Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARKER HANNIFIN CORP | form8-k1qfy14.htm |

| EX-99.1 - 8-K - PARKER HANNIFIN CORP | exhibit9911qfy14.htm |

1st Quarter Fiscal Year 2014 Earnings Release Parker Hannifin Corporation October 18, 2013 Exhibit 99.2

Forward-Looking Statements Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. All statements regarding future performance, earnings projections, events or developments are forward-looking statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments, disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; the ability to realize anticipated benefits of the consolidation of the Climate and Industrial Controls Group; threats associated with and efforts to combat terrorism; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; increases in raw material costs that cannot be recovered in product pricing; the company's ability to manage costs related to insurance and employee retirement and health care benefits; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law. 2

Non-GAAP Financial Measures This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to sales amounts adjusted to remove the effects of acquisitions & divestitures made within the prior four quarters and the effects of currency exchange rates, (b) cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow from operating activities as a percent of sales without the effect of a discretionary pension plan contribution, and (c) earnings per diluted share reported in accordance with U.S. GAAP to earnings per diluted share without the effect of restructuring expenses. The effects of acquisitions, divestitures, currency exchange rates, the discretionary pension plan contribution and restructuring expenses are removed to allow investors and the company to meaningfully evaluate changes in sales, and cash flow from operating activities as a percent of sales and earnings per diluted share on a comparable basis from period to period. 3

Agenda 4 • CEO 1st Quarter Highlights • Key Performance Measures & Outlook • CEO Closing Comments • Questions and Answers

Highlights 1st Quarter FY2014 Sales & Orders • Sales of $3.2B • Contribution from acquisitions offset divestitures • Global economy still uncertain • Orders rates turned positive Earnings & Margins • Segment Operating Margins of 14.4% • Achieved Net Income of $244m or $1.61 earnings per diluted share • Excluding Restructuring, $1.67 earnings per diluted share • Influences on Earnings • Sound performance in Diversified Industrial International Cash Flow • Generated very strong cash flow of $358m or 11.1% of sales before a discretionary pension contribution of $75m 5

Diluted Earnings Per Share 1st Quarter FY2014 6 $1.61 $1.57 FY14 Q1 FY13 Q1

Influences on Earnings 1st Quarter FY2014 vs. 1st Quarter FY2013 7

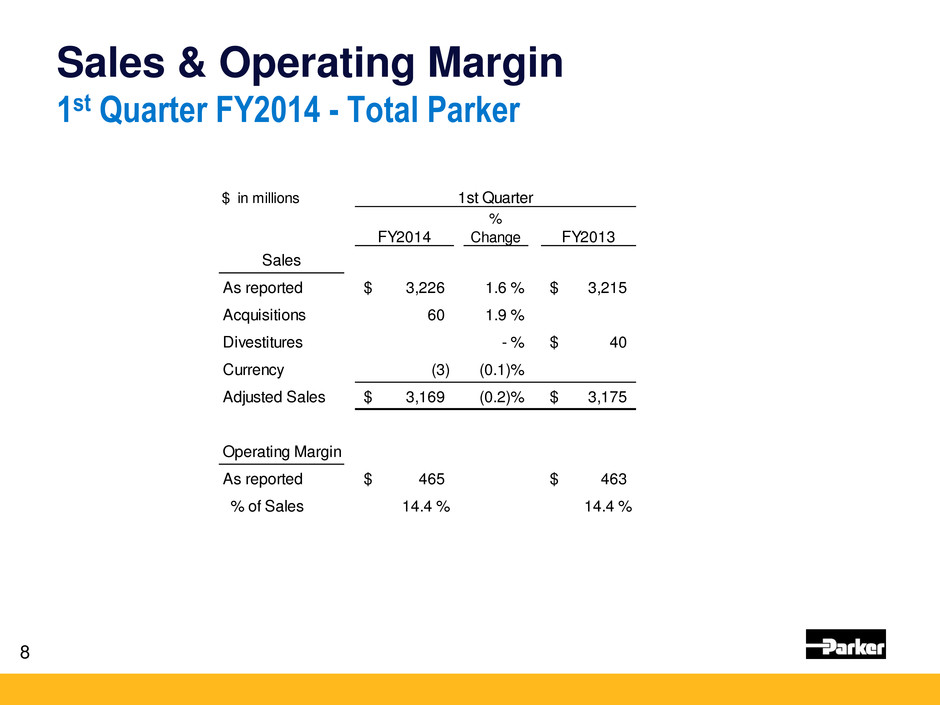

Sales & Operating Margin 1st Quarter FY2014 - Total Parker 8 $ in millions FY2014 % Change FY2013 Sales As reported 3,226$ 1.6 % 3,215$ Acquisitions 60 1.9 % Divestitures - % 40$ Currency (3) (0.1)% Adjusted Sales 3,169$ (0.2)% 3,175$ Operating Margin As reported 465$ 463$ % of Sales 14.4 % 14.4 % 1st Quarter

