Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MITEL NETWORKS CORP | d644574d8k.htm |

Exhibit 99.1

ARRANGEMENT

involving

AASTRA TECHNOLOGIES LIMITED

and

MITEL NETWORKS CORPORATION

SPECIAL MEETING OF SHAREHOLDERS OF

AASTRA TECHNOLOGIES LIMITED

TO BE HELD ON JANUARY 9, 2014

NOTICE OF SPECIAL MEETING AND

MANAGEMENT PROXY CIRCULAR

These materials are important and require your immediate attention. The shareholders of Aastra Technologies Limited are required to make important decisions. If you have questions as to how to deal with these documents or the matters to which they refer, please contact your financial, legal or other professional advisor.

December 11, 2013

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

December 11, 2013

Dear Shareholder:

On behalf of the Board of Directors, we would like to invite you to join us at the special meeting of shareholders of Aastra Technologies Limited (“Aastra”) to be held at the offices of McCarthy Tétrault LLP, 66 Wellington Street West, Suite 5300, Toronto, Ontario, M5K 1E6, on January 9, 2014 commencing at 1:00 p.m. (Toronto time).

At the meeting, you will be asked to consider and vote upon a special resolution (the “Arrangement Resolution”) with respect to a plan of arrangement contemplated by the arrangement agreement entered into between Aastra and Mitel Networks Corporation (“Mitel”) on November 10, 2013 and pursuant to which holders of common shares of Aastra (“Aastra Shares”) will receive, for each Aastra Share that they hold, U.S.$6.52 in cash and 3.6 common shares in the capital of Mitel (“Mitel Shares”).

Based on the closing price of Mitel Shares on the Toronto Stock Exchange (the “TSX”) on November 8, 2013, the last trading day before the announcement of the transaction and a U.S. Dollar/Canadian Dollar exchange rate of 0.9531, the transaction values the equity of Aastra on a fully-diluted basis at approximately CAD$392 million or CAD$31.96 per Aastra Share. This represents a 20.9% premium to the 30-day volume weighted average price of Aastra Shares as of November 8, 2013. Based on the closing price of Mitel Shares on the TSX on December 10, 2013, the transaction values the equity of Aastra on a fully-diluted basis at approximately CAD$525 million or CAD$44.43 per Aastra Share.

In order to become effective, the arrangement must be approved by a resolution passed by not less than two-thirds of the votes cast by shareholders at the meeting in person or by proxy. In addition, the arrangement must be approved by at least a simple majority of the votes cast by “minority” shareholders as determined in accordance with applicable securities laws and stock exchange rules. Completion of the arrangement is also subject to certain other conditions, including the approval of the Ontario Superior Court of Justice (Commercial List) (the “Court”), the relevant French governmental authorities controlling the foreign investment as per, in particular, article L. 151-1 seq. of the French Monetary and Financial Code (Code monétaire et financier), compliance with the Investment Canada Act (Canada), and other closing conditions customary in transactions of this nature which are described in the attached management proxy circular.

The transaction has been unanimously approved by the Board of Directors of Aastra. In doing so, the Board determined that the arrangement is fair to the shareholders and in the best interests of Aastra and authorized the submission of the arrangement to the shareholders for their approval at a special meeting. The Board recommends that you vote FOR the Arrangement Resolution.

In making their determinations, the Board considered, among other things, a fairness opinion delivered by TD Securities Inc. to the effect that, as of November 10, 2013 and based upon and subject to the assumptions, qualifications and limitations set out therein, the consideration to be received under the arrangement by the holders of Aastra Shares is fair, from a financial point of view, to such holders of Aastra Shares. A copy of TD Securities’ fairness opinion is attached as Appendix “G” to the attached management proxy circular.

Mr. Francis Shen, Aastra’s Chairman and Co-Chief Executive Officer, Mr. Anthony Shen, Aastra’s Co-Chief Executive Officer, President and Chief Operating Officer, and each of Aastra’s independent directors, who in the aggregate control approximately 14.33% of the outstanding Aastra Shares, have entered into voting support agreements and confirmed their intention, subject to the terms of such agreements, to vote their Aastra Shares in favour of the Arrangement Resolution.

The attached management proxy circular and the documents incorporated by reference therein contain a detailed description of the arrangement and include certain other information relating to Aastra and Mitel, including Mitel Shares, to assist you in considering the matter to be voted upon. You are urged to carefully consider all of the information in the attached management proxy circular and the documents incorporated by reference therein. If you require assistance, you should consult your financial, legal or other professional advisor.

- 1 -

Your vote is important regardless of the number of Aastra Shares you own.

Voting

If you are not registered as the holder of your Aastra Shares but hold your Aastra Shares through a broker or other intermediary, you should follow the instructions provided by your broker or other intermediary to vote your Aastra Shares. See the section in the attached management proxy circular entitled “General Proxy Information — Non-Registered Holders” for further information on how to vote your Aastra Shares.

If you are a registered holder of Aastra Shares, we encourage you to vote by completing the enclosed form of proxy (printed on white paper). You should specify your choice by marking the box on the enclosed form of proxy and by dating, signing and returning your proxy in the enclosed return envelope addressed to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 by 5:00 p.m. (Toronto time) on January 7, 2014 or at least 24 hours (excluding Saturdays, Sundays and holidays) prior to the time of any adjournment(s) or postponement(s) of the meeting. Please do this as soon as possible. Voting by proxy will not prevent you from voting in person if you attend the meeting and revoke your proxy, but will ensure that your vote will be counted if you are unable to attend.

Letters of Transmittal for Aastra Shares

If you hold your Aastra Shares through a broker or other intermediary, please contact that broker or other intermediary for instructions and assistance in receiving the Mitel Shares and cash consideration in respect of such Aastra Shares.

If you are a registered holder of Aastra Shares, we also encourage you to complete and return the enclosed letter of transmittal (printed on yellow paper) together with the certificate(s) representing your Aastra Shares and any other required documents and instruments, to the depositary, Computershare Investor Services Inc. in the enclosed return envelope in accordance with the instructions set out in the letter of transmittal so that if the arrangement is approved, the consideration for your Aastra shares can be sent to you as soon as possible following the arrangement becoming effective. The letter of transmittal contains other procedural information related to the arrangement and should be reviewed carefully.

Holders of Aastra Shares receiving Mitel Shares under the Arrangement who are entitled to, and who propose to, make an income tax election (a “Joint Tax Election”) in respect of the disposition of their Aastra Shares under the Arrangement are encouraged to promptly return the Letter of Transmittal and to review the time limits relevant to making the Joint Tax Election. See the sections in the attached management proxy circular entitled “The Arrangement—Tax Election” and “Certain Canadian Federal Income Tax Considerations”.

While certain matters, such as the receipt of Court approval, are beyond the control of Aastra, if the requisite shareholder approval for approving the arrangement is obtained at the meeting and all other conditions precedent to the transaction are either satisfied or waived, it is currently anticipated that the arrangement will be completed and become effective before the end of the first quarter of 2014.

| Sincerely, | Sincerely, | |

| “Francis Shen” | “David Williams” | |

| Francis Shen | David Williams | |

| Chairman and Co-Chief Executive Officer | Chair of the Special Committee | |

- 2 -

AASTRA TECHNOLOGIES LIMITED

NOTICE OF SPECIAL MEETING

NOTICE IS HEREBY GIVEN that a special meeting (the “Meeting”) of the holders (the “Shareholders”) of common shares (“Aastra Shares”) of Aastra Technologies Limited (“Aastra”) will be held at the offices of McCarthy Tétrault LLP, 66 Wellington Street West, Suite 5300, Toronto, Ontario, M5K 1E6, on January 9, 2014 at 1:00 p.m. (Toronto time) for the following purposes:

| 1. | to consider pursuant to an interim order of the Ontario Superior Court of Justice (Commercial List) dated December 10, 2013 (the “Interim Order”) and, if deemed advisable, to pass, with or without amendment, a special resolution (the “Arrangement Resolution”), the full text of which is set forth in Appendix “B” to the accompanying management proxy circular (the “Circular”), to approve a plan of arrangement (the “Plan of Arrangement”) under section 192 of the Canada Business Corporations Act (the “CBCA”) whereby, among other things, holders of Aastra Shares will receive, for each Aastra Share that they hold, U.S.$6.52 in cash and 3.6 common shares (“Mitel Shares”) in the capital of Mitel Networks Corporation (“Mitel”) and Mitel will acquire all of the issued and outstanding common shares in the capital of Aastra; and |

| 2. | to transact such further or other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

The Circular provides additional information relating to the matters to be addressed at the Meeting, including the arrangement, and accompanies this Notice.

