Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d643235d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

SunCoke Energy, Inc.

2014 Guidance Call

December 16, 2013

SunCoke Energy TM

|

|

Forward-Looking Statements TM

This slide presentation should be reviewed in conjunction with the 2014 Guidance Update of SunCoke Energy, Inc. (SXC) and the conference call held on December 16, 2013 at 11:00 a.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (“SXCP”), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. Neither SXC nor SXCP has any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

SXC 2014 Guidance Call 1

|

|

2013 Accomplishments

Continued operations excellence

Sustained solid Domestic Coke performance

Maintained top quartile coke and coal safety performance

Improved productivity and reduced production costs per ton in coal mining segment

Initiated environmental project and consent decree filed

Positioned SXC & SXCP for future growth

Entered India via VISA SunCoke JV

Renewed Indiana Harbor contract; refurbishment on track

Progressed on permit for potential new coke plant

SXCP completed two accretive coal logistics transactions

SXCP received favorable IRS ruling on ferrous activities

Built financial strength and flexibility

Expect to achieve 2013 financial targets

IPO of SXCP in January 2013 delivered as planned

SXC and SXCP capitalized for future growth

SXC 2014 Guidance Call

2

|

|

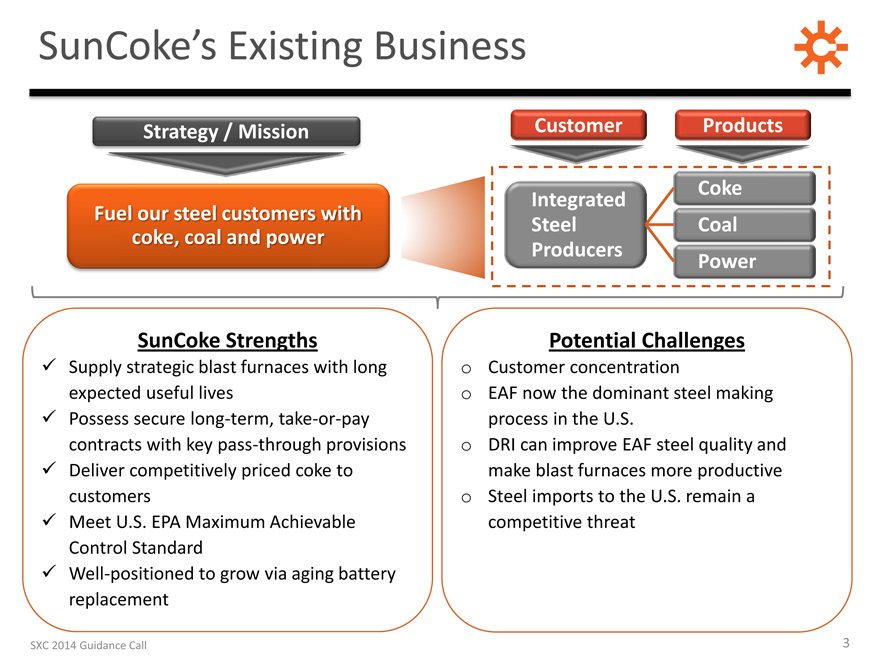

SunCoke’s Existing Business

Strategy / Mission

Fuel our steel customers with coke, coal and power

SunCoke Strengths

Supply strategic blast furnaces with long expected useful lives

Possess secure long-term, take-or-pay contracts with key pass-through provisions

Deliver competitively priced coke to customers

Meet U.S. EPA Maximum Achievable Control Standard

Well-positioned to grow via aging battery replacement

Customer

Products

Integrated Steel Producers

Coke

Coal

Power

Potential Challenges

Customer concentration

EAF now the dominant steel making process in the U.S.

