Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KINDRED HEALTHCARE, INC | d622949d8k.htm |

| EX-99.1 - EX-99.1 - KINDRED HEALTHCARE, INC | d622949dex991.htm |

| EX-99.2 - EX-99.2 - KINDRED HEALTHCARE, INC | d622949dex992.htm |

KINDRED

HEALTHCARE

NYSE: KND

Investor Update on

Strategic Plan and

Repositioning

Initiatives

Exhibit 99.3 |

| 2

Forward-Looking Statements

2

This press release includes forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All

statements regarding the Company’s expected future financial position, results of

operations, cash flows, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and

objectives of management and statements containing the words such as “anticipate,”

“approximate,” “believe,” “plan,” “estimate,” “expect,” “project,” “could,” “should,” “will,” “intend,” “may” and other similar

expressions, are forward-looking statements. Statements in this press release

concerning the Company’s business outlook or future economic performance, anticipated profitability, revenues, expenses or other financial items, and product or

services line growth, together with other statements that are not historical facts, are

forward-looking statements that are estimates reflecting the best judgment of the Company based upon currently available information.

Such forward-looking statements are inherently uncertain, and stockholders and other

potential investors must recognize that actual results may differ materially from the Company’s expectations as a result of a

variety of factors, including, without limitation, those discussed below. Such

forward-looking statements are based upon management’s current expectations and include known and unknown risks, uncertainties and other factors,

many of which the Company is unable to predict or control, that may cause the Company’s

actual results or performance to differ materially from any future results or performance expressed or implied by such forward-looking

statements. These statements involve risks, uncertainties and other factors discussed below

and detailed from time to time in the Company’s filings with the Securities and Exchange Commission.

In addition to the factors set forth above, other factors that may affect the Company’s

plans, results or stock price include, without limitation, (a) the impact of healthcare reform, which will initiate significant changes

to the United States healthcare system, including potential material changes to the delivery

of healthcare services and the reimbursement paid for such services by the government or other third party payors, including reforms

resulting from the Patient Protection and Affordable Care Act and the Healthcare Education and

Reconciliation Act (collectively, the “ACA”) or future deficit reduction measures adopted at the federal or state level. Healthcare

reform is affecting each of the Company’s businesses in some manner. Potential

future efforts in the U.S. Congress to repeal, amend, modify or retract funding for various aspects of the ACA create additional uncertainty about

the ultimate impact of the ACA on the Company and the healthcare industry. Due to the

substantial regulatory changes that will need to be implemented by the Centers for Medicare and Medicaid Services (“CMS”) and others, and

the numerous processes required to implement these reforms, the Company cannot predict which

healthcare initiatives will be implemented at the federal or state level, the timing of any such reforms, or the effect such reforms or

any other future legislation or regulation will have on the Company’s business, financial

position, results of operations and liquidity, (b) the impact of final rules issued by CMS on August 1, 2012 which, among other things, will

reduce Medicare reimbursement to the Company’s transitional care (“TC”)

hospitals in 2013 and beyond by imposing a budget neutrality adjustment and modifying the short-stay outlier rules, (c) the impact of final rules issued by

CMS on July 29, 2011 which significantly reduced Medicare reimbursement to the Company’s

nursing centers and changed payments for the provision of group therapy services effective October 1, 2011, (d) the impact of the

Budget Control Act of 2011 (as amended by the American Taxpayer Relief Act of 2012 (the

“Taxpayer Relief Act”)) which will automatically reduce federal spending by approximately $1.2 trillion split evenly between domestic and

defense spending. An automatic 2% reduction on each claim submitted to Medicare began on

April 1, 2013, (e) the impact of the Taxpayer Relief Act which, among other things, reduces Medicare payments by 50% for subsequent

procedures when multiple therapy services are provided on the same day. At this time, the

Company believes that the rules related to multiple therapy services will reduce the Company’s Medicare revenues by $25 million to $30

million on an annual basis, (f) changes in the reimbursement rates or the methods or timing of

payment from third party payors, including commercial payors and the Medicare and Medicaid programs, changes arising from and

related to the Medicare prospective payment system for long-term acute care

(“LTAC”) hospitals, including potential changes in the Medicare payment rules, the Medicare Prescription Drug, Improvement, and Modernization Act

of 2003, and changes in Medicare and Medicaid reimbursement for the Company’s TC

hospitals, nursing centers, inpatient rehabilitation hospitals and home health and hospice operations, and the expiration of the Medicare Part

