Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGENERON PHARMACEUTICALS, INC. | d659873d8k.htm |

J.P. Morgan

Healthcare Conference January 2014

Leonard S. Schleifer, M.D., Ph.D.

Chief Executive Officer

Exhibit 99.1 |

Page 2

| Copyright Regeneron 2014 Safe Harbor Statement

This presentation includes forward-looking statements that involve risks and

uncertainties relating to future events and the future performance of Regeneron

Pharmaceuticals, Inc. (“Regeneron” or the “Company”), and actual events

or results may differ materially from these forward-looking statements. Words such as

“anticipate,” “expect,” “intend,” “plan,”

“believe,” “seek,” “estimate,” variations of such words and similar expressions are intended to identify such forward-looking

statements, although not all forward-looking statements contain these identifying

words. These statements concern, and these risks and uncertainties include,

among others, the nature, timing, and possible success and therapeutic applications of

Regeneron's products, product candidates, and research and clinical programs now

underway or planned; unforeseen safety issues resulting from the administration of products and product candidates in patients, including serious

complications or side effects in connection with the use of Regeneron’s product

candidates in clinical trials; the likelihood and timing of possible regulatory

approval

and

commercial

launch

of

Regeneron's

late-stage

product

candidates

and

new

indications

for

marketed

products,

including

without

limitation

EYLEA

®

,

Alirocumab, Sarilumab, and Dupilumab; ongoing regulatory obligations and oversight and

determinations by regulatory and administrative governmental authorities which may

delay or restrict Regeneron's ability to continue to develop or commercialize Regeneron's products and product candidates; competing

drugs and product candidates that may be superior to Regeneron's products and product

candidates; uncertainty of market acceptance and commercial success of Regeneron's

products and product candidates; the ability of Regeneron to manufacture and manage supply chains for multiple products and product

candidates; coverage and reimbursement determinations by third-party payers, including

Medicare and Medicaid; unanticipated expenses; the costs of developing, producing,

and selling products; the ability of Regeneron to meet any of its sales or other financial projections or guidance and changes to the

assumptions underlying those projections or guidance, including without limitation those

relating to non-GAAP unreimbursed R&D, non-GAAP SG&A and capital

expenditures, the potential for any license or collaboration agreement, including

Regeneron's agreements with Sanofi and Bayer HealthCare, to be cancelled or

terminated without any further product success; and risks associated with third party

intellectual property and pending or future litigation relating thereto. A more

complete description of these and other material risks can be found in Regeneron's filings

with the U.S. Securities and Exchange Commission, including its Form 10-K for the

fiscal year ended December 31, 2012 and its Form 10-Q for the quarterly period ended September 30, 2013, in each case including in the sections

thereof captioned “Item 1A. Risk Factors.” Any forward-looking

statements are made based on management's current beliefs and judgment, and the reader is

cautioned not to rely on any forward-looking statements made by Regeneron.

Regeneron does not undertake any obligation to update publicly any forward-

looking statement, including without limitation any financial projection or guidance,

whether as a result of new information, future events, or otherwise. This

presentation uses non-GAAP net income, non-GAAP unreimbursed R&D, and non-GAAP SG&A, which are financial measures that are not calculated in

accordance with the U.S. Generally Accepted Accounting Principles (“GAAP”).

Regeneron believes that the presentation of these non-GAAP measures is useful to

investors because they exclude, as applicable, (i) non-cash share-based compensation expense which fluctuates from period to period based on factors that

are not within the Company's control, such as the Company's stock price on the dates

share-based grants are issued, (ii) non-cash interest expense related to

the Company's convertible senior notes since this is not deemed useful in evaluating the

Company's operating performance, (iii) non-cash income tax expense, since the

Company does not currently pay, or expect to pay in the near future, significant cash income taxes due primarily to the utilization of net operating loss

and tax credit carry-forwards; therefore, non-cash income tax expense is not deemed

useful in evaluating the Company's operating performance, and (iv) a non- cash tax

benefit as a result of releasing substantially all of the valuation allowance associated with the Company’s deferred tax assets. Non-GAAP unreimbursed

R&D represents non-GAAP R&D expenses reduced by R&D expense reimbursements

from the Company's collaboration partners. Management uses these non- GAAP

measures for planning, budgeting, forecasting, assessing historical performance, and making financial and operational decisions, and also provides

forecasts to investors on this basis. However, there are limitations in the use of

these and other non-GAAP financial measures as they exclude certain expenses that

are recurring in nature. Furthermore, the Company's non-GAAP financial measures may not be comparable with non-GAAP information provided by other

companies. Any non-GAAP financial measure presented by Regeneron should be

considered supplemental to, and not a substitute for, measures of financial

performance prepared in accordance with GAAP. A reconciliation of the Company's GAAP

to non-GAAP results is included at the end of this presentation.

|

Page 3

| Copyright Regeneron 2014 Regeneron Today

Products

*EYLEA

ex-U.S is partnered with Bayer HealthCare.