The record date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting is December 10, 2013 (the “Record Date”). Only Shareholders whose names have been entered in the register of Shareholders as of the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting.

Shareholders are entitled to vote at the Meeting either in person or by proxy. Registered Shareholders who are unable to attend the Meeting in person are encouraged to read, complete, sign, date and return the enclosed form of proxy (printed on white paper) in accordance with the instructions set out in the proxy and in the Circular. In order to be valid for use at the Meeting, proxies must be received by Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 by 5:00 p.m. (Toronto time) on January 7, 2014 or at least 24 hours (excluding Saturdays, Sundays and holidays) prior to the time of any adjournment(s) or postponement(s) of the Meeting.

If you are a non-registered Shareholder, please refer to the section in the Circular entitled “General Proxy Information — Non-Registered Holders” for information on how to vote your Aastra Shares.

Pursuant to the Interim Order, registered Shareholders have been granted the right to dissent in respect of the Arrangement Resolution. If the Plan of Arrangement becomes effective, a registered Shareholder who dissents in respect of the Arrangement Resolution (each a “Dissenting Shareholder”) is entitled to be paid the fair value of such Dissenting Shareholder’s shares, provided that such Dissenting Shareholder has delivered a written objection to the Arrangement Resolution to Aastra not later than 5:00 p.m. (Toronto time) on January 7, 2014, being two business days preceding the Meeting (or, if the Meeting is postponed or adjourned, two business days preceding the date of the postponed or adjourned Meeting) and has otherwise complied strictly with the dissent procedures described in the Circular, including the relevant provisions of section 190 of the CBCA, as modified by the Interim Order, the Plan of Arrangement and the Final Order. Beneficial owners of Aastra Shares registered in the name of a broker, investment dealer or other intermediary who wish to dissent should be aware that only registered Shareholders are entitled to dissent. Failure to

- 1 -

comply strictly with the dissent procedures described in the Circular may result in the loss of any right of dissent. These rights are described in detail in the accompanying Circular under the heading “Dissent Rights”. The text of section 190 of the CBCA, which will be relevant in any dissent proceeding, is attached as Appendix “H” to this Circular.

DATED at Toronto, Ontario this 11th day of December, 2013.

| BY ORDER OF THE BOARD OF DIRECTORS OF AASTRA TECHNOLOGIES LIMITED |

| “Francis Shen” |

| Francis Shen |

| Chairman and Co-Chief Executive Officer |

- 2 -

TABLE OF CONTENTS

| INFORMATION CONTAINED IN THIS PROXY CIRCULAR |

1 | |||

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISKS |

1 | |||

| FINANCIAL INFORMATION |

3 | |||

| NOTICE TO SHAREHOLDERS IN THE UNITED STATES |

3 | |||

| GLOSSARY OF TERMS |

5 | |||

| SUMMARY |

15 | |||

| The Meeting |

15 | |||

| Purpose of the Meeting |

15 | |||

| Effects of the Arrangement |

15 | |||

| Description of the Arrangement |

15 | |||

| Recommendation of the Special Committee |

16 | |||

| Recommendation of the Aastra Board |

17 | |||

| Reasons for the Arrangement |

17 | |||

| Fairness Opinion |

19 | |||

| Voting Support Agreements |

19 | |||

| Conditions to the Arrangement |

20 | |||

| Treatment of Aastra Share Plans |

20 | |||

| Description of Mitel Shares |

21 | |||

| Fractional Shares and Rounding of Cash Consideration |

21 | |||

| Letter of Transmittal |

21 | |||

| Cancellation of Rights After Six Years |

22 | |||

| Dissent Rights |

22 | |||

| Certain Canadian Federal Income Tax Considerations |

23 | |||

| Court Approval |

23 | |||

| Stock Exchange Listing and Reporting Issuer Status |

23 | |||

| Risk Factors |

24 | |||

| United States Securities Law Matters |

24 | |||

| GENERAL PROXY INFORMATION |

25 | |||

| The Meeting |

25 | |||

| Record Date |

25 | |||

| Solicitation of Proxies |

25 | |||

| How a Vote is Passed |

25 | |||

| Who can Vote? |

25 | |||

| Appointment of Proxies |

26 | |||

| What is a Proxy? |

26 | |||

| Appointing a Proxyholder |

26 | |||

| Instructing your Proxyholder and Exercise of Discretion by your Proxyholder |

26 | |||

| Changing your mind |

26 | |||

| Non-Registered Holders |

27 | |||

| Voting Securities and Principal Holders |

27 | |||

| THE ARRANGEMENT |

28 | |||

| Background to the Arrangement |

28 | |||

| Recommendation of the Special Committee |

32 |

i

| Recommendation of the Aastra Board |

32 | |||

| Reasons for the Arrangement |

32 | |||

| Fairness Opinion |

35 | |||

| Principal Steps of the Arrangement |

35 | |||

| Completion of the Arrangement |

36 | |||

| Voting Support Agreements |

39 | |||

| Procedure for Exchange of Aastra Shares |

40 | |||

| Tax Election |

42 | |||

| No Fractional Shares and Rounding of Cash Consideration |

42 | |||

| Cancellation of Rights after Six Years |

43 | |||

| Treatment of Aastra Share Plans |

43 | |||

| Stock Exchange Listing and Reporting Issuer Status |

43 | |||

| Interests of Certain Persons in the Arrangement |

44 | |||

| INFORMATION RELATING TO AASTRA |

47 | |||

| Information Respecting Directors and Executive Officers |

47 | |||

| Trading Price and Volume of Aastra Shares |

48 | |||

| Prior Sales |

48 | |||

| Available Information |

49 | |||

| Risk Factors |

49 | |||

| Aastra Documents Incorporated by Reference |

50 | |||

| INFORMATION RELATING TO MITEL |

51 | |||

| Overview |

51 | |||

| Description of Mitel Shares |

51 | |||

| Principal Holders of Mitel Shares |

52 | |||

| Trading Price and Volume of Mitel Shares |

52 | |||

| Prior Sales |

53 | |||

| Available Information |

56 | |||

| Dividend Policy |

56 | |||

| Risk Factors |

56 | |||

| Mitel Documents Incorporated by Reference |

56 | |||

| INFORMATION RELATING TO THE COMBINED COMPANY |

57 | |||

| Anticipated Corporate Structure |

57 | |||

| Description of the Business of the Combined Company |

57 | |||

| Directors and Officers |

59 | |||

| Mitel Shares to be Issued Under the Arrangement |

65 | |||

| Principal Holders of Combined Company Shares |

65 | |||

| Shareholders Agreement |

66 | |||

| ARRANGEMENT AGREEMENT |

67 | |||

| The Arrangement Agreement |

67 | |||

| Representations and Warranties |

67 | |||

| Conditions Precedent to the Arrangement |

68 | |||

| Covenants |

69 | |||

| Termination of the Arrangement Agreement |

73 | |||

| Amendment |

75 |

ii

| REGULATORY MATTERS |

75 | |||

| Canadian Securities Law Matters |

75 | |||

| U.S. Securities Law Matters |

77 | |||

| Investment Canada Act Approval |

78 | |||

| French Authorization |

79 | |||

| Exchange Approvals |

80 | |||

| RISKS RELATING TO THE ARRANGEMENT AND THE COMBINED COMPANY |

80 | |||

| DISSENT RIGHTS |

82 | |||

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS |

84 | |||

| Holders Resident in Canada |

85 | |||

| Holders Not Resident in Canada |

88 | |||

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS |

89 | |||

| INTERESTS OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

89 | |||

| INTERESTS OF EXPERTS OF AASTRA AND MITEL |

89 | |||

| OTHER INFORMATION |

90 | |||

| APPROVAL OF DIRECTORS |

91 | |||

| CONSENT OF TD SECURITIES INC. |

92 | |||

| CONSENT OF LEGAL COUNSEL |

93 |

| APPENDICES | ||||

| APPENDIX “A” UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS OF MITEL |

