Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Tecnoglass Inc. | v359134_8-k.htm |

EXHIBIT 99.1

A Leading Manufacturer of Architectural Glass & Windows Proposed Merger with Andina Acquisition Corporation (NASDAQ:ANDA/ANDAU/ANDAW) November 2013

2 Andina Acquisition Corporation (“ Andina ”) is holding presentations for certain of its shareholders, as well as other persons who might be interested in purchasing Andina’s securities, regarding its business combination with Tecnoglass S . A . (“ Tecnoglass ”) and C . I . Energia Solar S . A . E . S . Windows (“ES”) . This slide show will be distributed to attendees of these presentations . EarlyBirdCapital , Inc . (“EBC”), the managing underwriter of Andina’s initial public offering (“IPO”) consummated in March 2012 , and Morgan Joseph TriArtisan (“MJTA”) are acting as Andina’s investment bankers in these efforts . EBC will receive a fee of $ 1 , 610 , 000 and MJTA will receive a fee of $ 500 , 000 in connection with this engagement . Andina and its directors and executive officers, and EBC and MJTA may be deemed to be participants in the solicitation of proxies for the extraordinary general meeting of Andina’s shareholders to be held to approve the business combination . SHAREHOLDERS OF ANDINA AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, ANDINA’S PROXY STATEMENT (“PROXY STATEMENT”) WHICH WILL CONTAIN IMPORTANT INFORMATION . Such persons may read Andina’s Proxy Statement, Andina’s final Prospectus for its IPO and its Annual Report on form 10 - K for the fiscal year ended February 28 , 2013 , as amended, for a description of the security holdings of Andina’s officers and directors and of EBC and MJTA and their respective interests in the successful consummation of the business combination . The Proxy Statement will be mailed to shareholders as of a record date to be established for voting on the business combination . Shareholders will also be able to obtain a copy of the Proxy Statement, without charge, by directing a request to : The Equity Group Inc . , 800 Third Avenue, 36 th Floor, New York, NY 10022 . The preliminary Proxy Statement and definitive Proxy Statement, once available, and final Prospectus can also be obtained, without charge, at the Securities and Exchange Commission’s internet site (http : //www . sec . gov) .

3 FORWARD LOOKING STATEMENTS This presentation may include “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . Such forward looking statements with respect to the timing of the proposed business combination between Andina and Tecnoglass and ES, as well as the expected performance, strategies, prospects and other aspects of the business of Tecnoglass and ES and the combined company after completion of the proposed business combination, are based on current expectations that are subject to risks and uncertainties . A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements . These factors include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement for the business combination (the “Merger Agreement”), ( 2 ) the outcome of any legal proceedings against Andina , Tecnoglass , ES ; ( 3 ) the inability to complete the transaction contemplated by the Merger Agreement, including due to failure to obtain approval of the shareholders of Andina or other conditions to closing in the Merger Agreement ; ( 4 ) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulator reviews required to complete the transactions contemplated by the Merger Agreement ; ( 5 ) the risk that the proposed transaction disrupts current plans and operations as a result of the announcement and consummation of the transaction described therein and herein ; ( 6 ) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with suppliers and obtain adequate supply of products and retain its key employees ; ( 7 ) costs related to the proposed business combination ; ( 8 ) changes in applicable laws or regulations ; ( 9 ) the possibility that the combined company may be adversely affected by other economic, business, and/or competitive factors ; and ( 10 ) other risks and uncertainties indicated from time to time in Andina’s filings with the SEC . Readers are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and Andina and Tecnoglass undertake no obligation to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise .

4 FINANCIAL PRESENTATION Certain of the financial information contained herein is unaudited and does not conform to SEC Regulation S - X . Furthermore, it includes EBITDA (earnings before interest, taxes depreciation and amortization) which is a non - GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933 , as amended . Accordingly, such information may be materially different when presented in Andina’s filings with the Securities and Exchange Commission . Andina and Tecnoglass believe that the presentation of this non - GAAP financial measure provides information that is useful to investors as it indicates more clearly the ability of Tecnoglass to meet capital expenditures and working capital requirements and otherwise meet its obligations as they become due . EBITDA was derived by taking earnings before interest, taxes, depreciation and amortization as adjusted for certain one - time non - recurring items and exclusions .

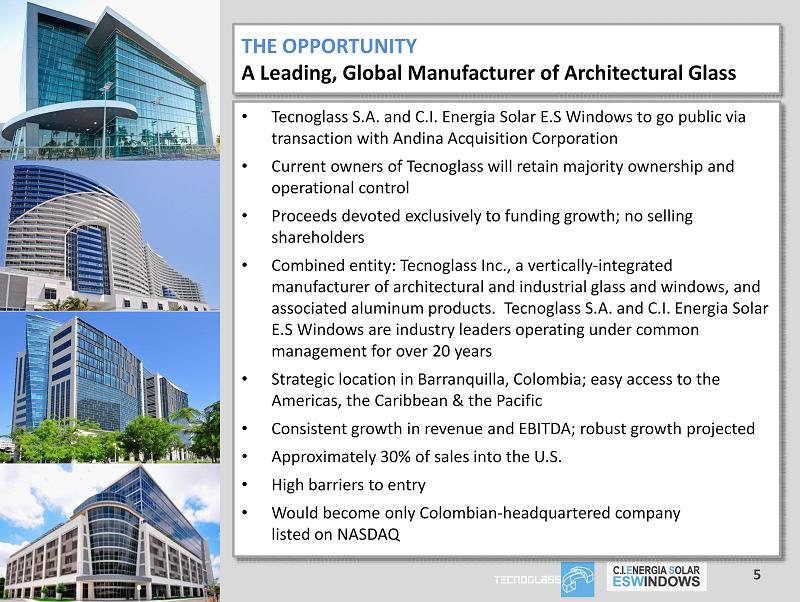

• Tecnoglass S.A. and C.I. Energia Solar E.S Windows to go public via transaction with Andina Acquisition Corporation • Current owners of Tecnoglass will retain majority ownership and operational control • Proceeds devoted exclusively to funding growth; no selling shareholders • Combined entity: Tecnoglass Inc., a vertically - integrated manufacturer of architectural and industrial glass and windows, and associated aluminum products. Tecnoglass S.A. and C.I. Energia Solar E.S Windows are industry leaders operating under common management for over 20 years • Strategic location in Barranquilla, Colombia; easy access to the Americas, the Caribbean & the Pacific • Consistent growth in revenue and EBITDA; robust growth projected • Approximately 30% of sales into the U.S. • High barriers to entry • Would become only Colombian - headquartered company listed on NASDAQ 5 THE OPPORTUNITY A Leading, Global Manufacturer of Architectural Glass

