Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAPITAL SENIOR LIVING CORP | d622256d8k.htm |

| EX-99.1 - EX-99.1 - CAPITAL SENIOR LIVING CORP | d622256dex991.htm |

Capital Senior Living

Company Presentation

Exhibit 99.2 |

2

Forward-Looking Statements

•

The forward-looking statements in this presentation are subject to certain risks

and

uncertainties

that

could

cause

results

to

differ

materially,

including,

but

not

without limitation to, the Company’s ability to complete the refinancing of

certain

of

our

wholly

owned

communities,

realize

the

anticipated

savings related

to such financing, find suitable acquisition properties at favorable terms,

financing,

licensing,

business

conditions,

risks

of

downturns

in

economic

conditions

generally,

satisfaction

of

closing

conditions

such

as

those

pertaining

to licensures, availability of insurance at commercially reasonable rates and

changes in accounting principles and interpretations among others, and other

risks and factors identified from time to time in our reports filed with the

Securities and Exchange Commission

•

The Company assumes no obligation to update or supplement forward-looking

statements in this presentation that become untrue because of new information,

subsequent events or

otherwise. |

3

Investment Highlights

•

Value leader in providing quality seniors housing and care at

reasonable prices

•

Well positioned to make meaningful gains in shareholder value

•

Substantially all private pay with strong cash flow generation

•

Industry benefits from need-driven demand, limited new supply and

improving housing market

•

Achieving solid growth in occupancy, revenue and net operating

income

•

Executing on disciplined accretive growth initiatives through

acquisitions and conversions to higher levels of care

•

Solid balance sheet |

4

Company Overview

•

Capital Senior Living operates 108 communities in geographically

concentrated regions with the capacity to serve 14,300 residents

|

5

Resident Demographics at CSU Communities

•

Average age of resident: 85 years

•

Average age of resident moving in: 82 years

•

Average

stay

period:

2-3

years

•

Percent of female residents: 80%

•

Resident turnover is primarily attributed to death or need for

higher care |

6

The Capital Advantage: Senior Living Options

Independent Living –

54% of Resident Capacity

•

Average 115 units per IL community with large common areas and

amenities

•

Supportive services, wellness programs, social, recreational and

educational events

•

Average monthly rate of $2,475

•

100% private pay

•

Average length of resident stay is 34 months |

7

The Capital Advantage: Senior Living Options

Assisted Living-

46% of Resident Capacity

•

Average 66 units per community

•

73% of communities offer AL

•

Assistance with activities of daily living including medication

reminders, bathing, dressing and grooming

•

Average monthly rate of $3,677

•

Substantially all private pay

•

Average length of resident stay is 26 months |

8

The Capital Advantage: Need Driven Demand

U.S. population 75+ years old is estimated to grow by 3.5 million from

2009 through 2015

•

Only 1.3 million units serving a population of 18.9 million seniors

•

Current 6.9% penetration rate implies demand growth of 40,000 units

per year

U.S. Seniors Population Trends (75+ years old)

(Population in

millions)

Implied demand growth of

40,000 units per year

Source: NIC Investment

Guide 2010 and U.S.

Census Bureau |

9

The Capital Advantage: Limited New Supply

Source: Seniors NIC MAP100 Trends |

10

The Capital Advantage: Senior Housing Occupancy Trends

Source: Seniors NIC MAP100 Trends |

11

The Capital Advantage: Competitive Strengths

•

Value leader in geographically concentrated regions

•

Experienced on-site, regional and corporate management

•

Larger company economies of scale and proprietary systems

that yield operating efficiencies in highly fragmented industry

•

Solid reputation in industry and 95% resident satisfaction

•

Employer of choice

•

Solid balance sheet

•

Strong Board of Directors |

12

The Capital Advantage: Strategy

•

Focus on our core strengths

•

Capitalize on competitive strengths within each of our regions

to maximize the cash flow generated by our communities and

our operations

•

Capitalize on the fragmented nature of the senior living

industry to strategically aggregate local and regional operators

in geographically concentrated regions

•

Increase levels of care through conversions to Assisted Living

or Memory Care units

•

Attract and retain the best talent in the senior living industry

|

13

2013 Business Plan

•

Focused on Operations, marketing and growth to enhance

shareholder value through:

•

Organic growth

•

Proactive expense Management

•

Accretive acquisitions and unit conversions

•

Utilization of technology |

14

2013 Business Plan: Organic Growth

•

Increase average rents

•

Each 3% increase generates $10.4M of revenue

•

Improve occupancies

•

Each 1% generates $3.5M of revenue, $2.5M of EBITDAR and $0.06 per

share of CFFO

•

Convert units to higher levels of care

•

Cash flow enhancing renovations and refurbishments

•

New branding strategy, eMarketing and website enhancements

•

Implement software programs to optimize care plans and level of

care changes |

15

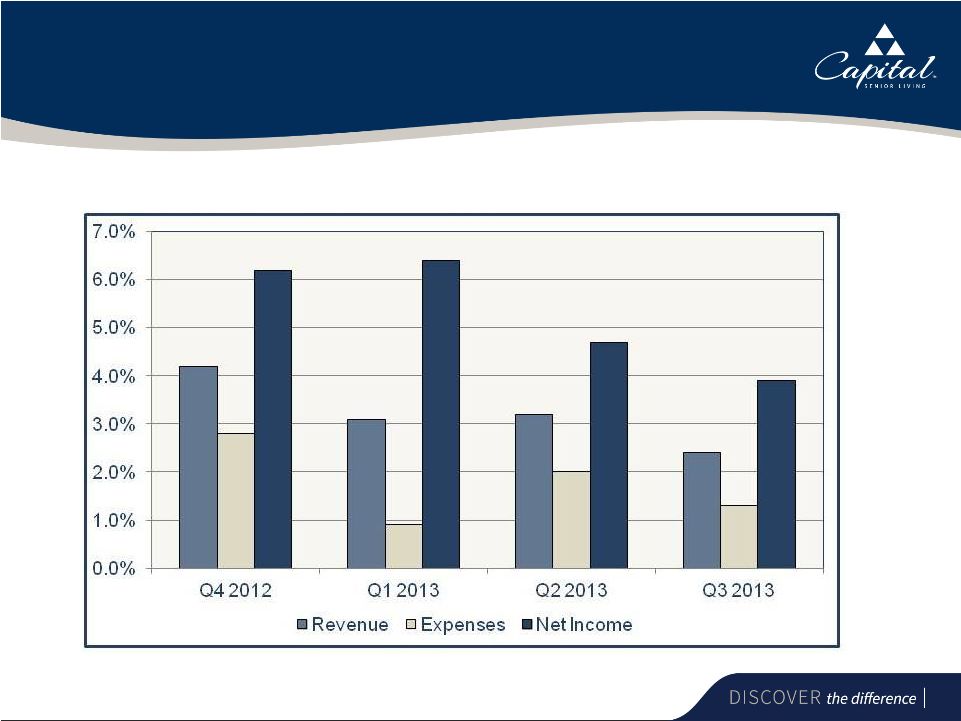

Operating Performance

•

Same-store comparable trends |

16

2013 Business Plan: External Growth

•

Strategic acquisitions of high quality senior living communities

to

enhance

geographic

concentrations

-

17%

cash

on

cash

returns

(in millions except number of communities and units)

2012

2013 YTD

Combined

Purchase Price

$181.3

$85.4

$266.7

Communities

17

7

24

Units

1,367

493

1,860

Debt

$129.5

$63.7

$193.1

Equity

$51.8

$21.7

$73.5

First Year Revenue

$49.1

$20.5

$69.6

First Year EBITDAR

$19.1

$8.4

$27.5

First Year Cash Flow from

Operations (CFFO)

