Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IBERIABANK CORP | d616262d8k.htm |

| EX-99.1 - EX-99.1 - IBERIABANK CORP | d616262dex991.htm |

3Q13 Earnings Conference Call

Supplemental Presentation

October 22, 2013

Exhibit 99.2 |

Safe Harbor Language

To

the

extent

that

statements

in

this

presentation

and

the

accompanying

press

release

relate

to

future

plans,

objectives,

financial

results

or

performance

of

IBERIABANK

Corporation,

these

statements

are

deemed

to

be

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements,

which

are

based

on

management’s

current

information,

estimates

and

assumptions

and

the

current

economic

environment,

are

generally

identified

by

the

use

of

the

words

“plan”,

“believe”,

“expect”,

“intend”,

“anticipate”,

“estimate”,

“project”

or

similar

expressions.

IBERIABANK

Corporation’s

actual

strategies

and

results

in

future

periods

may

differ

materially

from

those

currently

expected

due

to

various

risks

and uncertainties.

Actual

results

could

differ

materially

because

of

factors

such

as

the

level

of

market

volatility,

our

ability

to

execute

our

growth

strategy,

including

the

availability

of

future

FDIC-assisted

failed

bank

opportunities,

unanticipated

losses

related

to

the

integration

of

and

refinements

to

purchase

accounting

adjustments

for,

acquired

businesses

and

assets

and

assumed

liabilities

in

these

transactions,

adjustments

of

fair

values

of

acquired

assets

and

assumed

liabilities

and

of

deferred

taxes

in

acquisitions,

actual

results

deviating

from

the

Company’s

current

estimates

and

assumptions

of

timing

and

amounts

of

cash

flows,

credit

risk

of

our

customers,

effects

of

the

on-going

correction

in

residential

real

estate

prices

and

reduced

levels

of

home

sales,

our

ability

to

satisfy

new

capital

and

liquidity

standards

such

as

those

imposed

by

the

Dodd-Frank

Act

and

those

adopted

by

the

Basel

committee

and

federal

banking

regulators,

sufficiency

of

our

allowance

for

loan

losses,

changes

in

interest

rates,

access

to

funding

sources,

reliance

on

the

services

of

executive

management,

competition

for

loans,

deposits

and

investment

dollars,

reputational

risk

and

social

factors,

changes

in

government

regulations

and

legislation,

increases

in

FDIC

insurance

assessments,

geographic

concentration

of

our

markets

and

economic

conditions

in

these

markets,

rapid

changes

in

the

financial

services

industry,

dependence

on

our

operational,

technological,

and

organizational

systems

or

infrastructure

and

those

of

third-party

providers

of

those

services,

hurricanes

and

other

adverse

weather

events,

the

modest

trading

volume

of

our

common

sock,

and

valuation

of

intangible

assets.

These

and

other

factors

that

may

cause

actual

results

to

differ

materially

from

these

forward-looking

statements

are

discussed

in

the

Company’s

Annual

Report

on

Form

10-K,

subsequent

Quarterly

Reports

on

Form

10-Q,

and

other

filings

with

the

Securities

and

Exchange

Commission

(the

“SEC”),

available

at

the

SEC’s

website,

http://www.sec.gov,

and

the

Company’s

website,

http://www.iberiabank.com,

under

the

heading

“Investor

Information.”

All

information

in

this

presentation

and

the

accompanying

press

release

is

as

of

the

date

of

this

release.

The

Company

undertakes

no

duty

to

update

any

forward-looking

statement

to

conform

to

the

statement

to

actual

results

or

changes

in

the

Company’s

expectations.

Certain

tabular

presentations

may

not

reconcile

because

of

rounding.

2

2 |

3

•

Operating EPS of $0.83 driven by higher net interest income, improvement in

operating expenses and continued strong organic loan and core deposit

growth •

Legacy loan growth:

•

Core deposit growth:

•

Stable net interest margin -

2 bps decline to 3.37%

•

Tax equivalent net interest income increased $1 million, or 1%, while average

earning assets increased $89 million, or 1%

•

$3.6

million

aggregate

provision

for

credit

losses

--

$2

million

provision

for

loan

losses

and $1.6 million provision for unfunded lending commitments

•

Total operating expenses declined from $110 million in 2Q13 to $106 million in

3Q13. Included in 3Q13 operating expense is a $1.1 million increase

in provision for unfunded

lending commitments

Introductory Comments

Third Quarter 2013 –

Summary Comments

$295 million since June 30, 2013 (+16% annualized)

$2.4 billion since year-end 2011 (+25% annualized)

$413 million since June 30, 2013 (+19% annualized)

$2.1 billion since year-end 2011 (+17% annualized)

6 bps decline in the earning asset yield

2 bps decline in total cost of deposits |

4

Loan Growth

Since Year-End 2008

Year-End 2008

$3.7 Billion

September 30, 2013

$9.0 Billion

Acquired loans, net of discount

+$2.9 billion

Acquired loan pay downs

($1.6 billion)