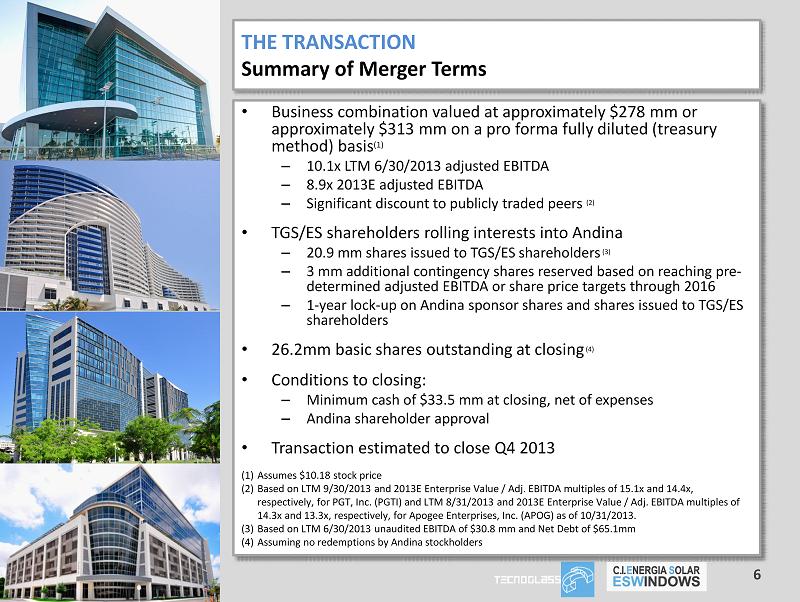

THE TRANSACTION Summary of Merger Terms • Business combination valued at approximately $278 mm or approximately $313 mm on a pro forma fully diluted (treasury method) basis (1 ) – 10.1x LTM 6/30/2013 adjusted EBITDA – 8.9x 2013E adjusted EBITDA – Significant discount to publicly traded peers (2) • TGS/ES shareholders rolling interests into Andina – 20.9 mm shares issued to TGS/ES shareholders ( 3 ) – 3 mm additional contingency shares reserved based on reaching pre - determined adjusted EBITDA or share price targets through 2016 – 1 - year lock - up on Andina sponsor shares and shares issued to TGS/ES shareholders • 26.2mm basic shares outstanding at closing ( 4 ) • Conditions to closing: – Minimum cash of $33.5 mm at closing, net of expenses – Andina shareholder approval • Transaction estimated to close Q4 2013 (1) Assumes $10.18 stock price (2) Based on LTM 9/30/2013 and 2013E Enterprise Value / Adj. EBITDA multiples of 15.1x and 14.4x , respectively, for PGT, Inc. (PGTI) and LTM 8/31/2013 and 2013E Enterprise Value / Adj. EBITDA multiples of 14.3x and 13.3x , respectively, for Apogee Enterprises, Inc. (APOG) as of 10/31/2013. (3) Based on LTM 6/30/2013 unaudited EBITDA of $30.8 mm and Net Debt of $65.1mm (4) Assuming no redemptions by Andina stockholders 6

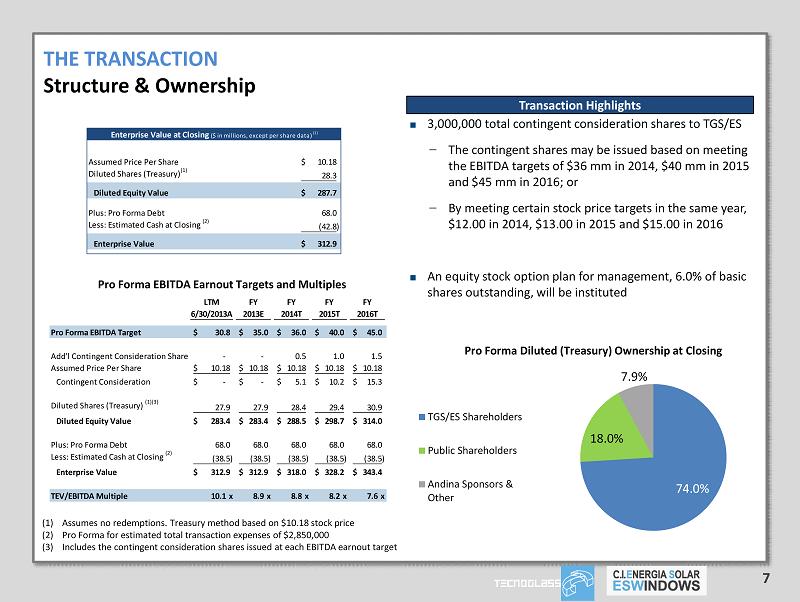

LTM FY FY FY FY 6/30/2013A 2013E 2014T 2015T 2016T Pro Forma EBITDA Target 30.8$ 35.0$ 36.0$ 40.0$ 45.0$ Add'l Contingent Consideration Shares - - 0.5 1.0 1.5 Assumed Price Per Share 10.18$ 10.18$ 10.18$ 10.18$ 10.18$ Contingent Consideration -$ -$ 5.1$ 10.2$ 15.3$ Diluted Shares (Treasury) (1)(3) 27.9 27.9 28.4 29.4 30.9 Diluted Equity Value 283.4$ 283.4$ 288.5$ 298.7$ 314.0$ Plus: Pro Forma Debt 68.0 68.0 68.0 68.0 68.0 Less: Estimated Cash at Closing (2) (38.5) (38.5) (38.5) (38.5) (38.5) Enterprise Value 312.9$ 312.9$ 318.0$ 328.2$ 343.4$ TEV/EBITDA Multiple 10.1x 8.9x 8.8x 8.2x 7.6x 3,000,000 total contingent consideration shares to TGS/ES − The contingent shares may be issued based on meeting the EBITDA targets of $36 mm in 2014, $40 mm in 2015 and $45 mm in 2016; or − By meeting certain stock price targets in the same year, $12.00 in 2014, $13.00 in 2015 and $15.00 in 2016 An equity stock option plan for management, 6.0% of basic shares outstanding, will be instituted Transaction Highlights THE TRANSACTION Structure & Ownership 7 (1) Assumes no redemptions. Treasury method based on $10.18 stock price (2) Pro Forma for estimated total transaction expenses of $2,850,000 (3) Includes the contingent consideration shares issued at each EBITDA earnout target 74.0% 18.0% 7.9% Pro Forma Diluted (Treasury) Ownership at Closing TGS/ES Shareholders Public Shareholders Andina Sponsors & Other Enterprise Value at Closing ($ in millions, except per share data) (1) Assumed Price Per Share 10.18$ Diluted Shares (Treasury) (1) 28.3 Diluted Equity Value 287.7$ Plus: Pro Forma Debt 68.0 Less: Estimated Cash at Closing (2) (42.8) Enterprise Value 312.9$ Pro Forma EBITDA Earnout Targets and Multiples

