Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TELEFLEX INC | d645298d8k.htm |

| EX-99.1 - EX-99.1 - TELEFLEX INC | d645298dex991.htm |

Teleflex Incorporated

2013 Analyst Day

Jake Elguicze –

Treasurer and Vice President of Investor Relations

Exhibit 99.2 |

Agenda

Strategic Overview

Benson Smith –

Chairman, President & Chief Executive Officer

Gross Margin Opportunities

Liam Kelly –

Executive Vice President and President, International

Tony Kennedy –

Senior Vice President, Global Operations

Product Mix & Innovation

Jay White –

Surgical Division

Jan Verstreken –

President, Asia Pacific

Justin McMurray –

Vice President and General Manager, Vidacare

Question & Answer

Break

2 |

Agenda

– Continued

Financial Overview

Thomas Powell –

Executive Vice President & Chief Financial Officer

Closing Comments

Benson Smith –

Chairman, President & Chief Executive Officer

Question & Answer

Product Demonstrations

Lunch Reception

3 |

4

Forward Looking Statements

This presentation and our discussion contain forward-looking information and statements

including, but not limited to, our forecasted 2013 constant currency revenue growth, adjusted

gross and operating margins and adjusted earnings per share; our longer-term financial goals of

achieving constant currency revenue growth of 5%, adjusted gross margin of 55%, investment

in research and development of 5% and adjusted operating margin of 25%; our expectations with

respect to new product introductions; our ability to reduce our facility footprint and relocate

manufacturing to low-cost locations, reduce direct material spending and make improvements

to packaging and invest in automation and become less reliant on manual labor; our ability to

improve gross margin by 250bps to 350bps over a multi-year period; strategic priorities and

objectives for our Surgical division and our LMA business; our expectation that the Vidacare

business will contribute between $68 million and $72 million to our 2014 revenue and between

$0.10 and $0.15 to our 2014 adjusted earnings per share; our preliminary 2014 forecast with

respect to constant currency revenue growth, gross margin, adjusted operating margin and

adjusted earnings per share and the assumptions underlying those forecasted items; and other

matters which inherently involve risks and uncertainties which could cause actual results to

differ from those projected or implied in the forward–looking statements. These risks and

uncertainties are addressed in the Company’s SEC filings, including its most recent Form

10-K.

This presentation includes certain non-GAAP financial measures, which include constant

currency revenue growth; adjusted gross and operating margins; adjusted earnings per share.

Reconciliation of these non-GAAP measures to the most comparable GAAP measures is

contained within this presentation.

The following slides reflect continuing operations. |

Teleflex Incorporated

2013 Analyst Day

Benson Smith –

Chairman, President and Chief Executive Officer |

6

Key Themes

Teleflex Today Versus 2010

Preliminary 2013 Year In Review

Preliminary 2014 Revenue Outlook

Longer-Term Strategy and Opportunities |

7

Teleflex in 2010

Multi-industry company with businesses serving Medical,

Aerospace and Commercial markets

Note: amounts per 2010 Form 10K.

2010 Revenue by Business Segment

10%

10%

80%

Medical

Aerospace

Commercial |

8

Medical Division in 2010

Division aligned solely by geographic region

Year-over-year constant currency revenue growth of 1%

compared to 2009

Minimal revenue associated with new product introductions

History of declining ASPs

Significant backorders and poor on-time delivery record

Market capitalization of ~2.2 billion as of December 31, 2010

|

9

Teleflex Today

Vascular

Access

Surgical

Specialty

Cardiac Care

Anesthesia /

Respiratory

OEM

Central,

Peripheral and

Arterial Vascular

Access

Catheters

Catheter Tip

Positioning

Systems

Intraosseous

access devices

Sheath

Introducers

Vascular Access

Accessories

Ligation

Systems

Closure Devices

Laparoscopic

Access

Ports/Trocars

General &

Specialty

Instruments

Chest Drainage

Systems

CV Sutures

Foley Catheters

Intermittent

Catheters

Atomization

Dialysis

Catheters

PTA Balloons

Interventional

Access

Intra Aortic

Balloon Pumps

IAB Catheters

TransRadial

Access

Right Heart

Products

Percutaneous

Sheath

Introducers

Supraglottic

Airways

Atomization

Epidurals

Peripheral Nerve

Blocks

Airway

Management

Respiratory

Therapy

Specialty

Sutures

Catheter

Fabrication

Performance

Fibers

Custom

Engineered

Precision

Extrusion |

10

Teleflex Today

Diverse product portfolio capable of above-market growth rates

Demonstrated the ability to increase ASPs over multi-year period

in cost-sensitive hospital environment

Enhanced product pipeline through a combination of internally

developed and externally acquired technologies

Substantial improvements made in backorders and on-time

delivery metrics lead to GPO industry recognition

Market capitalization of ~4.0 billion as of December 13, 2013

|

11

Preliminary 2013 Year In Review

Domestic utilization declines and European austerity measures

pressure mature healthcare markets and Teleflex constant

currency revenue growth rates as compared to initial

expectations

Despite macro uncertainty, Teleflex able to grow revenues above

market growth rates through acquisition of LMA, new product

introductions and contribution from price increases

Positioned for sustainable revenue growth through continued

expansion of GPO and IDN relationships

20 new agreements awarded and 7 agreements renewed through September 2013

|

12

Preliminary 2013 Year In Review

Profitability improvement and facility rationalization initiatives

continue

Completed the North American Distribution Center consolidation program and

integration of legacy Arrow ERP system to Teleflex SAP platform

Integration of LMA acquisition is ahead of schedule

Completed additional technology / strategic acquisitions to

augment existing strategic business unit franchises

Vidacare Corporation (Vascular and Interventional Access)

Eon Surgical (Surgical)