Legacy loan growth

+$4.0 billion

Total net growth

+$5.3 billion |

5

Deposit Growth

Since Year-End 2008

Year-End 2008

$4.0 Billion

September 30, 2013

$11.0 Billion

•

$7.0 billion growth in total

deposits or +174% (+37%

annualized) |

6

Financial Overview

Financial Overview

Performance Metrics –

Yields and Costs

•

Investment yield

increased 6 bps due to

reduced bond premium

amortization

•

Non-covered loan yield

was stable on a linked

quarter basis

•

Net covered loan yield

declined 145 bps due to

improving credit quality

and lower income on

covered loans that led to

higher amortization on

the Indemnification Asset

•

Average noninterest

bearing deposits up $329

million (+16% linked

quarter basis)

•

Interest bearing deposit

costs declined 2 bps

•

Margin declined 2 bps to

3.37%

6/30/2013

9/30/2013

Investment Securities

1.92%

1.98%

6

bps

Covered Loans, net of loss share receivable

5.11%

3.66%

(145)

bps

Noncovered Loans

4.40%

4.39%

(1)

bps

Loans & Loss Share Receivable

4.35%

4.21%

(14)

bps

Mortgage Loans Held For Sale

3.17%

4.32%

115

bps

Other Earning Assets

0.87%

0.89%

2

bps

Total Earning Assets

3.80%

3.74%

(6)

bps

Interest Bearing Deposits

0.42%

0.40%

(2)

bps

Short-Term Borrowings

0.16%

0.14%

(2)

bps

Long-Term Borrowings

3.39%

3.37%

(2)

bps

Total Interest Bearing Liabilities

0.51%

0.49%

(2)

bps

Net Interest Spread

3.29%

3.25%

(4)

bps

Net Interest Margin

3.39%

3.37%

(2)

bps

(1)

Earning asset yields are shown on a fully taxable equivalent basis.

Basis Point

Change

For Quarter Ended: |

7

Financial Overview

Non-Interest Income Trends

•

Mortgage loan income declined $2.5 million or -14%

•

Title insurance income decreased $0.2 million, or -4%

•

Increased brokerage commissions of $0.1 million or 2%

•

Deposit service charge income increased $0.4 million, or 6%,

from 2Q13

•

Increased client derivative income of $1.8 million

3Q13 originations down 25% from 2Q13

due to market forces and seasonal trends

Refinancings were 19% of production,

down from 31% in 2Q13

Sales down 19% in 3Q13 and down 18%

from 3Q12

$15 million in 3Q13 revenues (down

14%)

Margins declined as industry rates rose;

Small buyback costs

Pipeline of $182 million at quarter-end

and

$191

million

on

October

11

th

(+9%)

Noninterest Income ($000s)

3Q12

4Q12

1Q13

2Q13

3Q13

$ Change

% Change

Service Charges on Deposit Accounts

6,952

$

7,295

$

6,797

$

7,106

$

7,512

$

406

$

6%

ATM / Debit Card Fee Income

2,377

2,412

2,183

2,357

2,476

119

5%

BOLI Proceeds and CSV Income

916

909

939

901

908

7

1%

Mortgage Income

23,215

22,935

18,931

17,708

15,202

(2,506)

-14%

Title Revenue

5,623

5,492

5,021

5,696

5,482

(214)

-4%

Broker Commissions

3,092

4,192

3,534

3,863

3,950

87

2%

Other Noninterest Income

4,337

4,928

4,727

4,915

7,720

2,805

57%

Noninterest

income

excluding

non-operating

income

46,512

48,162

42,132

42,546

43,250

704

2%

Gain (Loss) on Sale of Investments, Net

41

(4)

2,359

(57)

13

70

123%

Other Non-operating income

-

2,196

-

-

-

-

-

Total Noninterest Income

46,553

$

50,354

$

44,491

$

42,489

$

43,263

$

774

$

2%

3Q13 vs. 2Q13 |

8

Financial Overview

Non-Interest Expense

•

Noninterest expenses excluding non-operating items down $4

million, or 4%, as compared to 2Q13

•

Total expenses down $9 million, or 8%, in 3Q13

•

Severance expense down $1 million, or 67%

•

Occupancy and branch closure costs down $4 million

•

Impairment of closed fixed assets of $1 million

•

Provision for FDIC clawback liability up $0.5 million

•

Debit Card Rewards program termination down $0.5 million

Mortgage commissions

(1.9)

$

mil.

Salaries and benefits

(1.9)

Consulting and professional expense

(0.8)

Occupancy expense

(0.2)

Reserve for unfunded lending commitments

1.1

(3.7)

$

Noninterest Expense ($000s)

3Q12

4Q12

1Q13

2Q13

3Q13

$ Change

%

Change

Mortgage Commissions

6,006

$

5,747

$

4,327

$

6,127

$

4,238

$

(1,889)

$

-31%

Hospitalization Expense

3,773

4,005

4,407

3,994

4,303

309

8%

Other Salaries and Benefits

49,270

50,675

53,668

52,024

50,140

(1,884)

-4%

Salaries and Employee Benefits

59,049

$

60,426

$

62,402

$

62,145

$

58,681

$

(3,464)

$

-6%

Credit/Loan Related

4,846

4,386

3,739

4,168

5,248

1,080

26%

Occupancy and Equipment

13,500

14,413

14,774

14,321

13,863

(457)

-3%

Amortization of Acquisition Intangibles

1,287

1,285

1,183

1,181

1,179

(2)

0%

All Other Noninterest Expense

26,611

30,328

28,050

28,222

26,933

(1,288)

-5%

Nonint. Exp. (Ex-Non-Operating Exp.)

