Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLEGHANY CORP /DE | d633227d8k.htm |

Investor Day

November 22, 2013

Alleghany

Exhibit 99.1 |

Jack

Sennott Welcome and Introductions

22 November 2013

Alleghany

2 |

Alleghany

3

Investor Day Agenda

Topic

Presenters

10:00 AM

Registration and

Refreshments

10:30 AM

Welcome and Introductions

Jack Sennott

Senior Vice President and Chief Financial Officer, Alleghany Corporation

10:35 AM

Alleghany Overview

Weston Hicks

President and Chief Executive Officer, Alleghany Corporation

11:05 AM

Alleghany Insurance

Operations

Joe Brandon

Executive Vice President, Alleghany Corporation

11:35 PM

TransRe

Michael Sapnar

President and CEO, Transatlantic Holdings

12:05 PM

Lunch

1:00 PM

RSUI Group, Inc.

Dave Leonard

Chairman and CEO, RSUI Group

1:30 PM

Capitol Companies

Stephen Sills

Chairman and CEO, Capitol Companies

2:00 PM

Investments Panel

Roger Gorham

Senior Vice President, Head of Fixed Income and Treasurer, Alleghany

Corporation Jack Liebau

President and CEO, Alleghany Capital Partners LLC

David Van Geyzel

President and CEO, Alleghany Capital Corporation

Udi Toledano

Chairman, Alleghany Capital Corporation

2:30 PM

Financial Review

Jack Sennott

Senior Vice President and CFO, Alleghany Corporation

3:00 PM

Closing Remarks

4:00 PM

Alleghany Corporation Rings the Closing Bell |

Alleghany

4

Forward-Looking Statements

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of the Private Securities Litigation Reform Act of 1995. These forward-

looking statements are not historical facts but instead represent only

Alleghany’s belief regarding future events, many of which, by their nature,

are inherently uncertain and outside Alleghany’s control. Except for

Alleghany’s ongoing obligation to disclose material information as required

by federal securities laws, Alleghany is not under any obligation (and

expressly disclaims any obligation) to update or alter any projections, goals,

assumptions, or other statements, whether written or oral, that may be made

from time to time, whether as a result of new information, future events or

otherwise. Factors that could cause Alleghany’s actual results and

experience to differ, possibly materially, from those expressed in the

forward-looking statements include the factors set forth in Alleghany’s most

recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q

filed with the United States Securities and Exchange Commission.

|

Weston Hicks

Alleghany Overview

22 November 2013

Alleghany |

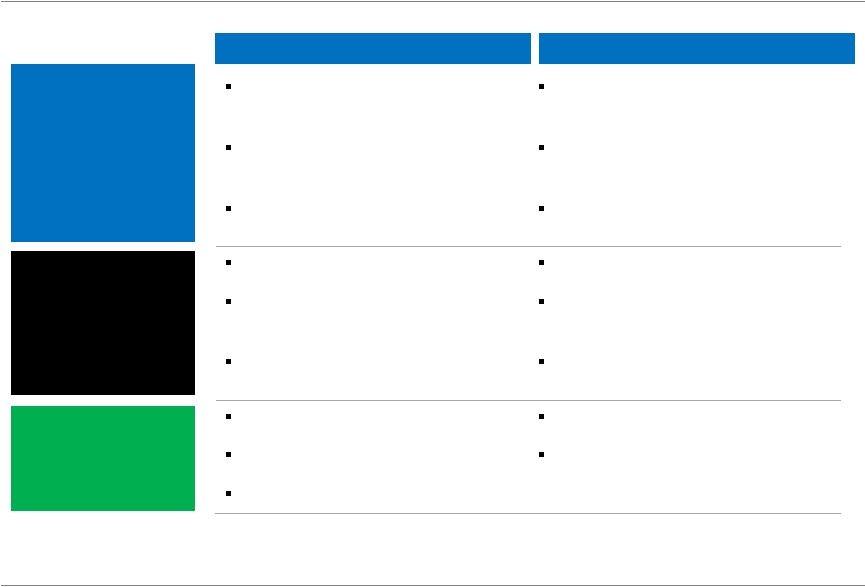

Alleghany

6

Alleghany Today

Alleghany Overview

Insurance

Reinsurance

Capitol

Companies

(“Capitol”)

Pacific

Compensation

(“PacificComp”)

RSUI

TransRe

Statutory Surplus

of $4.4 billion

(2)

2012 Gross

Premiums Written

of $3.6 billion

(3)

Top 10 global

reinsurer

(4)

Statutory Surplus of

$1.5 billion

(2)

2012 Gross

Premiums Written

of $1.1 billion

11 largest

U.S.

excess and surplus

lines insurer

(5)

Statutory Surplus

of $217 million

(2)

2012 Gross

Premiums Written

of $158 million

Focus on small

niche specialty

commercial lines

Statutory Surplus

of $99 million

(2)

2012 Gross

Premiums Written

of $19.4 million

Specializes in

California

workers’

compensation

insurance

Investments

Alleghany

Capital

Corporation

Alleghany

Capital

Partners

$2.0 billion equity

portfolio

(2)

Investments in:

~85 years as a public company (NYSE: Y)

$6.7 billion in book value

$6.6 billion equity market capitalization

$19.2 billion in total cash & investments

Baa2 senior debt rating from Moody’s

BBB senior debt rating from Standard & Poor’s

bbb+ senior debt rating from A.M. Best

(1)

Notes: Financial data as of September 30, 2013 unless otherwise specified; Market

data as of November 21, 2013 (1) Moody’s = Long Term Rating; Standard

& Poor’s = LT Local issuer Credit; and A.M. Best = Long Term Issuer Credit

(2) As of September 30, 2013

(3) Pro forma from January 1, 2012

Fixed Income

(4) Standard & Poor’s RatingsDirect, 2013

(5)

A.M.

Best’s U.S.

Surplus

Lines –

Segment

Review,

September

2013

th

–

Kentucky Trailer

–

Bourn & Koch

–

Stranded Oil

–

ORX Exploration |

Alleghany

7

A History of Successful Strategic Investing

1929

1949

1954

1968

1974

1984

1999

2007

2013…

Nickel Plate, Chesapeake & Ohio,

Erie and Pere Marquette Railroads

(merged into Penn Central in 1968)

New York Central

Railroad (merged

into Penn Central

in 1968)

Investors Diversified Services (“IDS”) (sold to

American Express in 1984)

MSL Industries

Jones Motor

Company

Alleghany Asset

Management (sold to ABN

Amro in 2001)

Chicago Title (spun off

in 1998/1999)

Shelby

Insurance

(sold in

1991)

Underwriters

Reinsurance

Company (sold

to Swiss Re in

2000)

Capitol

RSUI

World Minerals (sold in 2005)

Darwin (IPO

in 2006 and

sold in

2008)

PacificComp

TransRe

Alleghany Overview

Legacy Alleghany Investment

Current Alleghany Investment |

Alleghany

8

A Consistent Approach to Book Value Growth

“We shun investment fads and fashions in favor of investing in basic financial

and industrial enterprises that offer long-term value to the

investor.” —

John

Burns,

CEO

1992

-

2004

“Our objective is to create stockholder value through the ownership and

management of a small group of operating subsidiaries and

investments.” —

Weston

Hicks,

CEO

2004

-

Present

“Alleghany’s operating units conduct their business on a

quasi-autonomous basis while the parent company sets goals, provides

incentives, and monitors performance through a small but select parent

company staff.” —

F.

M.

Kirby,

CEO

1967

-

1992

Alleghany Overview |

Alleghany

9

Experienced Management Team

Name

Title

Years

Industry

Experience

Years

Alleghany

Experience

Holding Company

Weston Hicks

President & Chief Executive Officer

29

11

Joseph Brandon

Executive Vice President

27

2

Jack Sennott

SVP –

Chief Financial Officer

27

6

Christopher Dalrymple

SVP –

General Counsel

17

11

Roger Gorham

SVP –

Head of Fixed Income and Treasurer

29

9

Jerry Borrelli

VP –

Principal Accounting Officer

26

7

Investment Subsidiaries

David Van Geyzel

President & Chief Executive Officer, Alleghany Capital Corporation

14

6

Udi Toledano

Chairman, Alleghany Capital Corporation

38

4

Jack Liebau

President & Chief Executive Officer, Alleghany Capital Partners

29

1

Operating Companies

Michael Sapnar

President & Chief Executive Officer, TransRe

25

2

Dave Leonard

Chairman & Chief Executive Officer, RSUI

34

10

Stephen Sills

Chairman & Chief Executive Officer, Capitol Companies

35

6

Janet Frank

Chairman / President & Chief Executive Officer, PacificComp

36

2

Mark See

Chief Executive Officer, Stranded Oil Resources Corporation

26

2

Tim Helle

President, Bourn & Koch

30

2

Gary Smith

Chief Executive Officer, Kentucky Trailer

17

1

Alleghany Overview

Note: Includes experience prior to acquisition by Alleghany

|

Alleghany

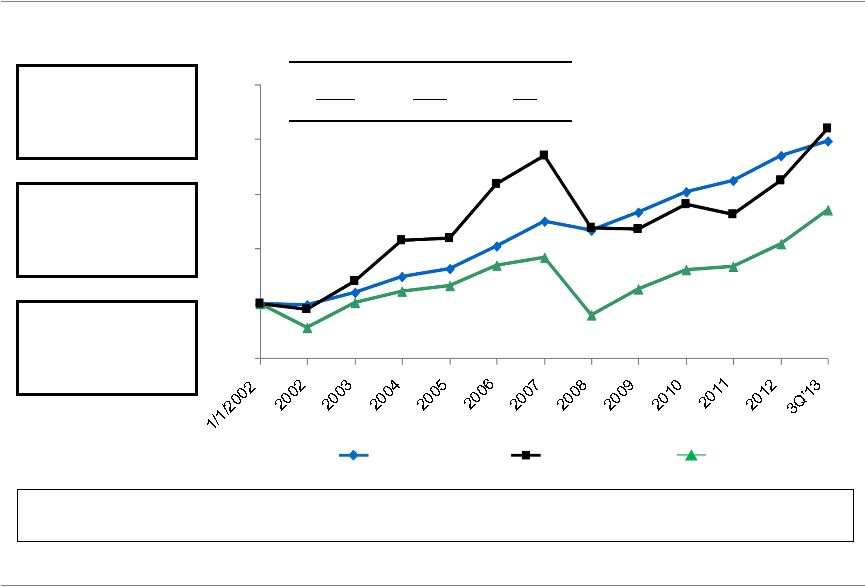

10

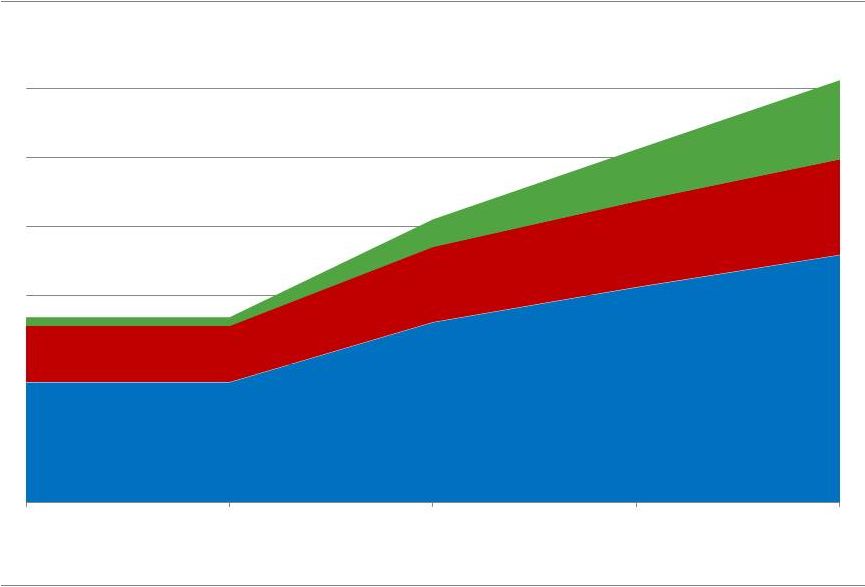

Attractive Long-Term Returns

(%)