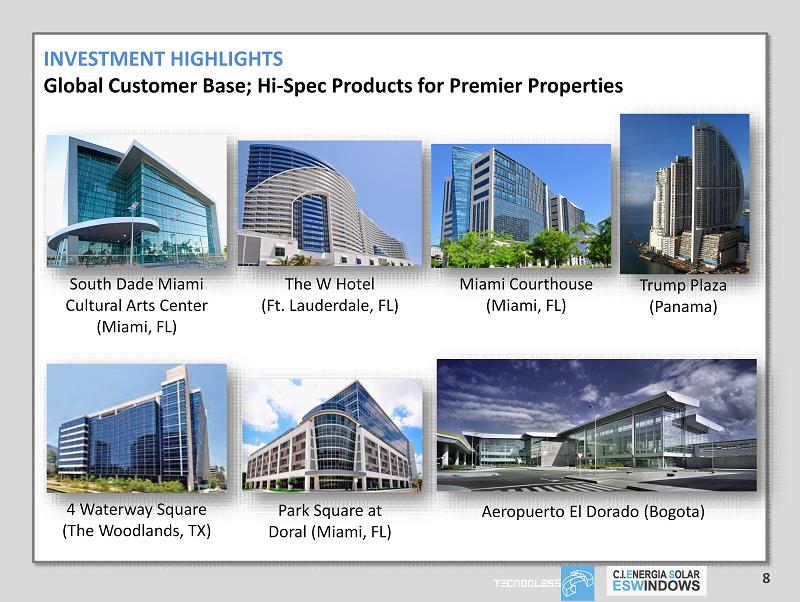

8 INVESTMENT HIGHLIGHTS Global Customer Base; Hi - Spec Products for Premier Properties Park Square at Doral (Miami, FL) Trump Plaza (Panama) South Dade Miami Cultural Arts Center (Miami, FL) The W Hotel (Ft. Lauderdale, FL) Miami Courthouse (Miami, FL) 4 Waterway Square (The Woodlands, TX) Aeropuerto El Dorado (Bogota)

INVESTMENT HIGHLIGHTS High Barriers to Entry: Vertically Integrated State - of - the - Art Manufacturing Facility 9 1.2 mm square foot, state - of - the - art manufacturing complex in Barranquilla, Colombia provides distinct and formidable competitive advantage Glass production; features include: – Four lamination machines; independent assembly rooms – Six specialized tempering furnaces and state - of - the - art glass molding furnaces – CNC - controlled profile bending machine; five silk - screening machines Aluminum plant – Capacity of 1,000 tons/month – Creates wide variety of shapes and forms for the door and window industries – Smelter furnace provides 90% of raw materials used in aluminum production Window and façade assembly plant Tecnoglass manufactures various glass + aluminum products C.E. Energia Solar produces customized finished products Tecnoglass purchases prime raw materials Quick, on - time delivery to global customers Vertical Integration : Price Competitiveness, Quality Control, Delivery Assurance

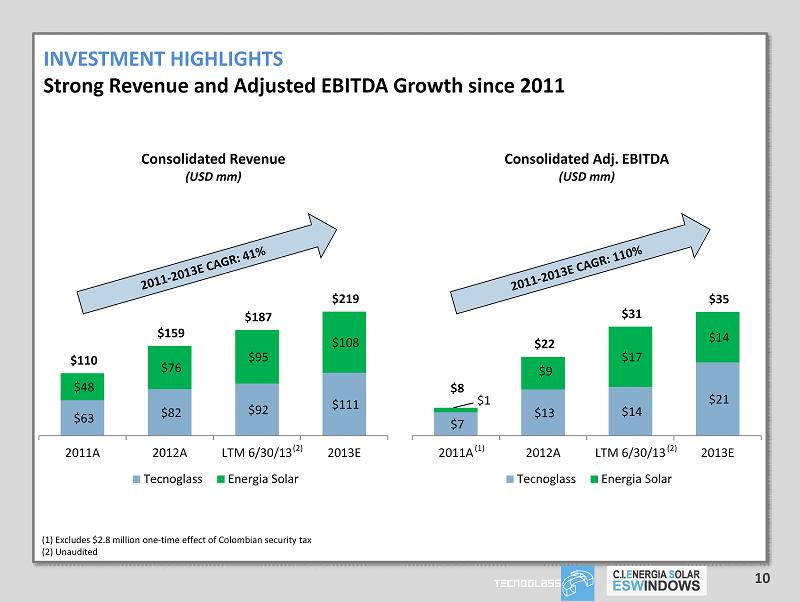

INVESTMENT HIGHLIGHTS Strong Revenue and Adjusted EBITDA Growth since 2011 10 $63 $82 $92 $111 $48 $76 $95 $108 $110 $159 $187 $219 2011A 2012A LTM 6/30/13 2013E Consolidated Revenue (USD mm) Tecnoglass Energia Solar $7 $13 $14 $21 $1 $9 $17 $14 $8 $22 $31 $35 2011A 2012A LTM 6/30/13 2013E Consolidated Adj. EBITDA (USD mm) Tecnoglass Energia Solar (2) (2) (1) (1) Excludes $2.8 million one - time effect of Colombian security tax (2) Unaudited

