Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENCORE CAPITAL GROUP INC | d626857d8k.htm |

Encore Capital Group, Inc.

Q3 2013 EARNINGS CALL

Exhibit 99.1 |

PROPRIETARY

2

CAUTIONARY NOTE ABOUT

FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not

historical facts, including, most importantly, those

statements preceded by, or that include, the words

“will,” “may,” “believe,” “projects,” “expects,”

“anticipates” or the negation thereof, or similar

expressions, constitute “forward-looking statements”

within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). These

statements may include, but are not limited to,

statements regarding our future operating results,

earnings per share, and growth. For all “forward-

looking statements,” the Company claims the

protection of the safe harbor for forward-looking

statements contained in the Reform Act. Such

forward-looking statements involve risks, uncertainties

and other factors which may cause actual results,

performance or

achievements of the Company and its subsidiaries

to be materially different from any future results,

performance or achievements expressed or implied

by such forward-looking statements. These risks,

uncertainties and other factors are discussed in the

reports filed by the Company with the Securities

and Exchange Commission, including its most

recent report on Form 10-K, and its subsequent

reports on form 10-Q, each as it may be amended

from time to time. The Company disclaims any

intent or obligation to update these forward-looking

statements. |

PROPRIETARY

3

ENCORE DELIVERED A RECORD QUARTER

Estimated Remaining Collections of $4.0 billion

* From continuing operations attributable to Encore

** Please refer to Appendix for reconciliation of Adjusted EPS, Adjusted EBITDA, and

Adjusted Net Income to GAAP *** Cost to Collect is Adjusted Operating Cost /

Dollars collected. See Appendix for reconciliation of Adjusted Operating Cost to GAAP

Note: All Figures Include Cabot Credit Management UK results unless otherwise

indicated $27

$22

40.7%

$234 million

$380 million

$1.02

$0.82

million

million

GAAP EPS*

Adjusted EPS**

Collections

Adjusted EBITDA**

Adjusted

Net Income**

GAAP Net Income*

Cost to Collect*** |

PROPRIETARY

4

YEAR TO DATE PERFORMANCE HAS BEEN STRONG

* From continuing operations attributable to Encore

** Please refer to Appendix for reconciliation of Adjusted EPS, Adjusted EBITDA, and

Adjusted Net Income to GAAP *** Cost to Collect is Adjusted Operating Cost /

Dollars collected. See Appendix for reconciliation of Adjusted Operating Cost to GAAP

