Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d604352d8k.htm |

ENCORE CAPITAL GROUP, INC.

JMP SECURITIES FINANCIAL SERVICES &

REAL ESTATE CONFERENCE

October 1, 2013

Exhibit 99.1 |

PROPRIETARY

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words

“will,” “may,”

“believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions, constitute “forward-looking statements”

within the meaning of the Private

Securities

Litigation

Reform

Act

of

1995

(the

“Reform

Act”).

These

statements

may

include,

but

are

not

limited

to,

statements

regarding

our

future

operating

results,

earnings per share, and growth.

For all “forward-looking statements,”

the Company

claims the protection of the safe harbor for forward-looking statements

contained in the Reform Act.

Such forward-looking statements involve risks, uncertainties and other

factors which may cause actual results, performance or achievements of the Company

and its subsidiaries to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in

the reports filed by the Company with the Securities and Exchange

Commission, including the most recent reports on Forms 10-K and

10-Q, as they may be amended from time to time. The Company disclaims

any intent or obligation to update these forward-looking statements.

|

PROPRIETARY

ENCORE IS A LEADING PLAYER IN THE CONSUMER DEBT BUYING

AND RECOVERY INDUSTRY

3

We deploy capital to acquire

delinquent consumer receivables...

... and generate predictable cash

flows over a multi-year time horizon

Total Cash

Collections

Portfolio

Purchase

Price

Illustrative cash collections

2-3x

Years

1-2

Years

3-4

Years

5-6

Years

7-8

1 in 7

American consumers

have accounts with us

3.1 million

consumers have

satisfied their obligations

$2.7 billion

in estimated

remaining collections

27%

Adjusted EBITDA

†

5-year

compound annual growth rate

3,530

employees worldwide

$1 billion

collected in the last

twelve months

†

Adjusted EBITDA is a non-GAAP number which the Company considers to be and

utilizes as a meaningful indicator of operating performance. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of this presentation.

|

PROPRIETARY

WITH A STRONG DOMESTIC AND INTERNATIONAL PRESENCE

4

St Cloud, MN

Phoenix, AZ

New Delhi, India

Call Center /

Technology Site

Call Center Site

Call Center Site

San Diego, CA

Headquarters /

Call Center Site

Call Center Site

Costa Rica

San Antonio, TX

Propel

Cabot HQ /

Call Center Sites

West Malling, UK

Stratford-upon-Avon, UK

Call Center Site

Dublin, Ireland

Tampa, FL

Call Center Site

Warren, MI

Call Center Site |

PROPRIETARY

ENCORE PROVIDES A PRINCIPLED AND ESSENTIAL SERVICE

5 |

PROPRIETARY

OUR BUSINESS PRINCIPLES ARE BUILT ON TREATING CONSUMERS

FAIRLY AND WITH RESPECT

6

Understanding

our consumers

•

Acknowledging limitations of our consumers’

household balance sheets to align recovery plans

•

Deploying specialized surveys to test consumer

satisfaction

Making focused

investments

•

Built specialized non-collections work groups to serve

consumer needs

•

Established Consumer Credit Research Institute to

better understand the financially stressed consumer

Improving

consumer

experience

•

Living the Consumer Bill of Rights

•

Creating resources and directing financially stressed

consumers to best external references

•

Founded Consumer Experience Council |

PROPRIETARY

ENCORE HAS DELIVERED A TRACK RECORD OF STRONG,

SUSTAINABLE FINANCIAL RESULTS

7

Strong business

fundamentals...

Cash Collections ($M)

Cost to Collect

(%)

...driving

profitable

growth

Adjusted EBITDA ($M)

Earnings Per Share ($)

1

3

2

1.

Cost

to

Collect

is

Adjusted

Operating

Expenses

/

Dollar

Collected.

See

Reconciliation

of

Adjusted

Operating

Expenses

to

GAAP

Total

Operating

Expenses

at

the

end

of

this

presentation.

2.