DRI can improve EAF steel quality and make blast furnaces more productive

Steel imports to the U.S. remain a competitive threat

SXC 2014 Guidance Call

3

|

|

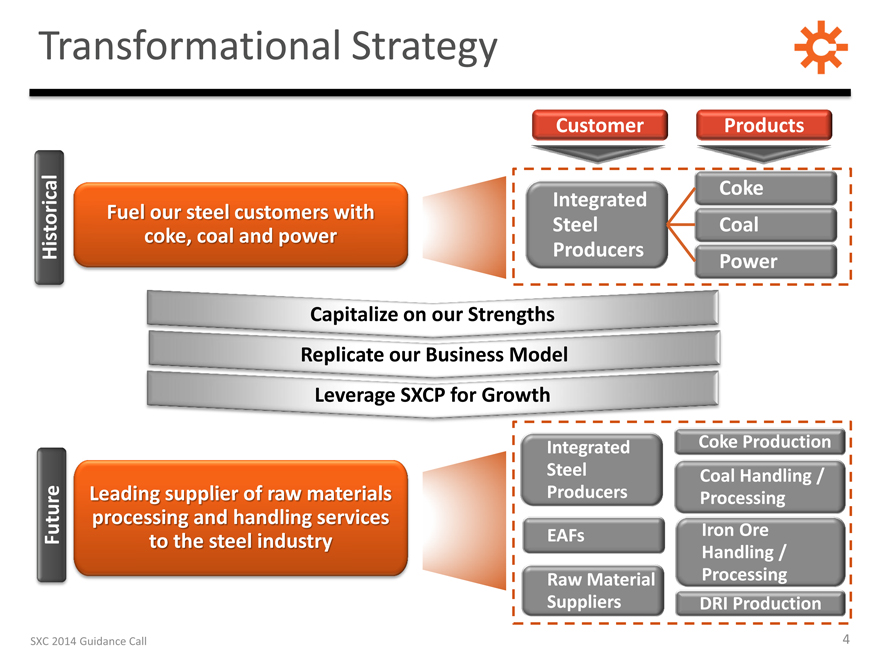

Transformational Strategy

Historical

Fuel our steel customers with coke, coal and power

Customer Products

Integrated Coke

Steel Coal

Producers Power

Capitalize on our Strengths

Replicate our Business Model

Leverage SXCP for Growth

Future

Leading supplier of raw materials processing and handling services to the steel industry

Integrated Coke Production

Steel Coal Handling /

Producers Processing

EAFs Iron Ore

Handling /

Raw Material Processing

Suppliers DRI Production

SXC 2014 Guidance Call

4

|

|

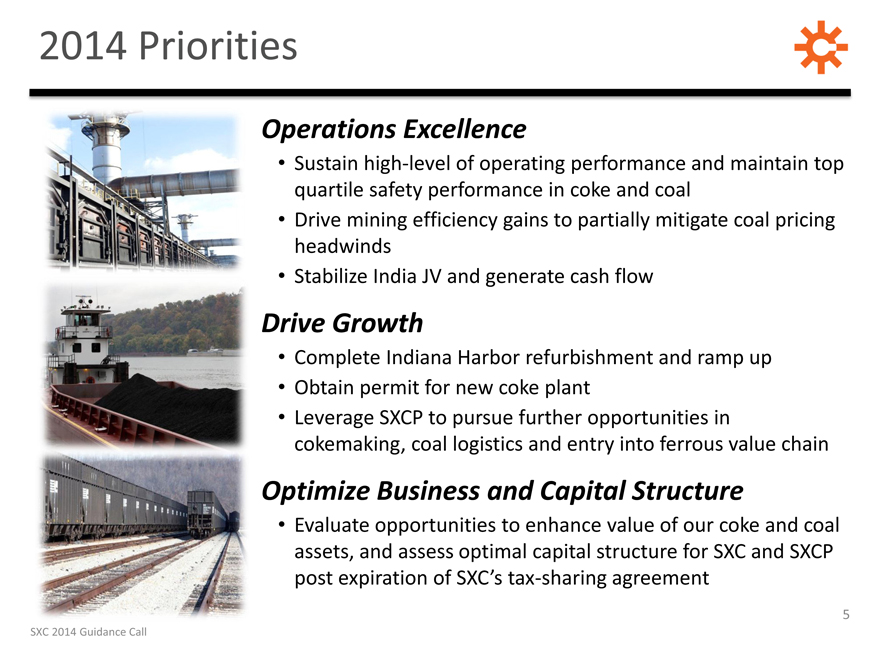

2014 Priorities

Operations Excellence

Sustain high-level of operating performance and maintain top quartile safety performance in coke and coal