Ultimate Medical (Anesthesia) |

13

Updated 2013 Outlook

Constant currency revenue growth expected to be between 8.0%

and 8.7%

Adjusted gross margins expected to be between 49.5% and 50%

Adjusted operating margin expected to be between 16% and 17%

Adjusted earnings per share expected to be between $4.85 to

$5.00 |

14

Preliminary 2014 Revenue Outlook

Preliminary 2014 constant currency revenue growth excluding

impact of Vidacare acquisition of between 3% and 5%

Vidacare expected to contribute between $68 to $72 million in

revenue, or an additional 4.0% to 4.5% of constant currency

revenue growth in 2014

Preliminary 2014 constant currency revenue growth including

impact of Vidacare acquisition of between 7% and 9% |

15

Preliminary 2014 constant currency revenue growth expectations

assume modest growth in mature markets

Investments in emerging markets (i.e. China and Latin America)

continue to pay benefits and are anticipated to lead to higher

overall revenue growth

Vidacare, LMA, distributor to direct conversions, and mix of

higher-margin new product introductions expected to impact

margins favorably

Preliminary 2014 Revenue Outlook |

16

Longer-Term Strategy and Opportunities

Near-term uncertainty brought to healthcare marketplace due to

implementation of Affordable Care Act

Teleflex portfolio is well-positioned to take advantage of shifting

healthcare environment

Product lines designed to gain from aging demographics phenomena

Not overly susceptible to elective procedure fluctuations or seasonality

Products represent small portion of overall procedure cost

Capital equipment represents minimal portion of product portfolio

Products designed to aide healthcare providers in reducing overall

procedure cost |

17

Longer-Term Strategy and Opportunities

To be successful in the future, Teleflex strategy is not dependent

upon continued generation of above-market revenue growth

Focused areas of additional investment

Select distributor to direct conversions in Asia

Investments in sales and marketing in China and Latin America

R&D increases targeted to higher-margin product areas

Evaluating opportunities to improve operating leverage |

18

Longer-Term Strategy and Opportunities

Opportunistic approach to future M&A

Continue to focus on combination of small to mid-sized

technology and strategic acquisitions within our existing product

verticals

Continue to evaluate existing product portfolio and SKU

rationalization opportunities

Prudent and conservative approach to future capital deployment

|

19

Longer-Term Strategy and Opportunities

Remain committed to achievement of longer-term financial goals

Constant currency revenue growth of 5%

Adjusted gross margin of 55%

Investment in research and development of 5%

Adjusted operating margin of 25% |

Thank you for your attention |

Teleflex Incorporated

2013 Analyst Day

Liam Kelly –

Executive Vice President & President, International

|

Key

Themes Teleflex International Today Versus 2010

International Strategy

International Product Pipeline

22 |

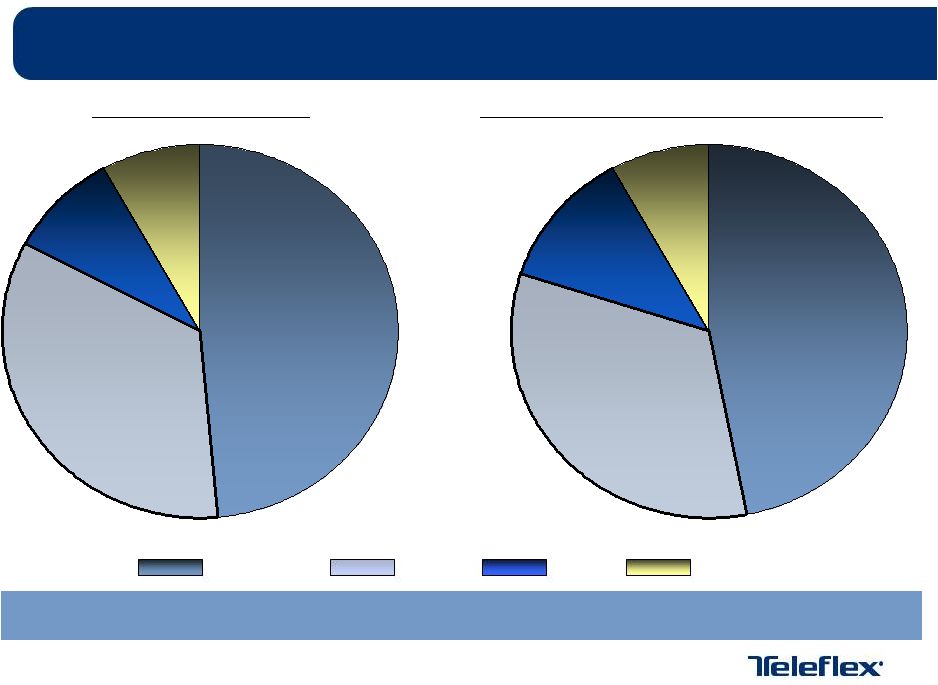

Teleflex International Today versus 2010

9%

34%

48%

8%

12%

33%

47%

8%

2010 Net Revenues

September 2013 YTD Net Revenues

Americas

EMEA

Asia

OEM

Note: amounts per 2012 Form 10K and September 2013 Form 10Q.

TFX

Constant

Currency

Revenue

Growth

Highest

in

International

Markets

in

2013

23 |

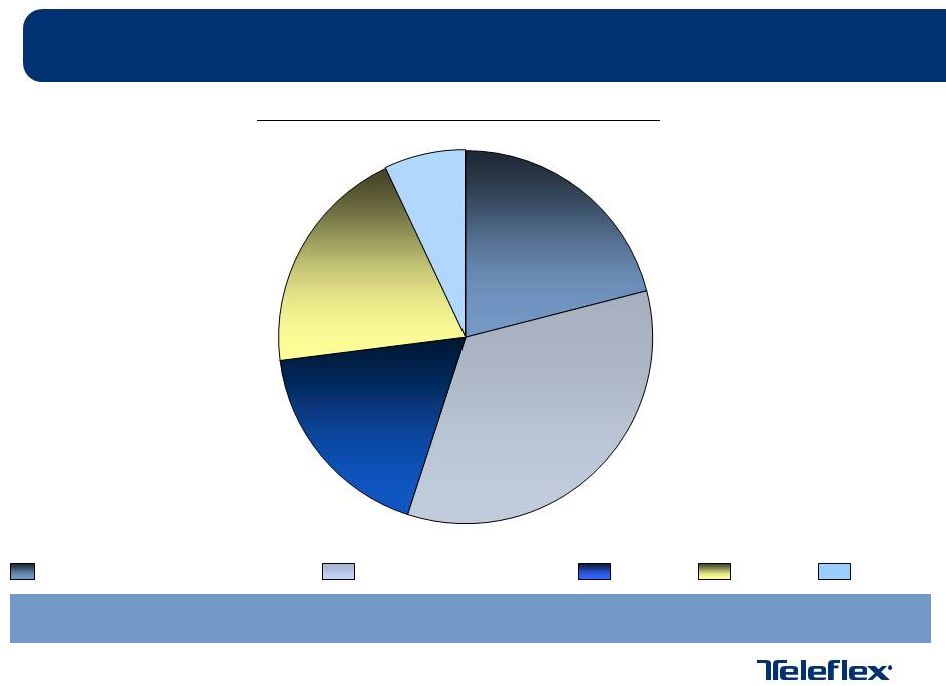

Teleflex International Today

September 2013 YTD Net Revenues

Vascular & Interventional Access

Anesthesia & Respiratory

Urology

Surgical

Note: sourced from Company data.

