Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KAPSTONE PAPER & PACKAGING CORP | a13-24658_18k.htm |

Exhibit 99.1

|

|

November 2013 THE BEST IS YET TO COME Andrea K. Tarbox Vice President and Chief Financial Officer |

|

|

2 FORWARD LOOKING STATEMENTS The information in this presentation and statements made during this presentation may contain certain forward-looking statements within the meaning of federal securities laws. These statements reflect management’s expectations regarding future events and operating performance. These forward-looking statements involve a number of risks and uncertainties. A list of the factors that could cause actual results to differ materially from those expressed in, or underlying, any forward-looking statements can be found in the Company’s filings with the Securities and Exchange Commission, such as its annual and quarterly reports. The Company disclaims any obligation to revise or update such statements to reflect the occurrence of events after the date of this presentation. This presentation refers to non-U.S. GAAP financial information. A reconciliation of those numbers to U.S. GAAP financial measures is available on the company’s website at KapStonePaper.com under Investors. Forward-Looking Statements Non-GAAP Financial Measures Risk Factors |

|

|

3 KAPSTONE PROVIDES COMPELLING OPPORTUNITY To co-invest with two successful, veteran entrepreneurs in the paper and packaging segment Roger Stone and Matt Kaplan Collectively, largest shareholders including immediate family Own/control 11% of shares KapStone formed in 2005 Shareholder funds invested o 2005 - $120 million from IPO o 2007/2009 - $102 million from warrant exercises Dec. 2012 - $95 million special dividend Rapid Investment Growth Shareholder Funds Invested November 2013 $2.6 Billion $2.5 Billion Market Cap $2.4 Billion Growth CAGR 39% $222 Million $95 M Dividend |

|

|

$224 $492 $626 $783 $906 $1,217 $1,743 $50 $78 $27 $95 $165 $183 $337 2007 2008 2009 2010 2011 2012 2013* $s in Millions Net Sales CAGR 41% Adj. EBITDA CAGR 37% US Corrugated Inc. Purchase Price $332 MM 6.4 Xs Adj. TTM EBITDA 4 BUILDING OF KAPSTONE 4 business Purchase Price $204 MM 3.3 Xs TTM Adj. EBITDA business Purchase Price $466 MM 5.8 Xs TTM Adj. EBITDA Jan 1, 2007 Jul 1, 2008 Oct 31, 2011 Annual Net Sales and Adjusted EBITDA Longview Fibre Purchase Price $1.025 Billion 6.1 Xs Adj. TTM EBITDA** **4.7 Xs after adjusting for known CB price increases and synergies Jul 18, 2013 consensus *Analysts’ IP’s Kraft paper MWV’s kraft paper |

|

|

Purchase completed July 18, 2013 Synergy target of $18 million in annual benefits expected to be realized by late 2015 Consists primarily of various operating functions including purchasing, fiber, and freight Substantial benefits from operating efficiencies and capital programs in progress will be more significant than the synergies identified Overfunded pension plan assets result in no cash funding requirements for foreseeable future 5 LONGVIEW ACQUISITION Highly Accretive in 1st Partial Quarter July 18 through September 30 Results (75 Days) Net Sales $ 198MM Adj. EBITDA* $ 54MM Adj. Diluted EPS** $ 0.47 * Adjusted to exclude acquisition and one-time costs ** Adjusted for additional interest and related financing fees in addition to items above |

|

|

Four paper mills - Total capacity of 2.7 million tons 6 KAPSTONE TODAY Longview mill has tremendous fiber flexibility located in excellent wood basket 100% virgin to 100% recycled 1.15 million ton annual capacity Excess pulping and recovery capacity of approximately 300,000 tons per year Charleston, SC and Roanoke Rapids, NC mills are 100% virgin fiber based and are located in excellent wood basket 1.315 million ton capacity Linerboard, kraft paper, saturating, and Kraftpak Cowpens, SC recycled fiber mill 240,000 ton capacity Linerboard and medium 18 bsf of capacity Corrugated boxes and sheets 22 converting plants located throughout the U.S. |

|

|

7 WELL POSITIONED TO MEET OUR CUSTOMERSEEDS |

|

|

8 PRODUCTS Kraft Containerboard Approximately 1,700,000 tons per year Wide range of grades and basis weights High performance light weight linerboard grades Kraft Papers Approximately 600,000 tons per year High performance multiwall and various kraft grades Only US producer of extensible (high performance) grades DuraSorb (Saturating Kraft) Approximately 250,000 tons per year Used in various high pressure laminates including furniture, countertops, and flooring Kraftpak Approximately 120,000 tons per year A virgin fiber, unbleached, uncoated folding carton board Corrugated Packaging - Approximately 12 billion square feet (860,000 tons) per year Corrugated boxes and sheets |

|

|

9 RAPIDLY GENERATING CASH $120 $102 $2,229 $959 $967 $2,027 $95 $268 $12 $ in Millions Source & Use of Funds Since Inception (Inception September 30, 2013) Use Source Generated $959 million of cash from operations since inception Sufficient cash to pay off 96% of first 3 acquisitions |