$9.1

$3.7

$12.8

First Year CFFO per share

$0.34

$0.13

$0.47 |

17

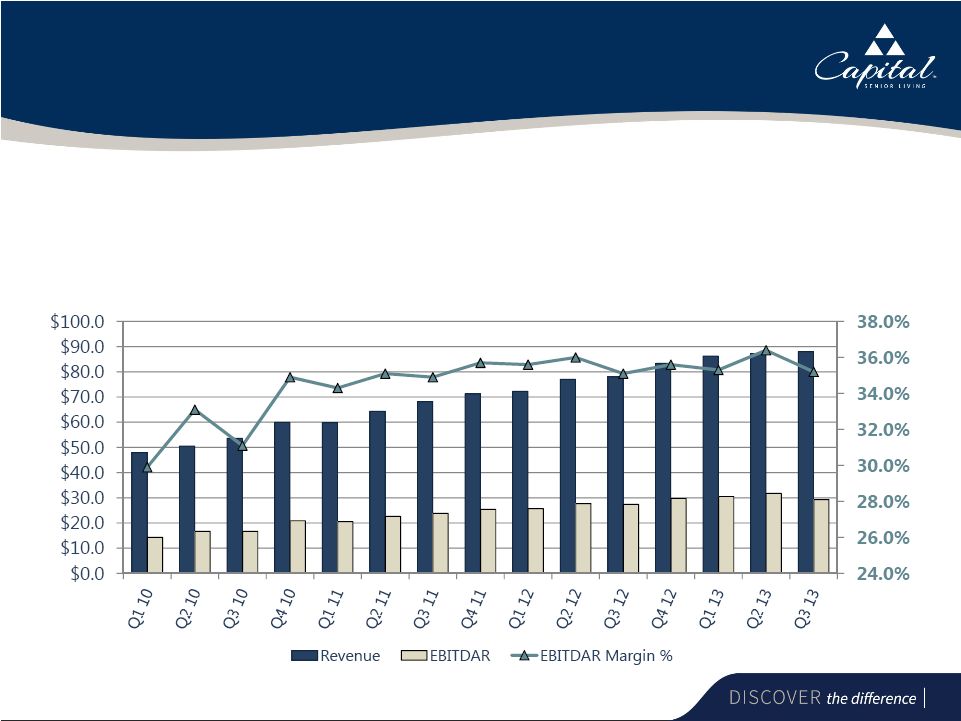

Operating Performance

•

Revenue and EBITDAR growth

•

EBITDAR increased 104.9% on an 83.7% increase in revenue

•

EBITDAR margin increased from 29.9% in Q1 2010 to 35.2% in Q3

2013

*

As adjusted in Q3 2013 earnings release |

18

Income Statement: September YTD Comparison

As adjusted in press releases

2013

2012

% Increase

Total Revenues

$ 261.4

$ 227.3

15.0%

Operating Expenses

(153.5)

(133.1)

General & Administrative Expenses

(13.8)

(9.7)

Other Expense

(4.3)

(3.7)

EBITDAR

$ 89.8

$ 80.8

11.1%

% Margin

35.0%

35.6%

Lease Expense

(42.8)

(41.2)

Interest, Taxes and Other

(43.4)

(33.8)

Net Income

$ 3.6

$ 5.8

Earning Per Share

$0.13

$0.21

CFFO

$ 28.1

$ 23.9

17.6%

CFFO Per Share

$1.01

$0.87 |

19

Balance Sheet

•

As of September 30, 2013 (in millions)

ASSETS

Cash and Securities

$ 30.2

Other Current Assets

25.1

Total Current Assets

55.3

Fixed Assets

565.9

Other Assets

48.7

TOTAL ASSETS

$ 669.9

LIABILITIES & EQUITY

Current Liabilities

$ 54.4

Long-Term Debt

387.7

Other Liabilities

61.3

Total Liabilities

503.4

Stockholders’

Equity

166.5

TOTAL LIABILITIES &

EQUITY

$ 669.9 |

20

Investment Highlights

•

Value

leader

in

geographically

concentrated

regions

•

Substantially

all

private

pay

•

Need-driven

demand,

limited

new

supply

and

improving

housing

market

•

Experienced

management

team

with

demonstrated

ability

to

operate,

acquire

and

create

shareholder

value

•

Accretive

acquisitions

in

highly

fragmented

industry

•

Conversions

to

higher

levels

of

care

with

significant

revenue

and

cash

flow

growth

•

Strong

cash

flow

generation

•

Solid

balance

sheet |

Capital Senior Living

Company Presentation |