Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WSFS FINANCIAL CORP | d633902d8k.htm |

| EX-99.1 - EX-99.1 - WSFS FINANCIAL CORP | d633902dex991.htm |

Exhibit 99.2

WSFS Financial Corporation to combine with The First National Bank of Wyoming (Delaware) November 25, 2013

Forward-Looking Statement Disclaimer

This presentation contains estimates, predictions, opinions, projections and other “forward-looking statements” as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company’s financial goals, management’s plans and objectives for future operations, financial and business trends, business prospects, and management’s outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to the economic environment, particularly in the market areas in which the Company operates, including an increase in unemployment levels; the volatility of the financial and securities markets, including changes with respect to the market value of financial assets; changes in market interest rates may increase funding costs and reduce earning asset yields thus reducing margin; increases in benchmark rates would increase debt service requirements for customers whose terms include a variable interest rate, which may negatively impact the ability of borrowers to pay as contractually obligated; changes in government regulation affecting financial institutions, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules being issued in accordance with this statute and potential expenses and elevated capital levels associated therewith; possible additional loan losses and impairment of the collectability of loans; seasonality, which may impact customer, such as construction-related businesses, the availability of public funds, and certain types of the Company’s fee revenue, such as mortgage originations; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations, may have an adverse effect on business; possible rules and regulations issued by the Consumer Financial Protection Bureau or other regulators which might adversely impact our business model or products and services; possible stresses in the real estate markets, including possible continued deterioration in property values that affect the collateral value of underlying real estate loans; the Company’s ability to expand into new markets, develop competitive new products and services in a timely manner and to maintain profit margins in the face of competitive pressures; possible changes in consumer and business spending and savings habits could affect the Company’s ability to increase assets and to attract deposits; the Company’s ability to effectively manage credit risk, interest rate risk market risk, operational risk, legal risk, liquidity risk, reputational risk, and regulatory and compliance risk; the effects of increased competition from both banks and non-banks; the effects of geopolitical instability and risks such as terrorist attacks; the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes, and the effects of man-made disasters; possible changes in the speed of loan prepayments by the Company’s customers and loan origination or sales volumes; possible acceleration of prepayments of mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on prepayments on mortgage-backed securities due to low interest rates; and the costs associated with resolving any problem loans, litigation and other risks and uncertainties, discussed in the Company’s Form 10-K for the year ended December 31, 2012 and other documents filed by the Company with the Securities and Exchange Commission from time to time. Forward looking statements are as of the date they are made, and the Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. This presentation speaks only as of its date, and WSFS disclaims any duty to update the information herein.

| 2 |

|

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This presentation is being made pursuant to and in compliance with Rules 165 and 425 of the Securities Act of 1933 and does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. In connection with the proposed transaction, WSFS and First Wyoming Financial Corporation expect to file a proxy statement/prospectus as part of a registration statement on Form S-4 regarding the proposed transaction with the Securities and Exchange Commission, or SEC. Investors and security holders are urged to read the proxy statement/prospectus because it will contain important information about WSFS and First Wyoming Financial Corporation and the proposed transaction. The final proxy statement/prospectus will be mailed to shareholders of First Wyoming Financial Corporation. Investors and security holders may obtain a free copy of the definitive proxy statement/prospectus and other documents when filed with the SEC at the SEC’s website at www.sec.gov. The definitive proxy statement/prospectus and other relevant documents may also be obtained free of charge from WSFS by directing such requests to: WSFS Financial Corporation, Attention: Investor Relations, 500 Delaware Avenue, Wilmington, DE 19801, or from First Wyoming Financial Corporation by directing such requests to: First Wyoming Financial Corporation, Attention: Investor Relations, 120 West Camden-Wyoming Avenue, Wyoming, DE 19934.