Note: All Figures Include Cabot Credit Management UK results unless otherwise

indicated $69

$53

38.9% $586

million

$928 million

$2.06

$2.74

million

million

Adjusted Net

Income**

Adjusted EPS**

Adjusted EBITDA**

Collections

GAAP EPS*

GAAP Net Income*

Cost to Collect*** |

PROPRIETARY

5

OUR STRATEGIC MOVES ARE BEARING FRUIT

Asset Acceptance

Continued to move accounts to

Encore -

835k in Q3

Collections were ahead of plan

Expenses were under budget

Cabot Credit Management

Analysis well underway to

expand into new market

segments

India team fully engaged –

expect to be making calls into

the UK in Q1 2014

Propel

Now in 9 states

First Nevada tax lien transfer

executed

Well positioned for industry

consolidation |

6

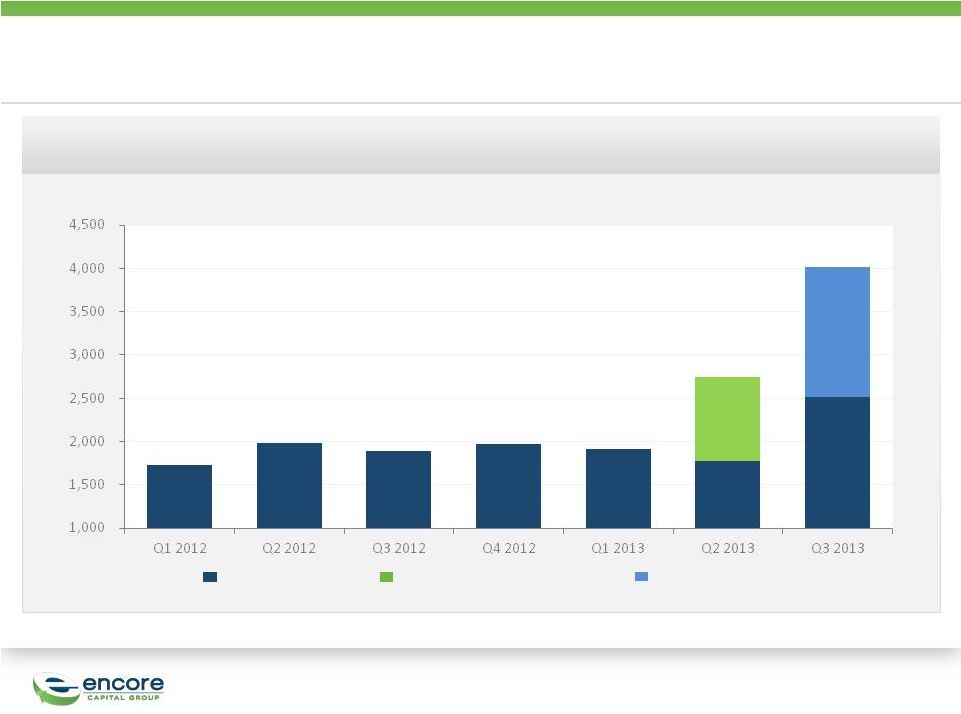

GROWTH IN DEPLOYMENTS WAS LED BY THE

ACQUISITION OF CABOT CREDIT MANAGEMENT

PROPEL DEPLOYMENTS

CABOT DEPLOYMENTS

DEPLOYMENTS

Market comments

US direct-from-issuer pricing pressure remains,

with consolidation among fewer, more stable

buyers

UK market dominated by a few large players

UK issuer inventory backlog expected to come to

market over the next few years

PROPRIETARY |

PROPRIETARY

7

THE CABOT TRANSACTION RESULTED IN STRONG

GROWTH IN ERC

$M

Encore ERC

Asset Acceptance ERC

Cabot ERC

2,519

1,780

1,911

1,967

1,890

1,983

1,724

1,503

4,022

2,741

961

Estimated Remaining Collections |

PROPRIETARY

8

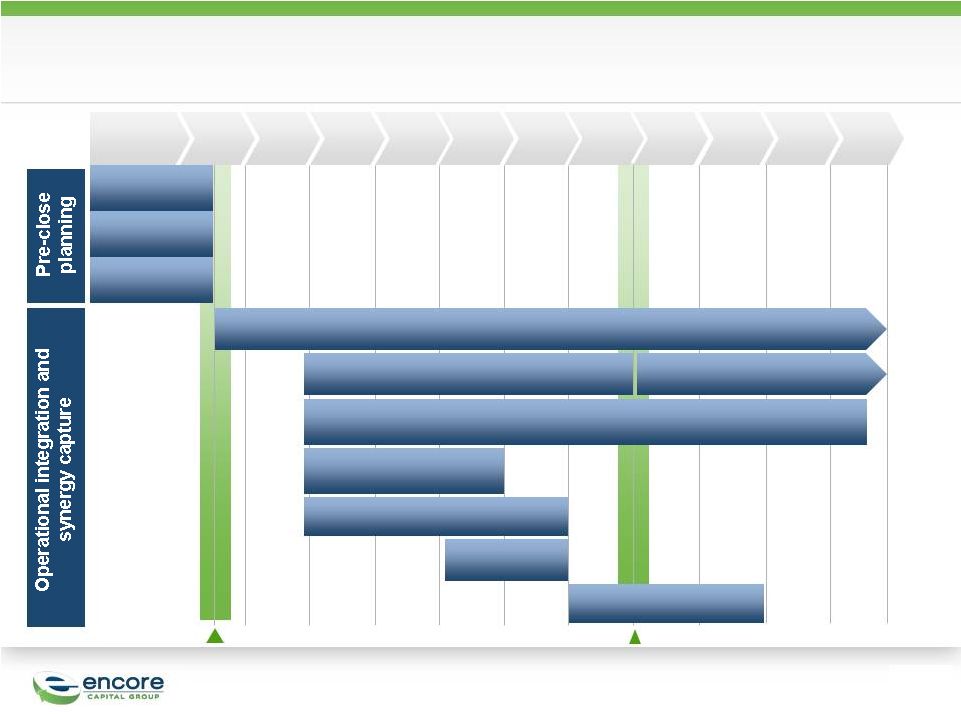

OUR INTEGRATION PLAN FOR AACC REMAINS ON TRACK

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Pre-close

Jun

Feb

Mar

Apr

Support Function Rationalization

Law Firm Management

Internal Legal Platform Integration

Finance

Integration

HR Integration

IL Acct Placement and

conversion

Collection Agency

Rationalization

Call Center Rationalization

Close Of AACC Transaction

Internal Legal Launch

Retention

Agreements

Synergy

Identification

Integration

Planning |

PROPRIETARY

PROPEL CONTINUES TO GROW AND CONTRIBUTE TO

ENCORE

9

$100 million of