A-1 | |||

| APPENDIX “B” FORM OF ARRANGEMENT RESOLUTION |

B-1 | |||

| APPENDIX “C” ARRANGEMENT AGREEMENT |

C-1 | |||

| APPENDIX “D” PLAN OF ARRANGEMENT |

D-1 | |||

| APPENDIX “E” NOTICE OF APPLICATION FOR FINAL ORDER |

E-1 | |||

| APPENDIX “F” INTERIM ORDER |

F-1 | |||

| APPENDIX “G” TD SECURITIES FAIRNESS OPINION |

G-1 | |||

| APPENDIX “H” SECTION 190 OF THE CANADA BUSINESS CORPORATIONS ACT |

H-1 | |||

iii

INFORMATION CONTAINED IN THIS PROXY CIRCULAR

The information contained in this Circular is given as of December 10, 2013, unless otherwise stated.

No person has been authorized to give any information or to make any representation in connection with the matters being considered herein other than those contained in this Circular and, if given or made, such information or representation should be considered as not having been authorized and should not be relied upon. This Circular does not constitute an offer to acquire, or a solicitation of an offer to sell, any securities, or the solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an offer of proxy solicitation. Neither the delivery of this Circular nor any distribution of securities referred to herein will, under any circumstances, create any implication that there has been no change in the information set forth herein since the date of this Circular.

Information contained in this Circular should not be construed as legal, tax or financial advice and Shareholders are urged to consult their own professional advisors in connection with the matters considered in this Circular.

The information concerning Mitel incorporated by reference or contained in this Circular has been publicly filed or provided by Mitel. Although the directors and senior officers of Aastra have no knowledge that would indicate that any statements contained herein taken or based upon such documents, records or sources are untrue or incomplete, Aastra does not assume any responsibility for the accuracy or completeness of the information taken from or based upon such documents, records or sources, or for any failure by Mitel, any of its affiliates or any of their respective Representatives to disclose events which may have occurred or may affect the significance or accuracy of any such information but which are unknown to Aastra. In accordance with the Arrangement Agreement, Mitel has provided Aastra with all necessary information concerning Mitel, its affiliates and the Mitel Shares that is required by the Interim Order or applicable Law to be included in this Circular and ensured that such information does not contain any misrepresentations (as such term is defined in the Arrangement Agreement).

THE MITEL SHARES TO BE ISSUED IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY ANY SECURITIES REGULATORY AUTHORITY (INCLUDING, WITHOUT LIMITATION, ANY SECURITIES REGULATORY AUTHORITY OF ANY CANADIAN PROVINCE OR TERRITORY, THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), OR ANY SECURITIES REGULATORY AUTHORITY OF ANY U.S. STATE), NOR HAS ANY SECURITIES REGULATORY AUTHORITY PASSED UPON THE FAIRNESS OR MERITS OF THE ARRANGEMENT OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS CIRCULAR OR ANY DOCUMENTS INCORPORATED BY REFERENCE HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

All summaries of, and references to, the Arrangement Agreement and the Plan of Arrangement in this Circular are qualified in their entirety by, in the case of the Arrangement Agreement, the complete text of the Arrangement Agreement, a copy of which is attached as Appendix “C” to this Circular and available on SEDAR at www.sedar.com, and in the case of the Plan of Arrangement, the complete text of the Plan of Arrangement, a copy of which is attached as Appendix “D” to this Circular. You are urged to carefully read the full text of the Plan of Arrangement and the Arrangement Agreement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISKS

This Circular, including the documents incorporated by reference herein, contains forward-looking information and forward-looking statements. These forward-looking statements are related to, but not limited to, the completion and potential benefits of the Arrangement, the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objective, strategies and outlook of Aastra, Mitel or the Combined Company. Forward-looking information typically contains statements with words such as “anticipate”, “believe”, “expect”, “plan”, “estimate”, “intend”, “will”, “may”, “should” or similar words suggesting future outcomes. Forward-looking statements reflect current estimates, beliefs and assumptions, which are based on Mitel’s and Aastra’s perception of current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Mitel’s and Aastra’s estimates, beliefs and assumptions are inherently subject to

1

significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change.

This Circular, including the documents incorporated by reference herein, contains forward-looking statements concerning: the Combined Company’s financial position, cash flow and growth prospects, including, but not limited to, statements relating to the accretive nature of the transaction and ability of the Combined Company to deliver long-term growth; certain strategic benefits, and operational, competitive and cost synergies, including, but not limited to, statements relating to the approximately $45 million of expected synergies; management of the Combined Company; the timing of the Meeting; the expected completion date of the Arrangement; the anticipated tax treatment of the Arrangement for Shareholders; and Mitel’s and Aastra’s anticipated future results.

Numerous risks and uncertainties could cause the Combined Company’s actual results to differ materially from the estimates, beliefs and assumptions expressed or implied in the forward-looking statements, including, but not limited to: failure to realize anticipated results, including revenue growth, anticipated cost savings or operating efficiencies from the Combined Company’s major initiatives, heightened competition, whether from current competitors or new entrants to the marketplace, changes in economic conditions including the rate of inflation or deflation, changes in interest and currency exchange rates and derivative and commodity prices; failure to attract and retain key employees or effectively manage succession planning; consolidation in the industry could create more intense competition; inability to keep up with rapidly changing technology and evolving market standards; volatile market conditions; challenging product development and market acceptance of new products; risk of third party claims for infringement; reliance on relationships with strategic sales partners; reliance on relationships with contract manufacturing partners; exchange rate fluctuations; risks associated with product returns and product defects; risks relating to international exposure such as business culture differences, international demand for products, and political and economic instability; continued expansion plans and acquisition strategy; ability to arrange future financing and issuance of share capital; fluctuations in quarterly financial results and possible volatility of share price; product and geographic concentration and limited range of products; ability to protect proprietary rights such as maintaining trade secret and patent protection; network security issues; flaws in strategic operating plans; unfavorable economic and market conditions in key markets, particularly in Europe (including the United Kingdom) and in the United States; gross margin levels that are potentially unsustainable; evolving market for virtualized, cloud-based and hosted UCC solutions are subject to market risks and uncertainties that could cause significant delays and expenses; danger of infringing intellectual property rights of third parties; breach of default clauses from significant debt loads causing acceleration of repayment; dependence on sole source and limited source suppliers for key components of products; inability to realize deferred tax assets; transfer pricing rules may adversely affect income tax expense; credit and commercial risks and exposures could increase if the financial condition of customers decline; governmental regulation could harm operating results; changes in regulatory compliance obligations; adverse resolutions to litigation or governmental investigations; risks inherent in Mitel’s defined benefit pension plan; risks associated with Sarbanes-Oxley regulatory compliance; each significant holder of Mitel shares has potential to exercise significant influence over matters requiring approval by shareholders; conducting of business with related parties of Mitel such as affiliates of Kanata Research Park Corporation; changes in the Combined Company’s income, commodity, other tax and regulatory liabilities including changes in tax laws, regulations or future assessments; new, or changes to existing, accounting pronouncements; the risk that the Combined Company would experience a financial loss if its counterparties fail to meet their obligations in accordance with the terms and conditions of their contracts with the Combined Company; the risk of violations of law, breaches of the Combined Company’s policies or unethical behaviour; property and casualty risks; injuries at the workplace or health issues; the risk of material adverse effects arising as a result of litigation; events or series of events which may cause business interruptions; as well as the risks described elsewhere in this Circular under “Risks Relating to the Arrangement and the Combined Company”, “Information Relating to Aastra — Risk Factors”, “Information Relating to Mitel — Risk Factors” and “Information Relating to the Combined Company”.