B therapy cap exception process, (g) the effects of additional legislative changes and

government regulations, interpretation of regulations and changes in the nature and enforcement of regulations governing the healthcare

industry, (h) the ability of the Company’s hospitals to adjust to potential LTAC

certification and medical necessity reviews, (i) the costs of defending and insuring against alleged professional liability and other claims (including

those related to pending whistleblower and wage and hour class action lawsuits against the

Company) and the Company’s ability to predict the estimated costs and reserves related to such claims, including the impact of

differences in actuarial assumptions and estimates compared to eventual outcomes, (j) the

impact of the Company’s significant level of indebtedness on the Company’s funding costs, operating flexibility and ability to fund

ongoing operations, development capital expenditures or other strategic acquisitions with

additional borrowings, (k) the Company’s ability to successfully redeploy its capital and proceeds of asset sales in pursuit of its business

strategy and pursue its development activities, including through acquisitions, and

successfully integrate new operations, including the realization of anticipated revenues, economies of scale, cost savings and productivity gains

associated with such operations, as and when planned, including the potential impact of

unanticipated issues, expenses and liabilities associated with those activities, (l) the Company’s ability to pay a dividend as, when and if

declared by the Board of Directors, in compliance with applicable laws and the Company’s

debt and other contractual arrangements, (m) the failure of the Company’s facilities to meet applicable licensure and certification

requirements, (n) the further consolidation and cost containment efforts of managed care

organizations and other third party payors, (o) the Company’s ability to meet its rental and debt service obligations, (p) the Company’s

ability to operate pursuant to the terms of its debt obligations, and comply with its

covenants thereunder, and its ability to operate pursuant to its master lease agreements with Ventas,Inc. (NYSE:VTR) (q) the condition of the

financial markets, including volatility and weakness in the equity, capital and credit

markets, which could limit the availability and terms of debt and equity financing sources to fund the requirements of the Company’s businesses,

or which could negatively impact the Company’s investment portfolio, (r) the

Company’s ability to control costs, particularly labor and employee benefit costs, (s) the Company’s ability to successfully reduce or mitigate (by

divestiture of operations or otherwise) its exposure to professional liability and other

claims, (t) the Company’s obligations under various laws to self-report suspected violations of law by the Company to various government

agencies, including any associated obligation to refund overpayments to government payors,

fines and other sanctions, (u) the potential for diversion of management time and resources in seeking to transfer the operations of 60

non-strategic nursing centers currently leased from Ventas, Inc. (v) national and regional

economic, financial, business and political conditions, including their effect on the availability and cost of labor, credit, materials and other

services, (w) increased operating costs due to shortages in qualified nurses, therapists and

other healthcare personnel, (x) the Company’s ability to attract and retain key executives and other healthcare personnel, (y) the

Company’s ability to successfully dispose of unprofitable facilities, (z) events or

circumstances which could result in the impairment of an asset or other charges, such as the impact of the Medicare reimbursement regulations that

resulted in the Company recording significant impairment charges in 2012 and 2011, (aa)

changes in generally accepted accounting principles (“GAAP”) or practices, and changes in tax accounting or tax laws (or authoritative

interpretations relating to any of these matters), and (bb) the Company’s ability to

maintain an effective system of internal control over financial reporting. Many of these factors are beyond the Company’s control. The Company cautions

investors that any forward-looking statements made by the Company are not guarantees of future performance. The Company

disclaims any obligation to update any such factors or to announce publicly the results of any

revisions to any of the forward-looking statements to reflect future events or developments.

In addition to the results provided in accordance with GAAP, the Company has provided

information in this release to compute certain non-GAAP measurements for the three months and nine months ended

September 30, 2013 and 2012 before certain charges or on a core basis. A reconciliation of the

non-GAAP measurements to the GAAP measurements is included in this press release. |

Executing on

Kindred’s 5-Year Strategic Plan Key Strategies

Succeed in the

Core

Repositioning

Strategy

1

2

Develop Care

Management

Capabilities

4

Advance Integrated

Care Market

Strategy

5

Improve Capital

Structure

6

Grow Kindred at

Home and

RehabCare

3

2013

2014

Ventas Transaction: 54 Facilities

Real Estate Acquisitions (eliminating $13 Million

Of Rents and Escalators): $118M

Divestitures Proceeds: $241M

Opportunistic Purchases / Lease Negotiations

of Additional Facilities

TherEx (IRF) Acquisition

$20M Rev

Senior Home Care Acquisition (FL/LA)

$143M Rev

Initiated Dividend of $0.12 per share in Q3 2013

Accretive Refinancing of Senior Debt, Repayment of

$264M of

Revolver

and Lease Deleveraging of $702M thru

Ventas transaction ($117 M of rents at 6x)