capital deployed YTD

Now operating in 9

states

Funded first tax lien

transfer in Nevada

Operating Income

Revenue

Capital Deployed

0

10

20

30

40

50

60

70

Q1

Q2

Q3

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Q1

Q2

Q3

0.0

0.5

1.0

1.5

2.0

Q1

Q2

Q3 |

10

CABOT’S Q3 RESULTS WERE STRONG AND IN LINE

WITH OUR INVESTMENT MODEL

Adjusted EBITDA*

$50.6

million

Collections

$67.4

Million

Revenue

$46.5

million

Portfolio purchases

$27.0

million

Cost to Collect**

27.2%

120-Month Estimated Remaining Collections of

$1.5 billion

*

Please

refer

to

Appendix

for

reconciliation

of

Adjusted

EBITDA

to

GAAP

** Cost to Collect is Adjusted Operating Cost / Dollar collected. See Appendix for

reconciliation of Adjusted Operating Cost to GAAP

PROPRIETARY |

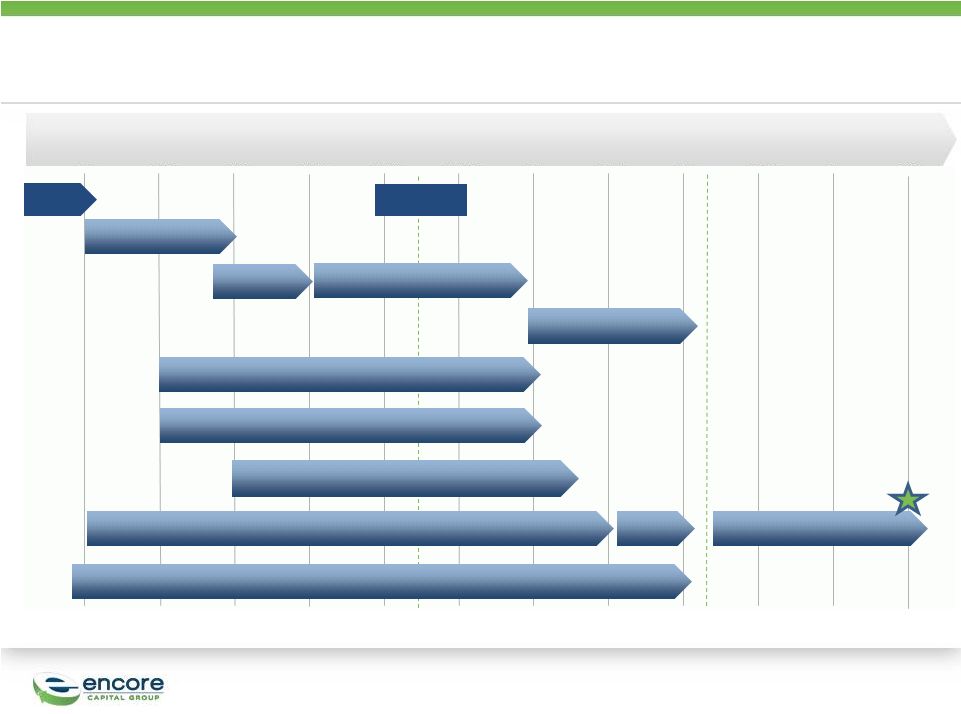

PROPRIETARY

OUR FOCUS AT CABOT IS TO BEGIN LEVERAGING

OUR INDIA SITE DURING THE DAY HOURS IN Q1 2014

11

9/1

9/15

10/1

10/15

11/1

11/15

12/1

12/15

1/1

1/15

Where we

are today

Kick-off

2/1

2/15

Overall IT infrastructure readiness

People selection &

onboarding

Onshore class room training

Visa/ Travel

readiness

On the job training

UAT

Pilot team ‘Go-Live’

@ India

Inventory identification

Servicing/ Dialer strategy

Legal & statutory compliance

Cabot & Encore teams to develop pricing model

ROADMAP –

CABOT INDIA OPERATIONS LAUNCH |

PROPRIETARY

REGULATORY DEVELOPMENTS CONTINUE TO HAVE A

MEANINGFUL EFFECT ON THE INDUSTRY

12

Office of the

Comptroller of the

Currency (OCC)

Debt Sales Best Practices

Memo –

3Q13

Emphasizes importance of

vendor management and

procedures designed to

reduce issuer risk

Accelerated issuer audit

programs

Consumer Financial

Protection Bureau

(CFPB)

Advanced Notice of

Proposed Rulemaking

(ANPR)

–

4Q13

Notice of Proposed

Rulemaking (NPR) –

summer 2014

Final rulemaking late 2014 |

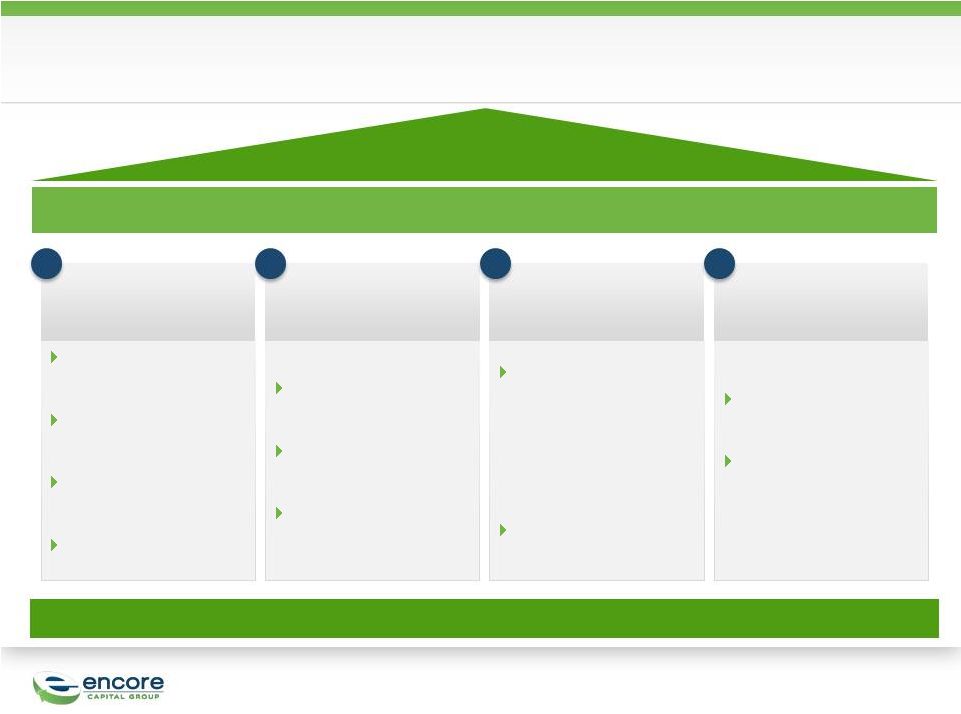

PROPRIETARY

Regulators

Encore Initiatives

ENCORE HAS LONG SHARED REGULATORS’