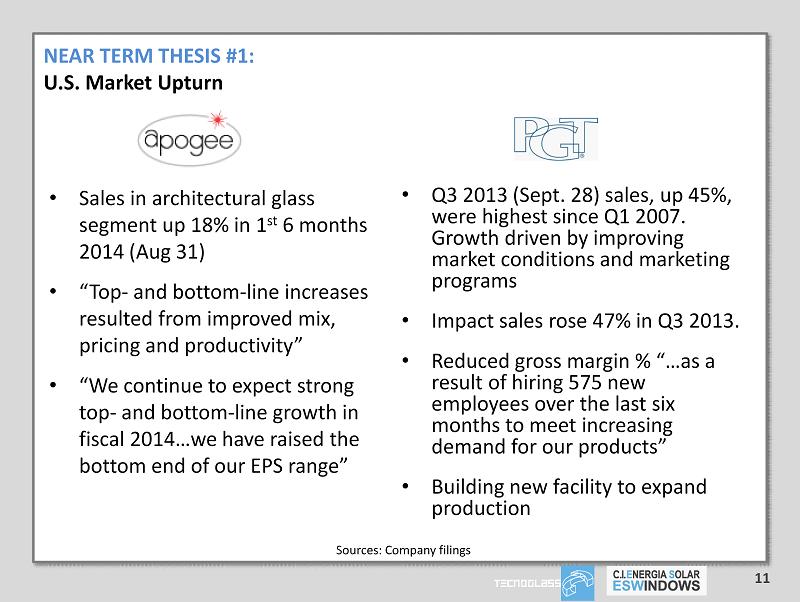

11 NEAR TERM THESIS #1: U.S. Market Upturn • Sales in architectural glass segment up 18% in 1 st 6 months 2014 (Aug 31) • “Top - and bottom - line increases resulted from improved mix, pricing and productivity” • “We continue to expect strong top - and bottom - line growth in fiscal 2014…we have raised the bottom end of our EPS range” • Q3 2013 (Sept. 28) sales, up 45%, were highest since Q1 2007. Growth driven by improving market conditions and marketing programs • Impact sales rose 47% in Q3 2013. • Reduced gross margin % “…as a result of hiring 575 new employees over the last six months to meet increasing demand for our products” • Building new facility to expand production Sources: Company filings

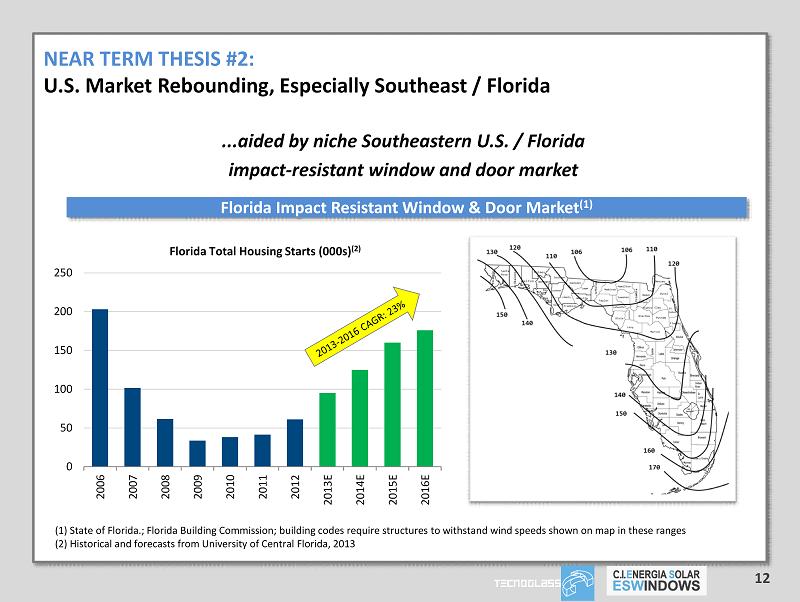

NEAR TERM THESIS #2: U.S. Market Rebounding, Especially Southeast / Florida ...aided by niche Southeastern U.S. / Florida impact - resistant window and door market 0 50 100 150 200 250 2006 2007 2008 2009 2010 2011 2012 2013E 2014E 2015E 2016E Florida Total Housing Starts (000s) (2) Florida Impact Resistant Window & Door Market (1) (1) State of Florida.; Florida Building Commission ; building codes require structures to withstand wind speeds shown on map in these ranges (2) Historical and forecasts from University of Central Florida, 2013 12

NEAR TERM THESIS #3: Deal Accelerates TGS’ Penetration of U.S. • Much of TGS’ U.S. business requires bonding • Currently constrained – approximately $60mm of bonding capacity • U.S. sales currently about 30% of total, i.e. approximately $54mm LTM • Equity plus U.S. listing could nearly triple TGS’ bonding capacity 13

NEAR TERM THESIS #4: TGS Has a Favorable Cost Structure • Barranquilla manufacturing highly advantaged – Captive aluminum extrusions production – high level of vertical integration including electricity generation – Colombian labor cost vs. U.S. – 4 - day transportation to Southeast U.S. markets Because of operating leverage, anticipate that sales growth beyond current $180mm level will drive strong incremental EBITDA 14

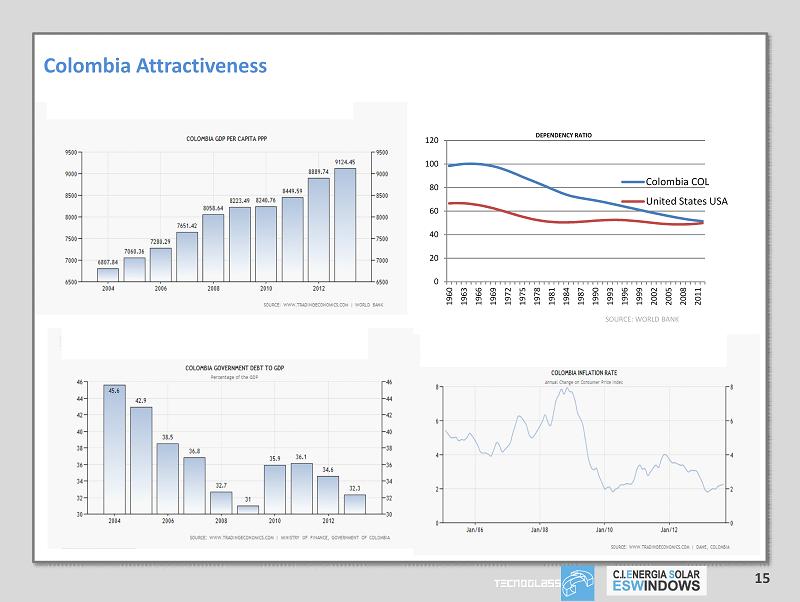

15 Colombia Attractiveness 0 20 40 60 80 100 120 1960 1963 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011 Colombia COL United States USA DEPENDENCY RATIO SOURCE: WORLD BANK