Readers are cautioned that the foregoing list of factors is not exhaustive. Other risks and uncertainties not presently known to Mitel and Aastra or that Mitel and Aastra presently believe are not material could also cause actual results or events to differ materially from those expressed in the forward-looking statements contained herein. Additional information on these and other factors that could affect the operations or financial results of Mitel, Aastra or the Combined Company are included in reports filed by Mitel and Aastra with applicable securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com).

2

There can be no assurance that the Arrangement will occur or that the anticipated strategic benefits and operational, competitive and cost synergies will be realized. The Arrangement is subject to various regulatory approvals, including approvals under the Investment Canada Act, the relevant French governmental authorities controlling the foreign investment as per, in particular, article L. 151-1 seq. of the French Monetary and Financial Code (Code monétaire et financier), and the fulfillment of certain conditions, and there can be no assurance that any such approvals will be obtained and/or any such conditions will be met. The Arrangement could be modified, restructured or terminated. There can be no assurance that the Arrangement will occur or that the anticipated strategic benefits and operational, competitive and cost synergies will be realized.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect Mitel’s and Aastra’s expectations only as of the date of this Circular. Mitel and Aastra disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable Law.

FINANCIAL INFORMATION

All financial statements and financial data derived therefrom included or incorporated by reference in this Circular pertaining to Aastra have been prepared in accordance with IFRS and all financial statements and financial data derived therefrom included or incorporated by reference in this Circular pertaining to Mitel, including the unaudited pro forma condensed combined financial statements of Mitel attached as Appendix “A” to this Circular, have been prepared and presented in accordance with U.S. GAAP.

The pro forma condensed combined financial statements of Mitel attached as Appendix “A” to this Circular are for informational purposes only and are unaudited. All unaudited pro forma financial information contained in this Circular has been derived from underlying financial statements prepared in accordance with or reconciled to U.S. GAAP to illustrate the effect of the Arrangement. The pro forma financial information set forth in this Circular should not be considered to be what the actual financial position or other results of operations would have necessarily been had Mitel and Aastra operated as a single combined company as, at, or for the periods stated.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

The Mitel Shares to be issued under the Arrangement will not be registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) or the securities laws of any state of the United States. They will be issued in reliance upon the exemption from registration provided by section 3(a)(10) of the U.S. Securities Act on the basis of the approval of the Court, which will consider, among other things, the fairness of the Arrangement to the persons affected. See “The Arrangement — Completion of the Arrangement – Court Approval”.

The Mitel Shares will generally not be subject to resale restrictions under U.S. federal securities laws for persons who are not affiliates of Mitel within three months before the resale. See “Regulatory Matters – U.S. Securities Law Matters—Resale of Mitel Shares Within the United States”.

Shareholders resident in the United States should be aware that the Arrangement described herein may have tax consequences both in the United States and in Canada. Such consequences for Shareholders may not be described fully herein. For a general discussion of certain Canadian federal income tax consequences to investors who are resident in the United States, see “Certain Canadian Federal Income Tax Considerations — Holders Not Resident in Canada”. U.S. holders are urged to consult their own tax advisors with respect to the Canadian and United States federal and state income tax consequences of the Arrangement to them based upon their circumstances.

This solicitation of proxies is not subject to the proxy requirements of section 14(a) of the Exchange Act. Accordingly, the solicitation of proxies contemplated herein is made in accordance with Canadian corporate and securities laws, and this Circular has been prepared in accordance with the disclosure requirements of Canada. Shareholders resident in the United States should be aware that, in general, such Canadian disclosure requirements are different from those applicable to proxy statements, prospectuses or registration statements prepared in accordance with U.S. federal securities laws. The financial statements of Aastra incorporated by reference herein have been

3

prepared in accordance with IFRS and have been subject to Canadian generally accepted auditing standards and thus may not be comparable to financial statements of United States companies.

The enforcement by investors of civil liabilities under the United States securities laws may be affected adversely by the fact that Aastra and Mitel are organized under the laws of a jurisdiction other than the United States, that some of their respective officers and directors are residents of countries other than the United States, that some or all of the experts named in this Circular may be residents of countries other than the United States, or that all or a substantial portion of the assets of Aastra, Mitel and such persons are located outside the United States. As a result, it may be difficult or impossible for Shareholders resident in the United States to effect service of process within the United States upon Aastra, Mitel, their respective officers and directors or the experts named herein, or to realize against them on judgments of courts of the United States. In addition, the Shareholders resident in the United States should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under the securities laws of the United States; or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the securities laws of the United States.

4

GLOSSARY OF TERMS

In this Circular and accompanying Notice of Meeting, unless there is something in the subject matter inconsistent therewith, the following terms will have the respective meanings set out below, words importing the singular number will include the plural and vice versa and words importing any gender will include all genders.

“Aastra” means Aastra Technologies Limited;

“Aastra 2006 Option Plan” means the stock option plan of Aastra approved by the Shareholders on May 23, 2006, as amended;

“Aastra Board” means the board of directors of Aastra, as the same is constituted from time to time;

“Aastra DSU Plan” means the deferred share unit plan for independent directors and senior officers of Aastra dated July 17, 2012;

“Aastra DSUs” means deferred share units issued under the Aastra DSU Plan;

“Aastra Employment Agreements” means, collectively, the Shen Employment Agreements, the Derungs Employment Agreement, the Tobia Employment Agreement and the Brett Employment Agreement;

“Aastra Expense Fee” means an amount equal to CAD$2,500,000;

“Aastra Material Adverse Effect” has the meaning ascribed thereto in the Arrangement Agreement, a copy of which is attached as Appendix “C” to this Circular;

“Aastra Option” means the outstanding options to purchase Aastra Shares granted by Aastra under the Aastra 2006 Option Plan;

“Aastra Optionholder” means a holder of an Aastra Option;

“Aastra SAR Plan” means Aastra’s share appreciation rights plan dated July 28, 2010;

“Aastra SARs” means stock appreciation rights issued under the Aastra SAR Plan;

“Aastra Share Plans” means the Aastra 2006 Option Plan, the Aastra DSU Plan and the Aastra SAR Plan;

“Aastra Shares” means the common shares in the authorized share capital of Aastra;

“Aastra Termination Fee” means an amount equal to CAD$11,000,000;