Drive mining efficiency gains to partially mitigate coal pricing headwinds

Stabilize India JV and generate cash flow

Drive Growth

Complete Indiana Harbor refurbishment and ramp up

Obtain permit for new coke plant

Leverage SXCP to pursue further opportunities in cokemaking, coal logistics and entry into ferrous value chain

Optimize Business and Capital Structure

Evaluate opportunities to enhance value of our coke and coal assets, and assess optimal capital structure for SXC and SXCP post expiration of SXC’s tax-sharing agreement

SXC 2014 Guidance Call

5

|

|

GUIDANCE

SunCoke Energy TM

SXC 2014 Guidance Call

6

|

|

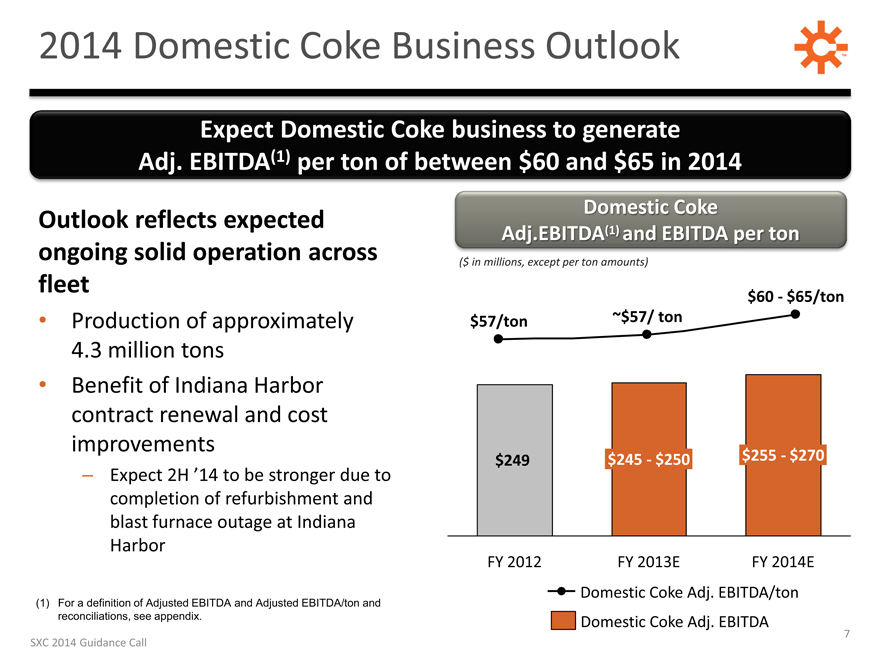

2014 Domestic Coke Business Outlook

Expect Domestic Coke business to generate Adj. EBITDA(1) per ton of between $60 and $65 in 2014

Outlook reflects expected ongoing solid operation across fleet

Production of approximately 4.3 million tons

Benefit of Indiana Harbor contract renewal and cost improvements

– Expect 2H ’14 to be stronger due to completion of refurbishment and blast furnace outage at Indiana Harbor

Domestic Coke Adj.EBITDA(1) and EBITDA per ton

($ in millions, except per ton amounts)

$57/ton

~$57/ ton

$60—$65/ton

$249

$245—$250

$255—$270

FY 2012

FY 2013E

FY 2014E

Domestic Coke Adj. EBITDA/ton

Domestic Coke Adj. EBITDA

(1) For a definition of Adjusted EBITDA and Adjusted EBITDA/ton and reconciliations, see appendix.

