Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 18, 2013

STRATUS MEDIA GROUP, INC.

| NEVADA | 000-24477 | 86-0776876 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1800 Century Park East, 6th Floor

Los Angeles, California 90067

(Address of principal executive offices)

(805) 884-9977

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act of 1933 (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(e) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement |

In connection with the closing of the Mergers described in Item 1.02, below, Stratus Media Group, Inc. (the “Company”) entered into employment agreements with (a) Yael Schwartz, Ph.D., pursuant to which Dr. Schwartz was appointed President of Canterbury Laboratories LLC, and Hygeia Therapeutics, Inc. (the new subsidiaries of the Company acquired pursuant to the Mergers); and (b) Craig Abolin, Ph.D. pursuant to which Dr. Abolin was appointed Vice President of Research and Development of the new subsidiaries.

Under the Employment Agreement with Dr. Schwartz, she is to be employed for an initial period of three years. During the initial year of her employment term, she is to receive a base salary of $330,000. Thereafter, her base salary will be subject to mutually agreed upon increases. The Company’s board of directors (the “Board”) or Compensation Committee may grant Dr. Schwartz bonuses in its sole discretion. Dr. Schwartz is also eligible for grants of awards under the Company’s Incentive Compensation Plan.

Under the employment agreement with Dr. Abolin, he is to be employed for an initial period of three years. During the initial year, he is to receive a base salary of $241,000. Thereafter his base salary will be subject to mutually agreed upon increases. The Company’s Board or Compensation Committee may grant Dr. Abolin bonuses in its sole discretion. Dr. Abolin is also eligible for grants of awards under the Company’s Incentive Compensation Plan.

| Item 1.02 | Completion of Acquisition on Disposition of Assets |

Effective September 30, 2013, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Canterbury Acquisition LLC, a wholly owned subsidiary of the Company (“Canterbury Merger Sub”), Hygeia Acquisition, Inc., a wholly owned subsidiary of the Company (“Hygeia Merger Sub”), Canterbury Laboratories, LLC (“Canterbury”), Hygeia Therapeutics, Inc. (“Hygeia”) and Yael Schwartz, Ph.D., as Holder Representative, pursuant to which the Company agreed to acquire all of the capital stock of Canterbury and Hygeia (the “Mergers”) with Canterbury and Hygeia becoming wholly owned subsidiaries of the Company. The consideration for the Mergers is the issuance by the Company of an aggregate of 115,011,563 restricted shares of the Company’s common stock issued to the stakeholders of Canterbury and Hygeia. Effective November 18, 2013 (the “Effective Date”), the Mergers were completed, and Canterbury and Hygeia became wholly owned subsidiaries of the Company.

The foregoing description of the Mergers and related transactions does not purport to be complete and is qualified in its entirety by reference to the complete text of the Merger Agreement which was filed with the Securities and Exchange Commission (“SEC”) as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on October 10, 2013.

The shares of the Company’s common stock issued to the holders of the capital stock of Canterbury and Hygeia in connection with the Mergers were not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act and Regulation D promulgated under that section, which exempts transactions by an issuer not involving any public offering. These securities may not be offered or sold in the U.S. absent registration or an applicable exemption from the registration requirements. Certificates representing these shares will contain a legend stating the restrictions applicable to such shares.

Changes to the Business. As of the Effective Date, the businesses of Canterbury and Hygeia (the “Canterbury Group”) constitute our sole line of business.

| 2 |

Changes to the Board of Directors and Executive Officers. Upon the closing of the Mergers, pursuant to the Merger Agreement Yael Schwartz, Ph.D. and Nelson Stacks were appointed by the Company’s board of directors (the “Board”) as directors of the Company. In addition, upon the closing of the Mergers, Dr. Schwartz was appointed as President of the Canterbury and Hygeia subsidiaries and Dr. Craig Abolin was appointed as Vice President of Research and Development of the subsidiaries.

All directors hold office for one-year terms until the election and qualification of their successors.

Accounting Treatment. The Mergers are being accounted for as the acquisition of a business. Canterbury and Hygeia are the acquired companies for financial reporting purposes as subsidiaries of the Company, with the former shareholders of Canterbury and Hygeia owning 20.6% of outstanding shares of the Company following the Mergers and the shareholders of the Company prior to the Mergers retaining 79.4% ownership of the outstanding shares of the Company following the Mergers. Consequently, the assets and liabilities and the operations that will be reflected in the historical financial statements prior to the Mergers are those of the Company and the consolidated financial statements after the Mergers will include the assets and liabilities of the Company, Canterbury and Hygeia, operations of Canterbury and Hygeia, and operations of the Company from the closing date of the Mergers.

Tax Treatment; Small Business Issuer. The Merger of Hygeia is intended to constitute a reorganization or other tax-deferred transaction within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”). The Merger of Canterbury will be taxable to the holders of the equity of Canterbury.

Following the Mergers, we will continue to be a “smaller reporting company,” as defined in Item 10(f)(1) of Regulation S-K, as promulgated by the SEC.

As used in this Current Report on Form 8-K, all references to “we,” “our” and “us” in the following description of the business of Canterbury and Hygeia for periods prior to the closing of the Exchange refer to Canterbury and Hygeia, as a privately owned companies, and for periods subsequent to the closing of the Mergers refer to the Company and its subsidiaries consisting of Canterbury and Hygeia.

CORPORATE INFORMATION

Company History – Stratus Media Group, Inc.

On March 14, 2008, pursuant to an Agreement and Plan of Merger dated August 20, 2007 between Feris International, Inc. (“Feris”) and Pro Sports & Entertainment, Inc. (“PSEI”), a company engaged in the sports and entertainment business, Feris issued 49,500,000 shares of its common stock for all issued and outstanding shares of PSEI, resulting in PSEI becoming a wholly-owned subsidiary of Feris and the surviving entity for accounting purposes (“Reverse Merger”). In July 2008, Feris’ corporate name was changed to Stratus Media Group, Inc. PSEI, a California corporation, was organized on November 23, 1998. In August 2005, PSEI acquired the business of Stratus White, LLC, a company engaged in developing a loyalty reward program for credit cards.

In June 2011, the Company acquired Series A Convertible Preferred Stock of ProElite, Inc. (“ProElite”), that organized and promoted mixed martial arts (“MMA”) matches. These holdings of Series A Convertible Preferred Stock provide the Company voting rights on an as-converted basis equivalent to a 95% ownership in ProElite.

As a result of, among other factors, a lack of working capital, the Company suspended development of its businesses other than Pro Elite as of December 31, 2012 and suspended development of its MMA business effective June 30, 2013. The Company’s Board authorized management to pursue acquisition opportunities in the life sciences area in view of the experience and expertise in that area of its largest stockholders, Sol. J. Barer and Isaac Blech.

| 3 |

Description of the Businesses of Canterbury and Hygeia

Background

Hygeia was organized to develop and commercialize new classes of estrogens and anti-androgens developed in the laboratory of Dr. Richard Hochberg at Yale University (“Yale”). Yale patented these compounds and they were then exclusively licensed to Hygeia. To fund the research and development, Hygeia raised $1,000,000 through the sale of its Series A Preferred Stock in 2010. By 2011, and given the state of the economy, Hygeia found itself unable to raise additional capital and suspended further research and development efforts. During this period, management considered the possibility of developing several of the patent protected assets for various cosmeceutical applications because of the strong activity on skin cells discovered during several of the tests and trials conducted by Hygeia. To further these efforts, on March 28, 2011, Hygeia entered into an Exclusive Development Collaboration Agreement with Ferndale Pharma Group, Inc. (“Ferndale”), an experienced developer, manufacturer and formulator of cosmeceutical products. The relationship with the Ferndale focused on the development of one of Hygeia’s estrogenic compounds for topical skin use as a remedy for aging skin. Hygeia identified the compound as “CL-214”.

