Attached files

| file | filename |

|---|---|

| 8-K/A - ROSE 8K DUG EF PRESENTATION - NBL Texas, LLC | rose8-kadugppt.htm |

Exhibit 99.1

Learning, Innovating & Creating

“If it was easy, anybody could do it”

Rosetta Resources Inc.

September 18, 2013

Mark D. Petrichuk

Vice President, Corporate Reserves

& Technical Services

Forward-Looking Statements and Terminology Used

This presentation includes forward-looking statements, which give the Company's current expectations or forecasts of future events based

on currently available information. Forward-looking statements are statements that are not historical facts, such as expectations regarding

drilling plans, including the acceleration thereof, production rates and guidance, resource potential, incremental transportation capacity,

exit rate guidance, net present value, development plans, progress on infrastructure projects, exposures to weak natural gas prices,

changes in the Company's liquidity, changes in acreage positions, expected expenses, expected capital expenditures, and projected debt

balances. The assumptions of management and the future performance of the Company are subject to a wide range of business risks and

uncertainties and there is no assurance that these statements and projections will be met. There are risks and uncertainties associated

with the Company’s recent acquisition of Permian Basin assets. Factors that could affect the Company's business include, but are not

limited to: the risks associated with drilling of oil and natural gas wells; the Company's ability to find, acquire, market, develop, and

produce new reserves; the risk of drilling dry holes; oil and natural gas price volatility; derivative transactions (including the costs

associated therewith and the abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and

possible reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's assumptions

regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of exploitation expenditures;

operating hazards attendant to the oil and natural gas business; drilling and completion losses that are generally not recoverable from

third parties or insurance; potential mechanical failure or underperformance of significant wells; availability and limitations of capacity in

midstream marketing facilities, including processing plant and pipeline construction difficulties and operational upsets; climatic conditions;

availability and cost of material, supplies, equipment and services; the risks associated with operating in a limited number of geographic

areas; actions or inactions of third-party operators of the Company's properties; the Company's ability to retain skilled personnel; diversion

of management's attention from existing operations while pursuing acquisitions or dispositions; availability of capital; the strength and

financial resources of the Company's competitors; regulatory developments; environmental risks; uncertainties in the capital markets;

general economic and business conditions; industry trends; and other factors detailed in the Company's most recent Form 10-K, Form 10-

Q and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties materialize (or the

consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially

from those forecasted or expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements

except as required by law. For filings reporting year-end 2012 reserves, the SEC permits the optional disclosure of probable and possible

reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the term “net risked

resources” or “inventory” to describe the Company’s internal estimates of volumes of natural gas and oil that are not classified as proved

reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of unproved

resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk

of actually being realized by the Company. Estimates of unproved resources may change significantly as development provides

additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates.

on currently available information. Forward-looking statements are statements that are not historical facts, such as expectations regarding

drilling plans, including the acceleration thereof, production rates and guidance, resource potential, incremental transportation capacity,

exit rate guidance, net present value, development plans, progress on infrastructure projects, exposures to weak natural gas prices,

changes in the Company's liquidity, changes in acreage positions, expected expenses, expected capital expenditures, and projected debt

balances. The assumptions of management and the future performance of the Company are subject to a wide range of business risks and

uncertainties and there is no assurance that these statements and projections will be met. There are risks and uncertainties associated

with the Company’s recent acquisition of Permian Basin assets. Factors that could affect the Company's business include, but are not

limited to: the risks associated with drilling of oil and natural gas wells; the Company's ability to find, acquire, market, develop, and

produce new reserves; the risk of drilling dry holes; oil and natural gas price volatility; derivative transactions (including the costs

associated therewith and the abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and

possible reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's assumptions

regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of exploitation expenditures;

operating hazards attendant to the oil and natural gas business; drilling and completion losses that are generally not recoverable from

third parties or insurance; potential mechanical failure or underperformance of significant wells; availability and limitations of capacity in

midstream marketing facilities, including processing plant and pipeline construction difficulties and operational upsets; climatic conditions;

availability and cost of material, supplies, equipment and services; the risks associated with operating in a limited number of geographic

areas; actions or inactions of third-party operators of the Company's properties; the Company's ability to retain skilled personnel; diversion

of management's attention from existing operations while pursuing acquisitions or dispositions; availability of capital; the strength and

financial resources of the Company's competitors; regulatory developments; environmental risks; uncertainties in the capital markets;

general economic and business conditions; industry trends; and other factors detailed in the Company's most recent Form 10-K, Form 10-

Q and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties materialize (or the

consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially

from those forecasted or expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements

except as required by law. For filings reporting year-end 2012 reserves, the SEC permits the optional disclosure of probable and possible

reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the term “net risked

resources” or “inventory” to describe the Company’s internal estimates of volumes of natural gas and oil that are not classified as proved

reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of unproved

resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk

of actually being realized by the Company. Estimates of unproved resources may change significantly as development provides

additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates.