SXC 2014 Guidance Call

7

|

|

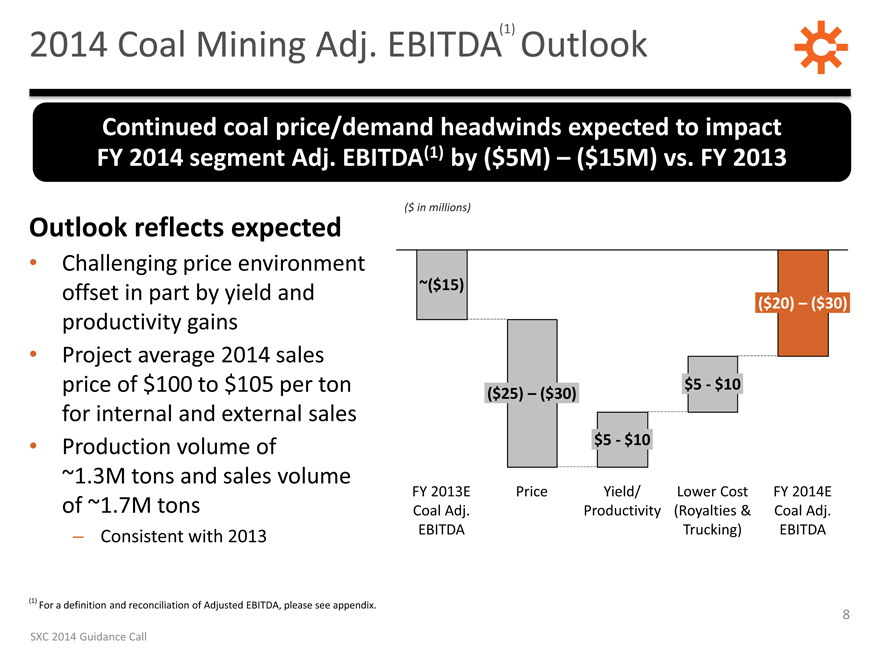

2014 Coal Mining Adj. EBITDA(1) Outlook

Continued coal price/demand headwinds expected to impact FY 2014 segment Adj. EBITDA(1) by ($5M) – ($15M) vs. FY 2013

Outlook reflects expected

Challenging price environment offset in part by yield and productivity gains

Project average 2014 sales price of $100 to $105 per ton for internal and external sales

Production volume of ~1.3M tons and sales volume of ~1.7M tons

– Consistent with 2013

($ in millions)

~($15)

($20) – ($30)

($25) – ($30)

$5—$10

$5—$10

FY 2013E Coal Adj. EBITDA

Price

Yield/ Productivity

Lower Cost (Royalties & Trucking)

FY 2014E Coal Adj. EBITDA

(1)

For a definition and reconciliation of Adjusted EBITDA, please see appendix.

