Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UMB FINANCIAL CORP | d665194d8k.htm |

| EX-3.(II).1 - EX-3.(II).1 - UMB FINANCIAL CORP | d665194dex3ii1.htm |

| EX-99.1 - EX-99.1 - UMB FINANCIAL CORP | d665194dex991.htm |

| EX-3.(II).2 - EX-3.(II).2 - UMB FINANCIAL CORP | d665194dex3ii2.htm |

Fourth Quarter 2013

January 28, 2014

UMB Financial

Exhibit 99.2 |

Cautionary Notice about Forward-Looking Statements

2

This

presentation

contains,

and

our

other

communications

may

contain,

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

statements

can

be

identified

by

the

fact

that

they

do

not

relate

strictly

to

historical

or

current

facts.

All

forward-looking

statements

are

subject

to

assumptions,

risks,

and

uncertainties,

which

may

change

over

time

and

many

of

which

are

beyond

our

control.

You

should

not

rely

on

any

forward-looking

statement

as

a

prediction

or

guarantee

about

the

future.

Our

actual

future

objectives,

strategies,

plans,

prospects,

performance,

condition,

or

results

may

differ

materially

from

those

set

forth

in

any

forward-looking

statement.

Some

of

the

factors

that

may

cause

actual

results

or

other

future

events,

circumstances,

or

aspirations

to

differ

from

those

in

forward-looking

statements

are

described

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2012,

our

subsequent

Quarterly

Reports

on

Form

10-Q

or

Current

Reports

on

Form

8-K,

or

other

applicable

documents

that

are

filed

or

furnished

with

the

Securities

and

Exchange

Commission

(SEC).

Any

forward-looking

statement

made

by

us

or

on

our

behalf

speaks

only

as

of

the

date

that

it

was

made.

We

do

not

undertake

to

update

any

forward-

looking

statement

to

reflect

the

impact

of

events,

circumstances,

or

results

that

arise

after

the

date

that

the

statement

was

made.

You,

however,

should

consult

further

disclosures

(including

disclosures

of

a

forward-looking

nature)

that

we

may

make

in

any

subsequent

Quarterly

Report

on

Form

10-Q,

Current

Report

on

Form

8-K,

or

other

applicable

document

that

is

filed

or

furnished

with

the

SEC. |

Business Segment Metrics |

A

B

C

E

AUM increased 32.4% year-

over-year to $31.2 billion

Net inflows of $941.9 million

for Q4’13; year-to-date flows

of $5.3 billion

Institutional Investment Management

4

th

Quarter 2013

Highlights

4

$23.5

$25.7

$26.3

$29.3

$31.2

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13

Total Scout Assets Under Management

($ billions)

Institutional Investment Management Operating Results

% Change

% Change

2013

2012

2013

2012

Net Interest income

(10)

-

NA

(32)

2

-1700.0%

Noninterest income

34,893

25,511

36.8%

126,442

100,051

26.4%

Noninterest expense

29,583

20,137

46.9%

88,336

70,981

24.5%

NI before taxes

5,300

5,374

-1.4%

38,074

29,072

31.0%

Income tax expense

1,127

1,204

-6.4%

10,011

8,118

23.3%

Net income

4,173

4,170

0.1%

28,063

20,954

33.9%

pre-tax profit margin

15.2%

21.1%

30.1%

29.1%

3 mos Ended

December 31,

Year Ended

December 31, |

AUM Drivers

($millions)

$2,204.5

$932.7

Total Change

($millions)

$25,746.8

$23,542.3

Total AUM

($millions)

$567.3

$26,314.1

Institutional Investment Management

5

$2,994.8

$29,308.9

$1,858.5

$31,167.4 |

Total

AUM $19.7B

$23.5B

$25.7B

$26.3B

Institutional Investment Management

6

$29.3B

$31.2B |

25.3%

21.4%

6.4%

13.4%

28.7%

1.8%

0.1%

2.9%

68.7%

26.6%

2.6%

1.9%

0.2%

AUM by Strategy –

As of 4Q’13

Fixed Income Strategies

Equity Strategies

International

Mid Cap

International ADR

Emerging Markets

Global

Small Cap

Other:

