Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DARDEN RESTAURANTS INC | a8-k12x19x13v2.htm |

December 19, 2013 Comprehensive Plan to Enhance Shareholder Value Exhibit 99.1

® Forward-Looking Statements 2 During the course of this presentation, Darden Restaurants’ officers and employees may make forward-looking statements concerning the Company’s expectations, goals or objectives. Forward-looking statements are made under the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements speak only as of the date on which such statements are made, and we undertake no obligation to update such statements to reflect events or circumstances arising after such date. We wish to caution investors not to place undue reliance on any such forward-looking statements. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to materially differ from those anticipated in the statements. The most significant of these uncertainties are described in Darden's Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports). These risks and uncertainties include the ability to achieve the strategic plan to enhance shareholder value including the separation of Red Lobster, the high costs in connection with a spin-off which may not be recouped if the spin-off is not consummated, food safety and food-borne illness concerns, litigation, unfavorable publicity, risks relating to public policy changes and federal, state and local regulation of our business including health care reform, labor and insurance costs, technology failures, failure to execute a business continuity plan following a disaster, health concerns including virus outbreaks, intense competition, failure to drive sales growth, failure to successfully integrate the Yard House business and the additional indebtedness incurred to finance the Yard House acquisition, our plans to expand our smaller brands Bahama Breeze, Seasons 52 and Eddie V’s, a lack of suitable new restaurant locations, higher-than-anticipated costs to open, close, relocate or remodel restaurants, a failure to execute innovative marketing tactics and increased advertising and marketing costs, a failure to develop and recruit effective leaders, a failure to address cost pressures, shortages or interruptions in the delivery of food and other products, adverse weather conditions and natural disasters, volatility in the market value of derivatives, economic factors specific to the restaurant industry and general macroeconomic factors including unemployment and interest rates, disruptions in the financial markets, risks of doing business with franchisees and vendors in foreign markets, failure to protect our service marks or other intellectual property, impairment in the carrying value of our goodwill or other intangible assets, a failure of our internal controls over financial reporting, or changes in accounting standards, an inability or failure to manage the accelerated impact of social media and other factors and uncertainties discussed from time to time in reports filed by Darden with the Securities and Exchange Commission.

® Summary Overview 3 Comprehensive plan to enhance shareholder value addresses important changes in consumer demand and dynamics and leverages Darden’s position as the premier full service restaurant company Key elements of the plan: – Separate Red Lobster from Darden – Reduce unit growth, lower capital expenditures and forgo acquisitions – Increase operating support cost savings ($60mm annually vs. previous estimate of $50mm) and increase support cost management intensity post-separation – Refine management compensation and incentive programs to more directly emphasize same restaurant sales and free cash flow – Current quarterly dividend of $0.55 per share expected to be maintained in aggregate Plan drives stronger alignment within increasingly divergent parts of the business, enhances Darden’s sales and earnings growth profile post-separation and supports further return of capital to shareholders No final decision has been made on the form of separation – Darden expects to execute a tax-free spin-off to its shareholders – Sale of Red Lobster being explored in parallel – Transaction expected to close in early FY15¹ (completion subject to certain customary conditions) ¹ Begins 26-May-2014.

