Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Altra Industrial Motion Corp. | d624186d8k.htm |

| EX-99.1 - EX-99.1 - Altra Industrial Motion Corp. | d624186dex991.htm |

Exhibit 99.2

|

|

Exhibit 99.2

Svendborg Acquisition Conference Call

November 7, 2013

9:00 AM ET Dial In Number

877-407-8293 Domestic 201-689-8349 International Webcast at www.altramotion.com

Replay Number

Through November 21, 2013, 2013 877-660-6853 Domestic 201-612-7415 International Conference ID: # 13572815 Webcast Replay at www.altramotion.com

|

|

Safe Harbor Statement

Cautionary Statement Regarding Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 conveying management’s expectations as to the future based on plans, estimates and projections at the time Altra makes the statements. Forward-looking statements involve inherent risks and uncertainties and Altra cautions you that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statement. The forward-looking statements contained in this press release include, but are not limited to, the anticipated timing of the transaction, the completion of the transaction on the terms proposed, the potential impact the acquisition will have on Altra including Altra’s earnings, market and geographic coverage, cross-selling opportunities, the timeline for and management of the integration of Svendborg and Altra, Svendborg’s anticipated 2013 revenues, an the expected synergies and working capital reduction, and Altra’s guidance for full year 2014. The forward-looking statements are based on assumptions regarding the timing of receipt of the necessary approvals, the time necessary to satisfy the conditions to the closing of the transaction, and management’s current plans and estimates. Management believes these assumptions to be reasonable but there is no assurance that they will prove to be accurate.

Factors that could cause actual results to differ materially from those described in this press release include, among others: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) changes in pension and retirement liabilities, (14) risks associated with compliance with environmental laws, (15) the ability to successfully execute, manage and integrate key acquisitions and mergers, (16) failure to obtain or protect intellectual property rights, (17) risks associated with impairment of goodwill or intangibles assets, (18) failure of operating equipment or information technology infrastructure, (19) risks associated with our debt leverage and operating covenants under our debt instruments, (20) risks associated with restrictions contained in our Convertible Notes and Credit Facility, (21) risks associated with compliance with tax laws, (22) risks associated with the global recession and volatility and disruption in the global financial markets, (23) risks associated with implementation of our new ERP system, (24) risks associated with the Bauer and Lamiflex acquisitions and integration and other acquisitions, (25) risks associated with the Company’s investment in a new manufacturing facility in China, (26) receipt of regulatory approvals with respect to the Svendborg acquisition without unexpected delays or conditions; (27) changes in expectations as to the closing of the Svendborg acquisition; (28) expected synergies and cost savings with respect to the Svendborg acquisition are not achieved or achieved at a slower pace than expected; (29) integration problems, delays or other related costs with respect to the Svendborg acquisition; (30) retention of Svendborg customers and suppliers; and (31) unanticipated changes in laws, regulations, or other industry standards affecting Altra and Svendborg.

The foregoing list of factors is not exhaustive. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Readers are urged to carefully review and consider the various disclosures, including but not limited to risk factors contained in the Altra’s Annual Report on Form 10-K for the years ending December 31, 2012 and subsequent Reports on Form 10-Q and Form 8-K, and Altra’s other securities filings. Exceptas required by law, Altra disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

.

