associated natural gas liquids; competitive product and pricing pressures; labor

conditions; our ability to attract and retain key personnel; operating

interruptions (including leaks, explosions, fires, weather-related incidents, mechanical

failure, unscheduled downtime, supplier disruptions, labor shortages, strikes, work

stoppages or other labor difficulties, transportation interruptions, spills

and releases and other environmental risks); the supply/demand

balances

for

our

and

our

joint

ventures’

products,

and

the

related

effects

of

industry

production

capacities

and

operating rates; our ability to achieve expected cost savings and other synergies;

legal and environmental proceedings; tax rulings, consequences or

proceedings; technological developments, and our ability to develop new

products and process technologies; potential governmental regulatory actions;

political unrest and terrorist acts; risks and uncertainties posed by

international operations, including foreign currency fluctuations; and our ability to comply

with debt covenants and service our debt. Additional factors that could cause

results to differ materially from those described

in

the

forward-looking

statements

can

be

found

in

the

“Risk

Factors”

section

of

our

Form

10-K

for

the

year

ended December 31, 2012, which can be found at www.lyondellbasell.com on the

Investor Relations page and on the Securities and Exchange Commission’s

website at www.sec.gov. The illustrative results

or returns of growth projects are not in any way intended to be, nor should they be taken as,

indicators or guarantees of performance. The assumptions on which they are based

are not projections and do not necessarily represent the Company’s

expectations and future performance. You should not rely on illustrated results

or returns or these assumptions as being indicative of our future results or

returns. This presentation contains time sensitive information that is

accurate only as of the date hereof. Information contained in this

presentation is unaudited and is subject to change. We undertake no obligation to update the

information presented herein except as required by law.

2 |

Information Related to Financial Measures

We have included EBITDA in this presentation, which is a non-GAAP measure, as

we believe that EBITDA

is

a

measure

commonly

used

by

investors.

However,

EBITDA,

as

presented

herein,

may

not

be

comparable to a similarly titled measure reported by other companies due to

differences in the way the measure is calculated.

We calculate EBITDA as income from continuing operations plus interest

expense (net), provision for (benefit from) income taxes, and depreciation &

amortization. EBITDA should not be considered an alternative to profit or

operating profit for any period as an indicator of our performance, or as an

alternative to operating cash flows as a measure of our liquidity. See Table 9 of

our accompanying earnings release for reconciliations of EBITDA to net

income. While we also believe that free cash flow (FCF) is a measure commonly

used by investors, free cash flow, as presented herein, may not be

comparable to a similarly titled measure reported by other companies due to

differences in the way the measure is calculated. For purposes of this presentation,

free cash flow means net cash provided by operating activities minus capital

expenditures. 3 |

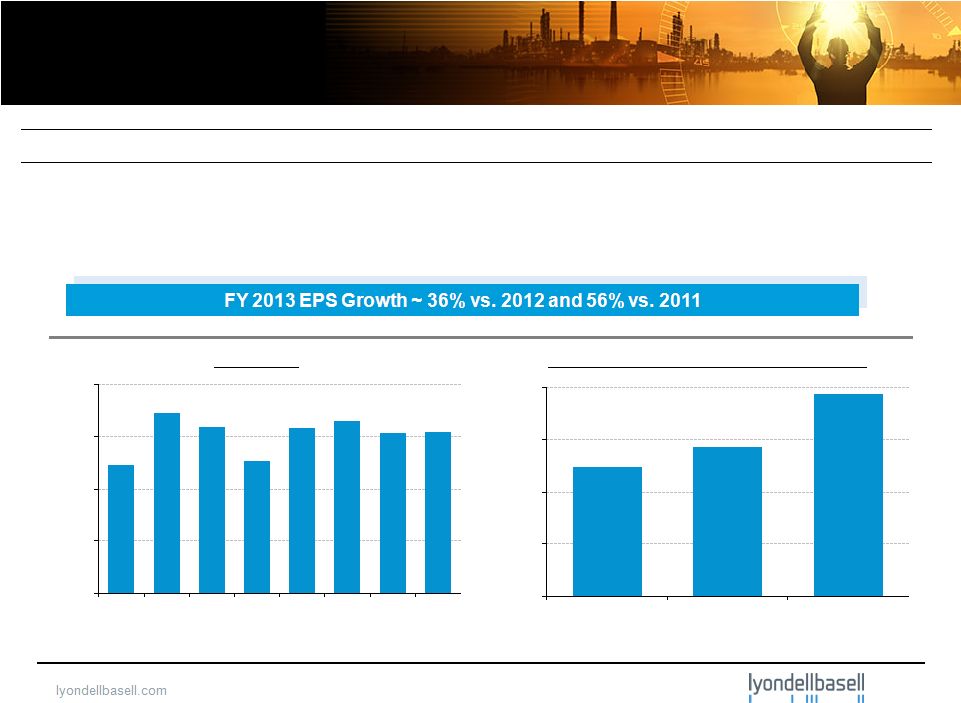

1,000

2,000

3,000

$4,000

2011

2012

2013

Highlights

EBITDA

(1)