SXC 2014 Guidance Call

8

|

|

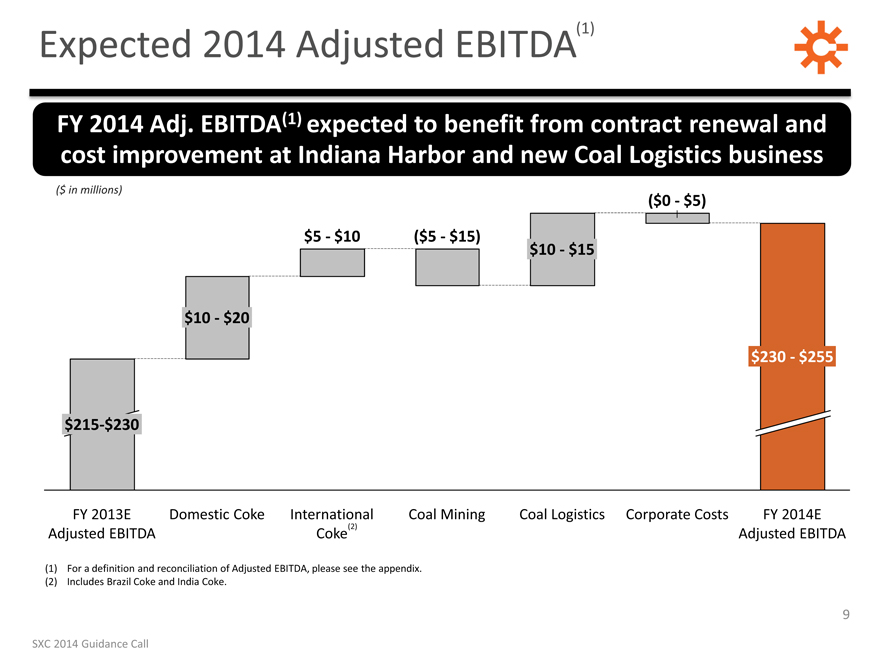

Expected 2014 Adjusted EBITDA(1)

FY 2014 Adj. EBITDA(1) expected to benefit from contract renewal and cost improvement at Indiana Harbor and new Coal Logistics business

($ in millions)

$215-$230

$10—$20

$5—$10

($5—$15)

$10—$15

($0—$5)

$230—$255

FY 2014E Adjusted EBITDA

Corporate Costs

Coal Logistics

Coal Mining

International

(2)

Coke

Domestic Coke

FY 2013E Adjusted EBITDA

(1) For a definition and reconciliation of Adjusted EBITDA, please see the appendix.

(2) Includes Brazil Coke and India Coke.

SXC 2014 Guidance Call

9

|

|

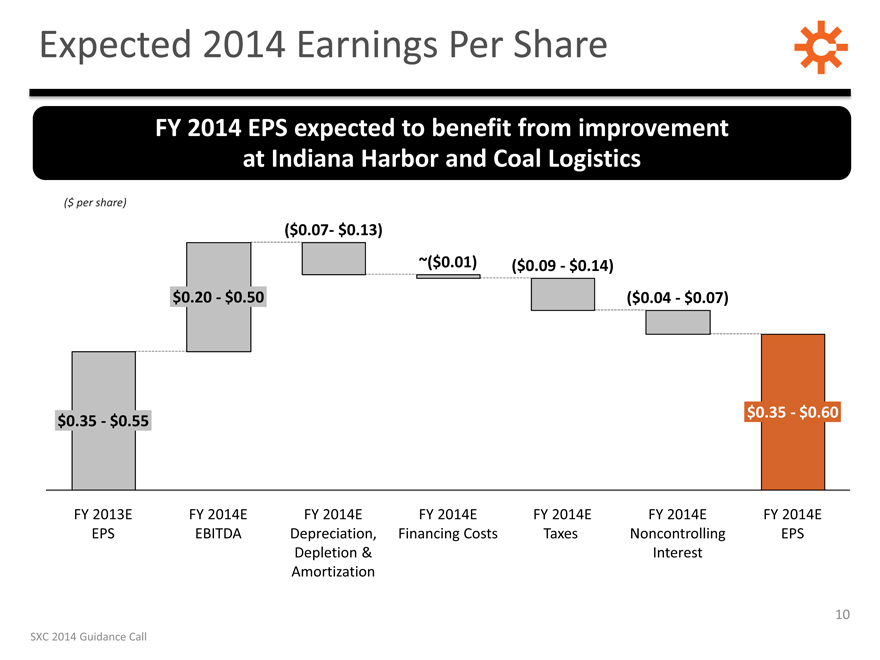

Expected 2014 Earnings Per Share

FY 2014 EPS expected to benefit from improvement at Indiana Harbor and Coal Logistics

($ per share)

$0.35—$0.55

$0.20—$0.50

($0.07- $0.13)

~($0.01)

($0.09—$0.14)

($0.04—$0.07)

