Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DORAL FINANCIAL CORP | d623136d8k.htm |

| EX-99.1 - EX-99.1 - DORAL FINANCIAL CORP | d623136dex991.htm |

Doral Financial Corporation

Q3 2013 Investor Presentation

November 5, 2013

Exhibit 99.2 |

Disclaimer

2

This presentation may include forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). These include comments with respect to our objectives and

strategies, and the results of our operations and our business.

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

They

often

include

words

such

as

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates,”

or

words

of

similar

meaning,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could”

or

“may.”

We

intend

these

forward-looking

statements to be covered by the safe harbor provisions of the PSLRA.

Forward-looking statements provide our expectations or predictions of future

conditions, events or results. They are, by their nature, subject to risks

and uncertainties. They are not guarantees of future performance, and actual results may differ materially.

By their nature, these forward-looking statements involve numerous assumptions

and uncertainties, both general and specific, including those discussed in

Doral Financial Corporation’s 2012 Annual Report on Form 10-K and other filings we make with the

Securities and Exchange Commission. Risk factors and uncertainties that could cause

the Company's actual results to differ materially from those described in

forward-looking statements can be found in the Company's 2012 Annual Report on Form 10-K,

which is available in the Company's website at

, as they may be updated from time to time in the

Company’s periodic and other reports filed with the Securities and Exchange

Commission. The statements in this presentation speak only as of the date

they are made. We do not undertake to update forward-looking

statements

to

reflect

the

impact

of

circumstances

or

events

that

arise

after

the

date

the

forward-looking

statements

were

made,

other than as required by law, including requirements of applicable securities

laws. www.doralfinancial.com |

Q3

2013 Results 3

Q3 results showed improvement versus Q2 2013; capital remains in

excess of regulatory requirements

Puerto Rico’s economic recession expected to continue

Doral Recovery strategy is producing benefits

o

NPAs

remained

flat

over

the

quarter

--

NPLs up 4MM; OREO down $6MM

o

Commercial NPAs fell by $20MM on strong collections and restructuring

activity US platform continues to fuel growth

o

Loans increased to $2.7B on $439MM of loan production during Q3

o

Retail deposits increased $250MM to $1.5B

o

Net Loss

$(7.5)MM

o

Pre-Tax, Pre-Credit Provision Income

$7.9MM

o

Provisions

$16.4MM

o

Net Interest Margin

303bps

o

Book Value per Share

$66.55

o

Tier-1 Leverage Ratio (Doral Bank)

8.3%

o

Total Risk-Based Capital (Doral Bank)

12.3% |

Doral

Financial Corporation Profile 4

Company Overview

$8.6B Asset PR Mortgage & US Commercial Bank

Capital Ratios continue to exceed regulatory requirements:

o

Tier-1 Leverage Ratio (DFC):

8.7%

o

Total Risk-Based Capital Ratio (DFC): 12.1%

Book Value of $66.55 per share

o

A valuation allowance against Doral’s remaining deferred

tax asset represents an additional $ 44.79 per share ($297.9MM)

Doral operates two segments:

1.

Doral Growth : Profitable Mortgage & Commercial Bank

o

PR Growth: Mortgage & Retail Bank

o

US: Commercial & Retail Bank

2.

Doral Recovery:

Puerto Rico Special Servicing Portfolio

o

PR Residential Mortgage & OREO

o

PR Commercial Loans & OREO

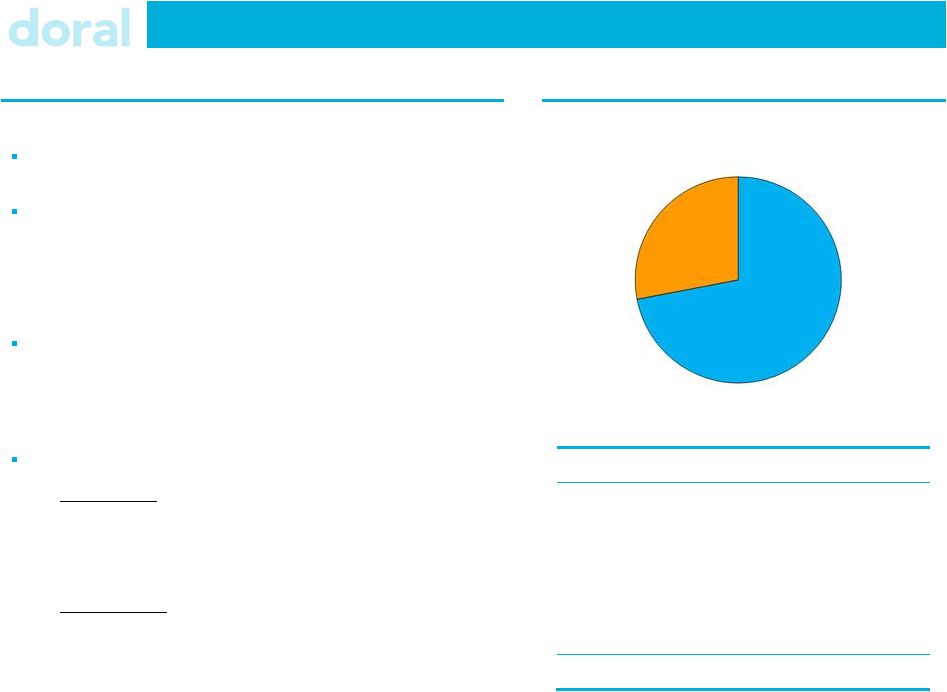

Loan Portfolio Composition ($6.8B)

Doral Growth

(73%)

Doral Recovery

(27%)

Loan Portfolio

$ MM

Loan Category

Growth

Recovery

Total

Residential

$2,260

$1,071

$3,331

CRE

701

477

1,178

C&I

1,527

111

1,638

Construction & Land

448

136

584

Consumer / Other

20

-

20

Total

$4,956

$1,795

$6,751 |

5

Doral Operating Segments

Two Operating Segments: Profitable, High Margin Bank & Special Servicing

Group Puerto Rico Mortgage & Retail Banking

o

$2.2B Residential Mortgage Portfolio

o

#2 Mortgage Originator in Puerto Rico

o

A $11.2B Mortgage Servicer

o

$1.6B of deposits

US Commercial & Retail Banking

o

$2.7B

High NIM Specialty Commercial Lender

o

8 branches with $1.5B of deposits

61% of Loans are Performing.

$1.1B of Puerto Rico Residential Mortgages

o

TDRs and Defaulted Loans (180 days past due)

o

63% of loans are Performing

$0.7B of Puerto Rico Commercial Loans

o

CRE, Small Business and Construction & Land

o

58% of loans are Performing

$0.1B of OREO & Other

Puerto Rico Loans

(33%)

US Loans

(40%)

PR OREO & Other

(7%)

Cash & Securities

(16%)

PR Commercial

(38%)

PR Residential Mortgage

(59%)

Taxes & Other

(11%)

Doral Growth: Profitable Mortgage & Commercial Bank

Doral Recovery: Puerto Rico Special Servicing Portfolio

|

Q3

Results Net Loss ($MM)

3Q ’13

Net Interest Income

$57.6

Non Interest Income

18.7

Total Net Revenue

76.3

Non-Interest Expense

68.4

Pre-Tax, Pre-Provision Income

7.9

Credit Provision

16.4

Pre-Tax Income

(8.5)

Tax Expense (Benefit)

(1.0)

Reported Net Loss

$(7.5)

Ratios:

NIM (bps)

303

Average Assets

$8,532

Improved Net Loss by $3MM vs. Q2’13

NIM returned to above 300 bps

Slow mortgage market continues to weigh on Non-

Interest Income

Significant improvement in Non-Interest Expense.

Credit Provisions largely driven by changes in

asset values / re-appraisals:

Tax Benefit reflects changes to the legislation in

PR.

