Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRUS ENERGY CORP | a8-k_20131213.htm |

| EX-99.2 - EXHIBIT 99.2 - CENTRUS ENERGY CORP | ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - CENTRUS ENERGY CORP | exhibit991.htm |

| EX-10.1 - EXHIBIT 10.1 - CENTRUS ENERGY CORP | exhibit101.htm |

CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT A C P D I S C U S S I O N M A T E R I A L S A U G U S T 2 0 1 3 C O N F I D E N T I A L

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT A C P D I S C U S S I O N M A T E R I A L S Disclaimer This presentation contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 – that is, statements related to future events. In this context, forward- looking statements may address our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will” and other words of similar meaning. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For USEC, particular risks and uncertainties that could cause our actual future results to differ materially from those expressed in our forward-looking statements include, but are not limited to: risks related to the ongoing transition of our business, including uncertainty regarding the transition of the Paducah gaseous diffusion plant and uncertainty regarding the economics of and continued funding for the American Centrifuge project and the potential for a demobilization or termination of the project; the impact of a potential de-listing of USEC's common stock on the NYSE, including the potential for the holders of USEC's convertible notes to require USEC to repurchase their notes in the event of a de-listing; the impact of a potential balance sheet restructuring on the holders of our common stock and convertible notes; risks related to the need to restructure the investments by Toshiba Corporation and Babcock & Wilcox Investment Company; risks related to the underfunding of our defined benefit pension plans and the impact of the potential requirement for us to place an amount in escrow or purchase a bond with respect to such underfunding; the impact of uncertainty regarding our ability to continue as a going concern on our liquidity and prospects; our ability to reach an agreement with DOE regarding the transition of the Paducah gaseous diffusion plant and uncertainties regarding the transition costs and other impacts of USEC ceasing enrichment at the Paducah gaseous diffusion plant and returning the plant to DOE; the continued impact of the March 2011 earthquake and tsunami in Japan on the nuclear industry and on our business, results of operations and prospects; the impact and potential extended duration of the current supply/demand imbalance in the market for low enriched uranium; the impact of enrichment market conditions, increased project costs and other factors on the economics of the American Centrifuge project and our ability to finance the project and the potential for a demobilization or termination of the project; uncertainty regarding the timing, amount and availability of additional funding for the research, development and demonstration (RD&D) program and the dependency of government funding on Congressional appropriations; restrictions in our credit facility on our spending on the American Centrifuge project; limitations on our ability to provide any required cost sharing under the RD&D program; uncertainty concerning our ability through the RD&D program to demonstrate the technical and financial readiness of the centrifuge technology for commercialization; uncertainty concerning the ultimate success of our efforts to obtain a loan guarantee from DOE and other financing for the American Centrifuge project or additional government support for the project and the timing and terms thereof and the potential for demobilization or termination of the project if financing or additional government support is not in place at the end of the RD&D program; potential changes in our anticipated ownership of or role in the American Centrifuge project, including as a result of the need to raise additional capital to finance the project; the impact of actions we have taken or may take to reduce spending on the American Centrifuge project, including the potential loss of key suppliers and employees, and impacts to cost and schedule; the potential for DOE to seek to terminate or exercise its remedies under the RD&D cooperative agreement or the June 2002 DOE-USEC agreement; changes in U.S. government priorities and the availability of government funding, including loan guarantees; our ability to extend, renew or replace our credit facility that matures on September 30, 2013; risks related to our inability to repay our convertible notes at maturity in October 2014; restrictions in our credit facility that may impact our operating and financial flexibility; our dependence on deliveries of LEU from Russia under a commercial agreement with a Russian government entity known as Techsnabexport that expires in 2013 and under a new commercial supply agreement with Russia and limitations on our ability to import the Russian LEU we buy under this agreement into the United States and other countries; risks related to our ability to sell our fixed purchase obligations under the new commercial supply agreement with Russia; the decrease or elimination of duties charged on imports of foreign-produced low enriched uranium; pricing trends and demand in the uranium and enrichment markets and their impact on our profitability; the impact of government regulation by DOE and the U.S. Nuclear Regulatory Commission; and other risks and uncertainties discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and quarterly reports on Form 10-Q, which are available on our website at www.usec.com. We do not undertake to update our forward-looking statements except as required by law.