International Markets Not Dependent Upon any One Product or Procedure

Cardiac

24

20%

18%

34%

21%

7% |

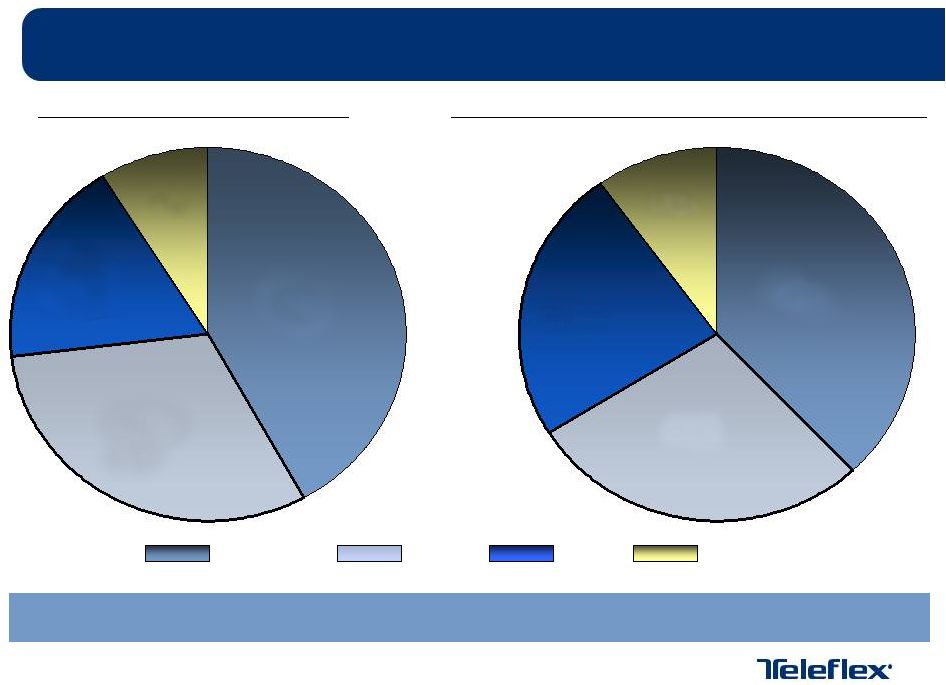

Teleflex International Today versus 2010

2010 Segment Operating Profit

September 2013 YTD Segment Operating Profit

Americas

EMEA

Asia

OEM

Note: amounts per 2012 Form 10K and September 2013 Form 10Q.

TFX Segment Operating Margins Highest in International Markets in 2013

25

18%

31%

42%

9%

24%

28%

38%

10% |

26

International Strategy (SMART)

Sales Growth

Continue investment in China and Southeast Asia

Make channel investments to control the customer relationship

Focus on product registrations and clinical education

Improve pricing through distributor to direct conversions / increased prices to

distributors Margin Expansion

Rationalize sales of third-party products in EMEA

Continue product mix shift towards sale of higher-margin products

Acquisitions

Target acquisitions that leverage sales channel and integrate efficiently

R&D Investments

Invest 5% of revenue in R&D

Generate 3% revenue growth per year from new product introductions

Talent Development

Invest in our People

Develop the leaders of tomorrow |

27

International Product Pipeline

2014

Pre-Activated

Intermittent

Catheters

Surgical Clip

Products in

China

LMA Protector

Microlap Surgical

Approach

2015

2016

Next Generation

Intra-Aortic

Balloon Pump

LMA with Cuff Pilot

EZ Blocker in Asia

Note: New product introductions subject to obtaining required governmental approvals

and authorizations. |

28

International Summary

Well defined strategy

Significant top-line growth rates

Segment Operating Margins Above Company Average

New product pipeline, combined with distributor to direct conversions,

positions International for further growth and margin expansion

|

Teleflex Incorporated

2013 Analyst Day

Tony Kennedy –

Senior Vice President, Global Operations |

30

My Background

Joined Teleflex in June of 2007

Previously responsible for all aspects of Teleflex’s International

supply chain and operations efforts

Promoted to the position of Senior Vice President of Global

Operations role in 2013

Previously held similar operationally focused positions with Philips,

Marconi, Biomedical Research and Saint Gobain |

31

Global Operations

In mid-2010, Teleflex announced longer-term goals and objectives,

including a goal of obtaining 55% gross margin

While operating in a difficult macro-environment, the Company has

made progress toward the achievement of this goal through:

Prices increases

Introduction of higher-margin products

Acquisition of companies like LMA and Vidacare

Facility eliminations

SKU Rationalization efforts

Product cost reductions |

32

Global Operations

Global Operations team created earlier this year to focus on

establishing a world-class, value-adding and efficient supply chain

organization to meet our customer’s needs

We are evaluating opportunities to improve operating leverage

over a multi-year period, though no plans approved to date

|

Global Operations

While we are still in the process of evaluating all of our options, we

think there is an opportunity to:

•

Reduce facility footprint and relocate manufacturing capacity to

low-cost

locations

•

Reduce direct material spending and make improvements to packaging

•

Invest in automation and become less reliant on manual labor

Through these and other initiatives, we believe there is an

opportunity to improve gross margin by 250bps to 350bps over

a multi-year period

33 |

|

Teleflex Incorporated

2013 Analyst Day

Jay White –

Surgical Division |

36

Key Themes

Surgical Strategic Priorities

Closure Objectives and New Product Launches

Access Objectives and New Product Launches

Microlaparoscopy Objectives and New Product Launches

Summary |

37

Surgical Strategic Priorities

Strategic Summary

To become a leading, global surgical device business focused on customer

solutions Closure Objectives

Drive penetration and expand market opportunity for existing polymer ligation

platform Successful development and execution of automatic ligation

platform Optimize pull thru with robotic procedures

Access Objectives

Development of next generation port closure platform

Continued partnership with robotics companies

Microlaparoscopy Objectives

Execute on platform development for our focused procedural rollout

Elevate surgical brand identity

Attract strategic partners for complementary advanced technologies

Successful commercialization of Weck EFx – Endo Facial Closure System

Successful commercialization of Weck Vista – Bladeless Laparoscopic Access Ports |

38

Global Closure Market

$442

$465

$488

$506

$537

$569

$162

$173

$184

$196

$208

$220

$477

$483

$490

$500

$530

$561

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2012

2013

2014

2015

2016

2017

Appliers

Clips

Suture

Market data based on management estimates. Actual amounts could differ.

|

39

Closure Objectives

Core Existing Products

Drive penetration and expand market opportunity for existing polymer

ligation platform

Successful development and execution of automatic ligation platform

Optimize pull thru with robotic procedures

New Product Offerings

Disposable automatic enhancements and extension

Reposable

automatic

platform

–

multiple

sizes

and

materials |

40

Reposable Platform

Disposable Platform

Closure New Product Offerings

L

10mm

ML

5mm

Note: New product introductions subject to obtaining required governmental approvals

and authorizations. |

41

Global Access Market

Market data based on management estimates. Actual amounts could differ.

$747

$755

$763

$772

$778

$783

$720

$730

$740

$750

$760

$770

$780

$790

2012

2013

2014

2015

2016

2017 |

42

Access Objectives

Core Existing Products

Continued partnership with robotics companies

Successful

commercialization

of

Weck

EFx

–

Endo

Facial

Closure

System

Successful

commercialization

of

Weck

Vista

–

Bladeless

Laparoscopic

Access Ports

New Product Offerings

Next generation port closure platform

Next generation access port seal system |

43

Next Generation Port Closure

Addresses concern over sharps into

the cavity

Potential for closure without direct

visualization

Next Generation Access Port

Seal System

Universal capabilities

Mitigates cost and dependence on

magnet components

Access New Product Offerings

Note: New product introductions subject to obtaining required governmental approvals

and authorizations. |

44

Evolution of Minimally Invasive Surgery

Standard

Laparoscopy

Single Port

NOTES

Micro

Laparoscopy

What is it?

Three or

more 5-12

mm devices

in abdomen

All devices

used through

single

umbilical port

Devices

inserted

through

natural

orifice and

internal

incisions

Standard

umbilical

port +

multiple ~2.5

mm devices |

45

Evolution of Minimally Invasive Surgery

Standard

Laparoscopy

Single Port

NOTES

Micro

Laparoscopy

Current

Standard of

Care

Almost invisible

umbilical scar

Reduced post-

operative pain

Less blood loss

Faster recovery

Pros

No external

scarring

Fewer

infections

Less hernia

formation

Reduced

scarring

Preserves

triangulation

No re-training |

46

Evolution of Minimally Invasive Surgery

Standard

Laparoscopy

Single Port

NOTES

Micro

Laparoscopy

Lack of

triangulation

Risk of seroma

or hernia

Requires re-

training

Increased

operation time

Cost

Cons

Poor

availability of

optimized

equipment

Not

reimbursed

Requires re-

training

Ergonomics

of tools

Full line of

surgical tools

not available

Size of the

working end

Strength of

device |

47

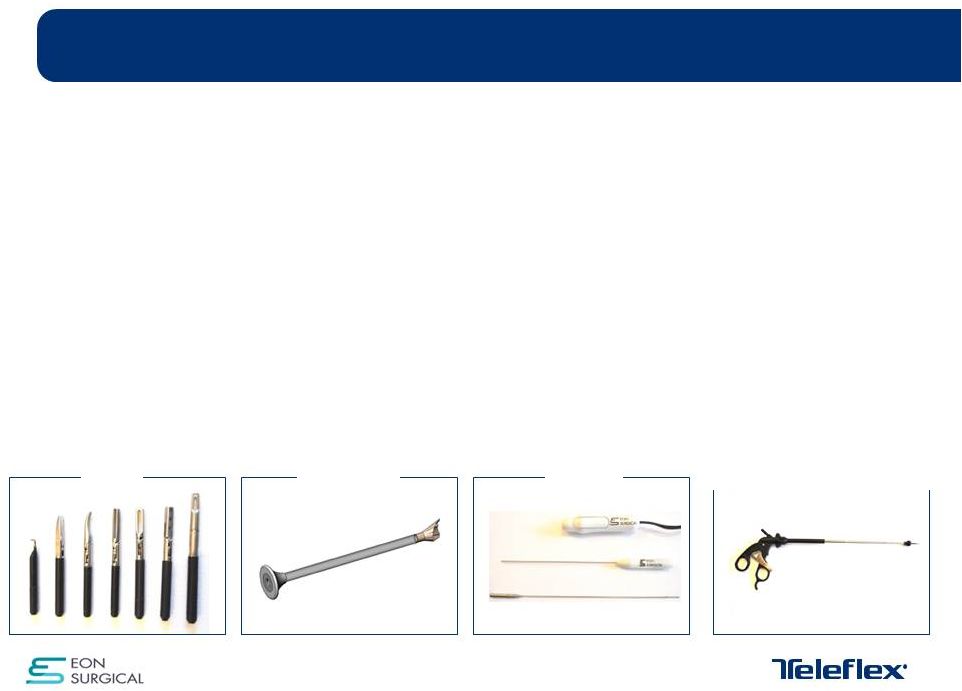

Eon Surgical –

Overview

Tools

Intersleeve

Camera

Telescoping Needle with Handle

Acquired in June of 2013, Eon Surgical is a late stage development

company that has advanced a minimally invasive micro-laparoscopy

surgical

platform

technology

designed

to

enhance

surgeons’

ability

to

perform scarless surgery while producing better patient outcomes

Developed the InterTip™

platform, a complete solution for performing

scarless laparoscopic surgery, that unlike single-port laparoscopy

allows the surgeon to maintain the triangulation of standard

laparoscopic surgery |

Patented Approach to Percutaneous Surgery

Step 1:

Percutaneous entry of 3mm

instrument and insertion of standard 10mm

port in umbilicus

Step 2:

Insertion of patented intersleeve

through trocar. Distal end of instrument shaft

exits through intersleeve

Step 3:

Attachment / detachment of

exchangeable 5mm or larger end-effectors

48 |

•

Aligned focus and resources

•

Selective market investment

•

Revenue growth from higher-margin products

•

Technology advancements

•

New technology adoption

•

Compress development cycle

•

Market development/professional education

•

Customer advocacy

•

Robust R&D pipeline

•

Transformational technologies

•

Customer advocacy

•

Brand strength

Innovative

Time

Surgical Strategy

Faster

Focused

49 |

Thank you for your attention |

Teleflex Incorporated

2013 Analyst Day

Jan Verstreken –

President, Asia Pacific |

52

Key Themes

Laryngeal Mask Industry Trends

LMA Integration Update

LMA Strategic Priorities

LMA New Product Launches |

53

Increased market adoption of second generation LMA device

Clinicians desire ability to monitor cuff-pressure

Interest in use of laryngeal masks in longer procedures

Growing desire in adding visualization to airway management

Laryngeal Mask Industry Trends |

54

On-pace to achieve 2013 revenue expectations and exceed 2013

adjusted earnings per share expectations

Multi-year integration of LMA acquisition ahead of schedule

Continued market adoption of second generation device in all

regions

2013 acquisition of Ultimate Medical, and associated cuff-pilot

technology, provides opportunity to enhance revenue growth

LMA Integration Update |

55

LMA Strategic Priorities

Strategic Summary

Maintain global leadership position in supra-glottic airway management.

Make Teleflex supra-glottic airway devices the number one choice of

clinicians when selecting a ventilation option

Increase indications for use of second generation product and continue global

upgrade from use of first generation to second generation devices Make cuff pressure

indication a standard feature for supra-glottic airway devices and integrate Ultimate Medical

cuff-pilot technology into LMA product

Invest in emerging markets and build adoption of laryngeal masks versus

endotracheal tubes

Nasal drug delivery is in its infancy; atomization is positioned to take advantage and

exploit vaccination market

|

56

PRODUCT DESCRIPTION

3rd Generation Laryngeal Mask Airway

All silicone, single use product

Flexible fixed-curve tube allows ease of

insertion ‘non-digital’

and anatomical

conformity

Dual gastric drainage channel and

pharyngeal chamber to improve laryngeal

seal during high volume regurgitation

Integrated suction port

LAUNCH DATE

Expected launch Q3 2014

New Product Launches –

LMA Protector™

Note: New product introductions subject to obtaining required governmental approvals and

authorizations. |

PRODUCT DESCRIPTION

Laryngeal Mask Airway

for upper endoscopic

procedures, to provide an airway while not

impeding use of the endoscope

All Silicone, single use product

Large diameter endoscope channel

Atraumatic endoscope insertion

Protection of endoscope with integrated bite

block

Easy fixation with attached strap

LAUNCH DATE

Expected launch Q3 2014

New Product Launches –

LMA Endoscopy

Note: New product introductions subject to obtaining required governmental approvals

and authorizations. 57 |

PRODUCT DESCRIPTION

2nd Generation Laryngeal Mask Airway for

shared airway procedures offering improved

protection against regurgitation and

aspiration

All silicone, single use product

Low profile back plate for easy access to

operating field

Dual function bite block: “non-digital

insertion”, clips on drain tube and allows

tubes to be separated

LAUNCH DATE

Expected launch Q4 2014

New Product Launches –

LMA Flexible™

Gastric Access

58

Note: New product introductions subject to obtaining required governmental approvals and

authorizations. |

59

Thank you for your attention |

Teleflex Incorporated

2013 Analyst Day

Justin McMurray –

Vice President & GM of Vidacare |

61

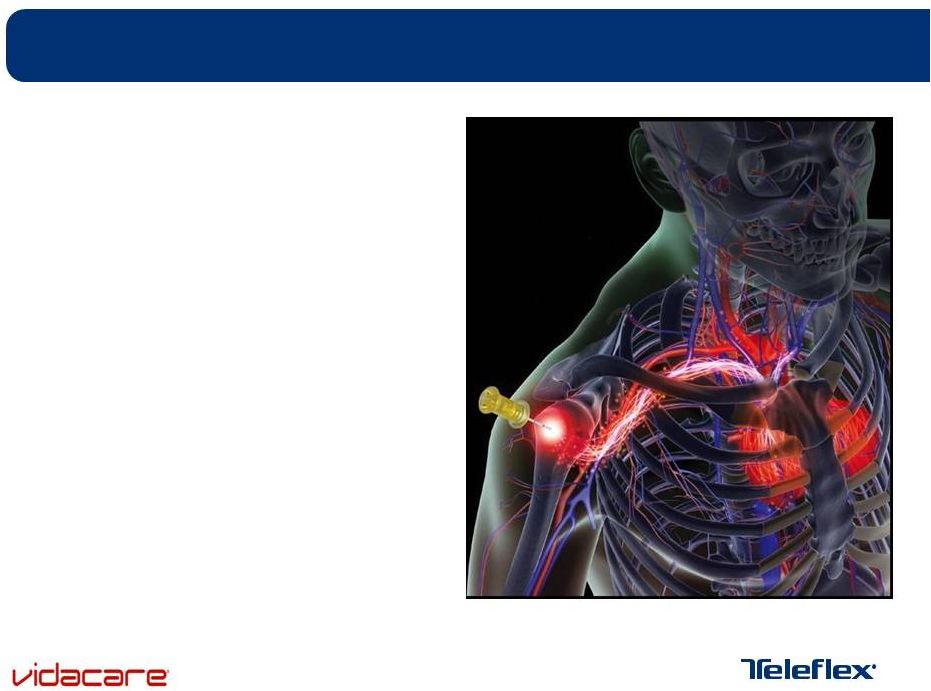

Vidacare Corporation –

Overview

Established in 2001, Vidacare Corporation is the developer of a broad

technology platform that is defining the field of intraosseous (inside the

bone) medicine.

