Attached files

| file | filename |

|---|---|

| 8-K - 8-K - General Motors Co | form8-kearningsreleaseq320.htm |

| EX-99.1 - EXHIBIT PRESS RELEASE AND FINANCIAL HIGHLIGHTS - General Motors Co | gm2013q3earningspressrelea.htm |

General Motors Company Q3 2013 Results October 30, 2013 Exhibit 99.2

Forward Looking Statements In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned,” “outlook” or similar expressions is intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors may include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate financing sources, including as required to fund our planned significant investment in new technology; our ability to successfully integrate Ally Financial’s International Operations; the ability of our suppliers to timely deliver parts, components and systems; our ability to realize successful vehicle applications of new technology; overall strength and stability of our markets, particularly Europe; and our ability to continue to attract new customers, particularly for our new products. GM's most recent annual report on Form 10-K and quarterly reports on Form 10-Q provide information about these and other factors, which we may revise or supplement in future reports to the SEC. 1

Third Quarter 2013 Performance 2Note: EBIT- Adjusted includes GM Financial on an Earnings Before Tax (EBT) basis * See Adjusted Automotive Free Cash Flow reconciliation on slide 18 Q3 2012 Q3 2013 vs. Q3 2012 Global Deliveries 2.3M 2.4M Global Market Share 11.6% 11.7% Net Revenue $37.6B $39.0B Net Income to Common Stockholders $1.5B $0.7B Net Cash from Operating Activities - Automotive $3.1B $3.3B EBIT- Adjusted $2.3B $2.6B - GMNA $1.7B $2.2B - GME $(0.5)B $(0.2)B - GMIO $0.8B $0.3B - GMSA $0.2B $0.3B - GM Financial $0.2B $0.2B - Adjusted Automotive Free Cash Flow * $1.2B $1.3B Favorable Unfavorable

Third Quarter 2013 Highlights 3 • Chevrolet Impala becomes the highest-scoring sedan in Consumer Reports’ ratings • Chevrolet Silverado named “Best Truck” by Consumer Reports • GM North America margins above 9% • 12 consecutive quarters of global Chevrolet sales growth • $4.5B refinancing to strengthen Fortress Balance Sheet • Investment grade rating at Moody’s

Summary of Q3 2013 Results 4Note: EBIT- Adjusted includes GM Financial on an Earnings Before Tax (EBT) basis Q3 Q3 2012 2013 Net Revenue ($B) 37.6 39.0 Operating Income ($B) 1.6 2.3 Net Income to Common Stockholders ($B) 1.5 0.7 EPS – Diluted ($/Share) 0.89 0.45 Net Cash from Operating Activities – Automotive ($B) 3.1 3.3 EBIT- Adjusted ($B) 2.3 2.6 EBIT- Adjusted % Revenue 6.1% 6.8% Adjusted Automotive Free Cash Flow ($B) 1.2 1.3 GAAP Non- GAAP

5 Impact of Special Items Q3 Q3 2012 2013 Net Income to Common Stockholders ($B) 1.5 0.7 EPS – Diluted ($/Share) 0.89 0.45 Included in Above ($B): GM Korea Goodwill Impairment (0.1) (0.0) Loss on Purchase of Series A Preferred - (0.8) Total Impact Net Income to Common Stockholders ($B) (0.1) (0.9) Total Impact EPS – Diluted ($/Share) (0.04) (0.51) Note: Results may not foot due to rounding