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT ACP Situation Overview Economics of nuclear power generation pressured by low power price environment OTHER PR O JECT S T A TU S POTENTIAL STRATEGIC ALTERNATIVES Current view of financial forecasts suggests significant additional government support required over and above $2.0 billion loan guarantee SWU prices (spot and term) continue to decline given substantial excess supply post Fukishima If material capital raise is not able to be completed by early January 2014, funding to carry ACP post RD&D completion will be required While strategically important, utility customers have indicated they are unwilling to pay a significant premium for ACP SWU No visible catalysts for SWU market improvement in the near-to medium- term In light of the market environment, prior debt/equity capital raise architecture may not be viable USEC ability to contribute equity capital limited Universe of potential equity investors/partners uncertain; prospects of utility support limited Uncertain and challenging political and budgetary environment RD&D program headed for successful completion Full scale construction cost estimate currently approximately 5% above target Operating costs/economics on target MARKET ENVIRONMENT COMMERCIALIZE ACP AS PLANNED Requires significant improvement in market environment and/or customer willingness to pay a substantial premium to market SWU prices Requires other forecast assumptions to hold or improve (i.e. construction costs, financing costs) Requires equity investors/partners to be willing to invest at challenging prospective IRRs SEEK ADDITIONAL GOVERNMENT SUPPORT DEMOBILIZE ACP Substantial cost to demobilize High hurdles to re-start ACP once demobilized USEC balance sheet restructuring ultimately required to maximize prospects of ultimate capital raise 1 A C P D I S C U S S I O N M A T E R I A L S

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT A C P D I S C U S S I O N M A T E R I A L S ACP Situation Overview: Commercialization Plan Status Review Commercializing ACP as currently contemplated is increasingly challenging PREREQUISITES FOR ACP TO BE VIABLE STATUS COMMENTS Successful completion of RD&D Program RD&D program on budget and schedule; have met all milestones to date Expected to be completed by the end of December 2013 Funding through September 2013 secured; balance of funding expected to be achieved through GFY 2014 appropriations and other funding mechanisms Construction costs meet target Extensive engagement with suppliers and contractors to refine, negotiate and value engineer to reduce project costs and schedule Total project costs are currently converging at a level approximately 5% above target Further cost reduction opportunities are limited Operating costs/economics within expected parameters Forecasts for O&M costs, plant availability remain within targets Long-term customer contracts at sufficient SWU prices Substantial SWU market weakness is pressuring the price at which customers will contract Further exacerbated by the challenges confronting US nuclear utilities due to low power price environment (primarily natural gas driven) Likely difficult to contract at prices that will facilitate attractive equity returns Raise $3.0 billion of DOE/JECA debt financing on commercially reasonable terms DOE loan guarantee application has remained pending during RD&D program JECAs are aware of project status having received periodic updates from Toshiba Feasibility of capital raise highly dependent on business case, including price at which customers will contract for ACP SWU Reduced SWU prices impacts the ability to support prior debt/equity capital architecture 2

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT A C P D I S C U S S I O N M A T E R I A L S ACP Situation Overview: Commercialization Plan Status Review (cont’d) PREREQUISITES FOR ACP TO BE VIABLE STATUS COMMENTS Credit subsidy fee and DOE covenants acceptable Credit subsidy will remain unknown until loan guarantee application process is restarted Acceptable debt covenants and terms subject to negotiation Raise $1.0+ billion of third-party equity financing Restructuring of B&W and Toshiba investments being negotiated; outcome uncertain Universe of potential equity investors/partners uncertain; prospects of utility investment limited Optimal tax structuring In the current entity and financial structure, projected equity returns are premised on ACP qualifying for accelerated depreciation Tax attributes are a significant value driver in the current financial forecasts and projected equity returns assume investors are able to realize tax losses as incurred Secure bridge financing between RD&D completion and financial close Gap between RD&D and financial close likely Depending on the length of the gap and project carrying costs, unlikely USEC has sufficient liquidity to carry the project on its own and will require bridge financing of some type USEC retains enough ownership in ACP to justify investment Assuming a successful balance sheet restructuring, our financial projections indicate that the Company could potentially contribute several hundred million dollars to ACP 3