As a result of that work, and in an effort to better position itself for a financing, Hygeia reorganized and separated into two companies. Effective as of October 20, 2011, Hygeia and Canterbury entered into an Agreement and Plan of Reorganization and Separation (the “Reorganization Agreement”). In accordance with the Reorganization Agreement, Hygeia spun out Canterbury creating two (2) side-by-side companies with than identical equity ownership. In connection with the reorganization, the exclusive license that Hygeia had entered into with Yale University was separated and all of the patent rights and other intellectual property rights related to the development of non-prescription, non-Food and Drug Administration (“FDA”) regulated products were transferred to Canterbury. All of the patent rights and other intellectual property rights related to the development of prescription, FDA approved products remained with Hygeia.

The Businesses’ Overview

Canterbury is engaged in the premium cosmeceutical business. Cosmeceuticals are sometimes described as cosmetic products with “drug-like benefits”. Generally, cosmeceuticals are products sold over-the-counter, without the regulatory requirement of FDA approval. Since the products are not FDA approved, medical benefits cannot be either claimed or discussed. The development of cosmeceuticals is short and typically ranges from twelve (12) to eighteen (18) months.

With the rise of a more knowledgeable, wealthy and beauty-conscious class of urban consumers, management believes that cosmeceuticals have become one of the fastest growing cosmetic options and include products for skin care, hair care, sun care, lip care, foot care, tooth and gum care. Through an analysis of the developments taking place globally, management believes that the market is presently dominated by skin care and hair care cosmeceuticals.

Hygeia is engaged in the prescription dermatology and prescription women’s health business. All prescription drugs must gain FDA approval before commercialization. Typically, the development of prescription drugs can take anywhere from five to nine years. The Hygeia pipeline consists of two lead compounds. One compound is under development for vulvar and vaginal atrophy and skin fragility, conditions affecting menopausal women through senescence due to the absence of estrogen. The other lead compound is under development for the treatment conditions of androgen excess e.g. acne, male-pattern baldness (androgenic alopecia) and hirsutism (unwanted excess hair).

| 4 |

Hormonal aging radically affects the mucous membranes, skin and hair of women in menopause due to loss of estrogen which affects how women look and feel and their sexual activity.

| · | Management believes it is an urgent problem for women. As a result, many women are purchasing anti-aging products at a high rate into their seventies, which management believes makes anti-aging products the fastest growing segment in all personal care categories. | |

| · | Management believes competitive products are unworkable: currently available prescription hormone replacement comes with risks and current Over-The-Counter (“OTC”) products are ineffective because they do not address the root problem. | |

| · | Management believes that the markets are underserved: products that ‘speak’ to the urogenital, skin and hair changes that women experience in the menopausal years to senescence are few. Marketing portrays 45+ women as old and these women, who feel dynamic and spirited, don’t relate. |

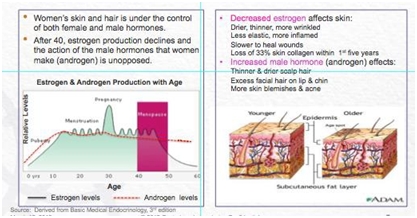

There is a scientific reason for women’s concerns. Aging accelerates for women when they go through menopause. When women enter menopause, the effects of aging accelerate in estrogen-dependent tissues such as the urogenital region, skin and hair. After the age of forty (40), estrogen production declines and the action of male hormone that women make (androgen) is unopposed. This change of control of both male and female hormones has profound effects on skin and hair as shown below:

Management believes that more women are experiencing the effects of pre- and post-menopause; there are 64.5 million U.S. women over 45 years of age and this group will grow +5.4% by 2015.

| 1. | The Solution |

Management believes that the Canterbury and Hygeia compounds are unique, safe and effective. Our technology creates so-called “soft” modulators of estrogen and androgen hormone receptors. In scientific terminology, “soft” means that the active ingredient has a predictable route of metabolism. Designed to convert rapidly to inactive metabolites, these novel and patent-protected molecules deliver strong topical effects on skin and mucous membranes without the potential for undesirable systemic side effects, irritation or toxicity seen with some currently marketed prescription hormone replacement drugs and cosmeceuticals. Management believes that this characteristic will allow for use of our products safely over body surface areas for the long term and at concentrations that will be highly effective.

| 5 |

Why management believes the compounds are safe. Chemically engineered as esters in the laboratory of Dr. Richard Hochberg at the Yale Medical School, all of our principal performance ingredients, estrogens and anti-androgens, undergo predictable metabolism to single inactive metabolites. After topical application they are absorbed and broken down by enzymes below the skin surface. The hydrolytic enzymes (esterases) below the skin and mucous membrane surfaces in body fat and blood breakdown our products into single inactive acid metabolites and, as acids, are rapidly excreted from the body.

Why management believes the compounds are effective: Hormonal aging affects all women. Science has long established that estrogen plays a vital role in support of total body collagen. Collagen is the main connective tissue that holds us together. It is a vital component of most structures in the body and plays a very important role in the support of skin and other tissues. Collagen support begins to decline at age forty (40) during peri-menopause, and accelerates with the onset of menopause. Within five (5) years after the onset of menopause, a woman will lose approximately 33% of her skin collagen. Estrogen supports collagen synthesis through its receptors, tiny “locks” that exist all over the body which are activated by “keys”, the estrogen molecule. These receptors are known to exist on skin. In fact, there are more estrogen receptors in facial skin than the skin of many other parts of the body. The decline in estrogen also makes skin drier and causes inflammation (redness). When circulating androgen is unopposed by sufficient levels of estrogen, the skin becomes more prone to blemishes, unwanted thick hairs appear on the chin, upper lip and sideburn areas and scalp hair thins. In fact, 50% of menopausal women will notice excessive, permanent hair loss (androgenic alopecia).

Management believes that the solution for aging skin deprived of estrogen and being exposed to unopposed circulating androgen is to offer another set of “keys” with our unique proprietary ingredients as shown below:

| 2. | The Regulatory Environment. |

The FDA defines the differences between a cosmetic/cosmeceutic and a drug as follows:

Cosmetic: “articles intended to be rubbed, poured, sprinkled or sprayed on, introduced into, or otherwise applied to the human body….for cleansing, beautifying, promoting attractiveness, or altering the appearance” [FD&C Act, sec. 201(i)].

Drug: “intended for use in the diagnosis, cure, mitigation, treatment, or prevention of disease” and “intended to affect the structure of any function of the body” [FD&C Act, sec. 210(g) (1)].

| 3. | Intellectual Property |

We have the exclusive license to three (3) patents (together “Yale Patents”):

U.S. Patent No. 7,015,211. 15.alpha.-Substituted Estradiol Carboxylic Acid Esters as Locally Active Estrogens Richard Hochberg, Inventor. Submitted March 9, 2004; granted March 21, 2006; expires March 9, 2024.

U.S. Patent No. 6,476,012. Estradiol-16.alpha Carboxylic Acid Esters as Locally Active Estrogens Richard Hochberg, Inventor. Submitted January 23, 2002; granted November 5, 2002; expires January 23, 2022.

U.S. Patent No. 8,552,061 Locally Active “Soft” Anti-Androgens Submitted May 2, 2008; granted October 8, 2013; expires May 2, 2028.