Debt Pay-Down and Deleveraging of

Lease Obligations

Creation of Care Management Division

Western Reserve Senior Care Acquisition

(Home Based Physician Group)

Continuous Improvement of Quality and Clinical Outcomes

Participate in the CMS Bundled Payment for

Care Improvement Initiative

Care Management Pilots

Develop Capabilities to Provide Population Health

Services for Pre and Post –Acute Patients

Opportunistic Home Health & Hospice and

Rehab Acquisitions

Develop Capabilities to Enter At-Risk Contracts

with Managed Care Providers

Take Care of Our Teammates through People Services Initiatives

Working to Overcome Difficult Macro Volume Trends

Project Apollo Cost Containment Initiatives Ahead of Plan

($36 million of additional savings targeted in 2014)

Integrated Sales & Leadership

Achieve IT Interoperability

Ventas Transaction: Transition 60 Facilities

3 |

Executing on

Kindred’s 5-Year Strategic Plan Hospital Division

•

Improved revenue/cost model has driven Division’s results despite soft volume

•

Total operating expense per patient day year-over-year up just 1%

•

Commercial revenues per patient day remain strong with shift towards more commercial

business RehabCare

•

Strong clinical program development and customer service functionality

•

Recruiting and retention of therapists and productivity continues to be a consistent source

of value creation for patients and shareholders

•

Financial performance ahead of plan year-to-date

•

Net new contracts and strong organic growth in both HRS & SRS

Nursing Center Division

•

Divestiture or non-renewal of 122 skilled nursing facilities proceeding toward

completion •

New Transitional Care Centers (“TCCs”) and hospital based sub-acute core growth

continuing •

Division overhead restructuring near completion, allowing for a smaller, but more profitable

business Care Management and Kindred at Home Division

•

Aggressive growth in Kindred at Home as annualized revenues now exceed $350 million

•

Successful rollout and completion of standardized clinical management tool (Homecare

Homebase) •

Advancement of physician strategy in Integrated Care Market around managing care transitions

more efficiently

•

Leading

multiple

care

and

payment

innovations

in

Integrated

Care

Markets

4

Despite $130 million of Reimbursement cuts heading into 2013, and

significant organizational change, essentially on Plan with

year-to-date goals

Succeed in the Core

1 |

5

Disposition of Ventas facilities with 2013 lease expiration

•

Ventas selected 11 tenants for 54 nursing centers Kindred did not renew.

•

As of July 1, 2013, all facilities have been transferred.

•

Actual accretion of $0.05.

Favorable agreement with Ventas for facilities with 2015 lease expiration

•

Agreement facilitates early disposition of 59 non-strategic nursing centers and the

closure of another facility.

•

Leases

renewed

for

22

Transitional

Care

Hospitals

and

26

Nursing

and

Rehabilitation

Centers.

•

Rents on renewed leases increased by $15 million beginning October 1, 2014.

•

Transaction slightly accretive to 2014 and beyond.

Repositioning

Strategy

2

Ventas Transaction

Executing on Kindred’s 5-Year Strategic Plan

Transactions allow Kindred to divest 114 non-strategic skilled nursing facilities with over

$1 billion of revenues by the third quarter of 2014. |

6

Sale of 7 facilities to Signature Healthcare, LLC

Divestiture of 7 non-strategic skilled nursing centers outside Integrated Care

Markets

$47 million of net sales proceeds

Sale of 16 facilities to Vibra Healthcare, LLC

Divestiture of 14 Transitional Care Hospitals (licensed as LTACs), 1 inpatient

rehab facility and 1 co-located skilled nursing facility.

$180 million of net sales proceeds

Selective sales of non-strategic assets allow Kindred to de-lever and

re-invest sale proceeds in higher margin growth

Businesses Home Health, Hospice, IRF and

Sub-Acute Rehab Services and Care Management.

Repositioning

Strategy

2

Signature & Vibra Sales

Executing on Kindred’s 5-Year Strategic Plan |

7

Kindred Continuing Operations Reset for 136

Facility Dispositions

Repositioning

Strategy

2

Executing on Kindred’s 5-Year Strategic Plan

The Company’s third quarter earnings release and this presentation reflect the

reclassifications to discontinued operations of the following completed and planned

disposals ($ in millions, except per share amounts):

Revenues

EPS (a)

Ventas 54 (net of RHB contracts)

$44

$475

$0.02

($0.05)

Vibra (15 hospitals, 1 SNF)

180

272

0.18

0.23

Signature (7 SNFs)

47

63

0.08

0.03

Ventas 59 (net of RHB contracts) (b)

56

512

0.12

(0.01)

Ventas Mt. Carmel (c)

N/A

28

(0.04)

(0.05)

Total - 137 facilities

$327

$1,350

$0.36

$0.15

(a)

(b)

(c)

Mt. Carmel expected to move to discontinued operations in Q4'13 or Q1'14.