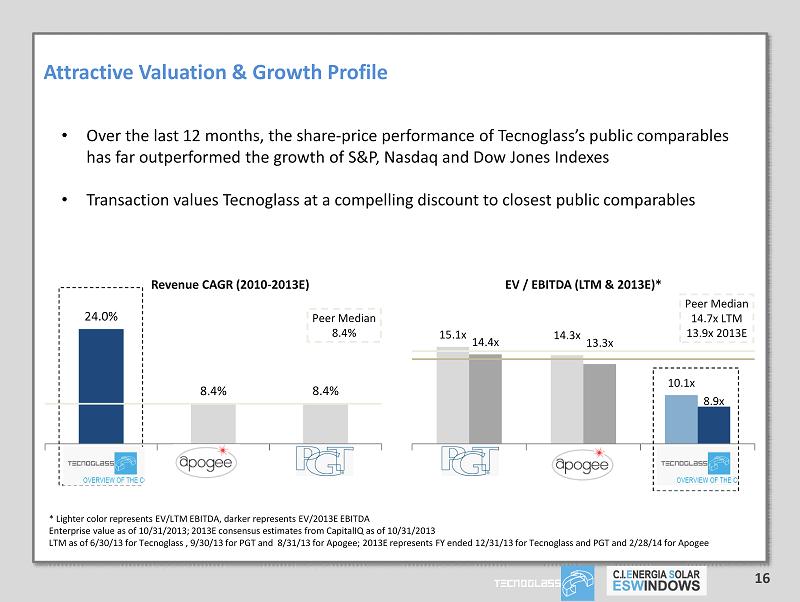

Attractive Valuation & Growth Profile 16 • Over the last 12 months, the share - price performance of Tecnoglass’s public comparables has far outperformed the growth of S&P, Nasdaq and Dow Jones Indexes • Transaction values Tecnoglass at a compelling discount to closest public comparables * Lighter color represents EV/LTM EBITDA, darker represents EV/2013E EBITDA Enterprise value as of 10/31/2013 ; 2013E consensus estimates from CapitalIQ as of 10/31/2013 LTM as of 6/30/13 for Tecnoglass , 9/30/13 for PGT and 8/31/13 for Apogee; 2013E represents FY ended 12/31/13 for Tecnoglass and PGT and 2/28/14 for Apogee 24.0% 8.4% 8.4% Revenue CAGR (2010 - 2013E) 15.1x 14.3x 10.1x 14.4x 13.3x 8.9x EV / EBITDA (LTM & 2013E)* Peer Median 8.4% Peer Median 14.7x LTM 13.9x 2013E

17 APPENDIX SLIDES

INVESTMENT HIGHLIGHTS Industry Leader High Quality, Innovative Products Global Customer Base; Hi - Spec Products for Premier Properties Record of Success; Robust Growth Projected High Barriers to Entry Attractive Market Dynamics Strong & Experienced Management Team Comparison to Public Comparables Prior SPAC Merger Success Stories

19 Industry Leader • Tecnoglass S.A. – founded 1994 – #1 glass transformation company in Colombia with 40% market share – Glass Magazine has ranked Tecnoglass as the second largest glass fabricator serving the U.S. market in 2012 (1) – Aluminum plant established 2007 ( Alutions by Tecnoglass ) • C.I. Energia Solar E.S Windows – founded 1984 – Designs, manufactures, markets, and installs architectural glass for commercial and large - scale residential construction – Utilizes glass and aluminum produced by Tecnoglass – Leading player in Colombia Target Markets Construction and remodeling of: • Hotels • Residential dwellings • Commercial & corporate centers • Office buildings • Educational facilities • Airports • Hospitals 2012 Revenue Tecnoglass S.A. 53% Energia Solar 47% http://www.glassmagazinedigital.com/publication/?i=145042&p=44&search_str=tecnoglass (1)

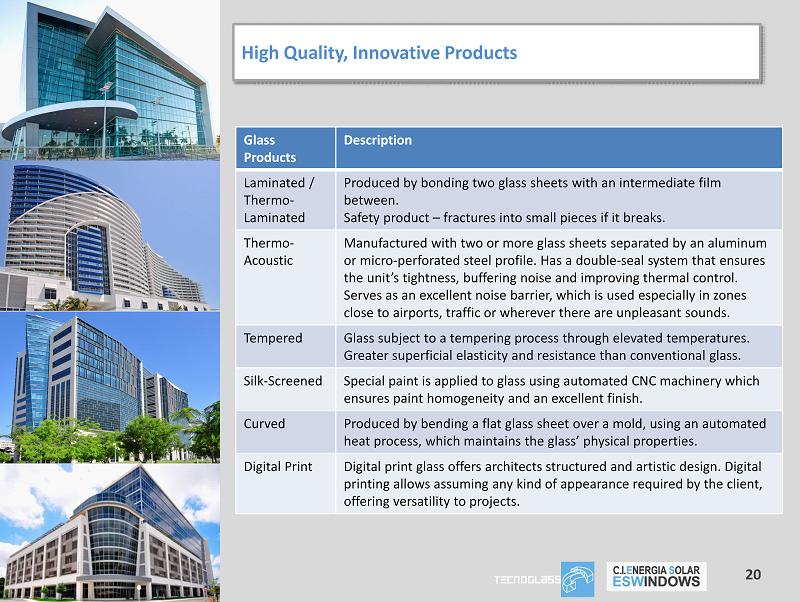

High Quality, Innovative Products 20 Glass Products Description Laminated / Thermo - Laminated Produced by bonding two glass sheets with an intermediate film between. Safety product – fractures into small pieces if it breaks. Thermo - Acoustic Manufactured with two or more glass sheets separated by an aluminum or micro - perforated steel profile. Has a double - seal system that ensures the unit’s tightness, buffering noise and improving thermal control. Serves as an excellent noise barrier, which is used especially in zones close to airports, traffic or wherever there are unpleasant sounds. Tempered Glass subject to a tempering process through elevated temperatures. Greater superficial elasticity and resistance than conventional glass. Silk - Screened Special paint is applied to glass using automated CNC machinery which ensures paint homogeneity and an excellent finish. Curved Produced by bending a flat glass sheet over a mold, using an automated heat process, which maintains the glass’ physical properties. Digital Print Digital print glass offers architects structured and artistic design. Digital printing allows assuming any kind of appearance required by the client, offering versatility to projects.