VISION TO

RAISE INDUSTRY STANDARDS

13

Consumer Credit

Research Institute

Consumer Bill of

Rights

Consumer Experience

Council

Enterprise Risk

Management

Benefit to consumers

Regulatory clarity &

balance

Industry consolidation

Stronger collections

industry

OCC

CFPB

Outcomes |

PROPRIETARY

14

ENCORE IS WELL POSITIONED TO MAINTAIN ITS

MOMENTUM & CONTINUE DELIVERING TOP QUARTILE TSR

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

Specialized call

centers

Efficient international

operations

Internal legal

platform

Operational Scale

& Cost Leadership

2

Sustained success at

raising capital

•

Low cost of debt

•

Sustainable

borrowing capacity

and cash flow

generation

Prudent capital

deployment

Strong Capital

Stewardship

3

Consumer

intelligence

Data driven,

predictive modeling

Portfolio valuation at

consumer level

Consumer Credit

Research Institute

Superior

Analytics

1

Uniquely scalable

platform

Strategic investment

opportunities in near-

in geographic and

paper type

adjacencies

Extendable

Business Model

4 |

15

Detailed Financial Discussion |

PROPRIETARY

16

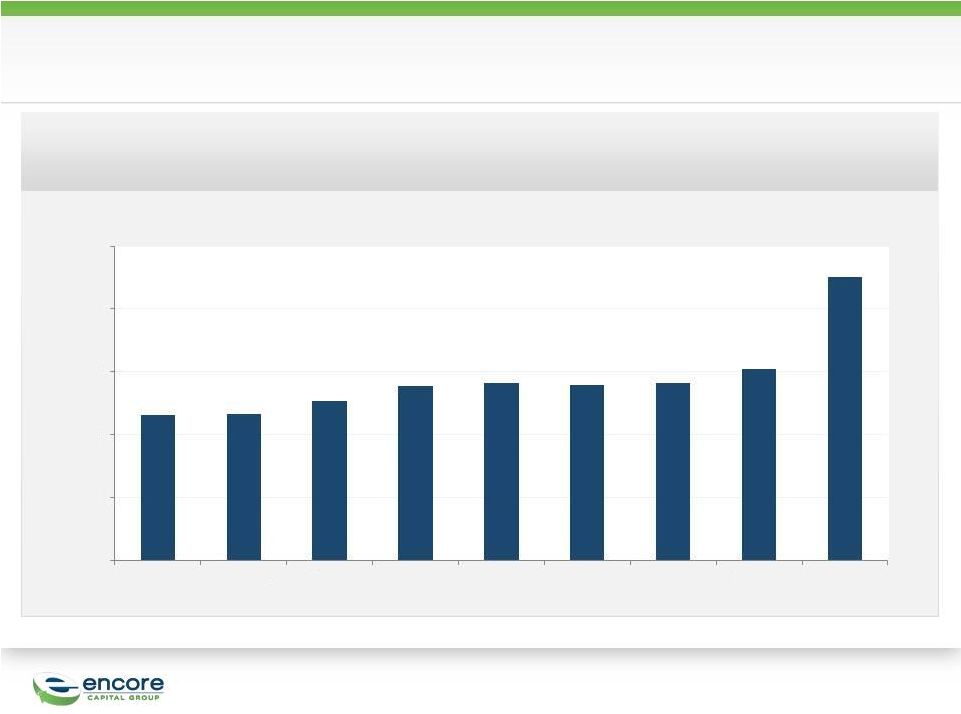

THE AACC AND CABOT ACQUISITIONS ACCELERATED Q3

COLLECTIONS

189

186

231

241

246

230

270

278

380

100

150

200

250

300

350

400

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

$M

Core Collections

83

80

110

112

117

104

127

117

119

95

96

110

115

111

113

122

134

154

11

10

11

14

18

13

21

27

40

67

0

100

200

300

400

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

-

Collection Sites

-

Legal Collections

-

Collection Agencies

-

Cabot

$M |

PROPRIETARY

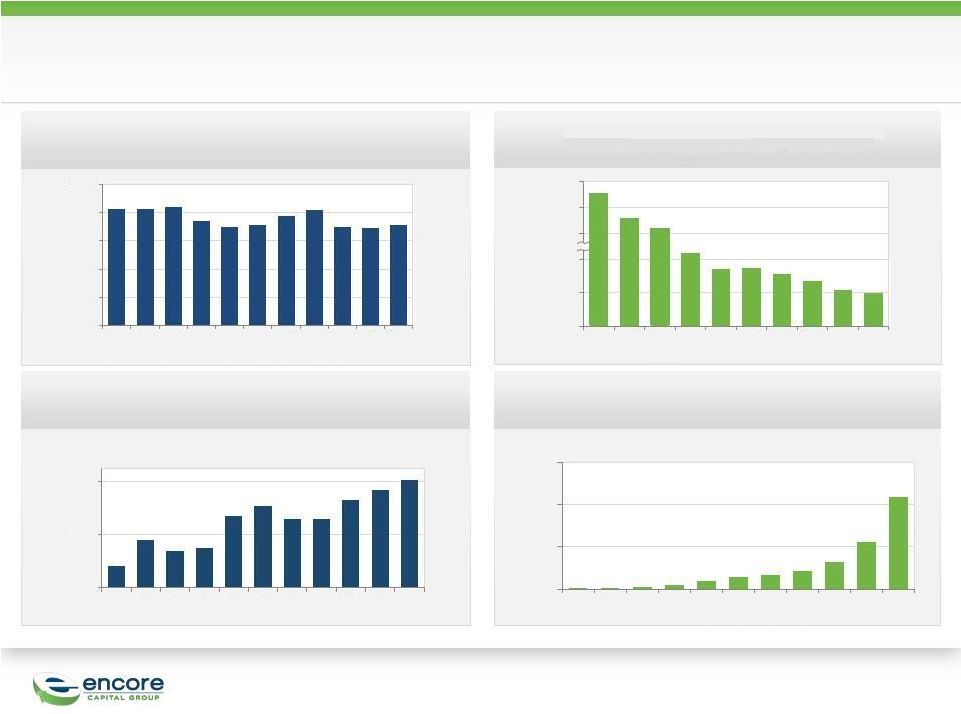

STRONG COLLECTIONS LED TO SOLID REVENUE

GROWTH

17

116

116

126

139