ZALTRAP

is partnered with Sanofi

Three approved products with sales in 50+ countries around

the world* |

Products

Pipeline

Regeneron Today

Page 4 | Copyright Regeneron 2014

Phase 1

Phase 2

Phase 3

Alirocumab

(REGN727)

PSCK9 Antibody for LDL cholesterol reduction

Sarilumab

(REGN88)

IL-6R Antibody for Rheumatoid arthritis

Dupilumab

(REGN668)

IL-4R Antibody for asthma, atopic dermatitis, nasal polyposis

Sarilumab

(REGN88)

IL-6R Antibody for Non-infectious Uveitis

REGN1033

(GDF8)

Antibody

for

Metabolic

disorders

Fasinumab

(NGF antibody)

on clinical hold

Enoticumab

(REGN421)

DII4 Antibody for Advanced malignancies

Nesvacumab

(REGN910)

Ang2 Antibody for Advanced malignancies

REGN1400

(ErbB3)

Antibody

for

Advanced

malignancies

REGN1154

(undisclosed

target)

REGN1500

(undisclosed

target)

REGN1193

(undisclosed

target)

REGN1908-1909

(undisclosed

target)

REGN2009

(undisclosed

target) |

Regeneron

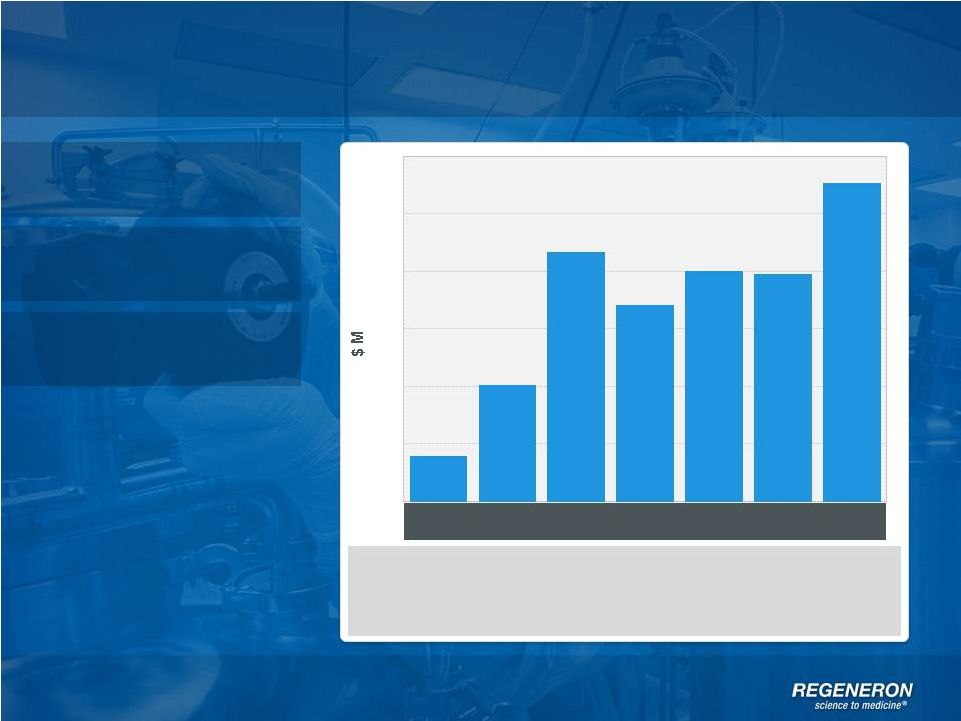

Today Page 5 | Copyright Regeneron 2014

Products

$65M in approval milestones received in 3Q12

$20M in upfront payments to Sanofi for rights to PDGF and ANG2

antibodies in 2Q13

$45M

in

milestone

payments

from

Bayer

for

ex-U.S.

EYLEA

®

in

3Q13

Profits

Pipeline

Non-GAAP Net Income*

Non-GAAP

net

income

excludes

non-cash

share-based

compensation

expense,

non-cash

interest

and

non-cash

income

tax

expense

See page 38 for GAAP to non-GAAP reconciliation

0

50

100

150

200

250

300

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13 |

Awards

Products

Regeneron named top employer in global biopharmaceutical industry by Science

Magazine

for

second

year

in

a

row

Named the best place to work by The Scientist in 2013

CEO and CSO named "Management Team of the Year" by Scrip Intelligence

Dupilumab

named

“Clinical

Advance

of

the

Year”

by

Scrip

Intelligence

Regeneron Today

Page 6 | Copyright Regeneron 2014

Profits

Pipeline |

Page 7

| Copyright Regeneron 2014 Products

Pipeline

Profits

Awards

People

Regeneron named top employer in global biopharmaceutical

industry by

Science

Magazine

for

second

year

in

a

row

Number of employees grew by 20 percent in 2013 to 2,340

In

four

locations:

Tarrytown,

NY;

Basking

Ridge,

NJ;

Rensselaer,

NY; and Limerick, Ireland

Regeneron Today |

Regeneron

Building

on

Success

Page 8 | Copyright Regeneron 2014

Organic Growth

Continuing

Top Line Growth

Investment in

R&D and

Technology |

Regeneron

Building

on

Success

Page 9 | Copyright Regeneron 2014

Significant News January 2014

What’s New for Regeneron

EYLEA

®

& Ophthalmology

Franchise

4Q13 and full year 2013 U.S.