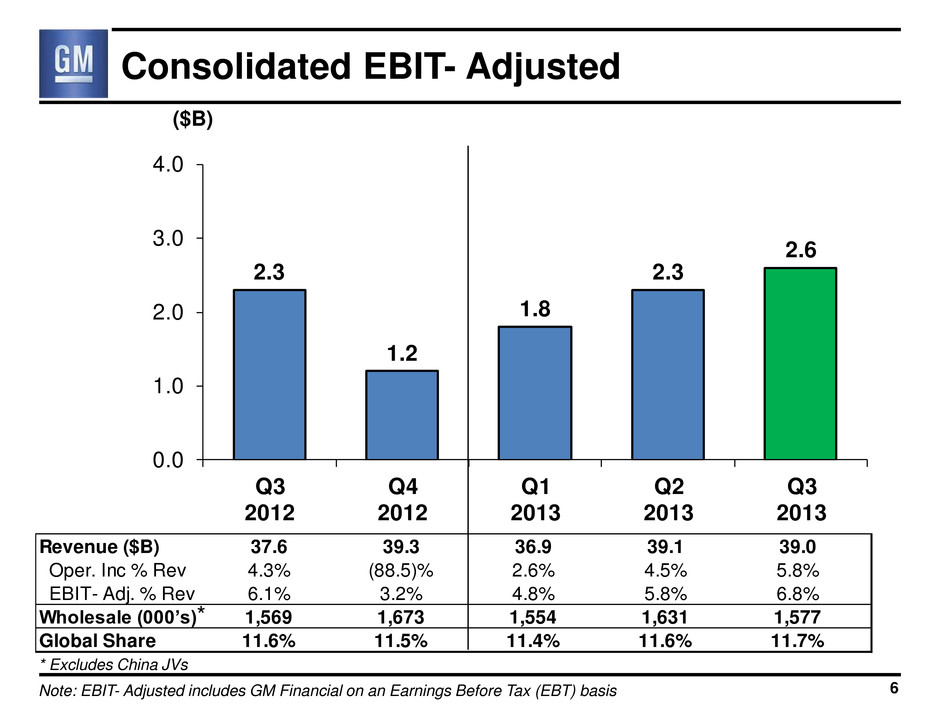

Revenue ($B) 37.6 39.3 36.9 39.1 39.0 Op r. Inc % Rev 4.3% (88.5)% 2. % 4.5% 5.8% EBIT- Adj. % Rev 6.1 3.2% 4.8 5.8 6. Wholesale (000’s) 1,569 1,673 1,554 1,631 1,577 Global Share 1. % 1.5% 1.4% 1.6% 1. % 2.3 1.2 1.8 2.3 2.6 0.0 1.0 2.0 3.0 4.0 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Consolidated EBIT- Adjusted ($B) Note: EBIT- Adjusted includes GM Financial on an Earnings Before Tax (EBT) basis 6 * Excludes China JVs *