141

140

141

152

225

50

100

150

200

250

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

$M

Revenue From Core Collections

- |

PROPRIETARY

18

COLLECTION MULTIPLES CONTINUE TO INCREASE

OVER TIME

-

0.5

1.0

1.5

2.0

2.5

3.0

2009

2010

2011

2012

Expected Multiple at Purchase

Current Multiple |

PROPRIETARY

ENCORE’S COST TO COLLECT FULLY REFLECTS AACC’S

AND CABOT’S OPERATIONS

19

* Cost to Collect is Adjusted Operating Cost / Dollar collected.

See Appendix for reconciliation of Adjusted Operating

Cost to GAAP.

Channel

Q3 2013

CTC

Q3 2012

CTC

Cabot

27.2%

24.5%

Legal

39.6%

41.5%

Core sites

8.4%

5.9%

44%

44%

38%

40%

41%

43%

37%

39%

41%

30%

40%

50%

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

Overall Cost to Collect* |

PROPRIETARY

AFTER SEVERAL QUARTERS OF INVESTMENT, COST

TO COLLECT IN INTERNAL LEGAL IS DECLINING

20

0%

10%

20%

30%

40%

50%

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

0%

50%

100%

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

150%

300%

450%

80

100

120

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

-

15.0

30.0

45.0

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

Legal Outsourcing Cost to Collect

Internal Legal Cost to Collect

Legal Outsourcing Collections

Internal Legal Collections

$M

$M |

PROPRIETARY

COLLECTIONS GROWTH AND COST IMPROVEMENTS

LED TO IMPROVED CASH FLOWS

21

* Please refer to Appendix for reconciliation of Adjusted EBITDA

to GAAP

Adjusted EBITDA*

107

105

144

148

151

135

174

177

234

-

50

100

150

200

250

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013 |

PROPRIETARY

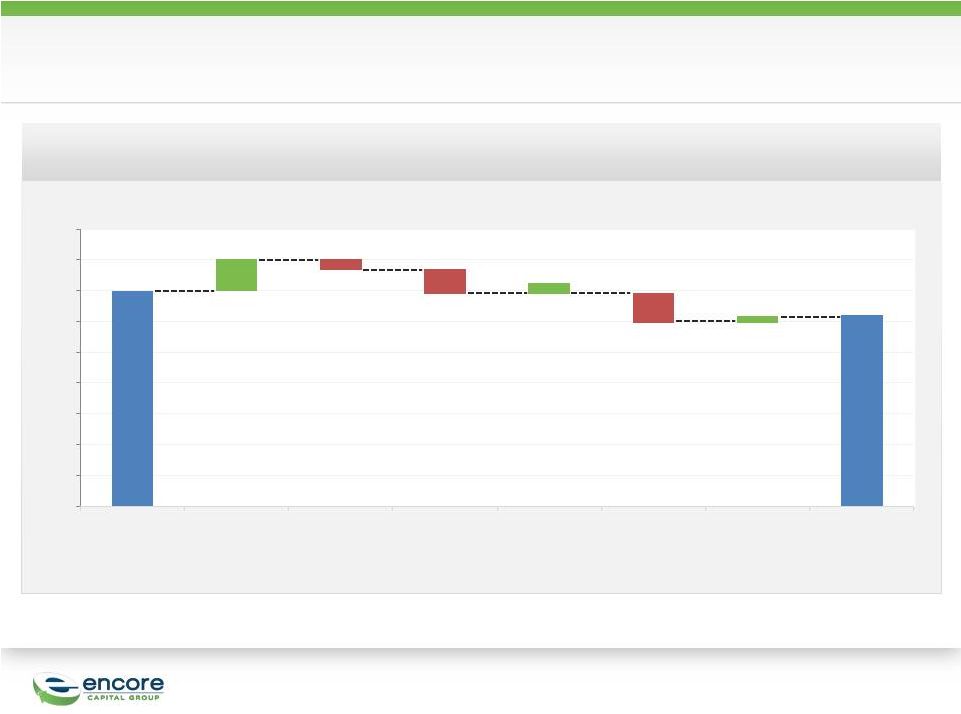

WE SAW IMPROVEMENT IN OUR EFFECTIVE TAX RATE

22

35.0%

5.2%

(4.0%)

1.8%

(4.8%)

1.1%

(1.8%)