ALTRA HOLDINGS, INC

NASDAQ: AIMC 2

|

|

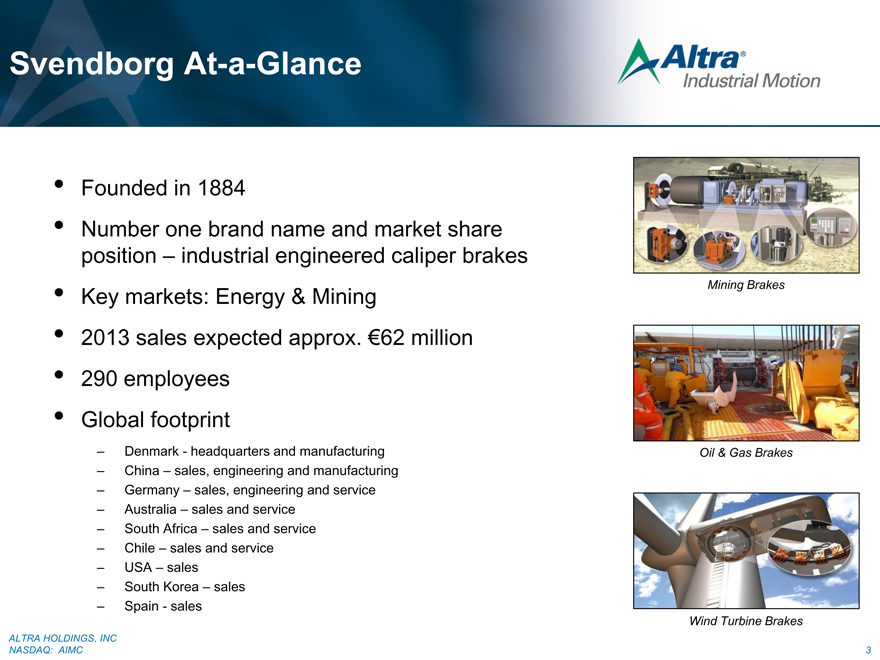

Svendborg At-a-Glance

Founded in 1884

Number one brand name and market share position – industrial engineered caliper brakes Key markets: Energy & Mining 2013 sales expected approx. €62 million 290 employees Global footprint

– Denmark - headquarters and manufacturing

– China – sales, engineering and manufacturing

– Germany – sales, engineering and service

– Australia – sales and service

– South Africa – sales and service

– Chile – sales and service

– USA – sales

– South Korea – sales

– Spain - sales

ALTRA HOLDINGS, INC NASDAQ: AIMC

Mining Brakes

Oil & Gas Brakes

Wind Turbine Brakes

3

|

|

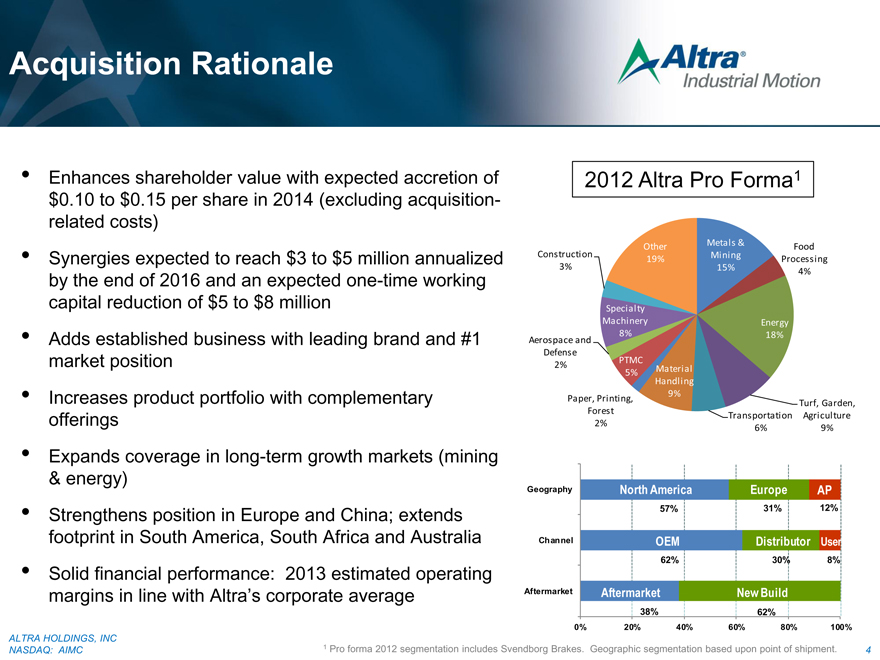

Acquisition Rationale

Enhances shareholder value with expected accretion of $0.10 to $0.15 per share in 2014 (excluding acquisition-related costs) Synergies expected to reach $3 to $5 million annualized by the end of 2016 and an expected one-time working capital reduction of $5 to $8 million Adds established business with leading brand and #1 market position Increases product portfolio with complementary offerings Expands coverage in long-term growth markets (mining & energy) Strengthens position in Europe and China; extends footprint in South America, South Africa and Australia Solid financial performance: 2013 estimated operating margins in line with Altra’s corporate average