(Tax rate increased from 30% to 39%, positively

impacting the Deferred Tax Assets)

6

$MM

Growth

Recovery

Total

Residential

$1.7

$9.3

$11.0

Commercial

$1.5

$3.9

$5.4

Total

$3.2

$13.2

$16.4

o

$144MM of production in Q3, 30% lower than Q2

o

Continue to see strong gains on sale (average 3.76%)

o

Fair Value Assets showed stability during the quarter.

|

Overview

Doral Growth

7

Segment

Results

1

Doral Growth generated $12MM in Pre-Tax Income

NIM remained strong at 325 bps

Non-Interest Income continues to suffer from a soft

mortgage market in Puerto Rico

Non-Interest Expense includes $3MM benefit related

to a PR housing tax credit

Continued strong US growth

($MM)

3Q 13

Net Interest Income

$47.0

Non Interest Income

18.7

Total Net Revenue

65.7

Non-Interest Expense

50.5

Pre-Tax, Pre-Provision Income

15.2

Credit Provision

3.2

Pre-Tax Income

$12.0

Ratios:

NIM (bps)

325

Efficiency Ratio

77%

Average Assets

$6,647

Pre-Tax ROAA

0.7%

Loan Portfolio

$ MM

Loan Category

PR

US

Total

Residential

$2,249

$11

$2,260

CRE

-

701

701

C&I

13

1,514

1,527

Construction & Land

-

448

448

Consumer / Other

20

-

20

Total

$2,281

$2,675

$4,956

1

Includes Allocation of Administrative Expenses ( Corporate and Treasury)

--

for additional details see exhibit B)

o

o

Loan originations of $439MM driving loans to $2.7B

Retail deposits grew by $250MM to $1.5B |

Segment

Results

1

Doral Recovery

8

($MM)

3Q 13

Net Interest Income

$10.6

Non Interest Income

0.0

Total Net Revenue

10.6

Non-Interest Expense

17.9

Pre-Tax, Pre-Provision Income

(7.3)

Credit Provision

13.2

Pre-Tax Income

$(20.5)

Ratios:

NIM (bps)

232

Average Assets

$1,884

Non-Performing Loans

$649

NPL %

38.7%

Overview

Net Loss improved by $2M versus Q2

Commercial NPAs fell by $20MM

61% of Recovery Loans are Performing

o

63% of Residential loans are performing

o

58% of Commercial loans are performing

$ MM

Loan Category

Total

NPL

% NPL

Residential

$996.2

$365.3

36.6%

Commercial Real Estate

434.9

184.2

42.3%

Commercial

111.3

3.4

3.0%

Land & Construction

135.6

96.5

71.2%

Total

$1,678.0

$649.4

38.7%

2

Excludes Loans HFS

1

Includes Allocation of Administrative Expenses ( Corporate and Treasury)

--

for additional details see exhibit B)

Loan

Portfolio

2 |

Asset

Quality 9

1

Excludes Loans Held for Sale & FHA / VA Loans

2

UPB-

Partial Charge Offs

3

Adjusted Coverage ratio, (ALLL+Partial Charge Offs)/UPB

NPAs down $2MM; Recovery efforts driving continued reduction in Commercial NPAs

NPL: Adjusted Coverage Ratios

1

$ MM

UPB

Partial Charge-Offs,

Deferred Fees and

Discounts

Recorded

Investment

2

ALLL

ALLL + Partial

Charge-Offs

Adjusted

Coverage

Ratio

3

Residential

508.3

77.3

431.0

80.5

157.8

31.0%

Commercial

415.4

128.9

286.5

32.8

161.7

38.9%

Total

$923.7

$206.2

$717.4

$113.3

$319.5

34.6%

NPL Adjusted Coverage Ratio maintained at 35%

NPL & NPA: Q2 vs. Q3

NPL

NPA

$ MM

Q2

Q3

Change

Q2

Q3

Change

Residential

409.7

431.0

21.3

527.1

544.4

17.3

Commercial

303.7

286.5

(17.2)

350.4

330.9

(19.5)

Total

$713.4

$717.4

$4.1

$877.5

$875.3

$(2.2)

1 |

10

Executive Summary

Third Quarter demonstrated improved financial performance

US platform continues profitable growth –

now represents 40% of loans and 47% of retail

deposits

Opportunity for further NIM expansion as ~$500MM of liabilities with an average cost

of 2.6% mature over the next six months.