2

Safety Moment

Can You Spot the Hazard?

3

Safety Moment

Be Seen….Always have your headlights ON!

4

During the last three conferences, we outlined some comments on

Rosetta’s approach in the Eagle Ford …

Rosetta’s approach in the Eagle Ford …

5

• Focus on understanding the rocks; appreciate your technical staffs!

• Faith, hope & luck are not substitutes for brains, initiative & work ethic!

• Focus on quality over quantity; know the difference!

• They are called sweet spots for a reason!

• Focus on optimizing full scale development; not just the next well

• It does you absolutely no good to drill your best well last!

• Focus on profitability

• Admire your activity but track your production and count your pennies!

• Focus on optionality

• There is not a better feeling in the world than knowing you have your future well in hand!

• Focus on ongoing refinement of well spacing and well recoveries

• You rarely go wrong when you grow what you know in your own backyard!

So, building on last year’s message, Rosetta’s Eagle Ford

development plan is leaving no stone unturned in our portfolio …

development plan is leaving no stone unturned in our portfolio …

6

• Focus on ongoing refinement of well spacing and well recoveries

• You rarely go wrong when you grow what you know in your own backyard!

q LEARNING

q INNOVATING

q CREATING

Rosetta Resources Asset Overview

|

Area

|

Window

|

|

Gates Ranch

|

|

|

Non-Gates Ranch

|

|

|

Encinal Area

|

Eagle Ford

64,650 Net Acres

Gaines Co.

Midland Basin - Exploratory

13,124 Net Acres

Reeves Co.

Delaware Basin - Delineated

40,182 Net Acres

7

Rosetta is no longer a pure-

play Eagle Ford producer.

Our “backyard” just got bigger.

play Eagle Ford producer.

Our “backyard” just got bigger.