$0.35—$0.60

FY 2013E EPS

FY 2014E EBITDA

FY 2014E Depreciation, Depletion & Amortization

FY 2014E Financing Costs

FY 2014E Taxes

FY 2014E Noncontrolling Interest

FY 2014E EPS

SXC 2014 Guidance Call

10

|

|

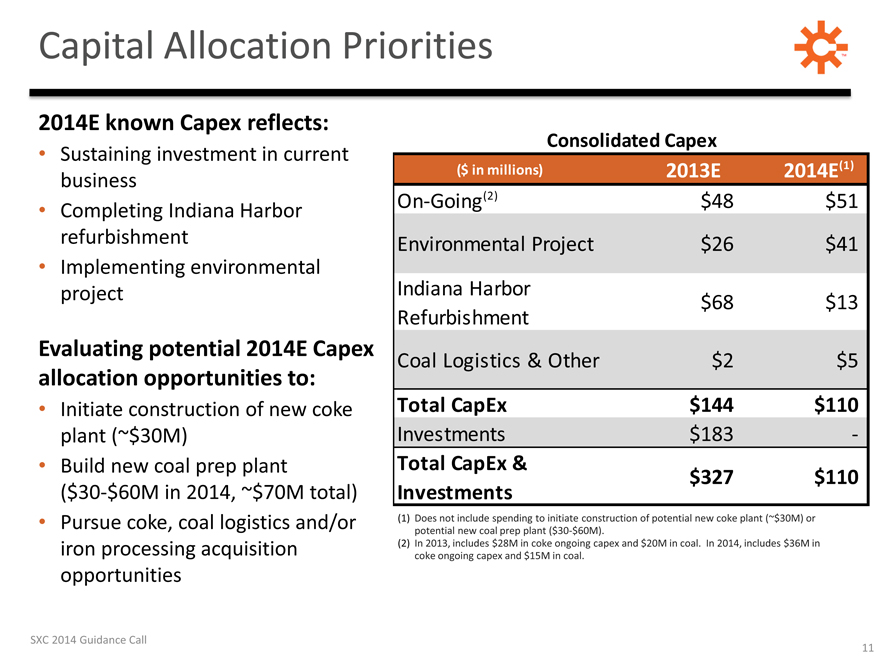

Capital Allocation Priorities

2014E known Capex reflects:

Sustaining investment in current business

Completing Indiana Harbor refurbishment

Implementing environmental project

Evaluating potential 2014E Capex allocation opportunities to:

Initiate construction of new coke plant (~$30M)

Build new coal prep plant

($30-$60M in 2014, ~$70M total)

Pursue coke, coal logistics and/or iron processing acquisition opportunities

Consolidated Capex

($ in millions) 2013E 2014E(1)

On-Going(2) $48 $51

Environmental Project $26 $41

Indiana Harbor

$68 $13

Refurbishment

Coal Logistics & Other $2 $5

Total CapEx $144 $110

Investments $183 -

Total CapEx &

$327 $110

Investments

(1) Does not include spending to initiate construction of potential new coke plant (~$30M) or potential new coal prep plant ($30-$60M).

(2) In 2013, includes $28M in coke ongoing capex and $20M in coal. In 2014, includes $36M in coke ongoing capex and $15M in coal.

