Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Inotiv, Inc. | v365958_8k.htm |

Confidential and Proprietary Noble Financial Capital Markets Tenth Annual Equity Conference Jacqueline M. Lemke President and CEO January 22, 2014

Confidential and Proprietary Safe Harbor Statement Matters discussed in this Presentation contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . When used in this document, the words "anticipate," "believe," "estimate," "may," "intend," "expect” and similar expressions identify such forward - looking statements . These forward - looking s

tatements are subject to risks, uncertainties, assumptions, and other factors that may cause the actual results, performance or achievements to differ materially from those contemplated, expressed or implied by such forward - looking statements . These factors include, but are not limited to, risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U . S . actions subsequently ; and other factors detailed in reports filed by the Company . Regulation G This presentation includes discussion of non - GAAP financial measures . We believe that the inclusion of these non - GAAP financial measures provide useful information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of one - time charges, consistent with the manner in which management measures and forecasts the Company’s performance . The non - GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP . The company intends to continue to assess the potential value of reporting non - GAAP results consistent with applicable rules and regulations . In accordance with Regulation G, you can find the comparable GAAP measures and reconciliations to those GAAP measures on our website at www . basinc . com 2

Confidential and Proprietary Presentation Outline Brief History Company Profile Services and Products Customers Geographic Reach Differentiators Key Financials Next Steps – Leveraging our Strengths 3

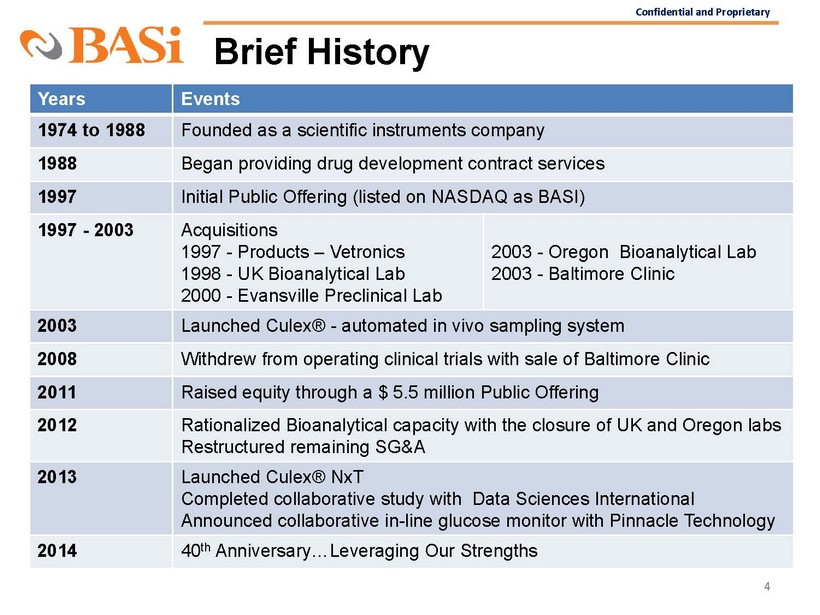

Confidential and Proprietary Brief History 4 Years Events 1974 to 1988 Founded as a scientific instruments company 1988 Began providing drug development contract services 1997 Initial Public Offering (listed on NASDAQ as BASI) 1997 - 2003 Acquisitions 1997 - Products – Vetronics 1998 - UK Bioanalytical Lab 2000 - Evansville Preclinical Lab 2003 - Oregon Bioanalytical Lab 2003 - Baltimore Clinic 2003 Lau

nched Culex® - automated in vivo sampling system 2008 Withdrew from operating clinical trials with sale of Baltimore Clinic 2011 Raised equity through a $ 5.5 million Public Offering 2012 Rationalized Bioanalytical capacity with the closure of UK and Oregon labs Restructured remaining SG&A 2013 Launched Culex® NxT Completed collaborative study with Data Sciences International Announced collaborative in - line glucose monitor with Pinnacle Technology 2014 40 th Anniversary…Leveraging Our Strengths