Alleghany BVPS

Alleghany Price

S&P 500

2002

–

3Q’13

CAGR

(%)

(1)

Alleghany

BVPS

8.0%

Alleghany

Price

8.4%

S&P

500

5.4%

+148%

+159%

+85%

Focus on Book

Value per Share

Growth

Long-term

Conservative

Orientation

Quasi-autonomous

Subsidiary

Operating Model

Source: SNL Financial, Company filings, CapIQ

(1)

Alleghany price and S&P500 CAGR calculated on a total return basis

Alleghany has a demonstrated track record of creating long-term stockholder

value Alleghany Overview

50

100

150

200

250

300 |

Strong

Culture of Underwriting Discipline Experienced

underwriters

with

deep

understanding

of

products

and

pricing

of

specialty

business

Focus on underwriting profits, not premium production

-

Compensation structured to reward underwriting profits

Alleghany has outperformed its specialty insurance peer group

Underwriting profitability and resulting book value growth are key performance

metrics Alleghany GAAP Combined Ratio vs. Peer Average

Alleghany Overview

Alleghany

Average

(1)

Peer

Group

Average

(2),(3)

Alleghany

Peer Group Average

(%)

(1)

Includes

all

current

(re)insurance

operations

(2003

–

YTD

2013)

(2)

Peer

Group

Average

includes

ACGL,

AWH,

AXS,

MKL

and

WRB

(2003

–

2011)

(3) Represents Peer Group Average for 2012 and YTD 2013; includes ACGL, AWH, AXS,

MKL, WRB, PRE, PTP and RE 120.0

110.0

100.0

90.0

80.0

70.0

60.0

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Q3 '13

87.0

83.5

88.8

90.2

114.3

96.8

83.0

71.3

72.5

82.8

92.4

90.3

86.2

84.7

89.0

83.0

93.4

103.3

94.1

89.9

93.6

87.0

Alleghany

11

87.9%

90.2% |

Alleghany

12

Leading Specialty Franchises

Reinsurance

Insurance

TransRe –

top 10 global

reinsurer

(1)

Best-in-class D&O, E&O and

medical malpractice reinsurer

Significant property catastrophe

reinsurer

Premier excess & surplus lines

insurer

RSUI

–

11

th

largest

U.S.

excess

and

surplus

lines

insurer

(2)

Capitol–

small niche specialty

commercial insurer

Assets:

$16.6

billion

(3)

2012 Gross Premiums Written:

$3.6 billion

(4)

Financial Strength Rating of “A+”

by S&P and “A”

by A.M. Best

Assets:

$6.0

billion

(3)

2012 Gross Premiums Written:

$1.3 billion

Financial Strength Rating of “A”

by

A.M.

Best

(5)

Leader in specialty reinsurance

Global footprint

Strong underwriting culture

Leader in specialty insurance

Strong underwriting culture

Business

Size and Ratings

Complementary

Strengths

(1) Standard & Poor’s RatingsDirect, 2013

(2)

A.M.

Best’s

U.S.

Surplus

Lines

–

Segment

Review,

September

2013

(3) At 9/30/2013

(4) Pro forma from 1/1/12

(5) For RSUI and Capitol

Alleghany Overview |

Alleghany

13

How We Think about Investment Risk

Alleghany Overview

Investments are a significant part of our earnings power

Total Cash & Investments

Total Equity

=

$19.2 billion

$6.7 billion

=

2.87x investment leverage

Central banks are trying to keep the

economy

“in

the

fairway”

but

there

is

no

guarantee this will be successful

We have structured our portfolio to withstand

any

of

these

macroeconomic

tailwinds

(1)

(1)

Pro forma assuming Ares and deflation-protected strips allocation are

fully-deployed The economy remains vulnerable to

deflationary shocks or recessionary trends

due to:

Falling money demand

Demographics

Weak employment data

Potential trade wars |

Alleghany

14

Key Alleghany Takeaways

Alleghany Overview

TransRe and RSUI are “true franchises”

Proprietary investment capability

Non-financial businesses likely to be a larger contributor in the future

Holding

company

maintains

significant

optionality

through

excess

liquidity

and

avoidance of excessive leverage

Goal is to compound book value per share at 7-10% per year with below

average risk |

Alleghany

15

Questions?

Alleghany Overview |

Joe

Brandon Insurance Operations

22 November 2013

Alleghany

16 |

Alleghany

17

Alleghany’s (Re)insurance Operations –

Consolidated View

Insurance Operations

Gross Premiums Written:

–

2012

$4.9 billion

–

2013 YTD

(1)

$3.8 billion

Investments and Cash

$18.3 billion

Net Loss and LAE Reserves

$10.7 billion

Stockholders’

Equity

$6.4 billion

(1)

YTD as of September 30, 2013 |

Alleghany

18

Alleghany’s (Re)insurance Operations –

By Company

Insurance Operations

Gross Premiums Written:

2012

(1)

$3.6 billion

2013 YTD

(2)

$2.6 billion

Cash & Investments

(2)

$14.4 billion

GAAP Equity

(2)

$4.4 billion

Michael Sapnar

Dave Leonard

Stephen Sills

Jan Frank

(1)

Full year 2012

(2)

As of September 30, 2013

Gross Premiums Written:

2012

$1.1 billion

2013 YTD

(2)

$962 million

Cash & Investments

(2)

$3.1 billion

GAAP Equity

(2)

$1.6 billion

Gross Premiums Written:

2012

$19 million

2013 YTD

(2)

$30 million

Cash & Investments

(2)

$229 million

GAAP Equity

(2)

$109 million

Gross Premiums Written:

2012

$158 million

2013 YTD

(2)

$135 million

Cash & Investments

(2)

$507 million

GAAP Equity

(2)

$305 million |

Alleghany

19

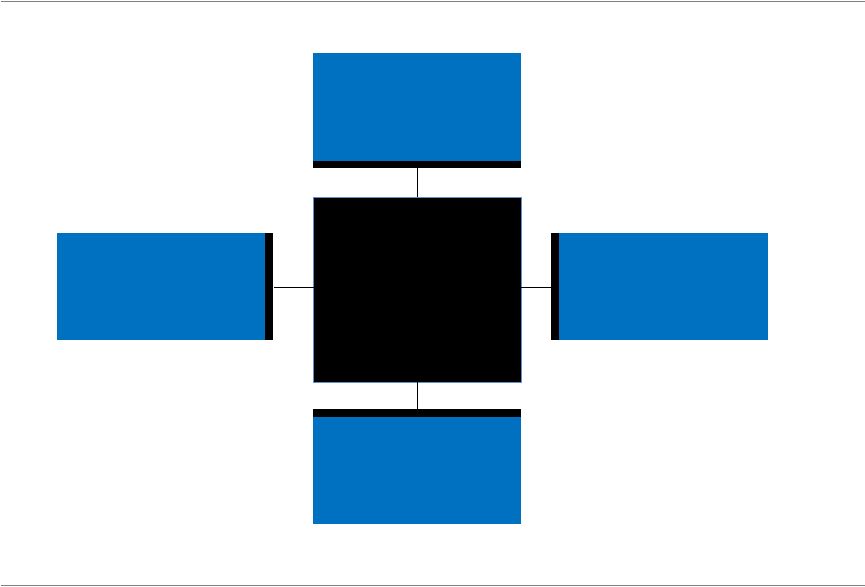

What Does Quasi-Autonomous Mean?

Insurance Operations

Alleghany

Corporate Governance

&

Risk Management

Investment

Management

Management

Compensation

Strategy /

Capital Allocation |

Alleghany

20

Investment Management

Insurance Operations

Macroeconomic views and long-term expected performance relative to risk

drive our investment allocations

Investments managed at the holding company level through a combination of

in-house and third-party resources

Risk asset allocations and liquidity requirements by subsidiary are determined

in conjunction with each operating company |

Alleghany

21

Management Compensation

Insurance Operations

Substantial part of senior management compensation is tied to their

respective operation’s underwriting profits and growth in book value

No incentive to grow premium by underpricing risk

Incented to think and act like long-term owners of their companies

Annual incentive compensation based on underwriting results

Long-term awards tied to growth in book value

–

Management shares in both profits and losses

–

Serves as retention vehicle

Incentive Compensation Directly Tied to Profitability

|

Alleghany

22

Corporate Governance and Risk Management

Insurance Operations

Alleghany senior management team sits on operating company boards

Risk assessment and management coordinated at holding company

Catastrophe exposures across entities modeled on a consolidated basis

Quarterly subsidiary board meetings include operational reviews by line of

business Price monitoring performed at operating company level and reviewed

corporately Regular actuarial loss reserve reviews (both internal and

external) Reinsurance

security

committee

reviews

reinsurer

credit

risk

and

sets

tolerances

on

a

consolidated basis

Internal audit function in place at each major subsidiary and holding company

|

Alleghany

23

Strong Catastrophe Risk Management

Insurance Operations

Catastrophe risk principally managed at TransRe and RSUI levels

Fixed caps established as a percentage of TransRe's and RSUI's respective

surplus Combined catastrophe risk modeled and monitored at parent level

Modeled combined catastrophe losses are managed to as a percentage of

consolidated equity Regularly reviewed with Alleghany board

1-in-250 Year PML / Equity

1-in-100 Year PML / Equity

PML/Equity

16

12

8

4

0

7

7

11

10

6

10

5

8

Florida -

Wind

California -

Earthquake

Northeast U.S. -

Wind

Gulf Coast -

Wind |

Alleghany

24

Historical Underwriting Results

Insurance Operations

Year

Amount

(1)

2002

(20)

2003

67

2004

74

2005

(115)

2006

259

2007

297

2008

143

2009

129

2010

131

2011

50

2012

220

2013 YTD

(2)

322

Total

$1,557

(1)

Includes Darwin Professional Underwriters, Inc.’s underwriting results from

2003 through 2008 (2)

YTD through September 30, 2013

($ in millions)

Annual average underwriting

profit of $137 million

Significant negative “cost of

float”

over time |

Alleghany

25

Key Takeaways

Insurance Operations

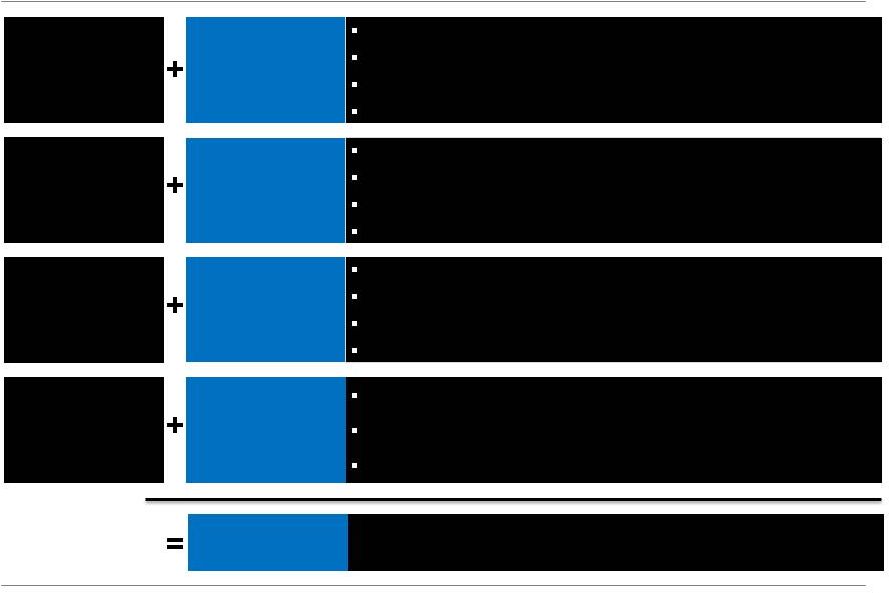

+ Operating company management is empowered

•

Set operating strategy

•

Run its business

+ Alleghany management provides assistance when needed but focuses on

capital allocation and investment management

+ Risk management is everyone’s job

•

Operating companies focus on their enterprises

•

Alleghany focuses on aggregations across the entities

+ Compensation aligns management and owners

= Builds franchise value and creates outperformance over long-term

|

Alleghany

26

Questions?