High Quality, Innovative Products 21 Finished Products Windows Floating facades Commercial display windows Hurricane - proof windows Automatic doors Commercial display windows Bathroom dividers Aluminum Products Bars Plates Profiles Rods Tubes

Global Customer Base; Hi - Spec Products for Premier Properties • 300+ customers in North, Central and South America • No customer accounts for greater than 10% of revenues • 80 - 85% of glass and aluminum sales to architectural market; 15 - 20% to industrial • Sell architectural products primarily through window contractors • Products used in premier projects across the Americas, particularly the U.S. and Colombia 22

Record of Success; Robust Growth Projected Strategy for Continued Growth • Post - transaction balance sheet significantly expands bonding capacity by at least $100mm in the US ( currently $60 mm), allowing participation in larger projects • Increase market share in U.S. and South America • Penetrate European and Asian markets, leveraging labor and transportation advantages • Establish and maintain alliances • Continued investments in product innovation and state - of - the - art manufacturing technology – “Thermal Break” system – ES powdered paint line 23

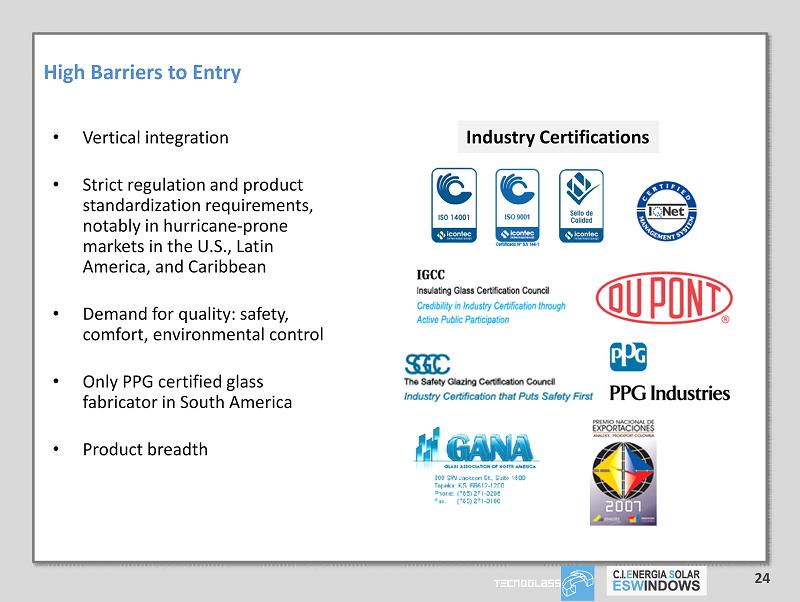

24 High Barriers to Entry • Vertical integration • Strict regulation and product standardization requirements, notably in hurricane - prone markets in the U.S., Latin America, and Caribbean • Demand for quality: safety, comfort, environmental control • Only PPG certified glass fabricator in South America • Product breadth Industry Certifications

• $29 mm in capital investments (2012) • Best practices in sustainability and environmental responsibility – Recycle ~ 30% of manufacturing - related residues – Self - supplied power generation • Location favors: – Exports to the Americas, the Caribbean, and the Pacific – Imports of raw materials BERLIN - GERMANY 25 High Barriers to Entry: Strategic Location

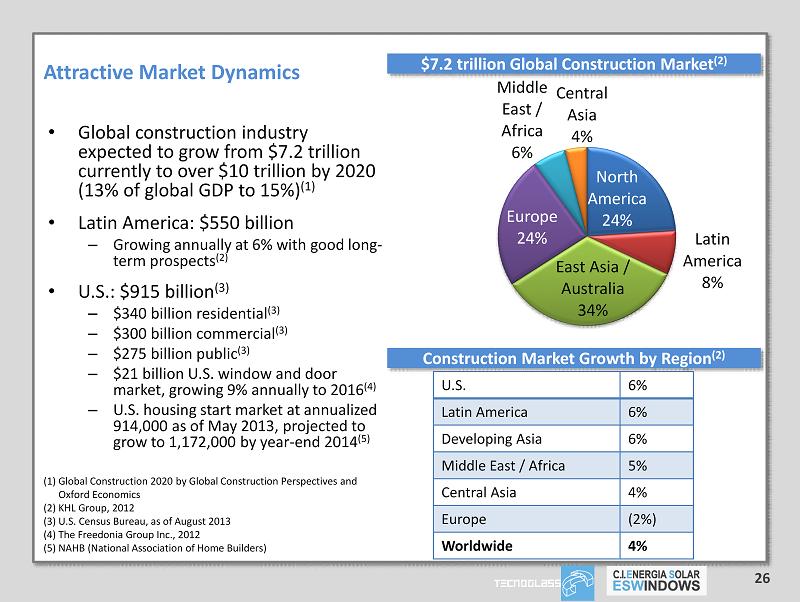

Attractive Market Dynamics • Global construction industry expected to grow from $7.2 trillion currently to over $10 trillion by 2020 (13% of global GDP to 15%) (1) • Latin America: $550 billion – Growing annually at 6% with good long - term prospects (2) • U.S.: $915 billion (3) – $340 billion residential (3) – $300 billion commercial (3 ) – $275 billion public (3) – $21 billion U.S. window and door market, growing 9% annually to 2016 (4) – U.S. housing start market at annualized 914,000 as of May 2013, projected to grow to 1,172,000 by year - end 2014 (5) North America 24% Latin America 8% East Asia / Australia 34% Europe 24% Middle East / Africa 6% Central Asia 4% $ 7.2 trillion Global Construction Market (2 ) Construction Market Growth by Region (2) U.S. 6% Latin America 6% Developing Asia 6% Middle East / Africa 5% Central Asia 4% Europe (2%) Worldwide 4% (1) Global Construction 2020 by Global Construction Perspectives and Oxford Economics (2) KHL Group, 2012 (3) U.S. Census Bureau, as of August 2013 (4 ) The Freedonia Group Inc ., 2012 (5) NAHB (National Association of Home Builders) 26