($ in millions)

4

(1) EBITDA includes a pre-tax lower of cost or market inventory valuation

adjustment of $71 million in the third quarter 2012 which reversed a charge in the second quarter of 2012, due to a recovery in market

prices.

Income from Continuing Operations

($ in millions, except per share data)

FY 2013

FY 2012

FY 2011

EBITDA

(1)

$6,311

$5,808

$5,469

Income from Continuing Operations

$3,860

$2,858

$2,472

Diluted Earnings ($ / share) from Continuing Operations

$6.76

$4.96

$4.32

500

1,000

1,500

$2,000

1Q'12

2Q'12

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13 |

Health, Safety and Environmental Performance

1) Includes employees and contractors.

Safety -

Injuries per 200,000 Hours

Worked

(1)

Indexed Environmental Incidents

Indexed Process Incidents

5

0%

25%

50%

75%

100%

2009

2010

2011

2012

2013

0%

25%

50%

75%

100%

2009

2010

2011

2012

2013

0.00

0.15

0.30

0.45

0.60

2009

2010

2011

2012

2013 |

2013

Accomplishments Record financial results, continued advancement made across

the company ($ in millions)

1)

Total

stock

return

based

on

CapIQ

dividend

adjusted

beginning

and

closing

prices

for

2012

and

2013.

6

Segment EBITDA

2011 EBITDA

2012 EBITDA

2013 EBITDA

2012 - 2013 Change

2012 - 2013 Change, %

Olefins & Polyolefins - Americas

$2,137

$2,968

$3,573

$605

20%

Olefins & Polyolefins - EAI

865

548

839

291

53%

Intermediates & Derivatives

1,410

1,621

1,492

(129)

-8%

Refining

977

481

182

(299)

-62%

Technology

191

197

232

35

18%

Total

$5,469

$5,808

$6,311

$503

9% |

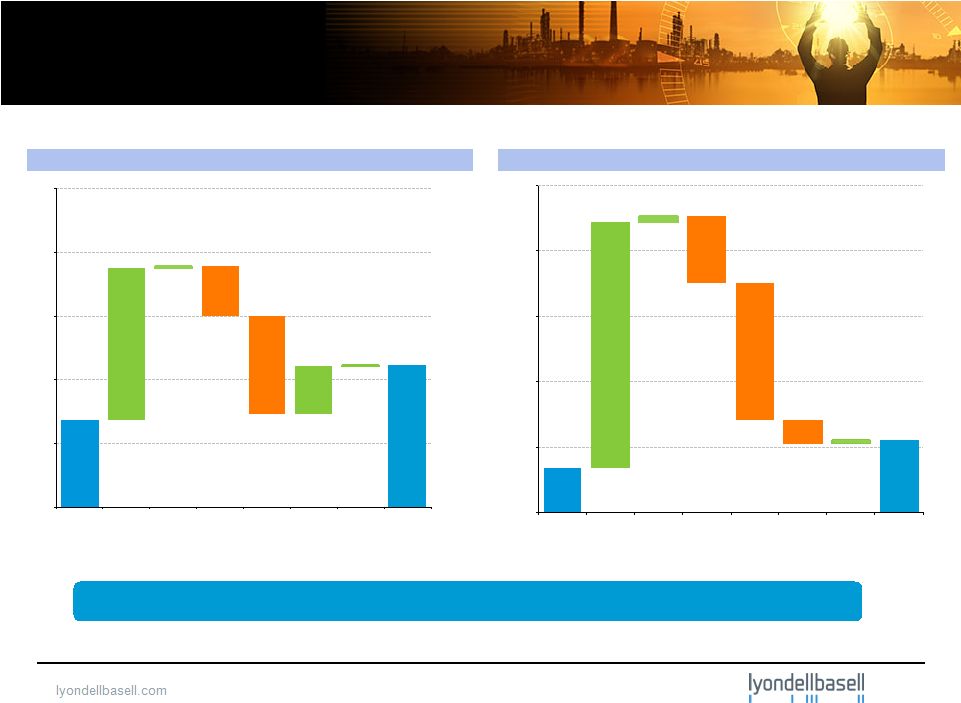

263

255

232

0

60

120

180

240

300

8.4

3.7

9.0

3.5

9.0

3.8

0

2

4

6

8

10

US

EU

1) I&D volumes exclude oxyfuels

2) EU ethylene cash margins normalized to 2010 US margins. 2010 indexed margin is