7

Core Plus

Low Duration

Long Duration

Core

Intermediate

Unconstrained

Global Aggregate

Real Return

49%

51%

Equity

Fixed Income |

25.3%

21.4%

6.5%

13.4%

28.7%

1.8%

0.1%

2.9%

36.6%

24.6%

16.8%

14.1%

5.5%

2.2%

0.2%

Fixed Income Rotation

Fixed Income AUM

Strategy Mix

4Q’13

4Q’12

8

Core Plus

Low Duration

Long Duration

Core

Intermediate

Unconstrained

Global Aggregate

Real Return |

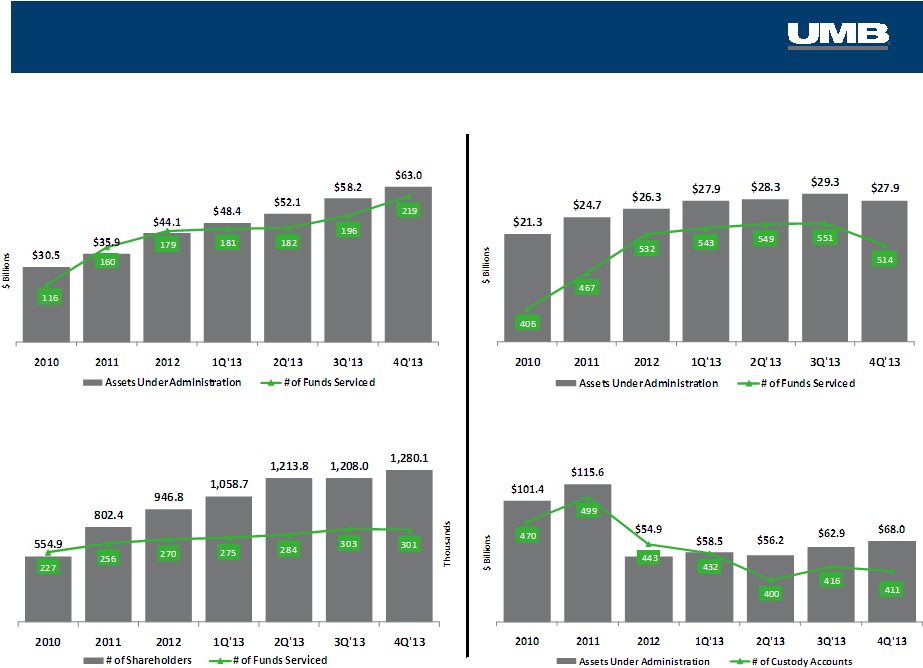

Asset Servicing

A

B

Total AUA increased by 22.4% to

$191.0 billion year-over-year

In the past 12 months, fund

accounting and administration

AUA grew by 42.9%; 40 new

funds added

4

th

Quarter 2013 Highlights

9

$162.4

$179.3

$206.4

$156.0

$191.0

2009

2010

2011

2012

2013

Assets Under Administration

($billions)

Asset Servicing Operating Results

% Change

% Change

2013

2012

2013

2012

Net interest income

545

534

2.1%

2,357

1,861

26.7%

Noninterest income

20,572

18,362

12.0%

80,633

75,589

6.7%

Noninterest expense

18,583

17,274

7.6%

72,731

68,793

5.7%

NI before taxes

2,534

1,622

56.2%

10,259

8,657

18.5%

Income tax expense

1,129

491

129.9%

4,184

3,382

23.7%

Net income

1,405

1,131

24.2%

6,075

5,275

15.2%

pre-tax profit margin

12.0%

8.6%

12.4%

11.2%

December 31,

3 mos Ended

Year Ended

December 31, |

Asset Servicing

Fund Accounting & Administration

Alternative Asset Servicing

Custody

Transfer Agency

Business Metrics

10 |

Payment Solutions

Total Card Purchase Volume

& Interchange Revenue

CAGR

B

Commercial credit card

purchase volume +5.1% year-

over-year to $314.9 million;