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Federal Provision

State Provision

State Benefit

Changes in State

Apportionment

Tax Reserves

International

Provision

Permanent Items

Q3 Effective

Rate

32.5% |

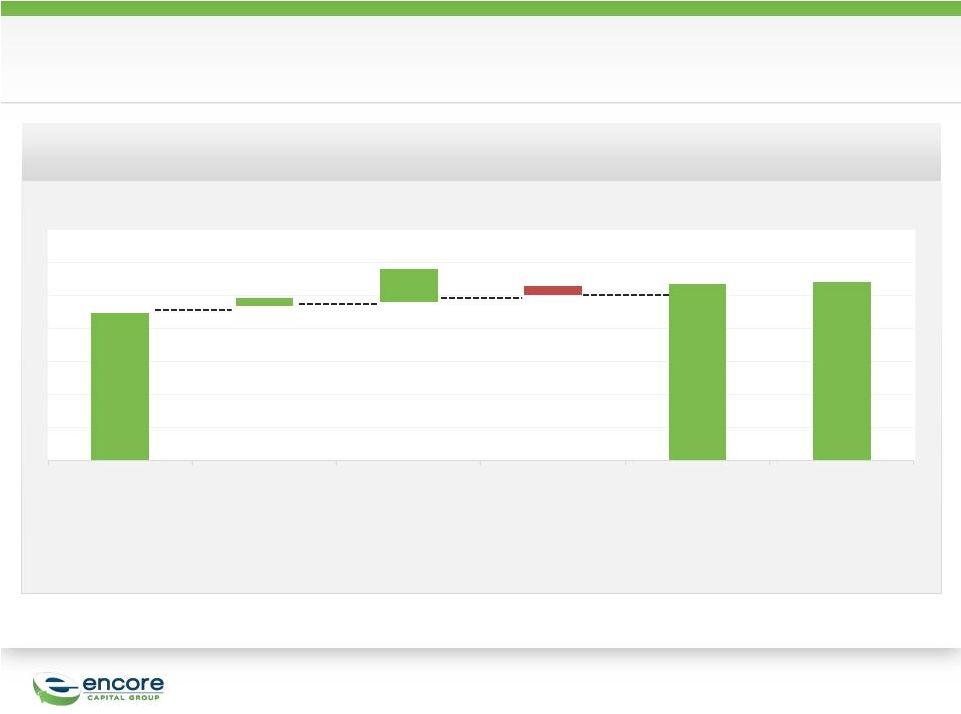

PROPRIETARY

ENCORE’S Q3 ADJUSTED EPS SET A RECORD OF $1.02

PER FULLY DILUTED SHARE

23

$(0.05)

Net income per diluted

share from continuing

operations attributable

to Encore

Net non-cash interest

and issuance cost

amortization, net of tax

Acquisition related legal

and advisory fees, net

of tax

Effect of tax credits

applicable to prior

periods

Adjusted net income

from continuing

operations per diluted

share attributable to

Encore -

(Accounting)

Adjusted net income

from continuing

operations attributable

to Encore -

(Economic)*

$0.82

$0.04

$0.18

$0.99

$1.02

* Please refer to Appendix for reconciliation of Adjusted EPS measurements to

GAAP Note: the following slide contains additional detail

|

–

Issued $115 million of

convertible bonds, due in

2017

–

The bonds are

convertible at $31.5625

–

Purchased hedges to

increase the effective

conversion price to

$44.1875

–

The average price of

Encore stock during Q3

2013 was $40.52

–

Initial cost of warrants

$11.6 million

–

Protected from 1.04

million shares of dilution

Note:

Non-GAAP economic EPS also removes non-cash interest expense from EPS

numerator OUR CONVERTIBLE HEDGE HAS PROTECTED US FROM

SIGNIFICANT ECONOMIC DILUTION

24

Impact of 3.00% Convertible due 2017 on Diluted Share Count

Increase to

Diluted

Share Count

=

Q3

Applicable

Share

Price

–

Conversion

Price

Q3 Applicable Share Price

Principal Amt Outstanding

Conversion Price

×

~805

Thousand

Shares

=

$40.52 –

$31.56

$40.52

$115 million

$31.56

×

$1.02

Adjusted EPS

-

economic

Adjusted

EPS

-

accounting

$0.99

Q3 GAAP Fully Diluted Shares Outstanding

27.2 million

(-) Shares from 2017 Bond Hedge

0.8 million

Non-GAAP Economic Shares Outstanding

26.4 million

$26.8 million

Adjusted Income from Continuing Operations Attributable to Encore

|

ENCORE’S OWNERSHIP OF CABOT REFLECTS THE MINORITY

INTERESTS OF J.C. FLOWERS AND MANAGEMENT

25

50.1%

49.9%

Not all entities depicted.

14.35%

Employee

Benefit Trust

(Management)

JFC III Europe

Holdings L.P.

(Cayman)

Encore

(US)

Encore Europe

Holdings s.a.r.l.

(Lux)

JFC III Europe

s.a.r.l.

(Lux)

Janus Holdings

s.a.r.l.

(Lux)

Cabot Holdings

s.a.r.l.

(Lux)

Cabot Credit

Management

(UK)

42.9% economic ownership

$177 million, consisting of:

$165 million -

PECs

$12 million -

shares

85.65% |

PROPRIETARY

CABOT CONTRIBUTED $0.17 TO ENCORE’S Q3 RESULTS

26

In 000’s except per share amounts

Janus

Encore Europe Holdings

EEH Consolidated

Revenue / other income

$46,568

-

$46,568

Total Expenses

(22,179)

-

(22,179)

EBITDA

24,389

-

24,389

Depreciation and Amortization

(1,461)

-

(1,461)

Non-PEC Interest Expense

(12,319)

-

(12,319)

PEC Interest –

JCF / Mgmt

(5,877)

-

(5,877)

PEC Interest –

Encore

(4,998)

4,998

-

Total Interest

(23,194)

4,998

(18,196)

Earnings Before Income Tax

(266)

4,998

4,731

Income tax

(1,173)

-

(1,173)

Net (loss) / profit before minority

interest

(1,440)

4,998

3,558

JCF / Mgmt non-controlling interest

(822)

-

(822)

Net (loss) / profit attributable to Encore

(618)