105,293

$

110,838

$

110,148

$

110,036

$

105,904

$

(4,132)

$

-4%

Severance

712

370

97

1,670

554

(1,116)

-67%

Occupancy and Branch Closure Costs

284

711

375

4,925

594

(4,330)

-88%

Impairment of Long-lived Assets

-

-

31,813

-

977

977

100%

Provision for FDIC clawback liability

-

-

-

130

667

537

414%

Debt Prepayment

-

-

2,307

-

-

-

0%

Termination of Debit Card Rewards Program

-

-

-

450

-

(450)

-100%

Consulting and Professional

574

339

-

150

(630)

(780)

-520%

Merger-Related Expenses

2,985

1,183

157

-

85

85

100%

Total Noninterest Expense

109,848

$

113,441

$

144,898

$

117,361

$

108,152

$

(9,209)

$

-8%

Tangible Efficiency Ratio -

excl Nonop Exp

71.2%

72.5%

74.1%

74.2%

70.3%

3Q13 vs. 2Q13

Linked

quarter

increases/(decreases)

of: |

9

Financial Overview

Non-Operating Items

•

Amortization of Indemnification Asset of $5.5 million in 3Q13 ($0.12 EPS)

•

3Q13 Provision for FDIC clawback liability of $0.7 million ($0.01 EPS)

•

3Q13 Severance expense of $0.6 million ($0.01 EPS)

•

Branch closure expense of $0.6 million in 3Q13 ($0.1 EPS)

Pre-tax

After-tax

(2)

Per share

Pre-tax

After-tax

(2)

Per share

Pre-tax

After-tax

(2)

Per share

Net Income (Loss) (GAAP)

29,378

$

21,234

$

0.73

$

19,803

$

15,590

$

0.53

$

30,549

$

23,192

$

0.78

$

Noninterest income adjustments

Loss (Gain) on sale of investments

(41)

(27)

(0.00)

57

37

0.00

(13)

(8)

(0.00)

Other noninterest income

-

-

-

-

-

-

-

-

-

Noninterest expense adjustments

Merger-related expenses

2,985

1,940

0.07

-

-

-

85

55

0.00

Severance expenses

712

463

0.02

1,670

1,086

0.04

554

360

0.01

Impairment of indemnification asset

-

-

-

4,618

3,002

0.10

977

635

0.02

Provision for FDIC clawback liability

-

-

-

130

84

0.00

667

434

0.01

Occupancy expenses and branch closure expenses

284

185

0.01

306

199

0.01

594

386

0.01

Termination of debit card rewards program

-

-

-

450

293

0.01

-

-

-

Professional expenses and litigation settlements

574

373

0.01

150

97

0.00

(630)

(410)

(0.01)

Operating earnings (Non-GAAP) (3)

33,892

24,168

0.83

27,185

20,388

0.69

32,783

24,644

0.83

Covered and acquired impaired (reversal of) provision for loan losses

3,827

2,488

0.09

(3,141)

(2,042)

(0.07)

(854)

(555)

(0.02)

Other (reversal of) provision for loan losses

226

147

0.01

4,949

3,217

0.11

2,868

1,864

0.07

Pre-provision operating earnings (Non-GAAP) (3)

37,945

$

26,803

$

0.92

$

28,992

$

21,563

$

0.73

$

34,797

$

25,953

$

0.89

$

Net Income (Loss) (GAAP)

29,378

$

21,234

$

0.73

$

19,803

$

15,590

$

0.53

$

30,549

$

23,192

$

0.78

$

Impact of adoption of new accounting standard

(3)

-

-

-

4,967

3,228

0.11

5,496

3,572

0.12

Earnings less impact of new accounting standard (Non-GAAP)

29,378

$

21,234

$

0.73

$

24,770

$

18,818

$

0.64

$

36,045

$

26,764

$

0.90

$

Operating earnings including the impact of the adoption

33,892

$

24,168

$

0.83

$

27,185

$

20,388

$

0.69

$

32,783

$

24,644

$

0.83

$

of new accounting standard (Non-GAAP)

Impact of adoption of new accounting standard

(3)

-

-

-

4,967

3,228

0.11

5,496

3,572

0.12

Operating

earnings

less

impact

of

new

accounting

standard

(Non-GAAP)

33,892

$

24,168

$

0.83

$

32,152

$

23,617

$

0.80

$

38,279

$

28,216

$

0.95

$

(1) Per share amounts may not appear to foot due to rounding.

(2) After-tax amounts estimated based on a 35% marginal tax rate.

