Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mattersight Corp | d621856d8k.htm |

| EX-99.1 - EX-99.1 - Mattersight Corp | d621856dex991.htm |

Mattersight

Q3 2013 Earnings Webinar

November 6, 2013

Exhibit 99.2 |

2

Safe Harbor Language

During today’s call we will be making both historical and forward-looking

statements in order to help you better understand our business.

These

forward-looking statements include references to our plans, intentions,

expectations, beliefs, strategies and objectives. Any forward-looking

statements speak only as of today’s date. In addition, these

forward- looking statements are subject to risks and uncertainties that

could cause actual results to differ materially from those stated or implied

by the forward-looking statements. The risks and uncertainties

associated with our business are highlighted in our filings with the SEC,

including our Annual Report filed on Form 10-K for the year ended

December 31, 2012, our quarterly reports on Form 10-Q, as well as our

press release issued earlier today.

Mattersight Corporation undertakes no obligation to publicly update or

revise any forward-looking statements in this call. Also, be advised that

this call is being recorded and is copyrighted by Mattersight

Corporation. |

Significant

Progress on All Fronts in Q3 •

Bookings

-

Booked $3.8m in Incremental ACV

-

YTD bookings up 115% over 2012

•

Revenues

-

Recognized $8.6m in revenue

-

Up 9% sequentially overall

-

Up 6% sequentially for subscription revenue

•

P&L

-

Achieved $0.3m of positive EBITDA

-

Achieved record gross margins of 68%, up 180 bps sequentially

•

Balance Sheet

-

Ended the quarter with $13.7m in cash

•

Pilots

-

Closed 17 new Predictive Behavioral Routing pilots

-

Ending pilots grew 50% sequentially to a record of 33

-

Ending pilot follow-on ACV grew 80% sequentially

3 |

Q3 Bookings

Highlights •

Strong overall bookings

-

$3.8m in Incremental ACV

-

YTD IACV total of $9.9m, up 115% from 2012 Q3 to date

•

Excellent bookings breadth

-

5 deals over $250k in ACV

-

No deals over $800k in ACV

•

Bookings were primarily driven by add-on orders for

performance management offering

•

Converted 2 pilots

-

First real time compliance application

-

OEM agreement to use algorithms for hiring

•

Grew pilot base

-

17 new pilots

-

Added 9 new logos

-

Ended quarter with record of 33 active pilots

4 |

Financial

Performance Discussion •

Q3 Revenues of $8.6M

-

Total revenue up 9%

-

Subscription revenue up 6%

•

Record Gross Margins

-

Overall GM of 68%, up 180 bps from Q2

-

Subscription GM of 76%, up 150 bps from Q2

•

Adjusted EBITDA of $0.3M

-

An improvement of $0.7M from Q2

-

First positive quarter

•

Improved Balance Sheet

-

Generated $6.0m in free cash flow

-

Ended the quarter with $13.7m in cash

5 |

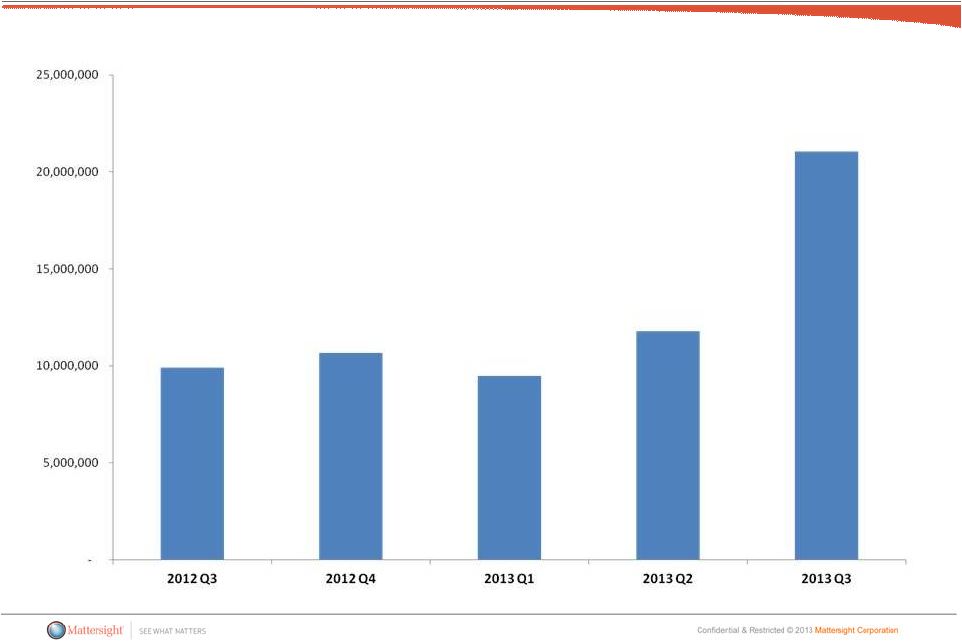

Incremental ACV

/ Ending Quarter Book of Business 6

2012 Q3

2012 Q4

2013 Q1

2013 Q2

2013 Q3

Starting Book of Business

8,734

8,693

8,392

8,065

8,774

Incremental ACV

100

465

602

933

945

Deployment/Cons Run Off

(124)

(543)

(340)

(201)

(277)

Subscription ACV Adj

(17)

(223)

(589)

(23)

(138)

Ending Book of Business

8,693

8,392

8,065

8,774

9,304 |

Pilot Review

Routing

Impact

Analysis

Routing

Appliance

Total

Routing

Performance

Management

Add-

on/Other

Total

Beginning

Pilots

8

-

8

4

10

22

Added

13

4

17

-

-

17

Converted

-

-

-

-

2

2

Dropped

1

1

2

-

2

4

Total

20

3

23

4

6

33

New Logo

Pilots

8

1

9

7

•

Total pilots up 50% Q2 to Q3

•

Added 35 routing opportunities to the pipeline in Q2 and 52 in Q3

•

Currently seeing demand for 30 meetings / month for routing

•

Strong routing activity across numerous verticals: Health Care; P&C; Tech and

Telecom; Education •

Growing SMB pipeline for routing

•

Broad routing interest: sales; customer retention; cost reduction; and

collections |

Pilot Follow On

ACV 8 |

Mattersight is

Uniquely Positioned •

Disruptive

technology

platform

combining

big

data,

behavioral

analysis,

predictive

modeling,

and

real

time

execution

applications

•

Big Data

-

Conversations

-

Targeted textual data

-

Desktop usage

-

IVR and web logs

-

Customer data

•

Behavioral Analysis

-

Customer personality

-

Customer sentiment

-

Employee behavioral connection

•

Predictive Modeling

-

CSAT

-

NPS

-

Probability of attrition

•

Real Time Execution Applications

-

Routing

-

Real time alerting

9 |

Business

Outlook •

Tone of Business

-

Pipeline for current products remains solid

-

Very strong interest in routing

-

GDIT remains uncertain

•

Q4 Revenue Outlook

-

We currently expect Q4 subscription revenues will increase

sequentially by 7%

10 |

Summary

•

Strong bookings performance

•

Record pilot activity

•

Excellent progress with Routing

•

Significantly improved operating performance

11 |

12

Thank You

•

Kelly Conway

-

847.582.7200

-

kelly.conway@mattersight.com

•

Mark Iserloth

-

312.454.3613

-

mark.iserloth@mattersight.com |