Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Silver Bay Realty Trust Corp. | a8ksbyq32013earningspressr.htm |

| EX-99.1 - EXHIBIT - Silver Bay Realty Trust Corp. | a11_06x2013xsilverbayrealt.htm |

SILVER BAY REALTY TRUST CORP. T h i r d Q u a r t e r 2 0 1 3 E a r n i n g s P r e s e n t a t i o n

2 S A F E H A R B O R S T A T E M E N T F O R W A R D - L O O K I N G S T A T E M E N T S This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include: Silver Bay’s ability to execute share repurchases upon terms acceptable to the company; adverse economic or real estate developments in Silver Bay’s target markets; defaults on, early terminations of or non-renewal of leases by residents; difficulties in identifying properties to acquire and completing acquisitions; increased time and/or expense to gain possession and renovate properties; Silver Bay’s failure to successfully operate its properties; Silver Bay’s ability to obtain financing arrangements; Silver Bay’s failure to meet the conditions to draw under the credit facility; general volatility of the markets in which it participates; interest rates and the market value of Silver Bay’s target assets; the impact of changes in governmental regulations, tax law and rates, and similar matters. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Silver Bay does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Silver Bay’s most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward looking statements concerning Silver Bay or matters attributable to Silver Bay or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

3 T H I R D Q U A R T E R 2 0 1 3 H I G H L I G H T S Total revenue increased 35% quarter-over-quarter to $14.5 million Net operating income, or NOI(1), outpaced revenue growth, increasing 44% quarter-over-quarter to $4.5 million Estimated net asset value(1), or NAV, appreciated 3% quarter-over-quarter to $19.50 per fully diluted share Increased the number of leased properties by 911 or 25% quarter-over-quarter Aggregate portfolio occupancy increased quarter-over- quarter to 81% from 65% Occupancy for properties owned six months or longer increased to 89% from 87% quarter-over-quarter (1) Estimated NOI and NAV are non-GAAP financial measures. Non-GAAP reconciliations of these measures are included on slides 13 and 14 in the appendix. AS OF SEPTEMBER 30, 2013 ESTIMATED NAV $19.50 PER SHARE