Insurance Operations |

Michael Sapnar

TransRe

22 November 2013

Alleghany

27 |

Alleghany

28

A Leading Reinsurance Franchise

CULTURE

Stable

Focused

Resilient

Profitable

DIVERSITY

Products

Territories

Distribution

Clients

People

LEADERSHIP

Treaties

Industry Issues

Longevity

Information

FLEXIBILITY

Balance Sheet

Infrastructure

Business Model

Capital Management

INITIATIVES

Fairco/Calpe/Capitol

Managed Capital

TReIMCo

Public to Private

TransRe |

Alleghany

29

Leadership Provides a Tangible Advantage

Years

(1)

2012 Assumed Premiums, excluding AIG

(2)

Estimated current underwriting year treaty premium

57%

60%

54%

55%

56%

163 underwriters worldwide

–

107 at officer level

–

Average tenure of 11.4 years

Experience drives advantages

–

Calibrates in-house economic capital & pricing models

–

Reduces reliance on generic industry data

–

Increases

ability

to

construct

bespoke

deals

–

10%

of

premium from private placement

Led

Co-led

TransRe

% Signed vs. Authorized by Class

Leadership Profile

11%

12%

8%

9%

60%

0%

25%

50%

75%

<5

6

-

10

11 -

15

16 -

20

>20

48%

52%

48%

48%

46%

9%

8%

6%

7%

10%

0%

25%

50%

75%

2008

2009

2010

2011

2012

0%

25%

50%

75%

100%

Guaranty

Marine &

Aviation

Catastrophe

Specialty

Casualty

Traditional

Casualty

2010

2011

2012

2013

(1)

%

of

Premium

by

Length

of

Relationship

%

of

Premium

Led

and

Co-Led

(2)

|

Alleghany

30

Leadership from a Stable and Experienced Senior Team

Management Team

Michael Sapnar

President & CEO

18 YEARS OF SERVICE

TransRe

Ken Brandt

North America

7 YEARS OF SERVICE

Javier Vijil

Latin America &

Caribbean

20 YEARS OF SERVICE

Paul Bonny

Europe & Asia Pacific

31 YEARS OF SERVICE

Beth Levene

Claims

15 YEARS OF SERVICE

Ken Apfel

Actuarial

9 YEARS OF SERVICE

Julian Spence

Risk

12 YEARS OF SERVICE

Steve Skalicky

Finance

18 YEARS OF SERVICE

Gary Schwartz

Legal

23 YEARS OF SERVICE

Donna Byron

HR

10 YEARS OF SERVICE

George DiMartino

IT

18 YEARS OF SERVICE

Bob Baldrey

Global Property Cat

32 YEARS OF SERVICE

Tom Cholnoky

Strategy &

Communications

4 YEARS OF SERVICE |

Alleghany

31

Leadership Builds Strong Customer Relationships

Factor

North

America

Latin

America

Europe

Strong Underwriting Capabilities

7.89

7.82

6.96

Financial Value

7.78

7.93

6.85

Financial Security

8.05

8.04

7.02

Strong Client Orientation

7.79

7.52

6.70

Valuable Expertise & Market Knowledge

7.75

8.07

6.92

Timely Service

7.87

7.68

7.08

Helps Your Company Improve Profitability

7.27

7.14

Not Rated

Strong Claims Handling Ability

7.74

7.81

7.00

Reasonable Approach to Contracts

7.48

7.64

Not Rated

Note: Reproduced with the permission of Flaspöhler Research Group, Inc.

Problematic

Average

Good

Excellent

< 6

>6

and

<

7

Top

Quartile

or

>7

Top

Quartile

and

>

7

TransRe

Our ability to execute on our strategic objectives relies upon the strength of our customer

relationships. The independent Flaspöhler Research Group, Inc.’s annual satisfaction

surveys in North America, Latin America and Europe measures how reinsurers are perceived