For all patents, strong freedom-to-operate opinions have been rendered and patent strategies developed.

| 6 |

| 4. | Scientific Summary |

Our scientific studies have shown that our “soft estrogenic” compounds for vulvar and vaginal atrophy, skin fragility and skin aging are both safe and effective.

| · | All of our principal performance ingredients exhibit varying degrees of attraction to the estrogen receptor and all have varying degrees of ability to activate the receptor. |

| · | All of our principal performance ingredients are capable of stimulating cellular repair and increasing the synthesis of skin cells. |

| · | All of our principal performance ingredients are susceptible to hydrolysis (rapid breakdown occurs in less than 20 minutes) indicating that all are safe and do not have systemic effects. |

Our data indicates that our estrogenic compounds will help the skin in two (2) different ways: genomically (DNA-related) and non-genomically (non-DNA related). The estrogenic compounds are safe, and devoid of systemic exposure. Genomically, they act on DNA to maintain skin structure and thickness by maintaining elastin and collagen and maintain blood flow to the skin by increasing the production of new blood vessels. Non-genomically, our proprietary estrogenic compounds will reduce inflammation and redness, inhibit the breakdown, increase moisture and decrease the incidence of facial hair and blemishes.

A topical, safe anti-androgen can safely and effectively treat excess androgen stimulation of the pilosebaceous unit of the skin and scalp. Excess androgen stimulation results in blemishes, oiliness, hair loss/thinning and unwanted facial hair. Scientific studies conducted with our “soft” anti-androgen have shown a strong safety and efficacy profile:

| · | Significant blockade of topical androgen-dependent tissue in an animal model of anti- androgen sensitivity without effects on androgen dependent internal tissues. |

| · | Potent inhibition of the androgen receptor. |

| · | Rapid breakdown to an inactive metabolite in human plasma. |

| · | Melting point close to that of human skin making it very permeable to the pilosebaceous unit where the oil glands and the hair follicles reside. |

Canterbury Laboratories

Canterbury currently has a cosmeceutical product program based on the16α- carboxylic acid esters of estrogen. This program is currently called, Nextgen Estrogenics.

Ferndale and Canterbury Laboratories

To begin the process of understanding the licensed compounds for cosmeceutical application, Canterbury entered into an Exclusive Development Collaboration (“EDC”) with Ferndale to select a lead product from Canterbury portfolio of ten (10) topical assets. Pursuant to the EDC, Ferndale performed early development studies to identify a lead dermaceutical candidate suitable for aging skin. As a result of the studies, a lead product, which Canterbury refers to as “CL-214” was selected and will be developed and commercialized by Ferndale Pharma Group’s Biopelle Division for sale through the offices of physicians, healthcare providers and plastic surgeons.

Ferndale is a privately owned company located in Ferndale, Michigan. Established in 1897, Ferndale is a holding company operating through six (6) specialty healthcare companies all focused on offering high-value prescription and over-the-counter products treating a wide variety of medical disorders ranging from benign anorectal disorders to skin conditions. Ferndale has over thirty (30) years of experience manufacturing topical Rx and OTC drugs, medical devices and cosmeceuticals for both domestic and international distribution.

| 7 |

Following the completion of the EDC studies, Canterbury, on March 22, 2012, entered into a Sublicense Agreement (the “Sublicense”) with Ferndale for the formulation, manufacture, sale and marketing of CL-214 within Ferndale’s established marketing channel for cosmeceuticals, which are the offices of surgeons, physicians and other health care providers (the “Distribution Channel”). Ferndale is responsible for all costs and expenses associated with developing marketing products for sale through the Distribution Channel. The Territory is the world.

In consideration of Canterbury entering into the Sublicense, Ferndale has agreed to pay to Canterbury the following amounts on a country by country basis:

| A. | Royalties |

Ten (10%) percent of Net Sales of products sold within the Territory where the Yale Patent is valid and in force; Four and One-Half (4 ½ %) percent of Net Sales sold within the Territory when the Yale Patent has expired and Two (2%) percent of Net Sales when the Yale Patent has been held invalid by final judgment of a court of competent jurisdiction.

| B. | Use Fee |

i. One Hundred Thousand ($100,000) Dollars payable within thirty (30) days following the first commercial sale of a product in the United States and Canada;

ii. Twenty Thousand ($20,000) Dollars payable within thirty (30) days following the first commercial sale of a product in each of the following countries: (a) Germany, (b) France, (c) United Kingdom, (d) Japan and (e) Brazil; and

iii. Any fees received by Ferndale from a distributor or other comparable party during the Term shall be divided equally and paid by Ferndale to Canterbury when received.

| C. | Sales Milestone Payments |

i. One Hundred Thousand ($100,000) Dollars at such time as the trailing twelve (12) months of Net Sales in any country in the Territory first exceeds One Million ($1,000,000) Dollars;

ii. Two Hundred Thousand ($200,000) Dollars at such time as the trailing twelve (12) months of Net Sales in any country in the Territory first exceeds Five Million ($5,000,000) Dollars; and

iii. Four Hundred Thousand ($400,000) Dollars at such time as the trailing twelve (12) months of Net Sales in any country in the Territory first exceeds Ten Million ($10,000,000) Dollars.

For purposes of the Ferndale Sublicense Agreement, the United States and Canada are considered to be one (1) country. Net Sales has the customary definition with the usual and standard permitted deductions provided, however, that under no circumstances can the aggregate deductions from gross sales exceed Seven and One-Half (7 ½ %) percent of the gross amount actually received by Ferndale or an Affiliate. None of the amounts described above have yet been paid to Canterbury. Ferndale has, to date, neither developed nor begun marketing any product covered by the Sublicense.

In addition to the Sublicense, Canterbury and Ferndale have agreed to enter into a Supply Agreement on commercially reasonable terms pursuant to which Ferndale has committed to purchase all of its required supply of CL-214 from Canterbury at Canterbury’s cost of raw material and directly related costs and expenses. The Supply Agreement has not yet been executed and the terms have not been finalized.

| 8 |

The term of the Sublicense, which is subject to the terms and conditions of the Yale License, will continue in full force and effect until the last of the claims in the Yale Patents expire, lapse or are declared to be invalid by a non-appealable decision of a court of competent jurisdiction. Ferndale may voluntarily terminate the license upon ninety (90) days prior written notice to Canterbury. Further, either party, upon thirty (30) days prior written notice and the failure to correct within that time period, may terminate the Sublicense upon the occurrence of a material breach or a default by the other party. Finally, either party may immediately terminate the Agreement if the other party is adjudged a bankrupt, becomes insolvent or enters into a composition with its creditors or if a receiver is appointed.

The Sublicense with Ferndale is Canterbury’s first collaboration. Canterbury believes, but has not established, that there are multiple distribution and marketing channels available for its products, from direct retail sales to consumers to infomercials and the internet. With additional resources and qualified partners and collaborators, Canterbury intends to explore all of these options. To date, Canterbury has not negotiated any agreements other than the Sublicense with Ferndale.

The Cosmeceutical Market for Aging Skin

Management believes that skin care is one of the most important categories in the global beauty and personal care industry. Anti-aging products continue to be a significant market performer, showing consistently high increases in revenue over the last five (5) years. While spending has curbed since the economic decline in late 2008, skin care products are one area of consumption that has not generally been negatively affected. Growth in the cosmeceuticals market worldwide is primarily attributed to the aging population in the United States and across the globe. Market gains are driven by a highly receptive, fast-expanding group of middle-aged customers who want to prevent and redress visible damage to the skin caused by aging, sun damage and other environmental stressors. There is also an increase in disposable income in emerging markets like Asia and South America. (Euromonitor: 2011)

For women in their late 40’s and early 50’s, aging accelerates due to the hormonal changes of menopause. Management believes that women’s top fear of aging is losing attractiveness. Many women are experiencing these fears, with 51 million U.S. women between the ages of forty-five and seventy (45-70).