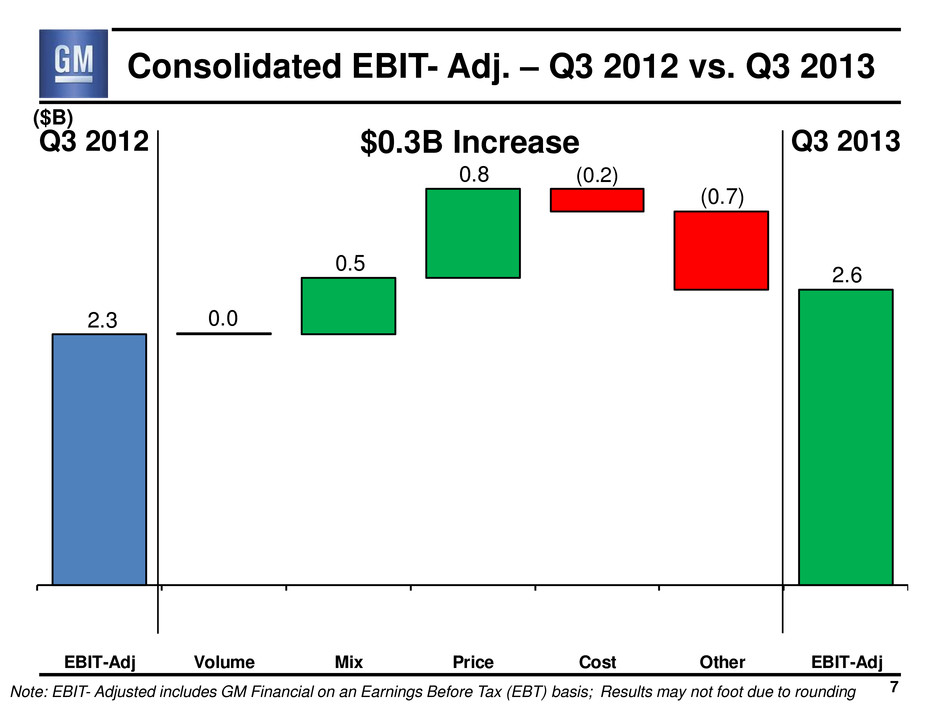

2.3 2.6 (0.2) (0.7) 0.0 0.5 0.8 EBIT-Adj Volume Mix Price Cost Other EBIT-Adj 7 $0.3B IncreaseQ3 2012 Q3 2013 ($B) Consolidated EBIT- Adj. – Q3 2012 vs. Q3 2013 Note: EBIT- Adjusted includes GM Financial on an Earnings Before Tax (EBT) basis; Results may not foot due to rounding

1.7 (0.5) 0.8 0.2 0.2 (0.1) 2.3 2.2 (0.2) 0.3 0.3 0.2 (0.2) 2.6 GMNA GME GMIO GMSA GM Financial* Corp. / Elims Total GM Q3 2012 Q3 2013 EBIT- Adjusted ($B) 8 Q3 2013 EBIT- Adjusted * GM Financial at an Earnings Before Tax basis (EBT)

Key GMNA Performance Indicators $/Unit Note: Incentive & ATP Information Based on J.D. Power and Associates Power Information Network data 9

1.7 1.1 1.4 2.0 2.2 -1.0 0.0 1.0 2.0 3.0 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 GMNA EBIT- Adjusted ($B) 10* 2012 Q4 estimated; all periods unaudited * * Revenue ($B) 22.3 22.8 23.0 23.5 23.5 EBIT- Adj. % Rev 7.7% 5.0% 6.2% 8.4% 9.3% U.S. Dealer Inv (000’s) 689 717 744 708 670 Wholesale (000’s) 773 826 829 809 775 North America Share 16.9% 16.6% 17.1% 17.3% 16.7%

1.7 2.2 (0.4) (0.2) 0.0 0.4 0.6 EBIT-Adj Volume Mix Price Cost Other EBIT-Adj GMNA EBIT- Adj. – Q3 2012 vs. Q3 2013 11 ($B) Q3 2012 Q3 2013 $0.5B Increase Note: Results may not foot due to rounding

(0.5) (0.8) (0.2) (0.1) (0.2) -1.0 0.0 1.0 2.0 3.0 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 GME EBIT- Adjusted ($B) 12 (1) (1) (1) 2012 Q4 estimated; all periods unaudited (2) Includes Chevrolet Europe (2) Revenue ($B) 4.7 5.2 4.8 5.2 4.9 EBIT- Adj. % Rev (10.4)% (14.6)% (3.6)% (2.1)% (4.4)% Wholesale (000’s) 254 269 249 276 253 E rope Share 8.4% 8.0% 8.2% 8.5% 8.6%

GME EBIT- Adj. – Q3 2012 vs. Q3 2013 ($B)