provided 45.7% of interchange

Interchange revenue +1.6%

year-over-year to $15.9 million

4

th

Quarter 2013 Highlights

11

Payment Solutions Operating Results

% Change

% Change

2013

2012

2013

2012

Net interest income

11,505

11,227

2.5%

45,832

43,350

5.7%

Provision for loan losses

2,660

1,719

54.7%

12,388

8,233

50.5%

Noninterest income

17,737

17,601

0.8%

74,223

67,887

9.3%

Noninterest expense

23,121

19,866

16.4%

86,746

69,095

25.5%

NI before taxes

3,461

7,243

-52.2%

20,921

33,909

-38.3%

Income tax expense

1,271

1,833

-30.7%

6,732

9,555

-29.5%

Net income

2,190

5,410

-59.5%

14,189

24,354

-41.7%

pre-tax profit margin

11.8%

25.1%

17.4%

30.5%

December 31,

3 mos Ended

Year Ended

December 31, |

Payment Solutions

Health Savings Accounts & Balances*

* Deposits and investment assets

A

B

Healthcare card purchase volume

+54.0% to $649.1 million vs. 4Q’12

Customer deposits and assets

+49.2% to $642.4 million vs. 4Q’12

4

th

Quarter 2013 Highlights

Healthcare Services

12

Card Utilization |

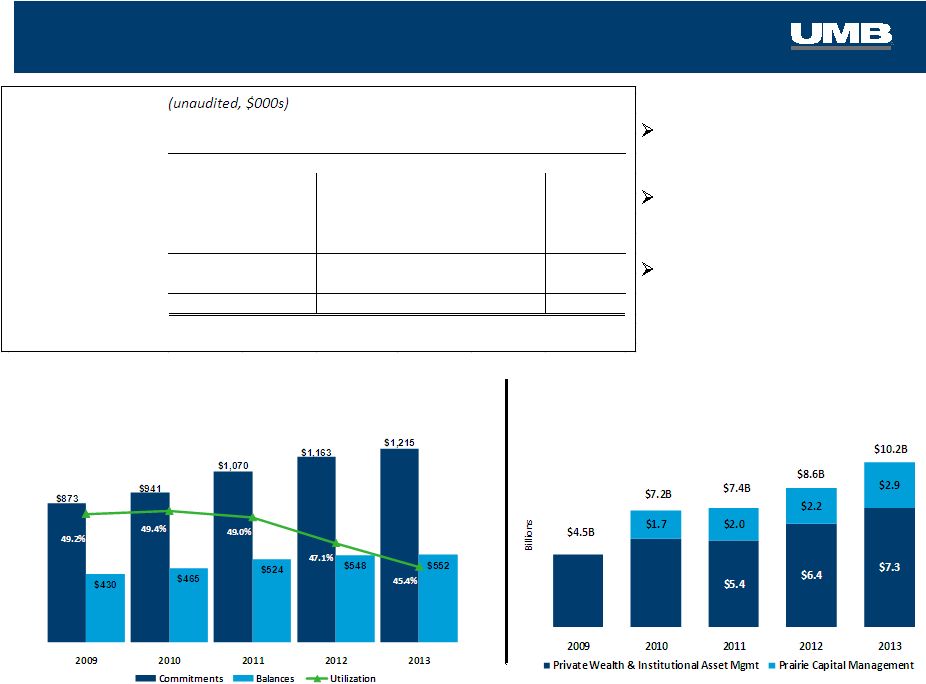

Bank

Assets Under Management

($ billions)

HELOC Lending

(average balances, $ millions)