Anti-aging is no longer just about reducing fine lines and minimizing wrinkles but in having skin that is hydrated, evenly toned, textured and supple. Management believes that today’s consumer wants a product that addresses all seven (7) signs of aging: dehydration, fine lines, wrinkles, skin discoloration, large pores, loss of elasticity and fullness. The product(s) that can address all of these issues and is correctly priced will succeed. Anti-aging is fueling the fast-growing cosmeceutical market; these women are actively seeking solutions for aging skin and hair. Anti-aging is the fastest growing segment of the personal care and cosmeceutical industries. Cosmeceutical anti-aging skincare is the fastest growing segment, projected to grow to $3.7 Billion by 2016 with +8. 3% Compound Annual Growth Rate (“CAGR”) (2010-2016, Mintel).

Canterbury believes that the science and technology behind the development of CL-214, and other members of our product portfolio, have the potential to make Canterbury a market leader by focusing on a plan that maximizes the value of its unique portfolio of assets:

| · | The need: For women in their late 40’s and early 50’s, aging accelerates due to the hormonal changes of menopause. Women’s top fear of aging is losing attractiveness. Many women are experiencing these fears, with 51 million U.S. women between the ages of forty-five and seventy (45-70). |

| · | Canterbury’s Solution: Canterbury’s proprietary ingredients bring a new, differentiated benefit to the anti-aging market. Our ingredients safely halt and reverse age-related hormonal changes in women’s skin and hair. Unlike other anti-aging topical cosmeceuticals, Canterbury’s ingredients act only at the point of application, are non-irritating and spare internal organs from unnecessary systemic exposure. |

| 9 |

| · | Anti-aging is fueling the fast-growing cosmeceutical market: These women are actively seeking solutions for aging skin and hair. Management believes that anti-aging is the fastest growing segment of the personal care and cosmeceutical industries. Cosmeceutical anti-aging skincare is the fastest growing segment, projected to grow to $3.7 Billion by 2016 with +8. 3% CAGR (2010-2106, Mintel). |

| · | Competition: Despite the growth in cosmeceuticals, many of the current anti-aging topical products are either ineffective, unsafe or both. As is the case with the retinoids, their effectiveness is limited by constraints on how much can be applied to skin without causing photo-sensitivity to the sun’s rays and irritation. |

| · | Canterbury’s products can fit multiple product segments: Canterbury’s ingredients can be formulated for multiple cosmeceutical applications where the total addressable U.S. market is $5.5 billion. Canterbury is focused on the cosmeceutical skin and hair care segments where the addressable U.S. market is $2.3 billion and $550 million, respectively. |

| · | Canterbury’s business plan maximizes the value of the ingredients and creates a large and growing business in skin and hair care: Canterbury’s plan is sequenced to attack the largest cosmeceutical market quickly with a unique benefit of halting and reversing the effects of aging, then accelerating growth in other key segments while leveraging current brand and channel assets. |

Current Status of Canterbury’s Products

Canterbury’s first product for aging skin, CL-214, will initially be sold and marketed by Ferndale Pharma Group through physican offices and medi-spas world-wide. Key findings in the synthesis and scale-up manufacturing of CL-214 have opened up opportunities for new patents. Preparation for manufacturing is expected to be completed in the second quarter of 2014 and the first batch of CL-214 will then start formulation development. Management believes that the product will be ready for Ferndale’s launch following human skin assessment studies in the fourth quarter of 2014.

Hygeia Therapeutics

Development Programs

HYG-102, the lead estrogenic candidate, is a member of the 15 alpha-carboxylic acid esters of estrogen, HYG-102, is under development for the topical treatment of skin aging (thinning and fragility) and vulvar and vaginal atrophy. HYG-102 is the first estrogenic drug candidate engineered to be rapidly deactivated to non-estrogenic metabolites by hydrolytic enzymes and represents a new generation of effective estrogens. In animal models, HYG-102 has strong estrogenic effects at the site of application but no effect on the most estrogen-sensitive systemic tissues even at high multiples of the locally effective dose. These observations are consistent with rapid formation of inactive metabolites. The expected major metabolite, HYG-103, has no detectable estrogenic effects in vitro.

Key findings to date in estrogen-deficient animals demonstrate superior safety over estradiol. HYG-102 has no impact on uterine tissues even at supra-therapeutic doses administered intravaginally (50x therapeutic dose) or subcutaneously (300x therapeutic dose). These studies indicate a favorable therapeutic index relative to currently marketed estrogen containing products. Half-life following intravaginal dosing is 20 minutes. In human keratinocytes, which comprise 90% of epithelium, HYG-102 was significantly proliferative. A proprietary model of human skin thickness (Living Skin Equivalency Model) demonstrated that HYG-102 elicited a positive trend toward increased thickness. These studies bode well for efficacy in the treatment of age-related skin fragility.

| 10 |

HYG-440 is our lead anti-androgenic candidate for the topical treatment of acne, hirsutism and androgenic alopecia. HYG-440 has strong androgen-receptor affinity and can inhibit androgenic effects of co-administered androgens in rat cells transfected with androgen receptors. The expected major metabolite has no detectable androgen-receptor affinity or ability to interfere with the androgenic effects of endogenous androgens. In vivo proof-of-concept studies will start shortly in the Syrian hamster. Hygeia recently shortened the synthesis route of HYG-440 from 7 steps to 2 steps creating a potential for a new process patent.

HYG-102440 is a combination product of HYG-102 and HYG-440 and will be developed for the topical treatment of hair loss due to increased hair follicle sensitivity to androgens.

Product Rationale

HYG-102: Estrogens are known to support skin health by maintaining skin thickness, elasticity and moisture content in both men and women. Estrogen levels and skin thickness and elasticity decline with age. Skin loses half of its elasticity by age 60 and continues to decline with age. Clinically, thinning skin leads to delicate wrinkles, ease of bruising and tearing, poor wound healing and sensitivity to cold. Vaginal wall atrophy, a condition that significantly reduces quality of life, affects 47% of women within three years of menopause and approaches 100% over time. The profound effects of estrogens on skin were known long before it was discovered that estrogen receptors are present in all epithelial tissues but most abundant in skin and the uterus. Decades after estrogens were first used over-the-counter (OTC) in facial creams, shampoos and hair conditioners to restore and maintain skin and hair health, unwanted estrogenic side effects were linked to the use of those products. In 1994, safety concerns finally led to the removal of all estrogens and other hormone-containing OTC products in the U.S. Less than ten (10) years later, the use of estrogen-containing prescription products was associated with an increased risk of cancer and cardiovascular disease. These risks associated with estrogen use have made many doctors and patients hesitant to use estrogens to manage aging skin and vaginal and vulvar atrophy associated with low estrogen.

HYG-440: Excess testosterone-like hormones in the skin of both men and women can lead to the overproduction of sebum which can block skin pores and lead to localized infection and inflammation. An anti-androgen applied to the skin can block the actions of testosterone-like hormones and heal acne. In some women, excess skin androgen (testosterone-like hormones) can lead to unwanted localized hair growth (hirsutism). An anti-androgen applied to those skin areas can greatly minimize excess body hair growth caused by excess androgens in the skin. Paradoxically, excess androgen in the scalp can cause androgenic alopecia or baldness and is the most common cause of hair loss affecting both men and women. An anti-androgen applied to the scalp at the first signs of thinning can block the actions of testosterone-like hormones. Hair thinning in some women coincides with menopause when estrogen levels decrease and androgen levels increase. Therefore, a combination product of HYG-102 and HYG-440 (HYG-102440) would be expected (but has not yet been established), to be more effective in those women than an anti-androgen alone.