This Wisconsin facility is currently in the process of closing in

cooperation with State officials. FY 2012

Proceeds

From

Disposals

Annualized

EPS (a)

Under accounting rules all VTR 59 RHB intercompany contracts are classified as

discontinued operations (approximately $8 million in pretax earnings, or

$0.09 per share). Annualized EPS computed based upon results through

disposal date. Excludes the benefit from debt pay downs, overhead

reductions and redeployment of capital. |

Pre-

After

dispositions

Discontinued

dispositions

HCPI Purchase/

Pro forma

FY 2012

operations

FY 2012

Mt. Carmel

FY 2012

Revenue

$2,192.2

$1,062.2

$1,130.0

$27.7

$1,102.3

OpEx

1,901.9

911.7

990.2

27.8

962.4

Operating Income

290.3

150.5

139.8

(0.1)

139.9

Margin %

13.2

14.2

12.4

12.7

Rent

215.5

118.6

96.9

11.4

85.5

EBITDAM

74.8

31.9

42.9

(11.5)

54.4

Margin %

3.4

3.0

3.8

4.9

Depr/Amort

53.4

24.8

28.6

(1.7)

30.3

Overhead

32.9

15.9

17.0

0.4

16.6

EBIT

($11.5)

($8.8)

($2.7)

($10.2)

$7.5

Margin %

(0.5)

(0.8)

(0.2)

0.7

Capital from Disposition/(Acquisition)

$127

(4)

($83)

$44

(1) Includes 121 nursing centers reclassified to discontinued operations during

2013. (2) See enclosed reconciliation NCD operating results using generally

accepted accounting principles measurements in the

Appendix section. (3) Corporate overhead allocated at 1.5% of revenue.

(4) Includes one-time lease termination fee of $20M paid to Ventas.

(3)

(1)

(2)

8

Nursing Center Division Path to Profitability

Repositioning

Strategy

2

Executing on Kindred’s 5-Year Strategic Plan

($ in millions) |

9

Change in Business Mix, Increased Facility Ownership and

Reduction in Lease Obligations Significantly Improves Future

Growth and Profitability

Repositioning

Strategy

2

Executing on Kindred’s 5-Year Strategic Plan

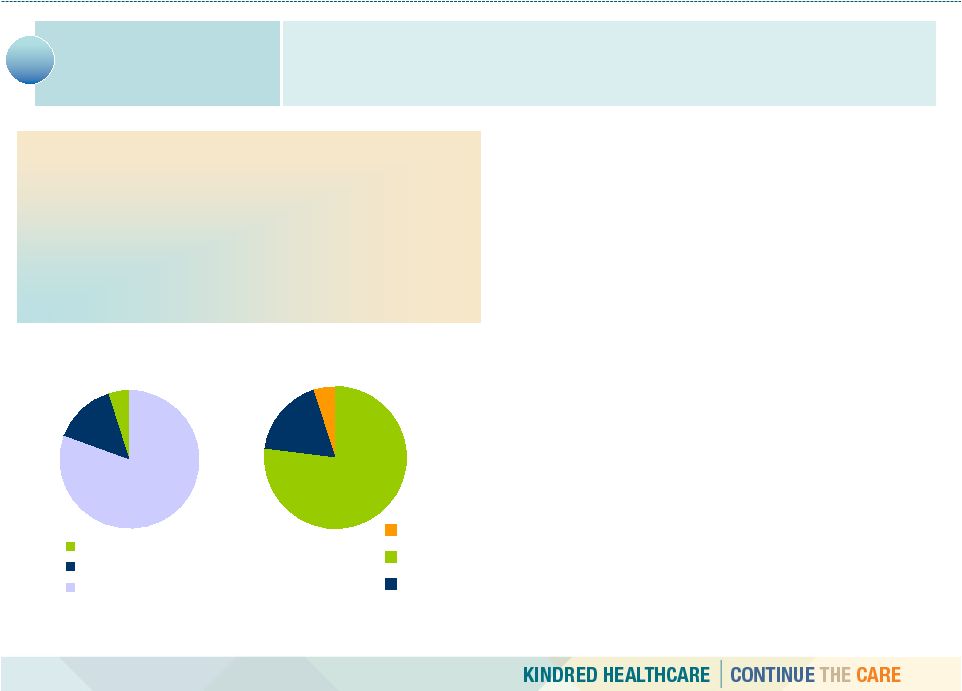

Business

Mix

Facility

Make-up

Capital

Structure

(1)

