Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COOPER TIRE & RUBBER CO | d667842d8k.htm |

| EX-99.1 - EX-99.1 - COOPER TIRE & RUBBER CO | d667842dex991.htm |

Cooper

Tire, Chengshan Group and CCT Labor Union Reach Agreement

Establishing Path Forward for CCT

Joint Venture

January 31, 2014

1

Exhibit 99.2 |

Safe

Harbor This presentation contains strategic goals and other

forward- looking statements related to future financial results and

business operations for Cooper Tire & Rubber Company.

Actual results may differ materially from the goals and from current

management forecasts and projections as a result of factors over

which the Company may have limited or no control. Information

on certain of these risk factors and additional information on

forward-looking statements are included in the Company’s reports

on file with the Securities and Exchange Commission and are set

forth at the end of this presentation.

Note

This

presentation

provides

an

overview

of

certain

details

of

the

agreement between Cooper Tire, Chengshan Group and the CCT

Union announced today, January 31, 2014. For additional details,

please refer to the Form 8-K filed by Cooper Tire & Rubber

Company today, January 31, 2014.

2 |

China to

remain a core growth market for Cooper

China tire market expected to grow by 60% over next five years and be

largest market globally *

Cooper has an established and growing market position in China

–

Participate in Passenger Car Radial (PCR) tire market and in Truck and Bus Radial

(TBR) tire market

–

PCR served by both Cooper and Cooper Chengshan Tire (CCT) brands; TBR served by

CCT brands in China

–

Largely replacement focused, with growing Original Equipment (OE)

partnerships –

Cooper distribution (focused on Cooper brand tires) has more than 5,000 points of

sale in China, up 72% from 2012

Cooper has proven manufacturing capabilities in China

–

Cooper owns 100% of Cooper Kunshan Tire (CKT) PCR operations with a current

capacity of 5M tires annually

•

Production shifting from export to domestic sales, with additional sourcing

shifting to CKT in 2014 •

Option to increase capacity to 8M tires using existing buildings, and can double

that to 16M at the current site which was designed to integrate another

building –

Cooper owns 65% of CCT Joint Venture (JV) with Chengshan Group

•

PCR and TBR manufacturing. Annual capacity of 10M tires

•

Cooper provides technical and design capabilities

•

Global TBR lines under Cooper’s Roadmaster brand receiving strong reception

in the U.S. * 2013 LMC Data

3 |

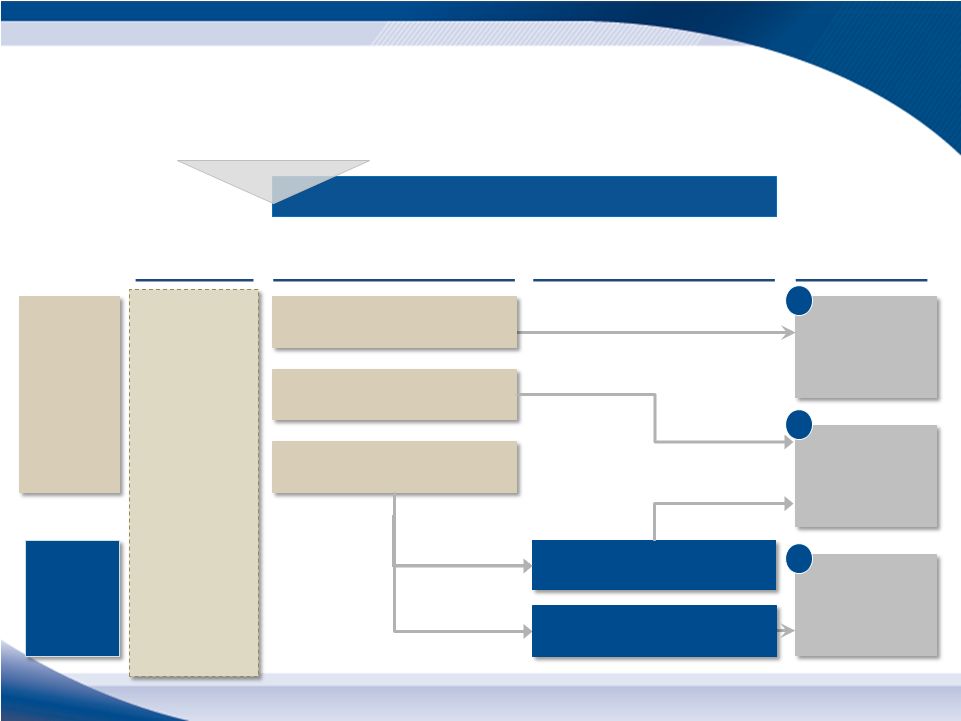

Path

forward for the CCT JV has been defined Cooper

options*

Execute put option:

Sell 35% stake to Cooper

Chengshan

options*

Do not execute either option

Execute call option:

Buy Chengshan's 35% stake

Chengshan

full ownership

of CCT

Cooper full

ownership of

CCT

Execute call option:

Buy Cooper's 65% stake

JV continues

under current

ownership

arrangement

45 days from option

commencement date

46 –

90 days from option

commencement date

Do not execute option

Outcomes

Fair market

valuation

completed by

independent firm

Targeted to be

completed 60

days after firm

selection or

Cooper's 2013

financial filings**

Option price

will be based on

the greater of

$435M or

the value

of CCT as

determined by

independent

valuation firm

Valuation

period

Option commencement date at

completion of valuation

Option period with target completion dates

4

**Agreement allows for 90 additional days to complete.

3

2

1

*The options are conditioned on Cooper reporting its financial results within the timeframe

described in the Form 8-K filed January 31, 2014. |

Scenario

1: Chengshan takes full ownership

of CCT

•

Cooper supply secured through CCT offtake rights for at least three

years

•

Cooper does not participate in sales through CCT distribution,

focuses on continuing to grow PCR sales through Cooper channels,

while continuing to shift PCR production to (and growing) CKT

•

Cooper continues to participate TBR through offtake rights

•

Cooper sells its 65% stake in the CCT joint venture

•

Cooper receives $283M or more for its stake based on independent

valuation

•

Continue to expand CKT operations to support domestic China

sales

•

Leverage cash injection to accelerate pursuit of new TBR sourcing

options and invest in distribution growth in China

•

Continue to evaluate new sources of supply for growing China

market including possible acquisition opportunities

5

Outcome

Short-term

Impact

Long-term China

strategy |

Scenario

2: Cooper takes full ownership

of CCT

•

Solidifies global TBR supply and China TBR distribution

•

Cooper's balance sheet is well positioned to finance purchase of

Chengshan's share of CCT

•

Production and distribution at CKT to continue and grow

•

Continue to expand CKT operations to support domestic China

sales

•

Use as a catalyst to accelerate Cooper's China growth plans

•

Accelerate development of global TBR business

•

Continue to evaluate new sources of supply for growing China

market including possible acquisition opportunities

•

Cooper owns 100% of CCT

•

Cooper pays $152M or more to acquire Chengshan's stake based

on independent valuation

6

Outcome

Short-term

Impact

Long-term China

strategy |

Planned

communications Agreement Announced

Q3 2013 Results

Q4 & FY 2013

Results

Investor Event

7

Today

Early March

Mid to Late March

April/May |

Risks

8

This presentation contains forward-looking statements within the meaning of the federal

securities laws. Forward-looking statements are not based on historical facts but

instead reflect Cooper’s expectations, estimates or projections concerning future results or events. These statements generally can be

identified by the use of forward-looking words or phrases such as “believe,”

“expect,” “anticipate,” “project,” “may,” “could,” “intend,” “intent,” “belief,”

“estimate,” “plan,” “likely,” “will,”

“should” or similar words or phrases. These statements are not guarantees of performance and are inherently subject to

known and unknown risks, uncertainties and assumptions that are difficult to predict and could

cause our actual results, performance or achievements to differ materially from those

expressed or indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be

achieved.

The forward-looking statements included in this presentation are only made as of the date

of this presentation and we disclaim any obligation to publicly update any

forward-looking statement to reflect subsequent events or circumstances.

Numerous factors could cause our actual results and events to differ materially from those

expressed or implied by forward-looking statements, including, without limitation:

volatility in raw material and energy prices, including those of rubber, steel, petroleum based products and natural gas and the

unavailability of such raw materials or energy sources; the failure of Cooper’s suppliers

to timely deliver products in accordance with contract specifications; changes in

economic and business conditions in the world; failure to implement information technologies or related systems, including failure by Cooper to

successfully implement an ERP system; increased competitive activity including actions by

larger competitors or lower-cost producers; the failure to achieve expected sales

levels; changes in Cooper’s customer relationships, including loss of particular business for competitive or other reasons; litigation brought

against Cooper, including products liability claims, which could result in material damages

against Cooper; changes to tariffs or the imposition of new tariffs or trade

restrictions; changes in pension expense and/or funding resulting from investment performance of Cooper’s pension plan assets and changes in

discount rate, salary increase rate, and expected return on plan assets assumptions, or

changes to related accounting regulations; government regulatory and legislative

initiatives including environmental and healthcare matters; volatility in the capital and financial markets or changes to the credit markets

and/or access to those markets; changes in interest or foreign exchange rates; an adverse

change in Cooper’s credit ratings, which could increase borrowing costs and/or

hamper access to the credit markets; the risks associated with doing business outside of the United States; the failure to develop technologies,

processes or products needed to support consumer demand; technology advancements; the

inability to recover the costs to develop and test new products or processes; the

impact of labor problems, including labor disruptions at Cooper or at one or more of its large customers or suppliers; failure to attract or

retain key personnel; consolidation among competitors or customers; inaccurate assumptions

used in developing Cooper’s strategic plan or operating plans or the inability or

failure to successfully implement such plans; failure to successfully integrate acquisitions into operations or their related financings may

impact liquidity and capital resources; the impact of labor disruptions and changes in

Cooper’s relationship with, or ownership interests in, joint-venture partners;

the ability to sustain operations at the Cooper Chengshan (Shandong) Tire Company Ltd. joint venture (“CCT”), including obtaining financial and

other operational data of CCT; the inability to obtain and maintain price increases to offset

higher production or material costs; inability to adequately protect Cooper’s

intellectual property rights; inability to use deferred tax assets; the ultimate outcome of legal actions brought by Cooper against wholly-

owned subsidiaries of Apollo Tyres Ltd.; and other factors that are set forth in

management’s discussion and analysis of Cooper’s most recently filed reports

with the SEC. This list of factors is illustrative, but by no means exhaustive. All

forward-looking statements should be evaluated with the understanding of their

inherent uncertainty. |