PARTICIPANTS IN THE SOLICITATION

WSFS and First Wyoming Financial Corporation and their respective directors, executive officers and certain other members of their management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information concerning all of the participants in the solicitation will be included in the proxy statement relating to the proposed transaction when it becomes available. Each of these documents is, or will be, available free of charge at the Securities and Exchange Commission’s Web site at http://www.sec.gov and from WSFS’s website at http://www.wsfsbank.com.

| 3 |

|

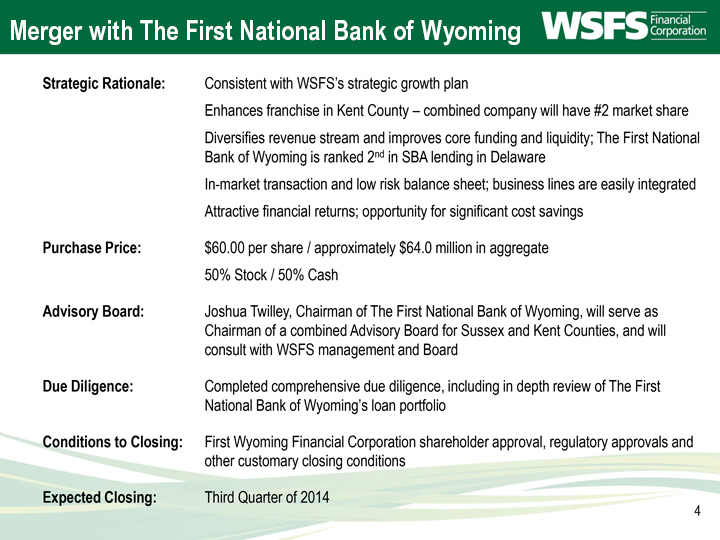

Merger with The First National Bank of Wyoming

Strategic Rationale: Consistent with WSFS’s strategic growth plan

Enhances franchise in Kent County – combined company will have #2 market share

Diversifies revenue stream and improves core funding and liquidity; The First National Bank of Wyoming is ranked 2nd in SBA lending in Delaware

In-market transaction and low risk balance sheet; business lines are easily integrated

Attractive financial returns; opportunity for significant cost savings

Purchase Price: $60.00 per share / approximately $64.0 million in aggregate

50% Stock / 50% Cash

Advisory Board: Joshua Twilley, Chairman of The First National Bank of Wyoming, will serve as Chairman of a combined Advisory Board for Sussex and Kent Counties, and will consult with WSFS management and Board

Due Diligence: Completed comprehensive due diligence, including in depth review of The First National Bank of Wyoming’s loan portfolio

Conditions to Closing: First Wyoming Financial Corporation shareholder approval, regulatory approvals and other customary closing conditions

Expected Closing: Third Quarter of 2014

| 4 |

|

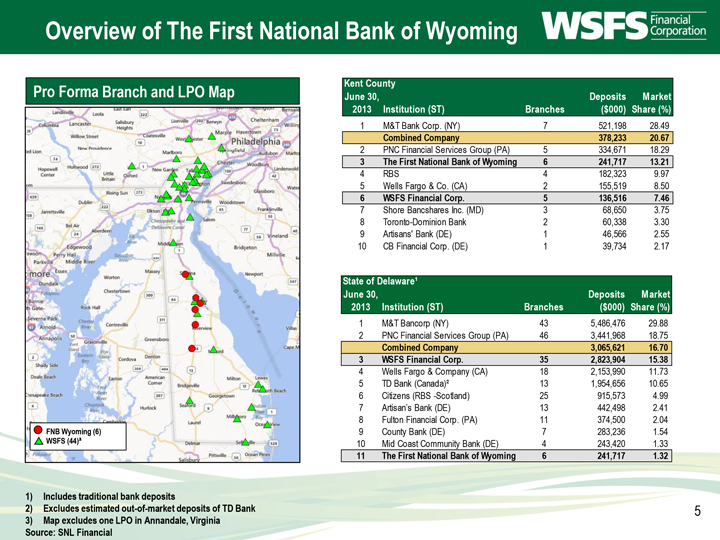

Overview of The First National Bank of Wyoming

FNB Wyoming (6)