Sales & Operating Margin 1st Quarter FY2014 – Diversified Industrial North America 9 $ in millions FY2014 % Change FY2013 Sales As reported 1,388$ (0.8)% 1,425$ Acquisitions 39 2.8 % Divestitures - % 26$ Currency (4) (0.3)% Adjusted Sales 1,353$ (3.3)% 1,399$ Operating Margin As reported 234$ 244$ % of Sales 16.9 % 17.1 % 1st Quarter

Sales & Operating Margin 1st Quarter FY2014 – Diversified Industrial International 10 $ in millions FY2014 % Change FY2013 Sales As reported 1,271$ 2.9 % 1,249$ Acquisitions 21 1.7 % Divestitures - % 14$ Currency - - % Adjusted Sales 1,250$ 1.2 % 1,235$ Operating Margin As reported 173$ 157$ % of Sales 13.6 % 12.5 % 1st Quarter

Sales & Operating Margin 1st Quarter FY2014 – Aerospace Systems 11 $ in millions FY2014 % Change FY2013 Sales As reported 567$ 4.9 % 541$ Acquisitions - - % Divestitures - % Currency 1 0.2 % Adjusted Sales 566$ 4.7 % 541$ Operating Margin As reported 57$ 62$ % of Sales 10.1 % 11.4 % 1st Quarter

Order Rates 12 Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average Sep 2013 Jun 2013 Sep 2012 Jun 2012 Total Parker 5 %+ 0 %+ 6 %- 1 %- Diversified Industrial North America 3 %+ 5 %- 11 %- 4 %+ Diversified Industrial International 5 %+ 3 %+ 8 %- 9 %- Aerospace Systems 11 %+ 3 %+ 5 %+ 7 %+

Balance Sheet Summary • Cash • Working capital • Accounts receivable • Inventory • Accounts payable 13

$358 $219 FY14 Q1 FY13 Q1 Cash Flow from Operating Activities 1st Quarter FY2014 14 Cash Flow From Operating Activities 1st Quarter Total Year FY2014 FY2013 As Reported 283$ (7)$ As Reported % Sales 8.8% -0.2% Discretionary Pension Plan Contribution 75$ 226$ Adjusted Cash From Operating Activities 358$ 219$ Adjusted % Sales 11.1% 6.8%

FY2014 Guidance Assumptions Sales & Segment Operating Margins 15 FY 2014 Sales Change versus FY 2013 Total Parker 0% - 3% Diversified Industrial North America 0% - 4% Diversified Industrial International 1% - 4% Aerospace Systems (3)% - (1)% FY 2014 Segment Operating Margin Percentages Total Parker 13.7 - 14.1% Diversified Industrial North America 16.5% - 17.0% Diversified Industrial International 11.4% - 11.8% Aerospace Systems 11.6% - 12.2%

