Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GMX RESOURCES INC | form8-kdisclosurestatement.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

WESTERN DISTRICT OF OKLAHOMA

In re: GMX RESOURCES INC., et al. Debtors. | ) ) ) ) ) ) ) | Chapter 11 Case No. 13-11456 (SAH) Jointly Administered |

FIRST AMENDED DISCLOSURE STATEMENT TO ACCOMPANY FIRST AMENDED JOINT PLAN OF REORGANIZATION OF GMX RESOURCES INC. AND ITS DEBTOR SUBSIDIARIES UNDER CHAPTER 11 OF THE BANKRUPTCY CODE

ANDREWS KURTH LLP | CROWE & DUNLEVY, P.C. s/William H. Hoch |

David A. Zdunkewicz Timothy A. Davidson II 600 Travis, Suite 4200 Houston, Texas 77002 Telephone: (713) 220-4200 Facsimile: (713) 220-4285 | William H. Hoch 20 North Broadway, Suite 1800 Oklahoma City, Oklahoma 73102 Telephone: (405) 235-7700 Facsimile: (405) 239-6651 |

ATTORNEYS FOR THE DEBTORS | |

Dated: Oklahoma City, Oklahoma

December 5, 2013

i

DISCLAIMER

ALL HOLDERS OF ELIGIBLE CLAIMS ARE ADVISED AND ENCOURAGED TO READ THIS DISCLOSURE STATEMENT (THE “DISCLOSURE STATEMENT”) AND THE FIRST AMENDED JOINT PLAN OF REORGANIZATION (THE “PLAN”) IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. ALL SUMMARIES OF THE PLAN AND OTHER STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE PLAN, THE EXHIBITS ANNEXED TO THE PLAN, AND THE EXHIBITS ANNEXED TO THIS DISCLOSURE STATEMENT. THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE ONLY AS OF THE DATE HEREOF UNLESS OTHERWISE INDICATED, AND THERE CAN BE NO ASSURANCE THAT THE STATEMENTS CONTAINED HEREIN WILL BE CORRECT AT ANY TIME AFTER THE DATE HEREOF.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND RULE 3016 OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE AND NOT NECESSARILY IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER APPLICABLE LAW. THIS DISCLOSURE STATEMENT AND THE JOINT PLAN OF REORGANIZATION DESCRIBED HEREIN HAVE NOT BEEN REVIEWED BY, AND THE NEW SECURITIES TO BE ISSUED ON OR AFTER THE EFFECTIVE DATE WILL NOT HAVE BEEN THE SUBJECT OF A REGISTRATION STATEMENT FILED WITH, THE SECURITIES AND EXCHANGE COMMISSION OR ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE UNDER THE SECURITIES ACT OR UNDER ANY STATE SECURITIES OR “BLUE SKY” LAWS. THE PLAN HAS NOT BEEN REVIEWED, APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. PERSONS OR ENTITIES TRADING IN OR OTHERWISE PURCHASING, SELLING OR TRANSFERRING SECURITIES OR CLAIMS OF THE DEBTORS IN THESE CASES SHOULD EVALUATE THIS DISCLOSURE STATEMENT AND THE PLAN IN LIGHT OF THE PURPOSE FOR WHICH THEY WERE PREPARED.

AS TO CONTESTED MATTERS, ADVERSARY PROCEEDINGS, AND OTHER PENDING OR THREATENED LITIGATION OR ACTIONS, THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE AND MAY NOT BE CONSTRUED AS AN ADMISSION OF ANY FACT OR LIABILITY, STIPULATION, OR WAIVER, BUT RATHER AS A STATEMENT MADE IN SETTLEMENT NEGOTIATIONS AND SHALL BE INADMISSIBLE FOR ANY PURPOSE ABSENT THE EXPRESS WRITTEN CONSENT OF THE DEBTORS AND THE PARTY AGAINST WHOM SUCH INFORMATION IS SOUGHT TO BE ADMITTED.

THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS INCLUDED HEREIN FOR PURPOSES OF SOLICITING ACCEPTANCES OF THE PLAN AND MAY NOT BE RELIED UPON FOR ANY PURPOSE OTHER THAN TO DETERMINE HOW TO VOTE ON THE PLAN. THE DESCRIPTIONS SET FORTH HEREIN OF THE ACTIONS, CONCLUSIONS, OR RECOMMENDATIONS OF THE DEBTORS OR ANY OTHER PARTY IN INTEREST HAVE BEEN PASSED UPON BY SUCH PARTY, BUT NO SUCH PARTY MAKES ANY REPRESENTATION OR WARRANTY REGARDING SUCH DESCRIPTIONS.

THIS DISCLOSURE STATEMENT WILL NOT BE ADMISSIBLE IN ANY NON-BANKRUPTCY PROCEEDING INVOLVING THE DEBTORS OR ANY OTHER PARTY, NOR WILL IT BE CONSTRUED TO CONSTITUTE CONCLUSIVE ADVICE ON THE TAX, SECURITIES, OR OTHER LEGAL EFFECTS

ii

OF THE REORGANIZATION AS TO HOLDERS OF CLAIMS AGAINST, OR INTERESTS IN, THE DEBTORS.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Disclosure Statement includes projected financial information regarding the Reorganized Debtors and certain other “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, all of which are based upon various estimates and assumptions that the Debtors believe to be reasonable as of the date hereof. These statements involve risks and uncertainties that could cause the Debtors’ and Reorganized Debtors’ actual future outcomes to differ materially from those set forth in this Disclosure Statement. Such risks and uncertainties include, but are not limited to:

• | the Debtors’ ability to effect their proposed restructuring, or any other restructuring on terms acceptable to the Debtors; |

• | the Debtors’ ability to preserve and utilize net operating loss carry forward and other tax attributes; |

• | the Debtors’ ability to continue as a going concern; |

• | the Debtors’ ability to meet debt service obligations and related financial and other covenants, and any possible resulting material default under the Debtors’ debt obligations that is not waived or rectified; |

• | limitations on the availability of sufficient credit to fund working capital; |

• | the availability of appropriate surety bonds which may be required for certain projects; |

• | inability to reach agreements with the Debtors’ surety companies to provide sufficient bonding capacity; |

• | general economic and capital markets conditions, including fluctuations in interest rates; |

• | difficulty in managing the operation of existing entities; |

• | loss of key personnel; |

• | litigation risks and uncertainties; |

• | distraction of management and costs associated with the Debtors’ restructuring efforts, including their chapter 11 filings; |

• | recent adverse publicity about the Debtors, including their chapter 11 filings; |

• | uncertainties inherent in making estimates of our oil and natural gas data; |

• | oil and natural gas prices, price volatility and competition; |

• | discovery and development of oil and natural gas reserves; |

• | cost of compliance with laws and regulations |

• | geological, technical, drilling and processing problems; |

• | weather-related interference with business operations; |

• | unanticipated results with the drilling or completion of wells; |

• | the effects of delays in completion of, or shut-ins of, gas gathering systems, pipelines and processing facilities; |

• | the impact of derivative positions; |

• | production expense estimates; |

• | cash flow estimates; |

• | future financial performance; |

• | planned capital expenditures; |

• | the cost and availability of adequate insurance coverage; and |

• | other risks and matters discussed in GMXR’s filings with the Securities and Exchange Commission. |

iii

You should understand that the foregoing as well as other risk factors discussed in this Disclosure Statement, including those listed in Section IX under the heading “Certain Factors to be Considered,” could cause future outcomes to differ materially from those expressed in such forward looking statements. Given the uncertainties, you are cautioned not to place undue reliance on any forward-looking statements in determining whether to vote in favor of the Plan or to take any other action. The Debtors undertake no obligation to publicly update or revise information concerning the Debtors’ restructuring efforts, borrowing availability, or their cash position or any forward-looking statements to reflect events or circumstances that may arise after the date of this Disclosure Statement, except as required by law. Forward-looking statements are provided in this Disclosure Statement pursuant to the safe harbor established under the private Securities Litigation Reform Act of 1995 and, to the extent applicable, Section 1125(e) of the Bankruptcy Code and should be evaluated in the context of the estimates, assumptions, uncertainties, and risks described herein.

iv

TABLE OF CONTENTS

I. INTRODUCTION AND EXECUTIVE SUMMARY | 1 | |||

A. | EXECUTIVE SUMMARY | 1 | ||

B. | CONSIDERATIONS IN PREPARATION OF THE DISCLOSURE STATEMENT AND PLAN; DISCLAIMERS | 1 | ||

C. | GENERAL | 4 | ||

D. | SOLICITATION PACKAGE | 4 | ||

E. | VOTING PROCEDURES, BALLOTS, AND VOTING DEADLINE | 5 | ||

F. | PURPOSE OF AND SUMMARY OF THE PLAN | 6 | ||

G. | SUMMARY OF PROPOSED DISTRIBUTIONS UNDER THE PLAN | 10 | ||

H. | THE CONFIRMATION HEARING AND OBJECTION DEADLINE | 11 | ||

I. | SUMMARY OF POST-CONFIRMATION OPERATIONS | 12 | ||

J. | RECOMMENDATION OF BOARDS OF DIRECTORS AND OTHERS TO APPROVE PLAN | 13 | ||

II. GENERAL INFORMATION REGARDING THE DEBTORS | 13 | |||

A. | BACKGROUND | 13 | ||

1 | Existing Capital Structure of the Debtors | 15 | ||

2 | Events Leading to the Debtors’ Restructuring | 18 | ||

3 | Litigation Pending Against the Debtors at the Time of Filing | 18 | ||

B. | EVENTS DURING CHAPTER 11 CASES | 23 | ||

1 | Entry of “First Day” Orders | 23 | ||

2 | Debtor-in-Possession Financing | 25 | ||

3 | The Official Committee of Unsecured Creditors | 26 | ||

4 | Compliance With THE Bankruptcy Code, Bankruptcy Rules, Local Court Rules and U.S. Trustee Deadlines | 26 | ||