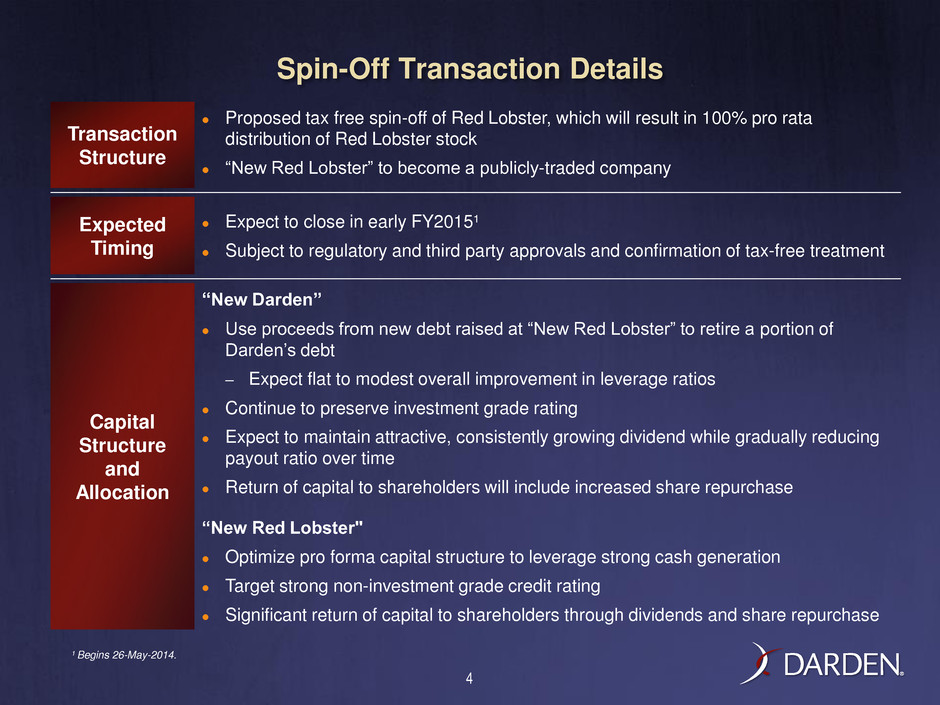

® Spin-Off Transaction Details 4 Transaction Structure Proposed tax free spin-off of Red Lobster, which will result in 100% pro rata distribution of Red Lobster stock “New Red Lobster” to become a publicly-traded company Expected Timing Expect to close in early FY2015¹ Subject to regulatory and third party approvals and confirmation of tax-free treatment Capital Structure and Allocation “New Darden” Use proceeds from new debt raised at “New Red Lobster” to retire a portion of Darden’s debt – Expect flat to modest overall improvement in leverage ratios Continue to preserve investment grade rating Expect to maintain attractive, consistently growing dividend while gradually reducing payout ratio over time Return of capital to shareholders will include increased share repurchase “New Red Lobster" Optimize pro forma capital structure to leverage strong cash generation Target strong non-investment grade credit rating Significant return of capital to shareholders through dividends and share repurchase ¹ Begins 26-May-2014.

® Strategic Rationale for Separation 5 Current portfolio hampered by divergent operating priorities, capital requirements, sales and earnings growth prospects and volatility profiles of Red Lobster and the rest of Darden Transaction transforms the portfolio into two independent companies that can each focus on separate and distinct opportunities to drive long-term shareholder value Changing industry consumer demand dynamics create need for intensive focus on key guest targets and related priorities Separation will allow “New Darden” and “New Red Lobster” to better serve their increasingly divergent guest targets Leading full-service restaurant companies with the appropriate strategic focus have abundant value creation opportunities Separate organizations enables “New Darden” and “New Red Lobster” to better focus on their divergent value creation levers Management incentive compensation expected to be tied closely to businesses’ operating results Announced compensation changes for “New Darden” and planned program for “New Red Lobster” will result in appropriate incentives for management teams passionate about their respective businesses Desire for increased financial transparency Easier to value and measure performance Differing shareholder requirements Separation repositions the business to better serve differing shareholder investment requirements (growth and income vs. income/yield) and maximizes total shareholder value

® Details of New Unit Growth Strategy, Cost Management Focus and Capital Return for Darden ex. Red Lobster 6 Same-Restaurant Sales 1– 2% growth 2 – 3% growth New Unit Growth Olive Garden ~1% new unit growth ~10 new units annually Minimal new units LongHorn 5 – 6% new unit growth 30 – 35 new units annually 3 – 4% new unit growth 15 – 20 new units annually SRG 11 – 12% new unit growth 25 – 30 new units annually 9 – 10% new unit growth 20 – 25 new units annually New Unit Capex ~$300mm annually ~$200mm annually Restaurant-Level Returns¹ Mid-teens (14 – 17%) Increase ~50bps Estimated Cost Savings $50mm $60mm currently identified, with heightened ongoing focus on cost discipline Dividend Policy Industry leading payout Unchanged Share Repurchase Limited share repurchase as allowed by excess cash flow Consistent, meaningful and growing share repurchase and debt paydown with immediate increase in excess cash flow and elevated free cash flow growth over time Previous Direction New Direction Note: All figures are pro forma for separation of Red Lobster. ¹ Includes marketing and depreciation expense and a credit that represents the implied interest in rent payment for leased units. Excludes rent averaging expense and direct new unit opening costs