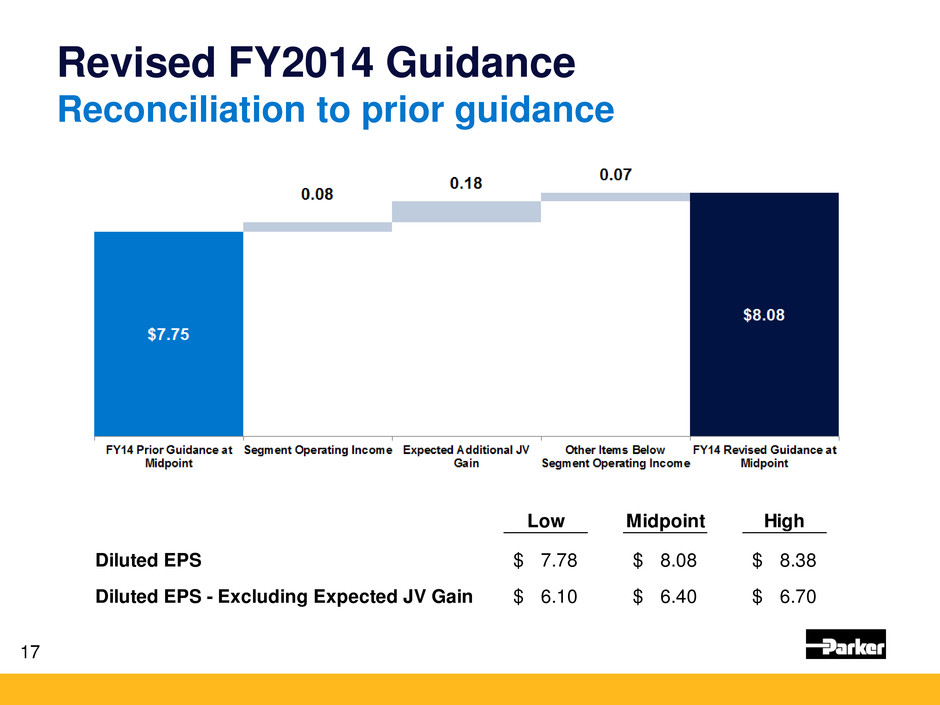

FY2014 Guidance Assumptions • Sales Growth, Flat to +3% • Segment Operating Margins, 13.7% to 14.1% • Below Segment Operating Margin Line (+/- 1.0%) • Corporate Admin, Interest and Other Expense (Income) • $75M at Midpoint including expected GE Aviation JV gain • Expected Pre-Tax gain of $411M from GE Aviation JV in Q2 • Tax Rate • 30.3% Full Year Rate including expected GE Aviation JV gain • Expected Gain on GE Aviation JV taxed at 38.0% in Q2 • 28.0% Full Year Rate excluding impact of GE Aviation JV • Shares Outstanding - 151.8M 16

Revised FY2014 Guidance Reconciliation to prior guidance 17 Low Midpoint High Diluted EPS 7.78$ 8.08$ 8.38$ Diluted EPS - Excluding Expected JV Gain 6.10$ 6.40$ 6.70$

18

Appendix • Consolidated Statement of Income • Business Segment Information By Industry • Consolidated Balance Sheet • Consolidated Statement of Cash Flows • Supplemental Sales Information – Global Technology Platforms

Consolidated Statement of Income 20 (Unaudited) Three Months Ended September 30, (Dollars in thousands except per share amounts) 2013 2012 Net sales 3,226,144$ 3,214,935$ Cost of sales 2,476,409 2,477,447 Gross profit 749,735 737,488 Selling, general and administrative expenses 406,930 381,122 Interest expense 20,958 23,509 Other (income), net (2,243) (3,201) Income before income taxes 324,090 336,058 Income taxes 79,770 96,110 Net income 244,320 239,948 Less: Noncontrolling interests 4 207 Net income attributable to common shareholders 244,316$ 239,741$ Earnings per share attributable to common shareholders: Basic earnings per share 1.64$ 1.61$ Diluted earnings per share 1.61$ 1.57$ Average shares outstanding during period - Basic 149,237,306 149,285,849 Average shares outstanding during period - Diluted 151,860,261 152,617,110 Cash dividends per common share .45$ .41$

Business Segment Information By Industry 21 (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2013 2012 Net sales Diversif ied Industrial: North America 1,387,875$ 1,425,279$ International 1,270,795 1,248,573 Aerospace Systems 567,474 541,083 Total 3,226,144$ 3,214,935$ Segment operating income Diversif ied Industrial: North America 234,198$ 244,075$ International 173,410 156,598 Aerospace Systems 57,298 61,898 Total segment operating income 464,906 462,571 Corporate general and administrative expenses 47,210 39,767 Income before interest and other expense 417,696 422,804 Interest expense 20,958 23,509 Other expense 72,648 63,237 Income before income taxes 324,090$ 336,058$

Consolidated Balance Sheet 22 (Unaudited) September 30, June, 30 September, 30 (Dollars in thousands) 2013 2013 2012 Assets Current assets: Cash and cash equivalents 1,945,623$ 1,781,412$ 436,131$ Accounts receivable, net 1,968,490 2,062,745 1,982,590 Inventories 1,465,431 1,377,405 1,489,748 Prepaid expenses 176,245 182,669 161,123 Deferred income taxes 123,390 126,955 130,490 Total current assets 5,679,179 5,531,186 4,200,082 Plant and equipment, net 1,833,748 1,808,240 1,803,412 Goodw ill 3,285,228 3,223,515 3,076,134 Intangible assets, net 1,280,431 1,290,499 1,193,815 Other assets 709,778 687,458 861,135 Total assets 12,788,364$ 12,540,898$ 11,134,578$ Liabilities and equity Current liabilities: Notes payable 1,335,339$ 1,333,826$ 264,582$ Accounts payable 1,130,676 1,156,002 1,162,797 Accrued liabilities 808,218 894,296 830,034 Accrued domestic and foreign taxes 180,776 136,079 109,052 Total current liabilities 3,455,009 3,520,203 2,366,465 Long-term debt 1,506,744 1,495,960 1,511,799 Pensions and other postretirement benefits 1,309,981 1,372,437 1,704,291 Deferred income taxes 107,000 102,920 112,532 Other liabilities 319,859 307,897 287,477 Shareholders' equity 6,086,861 5,738,426 5,141,124 Noncontrolling interests 2,910 3,055 10,890 Total liabilities and equity 12,788,364$ 12,540,898$ 11,134,578$