5 | Extension of the Debtors’ Exclusive Periods | 27 | ||

6 | Motion to Approve Plan Support Agreement | 30 | ||

7 | Extension of DIP Credit Facility and Potential Exit Facility | 31 | ||

8 | Retention of Opportune LLC as Retained Person | 31 | ||

9 | Lift Stay Motions Filed Against the Debtors | 31 | ||

10 | MOTION TO APPROVE SEVERANCE AND RETENTION PAYMENTS | 32 | ||

11 | Motion to ESTABLISH PROCEDURES FOR TRANSFER OF STOCK AND CLAIMS IN GMX RESOURCES Inc. | 33 | ||

12 | The Debtors Dispute with Emerald Oil, Inc. | 34 | ||

13 | THE DEBTORS DISPUTE WITH ONEOK Rockies Midstream, L.L.C. | 34 | ||

III. MANAGEMENT AND CORPORATE STRUCTURE OF THE REORGANIZED DEBTORS | 35 | |||

A. | THE BOARDS OF DIRECTORS AND EXECUTIVE OFFICERS OF THE REORGANIZED DEBTORS AND NEW GMXR | 35 | ||

B. | MANAGEMENT INCENTIVE PLAN | 36 | ||

IV. SUMMARY OF THE PLAN | 36 | |||

A. | INTRODUCTION | 36 | ||

B. | SCHEDULE OF TREATMENT OF CLAIMS AND EQUITY INTERESTS | 37 | ||

C. | TREATMENT OF UNCLASSIFIED CLAIMS | 37 | ||

1 | Administrative Claims | 37 | ||

2 | Priority Tax Claims | 40 | ||

D. | CLASSIFICATION AND TREATMENT OF CLAIMS AND EQUITY INTERESTS | 40 | ||

1 | Class 1 - Senior Secured Noteholder Secured Claims | 40 | ||

v

Class 1 consists of Senior Secured Noteholder Secured Claims. The Senior Secured Noteholder Secured Claims shall be deemed Allowed in the amount of $338,000,000.00. | 40 | |||

2 | Class 2 - Other Secured Claims | 42 | ||

3 | Class 3 - Priority Non-Tax Claims | 42 | ||

4 | Class 4 - General Unsecured Claims | 42 | ||

Class 4 consists of General Unsecured Claims, including, but not limited to, the Senior Secured Notes Deficiency Claim, the Convertible Notes Claims, the Old Senior Notes Claims, the Old Senior Notes Guaranty Claims, the Second-Priority Notes Claims and any other Claims secured by a Lien that is junior in priority to the Liens securing the Senior Secured Notes Claims. | 42 | |||

5 | Class 5 – Intercompany Claim | 43 | ||

6 | Class 6 - Equity Interests in GMXR | 43 | ||

7 | Class 7 - Equity Interests in Debtor Subsidiaries | 44 | ||

E. | ALLOWED CLAIMS AND EQUITY INTERESTS | 44 | ||

F. | POST-PETITION INTEREST | 44 | ||

G. | ALLOCATION | 44 | ||

H. | SPECIAL PROVISION GOVERNING UNIMPAIRED CLAIMS | 45 | ||

I. | CONTROVERSY CONCERNING IMPAIRMENT | 45 | ||

J. | MEANS FOR IMPLEMENTATION OF THE PLAN | 45 | ||

1 | Substantive Consolidation | 45 | ||

2 | The Creditor Trust | 45 | ||

3 | General Settlement of Claims and Equity Interests | 51 | ||

4 | Sources of Consideration for Plan Distributions | 51 | ||

5 | Section 1145 Exemption | 51 | ||

6 | Listing of the Reorganized GMXR Common Stock and Transfer Restrictions | 52 | ||

7 | Continued Corporate Existence | 52 | ||

8 | New Organizational Documents | 52 | ||

9 | Restructuring Transactions | 53 | ||

10 | Cancellation of EXISTING Securities and Agreements | 55 | ||

11 | Corporate Actions | 55 | ||

12 | Directors and Executive Officers | 56 | ||

13 | Compensation and Benefit Plans and Treatment of Retirement Plan | 56 | ||

14 | Director and Officer Liability Insurance | 57 | ||

15 | Vesting of Assets in Reorganized Debtors | 57 | ||

16 | Nondisturbance of VPP Interest | 57 | ||

17 | Preservation of Rights of Action; Settlement of Litigation Claims | 58 | ||

18 | Effectuating Documents; Further Transactions | 60 | ||

19 | Exemption from Certain Transfer Taxes | 60 | ||

K. | PROVISIONS GOVERNING DISTRIBUTIONS | 61 | ||

1 | Distributions for Claims Allowed as of the Effective Date | 61 | ||

2 | Disbursing Agent | 61 | ||

3 | Surrender of EXISTING Securities | 61 | ||

4 | [RESERVED] | 62 | ||

5 | Record Date for Plan Distributions | 62 | ||

6 | Means of Cash Payment | 62 | ||

7 | Calculation of Distribution Amounts of New Equity Securities | 62 | ||

8 | Delivery of Distributions; Undeliverable or Unclaimed Distributions | 62 | ||

9 | Withholding and Reporting Requirements | 63 | ||

10 | Setoffs | 63 | ||

vi

L. | PROCEDURES FOR RESOLVING DISPUTED, CONTINGENT, AND UNLIQUIDATED CLAIMS | 63 | ||

1 | Prosecution of Objections to Claims | 63 | ||

2 | Allowance of Claims | 64 | ||

3 | Distributions After Allowance | 64 | ||

4 | Estimation of Claims | 64 | ||

5 | Deadline to File Objections to Claims | 65 | ||

6 | Deadline to File Other Secured Claims; Objections | 65 | ||

M. | TREATMENT OF EXECUTORY CONTRACTS AND UNEXPIRED LEASES | 66 | ||

1 | Assumed Contracts and Leases | 66 | ||

2 | Payments Related to Assumption of Contracts and Leases | 67 | ||

3 | Rejected Contracts and Leases | 67 | ||

4 | Claims Based upon Rejection of Executory Contracts or Unexpired Leases | 67 | ||

5 | Indemnification of Directors, Officers and Employees | 67 | ||

N. | ACCEPTANCE OR REJECTION OF THE PLAN | 68 | ||

1 | Classes Entitled to Vote | 68 | ||

2 | Acceptance by Impaired Classes | 68 | ||

3 | Elimination of Classes | 68 | ||

4 | Nonconsensual Confirmation | 68 | ||

O. | CONDITIONS PRECEDENT TO CONFIRMATION AND EFFECTIVENESS | 69 | ||

1 | Conditions to Confirmation | 69 | ||

2 | Conditions to Effective Date | 69 | ||

3 | Effect of Failure of Conditions | 70 | ||

4 | Waiver of Conditions | 70 | ||

P. | MODIFICATIONS AND AMENDMENTS; WITHDRAWAL | 70 | ||

Q. | RETENTION OF JURISDICTION | 71 | ||

R. | SETTLEMENT, RELEASE, INJUNCTION AND RELATED PROVISIONS | 73 | ||

1 | Discharge of Claims and Termination of Equity Interests | 73 | ||

2 | Exculpation and Limitation of Liability | 73 | ||

3 | Injunction | 74 | ||

4 | Releases by the Debtors | 74 | ||

5 | Releases by Holders of Claims | 75 | ||

6 | Injunction Related to Releases and Exculpations | 76 | ||

7 | Release of Liens | 76 | ||

S. | MISCELLANEOUS PROVISIONS | 76 | ||

1 | Severability of Plan Provisions | 76 | ||

2 | Successors and Assigns | 77 | ||

3 | Binding Effect | 77 | ||

4 | Revocation, Withdrawal, or Non-Consummation | 77 | ||

5 | Committees and Retained Person | 77 | ||

6 | Plan Supplement | 78 | ||

7 | Notices to Debtors | 78 | ||

8 | Governing Law | 79 | ||

9 | Section 1125(e) of the Bankruptcy Code | 79 | ||

10 | Conflict | 80 | ||

11 | Entire Agreement | 80 | ||

V. CAPITAL STRUCTURE OF THE REORGANIZED DEBTORS | 80 | |||

vii

A. | EXIT FACILITY | 80 | ||

B. | ISSUANCE OF NEW SECURITIES AND TRUST INTERESTS | 81 | ||

1 | Issuance of Reorganized GMXR Common Stock and New GMXR Interests | 81 | ||

2 | New Shareholders Agreement | 81 | ||

3 | New GMXR Agreement | 82 | ||

4 | Issuance of Trust Interests | 82 | ||

C. | SECURITIES LAW MATTERS | 82 | ||

VI. CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 83 | |||

A. | GENERAL | 83 | ||

B. | CONSEQUENCES TO THE DEBTORS | 85 | ||

1 | Cancellation of Indebtedness Income | 85 | ||

2 | Net Operating Losses and Other Attributes | 86 | ||

3 | Annual Section 382 Limitation on Use of NOLS | 86 | ||

4 | Federal Alternative Minimum Tax | 88 | ||

5 | POSSIBLE Conversion of Reorganized Subsidiaries to Limited Liability Companies | 89 | ||

C. | CONSEQUENCES TO HOLDERS OF DIP FACILITY CLAIMS | 89 | ||

D. | CONSEQUENCES TO HOLDERS OF SENIOR SECURED NOTES | 89 | ||

1 | Definition of Securities | 90 | ||

2 | Holders of Senior Secured Note Claims if the Senior Secured Notes are Securities | 90 | ||

3 | Holders of Senior Secured Note Claims if the Senior Secured Notes are not Securities | 91 | ||

4 | Market Discount | 92 | ||

5 | Bad Debt and/or Worthless Securities Deduction | 93 | ||

E. | ALLOCATION | 93 | ||

1 | Senior Secured NOtes Exchanged | 93 | ||

2 | Accrued But Unpaid Interest | 93 | ||

F. | CONSEQUENCES TO HOLDERS OF ALLOWED GENERAL UNSECURED CLAIMS | 94 | ||

1 | Gain or Loss — Generally | 94 | ||

2 | Tax Treatment of the Creditor Trust and Holders of Beneficial Interests | 95 | ||

3 | Assets Held in Trust for Disputed General Unsecured Claims | 98 | ||

G. | CONSEQUENCES OF NEW GMXR INTERESTS OWNERSHIP | 99 | ||

1 | Partnership Status | 99 | ||

2 | Tax Consequences TO HOLDER’S OF INVESTMENTS IN NEW GMXR INTERESTS | 100 | ||

H. | TAX EXEMPT ORGANIZATIONS AND OTHER INVESTORS | 104 | ||

I. | INFORMATION REPORTING AND BACKUP WITHHOLDING | 105 | ||

J. | IMPORTANCE OF OBTAINING PROFESSIONAL TAX ASSISTANCE | 105 | ||

VII. FEASIBILITY OF THE PLAN AND THE BEST INTERESTS OF CREDITORS TEST | 106 | |||

A. | FEASIBILITY OF THE PLAN | 106 | ||

B. | BEST INTERESTS TEST | 106 | ||

C. | LIQUIDATION ANALYSIS | 107 | ||

D. | VALUATION OF THE REORGANIZED DEBTORS | 109 | ||

VIII. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | 109 | |||

A. | ALTERNATIVE PLAN(S) | 109 | ||

B. | LIQUIDATION UNDER CHAPTER 7 | 109 | ||

IX. CERTAIN FACTORS TO BE CONSIDERED | 111 | |||

A. | GENERAL | 111 | ||

B. | CERTAIN RISKS RELATED TO THE DEBTORS’ BUSINESS, INDUSTRY AND NEW EQUITY SECURITIES | 111 | ||

viii

1 | The Debtors’ current financial condition has adversely affected their business operations and their business prospects. | 111 | ||