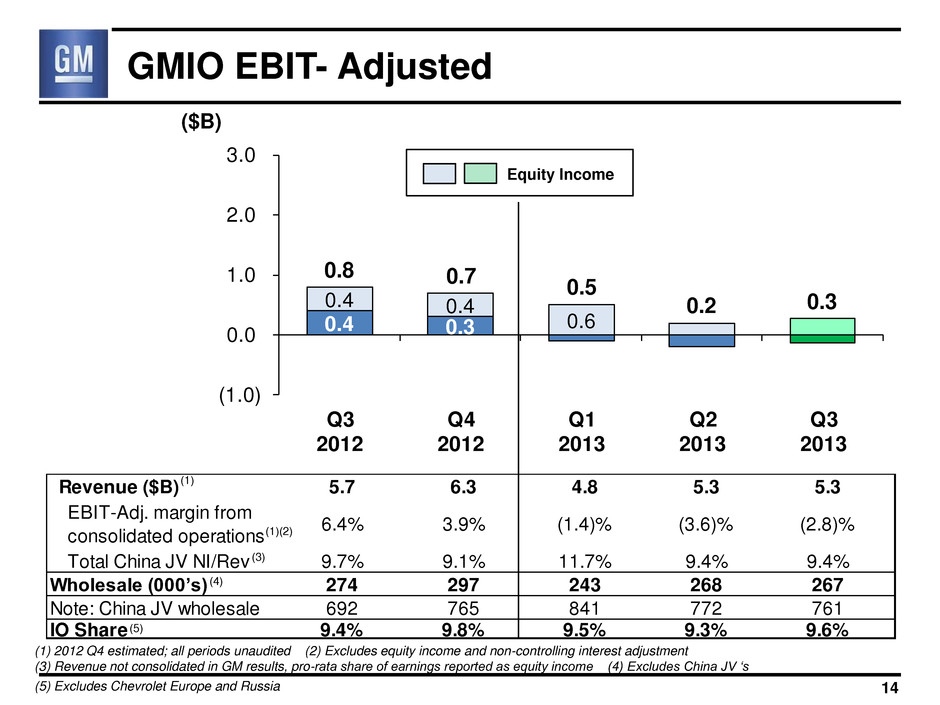

Revenue ($B) 5.7 6.3 4.8 5.3 5.3 EBIT-Adj. margin from consolidated operations 6.4% 3.9% (1.4)% (3.6)% (2.8)% Total China JV NI/Rev 9.7% 9.1% 11.7% 9.4% 9.4% Wholesale (000’s) 274 297 243 268 267 Note: China JV wholesale 692 765 841 772 761 IO Share 9.4% 9.8% 9.5% 9.3% 9.6% 0.4 0.3 0.4 0.4 0.6 (1.0) 0.0 1.0 2.0 3.0 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 GMIO EBIT- Adjusted ($B) 14 0.8 (1) 2012 Q4 estimated; all periods unaudited (2) Excludes equity income and non-controlling interest adjustment (3) Revenue not consolidated in GM results, pro-rata share of earnings reported as equity income (4) Excludes China JV ‘s (5) Excludes Chevrolet Europe and Russia 0.7 Equity Income 0.5 0.2 0.3 (4) (1)(2) (1) (3) (5)