Focus on enhancing clinical efficacy, patient safety and comfort, and

reducing complications and their associated costs.

87 Issued and 8 pending patent applications. |

62

EZ-IO®

Intraosseous Vascular Access

EZ-IO

®

provides an elegant

solution for Difficult Vascular

Access.

•Safe: <1% serious complication rate

•Fast: Vascular access with anesthesia

and good flow in 90 seconds

•Efficient: 97% first-attempt access

success rate

•Versatile: Can be placed by any

qualified healthcare provider

•Convenient: Requires no additional

equipment or resources

V |

63

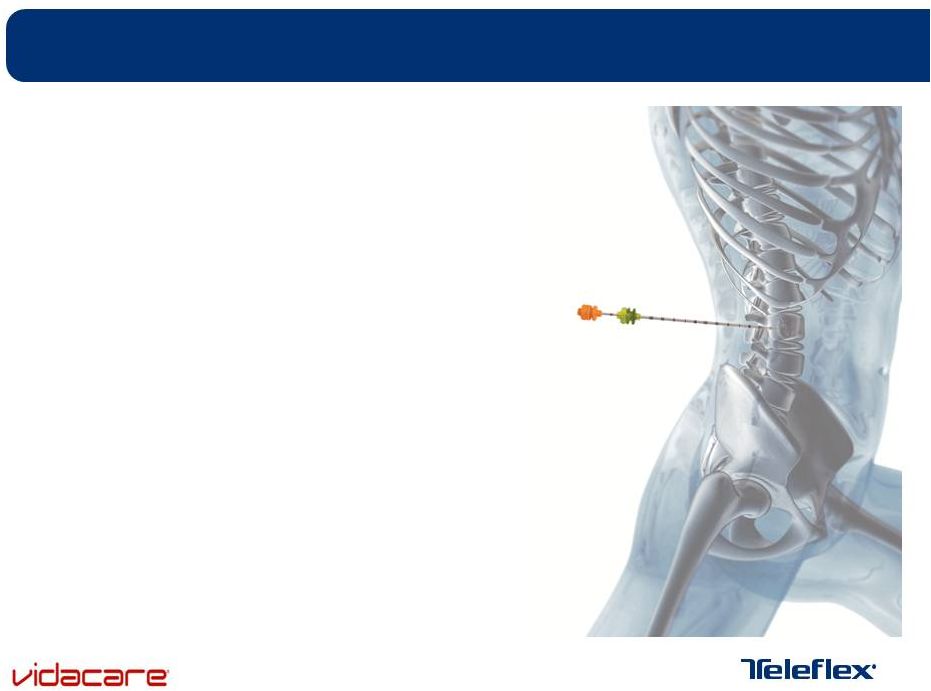

OnControl™

Bone Marrow Biopsies

OnControl

™

Bone Marrow Biopsies:

The first significant advance to bone marrow

biopsies in more than 50 years.

•98% core capture rate on the first attempt

•Higher quality sample

•Easier and faster

•Less patient pain |

64

OnControl™

Bone Access System

Hard Bone Lesions Made Easy

•

Rapid

Access

to

difficult

bone

lesions

•

Quality

Exceptional

core

biopsy

samples,

quickly and consistently

•

Precise

Control

with

clear

visibility

through

imaging |

65

The EZ-IO Intraosseous Infusion System Training

https://www.dropbox.com/home/2013%20Analyst%20Day |

66

OnControl Single Needle Approach

https://www.dropbox.com/home/2013%20Analyst%20Day |

67

Vidacare Corporation –

Summary

Expands vascular access product portfolio with a defining

technology and moves TFX into the IO segment

Strengthens EMS channel & Nursing call points

High gross and operating margin profile consistent with longer-term

corporate objectives

Accretive transaction which is expected to contribute between $68

and $72 million of Revenue and $0.10 to $0.15 of Adjusted Earnings

per Share in 2014 |

Thank you for your attention |

Question and Answer Session |

Intermission |

Teleflex Incorporated

2013 Analyst Day

Thomas Powell –

Executive Vice President and Chief Financial Officer |

72

Key Themes

Updated 2013 Financial Outlook

Preliminary 2014 Financial Outlook and Assumptions

Summary |

73

Updated 2013 Financial Outlook

Constant currency revenue growth expected to be between 8.0%

and 8.7%

•

Previously provided constant currency revenue growth range of 8.5% to 10%

Adjusted gross margins expected to be between 49.5% and 50%

Adjusted operating margin expected to be between 16% and 17%

•

Medical device tax to negatively impact year-over-year results by ~1%

Adjusted earnings per share expected to be between $4.85 to $5.00

|

74

Preliminary 2014 Financial Outlook and Assumptions

Constant currency revenue growth expected to be

between 7% and 9%

•

Full year impact of Vidacare and distributor-to-direct conversions

•

Growth from new product pipeline comparable to 2012-2013 levels

•

Assumption of modest base volume growth

•

Distributor-to-direct strategy yields majority of pricing gains; product

pricing opportunities will be selective |

75

Gross margin anticipated to improve by approximately 200bps to

300bps and reach 52.0% to 52.5%

•

Vidacare acquisition at 85% gross margin

•

Pricing and margin gains from distributor to direct strategy

•

Manufacturing cost improvement programs

Adjusted operating margin expected to be between 17% and 18%

•

Gross margin gains tempered by investment in distributor-to-direct

strategy and Vidacare’s higher relative SG&A

Tax strategies expected to drive sustainable reduction in GAAP and

Non-GAAP tax rate

Preliminary 2014 Financial Outlook and Assumptions |

76

Adjusted earnings per share anticipated to be between $5.35 and

$5.55 per share

•

Represents growth of between 7% and 14% as compared to forecasted

2013 EPS range

Adjusted weighted average shares expected to be ~44 million

Preliminary 2014 Financial Outlook and Assumptions |

Euro

to U.S. Dollar exchange rate assumed to be ~1.30 1 fewer selling day in

Q2’14 vs. Q2’13; 1 additional selling day in Q4’14 vs.