(2)

(1)

Revenue before intercompany

eliminations

(2)

Leases capitalized using 6x rent |

10

•

Senior Home Care operates 47 home health locations throughout Louisiana &

Florida, with $143 million in revenues

•

$95 million purchase price

•

$0.07 to $0.09 EPS accretion anticipated for 2014

Senior Home Care

•

Provides on-site, hospital-based rehabilitation services

•

$20 million in revenues across 11 states in 2012

•

$14 million purchase price

•

$0.02 accretive in 2014

TherEX, Inc.

Aggressively Grow

Kindred at Home

and RehabCare

3

Senior Home Care & TherEX Acquisitions

Executing on the 5-Year Strategic Plan |

11

Recently Announced TherEX Acquisition to Expand RehabCare’s

Hospital (IRF) Business and Home Care Acquisitions Advance Care

Management Capabilities

Aggressively Grow Kindred

at Home and RehabCare

3

Executing on Kindred’s 5-Year Strategic Plan

•

198 sites of service in 13 states

•

47 in Kindred’s Integrated Care Markets

•

5,700 caregivers serving over 10,000

patients on a daily basis

Care Management Division/Kindred At Home

$353 million Pro Forma Annualized Revenues

(1

)

(1)

Includes Senior Home Care acquisition. Annualized based upon revenues for the three

months ended September 30, 2013 (divisional revenues before intercompany

eliminations). Commercial

Insurance/

Other

($62 million)

Private Duty

Hospice

Home Health

Revenue Mix

(1)

Business Mix

(1)

80%

15%

5%

77%

18%

5%

Medicaid

($19 million)

Medicare

(272million)

•

Announced acquisition of Senior Home Care

–

Operates 47 home health locations throughout Florida and

Louisiana, with $143 million in revenues

–

$95 million purchase price

–

$0.07 to $0.09 EPS accretion anticipated in 2014

•

While implementation of HomeCare

HomeBase IT system contributed to

performance issues in 2013, all branches

(including Senior Home Care) will be fully

operational and standardized by Q1 2014

•

Building management team, clinical operations,

and functional support to enable platform for

continued growth

(1)

(1) |

12

•

Non-acquired growth: 24% census growth 18% revenue

growth since acquisitions were closed

•

8.6% total same-store YTD growth, supported by specialized

programs, branch expansions

•

Continuing to integrate and stabilize acquisitions in 2013

(excluding Senior Home Care)

Kindred At Home –

Revenue

•

Transition and integration costs associated with

the roll-out of

HomeCare HomeBase impacted results in 2013 •

Sequestration and increased managed care census also

effected margins

•

Implementing best practices in organizational structure, pay

practices, and clinical workflows to lower cost per visit

Kindred at Home –

Segment Operating Income

$0

$5

$10

$15

$20

$25

$30

$35

2011

2012

2013

2014E

$3.1

$13.7

$10.4

$32.7

$0

$100

$200

$300

$400

2011

2012

2013

2014E

$61

$143

$215

$372

(1)

(2)

(1)

Annualized based on revenues for the three months ended Sept. 30, 2013 (before intercompany

eliminations). (2)

Annualized based on operating income for the nine months ended Sept. 30, 2013.

(includes

Sr. Care)

(includes

Sr. Care)

Pro Forma Revenue and EBITDAR Results

Opportunities for Growth and Margin Improvement

Aggressively Grow Kindred

at Home and RehabCare

3

Executing on Kindred’s 5-Year Strategic Plan

(In millions)