net sales

PDGFR-

clinical and business update

Alirocumab

Sarilumab

Dupilumab

Update on data and filing timelines

Sanofi Collaboration

Amended

investor agreement

Early R&D

Regeneron Genetics Center

Immuno-Oncology

2014 Financial

Guidance

Non-GAAP SG&A,

unreimbursed R&D, and

capital expenditures |

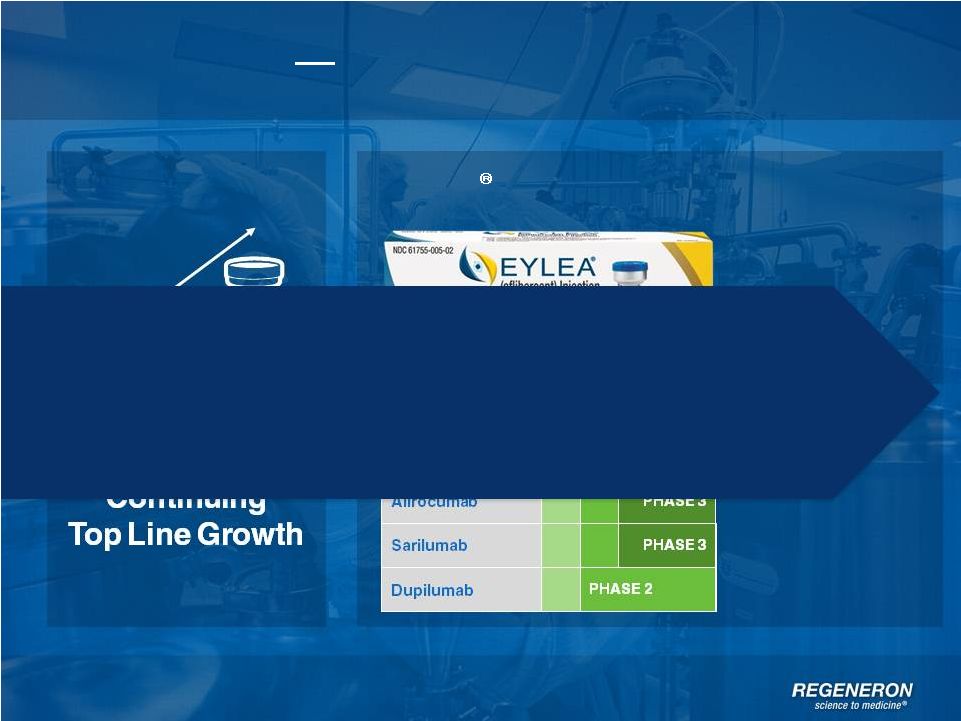

Regeneron

Building

on

Success

Page 10 | Copyright Regeneron 2014

Continuing

Top Line Growth |

Regeneron

Building

on

Success

EYLEA

Franchise

Page 11 | Copyright Regeneron 2014

Potential for five major regulatory

submissions or approvals

in next five years |

Page 12

| Copyright Regeneron 2014 EYLEA

Franchise |

Page

13 | Copyright Regeneron 2014 2013 U.S. Net Sales:

~$1.4 Billion* 4Q13 U.S. Net Sales: ~$400 Million* Distributor inventory increased to

slightly more than two weeks

Inventory has historically been

1-2 weeks

Commercial terms tightened in

January 2014

Full year guidance during 4Q13 call

DME:

PDUFA date of August 18, 2014

BRVO regulatory filing expected in

1Q14

Regeneron

Optimize and Extend EYLEA

U.S.

EYLEA

:

Demographics,

Market

Share,

New

Indications

to

Drive

Growth

DME : Diabetic Macular Edema

BRVO : Branch Retinal vein Occlusion

*

*Preliminary unaudited numbers

Impact of compounding legislation

uncertain

U.S. Net Sales |

Regeneron

Optimize and Extend EYLEA

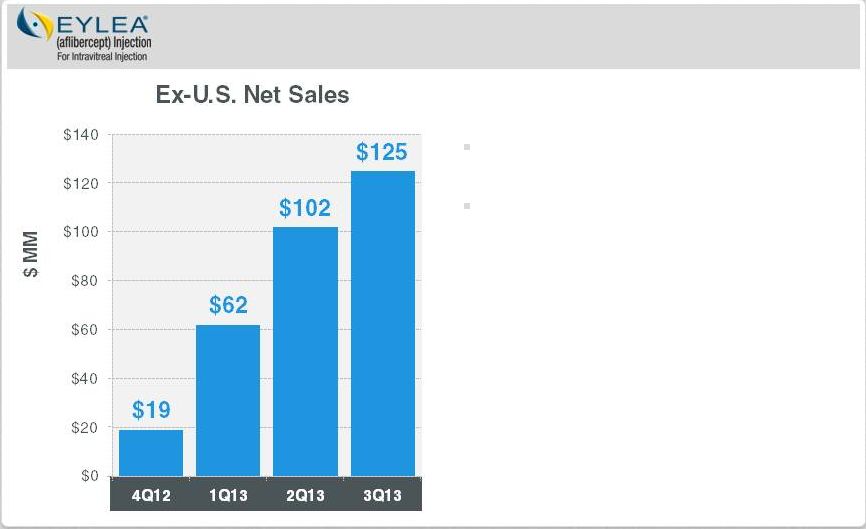

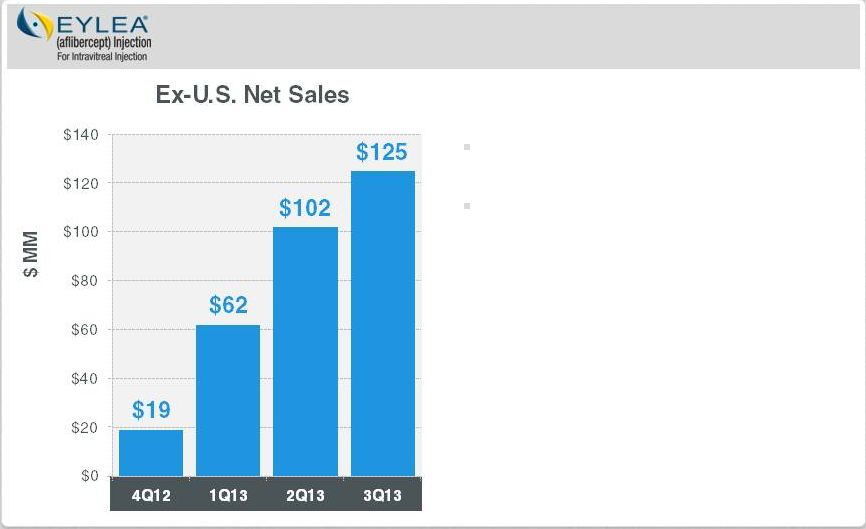

Ex-U.S. EYLEA: Launch is Still in Early Innings

Ex-U.S. sales contributing to bottom line

DME submitted in EU

Myopic CNV filed in Japan

Global macular edema following BRVO

submission expected in 2014

DME : Diabetic Macular Edema

AMD: Age-related macular degeneration

CRVO : Central Retinal Vein Occlusion

BRVO : Branch Retinal vein Occlusion

CNV : Choroidal Neovascularization

Ex-U.S. launch by partner, Bayer

HealthCare, continues to do well

In wet-AMD, 40%-50% market share in

Australia, Japan and Germany

Approved for macular edema following

CRVO in EU and Japan

Page 14 | Copyright Regeneron 2014 |

PDGFR-

/EYLEA

®

co-formulation IND

submitted in December 2013

First patient enrolled in Phase 1

expected in 1Q14

Regeneron owns 100% commercial

rights in U.S.

Bayer collaborating outside the U.S.

Page 15 | Copyright Regeneron 2014

Regeneron

Optimize and Extend EYLEA

Protecting the Long Term Value of The Retina Franchise

PDGFR-

Ophthalmology Research

ANG2

Commitment to remain a leader in

retinal diseases

Investment in internal research and

external collaborations

Intravitreal co-formulation with

EYLEA

®

: IND expected to be

submitted in 2014

$25.5M upfront

$40M in option and milestone

payments

Bayer/REGN share global

development expenses

Bayer responsible for certain third

party royalties and share of

milestones

Companies share profits equally |

Page 16

| Copyright Regeneron 2014 Late Stage Pipeline |

Three Late

Stage Programs Regeneron

Advance Late Stage Pipeline

Page 17 | Copyright Regeneron 2014

Late Stage Pipeline Expected to Drive Continued Top-Line Growth

PCSK9 antibody for elevated

cholesterol

IL6R antibody for rheumatoid

arthritis

IL4R antibody for asthma, atopic

dermatitis and nasal polyposis

All three programs—alirocumab, sarilumab and

dupilumab—are part of Sanofi collaboration

Two programs with positive Phase 3 data in

2013: alirocumab & sarilumab

Potential for four major regulatory submissions

or approvals in next five years*:

* Including EYLEA

®

for DME, five major

regulatory submissions or approvals in next five

years

Dupilumab

Sarilumab

Alirocumab

PHASE 3

PHASE 3

PHASE 2

Alirocumab for LDL lowering

Sarilumab for rheumatoid arthritis

Dupilumab for atopic dermatitis

Dupilumab for asthma |

Page 18

| Copyright Regeneron 2014 Advancing Late Stage Opportunities

Regeneron

Alirocumab

Positive data from the alirocumab clinical trials have been

published in peer-reviewed journals such as the New England

Journal of Medicine

and The Lancet |

Regeneron

Sarilumab

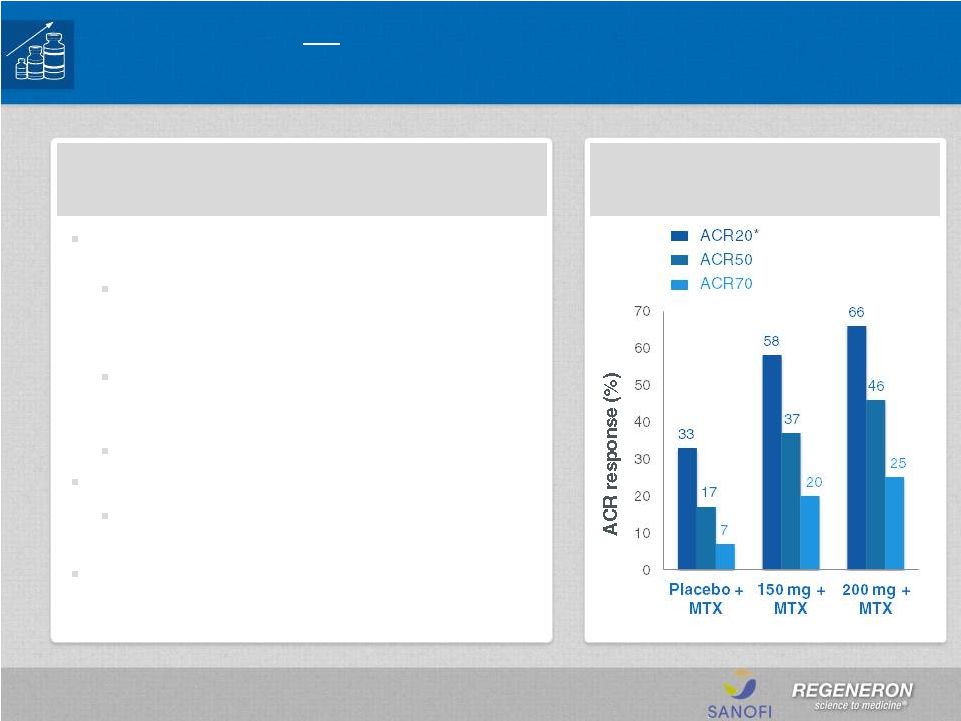

Page 19 | Copyright Regeneron 2014

Advancing Late Stage Opportunities

Positive Phase 3 data from MOBILITY (N=1,200)

reported 4Q13

Both sarilumab dose groups—150 mg and 200

mg—given subcutaneously, every other week, in

combination with methotrexate (MTX) achieved

all three co-primary endpoints

Patients receiving 200 mg + MTX showed a 90%

reduction in radiographic progression (mTSS) at

week 52

Data to be presented at a medical conference

Additional Phase 3 data expected in 2015

Ongoing Phase 3 studies are: COMPARE,

TARGET, ASCERTAIN, EXTEND

Regulatory submission expected in 2015

MOBILITY: ACR responses

at 24 weeks

Sarilumab for Rheumatoid Arthritis

Infections were the most frequently reported adverse events and were reported with a higher

incidence in the sarilumab groups vs. placebo, all in combination with MTX (39.6% for

200 mg, 40.1% for the 150 mg group and 31.1% for pbo).

The incidence of serious infections was 4.0% in the 200 mg

+ MTX group, 2.6% in the 150 mg + MTX group, and 2.3% in the placebo + MTX group.

.

*primary endpoint, p<0.0001 vs. pbo |

Page 20

| Copyright Regeneron 2014 Regeneron

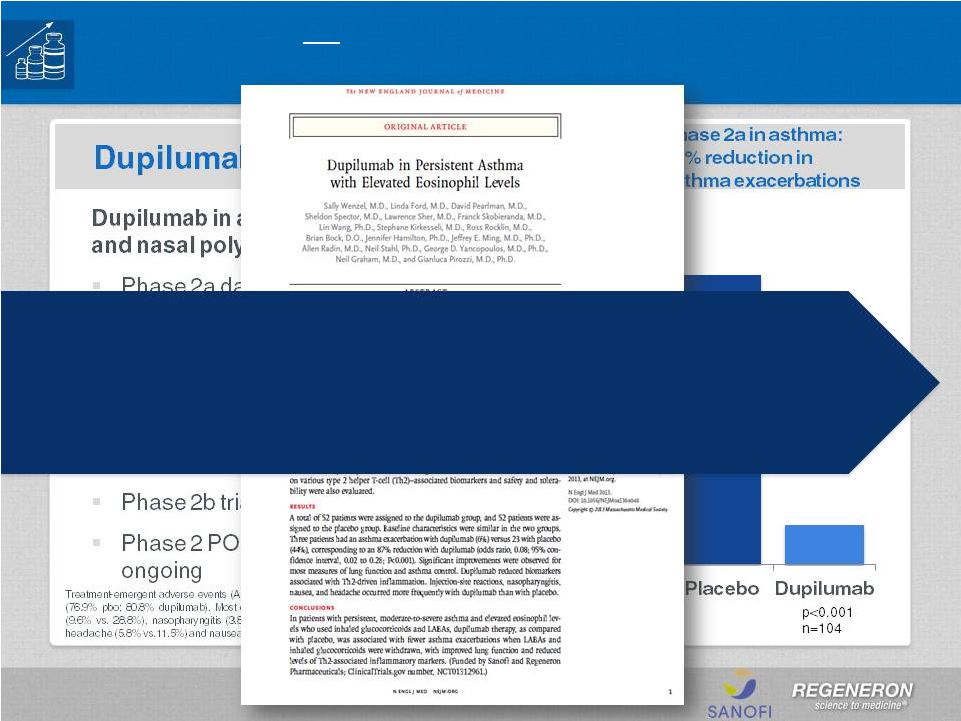

Dupilumab

Advancing Late Stage Opportunities

Positive data from the dupilumab asthma clinical trial have

been published in the New England Journal of Medicine |

Regeneron

Building on Success

Page 21 | Copyright Regeneron 2014

Investment in

R&D and

Technology |

Regeneron

Building on Success

Page 22 | Copyright Regeneron 2014

Wholly-Owned

Pipeline of Products

Sanofi Collaboration

Fasinumab*

Phase 2

REGN1400

Phase 1

REGN1154

Phase 1

REGN1500

Phase 1

REGN1193

Phase 1

REGN1908-1909

Phase 1

Innovative Research

& Technologies

Investment in

R&D and

Technology |

Page 23

| Copyright Regeneron 2014 Sanofi Collaboration |

Sanofi

Collaboration Regeneron

Sanofi Collaboration

Discovery

$160 million of annual funding

through 2017 (plus possible

tail period through 2020)

Sanofi Antibody Collaboration Continues to Provide R&D Leverage

Page 24 | Copyright Regeneron 2014

*Regeneron

repays

Sanofi

for

50%

of

development

costs

out

of

profits.