Adjusted EBITDA is a non-GAAP number which the Company considers to be and

utilizes as a meaningful indicator of operating performance. See Reconciliation of Adjusted EBITDA to GAAP

Net

Income

at

the

end

of

this

presentation.

3.

Per

Fully

Diluted

Share

from

Continuing

Operations

Note:

Growth

rate

percentages

for

Cash

Collections,

Adjusted

EBITDA,

and

EPS

signify

compounded

annual

growth

rate

from

2007

-

2012 |

PROPRIETARY

AND HAS CONTINUED TO BUILD UPON THIS PERFORMANCE WITH

STRONG RESULTS THIS YEAR

8

Year over year financial results

1.

Cost

to

Collect

is

Adjusted

Operating

Expenses

/

Dollar

Collected.

See

Reconciliation

of

Adjusted

Operating

Expenses

to

GAAP

Total

Operating

Expenses

at

the

end

of

this

presentation.

2.

Adjusted EBITDA is a non-GAAP number which the Company considers to be and

utilizes as a meaningful indicator of operating performance. See Reconciliation of Adjusted EBITDA to GAAP

Net Income at the end of this presentation. 3. See reconciliation of Adjusted EPS

to GAAP EPS at the end of this presentation. |

PROPRIETARY

Estimated Remaining Collections in core receivables

ENCORE HAS RAPIDLY GAINED SCALE AND POSITIONED ITSELF

FOR SUSTAINED GROWTH

9 |

PROPRIETARY

THIS SCALE HAS BEEN CREATED BY MARKET LEADING INVESTMENTS

10

Capital deployed in core receivables

($M) |

PROPRIETARY

ENCORE HAS DELIVERED INDUSTRY LEADING TOTAL SHAREHOLDER

RETURN OVER THE PAST 5+ YEARS

11

Total Shareholder Return (Dec. 2007-

Aug. 2013)

(%) |

PROPRIETARY

WE ARE WELL POSITIONED TO MAINTAIN OUR MOMENTUM AND

CONTINUE DELIVERING TOP QUARTILE TSR

12

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

•

Specialized call

centers

•

Efficient international

operations

•

Internal legal

platform

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

•

Consumer

intelligence

•

Data driven,

predictive modeling

•

Portfolio valuation at

consumer level

•

Consumer Credit

Research Institute

Superior

Analytics

1

•

Uniquely scalable

platform

•

Strategic investment

opportunities in

geographic and

paper type

adjacencies

Extendable

Business Model

4

•

Sustained success at

raising capital

-

Low cost of debt

-

Sustainable

borrowing capacity

and cash flow

generation

•

Prudent capital

deployment |

PROPRIETARY

OUR SUPERIOR ANALYTICS STEM FROM OUR INVESTMENTS TO

BETTER UNDERSTAND CONSUMERS...