2 | The Debtors’ asset carrying values have been impaired based, in part, on natural gas prices as of December 31, 2012 and they may be further impaired if gas prices continue to decline. | 112 | ||

3 | Even if the Debtors successfully emerge from bankruptcy and enter into the Exit Facility, the Debtors will continue to have substantial capital needs which they may not be able to meet in the future. | 112 | ||

4 | Properties of the Debtors may not produce as projected, and the Debtors may not have fully identified liabilities associated with these properties or obtained adequate protection from sellers against liabilities. | 112 | ||

5 | Loss of key management and failure to attract qualified management could negatively impact the Debtors’ operations. | 113 | ||

6 | Exploring for and producing oil and natural gas are high-risk activities with many uncertainties that could adversely affect the Debtors’ business, financial condition or results of operations. | 113 | ||

7 | A substantial or extended decline in oil and natural gas prices may have a material adverse effect on the Debtors’ business, financial condition, results of operations, cash flows and their ability to meet their obligations, operating cost requirements, capital expenditure requirements and other financial commitments. | 114 | ||

8 | The Debtors may incur substantial losses and be subject to substantial liability claims as a result of their oil and natural gas operations. Their insurance coverage may not be sufficient or may not be available to cover some of these losses and claims. | 116 | ||

9 | Reserve estimates depend on many assumptions that may prove to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and estimated values of the Debtors’ reserves. | 116 | ||

10 | If the Debtors are unable to replace the reserves that they have produced, their reserves and revenues will decline. | 117 | ||

11 | The Debtors’ business requires substantial capital investment and maintenance expenditures, and their capital resources may not be adequate to provide for all of their cash requirements. | 118 | ||

12 | Impediments to transporting the Debtors’ products may limit their access to oil and natural gas markets or delay their production. | 118 | ||

13 | The Debtors’ undeveloped acreage must be drilled before lease expiration in order to hold the acreage by production. | 118 | ||

14 | The Debtors are exposed to counterparty risk if they engage in hedging activities using commodity derivative instruments or through insurance and other arrangements they enter into with financial and other institutions. | 119 | ||

15 | The Debtors are subject to extensive governmental laws and regulations, including environmental regulations, which can adversely affect the cost, manner or feasibility of doing business and could result in restrictions on their operations or civil or criminal liability. | 119 | ||

16 | Potential legislative and regulatory actions could increase the Debtors’ costs, reduce their revenue and cash flow from oil and natural gas sales, reduce their liquidity or otherwise alter the way they conduct their business. | 120 | ||

17 | Competition in the oil and natural gas industry is intense, which may adversely affect the Debtors. | 120 | ||

18 | Adverse publicity about the Debtors, including their chapter 11 filings, may harm the Debtors’ ability to compete in a highly competitive environment. | 120 | ||

19 | The Reorganized Debtors will not have access to capital markets | 121 | ||

20 | The Exit Facility may contain certain restrictions and limitations that could significantly affect the Reorganized Debtors’ ability to operate their businesses, as well as significantly affect their liquidity. | 121 | ||

21 | The value of the New Equity Securities may be adversely affected by a number of factors. | 121 | ||

22 | There is no established trading market for the Reorganized GMXR Common Stock or New GMXR Interests , and if one develops, it may not be liquid. | 122 | ||

23 | Reorganized GMXR does not anticipate paying dividends on the Reorganized GMXR Common Stock in the foreseeable future. | 122 | ||

C. | CERTAIN BANKRUPTCY LAW CONSIDERATIONS | 123 | ||

1 | Parties-in-Interest May Object To the Plan and Confirmation | 123 | ||

2 | Parties-in-Interest May Object To the Debtors’ Classification of Claims and Equity Interests | 123 | ||

ix

3 | Undue Delay In Confirmation May Disrupt the Business of the Debtors and Have Potential Adverse Effects | 123 | ||

4 | The Debtors May Not Be Able To Obtain Confirmation of the Plan | 124 | ||

5 | Failure to Consummate the Plan | 125 | ||

6 | Risk of Non-Occurrence of the Effective Date | 125 | ||

7 | Risk of Post-Confirmation Default | 125 | ||

8 | Claims Estimation | 125 | ||

D. | CERTAIN TAX CONSIDERATIONS | 125 | ||

E. | INHERENT UNCERTAINTY OF FINANCIAL PROJECTIONS | 126 | ||

X. THE SOLICITATION; VOTING PROCEDURES | 126 | |||

A. | VOTING DEADLINE | 126 | ||

B. | VOTING PROCEDURES | 126 | ||

C. | SPECIAL NOTE FOR HOLDERS OF VOTING NOTES | 127 | ||

1 | Beneficial Owners | 127 | ||

2 | Nominees | 127 | ||

3 | Miscellaneous | 128 | ||

D. | FIDUCIARIES AND OTHER REPRESENTATIVES | 129 | ||

E. | PARTIES ENTITLED TO VOTE | 129 | ||

F. | AGREEMENTS UPON FURNISHING BALLOTS | 130 | ||

G. | WAIVERS OF DEFECTS, IRREGULARITIES, ETC. | 130 | ||

H. | WITHDRAWAL OF BALLOTS; REVOCATION | 130 | ||

I. | DELIVERY OF EXISTING SECURITIES | 131 | ||

J. | FURTHER INFORMATION; ADDITIONAL COPIES | 131 | ||

x

[THIS PAGE INTENTIALLY LEFT BLANK]

TABLE OF ATTACHMENTS

EXHIBIT A First Amended Joint Plan of Reorganization

EXHIBIT B Financial Projections

EXHIBIT C Unaudited Selected Financial Information

EXHIBIT D Plan Support Agreement

EXHIBIT E Liquidation Analysis

EXHIBIT F Creditors’ Committee’s Letter of Support

I. INTRODUCTION AND EXECUTIVE SUMMARY

A. | EXECUTIVE SUMMARY |

GMX Resources, Inc. (“GMXR”) and the Debtor Subsidiaries (together with GMXR, the “Debtors”) filed voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code on April 1, 2013 in the United States Bankruptcy Court for the Western District of Oklahoma. Pursuant to Sections 1107(a) and 1108 of the Bankruptcy Code, the Debtors have and will continue to operate their businesses and to manage their properties as debtors-in-possession during the pendency of the Chapter 11 Cases.

On October 23, 2013, the Debtors filed the “Joint Plan of Reorganization of GMX Resources Inc. and Certain of its Debtor Subsidiaries under Chapter 11 of the Bankruptcy Code” and on December 2, 2013, the Debtors filed the first amendment thereto. The Plan was formulated after extensive negotiations with the Steering Committee, DIP Lenders, and Creditors’ Committee and reflects the global settlement among such parties.1 This Disclosure Statement describes the Debtors’ current and future business operations, certain aspects of the Plan, including, but not limited to, the proposed reorganization of the Debtors upon Consummation of the Plan, significant events occurring in their Chapter 11 Cases and related matters.

B. | CONSIDERATIONS IN PREPARATION OF THE DISCLOSURE STATEMENT AND PLAN; DISCLAIMERS |

BECAUSE ACCEPTANCE OF THE PLAN WILL CONSTITUTE ACCEPTANCE OF ALL THE PROVISIONS THEREOF, HOLDERS OF ELIGIBLE CLAIMS ARE URGED TO CONSIDER CAREFULLY THE INFORMATION REGARDING TREATMENT OF THEIR CLAIMS CONTAINED IN THIS DISCLOSURE STATEMENT.

THE CONFIRMATION AND EFFECTIVENESS OF THE PLAN ARE SUBJECT TO MATERIAL CONDITIONS PRECEDENT. SEE SECTION IV.O - “SUMMARY OF THE

_______________________

1 For the avoidance of doubt, any reference contained herein or in the Plan to the Plan being consensual or a “global settlement” or “global resolution” is meant to refer to a resolution by and among the Debtors, the Steering Committee, and the Creditors’ Committee of the issues in these cases. Holders of Equity Interests were not involved or consulted in formulating this Plan and are not entitled to vote on this Plan.

1

PLAN - CONDITIONS PRECEDENT; WAIVER.” THERE CAN BE NO ASSURANCE THAT THOSE CONDITIONS WILL BE SATISFIED.

THE DEBTORS PRESENTLY INTEND TO SEEK TO CONSUMMATE THE PLAN AND TO CAUSE THE EFFECTIVE DATE TO OCCUR PROMPTLY AFTER CONFIRMATION OF THE PLAN. THERE CAN BE NO ASSURANCE, HOWEVER, AS TO WHEN AND WHETHER CONFIRMATION OF THE PLAN AND THE EFFECTIVE DATE ACTUALLY WILL OCCUR. PROCEDURES FOR DISTRIBUTIONS UNDER THE PLAN, INCLUDING MATTERS THAT ARE EXPECTED TO AFFECT THE TIMING OF THE RECEIPT OF DISTRIBUTIONS BY HOLDERS OF ALLOWED CLAIMS IN CERTAIN CLASSES AND THAT COULD AFFECT THE AMOUNT OF DISTRIBUTIONS ULTIMATELY RECEIVED BY SUCH HOLDERS, ARE DESCRIBED IN SECTION IV.K - “SUMMARY OF THE PLAN - PROVISIONS GOVERNING DISTRIBUTIONS.”