equal to 100% 3) Polyethylene and Polypropylene spreads indexed to 2010; 2010

indexed margins are equal to 100% * 2013 average crude processing rate

excluding the impact from Q1’13 turnaround Key Volumes and Margins: 2011

- 2013

HRO Crude Oil Rates

Polyethylene Volumes

Polypropylene Volumes

Maya 2-1-1 Spreads

Indexed Polyethylene

Spreads

(3)

Indexed Polypropylene

Spreads

(3)

Ethylene Volumes

Indexed Ethylene Cash

Margins

(2)

I&D Chemical

Volumes

(1)

MTBE Raw Material

Margin

MBPD

($/bbl)

billion lbs

billion lbs

billion lbs

billion lbs

(Cents/gal)

7

10.6

10.5

10.5

0

3

6

9

12

15

8.9

8.9

9.1

0

2

4

6

8

10

10.5

10.6

10.4

0

3

6

9

12

15

126

20

160

18

179

45

0

40

80

120

160

200

US

EU

91

94

95

78

120

80

0

30

60

90

120

150

US

EU

92

92

97

78

99

85

0

20

40

60

80

100

US

EU

83

118

79

0

25

50

75

100

125

23

25

23

0

5

10

15

20

25

%

%

%

253

(*) |

200

400

600

800

$1000

Olefins &

Polyolefins -

Americas

Olefins &

Polyolefins -

EAI

Intermediates

& Derivatives

Refining

Technology

FY 2013 EBITDA

Fourth Quarter 2013 and FY 2013 Segment EBITDA

Fourth Quarter 2013 EBITDA

($ in millions)

($ in millions)

8

750

1,500

2,250

3,000

$3,750

Olefins &

Polyolefins -

Americas

Olefins &

Polyolefins -

EAI

Intermediates

& Derivatives

Refining

Technology |

$2,711

$8,384

$4,450

0

4,000

8,000

12,000

16,000

$20,000

May 2010

Beginning

Cash

Balance

CF from

Operations

excl.

Working

Capital

Working

Capital

Changes

Capex

Dividends &

Share

Repurchases

Net Debt

Repayment

Other

Dec 2013

Ending Cash

Balance

$2,732

$3,076

$4,450

0

2,000

4,000

6,000

8,000

$10,000

Jan 2013

Beginning

Cash

Balance

CF from

Operations

excl.

Working

Capital

Working

Capital

Changes

Capex

Dividends &

Share

Repurchases

Net Debt

Borrowings

Other

Dec 2013

Ending Cash

Balance

Cash Flow

1) Beginning and ending cash balances include cash and cash equivalents; 2)

Includes accounts receivable, inventories, and accounts payable; 3) Includes capital and maintenance turnaround spending.

(3)

(2)

(1)

($ in millions)

(2)

(1)

FY 2013

May 2010 –

December 2013

(3)

(1)

9

(1)

~ $8.4 billion in dividends and share repurchases since inception

|

3,671

6,435

1,949

0

3,750

7,500

11,250

$15,000

Source of Cash

Use of Cash

Cash from Ops

Capex

Dividends

Share Repurchases

0

400

800

1,200

$1,600

2011

2012

2013

Base

Growth

1,500

3,000

4,500

$6,000

2011

2012

2013

Capex

Free Cash Flow

10

Indexed Cash Fixed Cost

(1)

Free Cash Flow

(2)

Capital Expenditures

2011 –

2013 Cash Deployment

Key Financial Statistics

($ in millions)

($ in millions)

($ in millions)

1) Cash fixed costs include costs related to compensation, travel, insurance, third

party services, maintenance, marketing, selling, and administration; 2) Free Cash Flow = net cash provided by operating activities –

capex

25%

50%

75%

100%

2008

2009

2010

2011

2012

2013

(Indexed to 2008) |

Olefins & Polyolefins -

Americas

Highlights and Business Drivers -

4Q’13

11

1) Source: quarterly average industry data from third party consultants; 2) The

direction of the arrows reflects our underlying business metrics. |

Olefins & Polyolefins -

Europe, Asia, International

Highlights and Business Drivers -

4Q’13

12

1) Source: quarterly average data from third party

consultants; 2) The direction of the arrows reflects our underlying business metrics. |