13

Industrialized

behavioral

science

R&D that

includes field

experiments

and new theory

development

Reporting and

alerts

Basic

consumer

segmentation

and targeting

Statistical

analysis and

forecasting

Simple

models to

increase

collection

returns

Predictive

modeling and

optimization

Advanced

models focused

on consumer

behavior and

financial ability

2001

2005

2012 |

PROPRIETARY

Encore’s individual

underwriting approach

to portfolio valuation

accommodates our

specialized operational

strengths

Low willingness

Low ability

High willingness

High capability

High willingness

Moderate capability

High willingness

Low capability

Low willingness

High ability

Low willingness

Moderate ability

...WHICH IS CLEARLY SEEN IN OUR APPROACH TO CONSUMER LEVEL

PORTFOLIO VALUATION

14

•

Strong partnership

and recovery

opportunities

•

Enforce legal contract

through formal channels

•

Payment plans and

opportunities to build

longer relationships

•

Significant discounts

and many small

payments

•

Remind consumers through

legal messaging

•

Hardship strategies and removal

from the collections process |

PROPRIETARY

OUR EFFECTIVENESS HAS IMPROVED SIGNIFICANTLY THROUGH

OUR INVESTMENTS IN ANALYTICS

15

Improved liquidation in our call center channel

1

1. Of like portfolios through call center channel 2. 2008 = 100

Note: Assumes 8% marginal cost to collect through call center channel, 40% tax

rate, 2.3x cumulative collections multiple, 25M diluted shares outstanding

Indexed liquidation rate

+11%

•

In

2012,

we

collected

$442M

through our call center channel

•

In 2008, we would have only

collected

$398M

•

~$44M

in

incremental

cash

collections

•

~$0.50

in incremental EPS

Impact of 11% improvement

in liquidation (2008-2012)

111

100

80

90

100

110

120

2012 Vintage

2008 Vintage

2 |

PROPRIETARY

Internal Legal investments

WE HAVE THE INDUSTRY LEADING COST PLATFORM, DRIVEN BY

CONTINUING OPERATIONAL IMPROVEMENTS

16

Increased specialization in call centers

Scaling Indian call center

Improving analytics

Overall Cost to Collect (%)

1. Cost to Collect is Adjusted Operating Cost / Dollar Collected. See

Reconciliation of Adjusted Operating Cost to GAAP Total Operating Expenses at the end of this presentation.

1 |

PROPRIETARY

•

Debt is our working capital

–

Capital deployment business

which generates strong cash

flows

EFFICIENT CAPITAL STEWARDSHIP IS CRITICAL TO ENCORE'S

SUCCESS

17

•

Strong cash flow allows for

TSR driving investments

–

Reinvest in wide range of

receivables

–

Prudent investment in

adjacencies to supplement core

growth

–

Return capital to shareholders

when it is highest return option |

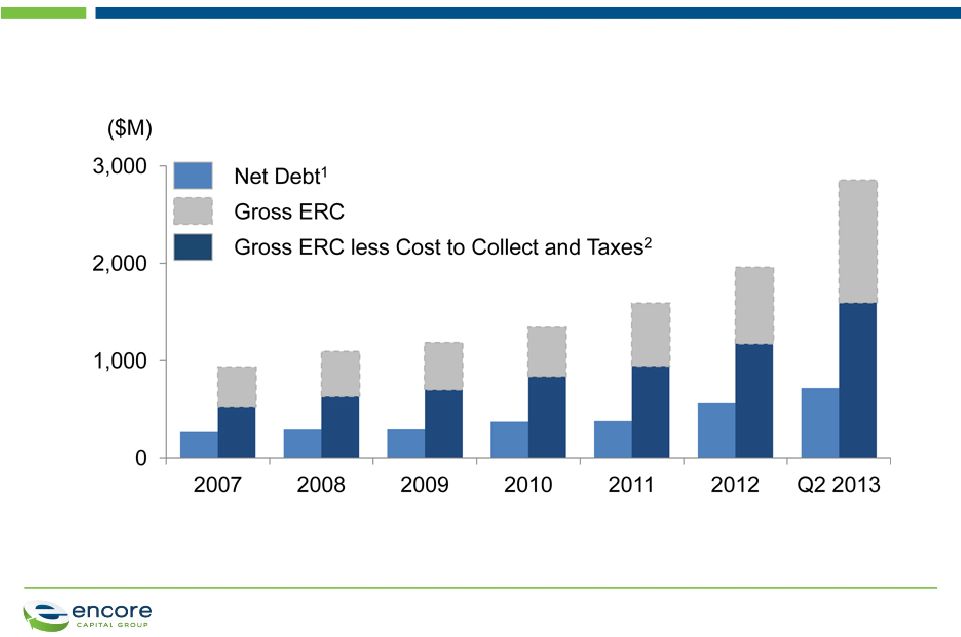

PROPRIETARY

WE HAVE A STRONG ABILITY TO QUICKLY RAISE CAPITAL WHICH IS

SUPPORTED BY OUR ESTIMATED REMAINING COLLECTIONS

18

Estimated Remaining Collections (ERC) vs. Net Debt

1. Includes revolver, term loan, senior, and net convertible debt less cash (excludes Propel debt) 2. Assumes

liquidation cost to collect of 30% and a tax rate of 39.2%; Q2 2013 values as of June 30, 2013. |