THE BOARDS OF DIRECTORS, MANAGERS AND MEMBERS (AS THE CASE MAY BE) OF EACH OF THE DEBTORS HAVE APPROVED THE PLAN AND RECOMMEND THAT THE HOLDERS OF ELIGIBLE CLAIMS VOTE TO ACCEPT THE PLAN IN ACCORDANCE WITH THE VOTING INSTRUCTIONS SET FORTH IN SECTION X - “THE SOLICITATION; VOTING PROCEDURES” AND IN THE BALLOT. TO BE COUNTED, YOUR BALLOT MUST BE DULY COMPLETED, EXECUTED, AND ACTUALLY RECEIVED BY THE VOTING DEADLINE. HOLDERS OF ELIGIBLE CLAIMS ARE ENCOURAGED TO READ AND CONSIDER CAREFULLY THIS ENTIRE DISCLOSURE STATEMENT, INCLUDING THE PLAN.

THE STEERING COMMITTEE, DIP LENDERS, AND CREDITORS’ COMMITTEE SUPPORT THE PLAN. THE PLAN REPRESENTS THE NEGOTIATED GLOBAL RESOLUTION OF THESE CASES BY THE DEBTORS, STEERING COMMITTEE, DIP LENDERS, AND CREDITORS’ COMMITTEE, AND THE STEERING COMMITTEE AND CREDITORS’ COMMITTEE ENCOURAGE THEIR CONSTITUENCIES TO VOTE FOR THE PLAN.2

*****

THIS DISCLOSURE STATEMENT CONTAINS SUMMARIES OF CERTAIN PROVISIONS OF THE PLAN, STATUTORY PROVISIONS, DOCUMENTS RELATED TO THE PLAN, ANTICIPATED EVENTS IN THE DEBTORS’ CHAPTER 11 CASES, AND FINANCIAL INFORMATION. ALTHOUGH THE DEBTORS BELIEVE THAT THE SUMMARIES ARE FAIR AND ACCURATE, SUCH SUMMARIES ARE QUALIFIED TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF THE PLAN OR CERTAIN DOCUMENTS (AND HOLDERS OF ELIGIBLE CLAIMS SHOULD REFER TO THE PLAN AND SPECIFIED DOCUMENTS IN THEIR ENTIRETY AS ATTACHED HERETO OR IN THE PLAN SUPPLEMENT), STATUTORY PROVISIONS, EVENTS, OR _____________________

2 Again, for the avoidance of doubt, any reference contained herein or in the Plan to the Plan being consensual or a “global settlement” or “global resolution” is meant to refer to a resolution by and among the Debtors, the Steering Committee, and the Creditors’ Committee of the issues in these cases. Holders of Equity Interests were not involved or consulted in formulating this Plan and are not entitled to vote on this Plan.

2

INFORMATION. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS BEEN PROVIDED BY THE DEBTORS, EXCEPT WHERE OTHERWISE SPECIFICALLY NOTED. THE DEBTORS ARE UNABLE TO WARRANT OR REPRESENT THAT THE INFORMATION CONTAINED HEREIN, INCLUDING THE FINANCIAL PROJECTIONS AND OTHER FINANCIAL INFORMATION, IS WITHOUT ANY INACCURACY OR OMISSION.

IN DETERMINING WHETHER TO VOTE TO ACCEPT THE PLAN, HOLDERS OF ELIGIBLE CLAIMS MUST RELY UPON THEIR OWN EXAMINATION OF THE DEBTORS AND THE TERMS OF THE PLAN, INCLUDING THE MERITS AND RISKS INVOLVED. THE CONTENTS OF THIS DISCLOSURE STATEMENT SHOULD NOT BE CONSTRUED AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE. EACH SUCH HOLDER SHOULD CONSULT WITH ITS OWN LEGAL, BUSINESS, FINANCIAL, AND TAX ADVISORS WITH RESPECT TO ANY SUCH MATTERS CONCERNING THIS DISCLOSURE STATEMENT, THE SOLICITATION, THE PLAN AND THE TRANSACTIONS CONTEMPLATED THEREBY. SEE SECTION IX - “CERTAIN FACTORS TO BE CONSIDERED” FOR A DISCUSSION OF VARIOUS FACTORS THAT SHOULD BE CONSIDERED IN CONNECTION WITH THE PLAN.

*****

THE DEBTORS ARE RELYING ON SECTION 1145(a)(1) AND (2) OF THE BANKRUPTCY CODE TO EXEMPT FROM REGISTRATION UNDER THE SECURITIES LAWS THE OFFER AND ISSUANCE OF NEW SECURITIES IN CONNECTION WITH THE SOLICITATION AND THE PLAN. SEE SECTION V.A - “CAPITAL STRUCTURE OF THE REORGANIZED DEBTORS - ISSUANCE OF NEW SECURITIES AND TRUST INTERESTS” FOR A DESCRIPTION OF THE NEW SECURITIES.

EXCEPT AS SET FORTH IN SECTION X.J - “THE SOLICITATION; VOTING PROCEDURES - FURTHER INFORMATION; ADDITIONAL COPIES,” NO PERSON HAS BEEN AUTHORIZED BY THE DEBTORS IN CONNECTION WITH THE PLAN OR THE SOLICITATION TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN AS CONTAINED IN THIS DISCLOSURE STATEMENT AND THE EXHIBITS ATTACHED HERETO OR INCORPORATED BY REFERENCE OR REFERRED TO HEREIN, AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MAY NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE DEBTORS. THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OTHER THAN THOSE TO WHICH IT RELATES, OR AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION IN WHICH, OR TO ANY PERSON TO WHOM, IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF, AND NEITHER THE DELIVERY OF THIS DISCLOSURE STATEMENT NOR THE DISTRIBUTION OF ANY NEW SECURITIES PURSUANT TO THE PLAN WILL, UNDER ANY CIRCUMSTANCE, CREATE ANY IMPLICATION THAT THE

3

INFORMATION CONTAINED HEREIN IS CORRECT AT ANY TIME SUBSEQUENT TO THE DATE HEREOF. ANY ESTIMATES OF CLAIMS SET FORTH IN THIS DISCLOSURE STATEMENT MAY VARY FROM THE AMOUNTS OF CLAIMS DETERMINED BY THE DEBTORS OR ULTIMATELY ALLOWED BY THE BANKRUPTCY COURT, AND AN ESTIMATE SHALL NOT BE CONSTRUED AS AN ADMISSION OF THE AMOUNT OF SUCH CLAIM.

C. | GENERAL |

This Disclosure Statement has been prepared to comply with section 1125 of the Bankruptcy Code and is hereby transmitted by the Debtors to Holders of Eligible Claims for use in the Solicitation of acceptances of the Plan, a copy of which is attached hereto as Exhibit A. Unless otherwise defined in this Disclosure Statement, capitalized terms used herein have the meanings ascribed to them in the Plan.

For purposes of this Disclosure Statement, the following rules of interpretation shall apply: (i) whenever the words “include,” “includes” or “including” are used, they shall be deemed to be followed by the words “without limitation,” (ii) the words “hereof,” “herein,” “hereby” and “hereunder” and words of similar import shall refer to this Disclosure Statement as a whole and not to any particular provision, (iii) article, section and exhibit references are to this Disclosure Statement unless otherwise specified, and (iv) with respect to any Distribution under the Plan, “on” a date means on or as soon as reasonably practicable thereafter.

The purpose of this Disclosure Statement is to provide “adequate information” to Entities who hold Eligible Claims and to enable them to make an informed decision before exercising their right to vote to accept or reject the Plan.

THE APPROVAL BY THE BANKRUPTCY COURT OF THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE AN ENDORSEMENT BY THE BANKRUPTCY COURT OF THE PLAN OR A GUARANTEE OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED HEREIN. THE MATERIAL CONTAINED HEREIN IS INTENDED SOLELY FOR THE USE OF HOLDERS OF ELIGIBLE CLAIMS IN EVALUATING THE PLAN AND VOTING TO ACCEPT OR REJECT THE PLAN AND, ACCORDINGLY, MAY NOT BE RELIED UPON FOR ANY PURPOSE OTHER THAN THE DETERMINATION OF HOW TO VOTE ON THE PLAN. THE PLAN IS SUBJECT TO NUMEROUS CONDITIONS AND VARIABLES AND THERE CAN BE NO ABSOLUTE ASSURANCE THAT THE PLAN WILL BE EFFECTUATED.

D. | SOLICITATION PACKAGE |

Accompanying this Disclosure Statement for the purpose of soliciting votes on the Plan are copies of (i) the Plan, (ii) the notice of, among other things, the time for submitting Ballots to accept or reject the Plan, the date, time, and place of the hearing to consider the confirmation of the Plan and related matters, and the time for filing objections to the confirmation of the Plan, (iii) the Creditors’ Committee’s letter in support of the Plan, and (iv) a Ballot or Ballots (and return envelope(s)) that you may use in voting to accept or to reject the Plan, or a notice of non-voting status, as applicable.

4

If you did not receive a Ballot and believe that you should have, please contact the Solicitation Agent at the address or telephone number set forth in the next subsection.

E. | VOTING PROCEDURES, BALLOTS, AND VOTING DEADLINE |

After carefully reviewing the Plan and this Disclosure Statement, and the exhibits thereto, and the detailed instructions accompanying your Ballot, Holders of Eligible Claims in Classes 1 and 4 should indicate their acceptance or rejection of the Plan by voting in favor of or against the Plan on the enclosed Ballot. Each such Holder should complete and sign his, her or its Ballot and return it in the envelope provided so that it is RECEIVED by the Voting Deadline (as defined below). Please note that if you are in Class 1 or Class 4 and hold Existing Securities evidencing a Claim through a Nominee, you may be required to return your Ballot to your Nominee sufficiently in advance of the Voting Deadline so as to permit your Nominee to fill out and return a Master Ballot by the Voting Deadline. See Section X - “THE SOLICITATION; VOTING PROCEDURES.”

Each Ballot has been coded to reflect the Class of Claims it represents. Accordingly, in voting to accept or reject the Plan, you must use only the coded Ballot or Ballots sent to you with this Disclosure Statement.