0

15

30

45

4Q12

3Q13

4Q13

1Q14 E

Intermediates & Derivatives

Highlights and Business Drivers -

4Q’13

EBITDA

Propylene Oxide and Derivatives

•

Higher deicer sales

Intermediates

•

Lower styrene margins

•

Methanol restart

Oxyfuels

EBITDA

Margin

Volume

Performance vs. 3Q’13

($ in millions)

13

EU MTBE Raw Material Margins (per Platts)

(1)

(cents / gallon)

P-Glycol Raw Material Margins (per Chemdata)

(1)

(cents / lb)

1) Data represents quarterly average; 2) The direction of the

arrows reflects our underlying business metrics. 100

200

300

400

$500

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13

0

40

80

120

4Q'12

3Q'13

4Q'13

Jan'14

(2)

•

Seasonal volume and margin decline |

Refining Highlights and Business Drivers -

4Q’13

1) Light Louisiana Sweet (LLS) is the referenced light crude. Data represents

quarterly average; 2) The direction of the arrows reflects our underlying business metrics.

14 |

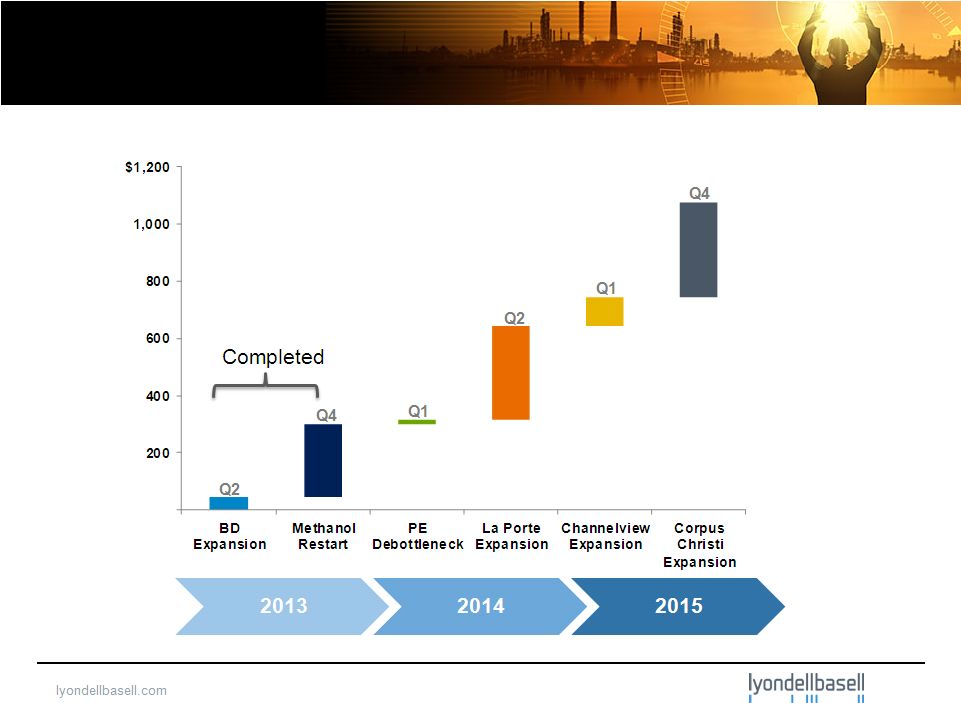

Projects Annual Potential Values &

Completion Timeline

15

Annual Potential Value

(1)

($ Million/ yr)

1) Annual potential values are based on LTM September 2013 industry benchmark

margins. |

–

U.S. NGL advantage continues

–

La Porte turnaround and expansion

scheduled to begin in late Q1’2014,

estimate ~ 80 days

–

January Maya 2-1-1 crack spread ~

$28 per barrel

–

Growth projects remain on schedule

•

Polyethylene expansion project target

completion in 1Q’2014

Fourth-Quarter Summary and Outlook

–

Continued strength in O&P –

Americas results

•

Building inventory in preparation for

La Porte turnaround

–

Business declines driven by

seasonal impacts such as

•

Lower European polyolefin volumes

•

Lower oxyfuels margins and

volumes

–

Improved refining results

–

Methanol project completion and

restart of operations

–

Increased interim dividend by 20%

to $0.60 per share

Fourth-Quarter Summary

Near-Term Outlook

16 |