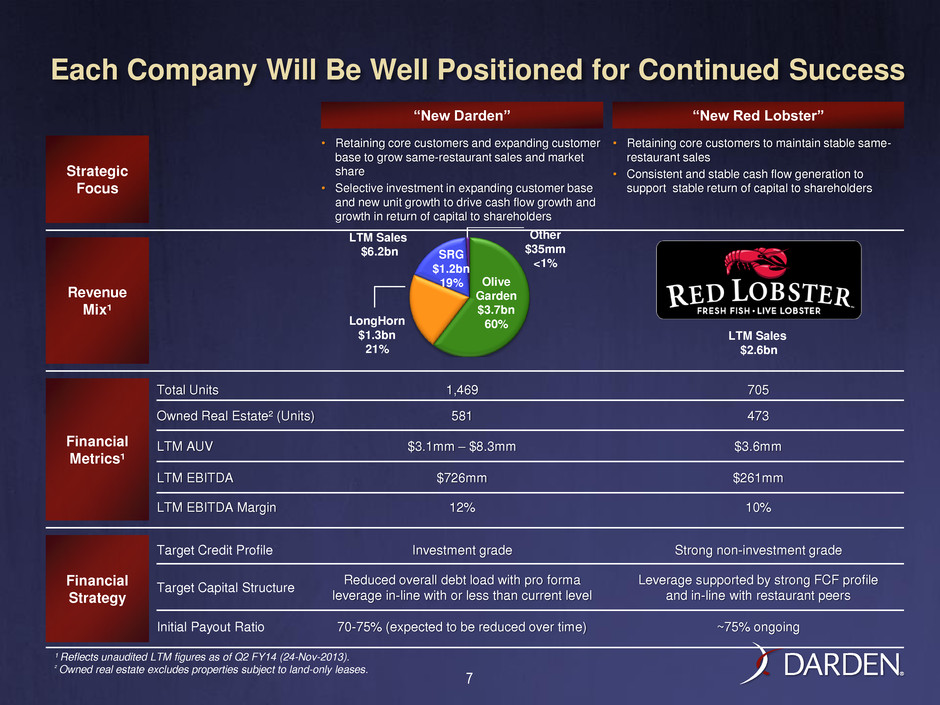

® “New Darden” “New Red Lobster” Strategic Focus • Retaining core customers and expanding customer base to grow same-restaurant sales and market share • Selective investment in expanding customer base and new unit growth to drive cash flow growth and growth in return of capital to shareholders • Retaining core customers to maintain stable same- restaurant sales • Consistent and stable cash flow generation to support stable return of capital to shareholders Revenue Mix¹ Financial Metrics¹ Total Units 1,469 705 Owned Real Estate² (Units) 581 473 LTM AUV $3.1mm – $8.3mm $3.6mm LTM EBITDA $726mm $261mm LTM EBITDA Margin 12% 10% Financial Strategy Target Credit Profile Investment grade Strong non-investment grade Target Capital Structure Reduced overall debt load with pro forma leverage in-line with or less than current level Leverage supported by strong FCF profile and in-line with restaurant peers Initial Payout Ratio 70-75% (expected to be reduced over time) ~75% ongoing Each Company Will Be Well Positioned for Continued Success Olive Garden $3.7bn 60% LongHorn $1.3bn 21% SRG $1.2bn 19% Other $35mm <1% ¹ Reflects unaudited LTM figures as of Q2 FY14 (24-Nov-2013). ² Owned real estate excludes properties subject to land-only leases. 7 LTM Sales $6.2bn LTM Sales $2.6bn