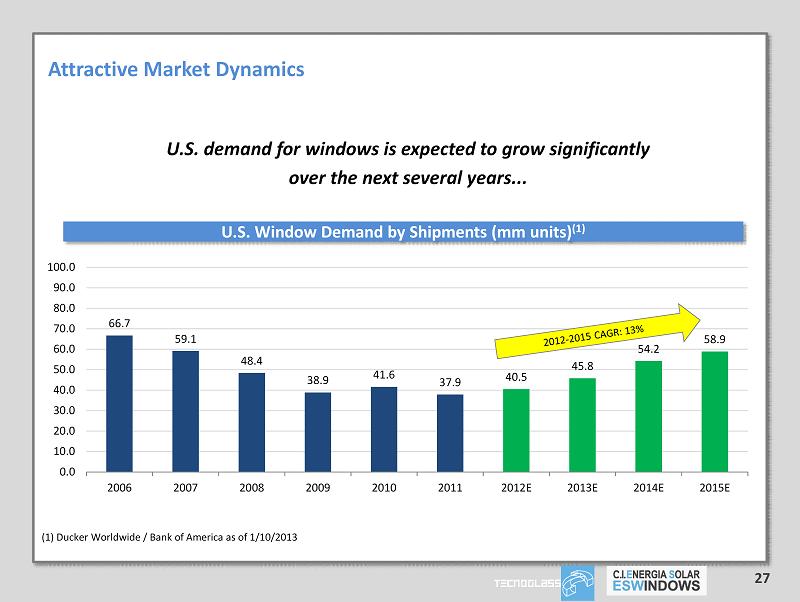

Attractive Market Dynamics U.S. demand for windows is expected to grow significantly over the next several years... 66.7 59.1 48.4 38.9 41.6 37.9 40.5 45.8 54.2 58.9 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0 2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E U.S. Window Demand by Shipments (mm units) (1) (1) Ducker Worldwide / Bank of America as of 1/10/2013 27

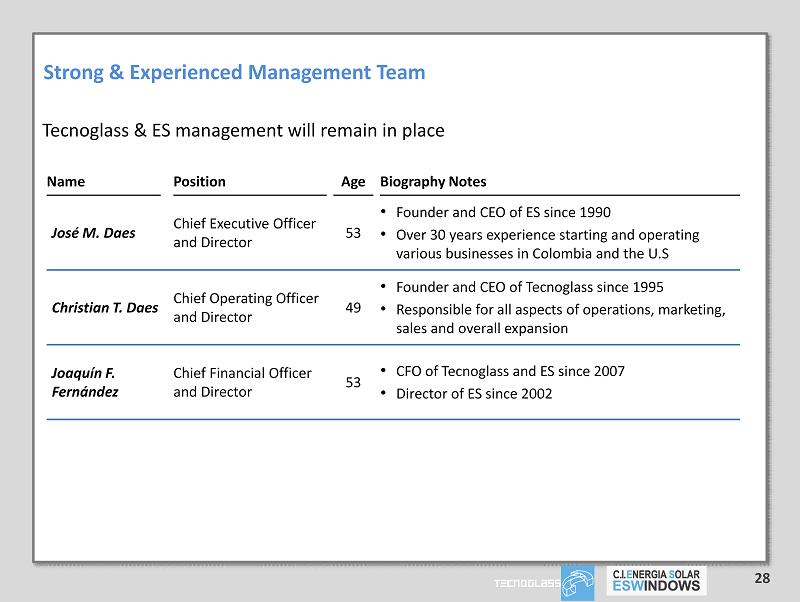

28 Strong & Experienced Management Team Name Position Age Biography Notes José M. Daes Chief Executive Officer and Director 53 • Founder and CEO of ES since 1990 • Over 30 years experience starting and operating various businesses in Colombia and the U.S Christian T. Daes Chief Operating Officer and Director 49 • Founder and CEO of Tecnoglass since 1995 • Responsible for all aspects of operations, marketing, sales and overall expansion Joaquín F. Fernández Chief Financial Officer and Director 53 • CFO of Tecnoglass and ES since 2007 • Director of ES since 2002 Tecnoglass & ES management will remain in place

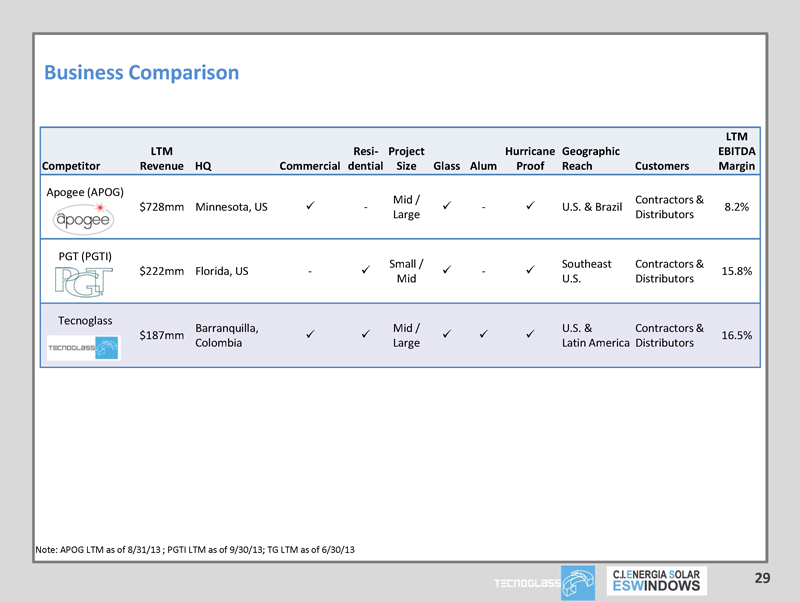

Business Comparison Competitor LTM Revenue HQ Commercial Resi - dential Project Size Glass Alum Hurricane Proof Geographic Reach Customers LTM EBITDA Margin Apogee (APOG) $728mm Minnesota, US x - Mid / Large x - x U.S. & Brazil Contractors & Distributors 8.2% PGT (PGTI) $222mm Florida, US - x Small / Mid x - x Southeast U.S. Contractors & Distributors 15.8% Tecnoglass $187mm Barranquilla, Colombia x x Mid / Large x x x U.S. & Latin America Contractors & Distributors 16.5% 29 Note: APOG LTM as of 8/31/13 ; PGTI LTM as of 9/30/13; TG LTM as of 6/30/13