If you have any questions about the procedure for voting your Eligible Claim or with respect to the packet of materials that you have received, please contact the Solicitation Agent (i) telephonically or (ii) in writing by (a) hand delivery, (b) overnight mail or (c) first class mail using the information below:

by hand delivery or overnight mail at:

GMX Resources Inc. Ballot Processing

c/o Epiq Bankruptcy Solutions, LLC

757 Third Avenue, 3rd Floor

New York, NY 10017

Telephone: (646) 282-2500

by first class mail at:

GMX Resources Inc. Ballot Processing

c/o Epiq Bankruptcy Solutions, LLC

FDR Station

P.O. Box 5014

New York, NY 10150 - 5014

Telephone: (646) 282-2500

THE SOLICITATION AGENT MUST RECEIVE ORIGINAL BALLOTS AND ORIGINAL MASTER BALLOTS CAST ON BEHALF OF BENEFICIAL OWNERS ON OR BEFORE 5:00 P.M., PREVAILING EASTERN TIME, ON JANUARY 13, 2014 (THE “VOTING DEADLINE”) AT THE APPLICABLE ADDRESS ABOVE. EXCEPT TO THE EXTENT ALLOWED BY THE BANKRUPTCY COURT, BALLOTS RECEIVED AFTER

5

THE VOTING DEADLINE WILL NOT BE ACCEPTED OR USED IN CONNECTION WITH THE DEBTORS’ REQUEST FOR CONFIRMATION OF THE PLAN OR ANY MODIFICATION THEREOF.

The Debtors reserve the right to amend the Plan. Amendments to the Plan that do not materially and adversely affect the treatment of Claims and are consistent with the terms of the Plan Support Agreement and Plan may be approved by the Bankruptcy Court at the Confirmation Hearing without the necessity of resoliciting votes. In the event resolicitation is required, the Debtors will furnish new solicitation packets that will include new ballots to be used to vote to accept or reject the Plan, as amended.

F. | PURPOSE OF AND SUMMARY OF THE PLAN |

The primary purpose of the Plan is to effectuate the restructuring of the Debtors’ capital structure (the “Restructuring”) by, among other things, reducing their overall indebtedness and improving free cash flow. Presently, the Debtors have a substantial amount of indebtedness outstanding under the Senior Secured Notes, Second-Priority Notes, Convertible Notes, Old Senior Notes, and other obligations to various third parties. If the Debtors are not able to consummate the Restructuring, the Debtors will likely have to formulate an alternative plan, and the Debtors’ financial condition will likely be further materially adversely affected.

The Restructuring will reduce the amount of the Debtors’ outstanding indebtedness by approximately $505,000,000 under their various indentures as follows: (i) satisfaction of $338,000,000.00 of the Senior Secured Notes through conversion of the Senior Secured Noteholders Secured Claim into all of the issued and outstanding shares of Reorganized GMXR Common Stock and approximately 61.40% of the New GMXR Interests; provided, that such Holders of Senior Secured Noteholder Secured Claims may hold a lower percentage of the New GMXR Interests to the extent that Holders of Allowed Senior Secured Noteholder Secured Claims demonstrate that such claims are Old and Cold Senior Secured Notes Claims; (ii) waiver of approximately $64,000,000.00 deficiency claim by the Holders of Senior Secured Notes if Class 4 votes to accept the Plan, or discharge of such deficiency claim with such claim being treated as a General Unsecured Claim if Class 4 votes to reject the Plan; (iii) discharge of the Second-Priority Notes in the approximate amount of $51,500,000, with such claims being treated as General Unsecured Claims under Class 4; (iv) discharge of the Convertible Notes in the approximate amount of $48,296,000, with such claims being treated as General Unsecured Claims under Class 4; and (v) discharge of the Old Senior Notes in the approximate amount of $1,970,000, with such claims being treated as General Unsecured Claims under Class 4.

Without the conversion of the Senior Secured Notes as contemplated in the Plan and the discharge of the Second-Priority Notes, Convertible Notes, and Old Senior Notes, the Debtors would not have sufficient liquidity to maintain their business as a going concern. Among other things, pursuant to the Restructuring:

• | The Senior Secured Noteholder Secured Claim shall be deemed an Allowed Secured Claim in the amount of $338,000,000.00. On the Effective Date, the Holders of Senior Secured Noteholder Secured Claims shall receive, in full and final satisfaction, |

6

settlement, release and discharge of and in exchange for such Allowed Secured Claims (i) one hundred percent (100%) of the Reorganized GMXR Common Stock and/or (ii) approximately 61.40% of the New GMXR Interests subject to dilution on account of the Management Interests to be issued pursuant to the Management Incentive Plan, each in accordance with a formula more fully described herein and in the Plan; provided, that such Holders of Senior Secured Noteholder Secured Claims may hold a lower percentage of the New GMXR Interests to the extent that Holders of Allowed Senior Secured Noteholder Secured Claims demonstrate that such claims are Old and Cold Senior Secured Notes Claims. If Class 4 (Holders of General Unsecured Claims) votes to accept the Plan, the Holders of Senior Secured Notes agree to waive their right to any recovery on the Senior Secured Notes Deficiency Claim.

• | The sole equity interests in Reorganized GMXR would consist of Reorganized GMXR Common Stock issued to the Holders of Senior Secured Notes. |

• | New GMXR shall be formed on or before the Effective Date. On the Effective Date, GMXR shall contribute all of its Assets (except the Creditor Trust Assets and Equity Interests in Endeavor) to New GMXR free and clear of all Liens, Claims, charges, or other encumbrances (except for any Liens granted to secure the Exit Facility) in exchange for 100% of the New GMXR Interests. New GMXR shall be the sole member of Diamond Blue as reorganized pursuant to the Plan and shall own Reorganized GMXR’s equity interest in Endeavor Gathering, LLC. Reorganized GMXR will own the New Endeavor Interests on the Effective Date. Thereafter, also on the Effective Date, Reorganized GMXR shall transfer an amount of New GMXR Interests to certain Holders of Allowed Senior Secured Noteholder Secured Claims in accordance with the Plan. Reorganized GMXR shall retain approximately 38.60% of the New GMXR Interests either directly or indirectly; provided that Reorganized GMXR may hold a higher percentage of the New GMXR Interests to the extent that Holders of Allowed Senior Secured Noteholder Secured Claims demonstrate that such claims are Old and Cold Senior Secured Notes Claims. The New GMXR Agreement will provide the identity of New GMXR’s managing member or general partner, as applicable. If New GMXR is a limited partnership, it is presently anticipated that its general partner will be a newly formed, wholly-owned subsidiary of GMXR (before the Effective Date) or Reorganized GMXR (on or after the Effective Date) as further identified in the New GMXR Agreement. The remaining approximately 61.40% of the New GMXR Interests shall be distributed to and owned by certain Holders of the Senior Secured Noteholder Secured Claims as set forth in the Plan; provided, that such Holders of Senior Secured Noteholder Secured Claims may hold a lower percentage of the New GMXR Interests to the extent that Holders of Allowed Senior Secured Noteholder Secured Claims demonstrate that such claims are Old and Cold Senior Secured Notes Claims. |

• | General unsecured creditors of the Debtors are classified as Class 4 creditors and shall be limited solely to recovery pursuant to Class 4. Holders of Allowed General Unsecured Claims shall receive their Pro Rata share of Common Trust Interests in the Creditor Trust. The Creditor Trust Assets shall include (i) (x) the Cash Distribution |

7

only if Class 4 votes to accept the Plan or (y) $25,000 to initially fund the Creditor Trust if Class 4 votes to reject the Plan and (ii) certain Avoidance Actions and Causes of Action listed on Exhibit “A” to the Plan that will be transferred to the Creditor Trust on the Effective Date. If Class 4 does not vote to accept the Plan, the Cash Distribution shall not be made or included in the Creditor Trust Assets, the Senior Secured Notes Deficiency Claim will share in the Creditor Trust Assets, and the Preferred Trust Interests will be issued to Holders of DIP Facility Claims and Holders of Senior Secured Notes Adequate Protection Claims (if any) to the extent such Claims are not otherwise paid in Cash or satisfied on the Effective Date.

• | GMXR Equity Interests shall be cancelled and Holders of GMXR Equity Interests shall not receive or retain any property or interest in property on account of their GMXR Equity Interests. |

• | Allowed Administrative Claims shall be paid in full. |

• | The DIP Facility Claims shall be paid in full and in Cash with the proceeds of, or converted into, the Exit Facility in accordance with the terms of the Exit Facility Credit Agreement; provided, that if the Class of Holders of General Unsecured Claims votes to reject the Plan, the Holders of DIP Facility Claims may elect to receive, either in whole or in part on account of such DIP Facility Claims, Preferred Series A Trust Interests. |

• | The Holders of Equity Interests in the Debtor Subsidiaries shall receive no Distribution or recovery on account of their existing Equity Interests in the Debtor Subsidiaries. Rather, on the Effective Date, the membership interests in the Debtor Subsidiaries will be held directly by either New GMXR or Reorganized GMXR for the benefit of the Holders of Reorganized GMXR Common Stock and New GMXR Interests, respectively. Diamond Blue shall be converted into a member-managed, single member Delaware limited liability company before the Effective Date in accordance with Section 18-214 of the Delaware Limited Liability Company Act and any other applicable law, with New GMXR as its sole member and manager. After the Effective Date, but no later than 15 Business Days after the Effective Date, Endeavor shall contribute its assets to New GMXR in exchange for New GMXR Interests to be issued to Endeavor (the “Post-Reorganization Contribution”). After the Post-Reorganization Contribution, New GMXR shall own 100% of the assets of Endeavor. |

• | Holders of Allowed Intercompany Claims shall, at the option of the Debtors and with the consent of the Steering Committee, be either Reinstated or eliminated in full or in part by offset, distribution, cancellation, assumption or contribution of such Intercompany Claim. |

8

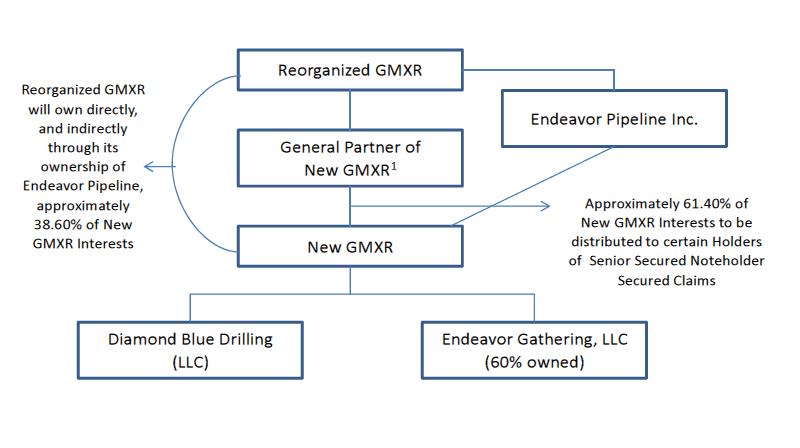

The current corporate organization structure is:

9

After the Effective Date and Post-Reorganization Contribution, the corporate organization structure3 will be:

This Disclosure Statement sets forth certain detailed information regarding the Debtors’ history, their projections for future operations, and significant events expected to occur during the Chapter 11 Cases. This Disclosure Statement also describes the Plan, alternatives to the Plan, effects of Confirmation of the Plan, and the manner in which Distributions will be made under the Plan. In addition, this Disclosure Statement discusses the Confirmation process and the voting procedures that Holders of Eligible Claims must follow for their votes to be counted.