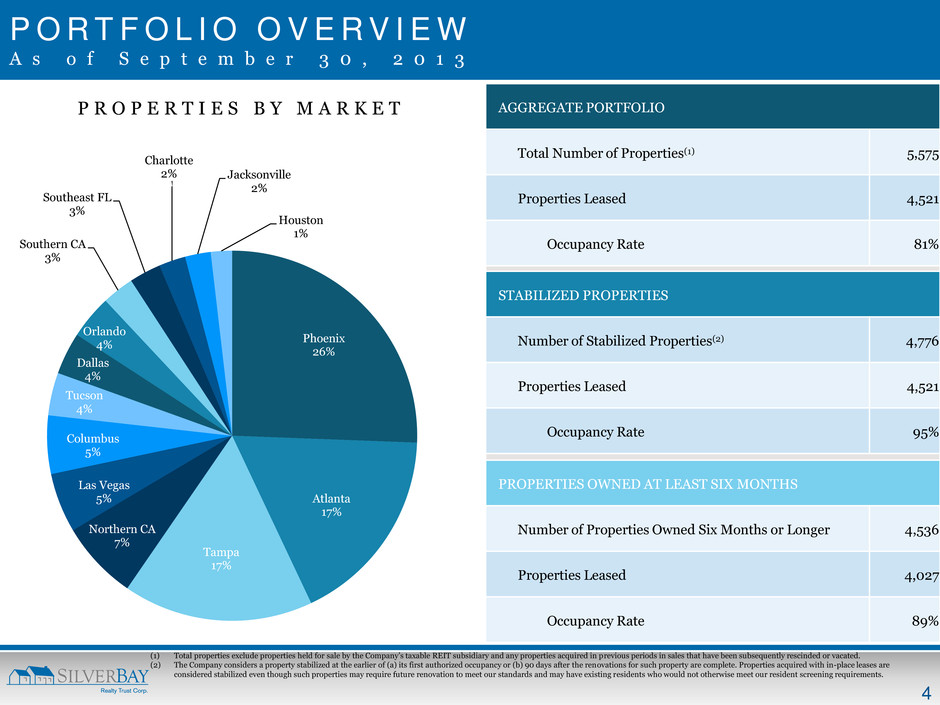

4 P O R T F O L I O O V E R V I E W A s o f S e p t e m b e r 3 0 , 2 0 1 3 AGGREGATE PORTFOLIO Total Number of Properties(1) 5,575 Properties Leased 4,521 Occupancy Rate 81% STABILIZED PROPERTIES Number of Stabilized Properties(2) 4,776 Properties Leased 4,521 Occupancy Rate 95% PROPERTIES OWNED AT LEAST SIX MONTHS Number of Properties Owned Six Months or Longer 4,536 Properties Leased 4,027 Occupancy Rate 89% P R O P E R T I E S B Y M A R K E T (1) Total properties exclude properties held for sale by the Company’s taxable REIT subsidiary and any properties acquired in previous periods in sales that have been subsequently rescinded or vacated. (2) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements. Phoenix 26% Atlanta 17% Tampa 17% Northern CA 7% Las Vegas 5% Columbus 5% Tucson 4% Dallas 4% Orlando 4% Southern CA 3% Southeast FL 3% Charlotte 2% Jacksonville 2% Houston 1%

5 C U R R E N T H O U S I N G M A R K E T E N V I R O N M E N T Home prices continue to appreciate, albeit at a more moderate pace due to seasonality and the rise in mortgage interest rates Housing starts moderated to ~600,000 on an annualized basis, representing levels well below historical average Distressed inventory still off normalized levels and remains concentrated in select states, including Florida, where Silver Bay is focused for future acquisitions Home prices up 12% year-over-year, marking eighteen consecutive months of growth Silver Bay markets reported strong increases of 3 -10% over the past three months as of August Most Silver Bay markets continue to be 30-45% off peak pricing and remain at significant discounts to replacement cost (1) “MSA” means Metropolitan Statistical Areas, which is generally defined as one or more adjacent counties or county equivalents that have at least one urban core area of at least a 50,000-person population, plus adjacent territory that has a high degree of social and economic integration with the core as measured by commuting ties. (2) Peak refers to highest historical home prices in a particular market prior to the start of the housing recovery. Trough refers to lowest home prices in a particular market since the peak. (3) MSA used for Northern California is Fairfield-Vallejo, which most closely approximates the geographic area in which we purchase homes in Northern California. This MSA is comprised of Solano County and the most populous cities in the MSA are Vallejo, Fairfield, Vacaville, Suisun and Benicia. (4) MSA used for Southern California is Riverside-San Bernardino-Ontario. This MSA is comprised of Riverside and San Bernardino Counties and the most populous cities in the MSA are Riverside, San Bernardino, Fontana and Moreno. (5) MSA used for Southeast FL is Fort Lauderdale-Pompano Beach-Deerfield Beach, FL. M S A H O M E P R I C E A P P R E C I A T I O N ( “ H P A ” ) ( 1 ) S o u r c e : C o r e l o g i c a s o f A u g u s t 3 1 , 2 0 1 3 MARKET HPA (Peak to Trough)(2) HPA (Peak to Current) HPA (Prior 12 months) HPA (Prior 3 months) Phoenix, AZ -53% -33% 18% 5% Tucson, AZ -43% -32% 9% 4% Northern CA(3) -60% -45% 29% 10% Southern CA(4) -53% -38% 23% 8% Jacksonville, FL -40% -29% 11% 4% Orlando, FL -55% -40% 16% 7% Southeast FL(5) -53% -40% 14% 6% Tampa, FL -48% -36% 13% 6% Atlanta, GA -34% -14% 17% 6% Charlotte, NC -17% -4% 8% 3% Las Vegas, NV -60% -44% 27% 7% Columbus, OH -18% -8% 3% 5% Dallas, TX -14% 1% 10% 3% Houston, TX -13% 5% 11% 3% NATIONAL -33% -17% 12% 4%

6 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 200 400 600 800 1,000 1,200 Q1 - 2012 Q2 - 2012 Q3 - 2012 Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 AG G RE G AT E OCC UP AN CY NU M BE R O F PR O PE RT IE S Acquisitions Increase in Number of Leased Properties Renovations Aggregate Portfolio Occupancy E X P A N S I O N I N R E N O V A T I O N A N D L E A S I N G DROVE INCREASES IN AGGREGATE OCCUPANCY ( 1 ) (1) The above chart shows the pace of quarterly acquisitions, renovations and increase in number of leased homes of the Company’s Predecessor and the Company and does not reflect accepted purchase agreements that have not yet closed. Fourth quarter 2012 numbers, other than aggregate occupancy, exclude the impact of the acquisition of the 881 properties owned by the Provident Entities. THIRD QUARTER 2013 AGGREGATE OCCUPANCY 81%