(3) Includes the impact of the adoption of ASU 2012-06 in the three-month periods ending

September 30, 2013 and June 30, 2013. Dollar Amount

Dollar Amount

Dollar Amount

RECONCILIATION

OF

NON-GAAP

FINANCIAL

MEASURES

(1)

(dollars in thousands)

For The Quarter Ended

September 30, 2012

June 30, 2013

September 30, 2013 |

10

9/30/2012

12/31/2012

3/31/2013

6/30/2013

9/30/2013

Net Income ($ in thousands)

21,234

$

23,208

$

717

$

15,590

$

23,192

$

49%

Per Share Data:

Fully Diluted Earnings

0.73

$

0.79

$

0.02

$

0.53

$

0.78

$

48%

Operating Earnings (Non-GAAP)

0.83

0.80

0.74

0.69

0.83

21%

Pre-provision Operating Earnings (Non-GAAP)

0.92

0.91

0.66

0.73

0.89

21%

Tangible Book Value

37.07

37.34

36.93

36.30

37.00

2%

Key Ratios:

Return on Average Assets

0.69%

0.73%

0.02%

0.49%

0.71%

22

bps

Return on Average Common Equity

5.56%

6.02%

0.19%

4.09%

6.08%

199

bps

Return on Average Tangible Common Equity (Non-GAAP)

7.91%

8.62%

0.55%

5.96%

8.74%

278

bps

Net Interest Margin (TE)

(1)

3.58%

3.55%

3.23%

3.39%

3.37%

(2)

bps

Tangible Efficiency Ratio (TE)

(1)

(Non-GAAP)

74.3%

73.2%

102.4%

81.9%

74.5%

(737)

bps

Tangible Common Equity Ratio (Non-GAAP)

9.01%

8.66%

8.75%

8.69%

8.64%

(5)

bps

Tier 1 Leverage Ratio

10.01%

9.70%

9.37%

9.59%

9.65%

6

bps

Tier 1 Common Ratio (Non-GAAP)

12.04%

11.74%

11.39%

11.08%

10.95%

(13)

bps

Total Risk Based Capital Ratio

14.54%

14.19%

13.80%

13.45%

13.28%

(17)

bps

Net Charge-Offs to Average Loans

(2)

0.12%

0.07%

0.06%

0.06%

0.02%

(4)

bps

Nonperforming Assets to Total Assets

(2)

0.65%

0.69%

0.68%

0.69%

0.66%

(3)

bps

(1)

Fully taxable equivalent basis.

(2)

Excluding FDIC Covered Assets and Acquired Assets.

%/Basis Point

Change

For Quarter Ended:

Financial Overview

Performance Metrics –

Quarterly Trends

•

Average earning

assets up $89

million (+1%)

•

T/E net interest

income up $1

million (+1%)

•

Provision for loan

losses of $2 million:

•

Net charge-offs:

$0.3 million (0.02%

annualized rate)

•

Covered and

acquired loan loss

provision reversal:

$0.9 million

•

Legacy provision

for loan losses:

$2.9 million |

11

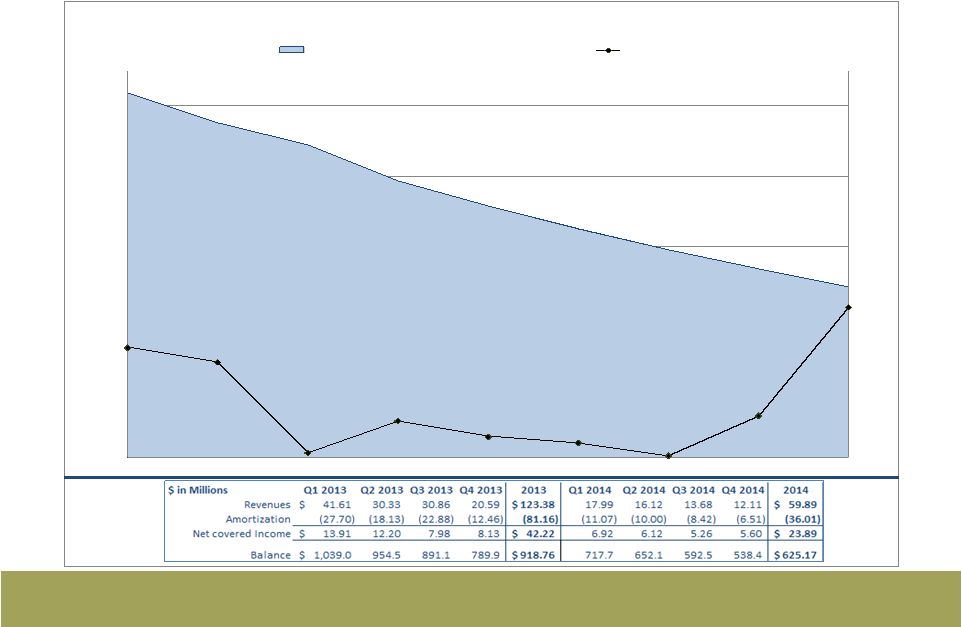

Financial Overview

Expected Amortization

3.50%

4.50%

5.50%

6.50%

7.50%

8.50%

9.50%

$0

$200

$400

$600

$800

$1,000

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Projected Average Loan Balances and Net Yields