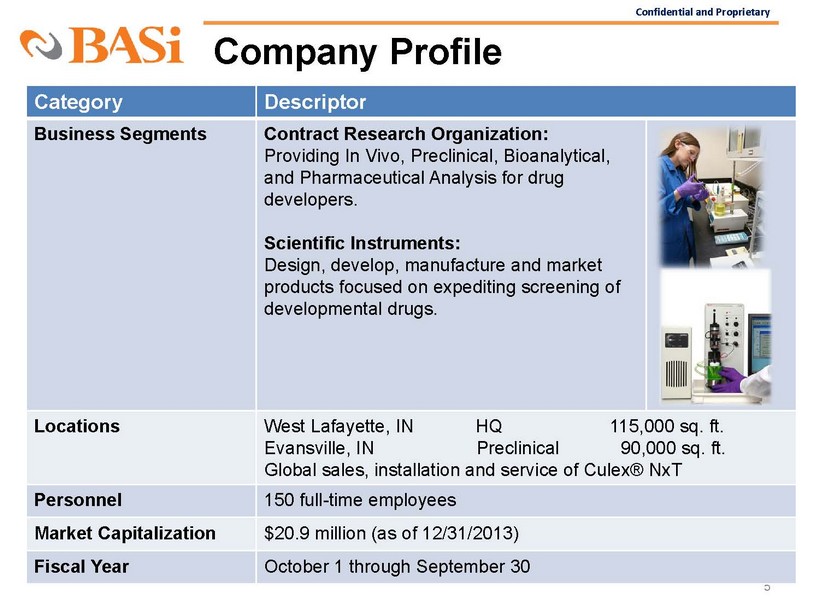

Confidential and Proprietary Company Profile 5 Category Descriptor Business Segments Contract Research Organization : Providing In Vivo, Preclinical, Bioanalytical, and Pharmaceutical Analysis for drug developers. Scientific Instruments: Design, develop, manufacture and market products focused on expediting screening of developmental drugs. Locations West Lafayette, IN HQ 115,000 sq. ft. Evansville,

IN Preclinical 90,000 sq. ft. Global sales, installation and service of Culex® NxT Personnel 150 full - time employees Market Capitalization $20.9 million (as of 12/31/2013) Fiscal Year October 1 through September 30