“Acquisition Proposal” means, other than the transactions contemplated by this Arrangement Agreement and other than any transaction involving only Aastra and/or one or more of its wholly-owned Subsidiaries or Mitel and/or one or more of its wholly-owned Subsidiaries, any offer, proposal or inquiry from any Person or group of Persons, whether or not in writing and whether or not delivered to the shareholders of either Aastra or Mitel, after the date hereof relating to: (a) any acquisition or purchase, direct or indirect, through one or more transactions, of (i) the assets of either Aastra or Mitel and/or one or more of its Subsidiaries that, individually or in the aggregate, constitute 20% or more of the consolidated assets of either Aastra or Mitel and their Subsidiaries, taken as a whole, or which contribute 20% or more of the consolidated revenue of either Aastra or Mitel and their Subsidiaries, taken as a whole, or (ii) 20% or more of any voting or equity securities of either Aastra or Mitel or any one or more of its Subsidiaries that, individually or in the aggregate, contribute 20% or more of the consolidated revenues or constitute 20% or more of the consolidated assets of either Aastra or Mitel and its Subsidiaries, taken as a whole; (b) any take-over bid, tender offer or exchange offer that, if consummated, would result in such Person or group of Persons beneficially owning 20% or more of any class of voting or equity securities of either Aastra or Mitel; or (c) a plan of arrangement, merger, amalgamation, consolidation, share exchange, share reclassification, business combination, reorganization, recapitalization, liquidation, dissolution or other

5

similar transaction involving either Aastra or Mitel and/or any of their Subsidiaries whose assets or revenues, individually or in the aggregate, constitute 20% or more of the consolidated assets or revenues, as applicable, of Aastra or Mitel and their Subsidiaries, taken as a whole;

“affiliate” has the meaning set out in section 1.2 of National Instrument 45-106—Prospectus and Registration Exemptions as in effect on the date hereof;

“Agents” means, collectively, Jefferies Finance LLC, TD Securities (USA) LLC and The Toronto-Dominion Bank and their respective successors and assigns;

“allowable capital loss” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Resident in Canada – Taxation of Capital Gains and Capital Losses”;

“Anthony Shen Consulting Agreement” means the consulting services agreement between Mitel and Anthony Shen, effective as of the Effective Date;

“Application for Review” has the meaning ascribed thereto under “Regulatory Matters – Investment Canada Act Approval”;

“Arrangement” means the arrangement of Aastra under section 192 of the CBCA on the terms and subject to the conditions set out in the Plan of Arrangement, subject to any amendments or variations thereto made in accordance with section 7.4 of the Arrangement Agreement or the Plan of Arrangement or made at the direction of the Court in the Final Order (provided that any such amendment or variation is acceptable to both Aastra and Mitel, each acting reasonably);

“Arrangement Agreement” means the arrangement agreement dated November 10, 2013 between Aastra and Mitel, as may be amended, supplemented and/or restated in accordance therewith prior to the Effective Date, providing for, among other things, the Arrangement;

“Arrangement Resolution” means a special resolution of the Shareholders in substantially the form of Appendix “B” to this Circular;

“Articles of Arrangement” means the articles of arrangement of Aastra in respect of the Arrangement to be filed with the Director after the Final Order is made, which shall be in form and content satisfactory to Aastra and Mitel, each acting reasonably;

“Authorization” means any authorization, order, permit, approval, grant, licence, registration, consent, right, notification, condition, franchise, privilege, certificate, judgment, writ, injunction, award, determination, direction, decision, decree, by-law, rule or regulation, of, from or required by any Governmental Entity;

“Brett Change of Control Payment” has the meaning ascribed thereto under “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“Brett Consulting Agreement” means the consulting services agreement between Mitel and Allan Brett effective as of the Effective Date;

“Brett Employment Agreement” means the employment agreement between Aastra and Allan Brett, dated February 15, 1996, as amended;

“Business Day” means any day, other than a Saturday, a Sunday or a statutory or civic holiday in the Province of Ontario;

“Canadian Securities Laws” means the Securities Act, together with all other applicable securities Laws, rules and regulations and published policies thereunder or under the securities laws of any other province or territory of Canada as now in effect and as they may be promulgated or amended from time to time;

6

“Cash Consideration” means U.S.$6.52 in cash for each Aastra Share;

“Cash Payments” has the meaning ascribed thereto in “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“CBCA” means the Canada Business Corporations Act and the regulations made thereunder, as now in effect and as they made be promulgated or amended from time to time;

“Change in Recommendation” means prior to the Effective Time: (1) the Aastra Board fails to recommend or withdraws, amends, modifies or qualifies, in a manner adverse to Mitel, or fails to publicly reaffirm within five Business Days (and in any case prior to the Meeting) after having been requested by Mitel to do so; or (2) the Aastra Board or a committee thereof shall have approved or recommended any Acquisition Proposal;

“Change of Control Payments” means the Shen Change of Control Payments, the Derungs Change of Control Payment, the Brett Change of Control Payment and the Tobia Change of Control Payment;

“CIC Termination” has the meaning ascribed thereto in “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“Circular” means, collectively, the Notice of Meeting and this Management Proxy Circular of Aastra, prepared and sent to Shareholders in connection with the Meeting, including all Appendices attached hereto and the documents incorporated by reference herein and together with any amendments or supplemented thereof;

“Closing Payments” has the meaning ascribed thereto under “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“Combined Company” has the meaning ascribed thereto in “Information Relating to the Combined Company – Anticipated Corporate Structure”;

“Commitment Parties” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Financing the Transaction”;

“Commitment Letter” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Financing the Transaction”;

“Confidentiality Agreement” means the mutual confidentiality agreement between Mitel and Aastra dated September 17, 2013 pursuant to which each of Mitel and Aastra has provided confidential information about its business to the other;

“Consideration” means the consideration to be received by the Shareholders pursuant to the Plan of Arrangement as consideration for their Aastra Shares, consisting of 3.6 Mitel Shares and U.S.$6.52 in cash for each Aastra Share held;

“Consideration Shares” means the Mitel Shares to be issued pursuant to the Arrangement;

“Consulting Agreements” mean the Francis Shen Consulting Agreement, the Anthony Shen Consulting Agreement, the Brett Consulting Agreement and the Tobia Consulting Agreement;

“Court” means the Ontario Superior Court of Justice (Commercial List);

“CRA” means the Canada Revenue Agency;

“Credit Facility” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Financing the Transaction”;

7

“Demand for Payment” means a written notice containing a Dissenting Shareholder’s name and address, the number of Dissent Shares and a demand for payment of the fair value of such Dissent Shares;

“Depositary” means Computershare Investor Services Inc.;

“Derungs Change of Control Payment” has the meaning ascribed thereto under “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“Director” means the Director appointed pursuant to section 260 of the CBCA;

“Derungs Employment Agreement” means the employment agreement between the Swiss Subsidiary of Aastra, Aastra Telecom Schweiz AG, and Martin Derungs;

“Dissent Notice” means a written objection to the Arrangement Resolution by a Dissenting Shareholder in accordance with the Dissent Rights;

“Dissent Right” means the right of a Dissenting Shareholder to dissent in respect of the Arrangement as described in the Plan of Arrangement and the Interim Order;

“Dissent Shares” has the meaning ascribed thereto in “Dissent Rights”;

“Dissenting Shareholder” means a Registered Shareholder who duly and validly exercised Dissent Rights;

“Effective Date” means the date shown on the certificate of arrangement to be issued by the Director pursuant to section 192(7) of the CBCA in respect of the Articles of Arrangement giving effect to the Arrangement;

“Effective Time” means 12:01 a.m. (Toronto time) on the Effective Date, or such other time as Aastra and Mitel may agree in writing before the Effective Date;

“Eleventh Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Eligible Holder” means a beneficial holder of Aastra Shares that is: (a) a resident of Canada for purposes of the Tax Act and not exempt from tax under Part I of the Tax Act; or (b) a partnership, any member of which is a resident of Canada for purposes of the Tax Act and not exempt from tax under Part I of the Tax Act;

“Eligible Institution” means a Canadian Schedule I Chartered Bank, a major trust company in Canada, a commercial bank or trust company in the United States, a member of the Securities Transfer Association Medallion Program (STAMP), a member of the Stock Exchange Medallion Program (SEMP) or a member of the New York Stock Exchange Inc. Medallion Signature Program (MSP);

“Enterprise Communication” means telecommunication devices, applications and services that enable businesses to access the PSTN or the Internet, either directly or indirectly;

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended;