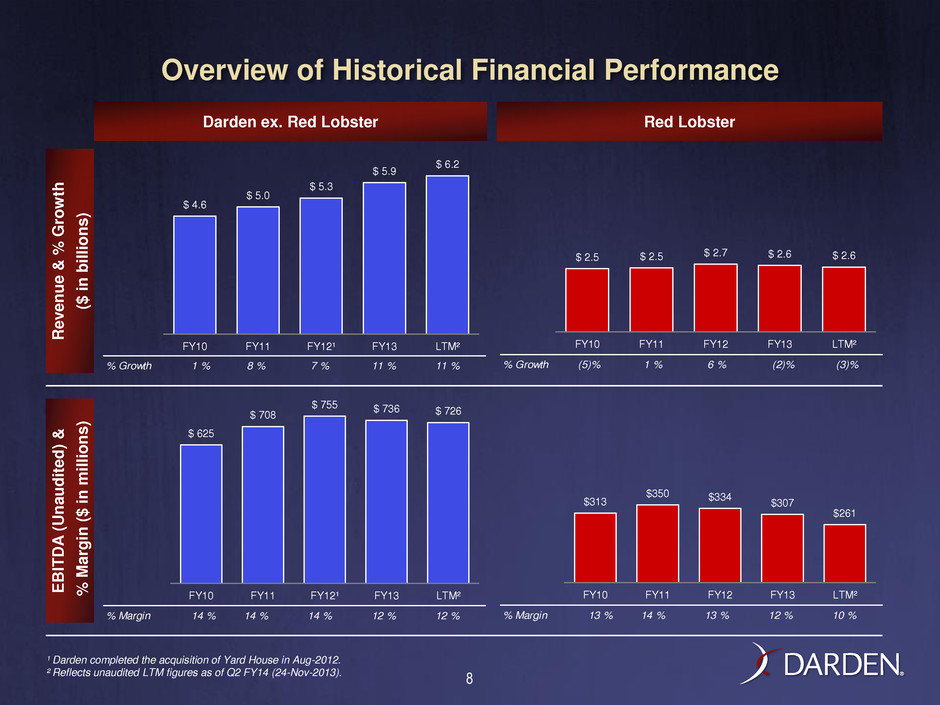

® Darden ex. Red Lobster Red Lobster Re v e nue & % G ro w th ($ in b il lion s ) E BIT D A ( U naudit e d ) & % M a rgi n ($ in m il lion s ) Overview of Historical Financial Performance ¹ Darden completed the acquisition of Yard House in Aug-2012. ² Reflects unaudited LTM figures as of Q2 FY14 (24-Nov-2013). 8 $ 4.6 $ 5.0 $ 5.3 $ 5.9 $ 6.2 FY10 FY11 FY12¹ FY13 LTM² % Growth 1 % 8 % 7 % 11 % 11 % $313 $350 $334 $307 $261 FY10 FY11 FY12 FY13 LTM² % Margin 13 % 14 % 13 % 12 % 10 % $ 2.5 $ 2.5 $ 2.7 $ 2.6 $ 2.6 FY10 FY11 FY12 FY13 LTM² % Growth (5)% 1 % 6 % (2)% (3)% $ 625 $ 708 $ 755 $ 736 $ 726 FY10 FY11 FY12¹ FY13 LTM² % Margin 14 % 14 % 14 % 12 % 12 %

® Overview of the “New Darden” 9 Premier Brands Stronger and more stable growth, reduced debt and better long-term shareholder value creation prospects Winning Culture Key Characteristics Balance of proven brands with leading positions and proven but earlier stage brands with significant runway Expect mid-to-high single digit revenue growth Expect low-to-mid teen operating income growth Excellent collective white space opportunity Reduced capital expenditures enables greater return of capital Meaningful free cash flow growth over time also supports return of capital Incentive plans more closely aligned with same-restaurant sales and free cash flow growth Sustained Industry Leadership & Superior Value Creation Strong Collective Experience and Expertise A Cost-Effective Support Platform Significant and Durable Operating Cash Generation A WINNING CULTURE