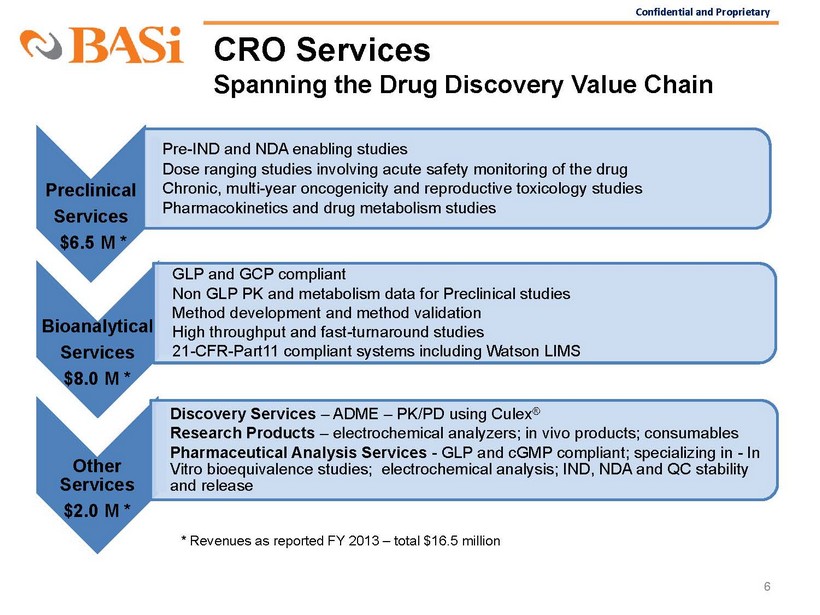

Confidential and Proprietary CRO Services Spanning the Drug Discovery Value Chain 6 Preclinical Services $6.5 M * • Pre - IND and NDA enabling studies • Dose ranging studies involving acute safety monitoring of the drug • Chronic, multi - year oncogenicity and reproductive toxicology studies • Pharmacokinetics and drug metabolism studies Bioanalytical Services $8.0 M * • GLP and GCP compliant • Non GLP PK and metabolism data for Preclinical studies • Method development and method validation • High throughput and fast - turnaround studies • 21 - CFR - Part11 compliant systems including Watson LIMS Other Services $2.0 M * • Discovery Services – ADME – PK/PD using Culex ® • Research Products – electrochemical analyzers; in vivo products; consumables • Pharmaceutical Analysis Services - GLP and cGMP compliant; specializing in - In Vitro bioequivalence studies; electrochemical analysis; IND, NDA and QC stability and release * Revenues as reported FY 2013 – total $16.5 million

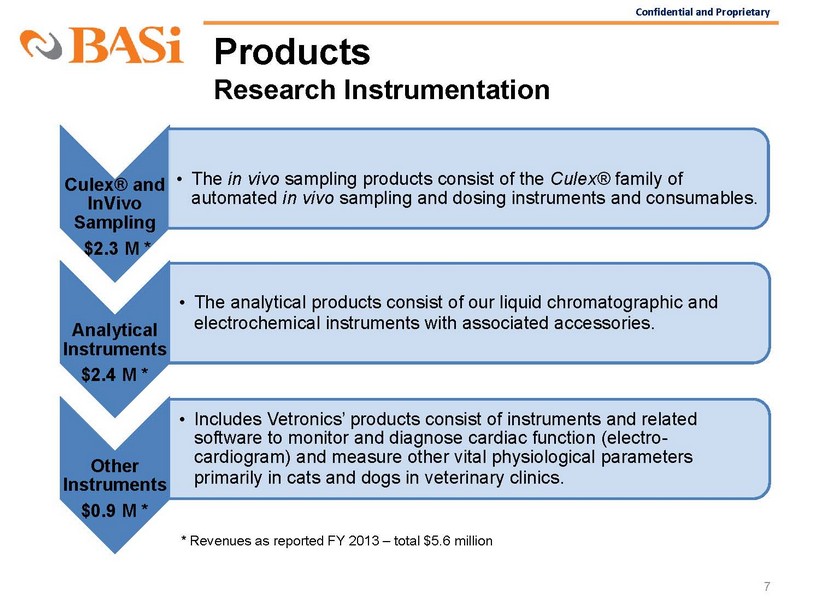

Confidential and Proprietary Products Research Instrumentation 7 Culex® and InVivo Sampling $2.3 M * • The in vivo sampling products consist of the Culex® family of automated in vivo sampling and dosing instruments and consumables. Analytical Instruments $2.4 M * • The analytical products consist of our liquid chromatographic and electrochemical instruments with associated accessories . Othe

r Instruments $0.9 M * • Includes Vetronics’ products consist of instruments and related software to monitor and diagnose cardiac function (electro - cardiogram) and measure other vital physiological parameters primarily in cats and dogs in veterinary clinics . * Revenues as reported FY 2013 – total $5.6 million

Confidential and Proprietary Who do we sell to? Diverse Customer Base 8

Confidential and Proprietary Where do we sell? Global Products Reach 9 Over 1,200 Culex ® stations sold globally

Confidential and Proprietary What differentiates us? 10 Innovation Regulatory Excellence Customer Focus