|

Alleghany

32

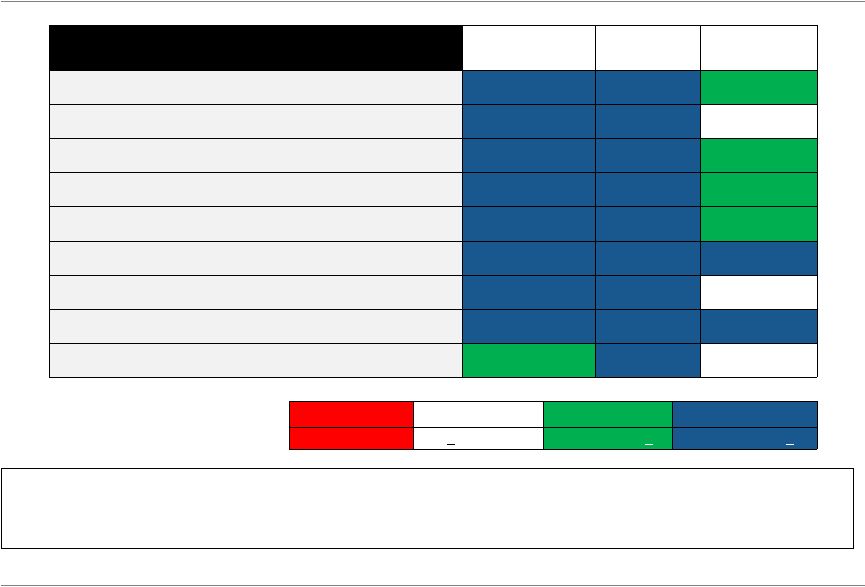

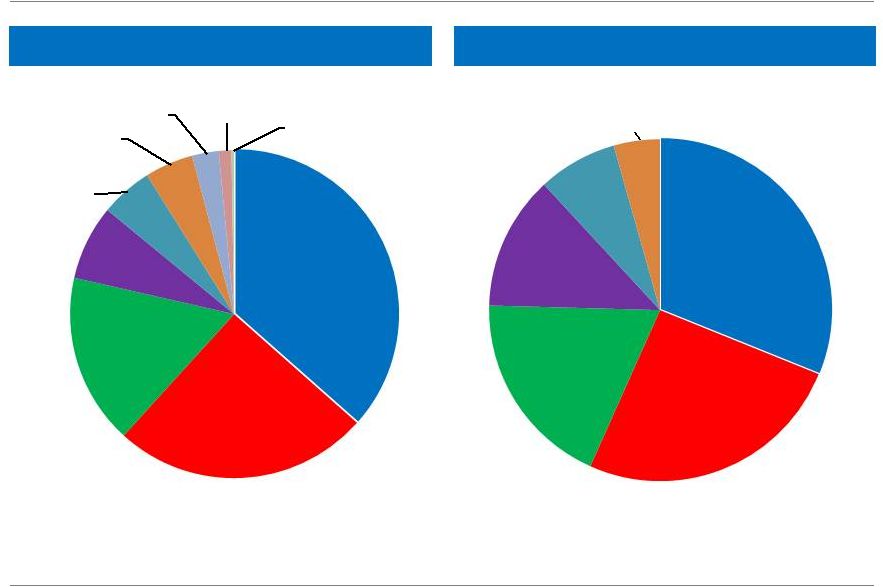

Diversity of Reach, Capability and Perspective

Note: Based on YTD September 2013 Net Written Premiums of $2.5 billion

Product Mix

Geographic Mix

TransRe

E&O / D&O

19%

All Other

Property

18%

Property

Catastrophe

12%

General

Liability

11%

Auto / Motor

8%

A&H

7%

Guaranty

6%

Marine &

Energy

6%

Medical

Malpractice

5%

Engineering

3%

Other

Casualty

3%

Aviation

2%

United

States

53%

London

20%

Zurich

8%

Latin 3%

American

Division

6%

Munich

Hong

Kong

3%

Toronto

2%

Tokyo

2%

Paris

2%

Sydney

1% |

Alleghany

33

Diversity of Source

2002

2012

Distribution

Customer Mix

2002

2012

TransRe

Other Direct

14%

AON

13%

AIG

13%

Other

Broker

48%

Guy Carp

12%

Guy Carp

20%

Other Direct

19%

Other

Broker

35%

AON

26%

All Others

32%

AIG

13%

Next 49

55%

All Others

35%

Next 49

61%

Largest

Client

4% |

Alleghany

34

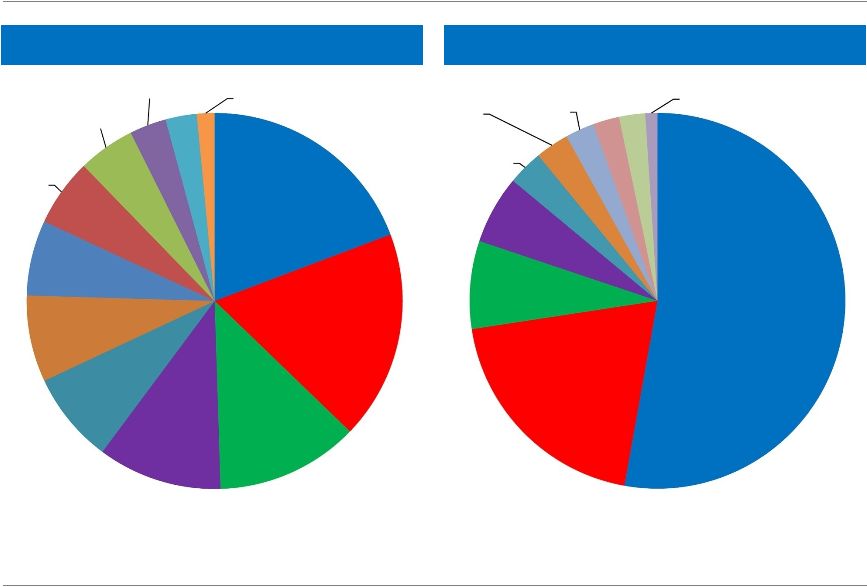

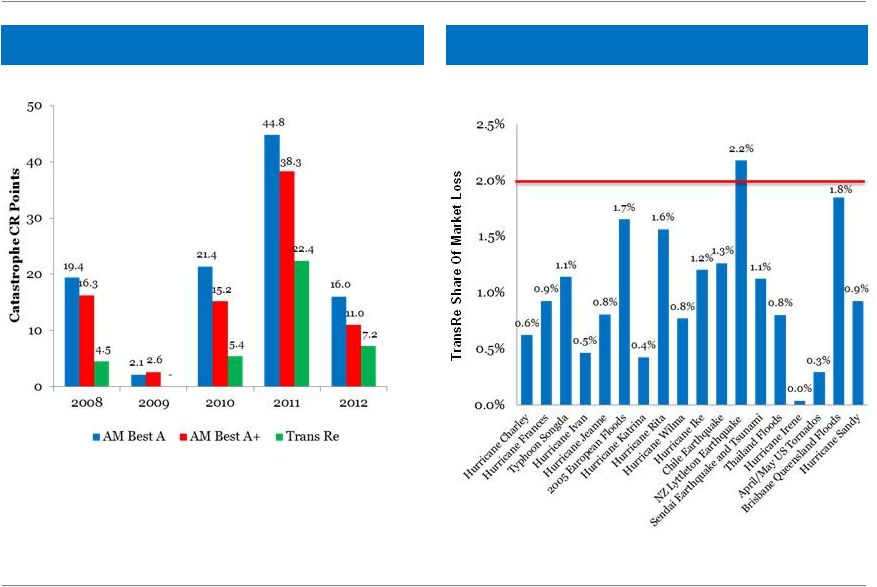

Diversity of Portfolio Minimizes Underwriting Volatility

Historical Market Share

Peer Group Cat Loss Points

Market Share > Loss Share

TransRe |

Alleghany

35

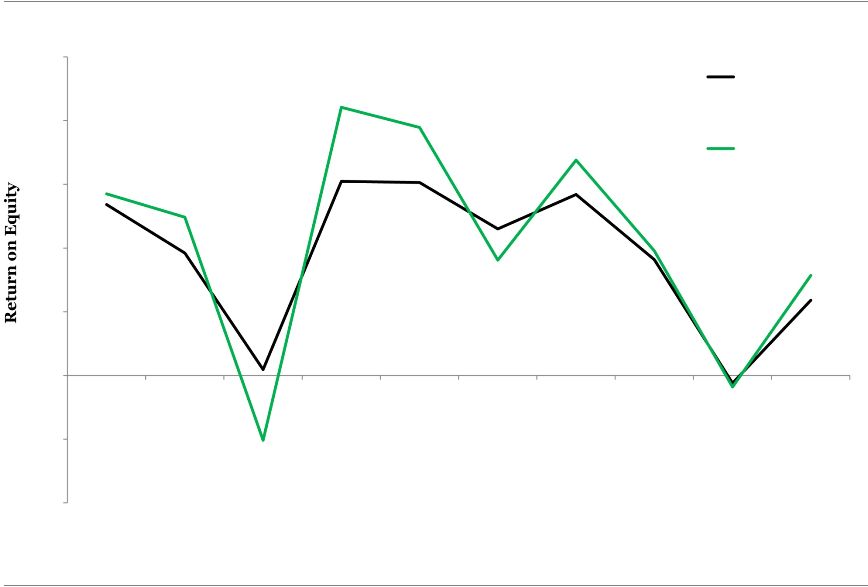

Diversity Delivers Quality Earnings

(1)

TransRe

Adjusted

ROE

to

exclude

merger

related

expenses

and

break-up

fee

in

2011

and

2012

(2)

Peer

Group

–

ACE,

ACGL

AXS,

RE,

PRE,

AWH,

Alterra,

AHL,

ENH,

PTP

and

XL

TransRe

-10%

-5%

0%

5%

10%

15%

20%

25%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

TransRe

Peer Group |

Alleghany

36

Flexibility from Financial Strength

Profitable book

Improved combined ratio

New Opportunities –

products/lines/territories/business relationships

Prudent casualty reserving philosophies

Efficient business model

$4.7 billion of new and renewed business since

3/6/12

$757 million business cancelled (AIG, auto,

Medex)

$685 million new business (mortgage guaranty,

property cat, property pro rata)

Note: All 2012 figures are for full 12 months

(1) YTD through September 30, 2013

($ in millions)

FY2012

YTD 2013

(1)

Gross premiums written

$3,617

$2,643

Net premiums written

$3,491

$2,499

Net premiums earned

$3,585

$2,481

Net losses and loss expenses

(2,561)

(1,473)

Acquisition costs

(599)

(614)

General & administrative expenses

(201)

(146)

Underwriting income

$223

$248

Consolidated GAAP Ratios

Loss and loss expense ratio

71.5%

59.4%

Acquisition cost ratio

16.7%

24.7%

General & administrative expense ratio

5.6%

5.9%

Combined ratio

93.8%

90.0%

Cash & Invested Assets

$14.5 billion

$14.4 billion

GAAP Equity

$4.3 billion

$4.4 billion

TransRe

Highlights

Summary Financials |

Alleghany

37

Flexibility from Strength of Reserve Profile

Source: Annual Statements, Schedule P

Note: Medmal (claims made) other liabilities (losses occurring and claims made) and

Reinsurance B; Peers includes ACGL, AXS, ENH, PRE, XL, AWH, ENH and Odyssey Re Holdings;

Excludes 2008 AY for RE

TransRe

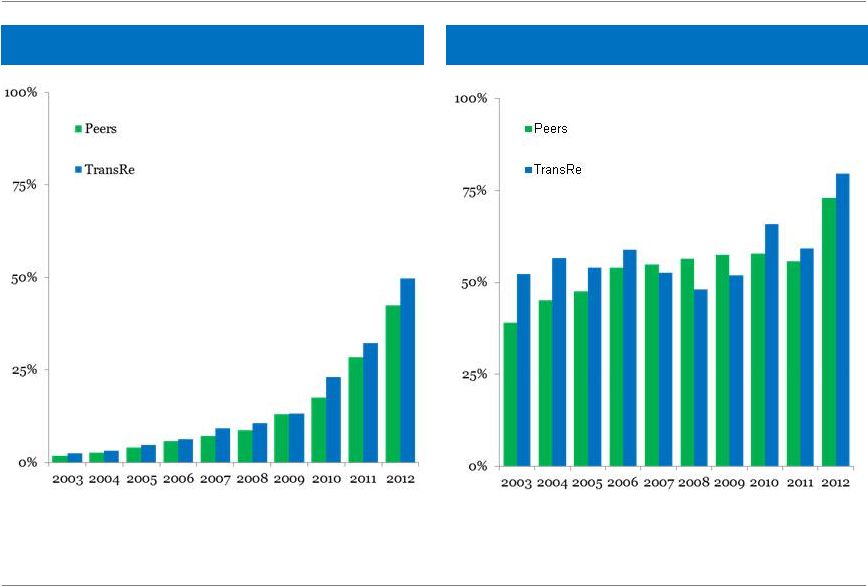

IBNR as % of Earned Premium

IBNR as % of AY Incurred Losses |

Flexibility from Strength of Reserve Profile (cont.)

As % Of Original Reserves Favorable/(Unfavorable)

(In millions)

By Accident Year –

As of 12/31/2012

TransRe

As of 9/30/2013

Total: $9.34 billion

Alleghany

38

2003-2011 AY Development

(1)

Reserve Development (AY)

Reserve Breakdown

Source: Company 10-K disclosure

(1) Peer Group: ACE, AWH, Alterra, ACGL, AHL, AXS, ENH, RE, PRE, PTP, and XL |

Alleghany

39

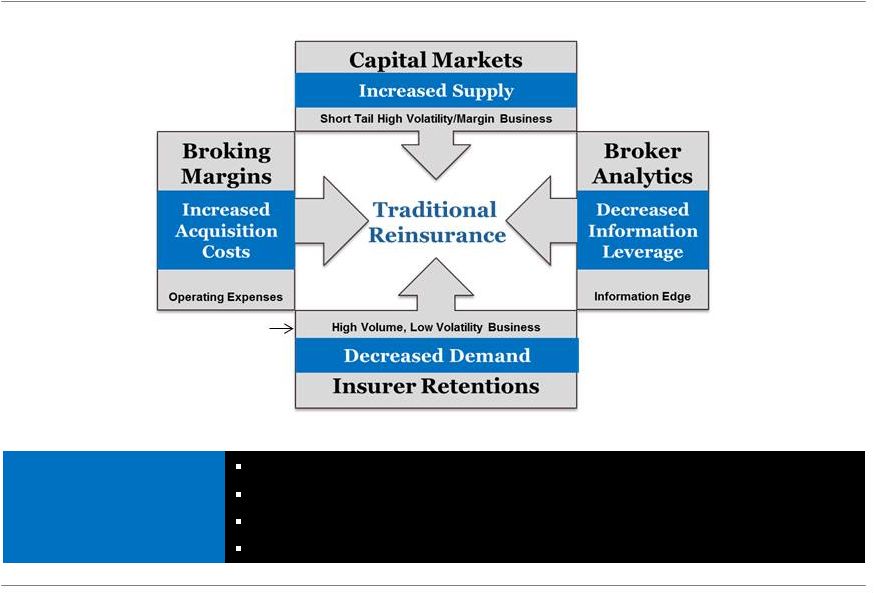

A Dynamic Competitive Environment

Hedge Fund Reinsurers

Implications

Growth will continue to be challenging

See it all, sign what you want

New initiatives are paramount

Patience and preparedness will be rewarded

TransRe |

Alleghany

40

Engage

Focus on

Efficiency

Focus on

Insights

Penetrate/

Alternate

Initiatives to Address the Challenges

Increased

Supply

Increased

Acquisition

Costs

Decreased

Information

Leverage

Decreased

Demand

Data analytics

Additional

value

propositions

(Underwriting

&

Claims

Audits

–

benchmarking)

Local network

Global Customer Program (larger lines, non-concurrent, private, direct)

Global Product Teams (property, aviation, marine)

Select insurance opportunities (Calpe/Fairco/TreIMCo)

Mortgage indemnity, terrorism

Pillar

Pangaea

Retro

TransRe Capital Partners

Profitable

Growth

Without changing the culture of the company

TransRe

Hub & Spoke branch network (Europe & Asia)

Infrastructure supports contraction or expansion

Leverage of labor, invested assets to equity and balance sheet

Intra-Y synergies (Capitol re-organization, modeling expenses)

|

Alleghany

41

Culture of Profitable Growth

$4B

3

2

1

0

New

York

Toronto

London

Tokyo

Hong Kong

Miami

Paris

Zurich

Buenos Aires

Shanghai

Rio de Janeiro

Johannesburg

Warsaw

Sydney

Panama

Stockholm

Munich

Hamilton

Gibraltar

San Francisco

Singapore

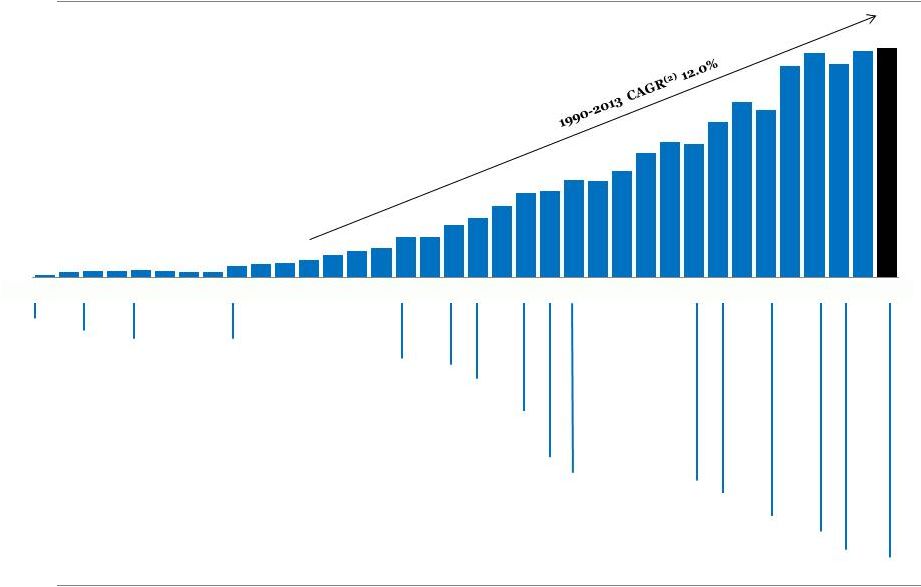

Equity/Surplus

(1)

Global City Network

(1) Statutory

surplus

from

1978-1989,

stockholders’

equity

from

1990

onwards

(2) CAGR includes cumulative dividends and share repurchases from March 31,

1990 to September 30, 2013 TransRe

Alleghany

41

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12

9M13 |

Alleghany

42

Culture of Experience

January 1 Themes

Capacity is abundant

Retentions are up

Peak price pressure in peak cat zones

Clients are increasingly attentive to who they trade with

Underlying casualty prices continue to improve

‘Unexpectedly’

large losses continue to occur (German hail, Costa

Concordia, SK Hynix, Quebec train, Alberta floods)

TransRe |

Alleghany

43

Truly a Franchise

CULTURE

DIVERSITY

LEADERSHIP

FLEXIBILITY

INITIATIVES

TransRe |

Alleghany

44

Questions?