Repayment

capped

in

any

year

at

10%

of

Regeneron

share

of

total

antibody

profits

Development

REGN funds 20% of Phase 3

costs for an antibody following

first positive Phase 3 data for

that antibody

Commercialization

Regeneron retains 35% to 45%

45% of profits ex-US*

Co-promotion rights

in US and other major market

countries

Ownership / Investor Agreement

•

Sanofi ownership is currently 15.8M shares or ~16%

•

Sanofi

has

obtained

right

to

nominate

an

independent

director

to

Regeneron

BOD

when they reach 20% ownership

•

Voting rights, lock-up, and standstill limit to 30% ownership

Ownership / Investor Agreement

•

Sanofi ownership is currently 15.8M shares or ~16%

•

Sanofi

has

obtained

right

to

nominate

an

independent

director

to

Regeneron

BOD

when they reach 20% ownership

•

Voting rights, lock-up, and standstill limit to 30% ownership

Sanofi funds approximately 100%

of clinical development cost

Regeneron retains

50% of profits in US* |

Phase

1 Phase 2

Phase 3

Alirocumab

(REGN727)

PSCK9 Antibody for LDL cholesterol

reduction

Sarilumab

(REGN88)

IL-6R

Antibody for Rheumatoid arthritis

Dupilumab

(REGN668)

IL-4R

Antibody for Asthma, Atopic dermatitis,

nasal polyposis

Sarilumab

(REGN88)

IL-6R

Antibody for Non-infectious Uveitis

REGN1033

GDF8

Antibody

for

Metabolic

disorders

Enoticumab

(REGN421)

DII4

Antibody for Advanced malignancies

Nesvacumab

(REGN910)

Ang2

Antibody for Advanced malignancies

REGN2009

(undisclosed

target)

Page 25 | Copyright Regeneron 2014

Sanofi collaboration a major

contributor to Regeneron R&D

Sanofi is estimated to spend

more than $1 Billion on

collaboration programs in 2014*

Regeneron contribution to

collaboration R&D funding

increasing in 2014

20% funding of alirocumab and

sarilumab Phase 3 trials

Estimated to be ~$115 MM in

2014

Sanofi Antibody Collaboration Continues to Provide R&D Leverage

Regeneron

Sanofi Collaboration

*Regeneron to repay 50% of collaboration clinical development

spending out of antibody profits

Sanofi Collaboration |

Page 26

| Copyright Regeneron 2014 Pipeline of Wholly-Owned

Antibodies |

Wholly-Owned Clinical Stage Antibodies

Advancing early stage pipeline of Regeneron-owned antibodies

Fasinumab* (Phase 2, NGF antibody)

REGN1400 (Phase 1, ErbB3, advanced malignancies)

REGN1154 (Phase 1, undisclosed target)

REGN1500 (Phase 1, undisclosed target)

REGN1193 (Phase 1, undisclosed target)

REGN1908-1909 (Phase 1, undisclosed target)

As pipeline advances, R&D expense will increase

Pipeline of Wholly-Owned Antibodies is Growing

Regeneron

Wholly-Owned Antibody Pipeline

*Currently on clinical hold by the FDA

Pipeline compounds address six distinct therapeutic areas

Committed to advance through POC to maximize value |

Page 28

| Copyright Regeneron 2014 Innovative Research and Novel

Technologies |

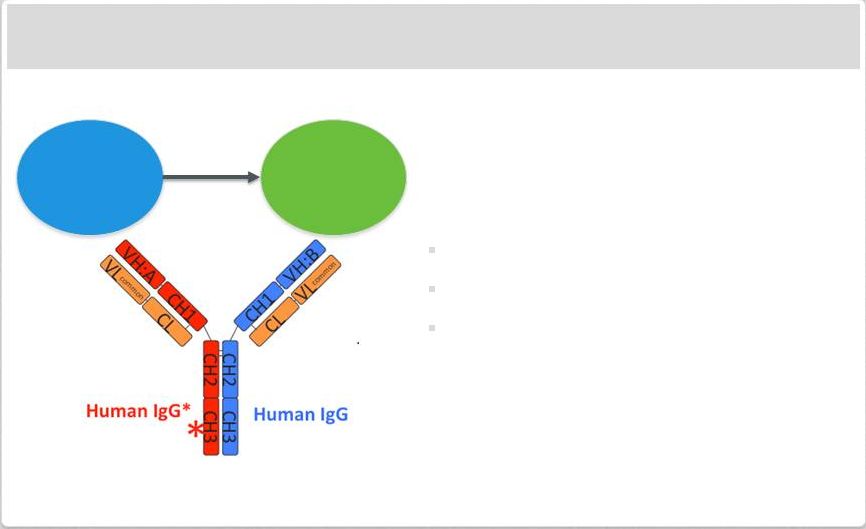

Immuno-Oncology

CD20-CD3 bispecific antibody

expected to enter clinic in

2014

Page 29 | Copyright Regeneron 2014

Regeneron

Innovating

for

the

Future

Investment in Research & Development and Technology

Regeneron Genetics Center

Major new investment in human

genetics research

Collaboration with Geisinger Health

System is cornerstone of population

based approach

Additional collaborations expected

Other Pipeline

Technologies

Long-acting antibodies

Antibody Drug Conjugates

Next Generation

VelocImmune

®

Mice |

Immuno-Oncology Approach: CD20-CD3 Bispecific Antibody

Bispecific antibody bind T Cells (via CD3)

and tumor (via specific surface marker)