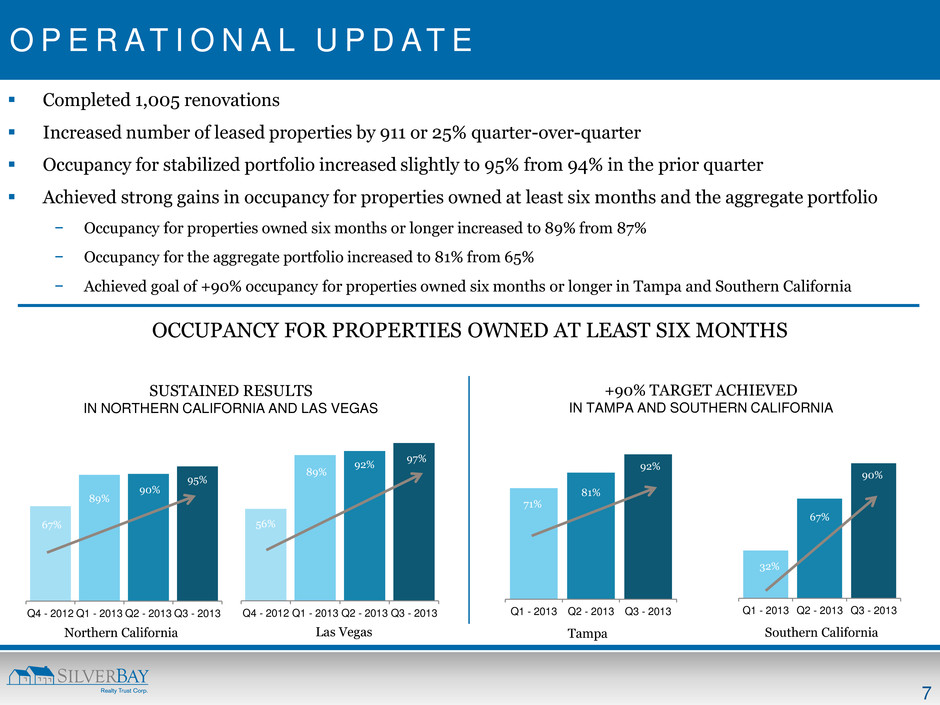

7 O P E R AT I O N A L U P D AT E 67% 89% 90% 95% Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 Northern California 56% 89% 92% 97% Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 Las Vegas 71% 81% 92% Q1 - 2013 Q2 - 2013 Q3 - 2013 Tampa 32% 67% 90% Q1 - 2013 Q2 - 2013 Q3 - 2013 Southern California Completed 1,005 renovations Increased number of leased properties by 911 or 25% quarter-over-quarter Occupancy for stabilized portfolio increased slightly to 95% from 94% in the prior quarter Achieved strong gains in occupancy for properties owned at least six months and the aggregate portfolio − Occupancy for properties owned six months or longer increased to 89% from 87% − Occupancy for the aggregate portfolio increased to 81% from 65% − Achieved goal of +90% occupancy for properties owned six months or longer in Tampa and Southern California SUSTAINED RESULTS IN NORTHERN CALIFORNIA AND LAS VEGAS +90% TARGET ACHIEVED IN TAMPA AND SOUTHERN CALIFORNIA OCCUPANCY FOR PROPERTIES OWNED AT LEAST SIX MONTHS

8 AVERAGE MONTHLY RENT AND TURNOVER UPDATE $1,148 $1,156 $1,148 $1,161 Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 AVERAGE MONTHLY RENT AGGREGATE PORTFOLIO Average monthly rent for aggregate portfolio increased to $1,161 from $1,148 primarily due to changes in portfolio mix − Primary focus has been on portfolio stabilization; strategic decision not to pursue increases on renewals during this phase Low resident turnover critical component of the single-family rental business − Turnover metrics will become increasingly more meaningful starting in first half of 2014 − Silver Bay estimates turnover to be 33% on an annualized basis for the institutional single-family rental sector