SXC 2014 Guidance Call

11

|

|

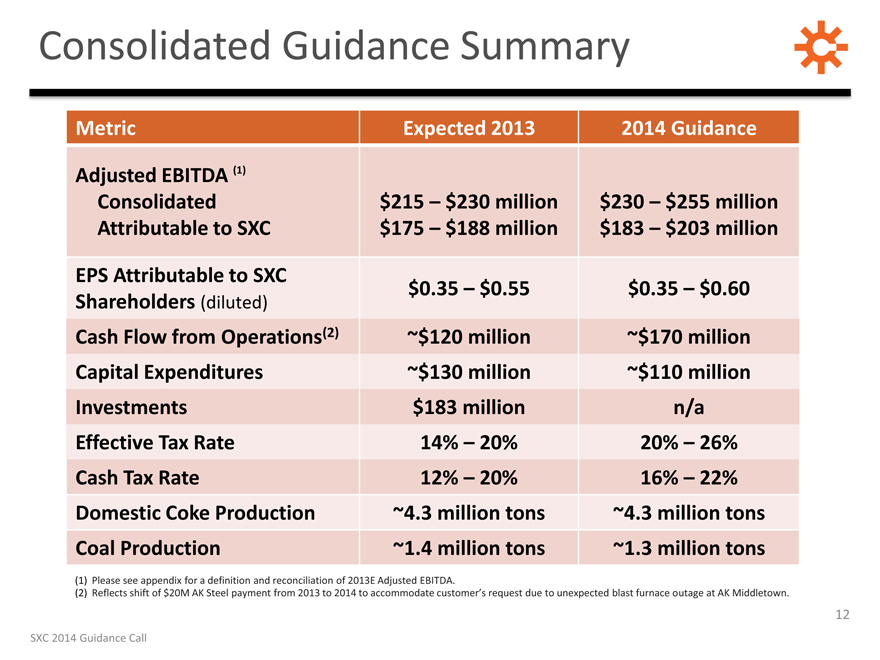

Consolidated Guidance Summary

Metric Expected 2013 2014 Guidance

Adjusted EBITDA (1)

Consolidated $215 – $230 million $230 – $255 million

Attributable to SXC $175 – $188 million $183 – $203 million

EPS Attributable to SXC

$0.35 – $0.55 $0.35 – $0.60

Shareholders (diluted)

Cash Flow from Operations(2) ~$120 million ~$170 million

Capital Expenditures ~$130 million ~$110 million

Investments $183 million n/a

Effective Tax Rate 14% – 20% 20% – 26%

Cash Tax Rate 12% – 20% 16% – 22%

Domestic Coke Production ~4.3 million tons ~4.3 million tons

Coal Production ~1.4 million tons ~1.3 million tons

(1) Please see appendix for a definition and reconciliation of 2013E Adjusted EBITDA.

(2) Reflects shift of $20M AK Steel payment from 2013 to 2014 to accommodate customer’s request due to unexpected blast furnace outage at AK Middletown.

SXC 2014 Guidance Call

12

|

|

QUESTIONS

SunCoke Energy TM

SXC 2014 Guidance Call

13

|

|

DEFINITIONS AND RECONCILIATIONS

SunCoke Energy TM

SXC 2014 Guidance Call

14

|

|

Definitions

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets. We believe Adjusted EBITDA is an important measure of operating performance and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/ton represents Adjusted EBITDA divided by tons sold.

