Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SALE OF PORTAMEDIC ASSETS - HOOPER HOLMES INC | a8k-saleofportamedicassets.htm |

EXHIBIT INDEX

Exhibit | Description | |

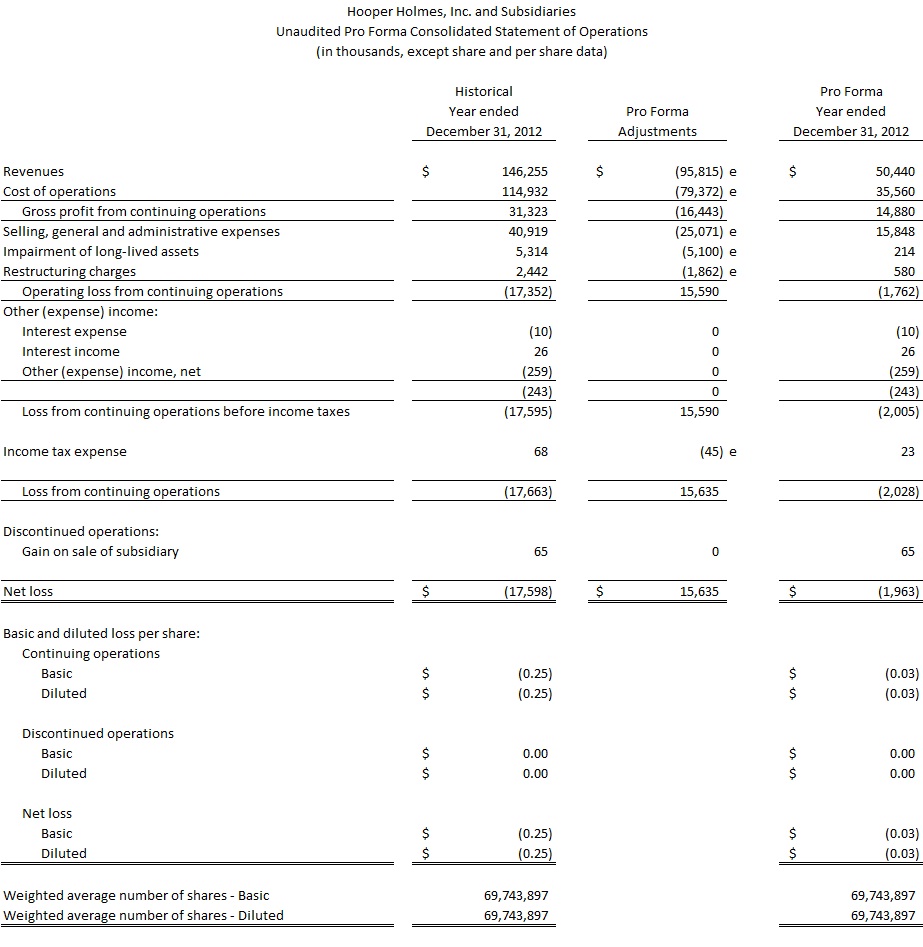

99.1 | Unaudited Pro Forma Consolidated Statements of Operations for the fiscal years ended December 31, 2011 and 2012 and for the six months ended June 30, 2013 and 2012, and the Unaudited Pro Forma Consolidated Balance Sheet as of June 30, 2013 of Hooper Holmes, Inc. | |

EXHIBIT 99.1

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The following unaudited pro forma consolidated balance sheet and statements of operations are based upon the historical consolidated financial statements of Hooper Holmes, Inc. (the “Company”). Unless the context indicates otherwise, any reference in this report to the “Company,” “we,” “us,” and “our” refers to Hooper Holmes, Inc. The unaudited pro forma consolidated financial statements have been prepared to illustrate the effect of the sale by the Company of certain assets related to its Portamedic service line to Piston Acquisition Inc. (“Piston”) pursuant to the terms of the asset purchase agreement by and among the Company and Piston, dated August 15, 2013, as amended by the First Amendment to the Asset Purchase Agreement and Agreement, dated September 30, 2013 (as amended, the “Asset Purchase Agreement”). The assets sold to Piston do not include the accounts receivable of Portamedic. Subject to certain exceptions set forth in the Asset Purchase Agreement, Piston will not assume the liabilities of Portamedic.

Under the terms of the Asset Purchase Agreement, Piston has agreed to pay approximately $8.4 million in cash, subject to adjustment, (the “Purchase Price”) for the Portamedic assets and assumption of specified liabilities (the “Portamedic Disposition”). At the closing of the transaction, certain adjustments with respect to other current assets reduced the Purchase Price to $8.1 million, $2.0 million of the Purchase Price (the “Holdback Amount”) was held back by Piston as security for the Company’s obligations and agreements under the Asset Purchase Agreement and certain other agreements. The Holdback Amount will be released as follows: within three business days after the date on which final closing adjustments for inventory and other current assets are determined and paid to Piston (the “Closeout Date”) (and after giving effect to any deductions from the Holdback Amount prior to such date), Piston will pay to the Company all amounts, if any, in excess of $1.0 million and the remaining $1.0 million of the Holdback Amount, less any deductions with respect to indemnification claims and any amounts in respect of any indemnification claims then in dispute, will be paid to the Company on the first anniversary of the Closeout Date. There cannot be any assurance that the Holdback Amount will be collected by the Company in full.