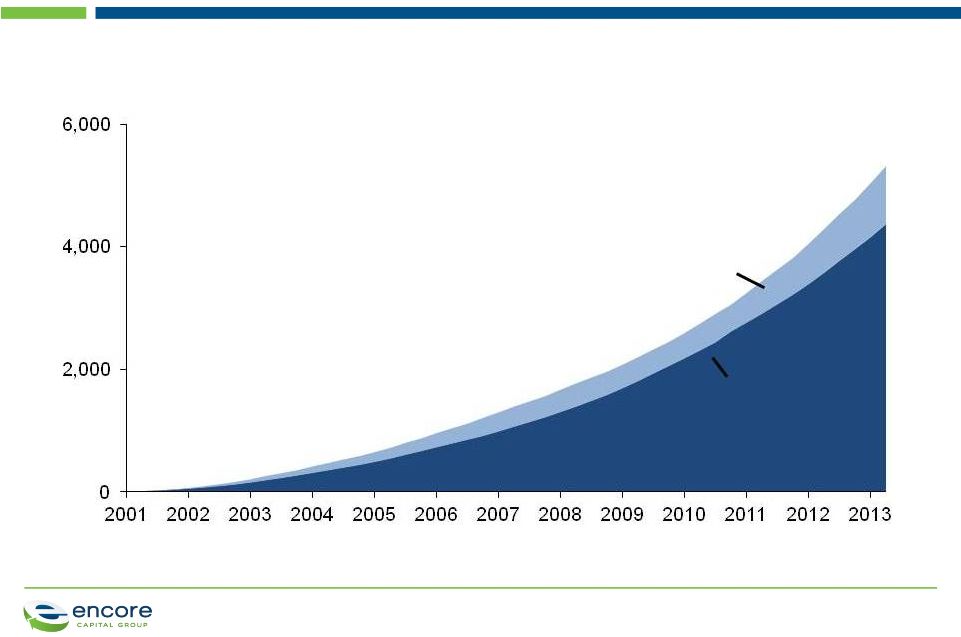

PROPRIETARY

WE BELIEVE THAT OUR CURRENT ESTIMATE OF REMAINING

COLLECTIONS IS CONSERVATIVE

19

Cumulative Collections -

initial expectation vs. actual

Actual Cash

Collections

Initial

Projections

($M) |

PROPRIETARY

OUR ABILITY TO RAISE ADDITIONAL CAPITAL ALLOWS US TO

PURSUE SUPPLEMENTAL GROWTH IN ADJACENT SPACES

20

–

No impact on ability to

purchase core US receivables

•

Propel facilities are incremental

to, and separate from, our core

debt facilities

•

We will continue to pursue and

deploy separate pools of capital

Note: Core debt includes the credit facility plus accordion

We have the debt markets expertise

to fund new opportunities...