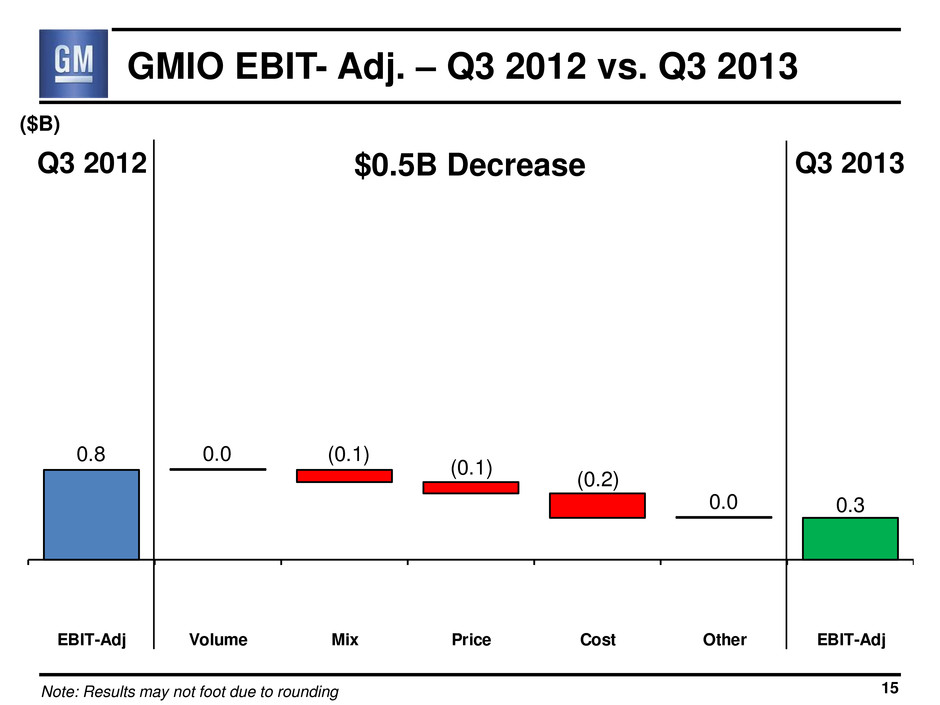

0.8 0.3 (0.1) (0.1) (0.2) 0.0 0.0 EBIT-Adj Volume Mix Price Cost Other EBIT-Adj GMIO EBIT- Adj. – Q3 2012 vs. Q3 2013 Q3 2012 Q3 2013 15 ($B) $0.5B Decrease Note: Results may not foot due to rounding

Revenue ($B) 4.3 4.4 3.7 4.3 4.4 EBIT- Adj. % Rev 3.7% 3.0% (1.0)% 1.3% 6.5% Wholesale (000’s) 268 282 233 278 282 South America Share 17.9% 17.7% 17.2% 17.2% 17. % 0.2 0.1 0.0 0.1 0.3 0.0 1.0 2.0 3.0 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 GMSA EBIT- Adjusted ($B) 16 * * * 2012 Q4 estimated; all periods unaudited