TransRe |

Dave

Leonard RSUI

22 November 2013

Alleghany

45 |

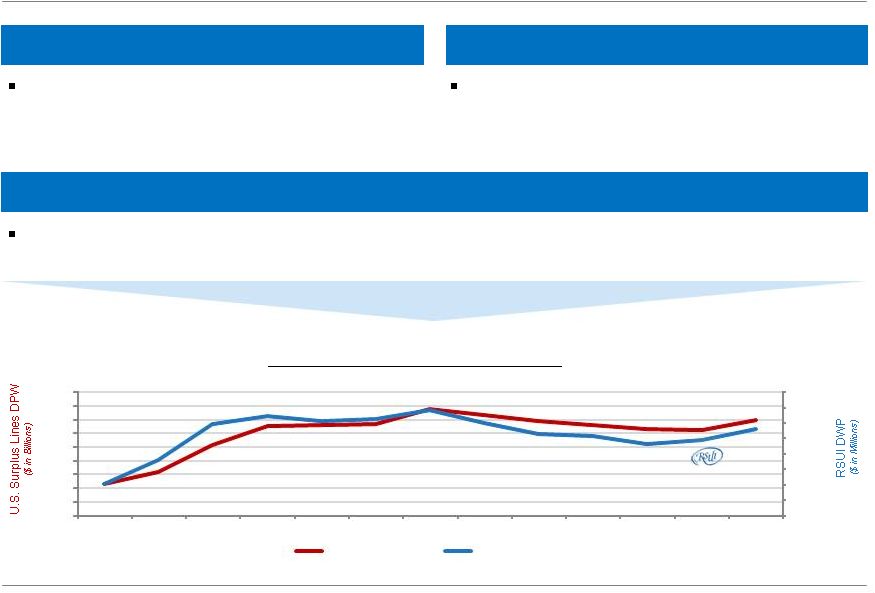

Alleghany

46

A Leading Specialty Insurer

Specialty Insurance

Focus on specialty lines of business where

underwriting expertise and experience are the

primary differentiators

Disciplined Underwriting

RSUI has demonstrated the ability to grow aggressively when market conditions are

favorable and the willingness to write less business when conditions are not

supportive of underwriting profit Marketing through a focused distribution

channel is efficient and cost effective

Comparison of Direct Written Premium

RSUI

Wholesale Only

Source:

AM

Best

Special

Report,

U.S.

Surplus

Lines

–

Segment

Review,

Thriving

Through

Turmoil,

September

2013

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$-

$5

$10

$15

$20

$25

$30

$35

$40

$45

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Total Surplus Lines

RSUI Group, Inc. |

Alleghany

47

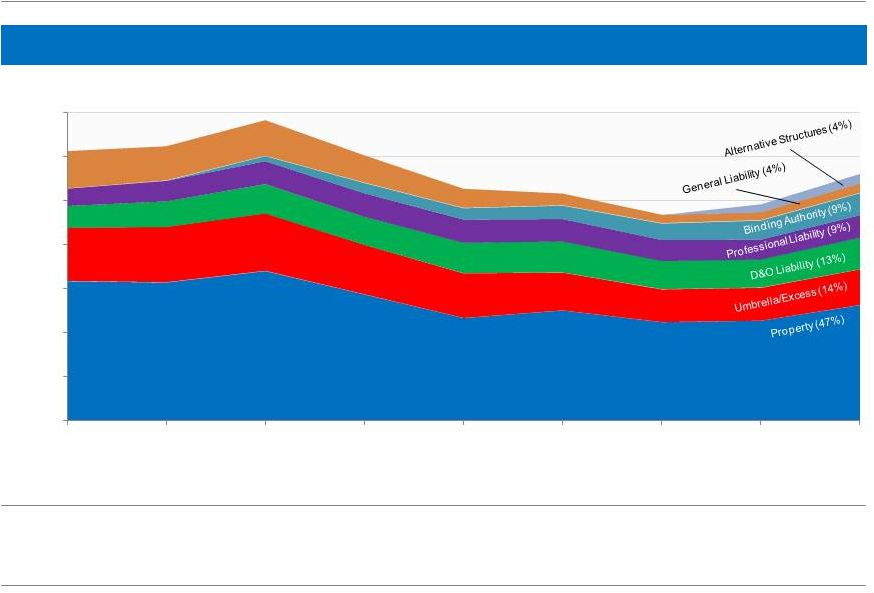

A Diversified Specialty Product Mix

RSUI

GWP Trend

Demonstrated track record of portfolio management based upon

pricing, loss experience and economic conditions

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

FY 2004

FY 2005

FY 2006

FY 2007

FY 2008

FY2009

FY 2010

FY2011

FY2012 |

Alleghany

48

THE RSUI VALUE CHAIN

Overview of the RSUI Value Chain

Severity

Focused

Risk Appetite

Cycle

Management

Property

Catastrophe

Exposure

Management

Employee Expertise and Experience

“Most important thing we do is hire people”

Service

“Respond with speed; positive interactions and relationships”

Management and Infrastructure

“Contrarian and reactive approach to market changes”

Information Technology

“Productive employees, effective communication, and reliable

reporting” Core Measurements of Success

Wholesale

Distribution

Reinsurance

Usage

Risk Mitigation Strategies

Underwriting

Profits

What Makes RSUI Special

RSUI |

Alleghany

49

Stable, Experienced Senior Team

Dave Leonard

Chairman and CEO

13 YEARS OF SERVICE

RSUI

Management Team

Greg Buonocore

President

14 YEARS OF SERVICE

Phillip McCrorie

Executive Vice President

10 YEARS OF SERVICE

Bill Kautter

SVP

Claims

11 YEARS OF SERVICE

David Norris

SVP

Property

18 YEARS OF SERVICE

Nancy Davis

SVP

Professional Liability

14 YEARS OF SERVICE

Clint Nokes

SVP

Binding Authority

5 YEARS OF SERVICE

Lee Sjostrom

SVP

Chief Financial Officer

9 YEARS OF SERVICE

Kathy Aberson

SVP

Administration

11 YEARS OF SERVICE

Phil Coletti

SVP

Casualty

24 YEARS OF SERVICE

Michelle Eason

SVP

D&O

23 YEARS OF SERVICE

Kelly Walls

SVP

Information Technology

22 YEARS OF SERVICE

Average Industry Experience (years)

Binding

Authority

D&O

Liability

General

Liability

Professional

Liability

Property

Umbrella/

Excess

Underwriting

15

15

25

19

23

27

Claims

27

14

26

17

27

32 |

Alleghany

50

Property

RSUI

There is widespread discussion about an over-capitalized market, the

impact

that

alternative

markets

are

having

on

reinsurance

costs,

and

the effect of RMS v13.0

Property Market Conditions and Outlook

Renewal

Rate Change

YTD 3Q 2013

$452.8m

5.8%

1.4%

5,133

8.9%

34,540

2.7%

2012

$527.8m

15.5%

5.2%

6,065

10.7%

44,543

15.3%

Premium

Policy Count

New Submissions

Property Coverage

Ground up, primary and excess commercial property business with

$100 million in risk capacity (4 walls)

Preference for business that can be “underwritten from the desk”

like

institutional, public entity, real estate, habitational, hospitality, and

natural catastrophe risks |

Alleghany

51

Umbrella / Excess

RSUI

Underwriters are seeing opportunities at attachment points and rate

levels they are comfortable with

Umbrella / Excess Market Conditions and Outlook

Renewal

Rate Change

YTD 3Q 2013

$134.5m

16.3%

7.4%

4,781

10.7%

24,277

6.9%

2012

$160.7m

8.1%

4.1%

5,884

1.6%

30,179

6.1%

Premium

Policy Count

New Submissions

Specialty book with up to $30 million in limits per risk Common markets are contractors, manufacturers, wholesalers,

distributors and certain public entities

Umbrella / Excess Coverage |

Alleghany

52

D&O

Liability

Coverage

D&O Liability

RSUI

Renewal retention continues to be very strong and is ahead of the

prior year for all sectors of the business. Similarly, we have seen

renewal rate increases in all sectors, especially in the private

company market

D&O Liability Market Conditions and Outlook

Renewal

Rate Change

YTD 3Q 2013

$119.5m

17.8%

5.5%

4,517

12.3%

15,713

19.3%

2012

$145.6m

11.5%

4.6%

5,473

9.8%

18,042

31.2%

Premium

Policy Count

New Submissions

Both primary and excess risks with capacity up to $20 million

The risks include public, non-profit, and private organizations.

Policies typically include Employment Practices Liability

|

Alleghany

53

Professional Liability

RSUI

Premium growth has come from “micro hard markets”

in Lawyers, Real

Estate Agents, and CyberTech

Both primary and excess risks with capacity up to $10 million

Risks are predominantly written claims made

Common classes include Miscellaneous Medical, Miscellaneous,

Architects and Engineers, Lawyers, Insurance Agents and Brokers,

Real

Estate Agent and Brokers, Environmental, CyberTech, Physicians,

Surgeons & Dentists, and Media

Professional Liability Coverage

Renewal

Rate Change

YTD 3Q 2013

$91.8m

16.8%

3.9%

6,403

15.1%

30,454

7.7%

2012

$103.1m

12.7%

3.4%

7,312

11.9%

36,948

19.9%

Premium

Policy Count

New Submissions

Professional Liability Market Conditions and Outlook |

Alleghany

54

Binding Authority

RSUI

Business opportunities are flowing to Binding Authority as many carriers

reevaluate their books of business, or face difficult financial challenges

RSUI strives to be the company that the market looks to as a consistent

leader in both service and technology

Binding Authority Market Conditions and Outlook

Renewal Rate

Change -

GL

Renewal Rate

Change -

Property

YTD 3Q 2013

$98.1m

32.1%

1.3%

4.6%

44,231

28.9%

2012

$99.3m

13.8%

0.6%

4.0%

45,795

9.7%

Premium

Policy Count

Binding Authority Coverage

Combined Property and Casualty contracts underwritten through 28

appointed Managing General Agents with limited statements of

authority for core Specialty Insurance classes

Premium mix 47% property, 53% casualty |

Alleghany

55

General Liability

RSUI

Maintain discipline and look for opportunities that are supportive of

underwriting profit

General Liability Market Conditions and Outlook

Renewal

Rate Change

YTD 3Q 2013

$27.6m

0.7%

3.9%

959

3.1%

14,939

2.4%

2012

$42.8m

13.6%

0.4%

1,347

8.5%

19,355

2.9%

Premium

Policy Count

New Submissions

General Liability Coverage

Mainly low frequency/high severity primary risks with limits of

up to $2 million

Common markets are specialty contractors, manufacturers,

wholesalers, and distributors |

Alleghany

56

Alternative Structures

RSUI

Assumed

Reinsurance

Solar Panel

Warranty

Crop

Reinsurance

Other

Total

YTD 3Q 2013

$26.3m

$5.5m

$2.9m

$2.5m

$37.2m

2012

$34.9m

$6.8m

$1.5m

$0.0m

$43.2m

Alternative Structures Market Conditions and Outlook

Alternative Structures Coverage

Unusual insurance risks that require specialized analysis and

underwriting. Available to our producers to consider risks that

are truly unique

Also includes Assumed Property Reinsurance and Property

Retrocession |

Alleghany

57

Challenges and Opportunities

RSUI

Challenges

Opportunities

Imitators, newly aggressive competitors or

start-up operations entering the E&S space

Pricing sustainability (especially in Property)