Market Potential

VVA: Vulvar and vaginal atrophy (VVA) is a urogenital disorder caused by a decrease in estrogen, typically occurring during menopause. When estrogen levels are low, the tissues of the vulvar vaginal region become less moist and the elastic and collagen fibers that give the vaginal wall stretch and stretchiness decreases in number. The skin of the opening becomes thinner and less protective. Thus, the vulvar and vaginal region becomes painful to intercourse and there is an increased incidence of urinary tract infections. In extreme cases, thinning of the tissue can lead to tiny abrasions that cause the sides of the vaginal opening to stick together and the opening may become fused closed. The VVA market is in need of a product with lower systemic activity since treatment guidelines issued by the FDA favor estrogenic products with lower systemic effects. Management believes that only 1 in 4 women with VVA symptoms are being treated because of safety concerns of currently marketed estrogen-containing products. Prevalence, severity and awareness of the condition is increasing as the population ages. Women spend 1/3 of their lives in menopause. Management believes that the post-menopausal VVA market in the US is currently approximately $1,022 billion. The CAGR has grown by 8.8% over the past 5 years and the world-wide market is expected to grow to $3 billion dollars by 2019.

| 11 |

Aging Skin (Skin Fragility): Currently, there are no preventative treatments for age-related skin fragility (thinning), bruising, and slow healing. Severe skin-thinning seen in nursing home patients often leads to skin tearing which can take 10-21 days to heal and increases nursing care costs for institutions, individuals and the community. Estrogen-containing hormone replacement therapy has been shown to improve skin thickness and elasticity, but is not approved for this purpose due to systemic side effects. HYG-102 has the potential to penetrate and expand the world-wide aging skin market in all adult age groups.

Acne, Alopecia and Hirsutism: The world-wide anti-acne market is $2.8 billion and constitutes the largest prescription market in dermatology. Currently available prescription anti-acne products are associated with undesirable side effects e.g., skin irritation, photosensitivity, hypopigmentation and GI-upset. There are no other known non-systemic “soft” topical anti-androgens in development. Hirsutism affects about 10% of the female population and Americans spend $1 billion dollars annually for the removal of unwanted hair. Androgenic baldness is a greatly underserved market and is primed for a safe, effective, non-invasive treatment. It affects both men and women and women constitute nearly half of the hair-loss market. In the U.S. alone, consumers spend $1.2 billion annually on topical treatments for thinning hair. This market is greatly underserved for safe and non-invasive remedies.

Current Status of Hygeia Products

Hygeia’s “soft estrogen” and “soft anti-androgen” have completed in vitro and in vivo proof-of-concept studies in widely accepted tissue and animal models. Chemical synthesis process development for both HYG-102, the “soft” analog of 15 alpha-carboxylic acid esters of estrogen and HYG-440, the “soft anti-androgen, have opened up new patent strategies. Both development programs will run in parallel. In the first quarter of 2014, we intend to scale up manufacturing and start formulation development for HYG-102 and HYG-440. This will be largely completed by the third quarter of 2016. Drug metabolism, pharmacokinetic testing (DMPK), toxicology studies and IND (“Investigative New Drug” application) will extend from the second quarter 2014 to the third quarter of 2014. It is anticipated that successful completion of DMPK and toxicology studies for HYG-102, will open up a Physician IND for the treatment of age-related skin fragility. Similarly, successful completion of the same for HYG-440 for acne will enable a Physician IND for the treatment of hirsuitism and alopecia. Management believes clinical studies for the treatment of VVA and acne will commence during the first quarter of 2016 and an NDA (new drug application) for HYG-102 and HYG-440 will be filed by 2018.

Employees

As of the Effective Date, the Canterbury Group had two employees, both of whom are full time employees. None of our employees is represented by a collective bargaining agreement. We consider our relations with our employees to be good.

Facilities

The Canterbury Group currently has no permanent executive offices and no lease obligations.

Legal Proceedings

We are not involved in any pending or threatened legal proceedings.

Forward-Looking Statements

This Current Report on Form 8-K and other written and oral statements made from time to time by us may contain so-called “forward-looking statements,” all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

| 12 |

Information regarding market and industry statistics contained in this Current Report on Form 8-K is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources, and cannot assure investors of the accuracy or completeness of the data included in this Current Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not assume any obligation to update any forward-looking statement. As a result, investors should not place undue reliance on these forward-looking statements.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion should be read in conjunction with the other sections of this Current Report on Form 8-K, including “Risk Factors,” “Description of the Businesses of Canterbury and Hygeia” and the Financial Statements attached hereto as Item 9.01 and the related exhibits. The various sections of this discussion contain a number of forward-looking statements, all of which are based on our current expectations and could be affected by the uncertainties and risk factors described throughout this Current Report on Form 8-K as well as other matters over which we have no control. See “Forward-Looking Statements.” Our actual results may differ materially.

Recent Events

On November 18, 2013, we completed the Mergers pursuant to which we acquired all of the capital stock of Canterbury and Hygeia, which became our wholly owned subsidiaries. In connection with the Mergers, we succeeded to the businesses of Canterbury and Hygeia as our sole lines of business. The Mergers are being accounted for as a recapitalization. Canterbury and Hygeia are the acquirers for accounting purposes and we are the acquired company. Accordingly, Canterbury’s and Hygeia’s historical financial statements for periods prior to the acquisition have become those of the registrant retroactively restated for, and giving effect to, the number of shares received in the Mergers. Operations reported for periods prior to the share exchange are those of Canterbury and Hygeia.

The following discussion relates to the operations of Canterbury and Hygeia and should be read in conjunction with the Notes to Financial Statements.

History of Business

Hygeia Therapeutics, Inc. (“Hygeia”), a Delaware Corporation, based in Holden, Massachusetts was formerly known as Orcas Therapeutics, Inc. It was incorporated on November 14, 2005 to acquire and develop biodegradable hormone receptor modulators for topical indications. Hygeia is focused on developing topical therapies for conditions where localized treatments offer advantages over systemic therapies. It also conducts testing on drugs including topical synthetic estrogen and anti-androgen.

Hygeia has signed an Exclusive License Agreement (the “Yale License”) with Yale University (“Yale”) under U.S. Patent 7,015,211“15.alpha.-Substituted Estradiol Carboxylic Acid Esters as Locally Active Estrogens,” U.S. Patent 6,476,012 “Estradiol-16.alpha Carboxylic Acid Esters as Locally Active Estrogens” and U.S. Patent 8,552,061 “Locally active "soft" antiandrogens” (“Yale Patents”). Hygeia agreed to pay royalty fees to Yale quarterly beginning in the first calendar quarter in which net sales occur.

| 13 |

Canterbury Laboratories, LLC (the “Canterbury”), is a Delaware Limited Liability Company that was formed on October 14, 2011 and began operations on February 22, 2012. Initially, the Company was a wholly owned subsidiary of Hygeia Therapeutics, Inc. (“Hygeia”). Canterbury is engaged in the premium cosmeceutical business. Cosmeceuticals are the latest addition to the health industry and are sometimes described as cosmetic products with “drug-like benefits”. Generally, cosmeceuticals are products sold over-the-counter, without the regulatory requirement of FDA approval.