® Portfolio of Premier Brands 10 Sales Profile ($ in billions) Unit Information¹ Key Highlights Olive Garden • Units: 834 • AUV: $4.6mm • Return on Sales²: 17% • FY13 SRS: (1.5)% • #1 Italian full service dining concept in the U.S. • Among the largest full service dining restaurant chains in the U.S. • Industry-leading AUVs and unit level and overall brand level returns • Consistently strong financial performance, even in difficult economic environments LongHorn • Units: 445 • AUV: $3.1mm • Return on Sales²: 14-17% • FY13 SRS: 1.2% • Poised to become America’s favorite steakhouse • One of only a few U.S. Steakhouse concepts with opportunity for national penetration • Highly attractive and improving AUVs and unit economics SRG • Units: 184 • AUV: $5.6-8.3mm • Return on Sales²: 14-17+% • FY13 SRS3: 2.1% • The Capital Grille is the premier upscale steakhouse chain in the US. • Yard House is one of the fastest growing high volume restaurant concepts in the country • Seasons 52 is an on-trend leader in the polished casual dining segment • Bahama Breeze is well positioned as a next generation Bar and Grill brand • Eddie V’s is a highly differentiated concept offering a modern luxury seafood experience Note: Darden completed the acquisition of Yard House in Aug-2012. ¹ LTM figures as of Q2 FY14 (24-Nov-2013) and are unaudited. ² Includes marketing and depreciation expense and a credit that represents the implied interest in rent payment for leased units. Excludes rent averaging expense and direct new unit opening costs. 3 Excludes Yard House $ 3.5 $ 3.6 $ 3.7 $ 3.7 FY11 FY12 FY13 LTM¹$ 1.0 $ 1.1 $ 1.2 $ 1.3 FY11 FY12 FY13 LTM¹ $ 0.5 $ 0.6 $ 1.0 $ 1.2 FY11 FY12 FY13 LTM¹

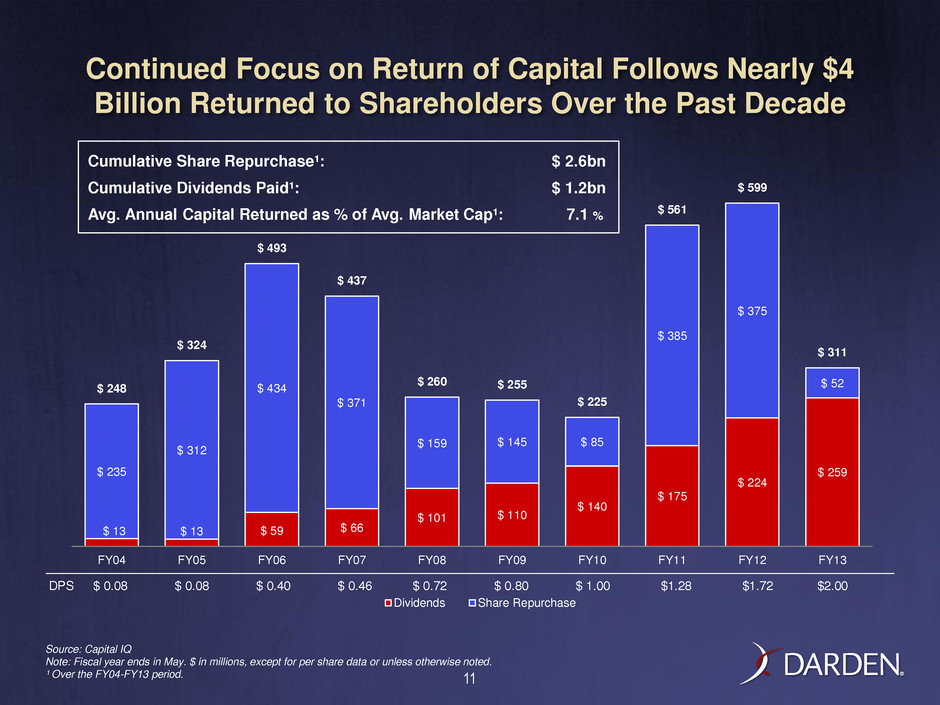

® Continued Focus on Return of Capital Follows Nearly $4 Billion Returned to Shareholders Over the Past Decade 11 Source: Capital IQ Note: Fiscal year ends in May. $ in millions, except for per share data or unless otherwise noted. ¹ Over the FY04-FY13 period. Cumulative Share Repurchase¹: $ 2.6bn Cumulative Dividends Paid¹: $ 1.2bn Avg. Annual Capital Returned as % of Avg. Market Cap¹: 7.1 % 13 $ 13 $ 59 $ 66 $ 101 $ 110 $ 140 $ 175 $ 224 $ 259 $ 235 $ 312 $ 434 $ 371 $ 159 $ 145 $ 85 $ 385 $ 375 $ 52 $ 248 $ 324 $ 493 $ 437 $ 260 $ 255 $ 225 $ 561 $ 599 $ 311 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 Dividends Share Repurchase DPS $ .08 $ 0.08 $ 0.40 $ 0.46 $ 0.72 $ 0.80 $ 1.00 $1.28 $1.72 $2.00