4,998

4,380 |

PROPRIETARY

27

ENCORE’S LONG-TERM PROSPECTS CONTINUE TO

BE FAVORABLE

Operating Results

& Deployment

A culture of constant

improvement drives

improved results

Liquidity &

Capital Access

Strong liquidity and

access to capital enhance

our ability to

take advantage

of consolidating markets

and new opportunities

Solid Cash Flows

Additional asset classes

and geographies continue

to enhance ERC and

collections

Geographic &

Asset Class

Diversification

We are an international

company in several asset

classes, positioned for

strong earnings growth

going forward |

28

Appendix |

PROPRIETARY

29

NON-GAAP FINANCIAL MEASURES

This presentation includes certain financial measures that exclude the impact of

certain items and therefore have not been calculated in accordance with U.S.

generally accepted accounting principles (“GAAP”). The Company has

included information concerning Adjusted EBITDA because management utilizes this

information, which is materially similar to a financial measure contained in

covenants used in the Company's revolving credit facility, in the evaluation

of its operations and believes that this measure is a useful indicator of

the Company’s ability to generate cash collections in excess of operating expenses

through the liquidation of its receivable portfolios. The Company has included

information concerning Adjusted Operating Expenses in order to facilitate a

comparison of approximate cash costs to cash collections for the portfolio

purchasing and recovery business in the periods presented. The Company has

included Adjusted Income from Continuing Operations per Share because management

believes that investors regularly rely on this measure to assess operating

performance, in order highlight trends in the Company’s business that

may not otherwise be apparent when relying on financial measures calculated in

accordance with GAAP. Adjusted EBITDA, Adjusted Operating Expenses and

Adjusted Income from Continuing Operations per Share have not been prepared

in accordance with GAAP. These non-GAAP financial measures should not be

considered as alternatives to, or more meaningful than, net income and total

operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP

financial measures, as presented by the Company, may not be comparable to similarly

titled measures reported by other companies. The Company has attached to

this presentation a reconciliation of these non- GAAP financial measures

to their most directly comparable GAAP financial measures. |

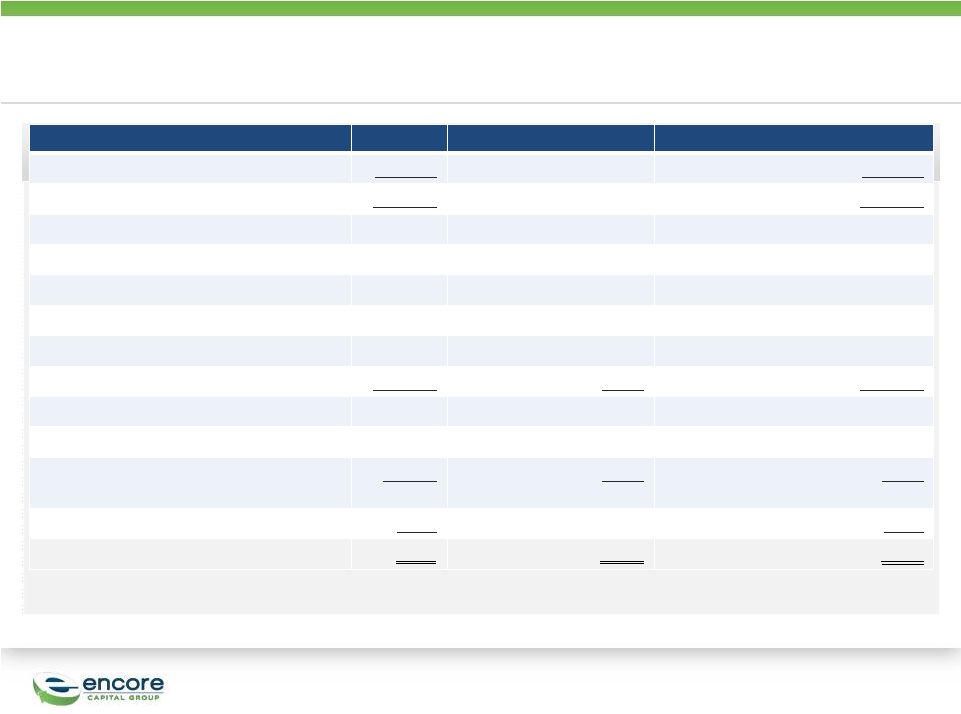

PROPRIETARY

September

30,

2013

2012

$

Per Diluted

Share –

Accounting

Per Diluted

Share –

Economic

$

Per Diluted

Share –

Accounting

Per Diluted

Share –

Economic

Net income from continuing operations

attributable to Encore

22,194

$0.82

0.84

21,308

$0.82

$0.82

Adjustments:

Net non-cash interest and issuance cost

amortization, net of tax

1,103

$0.04

0.04

-

-

-

Acquisition related legal and advisory fees,

net of tax

4,775

$0.18

0.18

-

-

-

Acquisition related integration and consulting

fees, net of tax

-

-

-

-

-

-

Effect

of

tax

credits

applicable

to

prior

periods

(1,236)

(0.05)

(0.05)

-

-

-

Adjusted net income from continuing

operations attributable to Encore

26,836

$0.99

$1.02

$21,308

$0.82

0.82

30

RECONCILIATION OF ADJUSTED EPS

Reconciliation of Adjusted EPS to GAAP EPS

(Unaudited, in thousands, except per share amounts), Three Months Ended

|

PROPRIETARY

31

RECONCILIATION OF ADJUSTED EPS

Reconciliation of Adjusted EPS to GAAP EPS

(Unaudited, in thousands, except per share amounts), Nine Months

Ended

September 30,

2013

2012

$

Per Diluted

Share –

Accounting

Per Diluted

Share –

Economic

$

Per Diluted

Share –

Accounting

Per Diluted

Share –

Economic

Net income from continuing operations

attributable to Encore

52,654

$2.06

2.08

58,404

$2.25

$2.25

Adjustments:

Net non-cash interest and issuance cost

amortization, net of tax

2,103

0.08

0.08

-

-

-

Acquisition related legal and advisory fees,

net of tax

9,756

0.38

0.39

2,567

0.10

0.10

Acquisition related integration and consulting

fees, net of tax

5,502

0.22

0.22

-

-

-

Effect of tax credits applicable to prior periods

(712)

(0.03)

(0.03)

-

-

-

Adjusted net income from continuing

operations attributable to Encore

69,303

$2.71

$2.74

$60,971

$2.35

$2.35 |

PROPRIETARY

Note:

The

periods

6/30/08

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20.