“Exchange Ratio” means the sum of (a) 3.6; plus (b) the fraction resulting from dividing U.S.$6.52 by the volume weighted trading price of Mitel Shares on the NASDAQ for the five day period immediately preceding the Effective Date;

“Fairness Opinion” means the opinion of TD Securities, dated November 10, 2013 delivered to the Aastra Board in connection with the Arrangement Agreement, a copy of which is attached as Appendix “G” to this Circular;

“Fifth Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

8

“Final Order” means the final order of the Court (or if appealed, of the appellate court) pursuant to section 192 of the CBCA approving the Arrangement as such order may be amended by the Court (with the consent of both Aastra and Mitel, each acting reasonably) at any time prior to the Effective Date;

“Financing Condition” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Financing the Transaction”;

“First Aastra Proposal” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“First Mitel Proposal” has the meaning ascribed there in “The Arrangement – Background to the Arrangement”;

“First Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Fourth Mitel Proposal” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Fourth Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Francis Shen Consulting Agreement” means the consulting services agreement between Mitel and Francis Shen, effective as of the Effective Date;

“Francisco Partners Group” means Francisco Partners Management, LLC and certain of its affiliates;

“French Authorization” means the approval of the French Ministry of Finance and Economy pursuant to articles L 151-2 et seq. of the French Monetary and Financial Code (Code monétaire et financier) (defined as the “French Determination” in the Arrangement Agreement);

“French Minister” has the meaning ascribed thereto in “Regulatory Matters – French Authorization”;

“Governmental Entity” means: (a) any multinational, federal, provincial, territorial, state, regional, municipal, local or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, board, ministry, bureau or agency, domestic or foreign; (b) any stock exchange, including TSX and NASDAQ; (c) any subdivision, agent, commission, board or authority of any of the foregoing; or (d) any quasi-governmental or private body, including any tribunal, commission, regulatory agency or self-regulatory organization, exercising any regulatory, antitrust, foreign investment, expropriation or taxing authority under or for the account of any of the foregoing;

“Holder” has the meaning ascribed thereto in “Certain Canadian Federal Income Tax Considerations”;

“IFRS” means International Financial Reporting Standards, which are issued by the International Accounting Standards Board, as adopted in Canada;

“Interim Order” means the interim order of the Court, attached as Appendix “F” to this Circular, providing for, among other things, the calling and holding of the Meeting as the same may be amended by the Court with the consent of Aastra and Mitel, each acting reasonably;

“Intermediary” means a broker, investment dealer or other intermediary through which a Shareholder holds its Aastra Shares;

“Investment” has the meaning ascribed thereto in “Regulatory Matters – French Authorization”;

“Investment Canada Act” means the Investment Canada Act (Canada), , R.S.C. 1985, c.28 (1st Supp.), as amended;

“Investment Canada Act Approval” means approval or deemed approval pursuant to the Investment Canada Act by the Minister of Industry;

9

“Joint Tax Election” has the meaning ascribed thereto under “The Arrangement – Tax Election”;

“Law” or “Laws” means all laws (including common law), by-laws, statutes, rules, regulations, principles of law and equity, orders, rulings, ordinances, judgments, injunctions, determinations, awards, decrees or other legally binding requirements, whether domestic or foreign, and the terms and conditions of any Authorization of or from any Governmental Entity, including for this purpose a self-regulatory authority (including, TSX and NASDAQ), and, for greater certainty, includes Canadian Securities Laws and U.S. Securities Laws; and the term “applicable” with respect to such Laws and in a context that refers to a Party, means such Laws as are applicable to such Party and/or its Subsidiaries or their business, undertaking, property or securities and emanate from a Person having jurisdiction over the Party and/or its Subsidiaries or its or their business, undertaking, property or securities;

“Letter of Transmittal” means the letter of transmittal(s) enclosed with the Circular, providing for the delivery of Aastra Shares to the Depositary;

“Locked-Up Securities” has the meaning ascribed thereto under “The Arrangement – Voting Support Agreements”;

“Locked-Up Shareholders” means, collectively, Francis Shen, Shen Capital Corporation, Anthony Shen, 1615282 Ontario Inc., Gerald Shortall, Michael Rosicki, and David Williams;

“Matthews Group” means Dr. Terence Matthews and certain entities controlled by Dr. Matthews;

“Meeting” means the special meeting of Shareholders, including any adjournment(s) or postponement(s) thereof made in accordance with the terms of the Arrangement Agreement, to be held in accordance with the Interim Order for the purpose of, among other things, obtaining the Shareholder Approval;

“Minister” has the meaning ascribed thereto under “Regulatory Matters – Investment Canada Act Approval”;

“Mitel” means Mitel Networks Corporation;

“Mitel Board” means the board of directors of Mitel as the same is constituted from time to time;

“Mitel Expense Fee” means CAD$2,500,000;

“Mitel Financing” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Financing the Transaction”;

“Mitel Material Adverse Effect” has the meaning ascribed thereto in the Arrangement Agreement;

“Mitel Options” means options to purchase Mitel Shares pursuant to Mitel’s equity compensation plans;

“Mitel Shareholder Approval” means the approval of Mitel Shareholders by ordinary resolution of the issuance of Mitel Shares pursuant to the Arrangement, as required by section 611 of the TSX Company Manual and Rule 5635(a)(1)(A) of the NASDAQ Stock Market Rules, which approval has been obtained through a written consent satisfactory to the TSX and the NASDAQ;

“Mitel Supporting Parties” has the meaning ascribed thereto under “The Arrangement – Completion of the Arrangement – Mitel Voting Support Agreements”;

“Mitel Shares” means the common shares in the capital of Mitel;

“Mitel Termination Fee” means an amount equal to CAD$11,000,000;

“MI 61-101” means Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions;

“NASDAQ” means The NASDAQ Global Market;

10

“net benefit ruling” has the meaning ascribed thereto under “Regulatory Matters – Investment Canada Act Approval”;

“Ninth Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Non-Registered Holder” means a Shareholder who is not a Registered Shareholder;

“Non-Resident Shareholder” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Not Resident in Canada”;

“Notice of Appearance” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Court Approval”;

“Notice of Application” means the notice of application to the Court attached hereto as Appendix “E” to this Circular;

“Notice of Meeting” means the notice of special meeting to the Shareholders which accompanies this Circular;

“Offer to Pay” means a written offer to a Dissenting Shareholder to pay the fair value for the Dissent Shares;

“Option Shares” means the Mitel Shares issuable on exercise of the Replacement Options;

“Outside Date” means March 14, 2014, or such later date as may be agreed to by Aastra and Mitel, provided however that if at that time all conditions to closing of the Arrangement shall have been satisfied or waived, other than Investment Canada Act Approval and the French Authorization (and those conditions that by their terms are to be satisfied at the Effective Time), then either Aastra or Mitel may postpone the Outside Date by an additional 30 days by giving written notice to the other Party to such effect no later than 5:00 p.m. (Toronto time) on March 14, 2014, or such later date as may be agreed to in writing by Aastra and Mitel;

“PSTN” means the public switched telephone network and is commonly referred to as basic telephone service;

“Person” includes an individual, partnership, association, body corporate, trustee, executor, administrator, legal representative, government (including any Governmental Entity) or any other entity, whether or not having legal status;

“Plan of Arrangement” means the plan of arrangement of Aastra, substantially in the form of Appendix “D” to this Circular, and any amendments or variations thereto made in accordance with section 7.4 of the Arrangement Agreement and the Plan of Arrangement or upon the direction of the Court in the Final Order with the consent of Aastra and Mitel, each acting reasonably;

“Proposed Agreement” has the meaning ascribed thereto in “Arrangement Agreement – Covenants – Non-Solicitation”;

“Record Date” has the meaning ascribed thereto in “General Proxy Information – Record Date”;