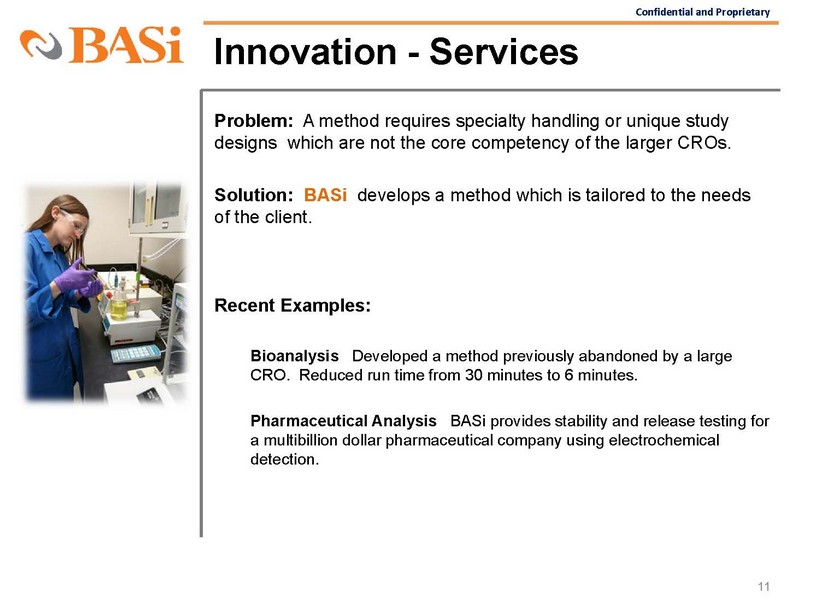

Confidential and Proprietary Innovation - Services Problem: A m ethod requires specialty handling or unique study designs which are not the core competency of the larger CROs. Solution: BASi develops a method which is tailored to the needs of the client. Recent Examples: Bioanalysis Developed a method previously abandoned by a large CRO. Reduced run time from 30 minutes to 6 minutes. Pharmaceutic

al Analysis BASi provides stability and release testing for a multibillion dollar pharmaceutical company using electrochemical detection. 11

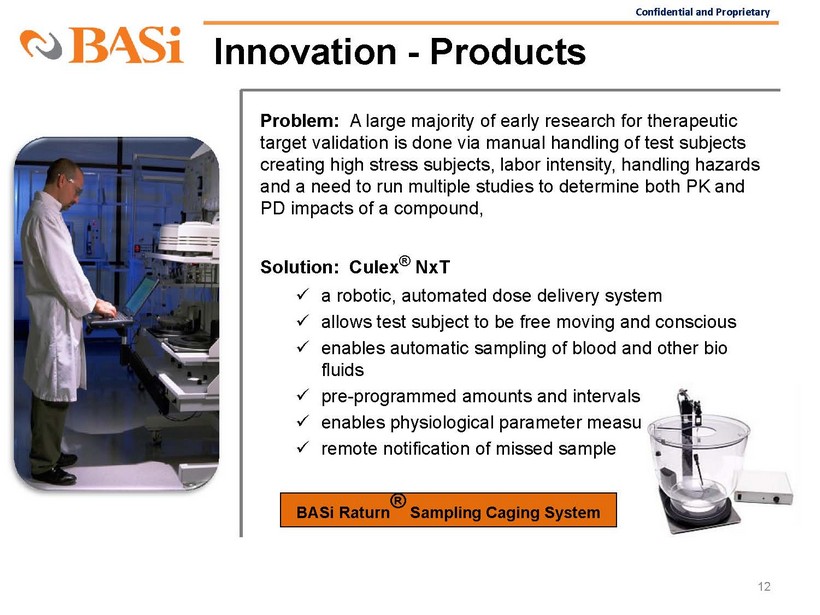

Confidential and Proprietary Innovation - Products Problem: A large majority of early research for therapeutic target validation is done via manual handling of test subjects creating high stress subjects, labor intensity, handling hazards and a need to run multiple studies to determine both PK and PD impacts of a compound, Solution: Culex ® NxT x a robotic, automated dose delivery system x allows

test subject to be free moving and conscious x enables automatic sampling of blood and other bio fluids x pre - programmed amounts and intervals x enables physiological parameter measurement x remote notification of missed sample 12 BASi Raturn ® Sampling Caging System