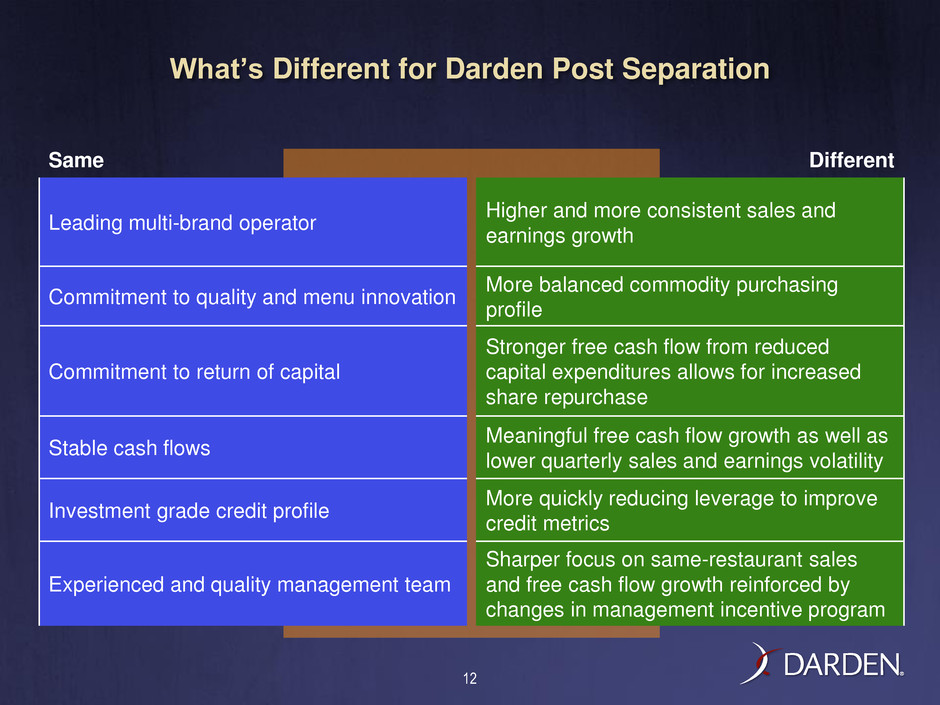

® What’s Different for Darden Post Separation 12 Same Different Leading multi-brand operator Higher and more consistent sales and earnings growth Commitment to quality and menu innovation More balanced commodity purchasing profile Commitment to return of capital Stronger free cash flow from reduced capital expenditures allows for increased share repurchase Stable cash flows Meaningful free cash flow growth as well as lower quarterly sales and earnings volatility Investment grade credit profile More quickly reducing leverage to improve credit metrics Experienced and quality management team Sharper focus on same-restaurant sales and free cash flow growth reinforced by changes in management incentive program

® Overview of the “New Red Lobster” 13 Key Characteristics Key Strengths/Opportunities Ability to streamline operations and support higher leverage while still providing attractive capital return profile Expect low single digit revenue growth to be driven by modestly increasing same-restaurant sales Expect mid-to-high single digit annual operating income growth Expect continued volatility in quarterly operating income but stable annual free cash flow Substantial return of capital via attractive dividend payout ratio and share repurchase Iconic American brand that helped pioneer the casual dining sector Positioned for business transformation to drive more stable same-restaurant sales results Strong and consistent annual free cash flow generation Significant margin improvement opportunity and better unit productivity Dedicated and highly experienced management team

® “New Red Lobster” Management Team 14 Brings extensive leadership experience in the foodservice industry Currently serves as President of the Specialty Restaurant Group and New Business for Darden Served as President of Red Lobster from FY05 – 11, during which time he spearheaded the revitalization of the brand Prior to joining Darden, served as Executive Vice President and Chief Operating Officer of North America for Burger King and Chief Executive Officer of International Division of Allied Domecq Quick Service Restaurants ( the international division of what is now called Dunkin’ Brands) Also currently serves on the Board of Directors of Wawa, Inc. Kim Lopdrup Chief Executive Officer

® “New Red Lobster” Management Team (Cont’d) 15 Salli Setta President Brad Richmond Chief Financial and Administrative Officer¹ Currently serves as President of Red Lobster and will continue in this role Previously served as Red Lobster’s Executive Vice President of Marketing for 8 years Currently serves as Senior Vice President and Chief Financial Officer for Darden Joined Darden in 1982, appointed Darden CFO in 2006 and was a member of the team that completed the spin-off of Darden from General Mills in 1995 ¹ If the form of a separation for Red Lobster is a spin‐off, Brad Richmond will become Chief Financial and Administrative Officer of Red Lobster upon completion of the transaction.