…and structure our debt to

maximize flexibility for future growth

Separate Propel

facilities

Core debt

Total debt availability ($M) |

PROPRIETARY

OUR CAPITAL DEPLOYMENT STRATEGY FOCUSES ON DELIVERING

ATTRACTIVE AND SUSTAINABLE TOTAL SHAREHOLDER RETURN

21

All investments viewed through lens of

Total Shareholder Return

Deployment priorities

Reinvestments in core

receivables business

•

All investments bound by IRR guidelines

•

Maintain operational flexibility with a

range of core asset classes

Principles for capital deployment

Investments in

adjacent spaces

•

Prudent investment in adjacent spaces

which leverage our core competencies

Return of capital

to shareholders

•

Recognize there are times when best

investment is to return cash |

PROPRIETARY

New asset

classes

Bankrupt

accounts

Outsourcing

services

International

Secured

assets

Performing

assets

WE

HAVE

PURSUED

DEALS

AND

INITIATIVES

THAT

ALIGN

WITH

OUR

CORE BUSINESS

22

Expand

geographically

Focus on

bankruptcy

Cover

different

type of debt

$83.6M

investment

in BK paper

in 2012 |

PROPRIETARY

Largely satisfies our 2013

purchasing goals with

attractive returns

23

THE ASSET ACCEPTANCE DEAL IS WELL ALIGNED WITH OUR

STRATEGY AND ADDS $1 BILLION TO OUR ERC

Allows us to be selective in

purchases for the remainder

of the year

Able to leverage best

practices across the two

platforms to drive synergies |

PROPRIETARY

WE HAVE A STRONG TRACK RECORD ACQUIRING PORTFOLIOS

FROM OTHER DEBT PURCHASERS SIMILAR TO AACC

24

$100+M portfolio purchased in 2012

Results to date:

$238M

Results to date:

$101M

$90M portfolio purchased in 2005

Cash Collections ($M)

Cash Collections ($M) |

PROPRIETARY

WE BELIEVE WE CAN LEVERAGE OUR PLATFORM AND CAPABILITIES TO

REALIZE SUBSTANTIAL SYNERGY VALUE AT AACC

Lower cost structure: Leverage Encore's

lower cost platform to expand margins on cash

collections

2

Match Encore's

lower collection

cost in 9-12 months

Internal legal collections: Integrate AACC's

strong internal legal platform

to drive additional

overall operating efficiencies

3

Accelerate migration

to internal legal

platform by ~2 years

Source of value

Expected Impact

Deeper consumer insight and analytics:

More focused segmentation and targeting,

resulting in better collections

CCM target

of > 2.5x

1

25 |

PROPRIETARY

WE HAVE MADE SIGNIFICANT PROGRESS EXECUTING OUR PLANS

FOR PROPEL

26

Our plan

Existing

market

•

Working to penetrate the

80% of the Texas market

that doesn't use tax lien

transfers

1

What we've delivered

•

Developed & implemented

model for direct mailing

•

Started outbound calling

w/existing Encore facilities

New

markets

•

Lobbying to introduce

legislation in other states

that will create new markets

2

•

Successfully worked with

Nevada to pass legislation

•

Advancing legislative push

to other states

•

Purchased tax lien

certificates in three states

New

opportunities

•

Exploring alternative tax lien

models that will allow us to

expand into new markets

3 |

PROPRIETARY

RESULTING IN GROWTH IN THE SIZE OF OUR PORTFOLIO WHILE

MAINTAINING AN EXCEPTIONALLY LOW RISK PROFILE

27

•

$8,600 average balance

•

8-year term

•

6-year weighted average life

•

13-15% typical interest rate

Texas portfolio characteristics

•

$227,000 average property value

•

3.9% average LTV at origination

•

Less than 1% foreclosure rate

•

Zero losses

Propel portfolio size |

PROPRIETARY

Market leader in U.K. debt management

•

Over 14 years of collections growth

•

Operations in Great Britain and Ireland

Specializes in higher balance, “semi-performing”

(i.e., paying) accounts

•

Favorable repayment characteristics

Key statistics as of June 30, 2013:

•

£8.4B face-value of debt acquired for £761M

•

Statutory ERC of £1,043M

•

3.8M customer accounts

•

2013 H1 collections of £81M

•

2013 H1 capital deployment of

£84M

Cabot was the leading purchaser

of debt in the U.K. in 2012

CABOT IS THE LEADING PURCHASER OF DEBT IN THE U.K.

1. £31M funded by Anacap

For FY 2012

28

91

42

0

50

100

150

(£M)

Arrow

Lowell

Cabot

130

1 |

PROPRIETARY

ENCORE PROVIDES CABOT WITH SEVERAL SYNERGY

OPPORTUNITIES

Leverage

Encore's

operations

and know-

how

•

Enhance collections by leveraging

Encore's efficient operations,

including our operations in India

•

Leverage Encore's experience in

secondary and tertiary debt to

pursue new investments in the U.K.