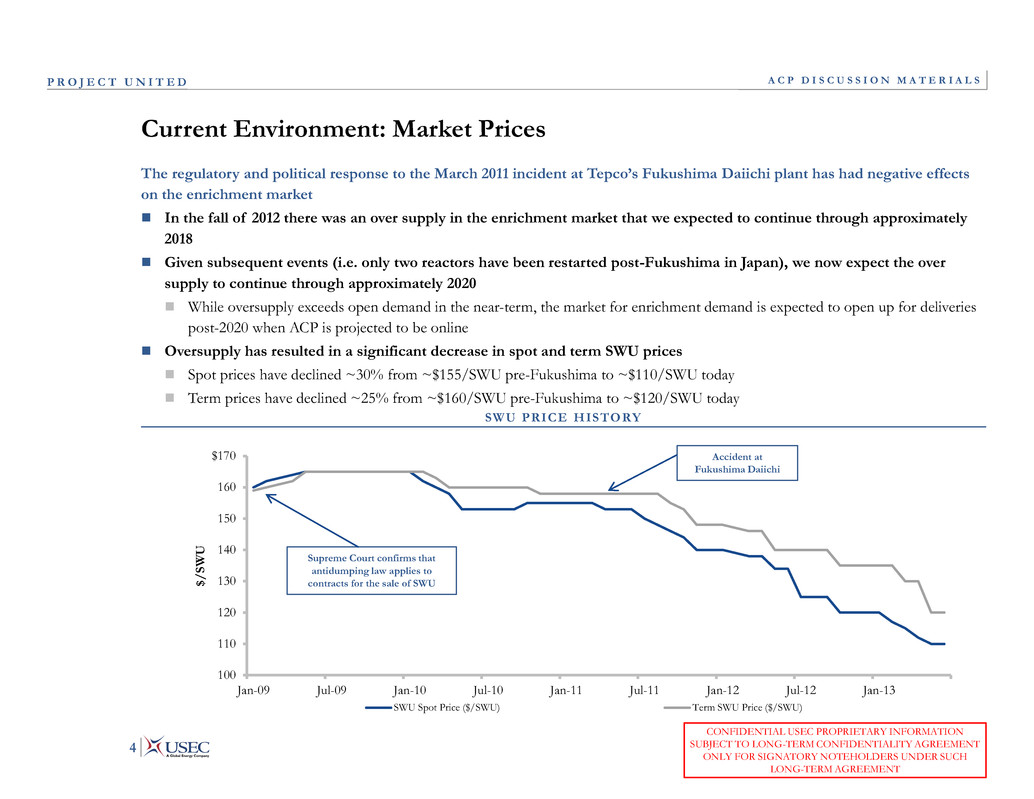

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT A C P D I S C U S S I O N M A T E R I A L S Current Environment: Market Prices The regulatory and political response to the March 2011 incident at Tepco’s Fukushima Daiichi plant has had negative effects on the enrichment market In the fall of 2012 there was an over supply in the enrichment market that we expected to continue through approximately 2018 Given subsequent events (i.e. only two reactors have been restarted post-Fukushima in Japan), we now expect the over supply to continue through approximately 2020 While oversupply exceeds open demand in the near-term, the market for enrichment demand is expected to open up for deliveries post-2020 when ACP is projected to be online Oversupply has resulted in a significant decrease in spot and term SWU prices Spot prices have declined ~30% from ~$155/SWU pre-Fukushima to ~$110/SWU today Term prices have declined ~25% from ~$160/SWU pre-Fukushima to ~$120/SWU today SWU PRICE HISTORY 100 110 120 130 140 150 160 $170 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 $ / S W U SWU Spot Price ($/SWU) Term SWU Price ($/SWU) Supreme Court confirms that antidumping law applies to contracts for the sale of SWU Accident at Fukushima Daiichi 4

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT Relative All-In Cost per SWU On a per-unit basis, smaller plants cost more to build and operate than the 16-train, 3.8 million SWU per year plant that USEC has been developing Higher operating costs result in lower operating margins and reduced ability to support debt Relative all-in costs are illustrated below; the all-in cost is the sum of per-unit operating costs and per-unit estimated annual capital recovery (debt repayment and returns to equity investors) A C P D I S C U S S I O N M A T E R I A L S Annual production (mil. SWU) 0.2 1.0 1.9 2.9 3.8 Relative All-In Cost (16 trains = 1) 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 1 Train 4 Trains 8 Trains 12 Trains 16 Trains ~ 9x 5

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT Remaining Project Cost Optimal Return Enhanced Return Minimum Return A C P D I S C U S S I O N M A T E R I A L S 6 Illustrative Equity Returns Based on the latest ACP commercialization analysis and market conditions, it will be difficult to achieve sufficient equity returns to support investment unless the remaining output can be contracted at SWU prices at least 30 percent above current market and WBS costs can be reduced to target levels The chart below highlights the sensitivity of the project ROE to changes in SWU prices and project costs RD&D on course for successful completion at YE2013 Declining SWU prices post-Fukushima No visible catalyst for near-term SWU price improvement Customers do not indicate willingness to pay substantial premium for ACP SWU Current construction cost estimates approximately 5% above target levels Operating costs remain on target Improved financing terms may be achievable, but by themselves would not be sufficient to generate adequate returns Additional governmental support may be necessary to support commercialization CONTEXT / DRIVERS SWU PRICE/PROJECT COST SENSITIVITY Current Market Current Cost Estimate (Target + 5%) Target Cost S W U P ri ce ( 20 13 ) Current Market + 30%

P R O J E C T U N I T E D CONFIDENTIAL USEC PROPRIETARY INFORMATION SUBJECT TO LONG-TERM CONFIDENTIALITY AGREEMENT ONLY FOR SIGNATORY NOTEHOLDERS UNDER SUCH LONG-TERM AGREEMENT Relative Equity Returns Considerations While no perfectly comparable hurdle rate exists for the unique ACP asset, the cost of equity benchmarks for commodity- exposed industries and those that face significant technology risk may serve as reference points for ACP Based on current market prices and cost estimates, the return profile for ACP is likely below that required to raise third party equity capital A C P D I S C U S S I O N M A T E R I A L S 7 Merchant Generator Peers Nuclear Supply Chain Peers Technology Venture/ Manufacturing Peers Integrated Solar Manufacturers/ Project Developers C o st o f E q uit y ACP 20% 17% 26% 23% 16% 14% 31% 31% (July 2013)