All

periods

have

been

adjusted

to

show

discontinued

ACG

operations.

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

GAAP net income, as

reported

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

10,861

11,730

12,290

14,171

13,679

(Gain) loss from discontinued operations, net of

tax

(89)

46

(483)

(457)

(365)

(410)

(901)

(687)

(684)

(315)

28

(397)

Interest expense

4,831

5,140

5,401

4,273

3,958

3,970

3,959

4,538

4,880

4,928

5,003

5,593

Provision for income taxes

4,161

2,429

(1,781)

5,670

3,936

5,676

4,078

6,080

6,356

6,474

9,057

8,349

Depreciation and amortization

482

396

391

410

402

443

516

522

591

650

789

904

Amount applied to principal on receivable

portfolios

35,785

35,140

46,364

42,851

48,851

49,188

47,384

58,265

64,901

63,507

53,427

85,709

Stock-based compensation

expense

1,288

860

382

1,080

994

1,261

1,049

1,761

1,446

1,549

1,254

1,765

Adjusted EBITDA

52,560

47,039

48,179

62,824

63,869

69,132

64,490

81,340

89,220

89,083

83,729

115,602

6/30/11

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

6/30/13

9/30/13

GAAP net income, as

reported

14,775

15,310

17,134

11,406

16,598

21,308

20,167

19,448

11,012

21,064

(Gain) loss from discontinued operations,

net of tax

(9)

(60)

101

6,702

2,392

-

-

-

-

308

Interest expense

5,369

5,175

4,979

5,515

6,497

7,012

6,540

6,854

7,482

29,186

Provision for income taxes

9,475

9,834

10,418

11,660

12,846

13,887

13,361

12,571

7,267

10,272

Depreciation and amortization

958

1,054

1,165

1,240

1,420

1,533

1,647

1,846

2,158

4,523

Amount applied to principal on receivable

portfolios

83,939

73,187

69,462

104,603

101,813

105,283

90,895

129,487

131,044

157,262

Severance and Stock-based

compensation

expense

1,810

2,405

1,729

2,266

2,539

1,905

2,084

3,001

5,455

3,983

Acquisition related expense

-

-

-

489

3,774

-

-

1,276

12,757

7,752

Adjusted EBITDA

116,317

106,905

104,988

143,881

147,877

150,928

134,694

174,483

177,175

234,350

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands) Three Months Ended

32

RECONCILIATION OF ADJUSTED EBITDA |

PROPRIETARY

Reconciliation of Adjusted EBITDA to GAAP net income

(Unaudited, In Thousands) Three Months Ended

33

RECONCILIATION

OF

ADJUSTED

EBITDA

-

CABOT

September 30, 2013

GAAP net income attributable to Encore Europe Holdings s.a.r.l.

4,380

Loss from noncontrolling interest

(822)

GAAP net income

3,558

Adjustments:

Interest expense

18,196

Provision for income taxes

1,174

Depreciation and amortization

1,461

Amount applied to principal on receivable portfolios

26,235

Adjusted EBITDA

50,624 |

PROPRIETARY

Reconciliation of Adjusted Operating Cost to GAAP Operating Cost

(Unaudited, In Thousands) Three Months Ended

34

RECONCILIATION OF ADJUSTED OPERATING COST

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

6/30/13

9/30/13

GAAP total operating expenses,

as reported

89,804

97,048

91,394

102,809

103,621

103,872

105,872

126,238

174,429

Adjustments:

Stock-based compensation expense

(2,405)

(1,729)

(2,266)

(2,539)

(1,905)

(2,084)

(3,001)

(2,179)

(3,983)

Operating expense related to other

operating segments

(4,622)

(13,409)

-

(1,513)

(2,055)

(2,113)

(3,022)

(3,504)

(8,008)

Acquisition related integration and

consulting fees and severance costs

-

-

-

-

-

-

-

(5,455)

-

Acquisition related legal and

advisory fees

-

-

(489)

(3,774)

-

-

(1,276)

(6,948)

(7,752)

Adjusted operating expenses for the

portfolio purchasing and recovery

business

82,777

81,910

88,639

94,983

99,661

99,675

98,573

108,152

154,686 |

PROPRIETARY

Reconciliation of Adjusted Operating Cost to GAAP Operating Cost

(Unaudited, In Thousands) Three Months Ended

35

RECONCILIATION OF ADJUSTED OPERATING COST -

CABOT

September 30, 2012

September 30, 2013

GAAP total operating expenses, as reported

$17,735

$23,640

Adjustments:

Operating expense related to other operating segments

(4,301)

(5,280)

Adjusted operating expenses for the portfolio purchasing and recovery

business

$13,434

$18,360 |

Encore Capital Group, Inc.

Q3 2013 EARNINGS CALL |