Projected Average Balance

Projected Net Yield |

12

Asset Quality

Non-Performing Assets Trends

$ in thousands |

13

Asset Quality

Legacy Portfolio

Asset Quality Summary

(Excludes FDIC covered assets and all acquired loans)

•

NPAs equated to 0.66%

of total assets, down 3

bps compared to 2Q13

•

$78 million in classified

assets (-20% from

2Q13)

•

$55 million special

mention loans (-29%

from 2Q13)

•

Net charge-offs of $0.3

million, or an annualized

rate of 0.02% of

average loans

•

$2.9 million provision for

legacy franchise in

3Q13

($ thousands)

9/30/2012

6/30/2013

9/30/2013

Nonaccrual Loans

45,094

$

49,069

$

43,838

$

-3%

-11%

OREO

18,467

25,893

30,607

66%

18%

Accruing Loans 90 Days+ Past Due

2,883

1,071

1,418

-51%

32%

Nonperforming Assets

66,444

76,033

75,863

14%

0%

Past Due Loans

58,487

65,316

57,662

-1%

-12%

Classified Loans

144,090

97,818

78,059

-46%

-20%

Nonperforming Assets/Assets

0.65%

0.69%

0.66%

1

bps

(3)

bps

NPAs/(Loans + OREO)

1.04%

1.02%

0.98%

(6)

bps

(4)

bps

Classified Assets/Assets

1.32%

0.85%

0.66%

(66)

bps

(19)

bps

(Past Dues & Nonaccruals)/Loans

0.92%

0.88%

0.75%

(17)

bps

(13)

bps

Provision For Loan Losses

226

$

4,949

$

2,868

$

1169%

-42%

Net Charge-Offs/(Recoveries)

1,923

1,029

303

-84%

-71%

Provision Less Net Charge-Offs

(1,697)

$

3,920

$

2,565

$

251%

-35%

Net Charge-Offs/Average Loans

0.12%

0.06%

0.02%

(11)

bps

(4)

bps

Allowance For Loan Losses/Loans

1.21%

0.83%

0.83%

(38)

bps

0

bps

Allowance For Credit Losses/Loans

1.21%

0.97%

0.99%

(22)

bps

2

bps

For Quarter Ended:

% or Basis Point Change

Year/Year

Qtr/Qtr |

14

Asset Quality

Total Portfolio Trends

($ thousands)

Nonaccruals

567,006

$

409,775

$

341,691

$

-40%

-17%

OREO & Foreclosed

129,173

129,607

128,987

0%

0%

90+ Days Past Due

5,538

4,126

10,844

96%

163%

Nonperforming Assets

701,717

$

543,508

$

481,522

$

-31%

-11%

NPAs/Assets

5.60%

4.24%

3.66%

(194)

bps

(58)

bps

NPAs/(Loans + OREO)

8.39%

6.02%

5.25%

(314)

bps

(77)

bps

LLR/Loans

2.45%

1.83%

1.64%

(81)

bps

(19)

bps

ACL/Loans

2.45%

1.95%

1.77%

(68)

bps

(18)

bps

Net Charge-Offs/Loans

0.10%

0.05%

0.01%

(9)

bps

(4)

bps

Past Dues:

30-89 Days Past Due

59,063

$

35,204

$

26,445

$

-55%

-25%

90+ days Past Due

5,538

4,126

10,844

96%

163%

Nonaccual Loans

567,006

409,775

341,691

-40%

-17%

Total 30+ Past Dues

631,607

$

449,105

$

378,979

$

-40%

-16%

% Loans

7.67%

5.04%

4.19%

(348)

bps

(85)

bps

Total Portfolio

3Q12

2Q13

3Q13

% or Basis Point Change

Year/Year

Qtr/Qtr |

15

Markets

Loan Growth

Legacy Loan Growth

$ in millions

3

rd

Quarter 2013:

•

$295 million, or

+4% (+16%

annualized)

Since YE 2011:

•

$2.4 billion, or

+44% (+25%

annualized)

Since YE 2009:

•

$3.6 billion, or

+88% (+23%

annualized)