Consolidated Statement of Cash Flows 23 (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2013 2012 Cash flows from operating activities: Net income 244,320$ 239,948$ Depreciation and amortization 85,580 81,172 Stock incentive plan compensation 48,998 31,261 Net change in receivables, inventories, and trade payables 16,213 (23,536) Net change in other assets and liabilities (106,293) (389,688) Other, net (6,127) 53,872 Net cash provided by (used in) operating activities 282,691 (6,971) Cash flows from investing activities: Acquisitions (net of cash of $20,329 in 2012) 1,491 (194,548) Capital expenditures (56,651) (76,685) Proceeds from sale of plant and equipment 2,915 8,645 Other, net 49 168 Net cash (used in) investing activities (52,196) (262,420) Cash flows from financing activities: Net payments for common stock activity (44,905) (72,530) Net proceeds from (payments for) debt 1,269 (37,773) Dividends (67,388) (61,365) Net cash (used in) financing activities (111,024) (171,668) Effect of exchange rate changes on cash 44,740 38,873 Net increase (decrease) in cash and cash equivalents 164,211 (402,186) Cash and cash equivalents at beginning of period 1,781,412 838,317 Cash and cash equivalents at end of period 1,945,623$ 436,131$

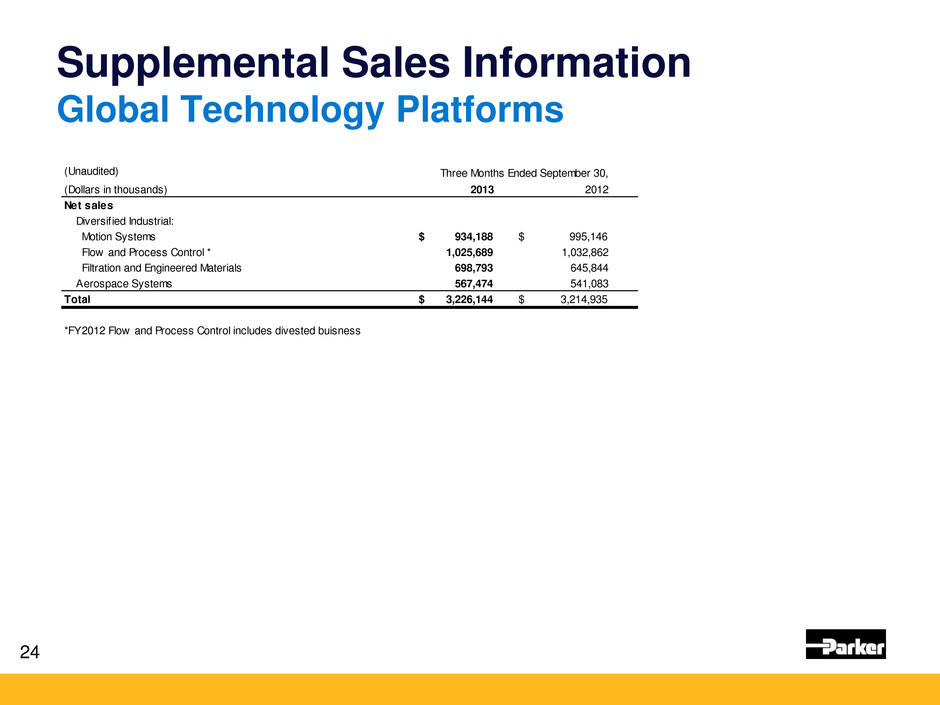

(Unaudited) Three Months Ended September 30, (Dollars in thousands) 2013 2012 Net sales Diversif ied Industrial: Motion Systems 934,188$ 995,146$ Flow and Process Control * 1,025,689 1,032,862 Filtration and Engineered Materials 698,793 645,844 Aerospace Systems 567,474 541,083 Total 3,226,144$ 3,214,935$ *FY2012 Flow and Process Control includes divested buisness Supplemental Sales Information Global Technology Platforms 24