A

B

C

Total net loans grew for the 15th

consecutive quarter, year-over-year,

increasing 14.8% to $6.4 billion

Private Banking reported $325.7 million

in average loan balances, an increase

of 36.0% over Q4 2012

Fourth quarter average Small Business

Banking loans increased 21.4% year-

over-year to $172.6 million

4

th

Quarter 2013 Highlights

Bank Operating Results

% Change

% Change

2013

2012

2013

2012

Net interest income

73,874

68,468

7.9%

285,112

274,843

3.7%

Provision for loan losses

1,340

2,281

-41.3%

5,112

9,267

-44.8%

Noninterest income

62,405

47,800

30.6%

210,535

214,595

-1.9%

Noninterest expense

99,139

100,682

-1.5%

376,365

381,585

-1.4%

NI before taxes

35,800

13,305

169.1%

114,170

98,586

15.8%

Income tax expense

8,905

2,956

201.3%

28,532

26,452

7.9%

Net income

26,895

10,349

159.9%

85,638

72,134

18.7%

pre-tax profit margin

26.3%

11.4%

23.0%

20.1%

3 mos Ended

December 31,

December 31,

Year Ended |

46.8%

47.6%

45.2%

44.0%

41.1%

0%

50%

100%

4Q'09

4Q'10

4Q'11

4Q'12

4Q'13

KC

CO

STL

Greater MO

KS

OK

AZ

NE

TX

Bank

High Growth Regions

4Q’13 vs. 4Q’12

•

Arizona

+94.6%

Commercial Loans By Region

•

St. Louis

+40.3%

•

Oklahoma +36.4%

Commercial Loan Balances

(Average C&I and CRE Loan Balances for Three Months Ended December 31)

14 |

Bank

Average Deposits

(Average deposits for the three months ended December 31)

4 yr

CAGR

4Q ‘09–’13

12.9%

Deposits By Region

15

53.6%

56.4%

57.8%

61.6%

66.2%

0%

50%

100%

4Q'09

4Q'10

4Q'11

4Q'12

4Q'13

KC

STL

CO

Gtr MO

KS

OK

AZ

NE

$7.1

$7.8

$8.8

$9.9

$11.1

29.1%

31.8%

33.4%

39.1%

42.5%

4Q'09

4Q'10

4Q'11

4Q'12

4Q'13

Interest Bearing

Non-Interest Bearing |

Deposit Composition

16

Deposit Composition by Line of Business

At December 31, 2013

Actual

Pro-forma,

After deposit migration

Commercial

Consumer

Asset Servicing

Private Wealth Management

Healthcare

Inst. Banking & Investor Services

Small Business

Inst. Asset Management

35.1%

24.3%

17.8%

7.2%

6.6%

4.5%

4.3%

0.2%

39.4%

27.3%

7.8%

8.0%

7.4%

5.1%

4.7%

0.3% |

Appendix |

1.6%

18.6%

43.5%

29.6%

6.7%

Average 2013 Balance:

$7.0 billion

Average Yield:

1.97%

Investment Mix

Securities Available for Sale as of December 31, 2013

Mortgage-Backed Securities

Municipals

CDs & Corporates

Agencies

Treasuries

Investment Portfolio Statistics –

Securities Available for Sale

18

Roll off

Purchased

($ millions)

Yield

($ millions)

Yield

1Q13

$413

1.98%

$769

1.31%

2Q13

$340

2.13%

$815

1.41%

3Q13

$265

1.85%

$77

1.02%

4Q13

$308

2.04%

$355

0.64%

Scheduled Cash Flow

1Q14

$398

1.71%

Next 12 months

$1,068

1.94%

Securities Gains

($ thousands)

4Q12

210

$

1Q13

5,893

$

2Q13

1,519

$

3Q13

1,140

$

4Q13

(10)

$

Duration/Life

(in months)

at 12/31/2013

at 9/30/2013

Avg. Life Total

47.55

49.39

Duration Total

44.12

46.31 |