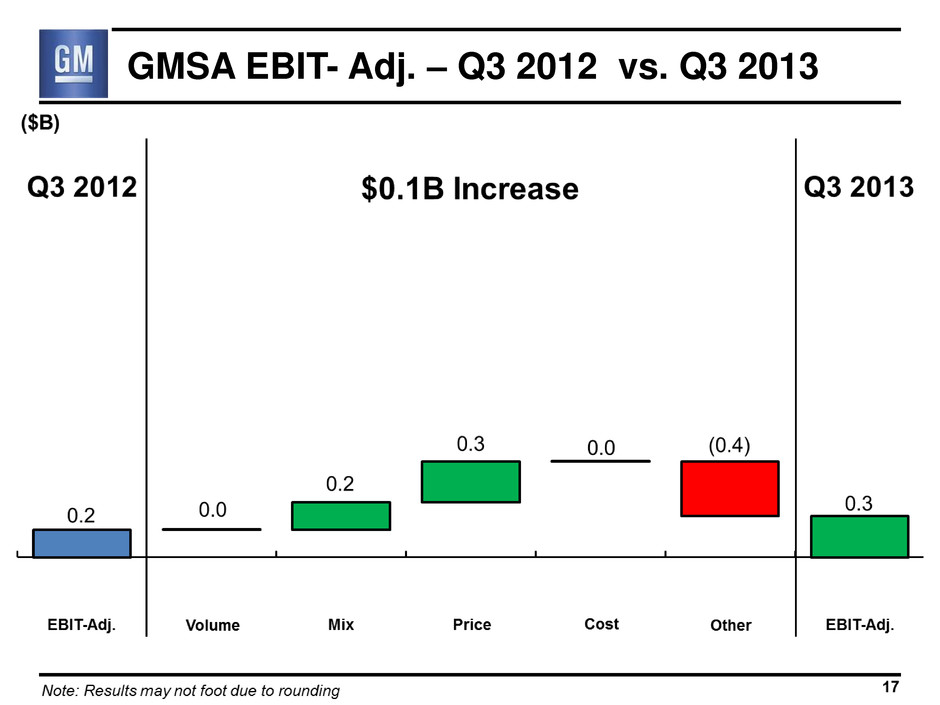

GMSA EBIT- Adj. – Q3 2012 vs. Q3 2013

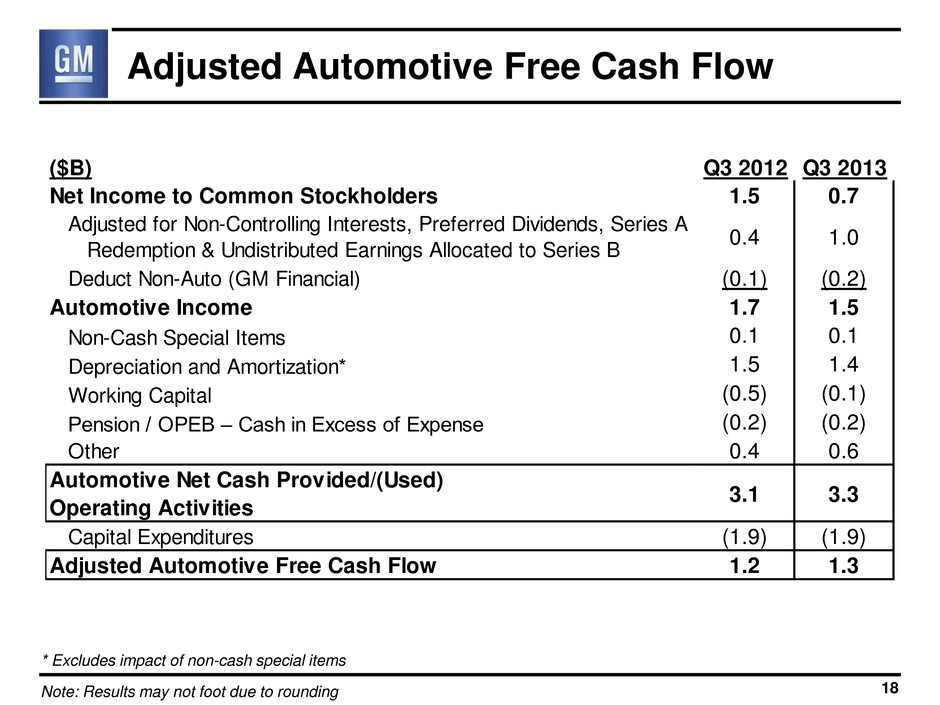

($B) Q3 2012 Q3 2013 Net Income to Common Stockholders 1.5 0.7 Adjusted for Non-Controlling Interests, Preferred Dividends, Series A Redemption & Undistributed Earnings Allocated to Series B 0.4 1.0 Deduct Non-Auto (GM Financial) (0.1) (0.2) Automotive Income 1.7 1.5 Non-Cash Special Items 0.1 0.1 Depreciation and Amortization* 1.5 1.4 Working Capital (0.5) (0.1) Pension / OPEB – Cash in Excess of Expense (0.2) (0.2) Other 0.4 0.6 Automotive Net Cash Provided/(Used) Operating Activities 3.1 3.3 Capital Expenditures (1.9) (1.9) Adjusted Automotive Free Cash Flow 1.2 1.3 Adjusted Automotive Free Cash Flow 18 * Excludes impact of non-cash special items Note: Results may not foot due to rounding

Key Automotive Balance Sheet Items 19 Sep. 30 Jun. 30 Sep. 30 ($B) 2012 2013 2013 Cash & Current Marketable Securities 31.6 24.2 26.8 Available Credit Facilities(1) 5.9 10.6 10.5 Available Liquidity 37.5 34.8 37.3 Key Obligations: Debt 5.6 4.0 8.4 Series A Preferred Stock 5.5 5.5 3.1 U.S. Pension Underfunded Status(2) (3) 13.4 12.9 12.8 Non-U.S. Pension Underfunded Status(3) 11.4 13.1 13.6 Unfunded OPEB(3) 7.2 7.6 7.3 (1) Excludes uncommitted facilities (2) Excludes U.S. non-qualified plan PBO of ~$0.8 billion (3) Balances are rolled forward and do not reflect remeasurement, except for the remeasurement of certain U.S., Canada and GME plans in March, June and September 2012 and September 2013