G. | SUMMARY OF PROPOSED DISTRIBUTIONS UNDER THE PLAN |

Under the Plan, Claims against and Equity Interests in the Debtors are divided into Classes. Certain Claims, including Administrative Claims and Priority Tax Claims are not classified and, if not paid prior, will receive payment in full in Cash on the Distribution Date, as such Claims are liquidated, or as agreed with the Holders of such Claims. All other Claims and Equity Interests will receive the Distributions described in the table below.

The table below summarizes the classification and treatment of the prepetition Claims and Equity Interests under the Plan and provides an estimated recovery percentage. This summary is qualified in its entirety by reference to the provisions of the Plan.

__________________

3 If New GMXR is a limited partnership, a new wholly-owned subsidiary of GMXR will be formed before the Effective Date and will be the general partner of New GMXR as will be more fully described in the Plan Supplement. This Entity will not be formed if New GMXR is a limited liability company.

10

Class | Claim/Equity Interest | Treatment of Claim/Equity Interest | Entitled to Vote | Estimated Recovery Percentage4 |

Class 1 | Senior Secured Notes Claim | Impaired | Yes | 83% |

Class 2 | Other Secured Claims | Unimpaired | No | 100% |

Class 3 | Priority Non-Tax Claims | Unimpaired | No | 100% |

Class 4 | General Unsecured Claims | Impaired | Yes | 1% - Undetermined |

Class 5 | Intercompany Claims | Impaired | No (deemed to reject) | —% |

Class 6 | Equity Interests in GMXR | Impaired | No (deemed to reject) | —% |

Class 7 | Equity Interests in Debtor Subsidiaries | Unimpaired | No (deemed to reject) | 100% |

H. | THE CONFIRMATION HEARING AND OBJECTION DEADLINE |

THE BANKRUPTCY COURT HAS SET JANUARY 21, 2014, AT 1:30 P.M., PREVAILING CENTRAL TIME, AS THE DATE AND TIME FOR THE HEARING ON CONFIRMATION OF THE PLAN AND TO CONSIDER ANY OBJECTIONS TO THE PLAN. THE CONFIRMATION HEARING WILL BE HELD AT THE UNITED STATES BANKRUPTCY COURT, NINTH FLOOR COURTROOM, OLD POST OFFICE BUILDING, 215 DEAN A. MCGEE AVENUE, OKLAHOMA CITY, OKLAHOMA. THE DEBTORS WILL REQUEST CONFIRMATION OF THE PLAN AT THE CONFIRMATION HEARING.

THE BANKRUPTCY COURT HAS FURTHER FIXED JANUARY 10, 2014, AT 5:00 P.M., PREVAILING CENTRAL TIME, AS THE DEADLINE (THE “OBJECTION DEADLINE”) FOR FILING OBJECTIONS TO CONFIRMATION OF THE PLAN WITH THE BANKRUPTCY COURT. OBJECTIONS TO CONFIRMATION OF THE PLAN MUST BE SERVED SO AS TO BE RECEIVED BY THE FOLLOWING PARTIES ON OR BEFORE THE OBJECTION DEADLINE:

____________________

4 In preparing their recovery analysis and the estimated recoveries, the Debtors made various estimates and assumptions based on available information, including assuming that Class 4 votes to accept the Plan. Therefore, actual results may significantly differ from estimated recovery and could have a material effect on the recovery percentages. The estimated recoveries contained herein are in no way a promise or guarantee of recovery.

11

◦ | Counsel for the Debtors, Andrews Kurth LLP, 600 Travis, Suite 4200, Houston, Texas 77002, Attn: David Zdunkewicz and Timothy A. Davidson II; |

◦ | Local-Counsel for the Debtors, Crowe & Dunlevy, 20 North Broadway, Suite 1800, Oklahoma City, Oklahoma 73102, Attn: William H. Hoch; |

◦ | The Office of the United States Trustee for the Western District of Oklahoma, 215 Dean A. McGee Ave. 4th Fl., Oklahoma City, Oklahoma 73102, Attn: Charles Snyder; |

◦ | Counsel to the Creditors’ Committee, Looper Reed & McGraw, P.C., 1601 Elm Street, Suite 4600, Dallas, Texas 75201, Attn: Jason Brookner; |

◦ | Counsel to the DIP Lenders and the Steering Committee, Paul, Weiss, Rifkind, Wharton & Garrison LLP, 1285 Avenue of the Americas, New York, New York 10019-6064, Attn: Brian Hermann and Sarah Harnett; |

◦ | Local Counsel to the DIP Lenders and the Steering Committee, McAfee & Taft, Two Leadership Square, 211 N. Robinson, Oklahoma City, Oklahoma 73102, Attn: Steven Bugg; and |

◦ | Counsel to the Senior Secured Notes Indenture Trustee, Faegre Baker Daniels LLP, 2200 Wells Fargo Center, 90 South Seventh Street, Minneapolis, Minnesota 55402-3901, Attn: Michael B. Fisco. |

ANY OBJECTION TO CONFIRMATION OF THE PLAN MUST BE IN WRITING AND (A) MUST STATE THE NAME AND ADDRESS OF THE OBJECTING PARTY AND THE AMOUNT OF ITS CLAIM OR THE NATURE OF ITS EQUITY INTEREST AND (B) MUST STATE WITH PARTICULARITY THE NATURE OF ITS OBJECTION. ANY CONFIRMATION OBJECTION NOT TIMELY FILED AND SERVED AS SET FORTH HEREIN SHALL BE DEEMED WAIVED AND SHALL NOT BE CONSIDERED BY THE BANKRUPTCY COURT.

I. | SUMMARY OF POST-CONFIRMATION OPERATIONS |

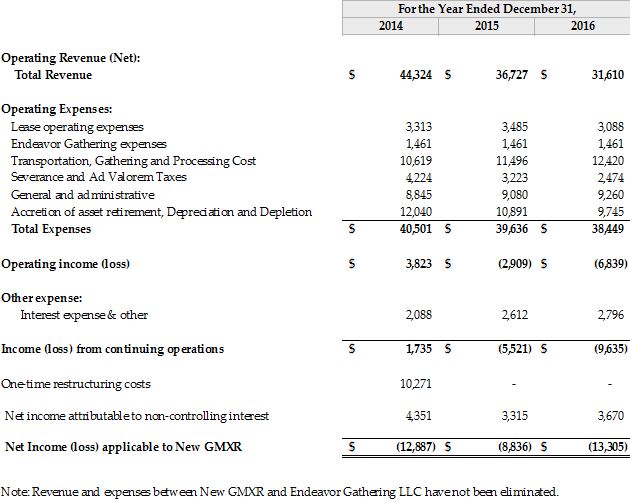

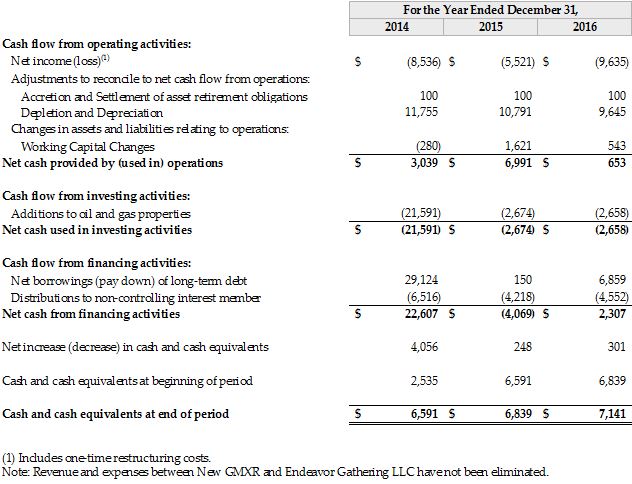

Attached hereto as Exhibit C are the Financial Projections, which project the expected financial performance of the Reorganized Debtors as of January 1, 2014 and through the period ending December 31, 2016. The Financial Projections are based upon information available as of August 31, 2013, and numerous assumptions are an integral part of the Financial Projections, many of which are beyond the control of the Reorganized Debtors and some or all of which may not materialize. See Section IX.E - “CERTAIN FACTORS TO BE CONSIDERED - INHERENT UNCERTAINTY OF FINANCIAL PROJECTIONS.”

12

J. | RECOMMENDATION OF BOARDS OF DIRECTORS AND OTHERS TO APPROVE PLAN |

The respective boards of directors of the Debtors approved the solicitation of acceptances of the Plan and all of the transactions contemplated thereby. In light of the benefits to be attained by the Holders of Eligible Claims pursuant to consummation of the transactions contemplated by the Plan, the Debtors’ respective boards of directors recommend that such Holders of Eligible Claims vote to accept the Plan. The Debtors’ respective boards of directors, have reached this decision after considering the alternatives to the Plan that are available to the Debtors and the possible effect on the Debtors’ business operations. These alternatives include liquidation under chapter 7 of the Bankruptcy Code or a reorganization under chapter 11 of the Bankruptcy Code with an alternative plan of reorganization. The Debtors’ respective boards of directors determined, after consulting with financial and legal advisors, that the Restructuring Transactions contemplated in the Plan would likely result in a distribution of greater values to creditors than would a liquidation under chapter 7. For a comparison of estimated distributions under chapter 7 of the Bankruptcy Code and under the Plan, see Section VII.C - “FEASIBILITY OF THE PLAN AND THE BEST INTERESTS OF CREDITORS TEST - LIQUIDATION ANALYSIS.”

THE DEBTORS’ RESPECTIVE BOARDS OF DIRECTORS EACH SUPPORT THE PLAN AND URGE ALL HOLDERS OF ELIGIBLE CLAIMS WHOSE VOTES ARE BEING SOLICITED TO TIMELY SUBMIT BALLOTS TO ACCEPT AND SUPPORT THE PLAN.

IN ADDITION, THE CREDITORS’ COMMITTEE SUPPORTS CONFIRMATION OF THE PLAN AND ENCOURAGES HOLDERS OF GENERAL UNSECURED CLAIMS TO VOTE TO ACCEPT THE PLAN AS SET FORTH IN THE LETTER FROM THE CREDITORS' COMMITTEE ATTACHED HERETO AS EXHIBIT G.