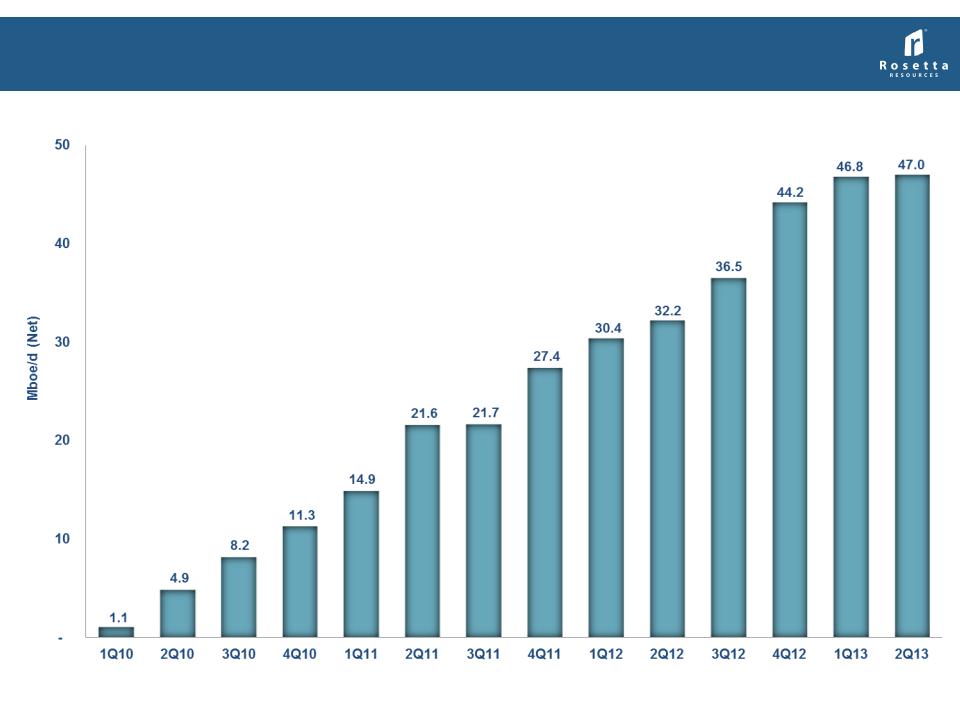

History of Growing Production

8

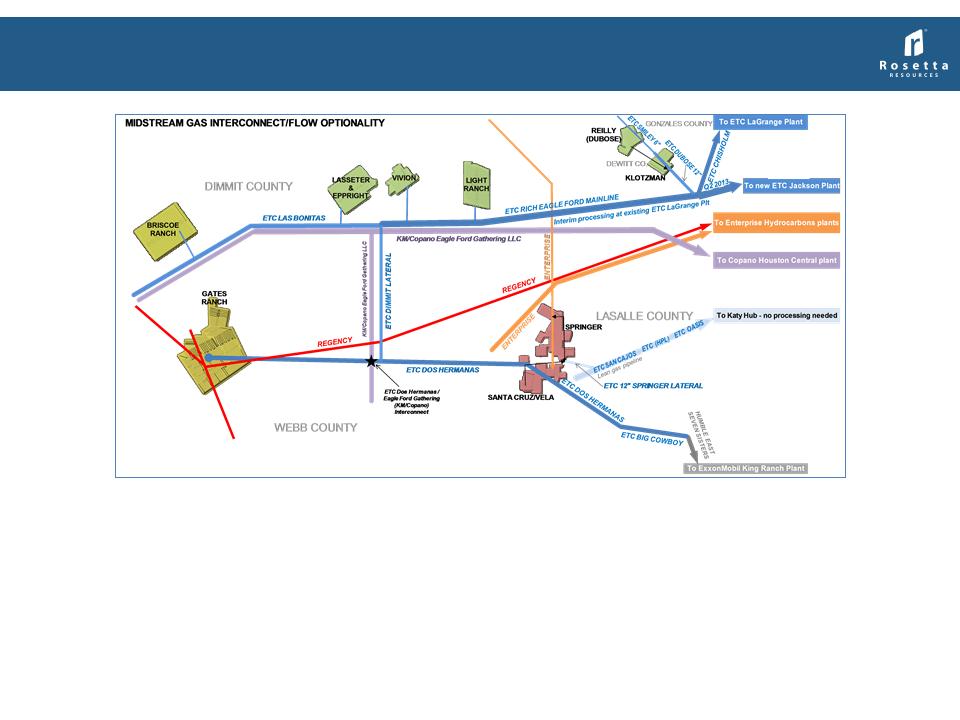

Eagle Ford Multiple Takeaway Options

9

• Excess capacity to move our product

• Multiple take points that provide flow optionality

• Marketing team works closely with operations to insure that

Rosetta will always have capacity to move production to market

Rosetta will always have capacity to move production to market

Gates Ranch

|

Average Well Characteristics

|

|

|

Well Costs

|

$6.5 - $7.0 MM

|

|

Spacing

|

55 acres (475 feet apart)