GM Financial 20Note: GM Sales Penetrations based on JD Power PIN Q3 Q3 Q3 Q3 GM Sales Penetrations 2012 2013 2012 2013 U.S. Subprime APR (<=620) 8.1% 7.8% 5.7% 6.1% U.S. Lease 16.2% 21.3% 21.1% 24.1% Canada Lease 6.6% 8.1% 17.4% 19.1% GM / GM Financial Linkage GM as % of GM Financial Loan and Lease Originations* (GM New / GMF Loan & Lease) GMF as % of GM U.S. Subprime & Lease 19% 20% GM Financial Performance* GM Financial Credit Losses (annualized net credit losses as % avg. consumer finance receivables) EBT ($M) 200 239 2.5% 1.9% Industry Avg. (Excl. GM) 44% 67% * Includes international Operations purchased in Q3 2013; Q3 2012 reflects North American operations only * Includes International Operations purchased in Q2 2013; Q3 2012 reflects North American operations only

Summary 21 • Solid third quarter with year-over-year increases in revenue, market share, EBIT-adjusted, margins, cash flow • Continue to strengthen fortress balance sheet • Focus remains on delivering to our customers – Winning vehicles – Compelling value – Great quality • Q3 results further validation of consistently delivering on our plan

General Motors Company Select Supplemental Financial Information

Q3 Q4 Q1 Q2 Q3 (000’s) 2012 2012 2013 2013 2013 North America 759 735 761 880 808 Europe 372 357 373 426 388 Chevrolet in Europe 127 120 112 140 138 International Operations 857 968 992 925 930 China 665 754 816 751 745 South America 285 265 235 262 273 Brazil 183 169 141 164 171 Global Deliveries 2,273 2,325 2,361 2,493 2,398 Global Deliveries Note: GM deliveries include vehicles sold around the world under GM and JV brands, and through GM-branded distribution network. S1 * * International Operations deliveries excludes Chevrolet Europe and Russia; Note: Results may not foot due to rounding

Q3 Q4 Q1 Q2 Q3 2012 2012 2013 2013 2013 North America 16.9% 16.6% 17.1% 17.3% 16.7% U.S. 17.6% 17.1% 17.7% 17.9% 17.3% Europe 8.4% 8.0% 8.2% 8.5% 8.6% Germany 7.4% 6.8% 7.4% 7.7% 7.7% U.K. 11.6% 12.3% 11.7% 11.7% 10.8% Russia 10.1% 9.4% 9.0% 8.7% 9.4% International Operations 9.4% 9.8% 9.5% 9.3% 9.6% China 14.9% 14.5% 15.1% 13.9% 14.6% South America 17.9% 17.7% 17.2% 17.2% 17.8% Brazil 17.1% 16.7% 17.0% 17.0% 17.4% Global Market Share 11.6% 11.5% 11.4% 11.6% 11.7% Global Market Share Note: GM market share includes vehicles sold around the world under GM and JV brands, and through GM-branded distribution network. Market share data excludes the markets of Iran, North Korea, Sudan and Syria. S2 (1) Europe share includes Chevrolet Europe (2) International Operations share excludes Chevrolet Europe and Russia (1) (2)

Operating Income Walk to EBIT- Adjusted S3 Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis Q3 Q3 2012 2013 Operating Income 1.6 2.3 Equity Income 0.4 0.4 Non-Controlling Interests 0.0 0.0 Non-Operating Income 0.2 (0.1) Special Items 0.1 0.0 EBIT- Adjusted 2.3 2.6 ($B)