The unaudited pro forma consolidated balance sheet as of June 30, 2013 reflects the pro forma effect as if the Portamedic Disposition had been consummated on that date. The unaudited pro forma consolidated statements of operations for the six months ended June 30, 2013 and 2012, and the years ended December 31, 2012 and 2011 include the Company’s historical statements of operations, adjusted to reflect the pro forma effect as if the Portamedic Disposition had been consummated on January 1, 2011. The historical consolidated financial statements referred to above for the Company were included in its Quarterly Report on Form 10-Q for the quarter and six months ended June 30, 2013 and Annual Report on Form 10-K for the year ended December 31, 2012. The accompanying unaudited pro forma consolidated financial information and the historical consolidated financial information presented therein should be read in conjunction with the historical consolidated financial statements and notes thereto for the Company.

The unaudited pro forma consolidated balance sheet and statements of operations include pro forma adjustments which reflect transactions and events that (a) are directly attributable to the Portamedic Disposition, (b) are factually supportable and (c) with respect to the unaudited pro forma consolidated statement of operations, are expected to have a continuing impact on consolidated results. The pro forma adjustments are described in the accompanying notes to the unaudited pro forma consolidated financial statements.

The unaudited pro forma consolidated financial information does not reflect future events that may occur after the Portamedic Disposition, including the financial impact related to the planned reorganization of the business and adjustments to the Holdback Amount. The unaudited pro forma consolidated financial information is provided for informational purposes only and is not necessarily indicative of the results of operations that would have occurred if the Portamedic Disposition had occurred on January 1, 2011 nor is it necessarily indicative of our future operating results. The pro forma adjustments are subject to change and are based upon currently available information.

HOOPER HOLMES INC.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(In Thousands)

Description of Transaction and Basis of Presentation

The unaudited pro forma condensed consolidated balance sheet and statements of operations are based upon the historical consolidated financial statements of Hooper Holmes, Inc. (the “Company”) which were included in its Quarterly Report on Form 10-Q for the quarter and six months ended June 30, 2013 and Annual Report on Form 10-K for the years ended December 31, 2012 and 2011. The unaudited pro forma condensed consolidated statements of operations reflect the sale by the Company of certain assets related to its Portamedic service line, as if the sale had been consummated on January 1, 2011. The unaudited pro forma condensed consolidated balance sheet as of June 30, 2013 reflects such sale as if it had been consummated on that date.

Pro Forma Adjustments

On September 30, 2013, the Company completed the sale of certain assets to Piston pursuant to the terms of our Asset Purchase Agreement dated August 15, 2013 for $8,053. At the closing of the transaction, $2,000 of the Purchase Price (the “Holdback Amount”) was held back by Piston as security for the Company’s obligations and agreements under the Asset Purchase Agreement and certain other agreements.

The following pro forma adjustments are included in the unaudited pro forma condensed consolidated balance sheet and/or the unaudited pro forma condensed consolidated statements of operations:

a) The elimination of assets and liabilities included in the Portamedic Disposition, including inventory, other current assets, property, plant and equipment - net and capital lease obligations.

b) Reflects the cash proceeds pertaining to the $8,053 sales price, after adjustments calculated at the Closing Date, less $2,000 of the Holdback Amount, and the recording in accrued expenses of approximately $900 of estimated costs related to the sale. The estimated accrued expenses of $900 have not been recognized in the unaudited pro forma consolidated statements of operations for any of the periods presented. These estimated costs will be recognized by the Company primarily during the three months ended September 30, 2013.

c) Reflects the Holdback Amount of $2,000 due from Piston as a result of the sale currently expected to be collected. At the closing of the transaction, $2,000 of the Purchase Price (the “Holdback Amount”) was held back by Piston as security for the Company’s obligations and agreements under the Asset Purchase Agreement and certain other agreements. The Holdback Amount will be released as follows: within three business days after the date on which final closing adjustments for inventory and other current assets are determined and paid to Piston (the “Closeout Date”) (and after giving effect to any deductions from the Holdback Amount prior to such date), Piston will pay to the Company all amounts, if any, in excess of $1,000; and the remaining $1,000 of the Holdback Amount, less any deductions with respect to indemnification claims and any amounts in respect of any indemnification claims then in dispute, will be paid to the Company on the first anniversary of the Closeout Date. In addition to the Holdback Amount, the Company has agreed to indemnify Piston for up to $200 of losses specified in the Asset Purchase Agreement. There cannot be any assurance that the Holdback Amount will be collected by the Company in full or that the Company will not incur costs for the indemnified losses.

d) The after-tax effect on stockholders’ equity pertaining to the estimated gain on sale for the Portamedic Disposition.

e) The elimination of historical revenues and expenses related to the Portamedic service line.