More frequent and more severe weather

related catastrophic loss activity

Maintaining close distribution relationships

as major consolidations occur

RSUI is recognized as the premier Specialty

Insurance franchise with underwriting staff

that has expertise and authority to quickly

react to opportunities

Weakness and disruption in competitors

provide opportunities across our product

lines

Umbrella/Excess, D&O, and Professional

Liability are experiencing growth

opportunities within sub-segments of their

operations |

Alleghany

58

Financial Snapshot

$1.2 billion net underwriting income

since 2003

Combined ratio of 81.9%

since 2003

Since becoming a subsidiary of

Alleghany in 2003, Stockholder’s equity

has grown at a compound annual growth

rate of 11.53%

RSUI has produced an underwriting

profit in 9 out of the last 10 years

RSUI

Highlights

Summary Financials

($ in millions)

FY

2011

FY

2012

YTD

Q3 2013

Gross premiums written

$986

$1,123

$962

Net premiums written

$628

$715

$631

Net premiums earned

$594

$656

$560

Net losses and loss expenses

(315)

(466)

(302)

Acquisition costs

(75)

(86)

(76)

General & administrative expenses

(96)

(99)

(79)

Underwriting income

$108

$5

$103

GAAP Ratios

Loss and loss expense ratio

53.1%

71.1%

53.9%

Acquisition cost ratio

12.7%

13.1%

13.6%

General & administrative expense ratio

16.1%

15.0%

14.1%

Combined ratio

81.9%

99.2%

81.6% |

Alleghany

59

Key Takeaways

RSUI

Leverage our 25 year track record as leading specialty insurer

Produce underwriting profits

Maintain our highly employee-centric culture

Remain singularly dedicated to the wholesale distribution channel

Continue to embed Risk Management within each line of

business/operation |

Alleghany

60

Questions?

RSUI |

Stephen Sills

Capitol

22 November 2013

Alleghany

61 |

Alleghany

62

Capitol Companies

Capitol

Committed to becoming the

preeminent specialty insurance

company for small and mid-sized

businesses

Product

Distribution

Technology |

Alleghany

63

Capitol and PRMS Today

P&C includes admitted and surplus lines business

Surety includes commercial and contract bonds

Professional lines includes miscellaneous professional liability,

healthcare professional, medical malpractice, and environmental

professional

Distribute through general and independent agents

Capitol |

Alleghany

64

Management Team

Stephen Sills

Chairman and CEO

36 YEARS OF EXPERIENCE

Management Team

Dan McGinnis

President

Professional Liability Division

19 YEARS OF EXPERIENCE

Rich Allen

President

Surety & Fidelity Operations

28 YEARS OF EXPERIENCE

Larry Seymour

Vice President

Actuarial & Chief Actuary

20 YEARS OF EXPERIENCE

Alan Ogilvie

Chief Operating Officer

22 YEARS OF EXPERIENCE

Troy Lethem

Vice President

Information Services & CIO

22 YEARS OF EXPERIENCE

John DiBiasi

Vice President

Distribution

36 YEARS OF EXPERIENCE

Paula Pearce

President

Director of Marketing

16 YEARS OF EXPERIENCE

John Rzepinski

Vice President

CFO & Treasurer

30 YEARS OF EXPERIENCE

Capitol |

Alleghany

65

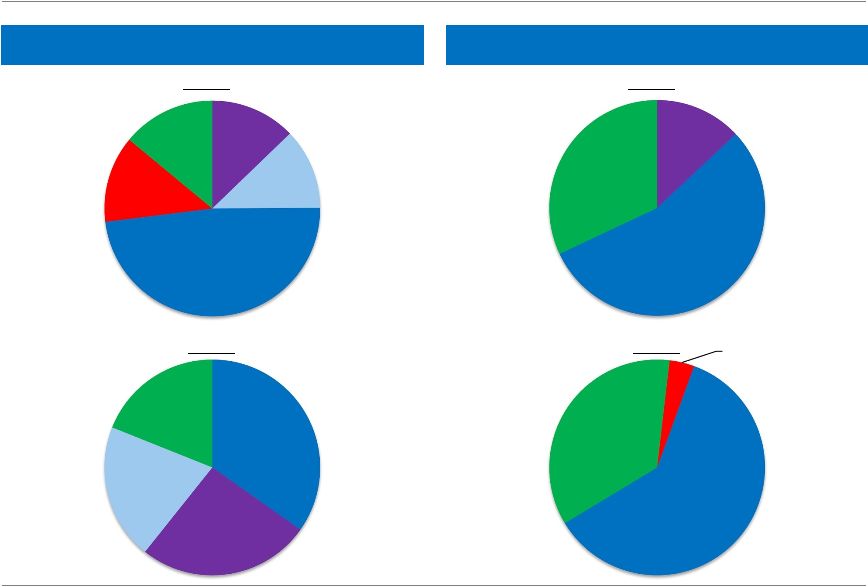

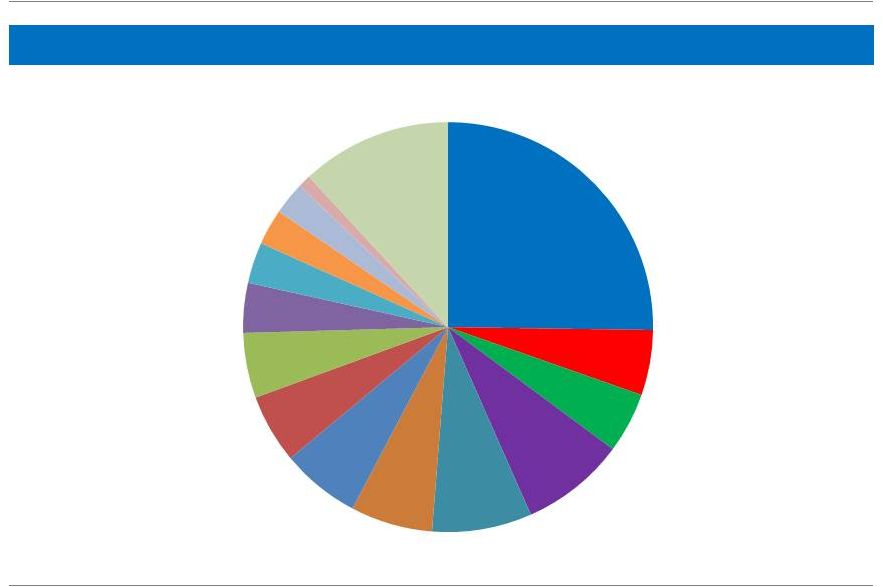

Product and Geographic Mix

Product Mix

Geographic Mix

Note: YTD September 30, 2013

Capitol

Casualty

37%

Commercial

Surety

25%

Property

17%

BOP

7%

Contract

Surety

5%

Misc. Prof.

Lines

5%

Workers’

Comp.

3%

Comm. Auto

1%

A&H

0.3%

Midwest

31%

Southwest

26%

Southeast

19%

13%

Northwest

7%

Northeast

4%

Mid-Atlantic |

Alleghany

66

Industry Mix

Industry

Note: YTD September 30, 2013

Capitol

Commercial Surety

25%

Contract Surety

5%

Misc. Prof. Lines

5%

Bars / Taverns

(P&C)

8%

Habit. Dwellings

(P&C)

8%

Restaurants (P&C)

7%

Bus. Services (P&C)

6%

Retail (P&C)

5%

Child Care (P&C)

5%

Construction (P&C)

4%

Amusement (P&C)

3%

Barber / Beauty

(P&C)

3%

Hotel / Motel (P&C)

3%

Detective/Security

(P&C)

All Other (P&C)

12%

1% |

Alleghany

67

Opportunity to Drive Growth with a Compelling Offering in the Large and

Fragmented SME Market

The SME market is highly fragmented

Few large insurers have focused on the SME

market in the past

Larger insurers are starting to pursue SME

with a micro-targeting strategy, but are moving

slowly

Small insurers lack product breadth,

distribution breadth, and resources to take

more market share

A compelling offering would allow Capitol to

gain profitable share quickly and become a

market leader in its selected markets

(1) Conning Research Report 2011

($ in Billions)

SME Market Share

(1)

Capitol

$0

$10

$20

$30

$40

$50

$60

$70

$80

2011 Market Share

AIG (3%)

Hartford (4%)

State Farm (4%)

Travelers (4%)

Other Small

Insurers (38%)

(Capitol ~0.13%)

Other Medium

Insurers (23%)

Other Large

Insurers (23%)

Nationwide (4%)

$

78 Billion |

Alleghany

68

Competitive Landscape of Business Model Options

Key competitors are evolving toward a buyer-centric approach and some are

preparing to venture into the direct space

Small

Business

Buyers

Medium Sized

Business

Buyers

Large

Business

Buyers

Product Focus Business

Model

Buyer-Centric Business

Model

Direct to Buyer Business

Model

Limited products to serve

the spectrum of buyer

Lack of focus on targeted

buyers (Product first, buyer

second)

Manual underwriting

Limited Package offerings

Industry-targeted appetite

with full product suite

Automated

Packaged products

Industry-focused marketing

materials

Package and sell commercial

& consumer products

Marketing is targeted to buyers

Direct-to-buyer web portal and

sales channel

Policy and customer service

centers work directly with

buyers

Capitol |

Alleghany

69

Challenges and Opportunities

Opportunities

Significant underwriting involvement is

required

Product set is not tailored to any segments

of the SME market

“We will entertain anything”

approach

precludes any differentiation and is time

consuming and resource intensive

Lack of automation

We will be more important to our distribution

partners as we identify the buyers that we

want to target

Select segments where we bring expertise

and can leverage cross-division products

into one-stop shop solutions

Continuously assess, prioritize, and launch

new targeted segments and distribution

partners

Build a unified small business system

Challenges

Capitol |

Alleghany

70

Where We Want to Go

70

Capitol

P&C

Surety

Professional Lines

FY2012

YTD2013

FY2014

FY2015

FY2016 |

Alleghany

71

Financial Snapshot

(1) YTD through September 30, 2013

Highlights

Summary Financials

Modest underwriting losses in each year

presented

Loss ratio overshadowed by high

expense ratio

Surety business continues to perform

well

Prior year results negatively impacted by

Axiom

Capitol

($ in millions)

FY

2011

FY

2012

YTD

2013

(1)

Gross premiums written

$150

$158

$135

Net premiums written

$142

$149

$126

Net premiums earned

$149

$145

$114

Net losses and loss expenses

(83)

(86)

(57)

Acquisition costs

(36)

(40)

(27)

General & administrative expenses

(36)

(40)

(33)

Underwriting income (loss)

($7)

($21)

($4)

GAAP Ratios

Loss and loss expense ratio

55.7%

59.4%

50.0%

Acquisition cost ratio

24.3%

27.4%

24.0%

General & administrative expense ratio

24.4%

27.4%

29.3%

Combined ratio

104.4%

114.2%

103.2% |

Alleghany

72

Questions?