•

The FDIC

covered loan

portfolio declined

52%, or $863

million (14%

annualized rate) |

16

Markets

Quarterly Legacy Loan Growth

•

First quarter of each year tends

to exhibit slower loan growth

than other quarters |

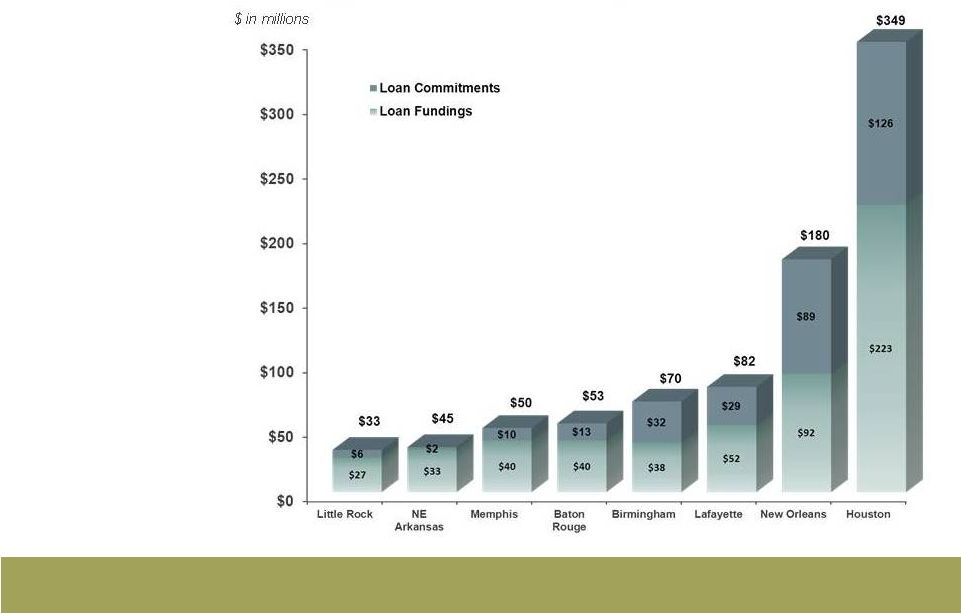

17

Markets

Loan Originations 3Q13 –Top Markets

•

$1.2 billion in total

funded loans and

unfunded loan

commitments

originated in 3Q13

•

Significant growth in

Houston and New

Orleans. Strong

growth across the

franchise

•

Continued growth in

other markets in which

we have invested

heavily

Loan commitments and originations include renewals |

18

Excludes acquired deposits

Markets

Deposit Growth

$ in millions

Organic Deposit Growth

3

rd

Quarter 2013:

•

Increase of $309

million, or +3% in

3Q13 (+12%

Annualized)

•

$474 million (+23%)

growth in NIB deposits

for 3Q13 (impacted by

transition of NOW

accounts to NIB)

•

$104 million (-5%)

decline in time

deposits in 3Q13

Total Deposit Growth

Very strong

transaction account

growth in 4Q12

•

Core deposit growth

of $413 million, or

+5% (+19%

annualized) |

19

Markets

Noninterest Bearing Deposit Accounts

•

Strong account growth in

high-focus markets

•

3Q13 includes accounts

transitioned from NOW

accounts to Noninterest

Bearing |

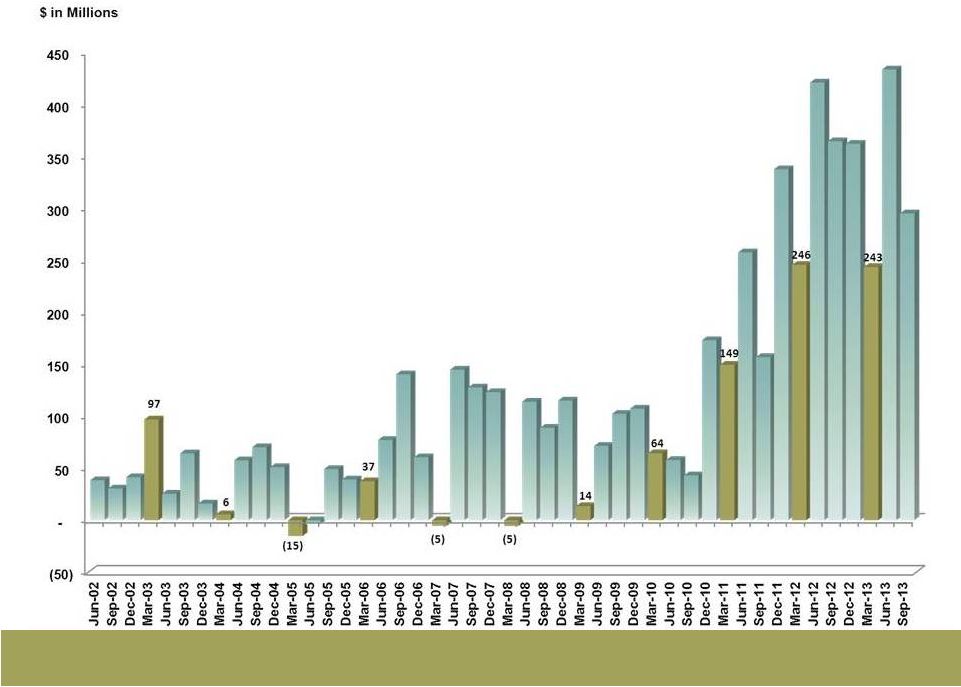

20

Markets

Noninterest Bearing Deposits

% of Total Deposits

•

Since

2010,

total

noninterest

bearing

deposits

increased

$1.7

billion

or

+188%

(+68%

annualized rate)

•

$228

million

of

incremental

noninterest

bearing

deposit

growth

or

+12%

(+48%

annualized)

