Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Advanced Emissions Solutions, Inc. | d624488d8k.htm |

| EX-99.1 - EX-99.1 - Advanced Emissions Solutions, Inc. | d624488dex991.htm |

2013

Third Quarter Conference Call November 7,2013

www.advancedemissionssolutions.com

©

2013 Advanced Emissions Solutions, Inc.

Exhibit 99.2 |

This

presentation includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of

1934, which provides a "safe harbor" for such statements in certain

circumstances. The forward-looking statements include statements or

expectations regarding future contracts, projects, demonstrations and technologies; amount and

timing of production of RC, revenues, earnings, cash flows and other financial

measures; future operations; our ability to capitalize on and expand our

business to meet opportunities in our target markets and profit from our proprietary

technologies; scope, timing and impact of current and anticipated regulations and

legislation; future supply and demand; the ability of our technologies to assist

our customers in complying with government regulations and related matters.

These statements are based on current expectations, estimates, projections, beliefs and

assumptions of our management. Such statements involve significant risks and

uncertainties. Actual events or results could differ materially from those

discussed in the forward-looking statements as a result of various factors,

including but not limited to, changes in laws,

regulations and IRS interpretations or guidance, government funding, accounting rules,

prices, economic conditions and market demand; timing of laws, regulations and

any legal challenges to or repeal of them; failure of the RC facilities to

produce coal that qualifies for tax credits; termination of or amendments to the

contracts for RC facilities; decreases in the production of RC; failure to lease

or sell the remaining RC facilities on a timely basis; our inability to ramp up

operations to effectively address expected growth in our target markets; inability to

commercialize our technologies on favorable terms; impact of competition;

availability, cost of and demand for alternative tax credit vehicles and other

technologies; technical, start-up and operational difficulties; availability of raw

materials and equipment; loss of key personnel; intellectual property

infringement claims from third parties; seasonality and other factors discussed in greater

detail in our filings with the Securities and Exchange Commission (SEC). You are

cautioned not to place undue reliance on such statements and to consult our SEC

filings for additional risks and uncertainties that may apply to our business and the

ownership of our securities. Our forward-looking statements are presented as of the

date made, and we disclaim any duty to update such statements unless required by

law to do so. We refer to certain non-GAAP financial measures in this

presentation. Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures can be found within this

presentation. SAFE HARBOR

©

2012-2013 Advanced Emissions Solutions, Inc.

-2- |

-3-

2013 Advanced Emissions Solutions, Inc |

EMISSION

CONTROL MATS market developing as expected

ADES is prepared for the equipment market

Supply agreements already in place, engineering capabilities expanded

$1-$2B market for consumables to control mercury starting in 2016

ADA has proprietary chemical additive for this market

©

2012-2013 Advanced Emissions Solutions, Inc.

-4- |

100+

MT/yr

~25

MT/yr

8 facilities

leased/sold

~5

MT/yr

©

2012-2013 Advanced Emissions Solutions, Inc.

-5-

10/29/13 A

12/31/13

3/31/14

12/31/14

3 facilities

CCS-operated

Additional 2

facilities in

full-time

operation

(using M-45-

PC™

technology)

All 28 RC facilities are expected to be in full-time operations by year end 2014

CCS

expects

to

retain

and

operate,

and/or

participate

in

some

RC

facilities

to

generate

tax

credits

sufficient

to

offset

expected

tax

liability

Full-Time Operations Roadmap

2015

2021

Additional

4 facilities

in full-time

operation

Additional

11 facilities

in full-time

operation

28

facilities in

full-time

operation

TM |

REFINED COAL:

FINANCIAL

IMPACT

OF

GAAP

REPORTING

©

2012-2013 Advanced Emissions Solutions, Inc.

-6-

CCS incurs no operating

costs for the RC facility

CCS receives ~$3-$4/ton in

rental income from RC

investor

CCS spends ~$3/T to

operate RC facility

CCS generates ~$7.50/T in

tax credits for its members

CCS incurs no operating

costs for the RC facility

CCS generates no value

RC facility

leased/sold

to RC

investor

RC facility

operated by

CCS

RC facility

not in full-

time

operation

* ADA’s 42.5% share of tax credits included in net deferred tax assets. NDTA

are offset by a valuation allowance as discussed in the footnotes to the financial statements

Typical RC facility

producing 4MT/Y

Quarterly

($M)

Annually

($M)

Cash Spent

$ --

$ --

Cash Received

$ --

$ --

Tax Benefits Generated

$ --

$ --

Status

Financial Impact

Typical RC facility

producing 4MT/Y

Quarterly

($M)

Annually

($M)

Cash Spent

$3.0

$12.0

Cash Received

$ --

$ --

Tax Benefits Generated*

~$7.50

~$30.0

Typical RC facility

producing 4MT/Y

Quarterly

($M)

Annually

($M)