Use of modified VelocImmune

®

mice to

generate fully human bispecific

antibodies provides benefits

High affinity to target

Ease of manufacturing

Typical antibody pharmacodynamics

Initial CD20-CD3 antibody expected to

enter the clinic in 2014

Additional immuno-oncology approaches

in preclinical development

Page 30 | Copyright Regeneron 2014

Investment in Research & Development and Technology

Regeneron

Innovating

for

the

Future

T-cell

Tumor

Cell

Killing |

Page 31

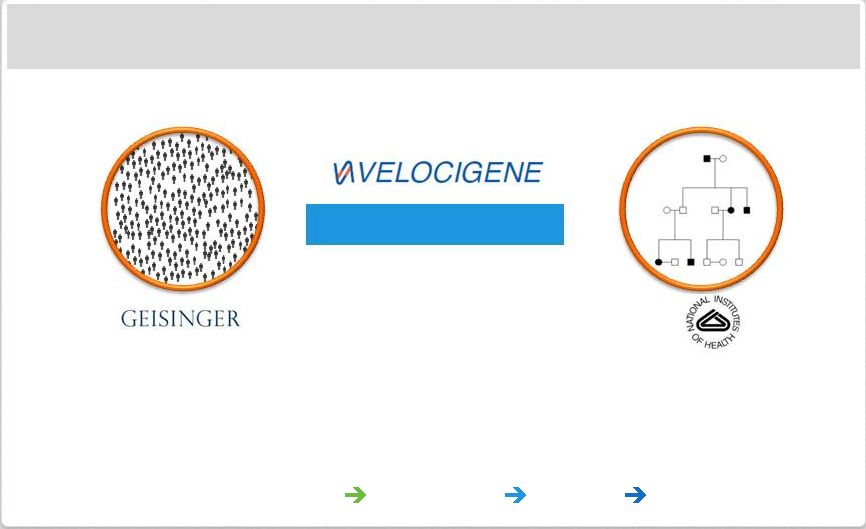

| Copyright Regeneron 2014 Regeneron Genetics Center a Major Initiative in Human

Genetics Regeneron

Innovating

for

the

Future

Regeneron Genetics Center

Population-Based

Family-Based

Collaborations:

Geisinger,

NIH,

and

pursuing

more

Approaches:

population

and

family

based,

consortia,

and

functional

studies

Technology:

large

scale

sequencing,

automation,

and

cloud

informatics

Fully Integrated: Sequencing

Informatics

Biology

Drug Development

Targets & Indications |

Organic

Growth Regeneron

Building

on

Success

Page 32 | Copyright Regeneron 2014 |

Page

33 | Copyright Regeneron 2014 Regeneron

Organic

Growth

Growth in Manufacturing and at Corporate Headquarters

Two new buildings to

support additional

research and

development

Expansion in

Tarrytown, NY

Expect to increase

headcount to >4,000 by

2018

People

Expansion in Rensselaer,

NY and new facility in

Limerick, Ireland

New Manufacturing

Facilities

Tarrytown, NY

Limerick, Ireland |

Regeneron

Financial

Guidance

Page 34 | Copyright Regeneron 2014

Financial Guidance

Non-GAAP

SG&A:

$330MM

-

$380MM

Increase in prelaunch commercial expenses, contribution to patient assistance

programs, pharma fee and headcount

Non-GAAP

Unreimbursed

R&D:

$425MM

-

$475MM

~$115 M in expenses related to alirocumab and sarilumab Phase

3 trials

Investment

in

PDGFR

and

Ang2

programs

Growing wholly-owned antibody pipeline

Early technologies, such as Regeneron Genetics Center

Capital

Expenditures:

$350MM

-

$425MM

Manufacturing expansions in Rensselaer and Ireland

R&D and corporate headquarters expansion in Tarrytown

2014 Financial Guidance |

Continuing

Top Line

Growth

Organic Growth

Regeneron

Building on Success

Page 35 | Copyright Regeneron 2014

Investment in

R&D and

Technology |

Regeneron

2014 Milestones

Page 36 | Copyright Regeneron 2014

Upcoming Milestones

Clinical

Phase 2 data for dupilumab

in atopic dermatitis in 1H14

Phase 3 trial to start with

dupilumab in AD in 2014

Phase 3 data from

alirocumab ODYSSEY

program in mid-2014

through 3Q14

PDGFR

/EYLEA

coformulation to enter

clinic in 1Q14

CD20-CD3 bispecific

antibody to enter clinic

Commercial

EYLEA U.S. net sales

guidance to be provided on

4Q13 conference call

Regulatory

EYLEA for DME PDUFA

date of August 18, 2014

Filing of EYLEA for BRVO

indication expected in

1Q14

EYLEA for DME regulatory

applications submitted

outside the U.S. |

Regeneron

News

Page 37 | Copyright Regeneron 2014

Significant News Flow at J.P. Morgan

What’s News for Regeneron at J.P. Morgan 2014

EYLEA

Full year 2013 U.S. Net Sales: ~$1.4

#

Billion

4Q13 U.S. Net Sales: ~$400 Million*

#

Clinical trial to start in 1Q14

Signed a collaboration with Bayer HealthCare for commercial rights outside the U.S.