9 $7.7 $10.7 $14.5 Q1 - 2013 Q2 - 2013 Q3 - 2013 TOTAL REVENUE ($ IN MILLIONS) Q 3 - 2 0 1 3 F I N A N C I A L S U M M A R Y Total revenue increased 35% on a sequential quarter basis to $14.5 million NOI(1) increased 44% on a sequential quarter basis to $4.5 million Property operating and maintenance expenses were $4.3 million, increase primarily attributed to a higher base of leased properties, increase in properties with resident turnover, and higher levels of repairs and maintenance Property management expenses were $3.7 million, reflecting continued sequential quarter improvement as a percentage of revenue As portfolio approaches stabilization, the Company has shifted its focus towards driving NOI(1) improvement $1.7 $3.1 $4.5 Q1 - 2013 Q2 - 2013 Q3 - 2013 NET OPERATING INCOME(1) ($ IN MILLIONS) (1) Estimated NOI is a non-GAAP financial measure. The non-GAAP reconciliation of this measure is included on Slide 14 of the appendix.

10 A P P E N D I X

11 P O R T F O L I O O F S I N G L E - F A M I LY P R O P E R T I E S T h e f o l l o w i n g t a b l e p r o v i d e s a s u m m a r y o f S i l v e r Bay ’ s po r t f o l i o o f s i n g l e - f a m i l y p r o p e r t i e s a s o f S e p t e m b e r 3 0 , 2 0 1 3 . (1) Total properties exclude properties held for sale by the Company’s taxable REIT subsidiary and any properties acquired in previous periods in sales that have been subsequently rescinded or vacated. (2) Aggregate cost includes all capitalized costs, determined in accordance with generally accepted accounting principles, incurred through September 30, 2013 for the acquisition, stabilization, and significant post-stabilization renovation of properties, including land, building, possession costs and renovation costs. Aggregate cost does not include accumulated depreciation. (3) As of September 30, 2013, approximately 19% of the properties in the combined portfolio were less than 10 years old, 26% were between 10 and 20 years old, 18% were between 20 and 30 years old, 17% were between 30 and 40 years old, 9% were between 40 and 50 years old, and 11% were more than 50 years old. (4) Total number of vacant properties includes properties in the process of stabilization as well as those available for lease. (5) Average monthly rent for leased properties was calculated as the average of the contracted monthly rent for all leased properties as of September 30, 2013 and reflects rent concessions amortized over the life of the related lease. (6) Northern California market currently consists of Contra Costa, Napa and Solano counties. (7) Southern California market currently consists of Riverside and San Bernardino counties. (8) Southeast Florida market currently consists of Miami-Dade, Broward and Palm Beach counties. MARKET NUMBER OF PROPERTIES(1) AGGREGATE COST BASIS(2) (THOUSANDS) AVERAGE COST BASIS PER PROPERTY (THOUSANDS) AVERAGE AGE(3) (IN YEARS) AVERAGE SQUARE FOOTAGE NUMBER OF LEASED PROPERTIES NUMBER OF VACANT PROPERTIES(4) AVERAGE MONTHLY RENT FOR LEASED PROPERTIES(5) Phoenix 1,427 $ 198,839 $ 139 24.2 1,636 1,275 152 $ 1,033 Atlanta 969 117,487 121 16.8 2,023 746 223 1,193 Tampa 926 128,300 139 23.6 1,656 853 73 1,208 Northern CA(6) 384 71,665 187 44.4 1,401 356 28 1,488 Las Vegas 290 40,901 141 16.7 1,719 277 13 1,153 Columbus 284 25,204 89 35.6 1,417 98 186 979 Orlando 214 31,536 147 24.8 1,684 164 50 1,254 Tucson 208 16,898 81 39.9 1,330 195 13 828 Dallas 205 25,201 123 20.4 1,643 147 58 1,255 Southern CA(7) 156 23,218 149 43.0 1,346 141 15 1,146 Southeast FL(8) 154 29,668 193 33.7 1,708 69 85 1,787 Charlotte 130 16,783 129 11.8 1,980 103 27 1,170 Jacksonville 125 16,081 129 30.7 1,575 44 81 1,079 Houston 103 10,597 103 29.8 1,698 53 50 1,181 Totals 5,575 $ 752,378 $ 135 25.6 1,676 4,521 1,054 $ 1,161