(In millions) |

HOME

ACUTE CARE

HOSPITAL

Transitional

Care Hospitals

Inpatient

Rehabilitation

Hospitals

Skilled

Nursing and

Rehabilitation

Centers

Outpatient

Rehabilitation

Assisted Living

Homecare

Hospice

Physician

Coverage Across

Sites of Service

Care Managers

to Smooth

Transitions

Information

Sharing and

IT Connectivity

Mechanisms to

Make Patient Care

Placement

Decisions

Condition-

Specific Clinical

Programs, Pathways

and Outcome

Measures

PRE-ACUTE AND

POST-ACUTE CARE IN

HOME AND OTHER

PAC SETTINGS

CARE MANAGEMENT DIVISION

Patient –Centered Population Health and Medical Home Model

Care

Management

Capabilities

13

Kindred ‘s New Care Management Division

Optimized for Episodic Care, Bundled Payment and Risk

Develop Care Management

Capabilities

4

Executing on Kindred’s 5-Year Strategic Plan |

14

Integrated Care Market Strategy

Market Implementation Update

Advance Integrated Care

Market Strategy and

Implement Care

Management

Capabilities

5

Executing on Kindred’s 5-Year Strategic Plan |

15

Purchased

Tampa

Hospital

and

Bridgewater

TCC

Real

Estate

for

$35

million

Agreement to purchase certain facilities leased from HCP REIT,

•

9 skilled nursing facilities acquired for $83 million.

•

Facilities to be removed from master lease expiring January 31, 2017, thereby eliminating

annual rent escalator.

•

Transaction expected to be accretive to earnings $0.04 and cash flow $4.3 million in

2014. •

Ownership provides additional flexibility with regard to strategic decisions:

Re-priced

and

amended

Senior

Secured

Financing

Arrangements

on

favorable

terms

resulting

in

$8

million

of

annualized

interest

savings,

extended

maturity

of

the

ABL

Revolver

and

option

to

increase

credit

capacity

by

$250

million.

Announced quarterly dividend of $0.12 per share, reflecting the Company’s confidence

in its ability to generate meaningful and sustainable Free Cash Flow

Improve Capital

Structure and

Enhanced

Shareholder Returns

6

Real Estate Purchases, Improved Senior Financing

Arrangements and Dividend Initiation

Executing on Kindred’s 5-Year Strategic Plan

Expansion/Relocation/Repurposing

Disposition of facilities deemed non-strategic and/or underperforming

|

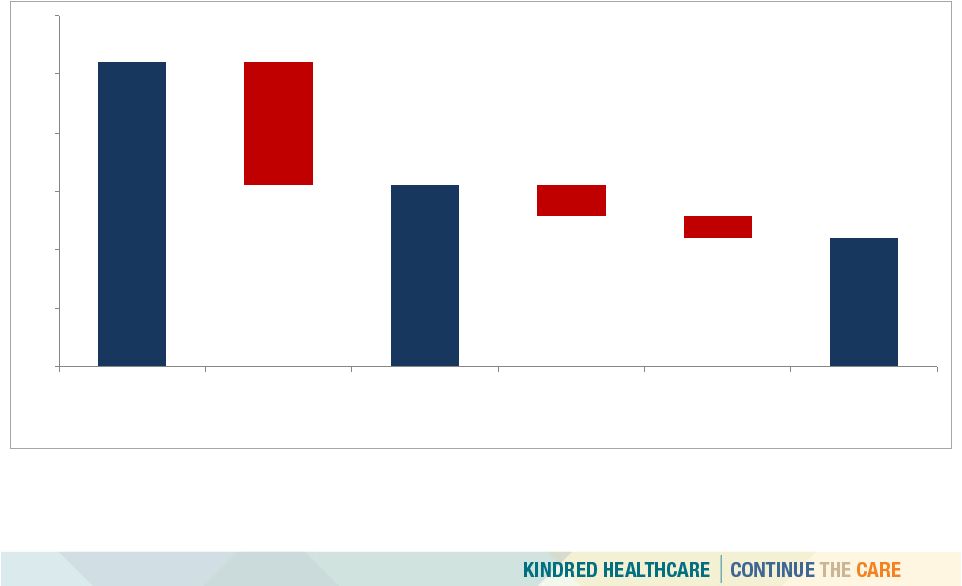

Crosswalk from

Rebased 2013 to Preliminary 2014 EPS Guidance (Mid-Point)

16

Repositioning and Redeployment

Non-Cash

(a)

See

attached

earnings

guidance

detail

in

Appendix,

including

the

effect

of

certain

excluded

items.

(b)

Excludes

the

benefit

from

debt

pay

downs,

overhead

reductions

and

redeployment

of

capital.

(c)

Sequestration;

Home

Health

Rebasing;

Hospital

25%

Rule

and

1.25%

BNA

cut

netted

against

Medicare

market

basket.