•

Leverage Encore’s favorable

financing to fund growth

Leverage

Encore's

analytics

•

Deploy Encore's superior analytical

capabilities to the Cabot platform

•

Focus on improving account

segmentation and specialized

collection strategies

29 |

PROPRIETARY

ENCORE'S ACQUISITION OF CABOT WILL PROVIDE A VEHICLE TO

CONTINUE ITS STRONG EARNINGS GROWTH

Growing market

•

Encore can deploy capital in a growing market

Profitable market

•

Portfolio IRRs are strong and favorable

Timeline

•

Deal closed in Q3 of 2013

Encore Adjusted

EPS

•

Supports Encore's 15% long-term Adjusted EPS growth

1

30

1. Calculation of Adjusted EPS excludes one-time transaction and integration costs and

non-cash interest associated with the Company’s convertible debt offerings. For forward-

looking Adjusted EPS projections, such one-time costs or charges are not presently quantified

|

PROPRIETARY

WE ARE WELL POSITIONED TO MAINTAIN OUR MOMENTUM AND

CONTINUE DELIVERING TOP QUARTILE TSR

31

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

•

Specialized call

centers

•

Efficient international

operations

•

Internal legal

platform

Operational Scale

& Cost Leadership

2

•

Sustained success

at raising capital

-

Low cost of debt

-

Sustainable

borrowing capacity

and cash flow

generation

•

Prudent capital

deployment

Strong Capital

Stewardship

3

•

Consumer

intelligence

•

Data driven,

predictive modeling

•

Portfolio valuation at

consumer level

•

Consumer Credit

Research Institute

Superior

Analytics

1

•

Uniquely scalable

platform

•

Strategic investment

opportunities in

geographic and

paper type

adjacencies

Extendable

Business Model

4 |

PROPRIETARY

32

APPENDIX |

PROPRIETARY

RECONCILIATION OF ADJUSTED EBITDA

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note:

The

periods

3/31/07

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20.

All

periods

have

been

adjusted

to

show

discontinued

ACG

operations.

PROPRIETARY

33 |

PROPRIETARY

RECONCILIATION OF ADJUSTED EPS TO GAAP EPS

Six Months Ended June 30,

2013

2012

$

Per Diluted

Share

$

Per Diluted

Share

Net income from continuing operations

30,460

$1.24

37,096

$1.44

Adjustments:

Convertible notes non-cash interest and issuance

cost amortization, net of tax

1,000

$0.04

Acquisition related legal and advisory fees, net of

tax

4,980

$0.20

2,567

$0.10

Acquisition related integration and severance

costs, and consulting fees, net of tax

3,304

$0.13

Acquisition related other expenses, net of tax

2,198

$0.09

Adjusted income from continuing operations

41,942

$1.70

39,663

$1.54

34 |

PROPRIETARY

RECONCILIATION OF ADJUSTED OPERATING EXPENSES

2007

2008

2009

2010

2011

2012

H1

2012

H1

2013

GAAP total operating expenses, as

reported

$201,849

$216,900

249,782

$269,952

$328,566

$401,696

$194,203

$232,110

Adjustments:

Ascension Operating Costs

(14,801)

(13,369)

(13,218)

Stock-based compensation

expense

(4,287)

(3,564)

(4,384)

(6,010)

(7,709)

(8,794)

(4,805)

(5,180)

Tax lien business segment

operating expenses

(5,681)

(1,513)

(6,526)

Acquisition related legal and

advisory fees

(4,263)

(4,263)

(8,224)

Acquisition related integration and

severance costs, and consulting

fees

(5,455)

Adjusted operating expenses

$182,761

$199,967

$232,180

$263,942

$320,857

$382,958

$183,622

$206,725

35

Reconciliation of Adjusted Operating Cost to GAAP Operating Expenses

(Unaudited, In Thousands) |