WSFS (44)3

Pro Forma Branch and LPO Map

1) Includes traditional bank deposits

2) Excludes estimate out of market deposits of TD bank

3) Map excludes one LPO in Annandale, Virginia

Source: SNL Financial

Kent County June 30, Deposits Market 2013 Institution (ST) Branches ($000) Share (%) 1 M&T Bank Corp. (NY) 7 521,198 28.49 Combined Company 3 78,233 20.67 2 PNC Financial Services Group (PA) 5 334,671 18.29 3 The First National Bank of Wyoming 6 241,717 13.21 4 RBS 4 182,323 9.97 5 Wells Fargo & Co. (CA) 2 155,519 8.50 6 WSFS Financial Corp. 5 136,516 7.46 7 Shore Bancshares Inc. (MD) 3 68,650 3.75 8 Toronto-Dominion Bank 2 60,338 3.30 9 Artisans’ Bank (DE) 1 46,566 2.55 10 CB Financial Corp. (DE) 1 39,734 2.17 State of Delaware¹ June 30, Deposits Market 2013 Institution (ST) Branches ($000) Share (%) 1 M&T Bancorp (NY) 43 5,486,476 29.88 2 PNC Financial Services Group (PA) 46 3,441,968 18.75 Combined Company 3,065,621 16.70 3 WSFS Financial Corp. 35 2,823,904 15.38 4 Wells Fargo & Company (CA) 18 2,153,990 11.73 5 TD Bank (Canada)² 13 1,954,656 10.65 6 Citizens (RBS -Scotland) 25 915,573 4.99 7 Artisan’s Bank (DE) 13 442,498 2.41 8 Fulton Financial Corp. (PA) 11 374,500 2.04 9 County Bank (DE) 7 283,236 1.54 10 Mid Coast Community Bank (DE) 4 243,420 1.33 11 The First National Bank of Wyoming 6 241,717 1.32

| 5 |

|

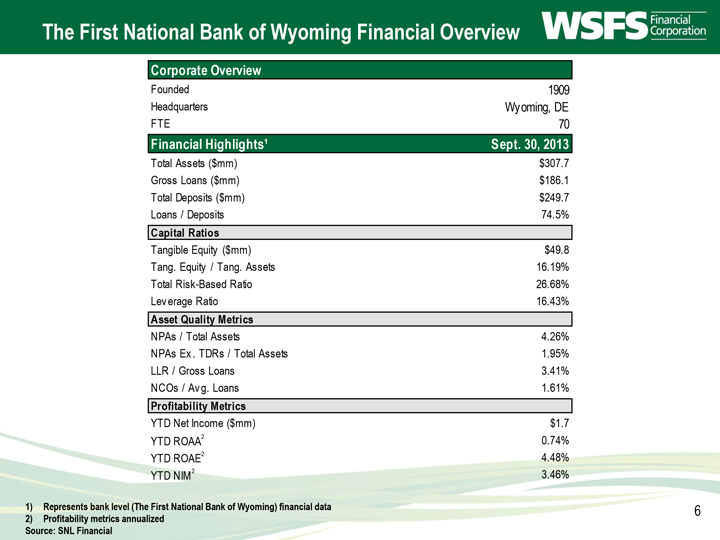

The First National Bank of Wyoming Financial Overview

1) Represents bank level (First National Bank of Wyoming) financial data

2) Profitability metrics annualized Source: SNL Financial

Corporate Overview Founded 1909 Headquarters Wyoming, DE FTE 70 Financial Highlights¹ Sept. 30, 2013 Total Assets ($mm) $307.7 Gross Loans ($mm) $186.1 Total Deposits ($mm) $249.7 Loans / Deposits 74.5% Capital Ratios Tangible Equity ($mm) $49.8 Tang. Equity / Tang. Assets 16.19% Total Risk-Based Ratio 26.68% Leverage Ratio 16.43% Asset Quality Metrics NPAs / Total Assets 4.26% NPAs Ex. TDRs / Total Assets 1.95% LLR / Gross Loans 3.41% NCOs / Avg. Loans 1.61% Profitability Metrics YTD Net Income ($mm) $1.7 YTD ROAA2 0.74% YTD ROAE2 4.48% YTD NIM2 3.46%