$0.83

$1.22

$0.96

$0.96

$1.15

$0.48

($0.20)

($0.04)

$0.12

$0.07

($0.11)

$0.50

$0.60

$0.70

$0.80

$0.90

$1.00

$1.10

$1.20

$1.30

Rebased 2013 EPS

(Mid

-Point)

(a)(b)

Core Growth,

Overhead Savings,

Debt Repricing

Regulatory

Headwinds

(c)

2015 Ventas

Straight Line Rent

Senior Home Care

&

HCPI

Real Estate Purchase

Additional

Development

2014 EPS (a) |

Net Free Cash

Flows 2014 Mid-Point of Guidance

(As of November 5, 2013)

17

(a)

The guidance for cash flows excludes the effect of (1) payments for pending litigation, (2)

any other reimbursement changes and (3) any further acquisition or divestitures

(unless otherwise noted). (b)

Includes approximately $36 million of working capital cash release for VTR 59.

$260

$155

$129

$110

$110

($105)

($26)

($19)

$0

$50

$100

$150

$200

$250

$300

Cash Flows from

Operations

(a)(b)

Routine

CAPEX

Cash Flows from

Operations

Dividend

Development

(De Novo Facilities)

Net Free

Cash Flows (a) |

Attractive

Investment Considerations Kindred Substantially Repositioned Going Into 2014

18

•

Repositioned to faster growth, higher

margin and less capital intensive

businesses

•

Essentially shifted $1 billion of revenues

from Skilled Nursing to Hospital, Rehab

and Home Health Care since 2011

1)

Pro Forma 2014 Rents of $339MM at 6x.

2)

Market Value calculated as of close of business 9/30/13 ($13.43).

3)

Free Cash Flow Yield represents free cash flows divided by Market Value of Equity.

Improving Business

Mix

(Revenues):

Enhanced Earnings, Margin

and Free Cash Flow Profile

(in millions)

(2014 Guidance, as of Nov.,

5

2013):

•

Approximately $110 of free cash flows

•

Approximately $264 million of ABL

Revolver paid down thru 9/30/13

•

Estimated fully diluted shares in 2014

52.3M

Improved Capital

Structure (in millions)

(As of 9/30/13):

•

Enterprise Multiple: 5.7x

•

Dividend Yield: 3.6%

•

Free Cash Flow Yield

3

: 16%

•

TAD / EBITDAR: 4.7x

2010

2014

Hospital Services

42%

48%

Rehab Services

10%

24%

Nursing Center

47%

21%

Care Management /

Home Health Care

0%

7%

Total

100%

100%

EBITDAR

Adjusted Cash Flows

from Operations

Dividend

Free Cash Flow (FCF)

$155

$726 - $744

$26

$110

Total Funded Debt

$1,391

Lease Obligations

1

$2,034

Total Adjusted Debt (TAD)

$3,425

Market Value of Equity

$727

Enterprise Value

$4,152

th

2 |

19

Questions & Answers |

| Appendix

20

******

******

******

******

******

******

******

******

******

******

****** |

21

Kindred continues to advance Care Management capabilities with market

specific and system level investments

Develop Care Management

Capabilities

4

Implementing dedicated resources to manage patient transitions between Kindred settings and with

discharge to home:

Care Transitions programs are now up and running in the Indianapolis, Cleveland, and Boston

Integrated Care Markets, with Las Vegas planning for implementation in 2014.

Programs are designed to address care transitions for specific patient groups with a focus on

primary care and specialist physician follow-up and medication management.

Advancing Physician Leadership as part of Care Management capabilities:

Western

Reserve

Senior

Care

acquisition

positions

Kindred

with

a

Home

Based

Primary

Care

services

that

offer

both

organic growth opportunities and care management capabilities for alternative / risk based

payment arrangement. The Boston, Las Vegas, and Cleveland Integrated Care Markets have

hired or contracted with Physician Medical

Executives

to aid development of Integrated Care delivery models and outreach with payor and hospital

referral sources.

Continue to Execute in I-T Interoperability and Information Sharing Platform:

Standardized division clinical information systems / electronic medical records (EMRs).

Established platform for sharing patient level clinical information from Kindred EMRs across

settings. Established infrastructure that supports standards based information sharing

with referral partners, which improves time to market and provides economies of

scale. Care and Payment Innovation Pilots/Discussions:

Kindred is moving forward to participate in the CMS Bundled Payment for Care Improvement

demonstration program. Managed Care and ACO outreach efforts underway in specific

markets (Boston and Las Vegas) and with national payers for alternative payment

arrangements. Executing on Kindred’s 5-Year Strategic Plan

|

22

2013 & 2014 Guidance

($ millions, except statistics)