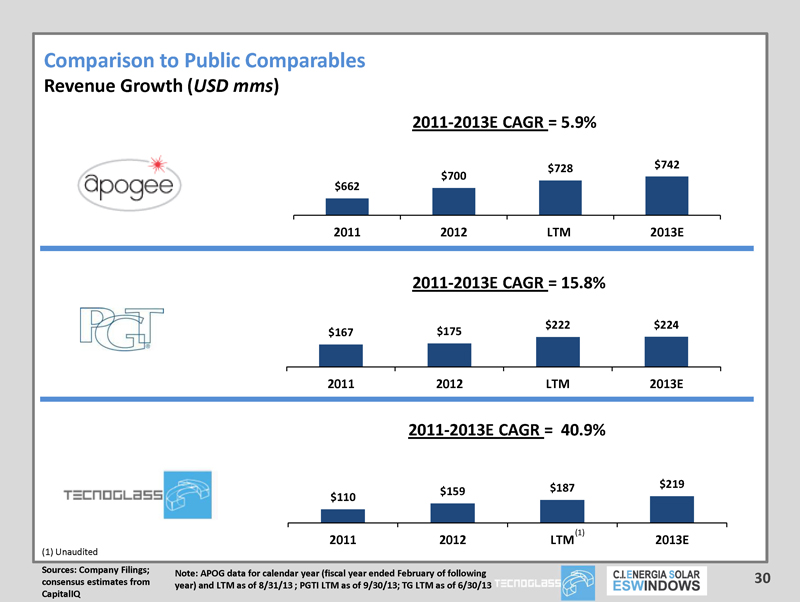

Comparison to Public Comparables Revenue Growth ( USD mms ) 30 Sources: Company Filings; consensus estimates from CapitalIQ Note: APOG data for calendar year (fiscal year ended February of following year) and LTM as of 8/31/13 ; PGTI LTM as of 9/30/13; TG LTM as of 6/30/13 2011 - 2013E CAGR = 5.9% 2011 - 2013E CAGR = 15.8% 2011 - 2013E CAGR = 40.9% $110 $159 $187 $219 2011 2012 LTM 2013E $167 $175 $222 $224 2011 2012 LTM 2013E $662 $700 $728 $742 2011 2012 LTM 2013E (1) Unaudited (1)

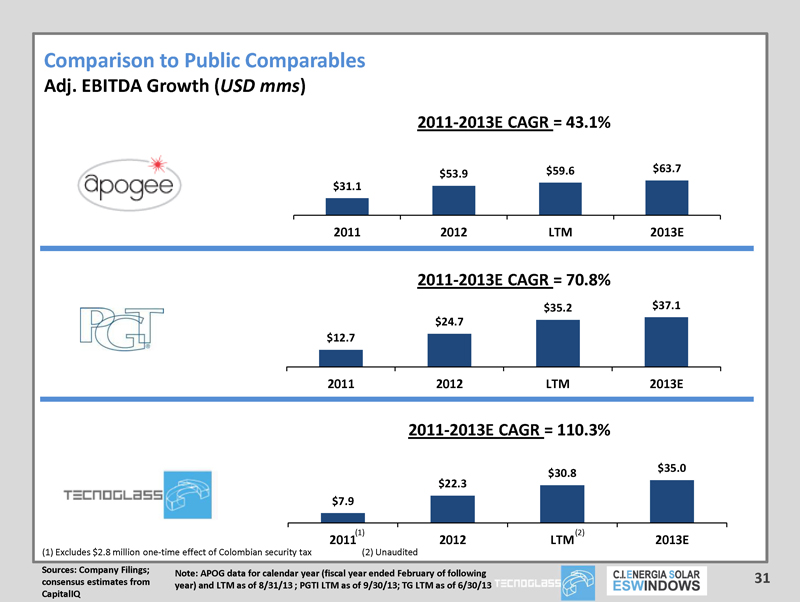

Comparison to Public Comparables Adj. EBITDA Growth ( USD mms ) 31 $31.1 $53.9 $59.6 $63.7 2011 2012 LTM 2013E $12.7 $24.7 $35.2 $37.1 2011 2012 LTM 2013E $7.9 $22.3 $30.8 $35.0 2011 2012 LTM 2013E 2011 - 2013E CAGR = 43.1% 2011 - 2013E CAGR = 70.8% 2011 - 2013E CAGR = 110.3% Note: APOG data for calendar year (fiscal year ended February of following year) and LTM as of 8/31/13 ; PGTI LTM as of 9/30/13; TG LTM as of 6/30/13 (2) (1) (1) Excludes $2.8 million one - time effect of Colombian security tax (2) Unaudited Sources: Company Filings; consensus estimates from CapitalIQ

32 Prior SPAC Merger Success Stories Spotlight on two notable recent transactions: Tile Shop Holdings / JWC Acquisition Corp. – Specialty retailer of tiles and related products – Strong historical and projected growth – Vertically integrated supply chain – $456 million enterprise value; transaction closed in August 2012 – Follow - on offering completed in December 2012 EveryWare Global / ROI Acquisition Corp. – Leading global wholesaler of tabletop and food preparation products – #1 or #2 share in key categories in consumer and foodservice markets – Highly diversified customer base – $420 million enterprise value; transaction closed in May 2013 – Follow - on offering completed in September 2013 - 1,000 2,000 3,000 4,000 $8.00 $14.00 $20.00 $26.00 $32.00 Jun-12 Aug-12 Nov-12 Feb-13 Apr-13 Jul-13 Oct-13 June 2012 Announcement of Definitive Agreement August 2012 Completion of Business Combination December 2012 Follow - On Equity Offering March 2013 End of Lock - up Period (Volume in thousands) - 500 1,000 1,500 $8.00 $10.00 $12.00 $14.00 Jan-13 Feb-13 Mar-13 May-13 Jun-13 Jul-13 Sep-13 Oct-13 January 2013 Announcement of Definitive Agreement May 2013 Completion of Business Combination September 2013 Follow - On Equity Offering ( Volume in thousands) (Share Price) (Share Price)