SXC 2014 Guidance Call

15

|

|

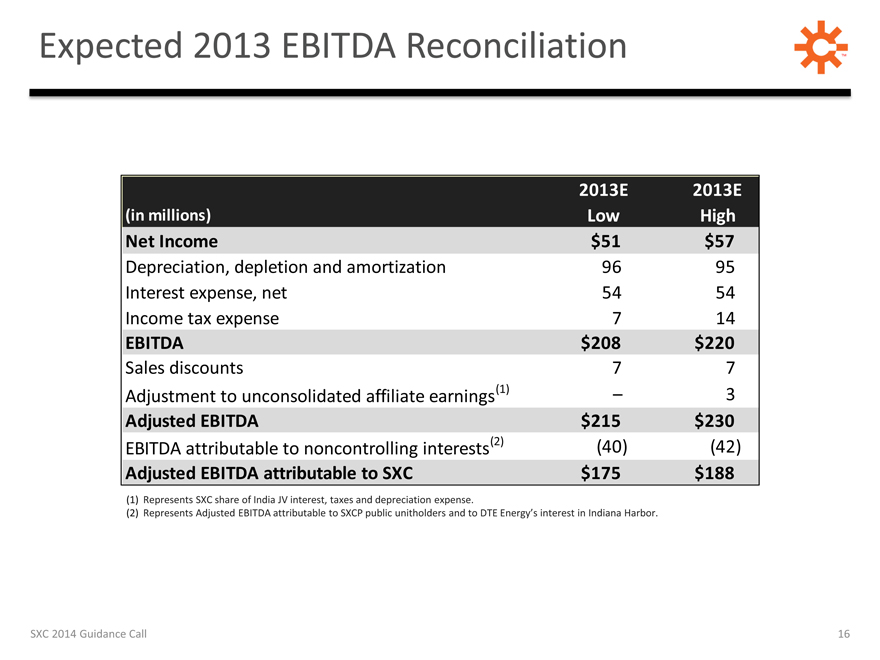

Expected 2013 EBITDA Reconciliation

2013E 2013E

(in millions) Low High

Net Income $51 $57

Depreciation, depletion and amortization 96 95

Interest expense, net 54 54

Income tax expense 7 14

EBITDA $208 $220

Sales discounts 7 7

Adjustment to unconsolidated affiliate earnings(1) – 3

Adjusted EBITDA $215 $230

EBITDA attributable to noncontrolling interests(2) (40) (42)

Adjusted EBITDA attributable to SXC $175 $188

(1) Represents SXC share of India JV interest, taxes and depreciation expense.

(2) Represents Adjusted EBITDA attributable to SXCP public unitholders and to DTE Energy’s interest in Indiana Harbor.

SXC 2014 Guidance Call

16

|

|

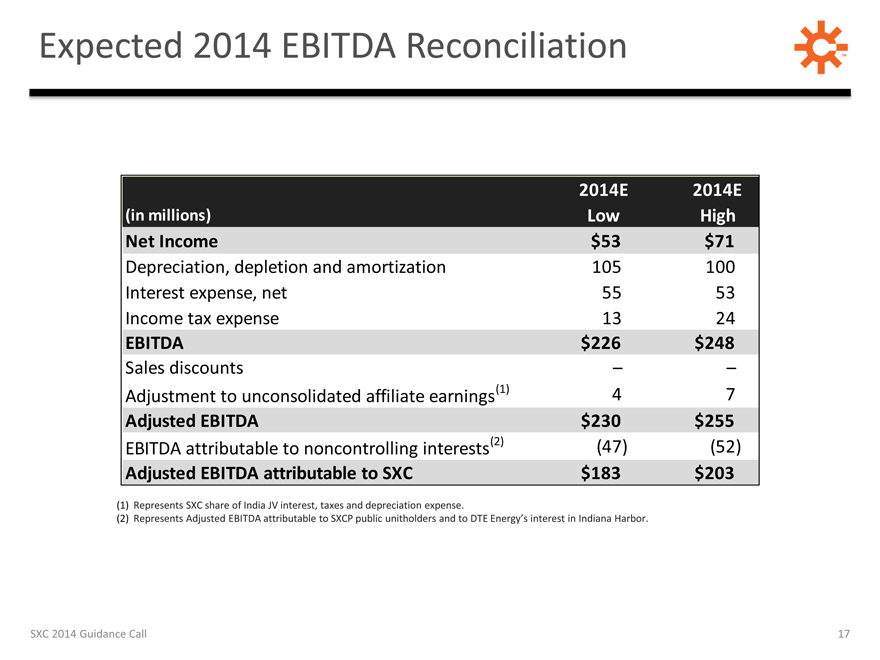

Expected 2014 EBITDA Reconciliation

2014E 2014E

(in millions) Low High

Net Income $53 $71

Depreciation, depletion and amortization 105 100

Interest expense, net 55 53

Income tax expense 13 24

EBITDA $226 $248

Sales discounts – –

Adjustment to unconsolidated affiliate earnings(1) 4 7

Adjusted EBITDA $230 $255

EBITDA attributable to noncontrolling interests(2) (47) (52)

Adjusted EBITDA attributable to SXC $183 $203

(1) Represents SXC share of India JV interest, taxes and depreciation expense.

(2) Represents Adjusted EBITDA attributable to SXCP public unitholders and to DTE Energy’s interest in Indiana Harbor.

SXC 2014 Guidance Call

17

|

|

Investor Relations: 630-824-1987 www.suncoke.com

SunCoke Energy TM