Capitol |

Roger Gorham –

Fixed Income

Jack Liebau –

Public Equity

David

Van

Geyzel

and

Udi

Toledano

–

Private

Capital

Investments

22 November 2013

Alleghany

73 |

74

Jack Liebau

President & CEO

Jack Liebau

President & CEO

Alleghany Investments

Team includes 6 investment

professionals

Weston Hicks

Alleghany Corporation, President & CEO

Roger Gorham

SVP, Head of Fixed Income,

and Treasurer

Roger Gorham

SVP, Head of Fixed Income,

and Treasurer

David Van

Geyzel

President & CEO

David Van

Geyzel

President & CEO

An integrated investment platform that balances fixed income exposure with public

and private capital Udi

Toledano

Chairman

Udi

Toledano

Chairman

Investments

Team includes 2 Vice Presidents

Support from Alleghany legal,

accounting, and tax groups

Fixed

Income

Alleghany Capital Partners

Public Equity

Alleghany Capital Corporation

Private Capital

Alleghany |

Alleghany

75

Property

&

Casualty

Insurance

Cycle

–

>

Drives

operational

cash

flow

Catastrophe

Losses

–

>

Drive

near

term

cash

flow

demands

Long-Term

Casualty

Loss

Reserves

–

>

Subject

to

loss

cost

inflation

risk

Mandatory

Fixed

Income

Holdings

–

>

Subject

to

inflation

risk

Manage duration and

credit quality, incorporate

fixed rate and floating rate

securities

Macro Environment and Strategy

Investments

Our

Environment

Our

Strategy

Maintain sufficient liquidity

Own assets and

businesses that do well in

inflationary environments

Alleghany Capital Corporation

Private Capital

Alleghany Capital Partners

Public Equity

Fixed

Income |

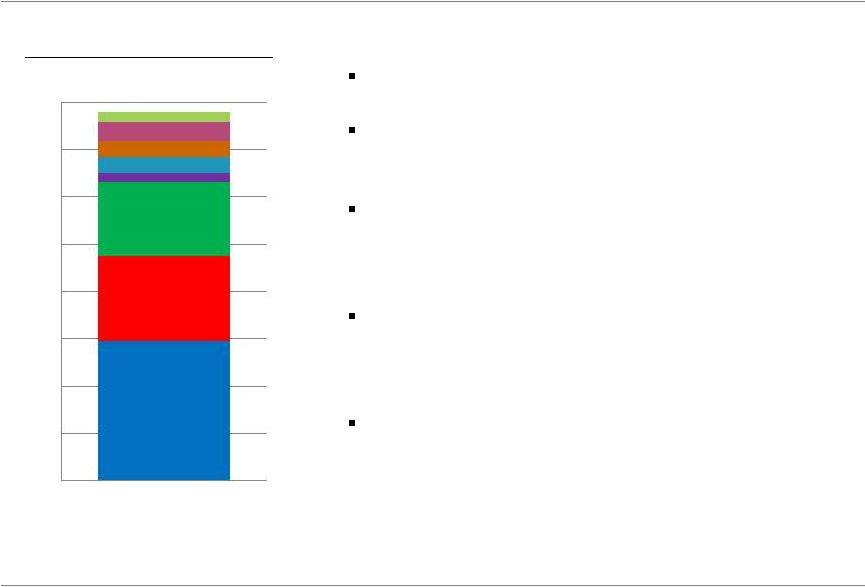

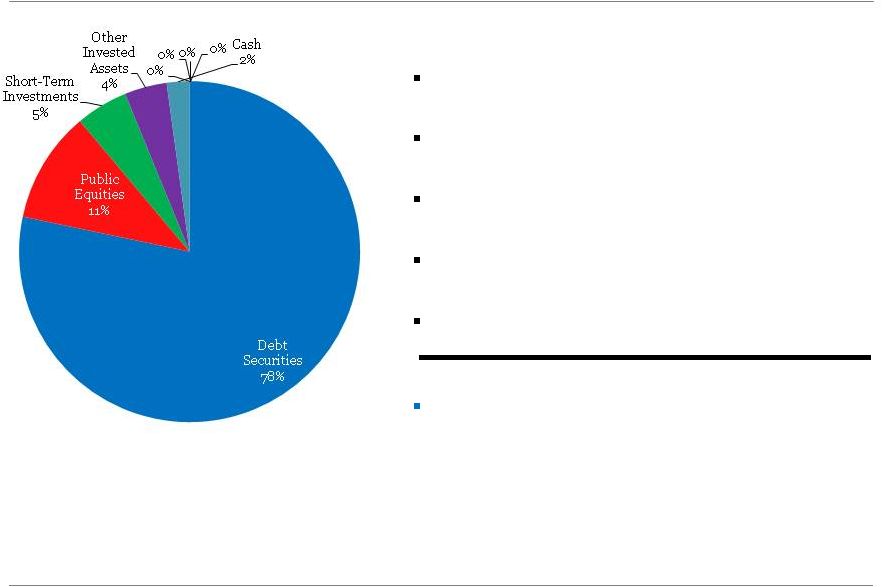

Portfolio Allocation

Investments

Debt Securities: $15.0 billion

Equity Securities: $2.0 billion

Short-Term Investments: $1.0 billion

Other Invested Assets: $0.8 billion

Cash: $415 million

Total: $19.2 billion

Note: Data as of September 30, 2013

Alleghany

76 |

Alleghany

77

Fixed Income: Introduction

Investments

Sector Allocation

Credit Quality ($ in billions)

Duration: 4.3 years

Note: Data as of September 30, 2013

Our goal is to preserve capital and maximize after-tax return

Municipals

37.4%

MBS and

ABS

19.1%

U.S.

Corporate

13.6%

Foreign

Corporate

11.1%

Foreign

Government

6.6%

U.S.

Government

6.3%

Short

5.9%

0.0%

0.0%

Term

$0.1

$1.3

$3.2

$7.8

$2.6

$ -

$4.0

$8.0

Below BBB/Baa

BBB/Baa

A/A

AA/Aa

AAA/Aaa |

Alleghany

78

Fixed Income: Ares Management, LLC

Investments

July 2013

$250 million direct equity investment

$1 billion total management opportunity

Transaction:

On July 31, 2013, Alleghany acquired a

6.25% stake in Ares Management, LLC for a purchase

price of $250 million and agreed to invest as much as

$1.0 billion in existing and new Ares investment

strategies

Investment Thesis:

Investment in a broad spectrum of

products, including both investment and non-investment

grade securities. Opportunity for Alleghany to access

Ares’

expertise in these products to prudently enhance

Alleghany’s fixed income returns and help Ares expand

into the insurance industry

has acquired a stake in:

Fixed Income Assets and Related Funds

Fixed Income Assets

6%

94%

Investment

grade assets

2%

Below

investment

grade assets

3%

Funds

1%

Ares Managed |

Alleghany

79

Alleghany Capital Partners (“ACP”): Goal and Strategy

Investments

ACP’s goal is to grow the equity portfolios of Alleghany and its

(re)insurance subsidiaries over the long term, at a rate consistently

above market averages, risk adjusted

ACP believes that intensive fundamental research, concentrated

positions, and long-term holding periods are necessary to produce

consistently superior investment results |

Alleghany

80

Alleghany Capital Partners: Highlights

Total equity exposure: $2.0 billion

Dividend yield: 2.2%

Team includes 6 investment professionals

Top 5 positions represent more than one third of total equities

Investments

Note: Data as of September 30, 2013 |

Alleghany

81

Alleghany Capital Corporation (“ACC”): Goal and Strategy

Horizon

Minimum investment

of $50 million, minimum annual

EBITDA of $10 million

Growth Capital

and

Special Situations

Acquisitions,

Recapitalizations, and

Management Buyouts

Control

Investment

Majority

Prefer majority control, but will

consider minority investments

1

2

Minimum investment

of $20 million, includes pre-revenue

companies

Long-term

Flexible

Investments

ACC’s goal is to generate above-market returns over the long-term,

investing primarily in equity securities of private companies

ACC’s strategy is to leverage its competitive advantages of permanent and

scalable capital to generate proprietary deal flow and then partner with a

select group of owner- managers to grow their businesses

|

Alleghany

82

Company

Highlights

Kentucky Trailer is a leading manufacturer of custom trailers for the moving and

storage industry and other niche markets. Investment closed in August

2013 ACC’s differentiated business model compared with standard

private equity funds was critical to Gary A. Smith, Sr. (CEO) and the Tway

Family Growing business with a dedicated management team, significant

competitive advantages, and meaningful organic and acquisition growth

opportunities Bourn & Koch is a manufacturer of precision machine tools

and provider of related replacement parts and services. Investment

closed in April 2012 ACC’s long-term investment horizon and

willingness to put limited leverage on the company were critical to the

partnership with Tim Helle (President) Niche business with a driven

management team, significant competitive advantages, and strong cash flow

dynamics. Platform for future acquisitions Growth

capital

investments

in

the

oil

and

gas

E&P

industry.

The

core

thesis

for

both investments is based on technology unlocking additional resources

SORC was founded in 2011 and ACC’s initial investment in ORX was made in

2008 ACC’s scalable capital model and long-term investment horizon

were key to ACC’s partnerships with Mark See (CEO of SORC) and Luis

Baños (CEO of ORX ) Alleghany Capital Corporation: Select Portfolio Company

Highlights Investments |

Alleghany

83

Questions?

Investments |

Jack

Sennott Financial Statements

22 November 2013

Alleghany

84 |

Alleghany

85

Financial Goal and Strategy

Financial Statements

Grow BVPS at a rate exceeding total

return on S&P 500

Total Return

Investment

Strategy

Global

Reinsurance

U.S. Specialty

Insurance

Superior Risk

Adjusted

Returns

Core Tenets of Our Strategy

Financial Goal

Own well-capitalized and financially

secure reinsurance and insurance

operations run by high quality

management teams

Align owners’

and managers’

interests by

structuring compensation to reward

underwriting profits

Maintain a strong balance sheet with

conservative reporting and reserving

practices

Maintain flexibility to allocate capital to

highest risk-adjusted return opportunities

Take a long-term approach |

Alleghany

86

Alleghany Consolidated Statement of Earnings

Financial Statements

($ in millions, except per share data)

September 30, 2013

September 30, 2012

Premiums written:

Gross premiums written

3,752.1

$

3,078.8

$

Net

premiums written 3,285.9

2,700.4

Revenues

Net premiums earned

3,183.2

$

2,622.9

$

Net

investment income 334.5

234.6

Net realized investment gains

95.6

119.8

Other than temporary impairment losses

(41.9)

(2.9)

Gain on bargain purchase

-

494.9

Other income

37.8

43.4

Total revenues

3,609.2

3,512.7

Costs and Expenses

Net loss and loss expenses incurred

1,862.4

1,587.8

Commissions, brokerage and other underwriting expenses

998.8

592.8

All other expenses

134.6

379.0

Interest expense

65.0

46.5

Total costs and expenses

3,060.8

2,606.1

Earnings before income taxes

548.4

906.6

Income taxes

125.0

111.7

Net earnings

423.4

794.9

Net earnings attributable to noncontrolling interest

0.2

-

Net earnings attributable to Alleghany stockholders

423.2

$

794.9

$

Basic earnings per share attributable to Alleghany stockholders

25.20

$

53.19

$

Diluted earnings per share attributable to Alleghany stockholders

25.20

53.14

Ratios and Supplemental Information

Net loss and loss expenses incurred:

Current year

2,043.8

1,594.6

Prior years

(181.4)

(6.8)

1,862.4

$

1,587.8

$

Loss and loss expense ratio

58.5%

60.5%

Expense ratio

31.4%

22.6%

Combined ratio

89.9%

83.1%

Nine Months Ended |

Alleghany

87

Alleghany Balance Sheet

Financial Statements

($ in

millions)

September 30, 2013

December

31, 2012

Assets

Investments:

Available-for-sale securities at fair value:

Equity securities

2,035.2

$

1,424.0

$

Debt securities

15,041.1

15,999.5

Short-term investments

949.3

366.0

18,025.6

17,789.6

Other invested assets

771.7

537.4

Total investments

18,797.3

18,326.9

Cash

414.7

649.5

Reinsurance recoverables

1,376.1

1,348.6

Goodwill and intangible assets

225.6

212.2

All other assets

2,428.1

2,270.7

Total assets

23,241.8

$

22,808.0

$

Liabilities

and

Stockholders’

Equity

Loss and loss adjustment expenses

12,030.3

$

12,239.8

$

Unearned

premiums 1,830.0

1,705.3

Senior Notes

1,798.7

1,811.5

All other liabilities

843.2

647.6

Total liabilities

16,502.2

16,404.2

$

-

$

-

Total

stockholders’

equity

attributable

to

Alleghany

stockholders

6,716.5

6,403.8

Noncontrolling interest

23.0

-

Total

stockholders’

equity

6,739.6

6,403.8

Total

liabilities

and

stockholders’

equity

23,241.8

$

22,808.0

$

|

Alleghany

88

Capital Structure and Leverage Ratios

Financial Statements

($ in millions, except ratios)

September 30, 2013

December 31, 2012

Capital Structure

Senior Notes

1,798.7

$

1,811.5

$

Total stockholders’

equity attributable to Alleghany stockholders

6,716.5

6,403.8

Total capitalization

8,515.2

$

8,215.3

$

Debt Detail

Total Debt

1,798.7

$

1,811.5

$

Less: Holding Company Liquidity

(629.2)

(731.7)

Total Net Debt

1,169.5

$

1,079.8

$

Leverage ratios

Total Debt to Capitalization

0.2

0.2

Total Net Debt to Capitalization

0.1

0.1

Net premiums written (trailing 12 months)

4,309.4

$

3,724.0

$

Net

premiums

written

(trailing

12

months)

to

stockholders’

equity

0.6

0.6

Total investments and cash

19,212.0

$

18,976.4

$

Total

investments

and

cash

to

stockholders’

equity

2.9

3.0

Reserve for losses and loss expenses

12,030.3

$

12,239.8

$

Deduct: reinsurance recoverable on ceded

losses (1,310.5)

(1,305.9)

Net reserve for losses and loss expenses

10,719.8

10,933.9

Net

reserve

for

losses

and

loss

expenses

to

stockholders’

equity

1.6

1.7 |

Alleghany

89

Return on Average Stockholders’

Equity

Financial Statements

Book Value Per Share (through 9/30/13)

Annualized BVPS growth

5.7%

7.5%

($ in millions, except ratios)

September 30, 2013

Opening stockholders’

equity attributable to Alleghany stockholders

6,403.8

$

Closing

stockholders’

equity

attributable

to

Alleghany

stockholders

6,716.5

Average

stockholders’

equity

6,560.2

$

Net earnings attributable to Alleghany stockholders

423.2

$

Return

on

average

stockholders’

equity

6.5%

Annualized

return

on

average

stockholders’

equity

8.6%

Nine Months Ended |

Alleghany

90

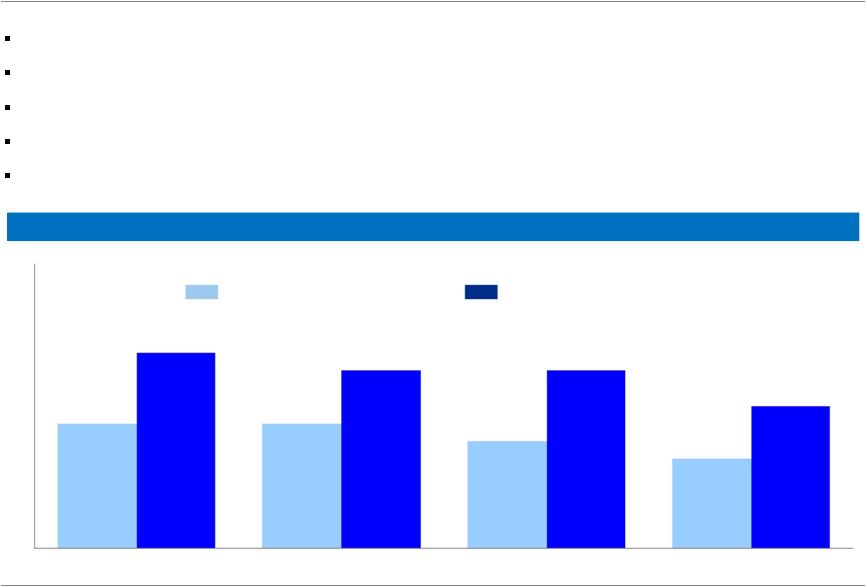

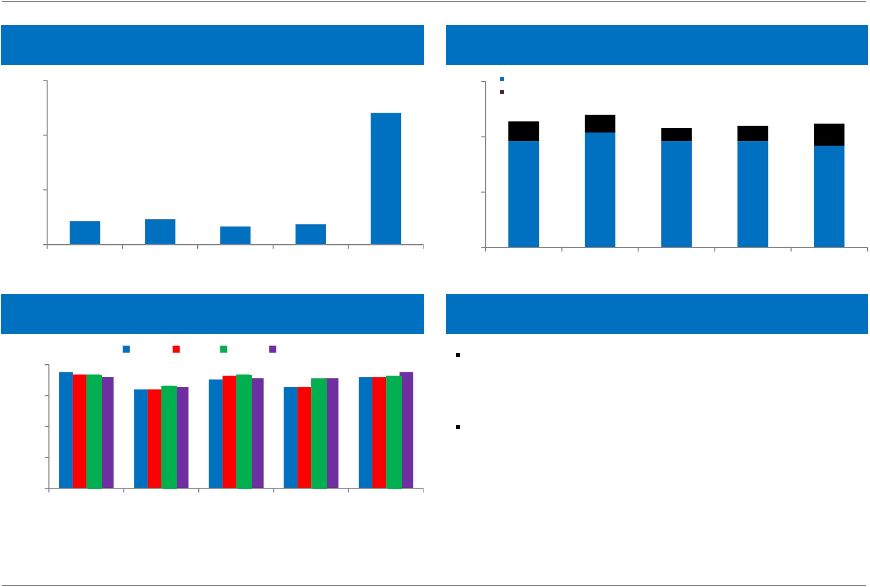

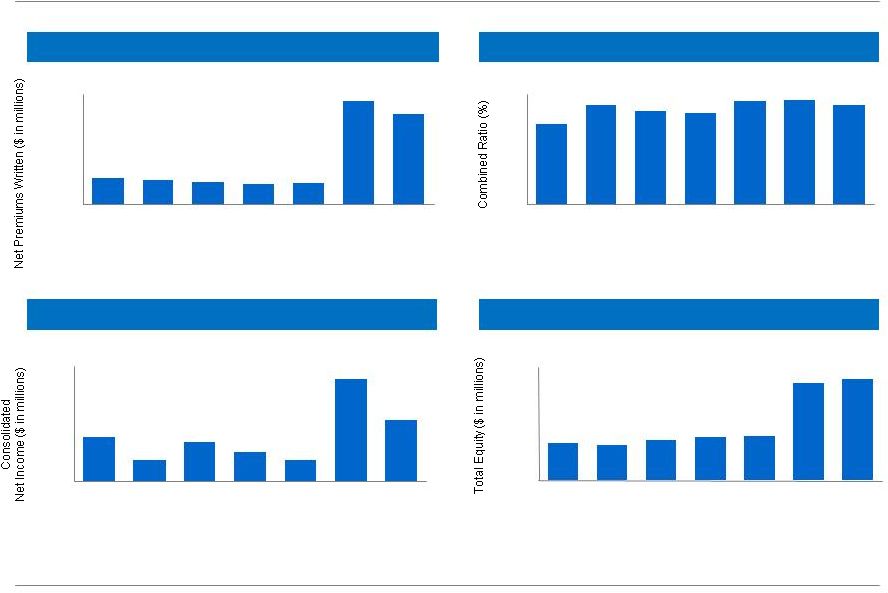

Alleghany Consolidated Performance

Financial Statements

Net Premiums Written

Source: Company filings

Consolidated Net Income

(1)

Combined Ratio

Total Equity

(1)

(1)

Attributable to Alleghany stockholders

$299

$148

$271

$199

$143

$702

$423

$0

$200

$400

$600

$800

2007

2008

2009

2010

2011

2012

9/30

2013

$963

$898

$831

$736

$775

$3,724

$3,286

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

2007

2008

2009

2010

2011

2012

9/30

2013

72.5

90.3

84.7

83.0

93.4

94.1

89.9

0

20

40

60

80

100

2007

2008

2009

2010

2011

2012

9/30

2013

$2,485

$2,347

$2,718

$2,909

$2,926

$6,404

$6,717

$0

$1,500

$3,000

$4,500

$6,000

$7,500

2007

2008

2009

2010

2011

2012

9/30

2013 |

Alleghany

91

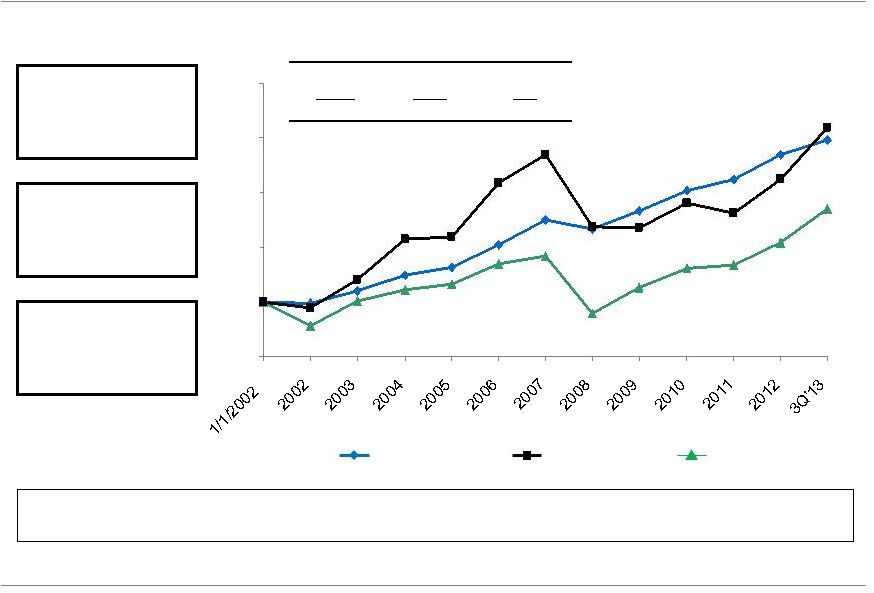

Attractive Long-Term Returns

(%)

Alleghany BVPS

Alleghany Price

S&P 500

2002 –

3Q’13 CAGR (%)

(1)

Alleghany

BVPS

8.0%

Alleghany

Price

8.4%

S&P

500

5.4%

+148%

+159%

+85%

Focus on Book Value

per Share Growth

Long-term

Conservative

Orientation

Quasi-autonomous

Subsidiary Operating

Model

Source: SNL Financial, Company filings, CapIQ

(1)

Alleghany price and S&P500 CAGR calculated on a total return basis

Alleghany has a demonstrated track record of creating long-term stockholder

value Financial Statements

50

100

150

200

250

300 |

Alleghany

92

Summary

Financial Statements

Long-term focus with track record of book value growth

Highly-experienced management team with a demonstrated

track record

Leading franchise across global reinsurance and U.S.

specialty insurance with significant capital and scale

Disciplined underwriter with superior risk management through

insurance cycles

Strong balance sheet with solid financial performance

An integrated investment platform that balances fixed income

exposure with public and private capital

Significant financial flexibility at the holding company level

|

Alleghany

93

Questions?

Financial Statements |