Alirocumab

Phase 3 data from ODYSSEY program expected mid-year**

Initial regulatory submission ex-US in early 2015, U.S. in 2015

Dupilumab

Phase 2a atopic dermatitis data to be presented at AAAAI in March

Top-line Phase 2b atopic dermatitis data expected in 2Q14

Plan to initiate Phase 3 trial in atopic dermatitis in 2014

Sanofi

Amended

investor

agreement

to

allow

for

Sanofi

to

nominate

a

single

director

to

Regeneron BOD; amended voting rights, lock-up, and stand still agreement

Human Genetics

Announced major effort in human genetics: The Regeneron Genetics Center

Entered into first significant genetics collaboration with Geisinger Health System

Immuno-Oncology

CD20-CD3 bispecific antibody to enter clinic in 2014

2014 Financial

Guidance

Non-GAAP SG&A: $330MM -

$380MM

Non-GAAP unreimbursed R&D: $425MM -

$475MM

Capital expenditures: $350MM -

$425MM

#

Preliminary unaudited numbers

*Includes increase in distributor inventory

**From

all

Phase

3

studies

except

OUTCOMES,

CHOICE

1,

and

CHOICE

2

PDGFR- |

GAAP to

Non-GAAP Reconciliation 1Q’12

2Q’12

3Q’12

4Q’12

1Q’13

2Q’13

3Q’13

GAAP net income

11,651

76,743

191,468

470,407

98,874

87,376

141,306

Adjustments

R&D: Non-cash share-based compensation expense

10,556

11,442

13,337

18,498

26,761

27,722

28,258

SG&A: Non-cash share-based compensation expense

12,578

7,790

7,030

11,851

25,787

16,344

17,114

COGS: Non-cash share-based compensation expense

111

391

150

422

483

376

373

Interest expense: Non-cash interest related to

convertible senior notes

5,218

5,316

5,499

5,591

5,781

5,535

5,823

Income taxes: Non-cash income tax expense

4,308

(

42,957

60,316

84,378

Income taxes: Release of valuation allowance

(340,156)

(8)

Non-GAAP net income

40,114

101,682

217,484

170,921

200,643

197,669

277,252

Non-GAAP net income per share –

basic

0.43

1.07

2.29

1.79

2.07

2.02

2.82

Non-GAAP net income per share –

diluted

0.37

(3)

0.90

(5)

1.89

(6)

1.47

(9)

1.78

(10)

1.73

(11)

2.40

(12)

Shares used in calculating Non-GAAP net income per

share -

basic

93,446

94,589

95,012

95,691

96,878

97,700

98,226

Shares used in calculating Non-GAAP net income per

share –

diluted

112,495

114,928

115,830

117,237

113,730

115,261

116,068

1)

To exclude non-cash compensation expense related to employee stock option and

restricted stock award 2)

To exclude non-cash interest expense related to the amortization of the debt discount

and debt issuance costs on the Company's 1.875% convertible senior notes

3)

For diluted non-GAAP per share calculations, excludes $1.9 million of interest

expense related to the contractual coupon interest rate on the Company's 1.875%

convertible senior notes, since these securities were dilutive

4)

Weighted average shares outstanding includes the dilutive effect, if any, of

employee stock options, restricted stock awards, convertible senior notes,

and warrants 5)

For diluted non-GAAP per share calculations, excludes $1.9 million of interest

expense for the three months ended June 30, 2012 related to the contractual

coupon interest rate on the Company's 1.875% convertible senior notes, since these

securities were dilutive 6)

For diluted non-GAAP per share calculations, excludes $1.9 million of interest

expense for the three months ended September 30, 2012 related to the contractual

coupon interest rate on the Company's 1.875% convertible senior notes, since these

securities were dilutive 7)

To

exclude

GAAP

income

tax

expense

as

this

amount

is

not

payable

in

cash

8)

To exclude non-cash tax benefit related to releasing substantially all of the

valuation allowance associated with the Company's deferred tax assets

9)

For diluted non-GAAP per share calculations, excludes $1.9 million of interest

expense for the three months ended

December

31,

2012

related to the contractual coupon interest rate on the Company's

1.875% convertible

senior notes, since these securities were dilutive

10)

For diluted non-GAAP per share calculations, excludes $1.9 million of interest

expense for the three month ended March 31, 2013 related to the contractual

coupon interest rate on the Company's 1.875% convertible

senior notes, since these securities were dilutive

11)

For diluted non-GAAP per share calculations, excludes $1.8 million of interest

expense for the three month periods ended June 30, 2013 related to the

contractual coupon interest rate on the Company's 1.875% convertible senior

notes, since these securities were dilutive 12)

For diluted non-GAAP per share calculations, excludes $1.8 million of interest

expense for the three months ended September 30, 2013, related to the

contractual coupon interest rate on the Company's 1.875% convertible senior

notes, since these securities were dilutive (1)

(1)

(1)

(2)

(4)

(7) |

|