|

|

Composite EUR

|

1.67 MMBoe

|

|

Condensate Yield

|

65 Bbls/MMcf

|

|

NGL Yield

|

110 Bbls/MMcf

|

|

Shrinkage

|

23%

|

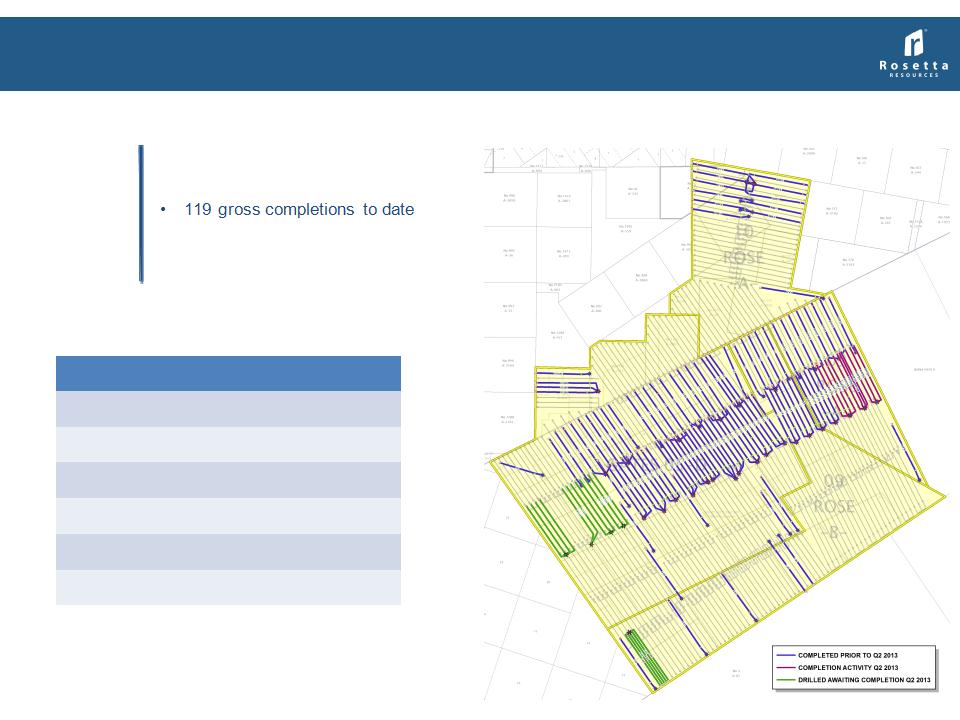

Summary

6/30/2013

• 26,230 net acres in Webb County

• 313 net well locations remaining1

18 wells drilled yet to be completed

2Q 2013: 11 completions

1. Under current 55-acre spacing assumptions

10

The more you drill, the more you learn …

11

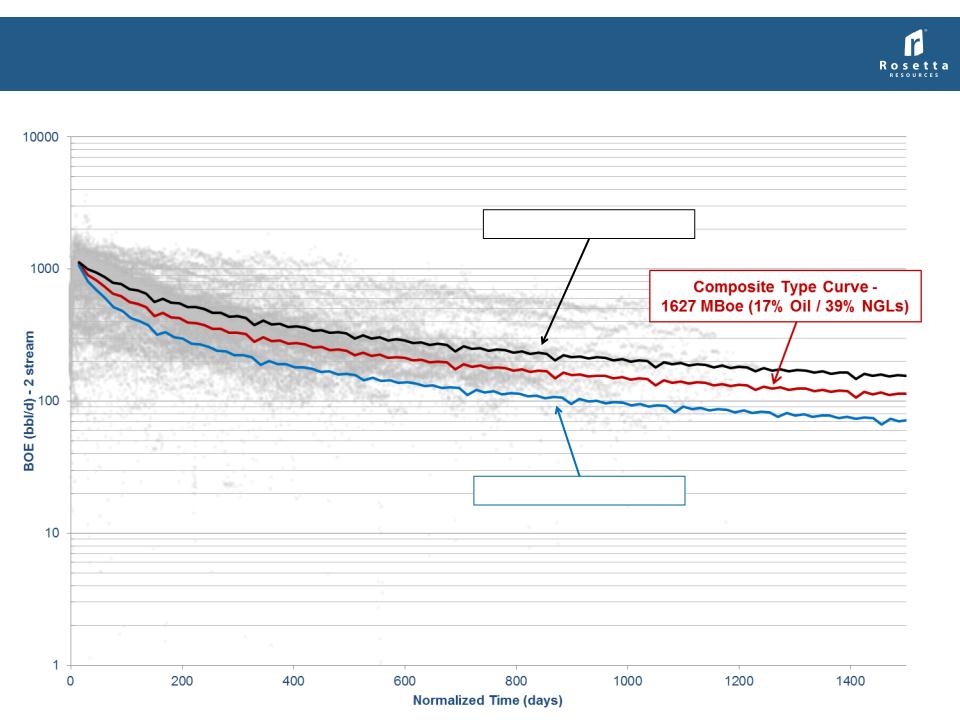

Gates Ranch Type Curves

South Type Curve

North Type Curve

55 wells

Our largest continuous group

of producing wells spaced on

55 acres

of producing wells spaced on

55 acres

Well Performance on 55 acres

Compared to similar offsetting wells spaced at 100 acres

Compared to similar offsetting wells spaced at 100 acres

The 55 wells are performing in

line with comparable offsetting

wells drilled and completed early

in the development of the area

and spaced on 100 acres…