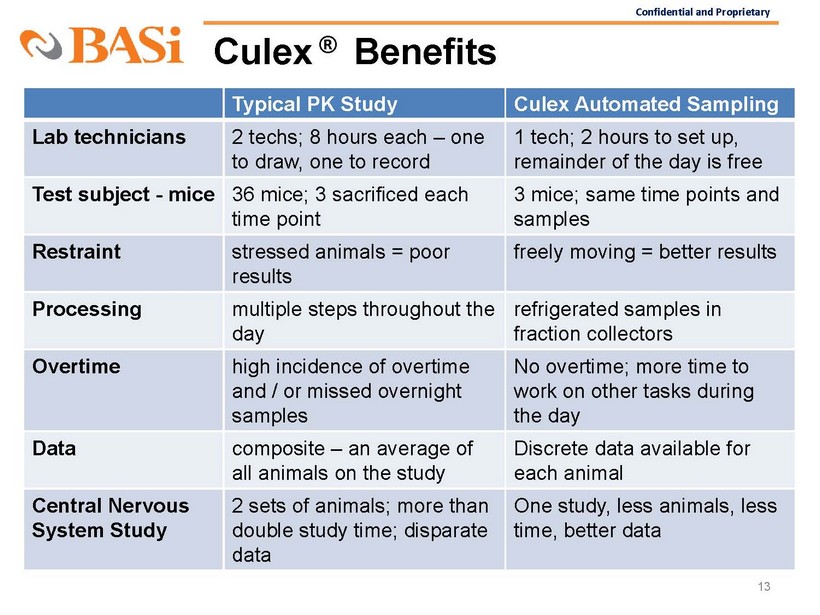

Confidential and Proprietary Culex ® Benefits 13 Typical PK Study Culex Automated Sampling Lab technicians 2 techs; 8 hours each – one to draw, one to record 1 tech; 2 hours to set up, remainder of the day is free Test subject - mice 36 mice; 3 sacrificed each time point 3 mice; same time points and samples Restraint stressed animals = poor results freely moving = better results Processing mul

tiple steps throughout the day refrigerated samples in fraction collectors Overtime high incidence of o vertime and / or missed overnight samples No overtime; more time to work on other tasks during the day Data composite – an average of all animals on the study Discrete data available for each animal Central Nervous System Study 2 sets of animals; more than double study time; disparate data One study, less animals, less time, better data

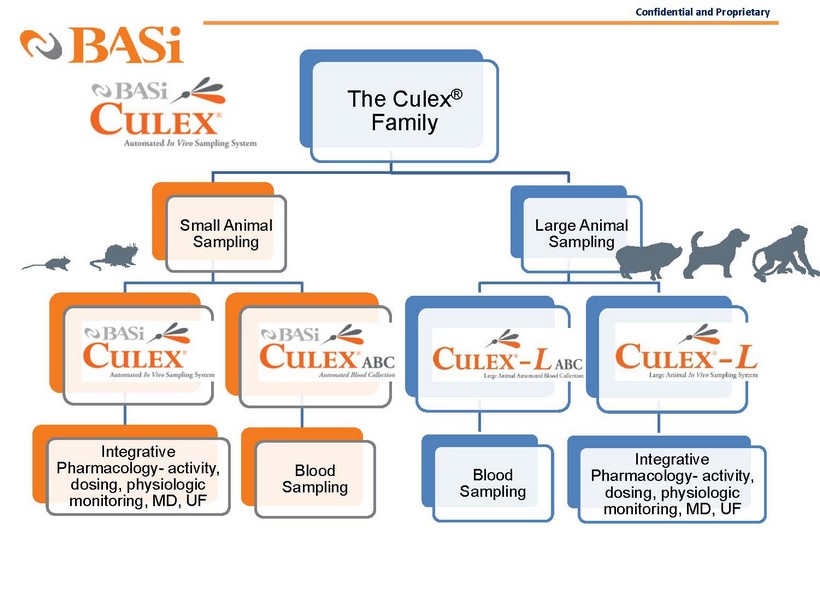

Confidential and Proprietary The Culex ® Family Small Animal Sampling Culex Integrative Pharmacology - activity, dosing, physiologic monitoring, MD, UF Culex ABC Blood Sampling Large Animal Sampling Culex - L ABC Blood Sampling Culex - L Integrative Pharmacology - activity, dosing, physiologic monitoring, MD, UF