Cash Spent

$ --

$ --

Cash Received

$3.5

$14.0

Tax Benefits Generated

$ --

$ -- |

Developing proprietary solid sorbent capture

technology to capture CO

2

from flue gas in

conventional coal-fired boilers

DOE and industry funding:

Phase I -

$3.8 M, R&D at 1 KWe scale, Completed in

2011

Phase II -

$20.5 M, 51-month contract to validate

technology at 1 MWe scale

Pilot Design: 2012, Construction: 2013, Testing: 2014

Located at Southern Company’s Plant Miller

Advantages over competing technologies:

For customer: lower cost and less parasitic energy

For ADA: continuous revenues from sale of

proprietary chemical sorbents

CO

2

CAPTURE:

OVERVIEW

Pilot plant being assembled

at Plant Miller

©

2012-2013 Advanced Emissions Solutions, Inc.

-7- |

2013

Q3

REVIEW

AND

FINANCIAL

RESULTS

MARK

M KINNIES,

SVP

AND

CFO

©

2013 Advanced Emissions Solutions, Inc

-8-

C |

Clean

Coal operated 10 RC facilities in 3Q13, 7 of which were leased or sold to RC

investors

In 3Q13 the three RC facilities operated by Clean Coal incurred operating expenses of

$3.1M but generated $6.8M in tax credits

The operation of these units included $36M in pass-through coal

purchases/sales REFINED

COAL

©

2013 Advanced Emissions Solutions, Inc

-9-

$(000)

2013

2012

Coal sales

35,568

$

59,021

$

31,769

$

Rental and other income

20,270

11,176

12,419

Total RC Revenues

55,838

$

70,197

$

44,188

$

Cost of Revenues

39,626

$

67,269

$

36,167

$

Gross Profit

16,212

$

2,928

$

8,021

$

Gross Profit Margin Percentage

29%

4%

18%

Adjusted Gross Profit*

19,338

$

11,041

$

12,393

$

Adjusted Gross Profit Margin Percentage*

95%

99%

99%

* Adjusted gross profit and adjusted gross profit margin percentage excludes coal sales and

raw coal purchases and retained tonnage operating expense See Appendix for explanation

of non-GAAP measures. Operating Statistics (millions)

Tons for leased facilities

5.3

2.8

2.6

Tons retained

1.0

2.5

1.2

Total tons treated

6.3

5.3

3.8

Tax Credits generated by JV

6.8

$

16.1

$

7.7

$

Tax Credits to ADA (42.5%)

2.9

$

6.8

$

3.3

$

For the Three Months Ended

September 30, For the Three

Months Ended

June 30, 2013 |

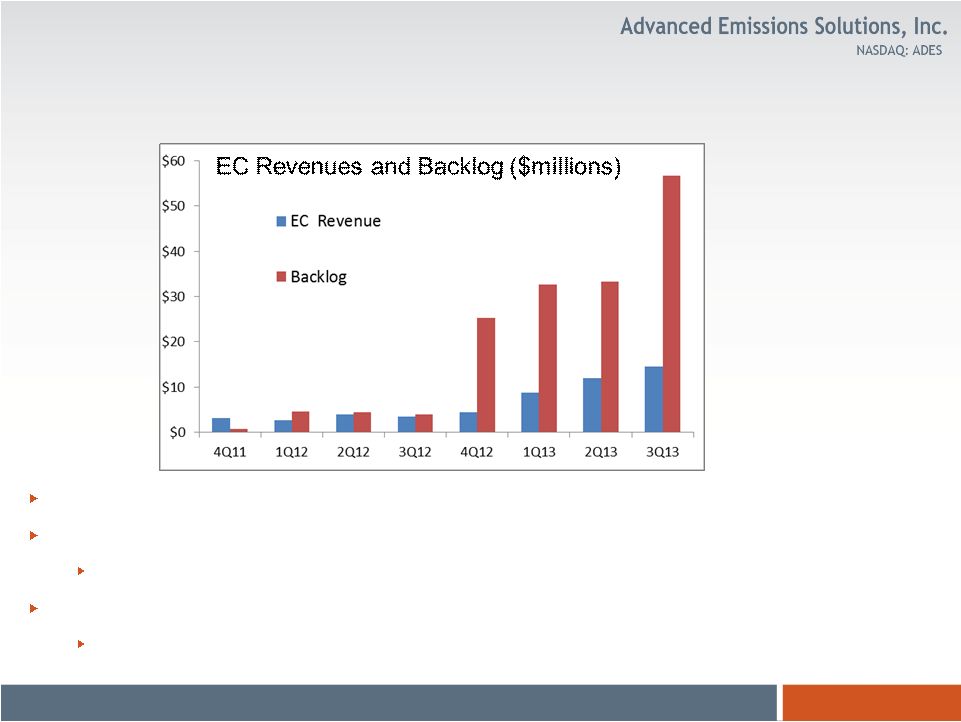

MATS

rule finalized in March 2012- compliance by 2015/2016

3Q13 Revenues up 300% year-over-year, driven by MATS demand for ACI

and DSI systems

Backlog at 9/30/13 stands at $56.6M, up from $33.2M at 6/30/2013

Currently working on bids or discussing potential projects for ACI and DSI

systems in excess of $120 million

EMISSION

CONTROL

©

2013 Advanced Emissions Solutions, Inc

-10-

2013

2012

$(000)