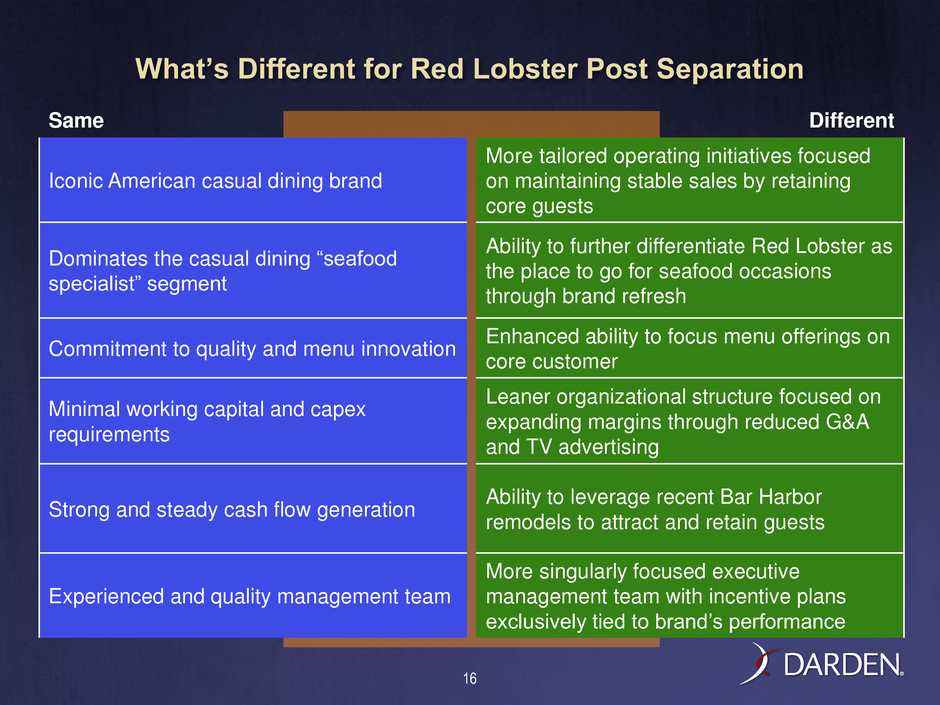

® What’s Different for Red Lobster Post Separation 16 Same Different Iconic American casual dining brand More tailored operating initiatives focused on maintaining stable sales by retaining core guests Dominates the casual dining “seafood specialist” segment Ability to further differentiate Red Lobster as the place to go for seafood occasions through brand refresh Commitment to quality and menu innovation Enhanced ability to focus menu offerings on core customer Minimal working capital and capex requirements Leaner organizational structure focused on expanding margins through reduced G&A and TV advertising Strong and steady cash flow generation Ability to leverage recent Bar Harbor remodels to attract and retain guests Experienced and quality management team More singularly focused executive management team with incentive plans exclusively tied to brand’s performance

® Updated FY 2014 Guidance 17 Previous Updated Unit Growth ~80 net new restaurants ~75 net new restaurants Same-Restaurant-Sales Flat on a blended basis for Red Lobster, Olive Garden and LongHorn Red Lobster: 4 – 5% Decrease Olive Garden: 1 – 2% Decrease LongHorn: 2 – 3% Increase Revenue Growth¹ 6 – 8% Increase 4 – 5% Increase Diluted EPS Growth 3 – 5% Decrease 15 – 20% Decrease Note: Figures exclude one-time costs from strategic transaction. ¹ Includes additional quarter of sales from Yard House.

® Next Steps 18 Build separate organizational structures, including corporate functions Prepare and audit separate accounts Explore sale opportunities Complete review process with SEC Confirm tax-free status of spin-off Create separate capital structures Obtain third party approvals Receive final approval from Darden Board of Directors