“Registered Shareholder” means a Person whose name appears on the register of securities as the owner of Aastra Shares;

“Regulatory Approvals” means those approvals, sanctions, rulings, consents, determinations, orders, exemptions, permits and other approvals (including the lapse, without objection, of a prescribed time under a statute or regulation that prohibits a transaction from being implemented until such prescribed time has lapsed, without objection, following the giving of notice thereunder), waivers, early terminations, authorizations, clearances, or written confirmations of no intention to initiate legal proceedings from Governmental Entity required to complete the Arrangement, including the Investment Canada Act Approval and the French Authorization;

“Replacement Option” means an option or right to purchase Mitel Shares granted by Mitel in replacement of Aastra Options on the basis set forth in section 3.1(e) of the Plan of Arrangement;

11

“Representatives” means any officer, director, employee, representative (including any financial or other advisor) or agent of either Aastra or Mitel or any of their Subsidiaries;

“Resident Shareholder” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Resident in Canada”;

“Response Period” has the meaning ascribed thereto under “Arrangement Agreement – Covenants – Non-Solicitation”;

“Reviewable Transaction” has the meaning ascribed thereto under “Regulatory Matters – Investment Canada Act Approval”;

“Revolving Facility” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement -Financing the Transaction”;

“RRIF” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Resident in Canada – Eligibility for Investment – Mitel Shares”;

“RRSP” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Resident in Canada – Eligibility for Investment – Mitel Shares”;

“Sarbanes-Oxley” means the Sarbanes-Oxley Act of 2002, as amended;

“Second Aastra Proposal” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Second Mitel Proposal” has the meaning ascribed there in “The Arrangement – Background to the Arrangement”;

“Securities Act” means the Securities Act (Ontario) and the rules, regulations and published policies made thereunder, as now in effect and as they may be promulgated or amended from time to time;

“SEC” has the meaning ascribed thereto under “Information Contained in this Proxy Circular”;

“SEDAR” means the System for Electronic Document Analysis and Retrieval as outlined in National Instrument 13-101 — System for Electronic Document Analysis and Retrieval (SEDAR), which can be accessed online at www.sedar.com;

“Shareholder Approval” means approval of (a) not less than two-thirds of the votes cast in respect of the Arrangement Resolution by Shareholders, present in person or represented by proxy at the Meeting; and (b) at least a simple majority of the votes cast in respect of the Arrangement Resolution by Shareholders, present in person or represented by proxy at the Meeting excluding votes attaching to Aastra Shares held by an “interested party” to the Arrangement within the meaning of MI 61-101, any related party to such interested party within the meaning of MI 61-101 (subject to the exceptions set out therein) and any person that is a joint actor with a person referred to in the foregoing for the purposes of MI 61-101;

“Shareholders” means the holders of Aastra Shares;

“Shareholders Agreement” has the meaning ascribed thereto under “Information Relating to the Combined Company – Shareholders Agreement”;

“Shen Change of Control Payment” has the meaning ascribed thereto under “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“Shen Employment Agreements” means, collectively, the employment agreement between Francis Shen and Aastra dated June 3, 1996, as amended, and the employment agreement between Anthony Shen and Aastra dated June 3, 1996, as amended;

12

“Shen Voting Support Agreements” means, collectively, the Voting Support Agreement between Mitel and Francis Shen and Shen Capital Corporation, and the Voting Support Agreement between Mitel and Anthony Shen and 161282 Ontario Inc.;

“SMEs” has the meaning ascribed thereto under “Information Relating to the Combined Company – Description of the Business of the Combined Company – Catapult the Combined Company into Leadership Positions”;

“Special Committee” means the committee established by the Aastra Board on August 26, 2013 comprised of independent directors the mandate of which included, among other things, the negotiation or supervision of the negotiation of the terms of the proposed transaction with Mitel, the commissioning of independent valuations and expert opinions as deemed necessary or desirable, the consideration of all applicable legal and regulatory requirements relating to such proposed transaction, and the overseeing of the provision of confidential information to third parties under cover of an appropriate confidentiality agreement;

“Subsidiary” has the meaning set out in section 1.1 of National Instrument 45-106—Prospectus and Registration Exemptions as in effect on the date hereof;

“Superior Proposal” means an unsolicited bona fide written Acquisition Proposal to acquire all of the shares of Aastra or all or substantially all of the assets of Aastra and its Subsidiaries made by a third party after the date of the Arrangement Agreement: (a) that is not subject to any financing condition and in respect of which any required financing to complete such Acquisition Proposal has been demonstrated to be available to the satisfaction of the Aastra Board, acting in good faith after consultation with its financial advisor(s) and outside legal counsel; (b) that is not subject to a due diligence and/or access condition; (c) in respect of which the Aastra Board, determines in good faith after consultation with its financial advisor(s) and outside legal counsel and after taking into account all the terms and conditions of such Acquisition Proposal, including all legal, financial, regulatory and other aspects of such Acquisition Proposal and the Person making such Acquisition Proposal, would, if consummated in accordance with its terms (but not assuming away any risk of non-competition), result in a transaction that is more favourable, from a financial point of view, to the Shareholders, than the Arrangement (including any adjustment to the terms and conditions of the Arrangement proposed by Mitel pursuant to the terms of the Arrangement Agreement; (d) that, after consultation with its financial advisor(s) and outside counsel, is reasonably likely to be consummated without undue delay, taking into account all legal, financial, regulatory and other aspects of such Acquisition Proposal and the Person making such Acquisition Proposal; and (e) after receiving the advice of outside counsel, that failure to recommend such Acquisition Proposal to the Shareholders, would be inconsistent with its fiduciary duties under applicable Laws;

“taxable capital gain” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Resident in Canada – Taxation of Capital Gains and Capital Losses”;

“Tax Act” means the Income Tax Act (Canada) and the regulations made thereunder, as now in effect and as they may be promulgated or amended from time to time;

“Tax Proposals” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations”;

“TD Securities” means TD Securities Inc., the financial advisor to Aastra;

“TFSA” has the meaning ascribed thereto under “Certain Canadian Federal Income Tax Considerations – Holders Resident in Canada – Eligibility for Investment – Mitel Shares”;

“Tenth Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Term Facility” has the meaning ascribed thereto in “The Arrangement – Completion of the Arrangement – Financing the Transaction”;

“Third Mitel Proposal” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

13

“Third Special Committee Meeting” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“Tobia Change of Control Payment” has the meaning ascribed thereto under “The Arrangement – Interests of Certain Persons in the Arrangement – Termination and Change of Control Benefits”;

“Tobia Consulting Agreement” means the consulting services agreement between Mitel and John Tobia effective as of the Effective Date;

“Tobia Employment Agreement” means the employment agreement between Aastra and John Tobia, dated July 11, 2000, as amended;

“Transaction Parameters” has the meaning ascribed thereto in “The Arrangement – Background to the Arrangement”;

“TSX” means Toronto Stock Exchange;

“United States” or “U.S.” means the United States of America, its territories and possessions, any State of the United States and the District of Columbia;

“Unreasonable Condition” has the meaning ascribed thereto under “Arrangement Agreement – Covenants – Matters relating to the Investment Canada Act Approval and the French Authorization”;

“U.S. GAAP” means United States generally accepted accounting principles;

“U.S. Securities Act” has the meaning ascribed thereto under “Notice to Shareholders in the United States”;

“U.S. Securities Laws” means the U.S. Securities Act, the Exchange Act and all other applicable U.S. federal and state securities laws, rules and regulations and published policies thereunder; and

“Voting Support Agreements” means the voting support agreements entered into on November 10, 2013 between Mitel and each of the Locked-Up Shareholders setting forth, among other things, the agreement of such Locked-Up Shareholders to vote their Aastra Shares in favour of the Arrangement Resolution.