Confidential and Proprietary Regulatory Excellence Problem: Many laboratories may not have experience working with the regulatory authorities or may have had significant negative audit findings. Solution: BASi has a long history of audited quality research and regulatory control. 10 consecutive FDA audits of the BASi Preclinical facilities and studies with zero 483s (since 1993) 16 FDA inspections in 8

years 1 EPA inspection in 2013 AAALAC certified Preclinical f acilities 15

Confidential and Proprietary Customer Focus 16 Innovation Problem: The client wanted to reduce significantly the concept to approval process for their drug. Solution: Through continuous collaboration and consultation with the client, BASi was able to help the client reduce the cycle from the industry norm of 10 years to 5 years. Fast tracked IND and NDA enabling program for Antiviral drug candidate for

Hepatitis C. Drug was approved in December of 2013 Enabled a new blockbuster drug Since 2006, have c ompleted 100% of Preclinical reports on time. Investigational New Drug (IND) New Drug Application (NDA)

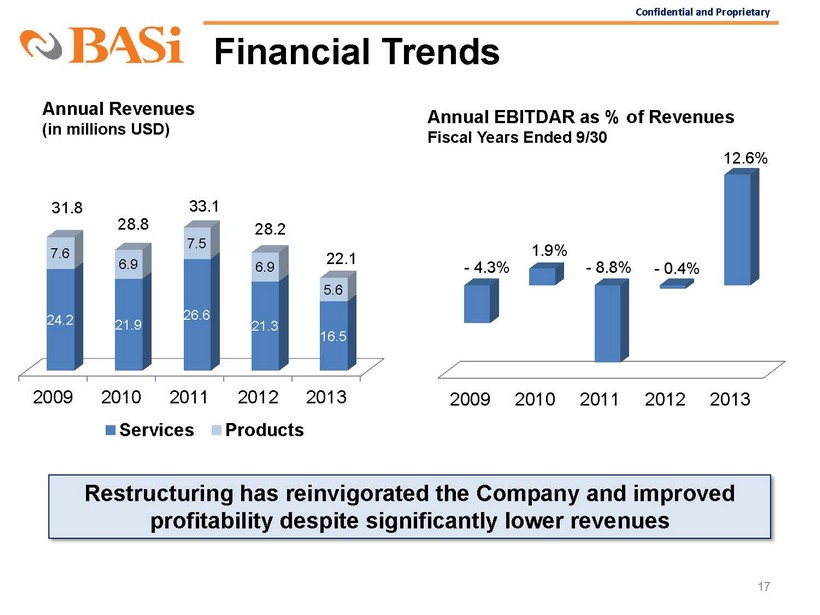

Confidential and Proprietary Financial Trends 17 2009 2010 2011 2012 2013 24.2 21.9 26.6 21.3 16.5 7.6 6.9 7.5 6.9 5.6 Services Products Annual Revenues (in millions USD) 31.8 28.8 33.1 28.2 22.1 2009 2010 2011 2012 2013 1.9% - 4.3% - 8.8% - 0.4% 12.6% Annual EBITDAR as % of Revenues Fiscal Years Ended 9/30 Restructuring has reinvigorated the Company and improved profitability despite significantly