12 STABILIZED PROPERTIES PROPERTIES OWNED AT LEAST SIX MONTHS MARKET NUMBER OF STABILIZED PROPERTIES PROPERTIES LEASED PROPERTIES VACANT OCCUPANCY RATE AVERAGE MONTHLY RENT FOR LEASED STABILIZED PROPERTIES(1) PROPERTIES OWNED 6 MONTHS OR LONGER PROPERTIES LEASED PROPERTIES VACANT OCCUPANCY RATE AVERAGE MONTHLY RENT FOR PROPERTIES OWNED AT LEAST 6 MONTHS(2) Phoenix 1,372 1,275 97 93% $ 1,033 1,274 1,171 103 92% $ 1,036 Atlanta 811 746 65 92% 1,193 773 688 85 89% 1,199 Tampa 870 853 17 98% 1,208 891 821 70 92% 1,211 Northern CA 373 356 17 95% 1,488 344 327 17 95% 1,486 Las Vegas 281 277 4 99% 1,153 277 268 9 97% 1,154 Columbus 107 98 9 92% 979 94 37 57 39% 1,080 Orlando 167 164 3 98% 1,254 132 127 5 96% 1,275 Tucson 202 195 7 97% 828 202 191 11 95% 828 Dallas 158 147 11 93% 1,255 98 80 18 82% 1,270 Southern CA 147 141 6 96% 1,146 156 141 15 90% 1,146 Southeast FL 74 69 5 93% 1,787 108 43 65 40% 1,743 Charlotte 110 103 7 94% 1,170 103 89 14 86% 1,185 Jacksonville 47 44 3 94% 1,079 51 22 29 43% 1,011 Houston 57 53 4 93% 1,181 33 22 11 67% 1,191 Totals 4,776 4,521 255 95% $ 1,161 4,536 4,027 509 89% $ 1,162 P O R T F O L I O S U M M A R Y O F S T A B I L I Z E D P R O P E R T I E S A N D T H O S E O W N E D S I X M O N T H S O R L O N G E R T h e f o l l o w i n g t a b l e s u m m a r i z e s S i l v e r B a y ’ s s t a b i l i z e d p r o p e r t i e s a n d t h o s e o w n e d s i x m o n t h s o r l o n g e r a s o f S e p t e m b e r 3 0 , 2 0 1 3 . (1) Average monthly rent for leased stabilized properties was calculated as the average of the contracted monthly rent for all stabilized leased properties as of September 30, 2013 and reflects rent concessions amortized over the life of the related lease. (2) Average monthly rent for properties owned at least six months was calculated as the average of the contracted monthly rent for all properties owned at least six months as of September 30, 2013 and reflects rent concessions amortized over the life of the related lease.