14

SUMMARY

This summary is qualified in its entirety by the more detailed information appearing elsewhere in, or incorporated by reference into, this Circular, including the Appendices which are incorporated into and form part of this Circular. Terms with initial capital letters in this summary are defined in the Glossary of Terms immediately preceding this summary. This summary is qualified in its entirety by the more detailed information appearing elsewhere, or incorporated by reference in this Circular.

The Meeting

The Meeting will be held at the offices of McCarthy Tétrault LLP, 66 Wellington Street West, Suite 5300, Toronto, Ontario, M5K 1E6, at 1:00 p.m. (Toronto time) on January 9, 2014.

Record Date

Only Shareholders whose names have been entered in the register of shareholders as of the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting, or any adjournment(s) or postponement(s) thereof.

Purpose of the Meeting

The Meeting is a special meeting of Shareholders. At the Meeting, Shareholders will be asked to consider and, if deemed advisable, to pass, with or without amendment, the Arrangement Resolution approving the Arrangement involving Aastra and Mitel. The full text of the Arrangement Resolution is attached as Appendix “B” to this Circular. In order to implement the Arrangement, the Arrangement Resolution must be approved, with or without amendment, by (a) not less than two-thirds of the votes cast in respect of the Arrangement Resolution by Shareholders, present in person or represented by proxy at the Meeting; and (b) at least a simple majority of the votes cast in respect of the Arrangement Resolution by Shareholders, present in person or represented by proxy at the Meeting excluding votes attaching to Aastra Shares held by an “interested party” to the Arrangement within the meaning of MI 61-101, any related party to such interested party within the meaning of MI 61-101 (subject to the exceptions set out therein) and any person that is a joint actor with a person referred to in the foregoing for the purposes of MI 61-101. See “The Arrangement — Completion of the Arrangement—Shareholder Approval of Arrangement Resolution” and “Regulatory Matters – Canadian Securities Law Matters”.

Effects of the Arrangement

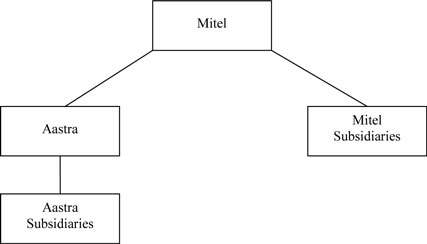

If the Arrangement Resolution is passed and all other conditions to closing of the Arrangement are satisfied, Mitel will acquire all of the issued and outstanding Aastra Shares. Each Shareholder who does not exercise Dissent Rights will receive, in exchange for each Aastra Share held, U.S.$6.52 in cash and 3.6 Mitel Shares. If the Arrangement is completed, Aastra will become a wholly-owned Subsidiary of Mitel. See “Information Relating to the Combined Company”.

Description of the Arrangement

The following description of the Arrangement is qualified in its entirety by reference to the full text of the Plan of Arrangement, which is attached as Appendix “D” to this Circular.

Under the Plan of Arrangement, commencing at the Effective Time, the following events or transactions will occur and will be deemed to occur in the following sequence without any further act or formality:

| (a) | the Aastra Shareholder Rights Plan will be terminated (and all rights issued thereunder will expire) and will be of no further force or effect; |

| (b) | each outstanding Aastra Share held by a Dissenting Shareholder shall be deemed to be transferred by the holder thereof to Mitel free and clear of all liens, claims and encumbrances of any nature whatsoever, and |

15

| each Dissenting Shareholder shall cease to have any rights as a Shareholder other than the right to be paid the fair value of their Aastra Shares by Mitel in accordance with the provisions of the Plan of Arrangement, and the name of such holder shall be removed from the register of holders of Aastra Shares, and Mitel shall be recorded as the registered holder of the Aastra Share so transferred and shall be deemed to be the legal and beneficial owner thereof, free and clear of any liens, claims or encumbrances of any nature whatsoever; |

| (c) | each outstanding Aastra DSU will be cancelled by Aastra, without any act or formality on the part of the holder thereof, (free and clear of any liens, charges and encumbrances of any nature whatsoever) in exchange for a cash payment by Aastra, less applicable withholdings, as determined in accordance with the Aastra DSU Plan; |

| (d) | each outstanding Aastra SAR that is vested or will vest in accordance with its terms at or before the Effective Time shall be disposed of and surrendered by the holder thereof (free and clear of any liens, charges and encumbrances of any nature whatsoever) to Aastra in exchange for a cash payment by Aastra, less applicable withholdings, as determined in accordance with the Aastra SAR Plan; |

| (e) | simultaneously with the exchange referred to in paragraph (f) below, each Aastra Option outstanding at the Effective Time (whether vested or unvested) shall be exchanged for a Replacement Option to acquire such number of Mitel Shares (rounded down to the nearest whole number) as is equal to the product of: (A) that number of Aastra Shares that were issuable upon exercise of such Aastra Option immediately prior to the Effective Time, multiplied by (B) the Exchange Ratio, rounded down to the nearest whole number of Mitel Shares, at an exercise price per Mitel Share equal to the greater of (1) the quotient determined by dividing: (X) the exercise price per Aastra Share at which such Aastra Option was exercisable immediately prior to the Effective Time, by (Y) the Exchange Ratio, rounded up to the nearest whole cent, and (2) such minimum amount that meets the requirements of paragraph 7(1.4)(c) of the Tax Act. All terms and conditions of a Replacement Option, including the term to expiry, vesting, conditions to and manner of exercising, shall be the same as the Aastra Option for which it was exchanged, and any certificate or option agreement previously evidencing the Aastra Option shall thereafter evidence and be deemed to evidence such Replacement Option; |

| (f) | each outstanding Aastra Share (other than those held by Dissenting Shareholders), shall be transferred by the holder thereof to Mitel free and clear of all liens, claims and encumbrances of any nature whatsoever in exchange for the Consideration and the name of such holder shall be removed from the register of holders of Aastra Shares and added to the register of holders of Mitel Shares, and Mitel shall be recorded as the registered holder of the Aastra Share so exchanged and shall be deemed to be the legal and beneficial owner thereof, free and clear of any liens, claims or encumbrances of any nature whatsoever; and |

| (g) | the Aastra Share Plans shall be terminated (and all rights issued thereunder shall expire) and shall be of no further force or effect. |

See “The Arrangement – Principal Steps of the Arrangement”.

If you hold your Aastra Shares through a broker or other Intermediary please contact that broker or other Intermediary for instructions and assistance in receiving the cash payable and the Mitel Shares to be distributed under the Arrangement.

In order to receive the cash payable and the Mitel Shares to be distributed under the Arrangement, a Registered Shareholder must complete, sign, date and return the enclosed Letter of Transmittal and all documents required thereby in accordance with the instructions set out therein.

Recommendation of the Special Committee

Having undertaken a review of, and carefully considered, the Arrangement, including consulting with financial and legal advisors, the Special Committee unanimously concluded that the Arrangement is fair to the Shareholders and in the best interests of Aastra (considering the interests of all affected stakeholders). The Special Committee unanimously

16

recommended that the Aastra Board approve the Arrangement and recommends that Shareholders vote in favour of the Arrangement.

See “The Arrangement – Recommendation of the Special Committee”.

Recommendation of the Aastra Board

After careful consideration by the Aastra Board following the unanimous recommendations of the Special Committee, the Aastra Board has unanimously determined that the Arrangement is fair to Shareholders and in the best interests of Aastra and authorized the submission of the Arrangement to Shareholders for their approval at the Meeting. Accordingly, the Aastra Board unanimously recommends that Shareholders vote FOR the Arrangement Resolution. All of the directors of Aastra intend to vote their Aastra Shares FOR the Arrangement Resolution and against any resolution submitted by any Shareholder that is inconsistent with the Arrangement.

See “The Arrangement – Recommendation of the Aastra Board”.

Reasons for the Arrangement