line with comparable offsetting

wells drilled and completed early

in the development of the area

and spaced on 100 acres…

12

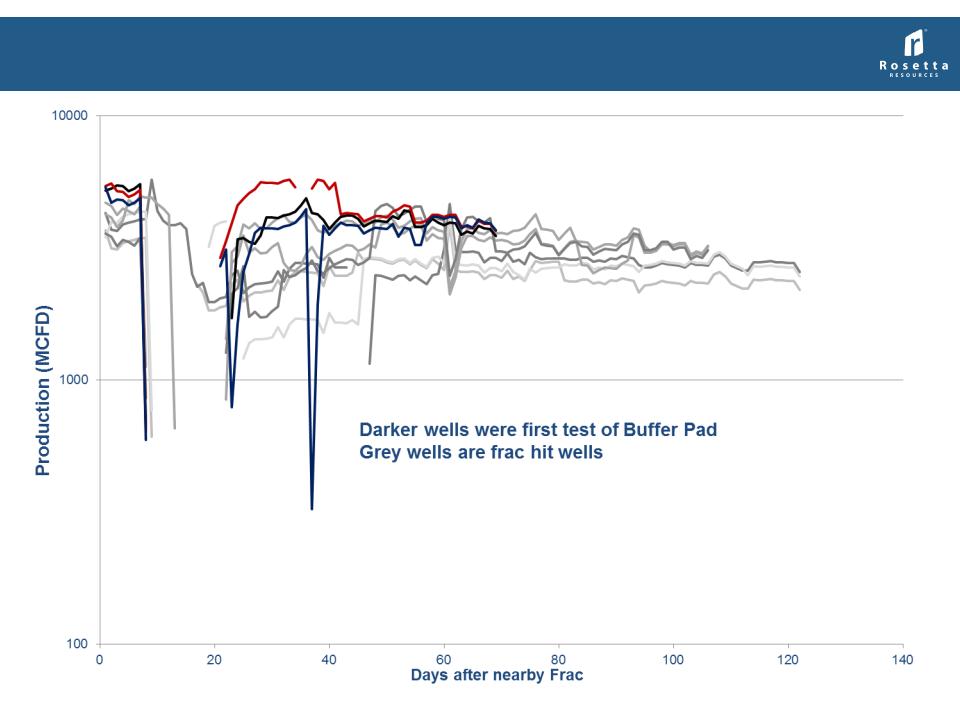

LEARNING: “Buffer Pad” Concept

• Purpose is to reduce production

downtime due to completion activities

downtime due to completion activities

• Wells in blue area remain shut-in after

their completion

their completion

• Producing wells in light orange area

shut-in during completion activities

shut-in during completion activities

• Wells in dark orange being completed

• Wells in blue area are flowed back

after current completions are

completed

after current completions are

completed

• Repeat for next pad completion

13

Frac Hit wells vs. Buffer Pad wells

14

Frac Hit wells vs. Shut In wells

15

Current Eagle Ford Strategy

16

Lower EF

Buda

Current Resource

CREATING: Upper Eagle Ford Potential

17

Gates Ranch

“Upper Eagle Ford” Pilots

“Upper Eagle Ford” Pilots

18

475

’

’