A reorganization and separation agreement was signed on October 14, 2011 between Canterbury and Hygeia under which Hygeia received 100% of all issued and outstanding units of all classes of limited liability company membership interests of Canterbury. Hygeia distributed these profit units to holders of its common and preferred stock, with each holder of one share of common or preferred stock in Hygeia given one profit unit in Canterbury. Further, 720,821 shares were issued to the Hygeia’s non-qualifying stock option (“NSO”) holders to liquidate the 720,821 shares of outstanding NSO’s. Holders of Hygeia stock purchase warrants for 1,782,901 shares were issued in exchange an equal number of units of Canterbury stock purchase warrants. Pursuant to the license agreement 1,606,035 shares of Series A convertible preferred stock was issued to Yale University for the Yale License. In February 2012, Hygeia assigned its rights and obligations related to non-prescription products under the Yale License to Canterbury.

As of July 31, 2013, equity holders of Hygeia held 94% of the membership units of Canterbury. Accordingly, the financial results of Hygeia and Canterbury are presented herein on a combined basis and the combination of Hygeia and Canterbury will be referred to herein as the “Company” or “Canterbury Group.”

OPERATIONS

Overview

Canterbury is engaged in the premium cosmeceutical business. Cosmeceuticals are the latest addition to the health industry and are sometimes described as cosmetic products with “drug-like benefits.” Generally, cosmeceuticals are products sold over-the-counter, without the regulatory requirement of FDA approval. Since the products are not FDA approved, medical benefits cannot be either claimed or discussed.

With the rise of a more knowledgeable, wealthy, and beauty-conscious class of urban consumers, management believes that cosmeceuticals have become one of the fastest growing cosmetic options and include products for skin care, hair care, sun care, lip care, foot care, tooth and gum care. Through an analysis of the developments taking place globally, management believes that the market is presently dominated by skin care and hair care cosmeceuticals.

Hygeia is engaged in the prescription dermatology and prescription women’s health business. All prescription drugs must gain FDA approval before commercialization. Typically, development of prescription drugs can take anywhere from five to nine years. The Hygeia pipeline consists of a two lead compounds. One compound is under development for vulvar and vaginal atrophy and skin fragility, conditions affecting menopausal women through senescence due to the absence of estrogen. The other lead compound is under development for the treatment conditions of androgen excess e.g. acne, male-pattern baldness and hirsutism.

| 14 |

Market

Women will spend approximately one-third of their life in menopause. Hormonal aging radically affects their mucous membranes skin and hair due to loss of estrogen which affects how women look and feel and their sexual activity.

Management believes it is an urgent problem for women. As a result, many women are purchasing anti-aging products at a high rate into their seventies, which management believes makes anti-aging the fastest growing segment in all personal care categories. Management believes competitive products are unworkable: Currently available prescription hormone replacement comes with risks and current OTC products are ineffective by not addressing the root problem. Management believes that the markets are underserved: Products that ‘speak’ to the urogenital, skin and hair changes that women experience in the menopausal years to senescence are few. Marketing portrays 45+ women as old and these women, who feel dynamic and spirited, don’t relate.

There is a scientific reason for women’s concerns. Aging accelerates for women when they go through menopause. When women enter menopause, the effects of aging accelerate in estrogen-dependent tissues such as the urogenital region, skin and hair. After the age of forty (40), estrogen production declines and the action of male hormone that women make (androgen) is unopposed. Management believes that more women are experiencing the effects of pre- and post-menopause; there are 64.5 million U.S. women over 45 years of age and this group will grow +5.4% by 2015.

Products

Management believes that the Canterbury and Hygeia compounds are unique, safe and effective. Our technology creates so-called “soft” modulators of estrogen and androgen hormone receptors. In scientific terminology, “soft” means that the active ingredient has a predictable route of metabolism. Designed to convert rapidly to inactive metabolites, these novel and patent-protected molecules deliver strong topical effects on skin and mucous membranes without the potential for undesirable systemic side effects, irritation or toxicity seen with some currently marketed prescription hormone replacement drugs and cosmeceuticals. Management believes that this characteristic will allow for use of our products safely over body surface areas for the long term and at concentrations that will be highly effective.

Chemically engineered as esters in the laboratory of Dr. Richard Hochberg at Yale Medical School, all of our principal performance ingredients undergo predictable metabolism to single inactive metabolites. After topical application they are absorbed and broken down by enzymes below the skin surface. The hydrolytic enzymes (esterases) below the skin and mucous membrane surfaces in body fat and blood breakdown our products into single inactive acid metabolites and, as acids, are rapidly excreted from the body.

Hormonal aging affects all women. Science has long established that estrogen plays a vital role in support of total body collagen. Collagen is the main connective tissue that holds us together. It is a vital component of most structures in the body and plays a very important role in the support of skin and other tissues. Collagen support begins to decline at age forty (40) during peri-menopause, and accelerates with the onset of menopause. Within five (5) years after the onset of menopause, a woman will lose 33% of her skin collagen. Estrogen supports collagen synthesis through its receptors, tiny “locks” that exist all over the body which are activated by “keys,” the estrogen molecule. These receptors are known to exist on skin. In fact, there are more estrogen receptors in facial skin than the skin of many other parts of the body. The decline in estrogen also makes skin drier and causes inflammation (redness). When circulating androgen is unopposed by sufficient levels of estrogen, the skin becomes more prone to blemishes, unwanted thick hairs appear on the chin, upper lip and sideburn areas and scalp hair thins. In fact, 50% of menopausal women will notice excessive, permanent hair loss (androgenic alopecia). Management believes that the solution for aging skin deprived of estrogen and being exposed to unopposed circulating androgen is to offer another set of “keys” with our unique proprietary ingredients.

| 15 |

Description of our Revenues, Costs and Expenses

Revenues

Past revenues were derived from fees received under an Economic Development Collaboration (“EDC”) done with Ferndale Pharmaceuticals. Future revenues are expected to consist of development fees, licensing fees and product sales.

Gross Profit (loss)

Our gross profit represents revenues less the Cost of Sales (“COS”). Past COS were for development and testing expenses paid to third parties for work performed under the EDC. Future COS are expected to be costs related to licensing fees and product costs.

Operating Expenses

Our selling, general and administrative expenses include personnel, travel, office and other costs for development and administrative functions of the Company. Legal and professional services are paid to outside attorneys, auditors and consultants are broken out separately given the size of these expenses relative to selling, general and administrative expenses. Operating expenses also include research and development expenses

Interest Expense

Our interest expense results from accruing interest on loans payable and notes payable.

Critical Accounting Policies

Goodwill and Intangible Assets

The intangible asset is the value of the $175,000 the Company paid for Yale License in 2011, net of amortization. The Company reviewed the value of the intangible asset as part of its annual reporting process. To review the value of the intangible asset and December 31, 2012 and 2011, the Company followed ASC Topic 350 “Intangibles- Goodwill and Other Intangible Assets” and first examined the facts and circumstances for the asset to determine if it was more likely than not that an impairment had occurred. The Company then compares discounted cash flow forecasts related to the asset with the stated value of the asset on the balance sheet. The objective is to determine the value of the intangible asset to an industry participant who is a willing buyer not under compulsion to buy and the Company is a willing seller not under compulsion to sell. Based on this process, the Company determined that the value of the intangible asset was not impaired as of December 31, 2012 and 2011 or September 30, 2013.

The forecast for the revenue streams associated with the intangible asset were discounted at a range of discount rates determined by taking the risk-free interest rate at the time of valuation, plus premiums for equity risk to small companies in general, for factors specific to the Company and the business for a total discount rate of 24%. Terminal values were determined by taking cash flows in year five of the forecast, then applying an annual growth of 2% and discounting that stream of cash flows by the discount rate used for that section of the business.

