Attached files

| file | filename |

|---|---|

| 8-K - U. S. Premium Beef, LLC | es8koct.htm |

|

Units Trade in

“This month, 6,270 Class A units with delivery rights available this delivery year and 6,270 Class B units sold in a private treaty transaction for $174.25 per Class A unit and $174.25 per Class B unit,” reports Tracy Thomas, vice president of Marketing. “These trades bring our total Class A unit sales for fiscal year 2013 to 17,456 (combining Class A units sold with delivery rights available in the current delivery year and Class A units sold with delivery rights available next delivery year), for an average price of $160.33.” Broken out, fiscal year to date, the Class A’s with delivery rights available this delivery year traded for an average of $174.16, and Class A’s with delivery rights available next delivery year have traded for an average of $150.00. Class B unit sales during fiscal year 2013 to date have totaled 17,171, for an average price of $173.34. (See table below.)♦ |

FY 2013 Annual Meeting To Be Held on March 28, 2014 Mark your calendars. U.S. Premium Beef’s fiscal year 2013 annual meeting will be held in Kansas City, MO, at the Kansas City Airport Hilton on March 28, 2014. A reception will be held on the evening of March 27 at the Airport Hilton. Watch upcoming UPDATES for more information on the annual meeting.♦ Qualified Seedstock Suppliers Schedule Fall Sales The following USPB Qualified Seedstock Suppliers (QSS) will conduct sales October through December. Go to USPB’s Qualified Custom Feedyards and Seedstock Suppliers link on our web page then scroll down to the supplier you are interested in for sale times and locations.♦ |

||||

|

USPB Non-Conditional Unit Trade Report |

Lyons Influence Feeder Calf Sale |

10/16 & 11/6 |

|||

|

DR = Delivery Rights; DY = Delivery Year |

FY 2013 Trades |

Most Recent Trades |

Heartland Simmental and Angus Heifer Sale |

10/27 |

|

| Fink Beef Genetics Bull Sale |

10/30 |

||||

| Downey Ranch, Inc. Bull and Female Sale |

11/1 |

||||

|

# Class A Units (DR available this DY) |

7,465 |

6,270 |

Kniebel Farms & Cattle, Inc. Bull and Female Sale |

11/1 |

|

|

Average Price Per Unit |

$174.16 |

$174.25 |

Pelton Simmental/Red Angus Feeder Calf Sale |

11/1 |

|

|

# Class A Units (DR available next DY) |

9,991 |

9,971 |

Dalebanks Angus Bull Sale |

11/23 |

|

|

Average Price Per Unit |

$150.00 |

$150.00 |

Marshall & Fenner Female Sale |

12/6 |

|

| # Class B Units |

17,171 |

6,270 |

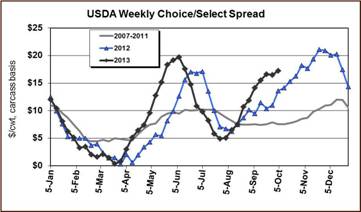

In addition, the following USPB QSS members are selling bulls at private treaty during the Fall: Cow Camp, Inc., Dalebanks Angus, Inc., Gardiner Angus Ranch, Harms Plainview Ranch, McCurry Brothers Angus, Oleen Brothers. USDA’s Choice/Select Spread Widens Seasonally

|

||

|

Average Price Per Unit |

$173.34 |

$174.25 |

|||

|

Understanding AgStockTrade.com |

|||||

|

In March 2010, USPB announced a method by which both Class A and Class B units can be bought or sold via an electronic trading service located at www.AgStockTrade.com. This is a good time to review how unitholders and associates can trade either class of units. Class A and Class B units can be bought and sold independent of each other. Sales of either class of units can occur on the electronic trading service or via a private treaty transaction. Regardless of which method is used, the seller will be assessed a 2% transaction fee when the transaction paperwork is signed and submitted to USPB. The website www.AgStockTrade.com is defined as a Qualified ...continued on page 2

|

|||||

Reproduction of any part of this newsletter is expressly forbidden without written permission of U.S. Premium Beef.

|

Understanding AgStockTrade.com... |

continued from page 1 |

|

Matching Service (QMS), is a public domain and is viewable by anyone. Although viewable by anyone, a user name and a password are required before an offer to buy or sell is placed on the site. If you are a unitholder, you have already been assigned a user name and password. If you are a unitholder or an associate who has already registered for a user name and password and do not recall what they are, please call our office and we will assist you in getting that information. Associates who have not registered for a user name and password must complete a Logon Request, which can be found on USPB’s website at http://www.uspremiumbeef.com/DocumentItem.aspx?ID=61. All requests are presented to the USPB Board of Directors for approval. Unitholders and associates with approved user names and passwords can then access the AgStockTrade.com website. All offers to buy or sell are anonymous until the transfer paperwork is distributed for signature, after a match occurs. The United States government has established regulations that govern the way in which QMS systems operate. Those regulations create several time requirements: An offer to sell must wait a mandatory 15 days prior to being eligible to be matched with an offer to buy. A transaction cannot close prior to 45 days after the offer to sell is posted. An offer to sell can only remain on the QMS website for 120 days at which time it will be deleted. However, the offer can be reposted to the QMS website after being off the site for 60 days. During the 120 day period, sellers have the option to change the asking price or adjust the desired quantity to sell. However, any changes to the initial sell offer (and any subsequent changes to the offer) will restart the 15 day wait period before a match can occur. Although the 15 day wait period restarts, the 120 day posting period remains static. Buyers are not subject to similar time constraints and have the option to change bids on a real time basis. Last year, AgStockTrade added two features to make the system even more user-friendly. First, a feature was added that allows for extended bidding. With this new feature, if one or more bids that would create a match are entered at any point between 4:58 and 5:00 p.m. CST, a new two minute bidding window automatically opens. The new bidding window remains open until no further bids are placed within the extended window. The second new feature allows those placing buy offers to indicate a maximum bid. This feature allows the system to automatically increase the bid of a potential buyer anytime someone is bidding against him until his maximum bid is met.

|

|

|

For more information about the electronic trading service, go to USPB’s website at www.uspremiumbeef.com.♦ |

||

|

BENCHMARK PERFORMANCE DATA TABLE |

||

|

Base Grid Cattle Harvested in KS Plants 09/01/13 to 09/28/13 |

||

|

(Numbers |

Base Grid |

|

|

All |

Top 25% |

|

|

Yield |

64.55 |

65.48 |

|

Prime |

2.22 |

4.47 |

|

CH & PR |

71.47 |

81.81 |

|

CAB |

24.82 |

35.00 |

|

BCP |

17.42 |

20.70 |

|

Ungraded |

1.73 |

1.03 |

|

Hard Bone |

0.45 |

0.19 |

|

YG1 |

10.38 |

8.26 |

|

YG2 |

35.77 |

34.30 |

|

YG3 |

40.22 |

42.62 |

|

YG4 |

12.36 |

13.55 |

|

YG5 |

1.27 |

1.27 |

|

Light Weight |

0.23 |

0.12 |

|

Heavy Weight |

1.27 |

1.05 |

|

Average Grid Premiums/Discounts ($/Head) |

||

|

Quality Grade |

$29.91 |

$49.57 |

|

Yield Benefit |

$28.68 |

$51.70 |

|

Yield Grade |

$2.15 |

$3.02 |

|

Out Weight |

$2.03 |

$1.61 |

|

Natural |

$3.20 |

$6.79 |

|

Total Premium |

$57.61 |

$103.43 |