|

|

10 POWERFUL CASH FLOW GENERATOR $ 75 Million free cash flow Free cash flow up $48 million, or 182%, over PY FCF per share of $1.54 Rapidly De-Levering Debt Q3 2013 Debt to EBITDA leverage ratio* Reduces debt rapidly Net debt at September 30, 2013 was $1.311 billion consisting of: $ 805 million of 5 year term loan A1 $ 470 million of 7 year term loan A2 $ 36 million of revolver borrowings Blended cash interest rate was 2.6 percent at September 30, 2013 Available revolver balance is $359 million and $300 million accordion 3.8 X on July 18 3.2 X at Sept. 30 *Calculated per bank agreement |

|

|

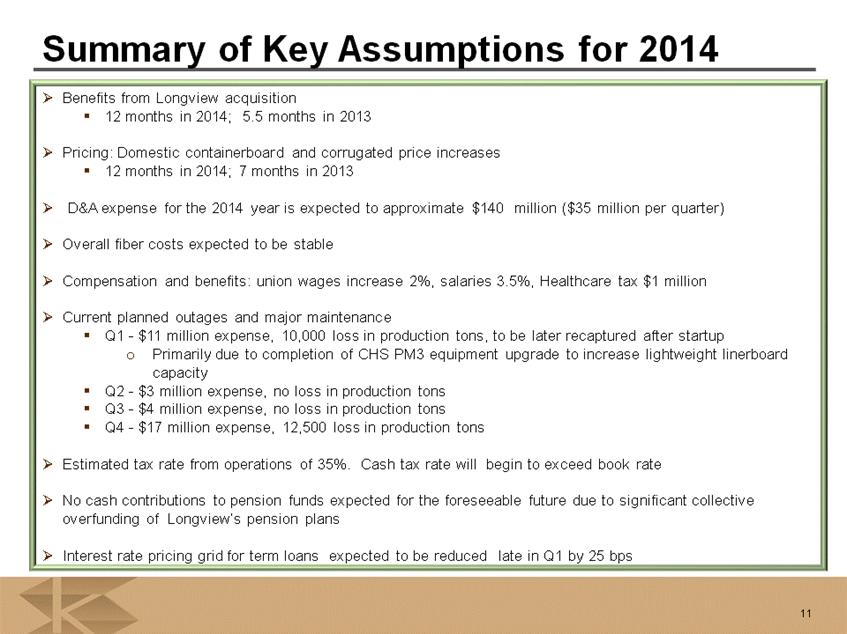

Summary of Key Assumptions for 2014 Benefits from Longview acquisition 12 months in 2014; 5.5 months in 2013 Pricing: Domestic containerboard and corrugated price increases 12 months in 2014; 7 months in 2013 D&A expense for the 2014 year is expected to approximate $140 million ($35 million per quarter) Overall fiber costs expected to be stable Compensation and benefits: union wages increase 2%, salaries 3.5%, Healthcare tax $1 million Current planned outages and major maintenance Q1 - $11 million expense, 10,000 loss in production tons, to be later recaptured after startup Primarily due to completion of CHS PM3 equipment upgrade to increase lightweight linerboard capacity Q2 - $3 million expense, no loss in production tons Q3 - $4 million expense, no loss in production tons Q4 - $17 million expense, 12,500 loss in production tons Estimated tax rate from operations of 35%. Cash tax rate will begin to exceed book rate No cash contributions to pension funds expected for the foreseeable future due to significant collective overfunding of Longview’s pension plans Interest rate pricing grid for term loans expected to be reduced late in Q1 by 25 bps 11 |

|

|

12 OPPORTUNITY IN IMPROVING SECTOR Significant industry consolidation Divestment of trees High industry-wide operating rates Supply and demand are in balance resulting in manageable inventory levels High entry costs and onerous permitting hurdles limit new capacity Anticipate increased demand as worldwide economies improve Strong Fundamentals for New Containerboard Industry Structure |

|

|

Continue to grow our business profitably by opportunistically investing in brown paper and packaging assets Maximize capital returns Optimizing operations of acquired companies Focusing on cash generation 13 KAPSTONES GUIDING PRINCIPLES & RESULTS Results Comparison of 71 Month Cumulative Total Return Assumes Initial Investment of $100 Closing Price of $52.52, Nov. 11, 2013 $826 $0 $200 $400 $600 $800 $1,000 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 11/11/13 KapStone Paper and Packaging Corporation S&P 500 Index - Total Returns S&P 500 Paper Packaging Index |

|

|

14 THE BEST IS YET TO COME Compelling industry fundamentals KS well-positioned in highly desirable containerboard market Dynamic combination of legacy KapStone and Longview expected to produce substantial operating benefits far in excess of the $18 million synergy benefits identified to date and to be achieved by end of 2015 Grow revenue and profits by increasing utilization of converting facilities Current asset base provides good growth opportunities Opportunity to quickly de-lever due to strong free cash flow 1 4 FOR VALUE CREATION & EARNINGS GROWTH |