Revenue Recognition

The Company performs research to develop prescription pharmaceuticals and also develops the compound for incorporation into a non-prescription, cosmeceutical product formulation ("Product") under EDC. The EDC party agreed to pay the Company the costs and expenses associated with the contract and fees for management services provided by the Company. Revenue is recognized when each sub-project of the product research is completed and delivered. Royalty revenue would be paid pursuant to the EDC agreement for ultimate product sales.

| 16 |

Income Taxes

The Company utilizes ASC Topic 740 “Accounting for Income Taxes,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that were included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. The provision for income taxes represents the tax payable for the period and the change during the period in deferred tax assets and liabilities.

Canterbury is a limited liability partnership for tax purposes and income and losses are distributed to the members. Hygeia is a C Corporation for tax purposes and Hygeia utilizes ASC Topic 740 “Accounting for Income Taxes,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. As of December 31, 2012, the Company had a deferred tax asset of $723,901 that was fully reserved and a net operating loss carryforward of $1,809,752 for Federal and state tax purposes. As of September 30, 2013, the Company had a deferred tax asset of approximately $775,000 that was fully reserved and a net operating loss carryforward of approximately $1,940,000 for Federal and state tax purposes.

The ability of Hygeia to utilize these net operating loss carryforwards is subject to a number of conditions and significant changes in the ownership structure of Hygeia will significantly impact the availability of these net operating loss carryforwards to reduce taxable income in future periods.

Results of Operations for the Year Ended December 31, 2012

Revenues

Revenues for 2012 were $246,731, a decrease of $71,415 from $318,146 in 2011, when most of the work was performed for the Ferndale EDC. Future revenues are expected to increase with the addition of additional development work and the initiation of licensing fees from Ferndale as they establish and expand revenues from products licensed from the Company.

Gross Profit

Gross profit for 2012 was $123,357, a decrease of $169,464 from $292,821 in 2011 from cost of revenues in 2012 of $123,374 versus $25,325 in 2011. Future gross profits are expected to increase with the addition of licensing fees from Ferndale as they establish and expand revenues from products licensed from the Company.

Operating Expenses

G&A expenses in 2012 of $324,261 decreased by $30,055 from $354,316 in 2011, primarily related to a $12,500 reduction in travel expenses and a $8,700 reduction in supply expense. As the Company expands operations to develop its business, general and administrative expenses are expected to increase significantly.

| 17 |

Legal and professional services were $77,965 in 2012, a decrease of $17,140 from $95,105 in 2011 from reduced levels of contract and licensing work. As the Company expands operations to develop its business, legal and professional expenses are expected to increase significantly.

Research and Development (“R&D”) expense declined from $83,000 in 2011 to $0 in 2012 as the research work to establish the Ferndale EDC was completed in 2011. The Company intends to increase its R&D efforts in the future to continue development of its existing compounds and to develop new compounds.

Depreciation and amortization of $17,196 in 2012 increased by $12,747 from $4,449 in 2011 related to increased amortization of the amount paid for the Yale License.

Interest Expense

There was no debt outstanding during 2012 and 2011so there was no interest expense for these years.

Results of Operations for the Nine Months Ended September 30, 2013

Revenues

Revenues for the nine months ended September 30, 2013 (“2013 Interim Period”) were $127,167 compared with $80,245 of revenues for the nine months ended September 30, 2012 (“2012 Interim Period”) from increased activity for the Ferndale EDC. Future revenues are expected to increase with additional development work and the addition of licensing fees from Ferndale as they establish and expand revenues from products licensed from the Company.

Gross Profit

Gross profit for the 2013 Interim Period was $37,780 compared to $41,740 in gross profit for the 2012 Interim Period. Future gross profits are expected to increase with the additional development work and the addition of licensing fees from Ferndale as they establish and expand revenues from products licensed from the Company.

Operating Expenses

General and Administrative (“G&A”) expenses were $210,359 in the 2013 Interim Period, an increase of $62,937 from $147,422 in the 2012 Interim Period, primarily related to increased travel expenses of $25,750 and other expenses incurred to secure funding and develop business opportunities. As the Company expands operations to develop its business, G&A expenses are expected to increase significantly.

Legal and professional services were $329,224 in the 2013 Interim Period, an increase of $289,304 from $39,920 in the 2012 Interim Period primarily from an increase in legal expenses of $144,000 from expanded financing and contract efforts, consulting expenses of $92,500 for the development of a marketing and branding plan and $52,000 for outside accountants to prepare financial statements for 2011, 2012 and the nine months ended September 30, 2013. As the Company expands operations to develop its business, legal and professional expenses are expected to increase significantly.

Depreciation and amortization of $24,566 in the 2013 Interim Period increased by $15,838 from $8,728 in the 2012 Interim Period from increased amortization of the amount paid for the Yale License.

| 18 |

Interest Expense

Interest expense was $20,267 for the 2013 Interim Period as the Company incurred $715,000 of debt during this period. There was no debt or interest expense during the 2012 Interim Period.

Liquidity and Capital Resources

The report of our independent registered public accounting firm on the financial statements as of and for the years ended December 31, 2012 and 2011 contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern as a result of recurring losses, a working capital deficiency, and negative cash flows. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that would be necessary if we are unable to continue as a going concern.

As of September 30, 2013, our principal sources of liquidity consisted of accounts payable, accrued expenses and the issuance of debt and equity securities. In addition to funding operations, our principal short-term and long-term liquidity needs have been, and are expected to be, the settling of obligations to our creditors, the funding of operating losses until we achieve profitability, and general corporate purposes. In addition, commensurate with our level of sales, we will require working capital for sales and marketing costs to market our products and technologies, production expenses and inventory. At September 30, 2013, we had $129,672 of cash on hand and we had negative working capital of $322,277. At December 31, 2012 we had $6,673 of cash on hand and negative working capital of $470,515. At December 31, 2011 we had $48,090 of cash on hand and negative working capital of $369,999.

Cash Flows

The following table sets forth our cash flows for 2012 and 2011 and for the nine months ended September 30, 2013 and 2012:

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

| Operating activities | $ | (217,728 | ) | $ | 21,430 | $ | (567,977 | ) | $ | (118,500 | ) | |||||

| Investing activities | (1,349 | ) | (2,418 | ) | (3,650 | ) | (922 | ) | ||||||||

| Financing activities | 177,660 | 5,912 | 694,626 | 143,102 | ||||||||||||

| Net change in cash | $ | (41,417 | ) | $ | 24,924 | $ | 122,999 | $ | 23,680 | |||||||

Operating Activities

Operating cash flows for 2012 reflect our net loss of $296,065, offset by adjustments for non-cash items totaling $78,337 for $53,886 of accrued expenses, $17,196 for depreciation and amortization and $7,255 for prepaid expenses. Operating cash flows for 2011 reflect our net loss of $244,049, offset by adjustments for non-cash items totaling $265,479 for $217,115 of accrued expenses, $4,449 for depreciation and amortization and $43,915 for prepaid expenses.

Operating cash flows for the nine months ended September 30, 2013 reflect our net loss of $576,546, increased by a reduction for non-cash items of $673, consisting a use of $1,584 for accrued expenses and $24,566 for depreciation and amortization, offset by a use of cash of $23,655 for accounts receivable. Operating cash flows the nine months ended September 30, 2012 reflect our net loss of $154,330, offset by adjustments for non-cash items of $27,102 for accrued expenses and $8,728 for depreciation and amortization.

| 19 |

Investing Activities

Capital constraints limited cash used in investing activities of $1,349, $2,418, $3,650 and $922 for 2012, 2011, nine months ended September 30, 2013 and 2012, respectively.