Capital ratios remain in excess of regulatory requirements

Doral Growth delivered $12MM of profits -- earnings are up $5MM from Q2

Doral Recovery continues to deliver strong results -- earnings are up while NPAs

are down |

Investor Relations Contact and Conference Replay Details

11

Investor Relations:

Christopher Poulton –

Executive Vice President

212 / 329-3794

christopher.poulton@doralfinancial.com

Media:

Lucienne Gigante –

SVP Public Relations

787 / 474-6298

lucienne.gigante@doralbank.com

Conference Call:

2.00 PM EST November 5, 2013

(800) 230-1093 or (612) 288-0329

Conference Call Replay:

November 5, 2013 –

December 5, 2013

(800) 475-6701 or (320) 365-3844

Replay Code: 306281 |

Exhibits |

Exhibit A –

Financial Summary

13

($ MM)

30-Sep-13

30-June-13

31-Mar-13

31-Dec-12

30-Sep-12

Income Statement

Net Interest Income

57.6

50.5

60.7

56.8

56.2

Provision for Credit Losses

16.4

5.5

18.7

21.3

34.4

NII After Provisions

41.2

45.0

42.0

35.5

21.8

Non-Interest Income

18.6

16.8

24.4

29.1

19.7

Non-Interest Expense

68.4

73.9

74.9

86.5

73.5

Pre-Tax Income

(8.5)

(12.1)

(8.5)

(21.9)

(32.0)

Taxes

(1.0)

(1.8)

3.9

(50.2)

0.5

Net Income

(7.5)

(10.4)

(12.4)

28.3

(32.5)

Pre-Tax Pre-Provision Income

7.9

(6.6)

10.2

(0.6)

2.4

Balance Sheet

Total Gross Loans (incl. HFS)

$6,751

$6,705

$6,614

$6,613

$6,611

Loan Loss Reserves

113

112

125

135

146

Total Deposits

4,980

4,972

4,783

4,629

4,614

Total Assets

8,570

8,521

8,369

8,479

8,371

Profitability Metrics

Net Interest Margin

3.03%

2.70%

3.31%

2.97%

2.95%

Capital & Credit Ratios

NPL / Loans

11.1%

11.6%

12.6%

12.2%

11.5%

Leverage Ratio

8.67%

8.98%

9.26%

9.39%

9.32%

1

Excludes

Loans

Held

for

Sale

and

Residential

loans

guaranteed

by

FHA

/

VA

1 |

14

($ MM)

PR

US

Doral Growth

1

Recovery

Corporate

Treasury

Total

Income Statement

Net Interest Income

$21.0

$26.5

$47.5

$10.6

$(0.1)

$(0.4)

$57.6

Non-Interest Income

17.4

1.4

18.8

0.0

0.0

(0.1)

18.6

Total Net Revenue

38.4

27.9

66.3

10.6

(0.1)

(0.5)

76.3

Non-Interest Expense

29.4

13.3

42.7

16.7

7.9

1.2

68.4

Pre-Tax , Pre Provision Income

9.0

14.6

23.6

(6.0)

(8.0)

(1.7)

7.9

Credit Provision

1.6

1.5

3.2

13.1

0.0

0.0

16.4

Pre-Tax Income

$7.4

$13.1

$20.4

$(19.3)

$(8.0)

$(1.7)

$(8.5)

Allocation of Corporate & Treasury

Adjusted Revenue

(0.6)

0.0

0.1

0.5

0.0

Adjusted Non Interest Expense

7.9

1.2

(7.9)

(1.2)

0.0

Adjusted Pre-Tax Income

$11.9

$(20.4)

$0.0

$0.0

$(8.5)

Exhibit B –

Segment Reconciliation

1

Doral Growth is the sum of PR and US Segments |