•

Additional

$246

million

of

NOW

accounts

transitioned

to

noninterest

bearing

this

quarter

•

Top

3Q13

noninterest

bearing

deposit

growth

markets

include

Naples,

Lafayette,

New

Orleans,

Houston

and

Lake

Charles

Noninterest bearing deposits at period-end

$ in billions |

21

Markets

3Q13 Highlights

•

Loan pricing and structure remain competitive for target commercial and

business banking clients

•

Houston, New Orleans, Acadiana, Birmingham and Baton Rouge showed

strong commercial loan originations

•

Loans and commitments originated during 3Q13 of $1.2 billion with 57% fixed

rate and 43% floating rate

•

Commercial loans originated and funded in 3Q13 totaled $466 million with a

mix of 41% fixed and 60% floating ($731 in commercial loan commitments

during the quarter)

•

Strong commercial pipeline of $765 million at quarter-end

•

Small business loan originations, including lines of credit, grew $72 million or

10% in 3Q13 (39% annualized)

•

Period-end core deposit growth of $413 million, with non-interest bearing

deposits up $474 million ($329 million linked quarter growth on an average

balance basis), of which 48% was the result of a transition of interest

bearing NOW accounts into noninterest bearing deposits

|

22

Retail and Small Business

3Q13 Progress

•

Completed closure and consolidation of 10 branches in the third quarter of 2013, as

planned, bringing total closures to 25 branches and one drive through

facility over the past 12 months

•

Balanced loan growth with Small Business, Consumer and Mortgage accounting for 60%

of total bank-wide loan growth:

•

Small Business of $34 million

•

Indirect of $18 million

•

Direct Consumer and Mortgage of $84 million

•

Strong checking account growth:

•

Small Business account growth increased 14% year-over-year

•

Consumer accounts increased 20% year-over-year

•

Continued emphasis on branch efficiency, productivity and enhanced digital

delivery, with Retail staffing mid-October down 5.5% from end of the

second quarter, with staff costs down 5.8%

•

Launched mobile deposit capture and iPad application during the quarter

|

23

Wealth And Capital Markets

3Q13 Progress

•

ICP/IWA revenues

of $3.2 million (up

6% compared to

2Q13 and up 67%

from 3Q12)

•

ICP currently

provides research

coverage on 77

public energy

companies

•

IWA assets under

management

increased 1%, to

$1.1 billion at

September 30, 2013

Total Quarterly Revenues For:

•

IBERIA Capital Partners

•

IBERIA Wealth Advisors |

Appendix

24 |

25

Appendix

Expected Quarterly Re-pricing Schedule

•

$1.6 Billion in time deposits re-price over next 12 months at 0.63% weighted

average rate •

During 3Q13, new and re-priced time deposits were booked at an average cost of

0.31% •

In 3Q13, retention rate of time deposits was 87% with average reduction in rate of

34 basis points $ in millions

Note: Amounts exclude re-pricing of assets and liabilities from prior

quarters Excludes FDIC loans and receivable, non-accrual loans and market value

adjustments 4Q13

1Q14

2Q14

3Q14

4Q14

Cash Equivalents

Balance

336.9

$

-

$

-

$

-

$

-

$

Rate

1.17%

0.00%

0.00%

0.00%

0.00%

Investments

Balance

77.7

$

76.4

$

79.6

$

81.8

$

57.3

$

Rate

2.74%

2.48%

2.81%

3.02%

3.03%

Fixed Rate Loans

Balance

262.5

$

235.9

$

233.3

$

213.8

$

198.5

$

Rate

5.03%

4.99%

4.92%

4.92%

4.86%

Variable Rate Loans

Balance

3,656.6

$

21.9

$

12.7

$

9.8

$

7.4

$

Rate

3.32%

2.85%

3.48%

3.96%

3.10%

Held for Sale Loans

Balance

108.3

$

-

$

-

$

-

$

-

$

Rate

4.84%

0.00%

0.00%

0.00%

0.00%

Time Deposits

Balance

690.4

$

418.8

$

324.2

$

201.0

$

70.1

$

Rate

0.57%

0.78%

0.61%

0.57%

0.72%

Repos

Balance

258.8

$

-

$

-

$

-

$

-

$

Rate

0.14%

0.00%

0.00%

0.00%

0.00%

Borrowed Funds

Balance

120.8

$

0.6

$

5.6

$

13.0

$

0.4

$

Rate

3.19%

3.37%

4.15%

4.04%

3.64% |

26

Appendix

Interest Rate Risk Simulation

Source: Bancware model, as of September 30, 2013

* Assumes instantaneous and parallel shift in interest rates based on static

balance sheet •

Asset sensitive from an interest rate risk position

•

The degree of asset sensitivity is a function of the reaction of

competitors to changes in deposit pricing

•

Forward curve has a slightly positive impact over 12 months

Base

Blue

Forward

Change In:

-200 bp*

-100 bp*

Case

+100 bp*

+200 bp*

Chip

Curve

Net Interest

Income

-3.8%

-1.6%

0.0%

3.5%

7.3%

0.4%

0.9%

Economic

Value of

Equity

-15.9%

-12.0%

0.0%

3.7%

6.4%

0.0%

0.0% |

27

Appendix

Expected Amortization Comparison

$(30.00)

$(25.00)

$(20.00)

$(15.00)

$(10.00)

$(5.00)

$-

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Indemnification Asset Expected Amortization ($ in Millions)

Current Method

Legacy Method |

28

Appendix

FDIC Covered Loan Portfolio Roll Forward

Average

Income /

Expense

Average Yield

Average

Income /

Expense

Average Yield

Average

Income /

Expense

Average Yield

Average

Income /

Expense

Average Yield

Covered Loans

1,112,153

49,550

17.528%

1,039,469

41,607

16.047%

954,555

30,324

12.619%

871,768

30,858

13.896%

Mortgage Loans

155,989

5,318

13.636%

180,902

4,398

9.724%

170,420

4,135

9.706%

163,485

2,718

6.650%

Indirect Automobile

(0)

-

0.000%

(0)

-

0.000%

-

-

0.000%

-

-

0.000%

Credit Card

860

14

6.664%

824

13

6.565%

789

14

7.147%

728

13

6.971%

Consumer

148,001

5,308

14.267%

130,960

3,509

10.867%

126,164

2,594

8.248%

104,668

3,029

11.481%

Line

Of

Credit-Consumer

Loans

69,910

3,661

20.831%

41,802

3,200

31.044%

40,543

2,967

29.355%

50,939

(190)

-1.476%

Commercial

&

Business

Banking

737,394

35,250

18.706%

684,981

30,487

17.803%

616,642

20,613

13.224%

551,950

25,288

17.928%

Loans in Process

(1)

-

0.000%

(1)

-

0.000%

(3)

-

0.000%

(2)

-

0.000%

Overdrafts

0

-

0.000%

0

-

0.000%

0

-

0.000%

-

-

0.000%

FDIC Loss Share Receivable

411,328

(28,201)

-26.828%

384,319

(27,702)

-28.832%

268,700

(18,130)

-26.692%

228,047

(22,875)

-39.252%

Net Covered Loan Portfolio

1,523,481

21,349

7.678%

1,423,788

13,905

5.351%

1,223,255

12,194

5.110%

1,099,815

7,983

3.663%

Average

Income /

Expense

Average Yield

Average

Income /

Expense

Average Yield

Average

Income /

Expense

Average Yield

Average

Income /

Expense

Average Yield

Covered Loans

1,112,153

49,550

17.528%

1,039,469

41,607

16.047%

954,555

30,324

12.619%

871,768

31,931

13.896%

CapitalSouth Bank

150,872

6,737

17.537%

138,793

4,109

11.855%

131,981

3,610

10.852%

123,412

2,840

10.332%

Orion Bank

641,252

29,720

18.235%

597,706

25,287

16.960%

548,977

17,685

12.789%

504,934

20,929

13.924%

Century Bank

232,967

7,137

12.108%

219,726

6,401

11.703%

199,836

4,943

9.869%

175,247

5,790

15.184%

Sterling Bank

87,063

5,956

26.806%

83,245

5,810

27.941%

73,762

4,087

21.956%

68,174

2,372

16.831%

FDIC Loss Share Receivable

411,328

(28,201)

-26.828%

384,319

(27,702)

-28.832%

268,700

(18,130)

-26.692%

228,047

(22,875)

-39.252%

CapitalSouth Bank

35,811

(3,431)

-37.492%

29,301

(2,388)

-32.596%

18,955

(2,347)

-48.987%

14,720

(2,538)

-67.473%

Orion Bank

251,749

(17,944)

-27.892%

235,594

(17,330)

-29.423%

164,219

(10,492)

-25.277%

141,213

(12,702)

-35.199%

Century Bank

92,076

(3,200)

-13.601%

90,384

(4,100)

-18.146%

65,145

(3,105)

-18.857%

55,021

(5,304)

-37.719%

Sterling Bank

31,691

(3,625)

-44.761%

29,040

(3,884)

-53.502%

20,382

(2,185)

-42.404%

17,093

(2,331)

-53.365%

Net Covered Loan Portfolio

1,112,153

21,349

7.678%

1,039,469

13,905

5.351%

954,555

12,194

5.110%

871,768

9,056

3.663%

CapitalSouth Bank

150,872

3,305

8.764%

138,793

1,721

4.961%

131,981

1,262

3.826%

123,412

301

2.301%

Orion Bank

641,252

11,776

7.345%

597,706

7,958

5.326%

548,977

7,192

5.240%

504,934

8,227

4.145%

Century Bank

232,967

3,937

6.760%

219,726

2,301

4.188%

199,836

1,837

3.678%

175,247

486

3.304%

Sterling Bank

87,063

2,331

10.709%

83,245

1,925

9.252%

73,762

1,903

10.317%

68,174

41

3.480%

4Q2012

1Q2013

2Q2013

4Q2012

1Q2013

2Q2013

3Q2013

3Q2013 |