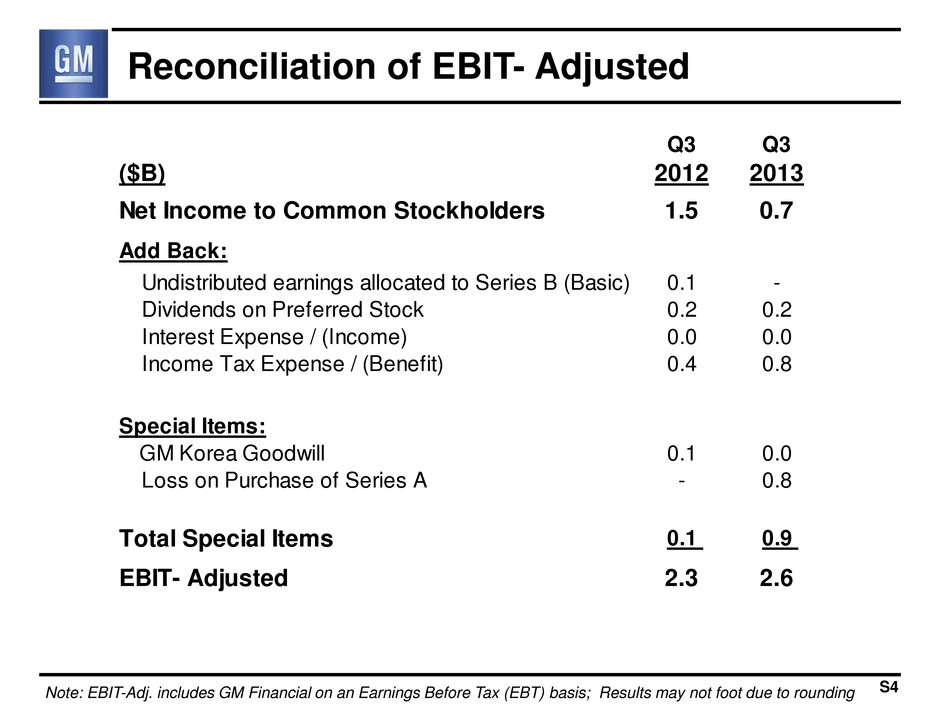

Reconciliation of EBIT- Adjusted S4Note: EBIT-Adj. includes GM Financial on an Earnings Before Tax (EBT) basis; Results may not foot due to rounding Q3 Q3 2012 2013 Net Income to Common Stockholders 1.5 0.7 Add Back: Undistributed earnings allocated to Series B (Basic) 0.1 - Dividends on Preferred Stock 0.2 0.2 Interest Expense / (Income) 0.0 0.0 Income Tax Expense / (Benefit) 0.4 0.8 Special Items: GM Korea Goodwill 0.1 0.0 Loss on Purchase of Series A - 0.8 Total Special Items 0.1 0.9 EBIT- Adjusted 2.3 2.6 ($B)

Restructuring (not included in special items) S5Note: Results may not foot due to rounding Q3 Q4 Q1 Q2 Q3 ($B) 2012 2012 2013 2013 2013 GMNA 0.1 0.0 0.0 0.0 0.0 GME 0.0 (0.1) 0.0 0.0 0.0 GMIO 0.0 0.0 0.0 0.0 (0.1) GMSA 0.0 0.0 0.0 0.0 0.0 Total 0.0 (0.2) (0.1) (0.1) (0.1)

Q3 Q3 ($M) 2012 2013 Earnings Before Tax 200 239 Total Loan and Lease Originations 1,777 3,230 GM as % of GM Financial Loan and Lease Originations 44% 67% Commercial Finance Receivables 284 4,611 Consumer Finance Receivables 10,853 19,264 Consumer Finance Delinquencies (>30 days) 7.1% 5.3% Annualized Net Credit Losses as % of Avg. Consumer Finance Receivables 2.5% 1.9% GM Financial – Key Metrics S6 (1) (3) (1) Includes International Operations purchased in Q2 2013; Q3 2012 reflects North American operations only (2) Excludes $22M and $635M for Q3 2012 and Q3 2013 respectively in outstanding loans to affiliates (3) Excludes consumer finance receivables in repossession (2)