II. GENERAL INFORMATION REGARDING THE DEBTORS

A. | BACKGROUND |

GMXR is an independent oil and gas exploration and production company that was founded in 1998 and publicly traded since 2001. GMXR has development acreage in two oil resource plays -- the Williston Basin (North Dakota and Montana) and the DJ Basin (Wyoming), targeting the Bakken Three Forks and Niobrara formations, respectively. The company also operates in two natural gas/liquids rich resource plays -- the Haynesville/Bossier formation and the Cotton Valley Sand formation in the East Texas Basin.

13

The following chart generally depicts GMXR’s organizational structure:

The interests in the oil and gas leases and properties are owned by GMX Resources Inc. GMX Resources Inc. is a debtor.

Endeavor Pipeline Inc. is 100% owned by GMX Resources Inc. and operates a water delivery and salt water disposal system in East Texas. Endeavor Pipeline Inc. also handles the North Dakota oil sales activity, and the East Texas gas marketing activities. It buys natural gas in East Texas from GMXR and other parties at the wellhead, and uses its gathering, processing and transportation contracts with Endeavor Gathering LLC and third parties to ship gas from the wellhead to the ultimate sales points. Endeavor Pipeline Inc. is a Debtor.

Diamond Blue Drilling Co. is 100% owned by GMX Resources Inc. and has inconsequential assets and no current operations. Diamond Blue Drilling Co. is a Debtor.

Endeavor Gathering, LLC owns a natural gas gathering system and related equipment in East Texas which is contractually operated by Endeavor Pipeline Inc. GMXR owns a 60% membership interest in Endeavor Gathering, LLC. Kinder Morgan Endeavor LLC owns 40% a membership interest in Endeavor Gathering, LLC. Endeavor Gathering, LLC is not a Debtor.

The Debtors are including Unaudited Selected Financial Information from their consolidated financial statements as Exhibit D for further background information on the Debtors’ financial condition as of December 31, 2012.

The Debtors hereby incorporate by reference into this Disclosure Statement the information GMXR files with the SEC. The information incorporated by reference is an important part of this Disclosure Statement, and information that is filed after the date of this Disclosure Statement with the SEC will automatically update and supersede this information. The Debtors incorporate by reference the documents listed below and any future filings made by GMXR with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act (excluding any information furnished pursuant to Item 2.02 or 7.01 on any Current Report on Form 8-K).

• | Annual Report on Form 10-K for the year ended December 31, 2011; |

• | Quarterly Report on Form 10-Q for the quarter ended September 30, 2012; |

14

• | Current Reports on Form 8-K filed with the SEC on (i) November 9, 2012, (ii) November 29, 2012, (iii) December 12, 2012, (iv)December 19, 2012, (v) December 31, 2012, (vi) January 4, 2013, (vii) January 14, 2013, (viii) February 1, 2013, (ix) February 19, 2013, (x) February 19, 2013, (xi) March 4, 2013, (xii) April 1, 2013, (xiii) April 5, 2013, (xiv) April 9, 2013, (xv) May 2, 2013, (xvi) May 22, 2013, (xvii) June 3, 2013, (xviii) June 17, 2013, (xix) June 18, 2013, and (xx) October 4, 2013; |

• | Notification of Late Filing on Form 12b-25 related to GMXR’s Form 10K for the year ended December 31, 2012; and |

• | Notification of Late Filing on Form 12b-25, as amended by Form 12b-25/A; related to GMXR’s Form 10-Q for the three months ended March 31, 2013. |

Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for all purposes to the extent that a statement contained in this Disclosure Statement or in any other subsequently filed document which is also incorporated or deemed to be incorporated by reference, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified, or superseded, to constitute a part of this Disclosure Statement.

All documents incorporated by reference herein may be accessed at www.sec.gov. Pleadings filed in the Chapter 11 Cases may also be obtained from the website maintained by the Debtors’ claim and noticing agent at http://dm.epiq11.com/GMX/Project#.

1. | EXISTING CAPITAL STRUCTURE OF THE DEBTORS |

Below is a chart summarizing the Debtors capital structure as of the Commencement Date. Each class is described in more detail below.

Senior Secured Notes due December 2017 | $402,363,309 |

Second-Priority Notes due 2018 | $51,500,000 |

Convertible Notes due May 2015 | $48,296,000 |

Old Senior Notes due February 2019 | $1,970,000 |

Drilling Cost Financing | $1,261,000 |

Total | $505,390,309 |

a.Senior Secured Notes Due December 2017

In December 2011, GMX Resources Inc. completed the issuance and sale of $283.5 million of Senior Secured Notes due 2017 (the “Series A Notes”). In December 2012, GMXR completed a private placement of $30.0 million of Senior Secured Notes due 2017 (the “Series B

15

Notes,” and together with the Series A Notes, the “Senior Secured Notes”). The Senior Secured Notes are governed by the Senior Secured Notes Indenture. The Series A and Series B Senior Secured Notes are secured by first-priority liens on substantially all right, title and interest in or to substantially all of the assets and properties owned or acquired by the Debtors.

As of February 11, 2013 GMXR had outstanding $324.3 million aggregate principal amount of the Senior Secured Notes, including $294.3 million aggregate amount of Series A Notes and $30.0 million aggregate principal amount of Series B Notes. As of April 1, 2013, there was $11.9 million in accrued unpaid interest on the Senior Secured Notes. There is also a make-whole premium, the Applicable Premium as defined in the Senior Secured Notes Indenture, that was triggered upon the automatic acceleration of the Senior Secured Notes, as a result of the commencement of these Chapter 11 Cases, which became immediately due and payable on the Commencement Date.

The Senior Secured Notes Claim has been allowed by order of the Bankruptcy Court in full in the aggregate amount of $402,363,309.00 (exclusive of post-petition interest, fees and expenses) consisting of (i) principal and accrued interest owing on the as of the Commencement Date in the amount of $336,276,571.00 and (ii) the Applicable Premium in the amount of $66,086,738.00

b.Second-Priority Notes Due 2018

In September 2012, GMX Resources Inc. issued $51.5 million of senior secured second-priority notes due 2018 through the consummation of certain exchange offers. The Second-Priority Notes are secured by second-priority perfected liens on the same collateral pledged for the Senior Secured Notes. There are no guarantors of the Second-Priority Notes. As of February 11, 2013, GMXR had outstanding $51.5 million aggregate principal amount of the Second-Priority Notes.

There is an Intercreditor Agreement among the collateral agents for the Senior Secured Notes and the Second-Priority Notes that governs the lien priorities and related rights of the Holders of the Senior Secured Notes, the Holders of the Second-Priority Notes, and EDF Trading North America, LLC, as a secured hedge counterparty.

c.4.50% Convertible Notes Due May 2015

In October 2009, GMX Resources Inc. completed an $86.3 million public offering of 4.50% convertible senior notes due 2015 (the “Convertible Notes”). The Convertible Notes are unsecured obligations of GMX Resources Inc. and there are no guarantors of the Convertible Notes. During September 2012, GMXR consummated an exchange offer for the outstanding Convertible Notes. Pursuant to the terms of this exchange offer, the company issued $26,540,000 aggregate principal amount of Second-Priority Notes in exchange for $37,954,000 aggregate principal amount of Convertible Notes. As of February 11, 2013, GMXR had outstanding $48.3 million aggregate principal amount of the Convertible Notes.

16

d.11.375% Senior Notes Due 2019

In February 2011, GMX Resources Inc. completed the issuance and sale of $200 million of 11.375% Senior Notes due 2019 (the “Old Senior Notes”). The Old Senior Notes are unsecured obligations of GMX Resources Inc. and the guarantors, Endeavor Pipeline Inc. and Diamond Blue Drilling Co. In December 2011, 99% of the Old Senior Notes were exchanged for new Senior Secured Notes. As of February 11, 2013 GMXR had outstanding $1,970,000 aggregate principal amount of the Old Senior Notes.

e.Drilling Cost Financing

In 2004, GMXR entered into an arrangement with Penn Virginia Oil & Gas L.P. (“PVOG”), in which PVOG agreed to purchase dollar denominated production payments from GMXR on certain wells drilled during a portion of 2004. Under this agreement, PVOG provided $2.8 million in funding for GMXR’s share of costs of four wells drilled by PVOG which is repayable solely from 75% of GMXR’s share of production revenues from these wells, without interest. The amount outstanding as of the Commencement Date was $1,261,000.00.

f.Hedging Agreements and Security Deposits

On the Commencement Date, GMXR had open hedge contracts for natural gas through 2015 and crude oil through 2014 with EDF Trading North America, LLC. Subsequent to the Commencement Date, EDF Trading North America, LLC terminated the hedge contracts. On August 13, 2013, the Court entered Order Approving Settlement Under Fed. R. Bankr. P. 9019 with EDF Trading North America, LLC pursuant to which the Debtors were authorized to pay $1,808,593.12 to EDF Trading North America in full satisfaction of all obligations under the hedging agreements. GMXR made the payment and hedging agreements have been terminated and the obligations thereunder satisfied in full.

Endeavor Pipeline Inc. has a $25,000 cash deposit with the Texas Railroad Commission for its operator’s license. Additionally, the Debtors have a $100,000 cash deposit with their insurance company to collateralize the Debtors’ surety bond with the Texas Railroad Commission.

g.Equity Interests of the Debtors

As of February 11, 2013, GMXR had issued and outstanding 7,405,783 shares of common stock.

GMXR’s certificate of incorporation authorizes the issuance of up to 10,000,000 shares of preferred stock, par value $0.001 per share, in one or more series. GMXR has designated 25,000 of such shares as Series A Junior Participating Preferred Stock in connection with a Rights Plan. GMXR has also designated 6,000,000 of such shares as 9.25% Series B Cumulative Preferred Stock (“9.25% Preferred Stock”), of which 3,176,734 shares were issued and outstanding as of December 31, 2012.

17

2. | EVENTS LEADING UP TO THE DEBTORS' RESTRUCTURING |

On April 1, 2013, the Debtors filed their voluntary petitions for relief under chapter 11 of the Bankruptcy Code. The underlying causes leading to the bankruptcy filing stemmed from a lack of liquidity and availability of capital to develop and exploit oil and natural gas properties, including drilling, completing, and producing the company’s “proved undeveloped reserves” of oil and gas assets. The Debtors had been struggling due to the substantial drop in and sustained low natural gas prices over the three years prior to the Commencement Date.