Systems and equipment

12,094

$

2,299

$

9,915

$

Consulting and development

2,150

968

2,020

Chemicals

254

213

79

Total EC

Revenues 14,498

$

3,480

$

12,014

$

Cost of Revenues

11,836

$

2,683

$

9,711

$

Gross Profit

2,662

$

797

$

2,303

$

Gross Profit Margin Percentage

18%

23%

19%

EC Segment Backlog

56,600

$

3,900

$

33,200

$

For the Three Months Ended September 30,

For the Three

Months Ended

June 30, 2013 |

In

Phase II of DOE and Industry funded $20.5M 51-month contract to scale

technology to 1MW Project started in June 2012

Estimated completion of construction in 2014

Testing in Fall 2014

CO

2

CAPTURE

©

2013 Advanced Emissions Solutions, Inc

-11-

2013

2012

$(000)

Total CC Revenues

4,257

$

676

$

2,728

$

Cost of Revenues

3,998

$

444

$

2,458

$

Gross Profit

259

$

232

$

270

$

Gross Profit Margin Percentage

6%

34%

10%

Total Backlog

4,300

$

14,600

$

8,500

$

For the Three Months Ended September 30,

For the Three

Months Ended

June 30, 2013 |

FINANCIAL RESULTS

©

2013 Advanced Emissions Solutions, Inc

-12-

$(000)

2013

2012

Revenues

74,593

$

74,353

$

58,930

$

*Revenues excluding coal sales

39,025

$

15,332

$

27,161

$

Gross Margin Before Depreciation and Amortization

19,133

$

3,957

$

10,594

$

General and administrative

8,955

5,173

8,109

Research and development

976

882

577

Depreciation and amortization

1,433

1,239

1,347

Operating Income (Loss)

7,769

$

(3,337)

$

561

$

Income from unconsolidated entity

547

232

274

Interest expense and other income, net

(25)

(115)

(83)

Other expense

(438)

(848)

(735)

Income (Loss) from Continuing Operations Before Income

Taxes and Non-controlling interests

7,853

$

(4,068)

$

17

$

Income taxes

-

-

-

Non-controlling

interests (6,262)

120

(3,195)

Net Income (Loss) Attributable to ADA

1,591

$

(3,948)

$

(3,178)

$

Net Income (Loss) Per Basic and Diluted Common

Share Attributable to ADA

0.16

$

(0.39)

$

(0.32)

$

Weighted Average Common Shares Outstanding

10,110

10,017

10,076

Weighted Average Diluted Common Shares Outstanding

10,278

10,017

10,076

*See page 15 for explanation of non-GAAP

measure For the Three Months Ended September 30,

For the Three

Months Ended

June 30, 2013 |

BALANCE SHEET

HIGHLIGHTS

$s in Millions

*Included in working capital at 9/30/13 is $50.2 million in deferred revenue. Included in working capital at 12/31/12 are $21.2 million in

deposits and $4.5 million in deferred revenue ** Long-term liabilities include $17.2

million and $0.9 million at 9/30/13 and 12/31/12 respectively, related

to Clean Coal

-13-

©

2013 Advanced Emissions Solutions, Inc |

APPENDIX

-14-

©

2013 Advanced Emissions Solutions, Inc |

NON-GAAP FINANCIAL

MEASURES

-15-

©

2013 Advanced Emissions Solutions, Inc

$(000)

September 30, 2013

September 30, 2012

June 30, 2013

Coal sales and cost of raw coal

35,568

$

59,021

$

31,769

$

Operating costs of retained

tonnage 3,126

$

8,349

$

4,372

$

Adjusted gross

profit and adjusted gross margin percentage excludes coal sales and raw coal purchases and retained tonnage

operating expenses. Adjusted gross profit and adjusted gross profit percentage are

non-GAAP financial measures which are used to provide investors with greater

transparency with respect to the effect on gross margin from Clean Coal’s operation of certain RC

facilities for its own account. We believe these non-GAAP financial measures provide

meaningful supplemental information for investors regarding the performance of our

business and the effect on gross margin and gross margin percentage of the operation of

these RC facilities by Clean Coal for its own account. For the Three Months Ended

|

CONTACTS Graham Mattison

Vice President, Investor Relations

(646)-319-1417

graham.mattison@adaes.com

Michael D. Durham, Ph.D., MBA

President & CEO

Mark H. McKinnies

SVP & CFO

-16-

©

2013 Advanced Emissions Solutions, Inc |