Q4’13 Preliminary 2014 Financial Outlook and Assumptions

77 |

Preliminary 2014 Revenue Outlook

Revenue Growth Expectations Favorable to Industry / Market

Volume - Core Business

0.75%

1.00%

New Product Introductions

1.25%

1.75%

Pricing - Core Business

0.00%

0.25%

Constant Currency Revenue Growth Excluding M&A and

Distributor-to-Direct 2.00%

3.00%

Vidacare

4.00%

4.50%

Pricing - Distributor-to-Direct

0.75%

1.00%

Volume - Distributor-to-Direct

0.25%

0.50%

2014 Preliminary Constant Currency Revenue Growth Range

7.00%

9.00%

Foreign Exchange

-1.00%

-1.00%

2014 Preliminary As-Reported Revenue Growth Range

6.00%

8.00%

78 |

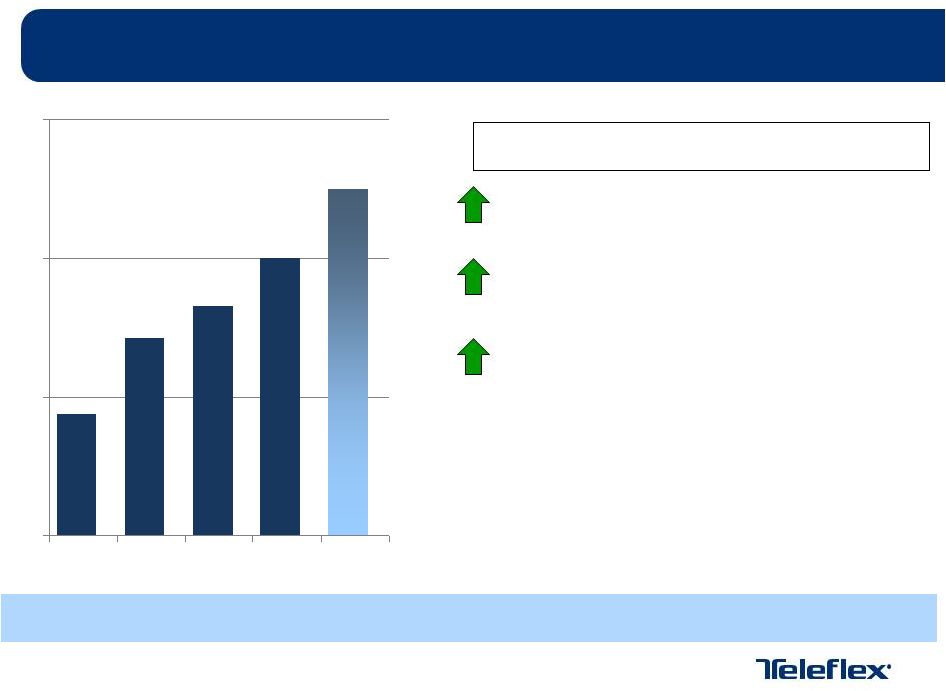

52.0%

to

52.5%

48.3%

47.1%

44.4%

49.5%

to

50.0%

40%

45%

50%

55%

2010A

2011A

2012A

2013E

2014E

2014 Adjusted Gross Margin Drivers

Vidacare

Distributor-to-Direct Pricing

Cost Programs

Preliminary 2014 Adjusted Gross Margin Outlook

Gross Margin Gains Driven by Vidacare, Distributor-to-Direct and Cost

Programs Note: figures represent adjusted gross margin. See Appendix for

reconciliation of GAAP to adjusted results. 79 |

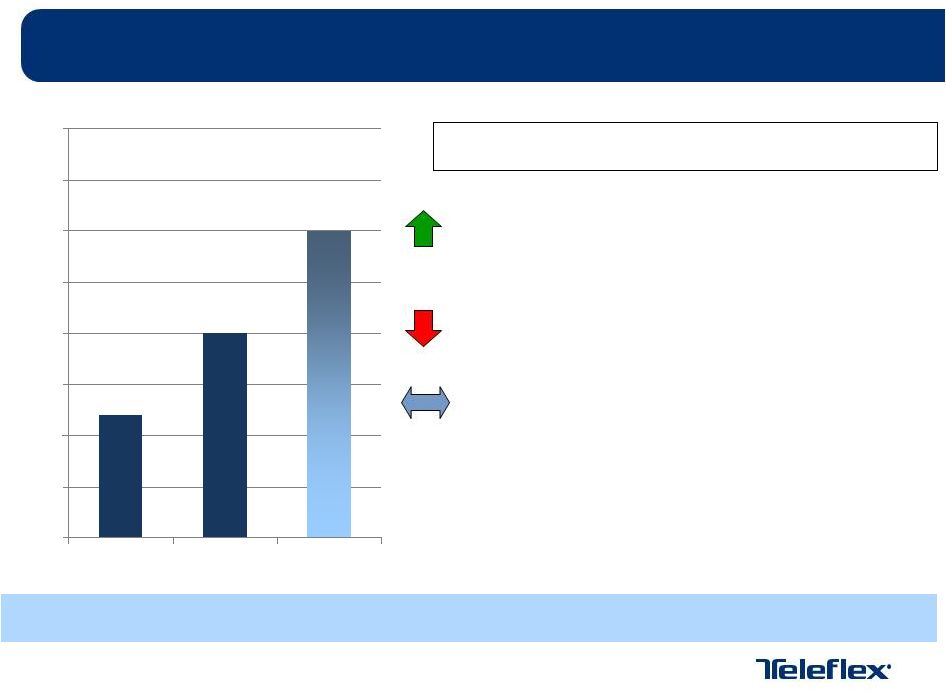

17%

to

18%

16%

to

17%

16.2%

15.0%

15.5%

16.0%

16.5%

17.0%

17.5%

18.0%

18.5%

19.0%

2012A

2013E

2014E

2014 Adjusted Operating Margin Drivers

Gross Margin Expansion

Vidacare & Distributor-to-Direct Opex

Reallocate investment from low-growth

to high-growth markets

Preliminary 2014 Adjusted Operating Margin Outlook

Gross Margin Gains Offset by Targeted Investments

Note: includes amortization expense impact of 285 bps in 2012; approx. 300 bps in

2013; approx. 325 bps in 2014 80 |

Preliminary 2014 Tax Planning Strategy

Tax

Planning

Strategies

Expected

to

Reduce

the

Sustainable

Non-GAAP

Tax

Rate

to

22.5%

to

23.5%

Rate Drivers

2013 Forecast

-

Discrete or non-sustainable benefits and planning

opportunities

-

Global Supply Chain Optimization (partial year

benefit)

2014 Plan

-

Global Supply Chain Optimization (full year benefit)

-

Full integration of recent acquisitions

Note:

non-GAAP

tax

adjustments

include

tax

benefit/expense

associated

with

restructuring,

impairment

charges,

and

special

items;

intangible

amortization

expense;

amortization

of

debt

discount

on

convertible

notes.