Prior to the Commencement Date, GMXR sought to raise capital through debt and equity offerings but was unsuccessful. In response to the Debtors’ depressed financial performance and declining financial condition, and after thoroughly evaluating their options, the Debtors undertook the process of negotiating a potential restructuring with certain holders of the Senior Secured Notes. In February 2013, such holders of the Senior Secured Notes formed the Steering Committee, which retained its own counsel and financial advisors. As the Debtors engaged in discussions with the Steering Committee, on March 4, 2013, GMXR elected not to make an interest payment due on its Second-Priority Notes. This missed payment triggered a number of cross defaults under the Senior Secured Notes Indenture and the Convertible Notes Indenture. After good faith, arm’s-length negotiations among the Debtors and the Steering Committee, the members of the Steering Committee agreed to provide debtor-in-possession financing to fund the orderly sale of substantially all of the Debtors’ assets, subject to a marketing and auction process, pursuant to section 363 of the Bankruptcy Code, with the Steering Committee pursuing a “stalking horse” credit bid for the Debtors’ assets, subject to higher and otherwise better offers.

3. | LITIGATION PENDING AGAINST THE DEBTORS AT TIME OF FILING |

The Debtors are party to a variety of legal proceedings and administrative actions. The claims made in the legal proceedings and administrative actions will be treated as General Unsecured Claims. The legal actions pending against the Debtors are summarized below:

a.In the Matter of an Arbitration Between Penn Virginia Oil & Gas, L.P., Claimant and GMX Resources Inc., Respondent.

On September 27, 2010, PVOG initiated arbitration proceedings and asserted a claim for well costs allegedly owed by GMXR on the Timmins #3H and the Timmins #3HR in the approximate amount of $3,078,623.62, plus interest and attorney fees. No punitive damages are sought against GMXR. A pivotal issue is whether PVOG misrepresented the status of the Timmins #3H to induce GMXR to participate in the well after it had been lost so that well costs would be shared by both parties. Evidence currently available indicates that PVOG employees, in fact, did inquire as to whether GMXR intended to participate in the Timmins #3H after operations to plug and abandon the well had been initiated by PVOG.

On November 5, 2010, GMXR served PVOG with its Answering Statement and Amended Counterclaims. GMXR has asserted counterclaims against PVOG for (i) fraud/concealment relating to PVOG’s obtaining GMXR’s participation election in the Timmins #3H well; (ii) Gross Negligence/Willful Misconduct/Refusal to Carry Out Duties as Operator relating to PVOG’s operations on the Participation Agreement properties; and (iii) for breach of contract for

18

failure to make timely lease offerings; failure to provide information, over billing, and failure to obtain consent to plugging.

On April 24, 2012, GMXR sought leave from the arbitration panel to assert an additional counterclaim against PVOG for PVOG’s purported breach of a Gas Gathering and Compression Agreement. The arbitration panel has not yet granted or denied GMXR’s request.

Regarding the Timmins #3HR, one of the key issues is whether the costs sought by PVOG constitute “sidetrack” operations for which PVOG was required to submit an Authority for Expenditure to GMXR and obtain GMXR’s consent before GMXR could be obligated for such costs. GMXR never consented to any sidetrack operations. PVOG contends the costs were not for sidetrack operations and that, therefore, GMXR’s original consent to participate in the well obligates GMXR for such costs.

For almost a year prior to GMXR filing bankruptcy, the parties were engaged in settlement dialogue. As a result of those ongoing discussions, the parties agreed to put the arbitration on hold while settlement was explored. No settlement was reached before GMXR filed bankruptcy.

b.Penn Virginia Oil & Gas, L.P v.. GMX Resources Inc., Summit Energy (Texas), LLC, And East Texas Exploration LLC., Civil Action No. 4:12-Cv-00748 in the United States District Court for the Eastern District of Texas.

On December 3, 2012, PVOG filed the above lawsuit alleging that it has a right of first refusal in connection with certain properties that GMXR sold to Summit Energy, LLC (“Summit”) pursuant a Purchase and Sale Agreement dated October 1, 2012. The complaint seeks specific performance to sell oil & gas property to PVOG instead of a third party or damages estimated at $42,650,000. PVOG alleged that the sale and transfer of properties from GMXR to Summit violated PVOG’s right of first refusal under the Participation Agreement between PVOG and GMXR effective December 5, 2003. PVOG claimed that the sale and transfer constituted a breach of the Participation Agreement and PVOG sought a declaratory judgment of its rights under the Participation Agreement. In addition, PVOG asserted a tortious interference claim against Summit and East Texas Exploration (the assignee of Summit).

On March 21, 2013, the Court compelled arbitration of PVOG’s claims and stayed all further proceedings in this case pending binding arbitration. No arbitration was commenced by the time GMXR filed bankruptcy. On May 8, 2013, PVOG filed a stipulation of dismissal to dismiss this lawsuit.

c.Alfred E. Lacy, A.K. Lacy And Robert Tiller, Plaintiffs v. GMX Resources Inc., Penn Virginia Oil & Gas LP and R. Lacy, Inc., Defendants. Case No. 07-0580 In the District Court of Harrison County, Texas, 71st Judicial District.

Plaintiffs requested a judgment that certain of the Debtors’ leases in East Texas have terminated and for payment of production proceeds from the alleged date of termination. Prior

19

to the Commencement Date, a tentative settlement agreement was reached, but not consummated. As such, the Debtors believe that the leases at issue in the litigation remain in full force and effect.

d.John H. Haynes, Jr., Individually and as Trustee For John H. Haynes, III, Loreeann Haynes Denny and Andrew Thomas Haynes; Stephen G. Taylor; Julie Taylor; Don Crutcher and Jeannie Crutcher, Plaintiffs, v. GMR Resources Inc. and Loutex Energy, L.L.C., Cause No. 1100104 in the District Court of Marion County, Texas

On June 17, 2011, plaintiffs filed the action disputing the interpretation of agreements between the plaintiffs and defendants as to payments due plaintiffs based upon defendants operations. Plaintiffs seek to recover in excess of $1,800,000 from defendants for alleged unpaid lease bonuses. Plaintiffs also sought a determination that the Haynes unit should be designated as an oil well as opposed to a gas well, which would reduce the amount of acreage held by such well. Defendants have answered, denying plaintiff’s claims. Plaintiffs filed a motion for partial summary judgment based on their interpretation of the agreements. Defendants responded and a hearing on the motion was held on December 16, 2011. The Court took the parties’ arguments under advisement and ruled in favor of defendants.

On February 12, 2013, at a court ordered mediation, the parties agreed to the terms of a settlement, subject to completion of definitive settlement documents. The proposed settlement was not consummated. The main terms of the settlement provided that GMXR would pay the Plaintiffs $725,000, the Haynes unit would be redesignated as an 80 acre unit, and GMXR would release all acreage lying outside that 80 acre unit to plaintiffs. The plaintiffs would then dismiss all claims against GMXR. Subsequent to the mediation but before the Commencement Date, the Texas Railroad Commission issued a ruling that the Haynes unit was a gas well, thus holding approximately 704 acres of the lease.

While the parties agreed to the terms of a settlement, formal settlement documents were not executed and payment of the settlement amount was not made as of the Commencement Date, nor was the Haynes unit redesignated. As such, the Haynes Unit remains a gas well and the Debtors do not intend to consummate the settlement.

The plaintiffs disagree with the Debtors’ position regarding the settlement and the acreage held by the various leases. Plaintiffs assert that the Irrevocable Rule 11 Mediated Settlement Agreement executed by the defendants following the mediation is substantively binding on the Debtors under Texas Law and has preemptive, res judicata effect. As a result, plaintiffs contend that the Debtors only hold an interest in the 80 acre unit and that any purchaser could, at best, take only the 80 acre unit. The plaintiffs' position regarding these issues is set forth more fully in their Objection to Debtors’ Motion for (I) An Order (A) Establishing Bidding Procedures In Connection With the Sale of Substantially All of the Debtors’ Assets; (B) Approving the Form and Manner of Notices; (C) Scheduling Dates for an Auction and Sale Hearing; (D) Authorizing and Approving the Form of a Stalking Horse Asset Purchase Agreement; (E) Approving Procedures to Determine Cure Amounts Related to the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases; and (II) an Order (A) Approving the Sale of the Assets Free and Clear of All Liens, Claims, and Encumbrances to the Winning Bidder; and (B) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases In Connection Therewith filed on August 27,

20

2013 [Docket No. 676] and in their respective proofs of claim. The Debtors dispute the position of the plaintiffs.

e.Alfred E. Lacy Jr. and A.K. Lacy, Plaintiffs v. GMX Resources Inc., Defendant, Cause No. 11-0838 in the District Court of Harrison County, Texas, 71st Judicial District.

On September 29, 2011, plaintiffs filed the action contending that GMXR’s oil and gas lease expired by its own terms due to a lack of commercial production in sufficient quantities. Plaintiffs seek to terminate the lease and seek an unknown amount of proceeds from the production or sale of oil, gas, and other minerals under the lease, which plaintiffs claim have not been accounted for by GMXR. GMXR has answered, denying plaintiffs’ claims.

As of the date GMXR filed bankruptcy, no scheduling order had yet been entered and discovery and investigation was still ongoing. The parties were engaged in settlement discussions prepetition.

f. Weatherford International Inc., Plaintiff v. GMX Resources Inc., Defendant., Cause No. 201249875 in the District Court of Harris County, Texas 165th Judicial District.

On August 29, 2012, plaintiff filed the action contending that there remains $659,971 due and owing on GMXR’s open account with plaintiff for certain equipment and services provided to GMXR under a Master Services Agreement dated December 1, 2010. Plaintiff is seeking actual damages in the amount of approximately $659,971, attorney’s fees and costs of litigation. Plaintiff is also seeking to foreclose a lien claimed against certain leasehold interest located in Harrison County, Texas known as the Mia Austin Gas Unit.

GMXR timely answered, denying all of plaintiff’s claims, and asserted a counterclaim against plaintiff for breach of the Master Services Agreement based on plaintiff’s refusal to refund and/or credit GMXR for approximately $2,187,572 in overpayments for invoiced, but unperformed, work.

As of the Commencement Date, no scheduling order had yet been entered and discovery and investigation were still ongoing.

g.GMX Resources Inc., Plaintiff v. Poseidon Concepts Inc., Defendant, Case No. 1:13-Cv-00 in the United States District Court for the District of North Dakota, Southwestern Division, 3.