Summary of Contractual Obligations

Set forth below is information concerning our known contractual obligations as of September 30, 2013 that are fixed and determinable by year.

| Beyond | ||||||||||||||||||||

| Total | 2013 | 2014 | 2015 | 2015 | ||||||||||||||||

| Convertible notes payable | $ | 715,000 | $ | – | $ | 715,000 | $ | – | $ | – | ||||||||||

| Accrued interest | 85,800 | 28,600 | 57,200 | – | – | |||||||||||||||

| Total | $ | 800,800 | $ | 28,600 | $ | 772,200 | $ | – | $ | – | ||||||||||

Financing Activities

During 2012, we received net cash proceeds of $179,702 from Canterbury Series A convertible preferred stock and used $2,042 to repay advances from a shareholder/member. During 2011, we received cash proceeds of $912 from a related party and $5,000 from advances from a shareholder/member. In the nine months ended September 30, 2013, we received $715,000 from convertible notes and used $20,374 for offering costs of ownership units for Canterbury. In the nine months ended September 30, 2012, we received $171,425 in cash proceeds from Canterbury Series A convertible preferred stock and used $16,600 to repay a related party and $12,181 for offering costs for ownership units.

Off Balance Sheet Arrangements

We have no off balance sheet arrangements.

RISK FACTORS

Risks Related to Our Business (As it Pertains to Canterbury and Hygeia)

We have a limited operating history, a history of losses and expect to incur losses for the foreseeable future.

Because of our focus on research and development, we have not yet established many of the necessary functions and systems that will be central to conducting business, including an administrative structure, sales and marketing activities and personnel recruitment. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications, competition and delays frequently encountered in connection with the development of a new business and new products. There can be no assurance that we will be able to generate sufficient funds from operations or be able to raise sufficient capital to enable us to continue with our business plan and develop new products or, if developed, that the products will be commercially successful. Any factor adversely affecting the sale of future products, including delays in product development, flaws or lack of acceptance of the products would have a material adverse effect on our business, financial condition and results of operations.

We are subject to all of the risks inherent in both the creation of a new business and the development of new products, including the absence of a history of significant operations and the absence of established products that have been produced and sold.

| 20 |

Our success will depend on achieving brand recognition within our targeted markets.

Establishing our brand is critical to our ability to establish and expand our customer base and revenues. We believe that the importance of brand recognition will increase as the number of competitors grows. To attract and retain customers and partners, we intend to increase expenditures to support sales and marketing of our products. We will spend additional funds to secure and maintain protection for our trademarks. Our inability to establish brand recognition will have a materially adverse effect on our business, financial condition and results of operations.

The high level of competition in our industry could harm our business, financial performance, market share and profitability. Many of our competitors have substantially greater resources than we do.

The business of developing prescription drugs for dermatology indications and selling cosmeceuticals for aging skin is highly competitive. These markets include numerous manufacturers, distributors, marketers and retailers that actively compete for consumers both in the United States and abroad. In particular, the cosmeceutical market is highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. In addition, our products may be, or are at the risk of becoming, obsolete due to new product introductions or new technologies. Our competitors may foresee the course of market development more accurately than we do, develop products and technologies that are superior to ours, produce similar products at a lower cost than we can or adapt more quickly to consumer preferences. Any of these developments would harm our operating results.

We plan to compete in select product categories against a number of multinational manufacturers and pharmaceutical companies, some of which are larger and have substantially greater resources than we do. Therefore, these larger competitors have the ability to spend more aggressively on advertising, marketing and research and to grow more quickly through acquisitions.

Our competitors may attempt to gain market share by offering products at prices at or below the prices at which our products may be offered. Competitive pricing may require us to reduce our prices, which would decrease our profitability or result in lost sales. Our competitors, many of whom have greater resources than ours, may be better able to withstand these price reductions and lost sales. We cannot assure you that future price or product changes by our competitors will not adversely affect our net sales or that we will be able to react with price or product changes of our own to maintain our current market position.

If our products do not appeal to a broad range of consumers, our sales and our business would be harmed.

Our success will depend on our products’ (as and when available for sale) appeal to a broad range of consumers whose preferences cannot be predicted with certainty and are subject to change. If our products do not meet consumer demands, our sales will suffer. In addition, our growth depends upon our ability to develop new products through new product lines, product line extensions and product improvements, which involve numerous risks. New product launches are essential to our growth. As we grow, our reliance on new products will increase. We may not be able to accurately identify consumer preferences, translate our knowledge into consumer-accepted products or successfully integrate new products with our existing product platform or operations. We may also experience increased expenses incurred in connection with product development or marketing and advertising that are not subsequently supported by a sufficient level of sales, which would negatively affect our margins. Furthermore, product development may divert management’s attention from other business concerns, which could cause sales of our existing products to suffer. We may not be able to successfully develop new products in the future, and our newly developed products may not contribute favorably to our operating results.

| 21 |

We are a small company that relies on a few key employees to ensure that our business operates efficiently. If we were to lose the services of any of these key employees, we would experience difficulty in replacing them, which would affect our business operations and harm our business and results of operations.

Our success depends to a significant degree upon the business expertise and continued contributions of our senior management team, any one of whom would be difficult to replace. As a result, our future results will depend significantly upon the efforts and retention of key employees, such as Yael Schwartz, Ph.D., the President of our Canterbury subsidiary, and Craig R. Abolin, Ph.D., Vice President of Research and Development for our Canterbury subsidiary. We rely on these individuals for managing our Canterbury subsidiary, developing our business strategy and maintaining strategic relationships. Any of these employees could, with little or no prior notice, voluntarily terminate their employment with us at any time. The loss of service of any of these key employees would harm our business and results of operations.

In addition, our senior management team may not be able to successfully manage our company as it grows larger. If they are unable to handle these increased responsibilities and we are unable to identify, hire and integrate new personnel, our business, results of operations and financial condition would suffer. Even if we are able to identify new personnel, the integration of new personnel into our business will inevitably occur over an extended period of time. During that time, the lack of sufficient senior management personnel would cause our results of operations to suffer.

Our initiatives to expand into product categories may not be successful and any failure to expand into new product categories would harm our business, results of operations, financial condition and future growth potential.

In order to expand our business, we plan to further develop additional products. We may not be successful in our expansion efforts in these areas. Each of these product initiatives involves significant risks, as well as the possibility of unexpected consequences, including:

| · | Our prescription based dermatology products may fail at any stage of development and/or not obtain FDA approval for commercialization |

| · | Sales of the new products to retailer customers may not be as high as we anticipate; |

| · | The rate of purchases by consumers may not be as high as we or our retailer customers anticipate; |

| · | Returns of new products by retailer customers may exceed our expectations; |

| · | Our marketing strategies and merchandising efforts may be ineffective and fail to reach the targeted consumer base or engender the desired consumption; |

| · | We may incur unexpected costs as a result of the continued development and launch of new products; |

| · | Our pricing strategies may not be accepted by retailer customers and/or their consumers; |

| · | We may experience a decrease in sales of our existing products as a result of introducing new products; |

| · | There may be delays or other difficulties impacting our ability, or the ability of our third-party manufacturers and suppliers, to timely manufacture, distribute and ship products in connection with launching new products; and |

| · | Attempting to accomplish all of the elements of expansion in multiple product categories simultaneously may prove to be an operational and financial burden on us and we may be unable to successfully accomplish all of the elements of the expansion simultaneously, if at all. |

| 22 |

Each of the risks referred to above could delay or impede our ability to successfully expand into new product categories, which would harm our business, results of operations, financial condition and future growth potential.