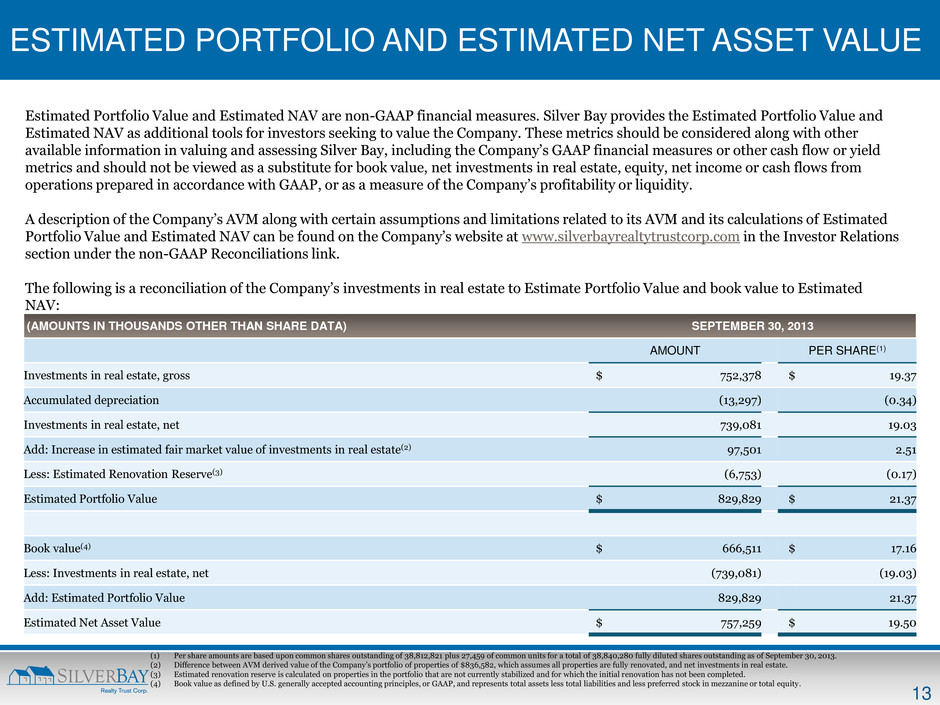

13 ESTIMATED PORTFOLIO AND ESTIMATED NET ASSET VALUE Estimated Portfolio Value and Estimated NAV are non-GAAP financial measures. Silver Bay provides the Estimated Portfolio Value and Estimated NAV as additional tools for investors seeking to value the Company. These metrics should be considered along with other available information in valuing and assessing Silver Bay, including the Company’s GAAP financial measures or other cash flow or yield metrics and should not be viewed as a substitute for book value, net investments in real estate, equity, net income or cash flows from operations prepared in accordance with GAAP, or as a measure of the Company’s profitability or liquidity. A description of the Company’s AVM along with certain assumptions and limitations related to its AVM and its calculations of Estimated Portfolio Value and Estimated NAV can be found on the Company’s website at www.silverbayrealtytrustcorp.com in the Investor Relations section under the non-GAAP Reconciliations link. The following is a reconciliation of the Company’s investments in real estate to Estimate Portfolio Value and book value to Estimated NAV: (1) Per share amounts are based upon common shares outstanding of 38,812,821 plus 27,459 of common units for a total of 38,840,280 fully diluted shares outstanding as of September 30, 2013. (2) Difference between AVM derived value of the Company’s portfolio of properties of $836,582, which assumes all properties are fully renovated, and net investments in real estate. (3) Estimated renovation reserve is calculated on properties in the portfolio that are not currently stabilized and for which the initial renovation has not been completed. (4) Book value as defined by U.S. generally accepted accounting principles, or GAAP, and represents total assets less total liabilities and less preferred stock in mezzanine or total equity. (AMOUNTS IN THOUSANDS OTHER THAN SHARE DATA) SEPTEMBER 30, 2013 AMOUNT PER SHARE(1) Investments in real estate, gross $ 752,378 $ 19.37 Accumulated depreciation (13,297) (0.34) Investments in real estate, net 739,081 19.03 Add: Increase in estimated fair market value of investments in real estate(2) 97,501 2.51 Less: Estimated Renovation Reserve(3) (6,753) (0.17) Estimated Portfolio Value $ 829,829 $ 21.37 Book value(4) $ 666,511 $ 17.16 Less: Investments in real estate, net (739,081) (19.03) Add: Estimated Portfolio Value 829,829 21.37 Estimated Net Asset Value $ 757,259 $ 19.50

14 N E T O P E R A T I N G I N C O M E Net operating income, or NOI, is a non-GAAP measure and is defined by the Company as total revenue less property operating and maintenance, real estate taxes, homeowners’ association fees and property management expenses. NOI excludes depreciation and amortization, advisory management fee, general and administrative expenses, interest expense and other expenses. The Company considers NOI to be a meaningful financial measure, when considered with the financial statements determined in accordance with U.S. generally accepted accounting principles. The Company believes NOI is helpful to investors in understanding the core performance of the real estate operations of the Company. The following is a reconciliation of the Company’s NOI to net loss as determined in accordance with GAAP: (AMOUNTS IN THOUSANDS) THREE MONTHS ENDED SEPTEMBER 30, 2013 THREE MONTHS ENDED JUNE 30, 2013 Net loss $ (6,362) $ (6,746) Depreciation and amortization 5,683 4,961 Advisory management fee 2,166 2,578 General and administrative 1,866 1,949 Other 142 217 Interest expense 989 158 Net operating income $ 4,484 $ 3,117

601 CARLSON PARKWAY | SUITE 250 | MINNETONKA | MN | 55305 P: 952.358.4400 | E: INVES TO RS@ SILVERBAYMGMT .C OM