lower revenues

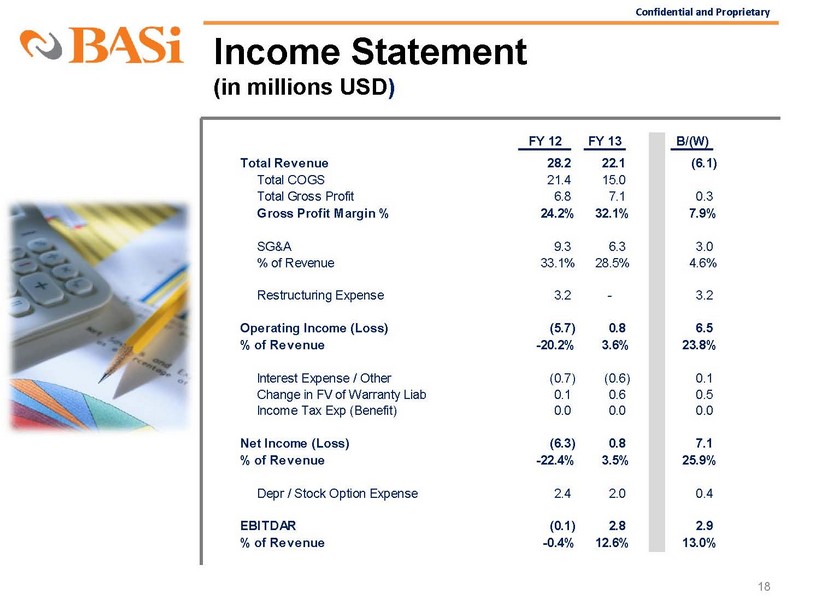

Confidential and Proprietary Income Statement (in millions USD ) 18 FY 12 FY 13 B/(W) Total Revenue 28.2 22.1 (6.1) Total COGS 21.4 15.0 Total Gross Profit 6.8 7.1 0.3 Gross Profit Margin % 24.2% 32.1% 7.9% SG&A 9.3 6.3 3.0 % of Revenue 33.1% 28.5% 4.6% Restructuring Expense 3.2 - 3.2 Operating Income (Loss) (5.7) 0.8 6.5 % of Revenue -20.2% 3.6% 23.8% Interest Expense / Other (0.7) (0.6)

0.1 Change in FV of Warranty Liab 0.1 0.6 0.5 Income Tax Exp (Benefit) 0.0 0.0 0.0 Net Income (Loss) (6.3) 0.8 7.1 % of Revenue -22.4% 3.5% 25.9% Depr / Stock Option Expense 2.4 2.0 0.4 EBITDAR (0.1) 2.8 2.9 % of Revenue -0.4% 12.6% 13.0%

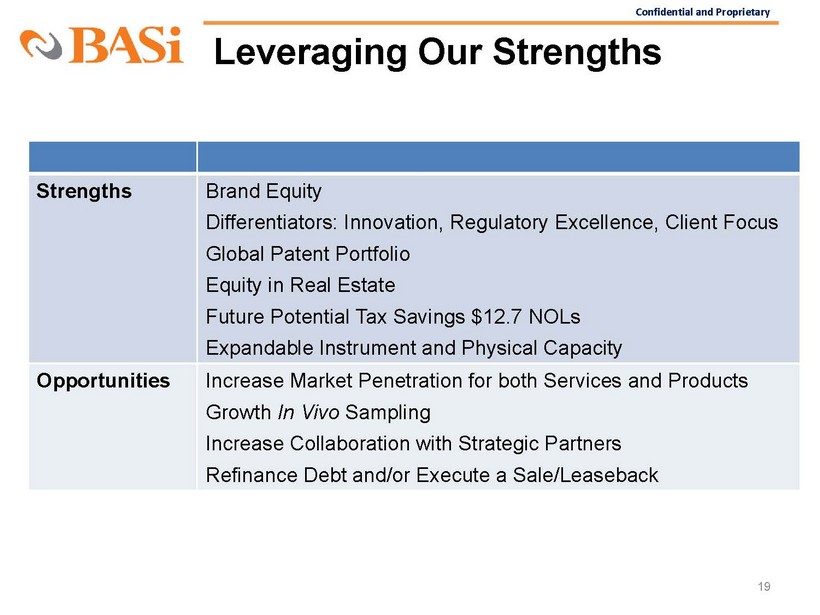

Confidential and Proprietary Leveraging Our Strengths 19 Strengths Brand Equity Differentiators: Innovation, Regulatory Excellence, Client Focus Global Patent Portfolio Equity in Real Estate Future Potential Tax Savings $12.7 NOLs Expandable Instrument and Physical Capacity Opportunities Increase Market Penetration for both Services and Products Growth In Vivo Sampling Increase Collaboration with Strateg

ic Partners Refinance Debt and/or Execute a Sale/Leaseback

Confidential and Proprietary Company Contact Jacqueline M. Lemke, CEO Bioanalytical Systems, Inc. Purdue Research Park 2701 Kent Avenue West Lafayette, IN 47906 (765) 463 - 4527 jlemke@BASinc.com Agency Contact Neil Berkman Berkman Associates 1900 Avenue of the Stars Los Angeles, CA 90067 (310) 477 - 3118 info@berkmanassociates.com www.BASinc.com 20