Low

High

Low

High

Revenue

$4,900

$4,900

$5,100

$5,100

EBITDAR

657

665

726

744

Rent

323

323

339

339

EBITDA

334

342

387

405

D&A

159

159

165

165

EBIT

175

183

222

240

Interest expense, net

103

103

106

106

Pretax

72

80

116

134

Taxes

28

31

46

53

Net income

44

49

70

81

Noncontrolling interest

2

2

12

12

Income to Kindred

$42

$47

$58

$69

Shares

52.3

52.3

53.2

53.2

Diluted EPS

$0.78

$0.88

$1.05

$1.25

(a)

(b)

2013 Range (a)

2014 Range (b)

The earnings guidance excludes the effect of (1) a one-time employee bonus distributed

in the first quarter of 2013, (2) changes in estimates related to pending litigation,

(3) the early lease termination payment to Ventas, (4) costs associated with the

closure of a hospital and a home health location, (5) costs associated with

certain severance and retirement benefits, (6) any transaction-related costs, (7)

charges associated with the modification of certain of the Company's senior debt, (8)

any other reimbursement changes, (9) any further acquisitions or divestitures (unless

otherwise noted), (10) any impairment charges, and (11) any repurchases of common

stock. The earnings guidance excludes the effect of (1) any other reimbursement

changes, (2) any further acquisitions or divestitures (unless otherwise noted), (3)

any impairment charges and (4) any repurchases of common stock.

|

Reconciliation

of Non-GAAP Measures Year 2012

(In thousands)

23

Severance,

employee

retention and

Employment-

Lease

Before

restructuring

related

Transaction

Impairment

cancellation

As

Charges

costs

lawsuits

costs

charges

charges

Total

Reported

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

570,095

$

4,224

$

5,000

$

-

$

-

$

-

$

9,224

$

560,871

$

Nursing center division

139,792

2,811

-

-

-

-

2,811

136,981

Rehabilitation division:

Skilled nursing rehabilitation services

68,847

354

-

-

-

-

354

68,493

Hospital rehabilitation services

69,852

107

-

-

-

-

107

69,745

138,699

461

-

-

-

-

461

138,238

Home health and hospice division

13,858

150

-

-

-

-

150

13,708

Corporate:

Overhead

(177,979)

1,084

-

-

-

-

1,084

(179,063)

Insurance subsidiary

(2,127)

-

-

-

-

-

-

(2,127)

(180,106)

1,084

-

-

-

-

1,084

(181,190)

Impairment charges

(1,243)

-

-

-

107,899

-

107,899

(109,142)

Transaction costs

-

-

-

2,231

-

-

2,231

(2,231)

Operating income

681,095

8,730

5,000

2,231

107,899

-

123,860

557,235

Rent

(311,801)

-

-

-

-

1,691

1,691

(313,492)

Depreciation and amortization

(164,052)

-

-

-

-

-

-

(164,052)

Interest, net

(106,876)

-

-

-

-

-

-

(106,876)

Income (loss) from continuing operations

before income taxes

98,366

8,730

5,000

2,231

107,899

1,691

125,551

(27,185)

Provision for income taxes

38,591

3,427

1,962

592

6,150

664

12,795

25,796

59,775

$

5,303

$

3,038

$

1,639

$

101,749

$

1,027

$

112,756

$

(52,981)

$

In addition to the results provided in accordance

with GAAP, the Company has provided information in this presentation to compute certain

non-GAAP measurements for the year ended December 31, 2012 before certain charges or on a

core basis. A reconciliation of the non-GAAP measurements to the GAAP

measurements is included below: |

24

Reconciliation of Non-GAAP Measures (Cont.)

Year 2012

(In thousands)

Lease

Before

cancellation

As

Charges

charges

Reported

Rent:

Hospital division

203,774

$

1,648

$

205,422

$

Nursing center division

96,919

-

96,919

Rehabilitation division:

Skilled nursing rehabilitation services

5,442

-

5,442

Hospital rehabilitation services

140

-

140

5,582

-

5,582

Home health and hospice division

3,097

43

3,140

Corporate

2,429

-

2,429

311,801

$

1,691

$

313,492

$

Depreciation and amortization:

Hospital division

79,620

$

-

$

79,620

$

Nursing center division

28,581

-

28,581

Rehabilitation division:

Skilled nursing rehabilitation services

11,168

-

11,168

Hospital rehabilitation services

9,309

-

9,309

20,477

-

20,477

Home health and hospice division

4,442

-

4,442

Corporate

30,932

-

30,932

164,052

$

-

$

164,052

$ |

KINDRED

HEALTHCARE

NYSE: KND

Investor Update on

Strategic Plan and

Repositioning

Initiatives |