81

29.0%

28.0%

27.0%

26.0%

25.0%

24.0%

23.0%

22.0%

21.0%

20.0%

2013 Plan

2013 Forecast

2014 Plan

22.5%

to

23.5%

24%

28% |

Preliminary 2014 Adjusted Earnings per Share Outlook

Growth of between 7% and 14% versus 2013 expectations

2013 Adjusted Earnings per Share Outlook

$4.85

$5.00

Base business

$0.55

$0.60

Vidacare

$0.10

$0.15

Distributor-to-direct

$0.10

$0.12

Foreign currency translation

($0.02)

($0.04)

Subtotal

$5.58

$5.83

Weighted average shares

($0.23)

($0.28)

2014 Adjusted Earnings per Share Outlook

$5.35

$5.55

82 |

Preliminary 2014 Financial Outlook Summary

Continue to expect strong constant currency revenue growth fueled

by a combination of modest volume growth and new product

introductions combined with distributor-to-direct conversions and

Vidacare

Cost improvements, distributor-to-direct and Vidacare acquisition

accelerate pace of gross margin expansion

Operating Margin tempered by investments in high growth potential

markets and infrastructure requirements of distributor-to-direct and

Vidacare

Adjusted earnings per share growth of between 7% and 14%

83 |

Teleflex Incorporated

2013 Analyst Day

Benson Smith –

Chairman, President and Chief Executive Officer |

Closing Comments

Well-positioned portfolio of products able to take advantage of

shifting healthcare environment

Success in the future not dependent upon continued generation

of above-market revenue growth

Opportunity to improve operating leverage over multi-year

period

Opportunistic and conservative approach to future M&A

Committed to the achievement of longer-term financial goals

85 |

Question and Answer Session |

Thank you for your attention |

Appendices |

Gross

Profit and Margin Reconciliation Dollars in Millions

Note: GAAP results represent amounts per Form 10K during year filed.

2010

2011

2012

Gross profit

$794.1

$718.8

$748.2

Losses and other charges

5.9

2.0

0.5

Adjusted gross profit

$800.0

$720.8

$748.7

Percentage of revenue

44.4%

47.1%

48.3%

Revenue

$1,801.7

$1,528.9

$1,551.0

In 2010, losses and other charges include factory shutdown costs associated with

the custom IV tubing product. In 2011, losses and other charges include costs

attributed to Stock Keeping Unit ("SKU") rationalization. In 2012,

losses and other charges include acquisition costs. 89

|

Operating Profit and Margin Reconciliation

Dollars in Millions

Note: GAAP results represent amounts per Form 10K during year filed.

2012

Income (loss) from continuing operations before interest, loss on extinguishments of debt and

taxes ($97.4)

Goodwill impairment

332.1

Restructuring and other impairment charges

3.0

(Gain) / loss on sales of businesses and assets

(0.3)

Losses and other charges

14.3

Adjusted income from continuing operations before interest, loss on extinguishments of debt and

taxes $251.8

Percentage of revenue

16.2%

Revenue

$1,551.0

90 |

2013

Forecasted Constant Currency Revenue Growth Reconciliation Low

High

Full Year 2013 Forecasted GAAP Revenue Growth

8.3%

9.0%

Foreign Exchange

(0.3%)

(0.3%)

Full Year 2013 Forecasted Constant Currency Revenue Growth

8.0%

8.7%

91 |

2014

Forecasted Constant Currency Revenue Growth Reconciliation 92

Low

High

Full Year 2014 Forecasted GAAP Revenue Growth

6.0%

8.0%

Foreign Exchange

1.0%

1.0%

Full Year 2014 Forecasted Constant Currency Revenue Growth

7.0%

9.0% |

2013

and 2014 Forecasted Gross Margin Reconciliation 2013

2014

Forecasted GAAP Gross Margin

49.4%

49.9%

52.0%

52.5%

Losses and other charges

0.1%

0.1%

-

-

Forecasted Adjusted Gross Margin

49.5%

50.0%

52.0%

52.5%

In 2013, losses and other charges include acquisition and severance costs, and a

reserve reversal associated with a previously announced stock keeping unit

("SKU") rationalization charge.

93 |

2013

and 2014 Forecasted Operating Margin Reconciliation 94

2013

2014

Forecasted GAAP Operating Margin

16.0%

17.0%

16.6%

17.5%

Losses and other charges

-

-

0.4%

0.5%

Forecasted Adjusted Operating Margin

16.0%

17.0%

17.0%

18.0%

In 2013, losses and other charges include the reversal of contingent consideration

liabilities, acquisition and severance costs, a reserve reversal associated with a

previously announced stock keeping unit ("SKU") rationalization charge, and a

litigation verdict against the Company with respect to a non-operating joint venture.

These adjustments are expected to net against each other and, as a result, are not currently

expected to result in an adjustment to GAAP results.

In 2014, losses and other charges include acquisition costs, and acceleration of

depreciation expense and labeling costs associated with the relocation of a facility.

|

2013

Forecasted Earnings Per Share Reconciliation Low

High

Diluted earnings per share attributable to common shareholders

$3.45

$3.60

Restructuring, impairment charges, and special items, net of tax

$0.50

$0.50

Intangible amortization expense, net of tax

$0.75

$0.75

Amortization of debt discount on convertible notes, net of tax

$0.15

$0.15

Adjusted diluted earnings per share

$4.85

$5.00

95 |

2014

Forecasted Earnings Per Share Reconciliation Low

High

Diluted earnings per share attributable to common shareholders

$3.68

$3.83

Restructuring, impairment charges, and special items, net of tax

$0.65

$0.70

Intangible amortization expense, net of tax

$0.85

$0.85

Amortization of debt discount on convertible notes, net of tax

$0.17

$0.17

Adjusted diluted earnings per share

$5.35

$5.55

96 |