2012 Altra Pro Forma1

Metals &

Other Food

Construction Mining

19% Processing

3% 15% 4%

Specialty

Machinery Energy

Aerospace and 8% 18%

Defense

PTMC

2% Material

5%

Handling

9%

Paper, Printing, Turf, Garden,

Forest Transportation Agriculture

2% 6% 9%

Geography North America Europe AP

57% 31% 12%

Channel OEM Distributor User

62% 30% 8%

Aftermarket Aftermarket New Build

38% 62%

0% 20% 40% 60% 80% 100%

ALTRA HOLDINGS, INC NASDAQ: AIMC

1 Pro forma 2012 segmentation includes Svendborg Brakes. Geographic segmentation based upon point of shipment. 4

|

|

Svendborg Transaction

Agreed to acquire Svendborg for 80.1 million Euros

Less cash remaining on balance sheet

Payable at close

To be financed through combination of European cash and additional borrowings under credit facility Subject to customary closing conditions, including receipt of required regulatory approvals. Plan to close in Q4 2013 Integration team managed full-time to ensure successful combination

ALTRA HOLDINGS, INC NASDAQ: AIMC

5

|

|

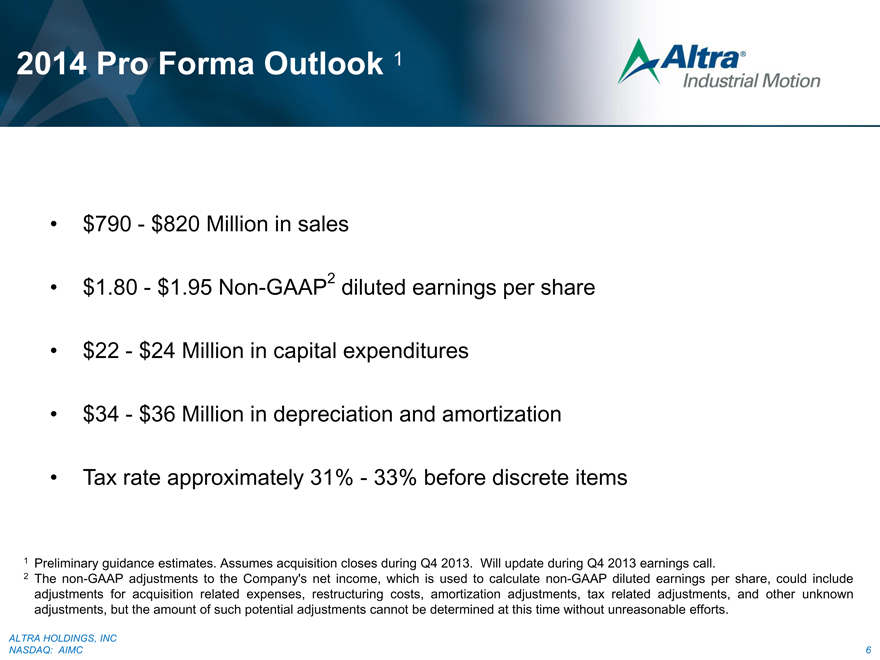

2014 Pro Forma Outlook 1

$790—$820 Million in sales

$1.80—$1.95 Non-GAAP2 diluted earnings per share

$22—$24 Million in capital expenditures

$34—$36 Million in depreciation and amortization Tax rate approximately 31%—33% before discrete items

1 Preliminary guidance estimates. Assumes acquisition closes during Q4 2013. Will update during Q4 2013 earnings call.

2 The non-GAAP adjustments to the Company’s net income, which is used to calculate non-GAAP diluted earnings per share, could include adjustments for acquisition related expenses, restructuring costs, amortization adjustments, tax related adjustments, and other unknown adjustments, but the amount of such potential adjustments cannot be determined at this time without unreasonable efforts.

ALTRA HOLDINGS, INC

NASDAQ: AIMC 6

|

|

Questions