| 6 |

|

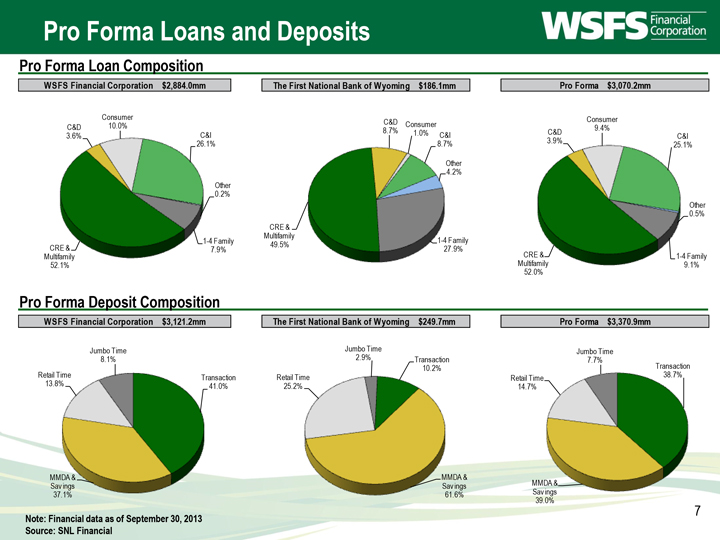

Pro Forma Loans and Deposits

Pro Forma Loan Composition

Pro Forma Deposit Composition

Note: Financial data as of September 30, 2013

Source: SNL Financial WSFS Financial Corporation $2,884.0mm The First National Bank of Wyoming $186.1mm Pro Forma $3,070.2mm 1-4 Family 7.9% CRE & Multifamily 52.1% C&D 3.6% Consumer 10.0% C&I 26.1% Other 0.2% 1-4 Family 27.9% CRE & Multifamily 49.5% C&D 8.7% Consumer 1.0% C&I 8.7% Other 4.2% 1-4 Family 9.1% CRE & Multifamily 52.0% C&D 3.9% Consumer 9.4% C&I 25.1% Other 0.5% WSFS Financial Corporation $3,121.2mm The First National Bank of Wyoming $249.7mm Pro Forma $3,370.9mm Transaction 41.0% MMDA & Savings 37.1% Retail Time 13.8% Jumbo Time 8.1% Transaction 10.2% MMDA & Savings 61.6% Retail Time 25.2% Jumbo Time 2.9% Transaction 38.7% MMDA & Savings 39.0% Retail Time 14.7% Jumbo Time 7.7%

| 7 |

|

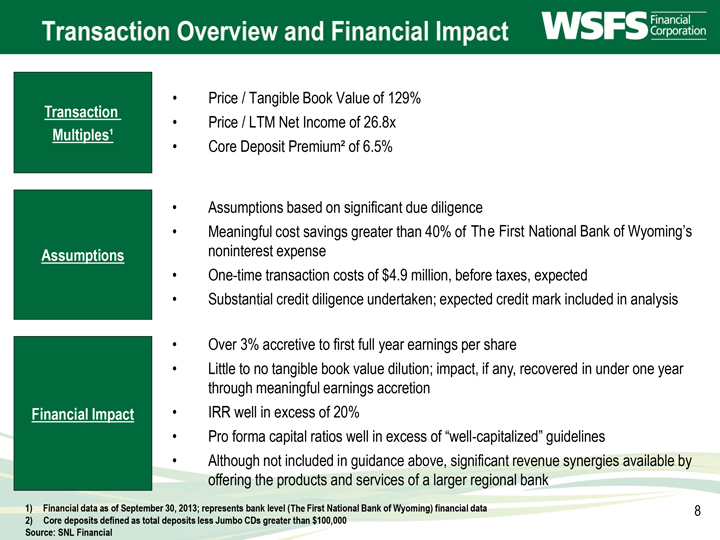

Transaction Overview and Financial Impact

• Assumptions based on significant due diligence

• Meaningful cost savings greater than 40% of The First National Bank of Wyoming’s noninterest expense

• One-time transaction costs of $4.9 million, before taxes, expected

• Substantial credit diligence undertaken; expected credit mark included in analysis

1) Financial data as of September 30, 2013; represents bank level (The First National Bank of Wyoming) financial data

2) Core deposits defined as total deposits less Jumbo CDs greater than $100,000 Source: SNL Financial

• Over 3% accretive to first full year earnings per share

• Little to no tangible book value dilution; impact, if any, recovered in under one year through meaningful earnings accretion

• IRR well in excess of 20%

• Pro forma capital ratios well in excess of “well-capitalized” guidelines

• Although not included in guidance above, significant revenue synergies available by offering the products and services of a larger regional bank

Transaction

Multiples¹

Assumptions

Financial Impact

• Price / Tangible Book Value of 129%

• Price / LTM Net Income of 26.8x

• Core Deposit Premium² of 6.5%

| 8 |

|

For more information please contact: www.wsfsbank.com Corporate Headquarters 500 Delaware Avenue Wilmington, DE 19801

9