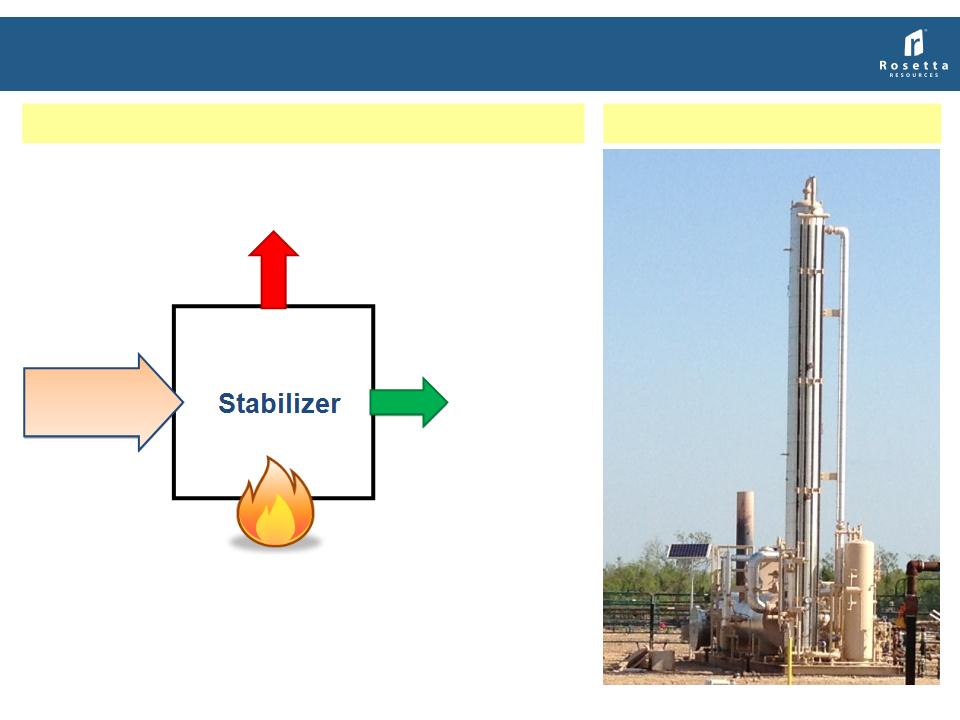

LEARNING: Condensate Stabilization

Inlet Stream

≈18 RVP*

Condensate

≈ 9 RVP*

GAS & NGL

*RVP = Reid Vapor Pressure

Stabilizer - Gates Ranch

Pipeline Specs require RVP* ≤ 9

19

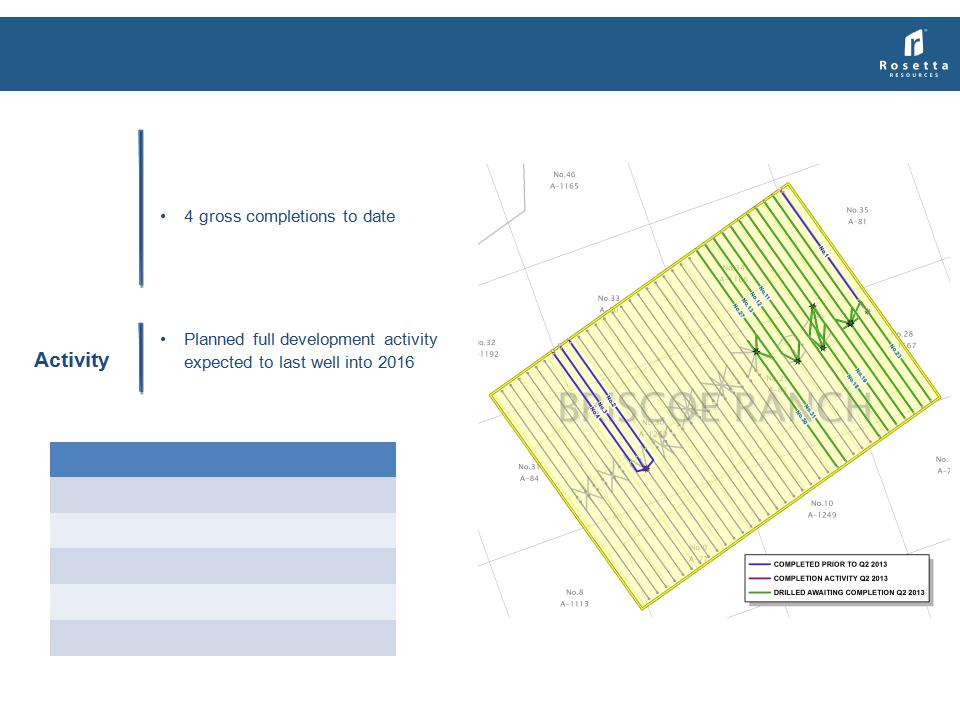

Summary

6/30/2013

Briscoe Ranch

• 3,545 net acres in southern

Dimmit County

Dimmit County

• 64 net well locations remaining

Future

|

Average Well Characteristics

|

|

|

Well Costs

|

$6.5 - $7.0 MM

|

|

Spacing

|

50 acres (425 feet apart)

|

|

Condensate Yield

|

100 Bbls/MMcf

|

|

NGL Yield

|

130 Bbls/MMcf

|

|

Shrinkage

|

23%

|

19 wells drilled yet to be completed

20

INNOVATING: Rosetta’s Pad Drilling History

21

Drilling Time Performance

INNOVATING & CREATING: Lopez Farm-In

• 505 net acres in Live Oak County

• Farm-In from Killam Oil

• BPO: 100% WI, 75% NRI

• APO: 65% WI, 48.75% NRI

• 7-day gross stabilized IP 1,966 Boe/d

(46% oil / 24% NGLs)

(46% oil / 24% NGLs)

• 7 net well locations remaining

Summary

6/30/2013

|

Average Well Characteristics

|

|

|

Well Costs

|

$7.5 - $8.0 MM

|

|

Spacing

|

~ 50 acres (400 feet apart)

|

2Q 2013: 1 completion

23

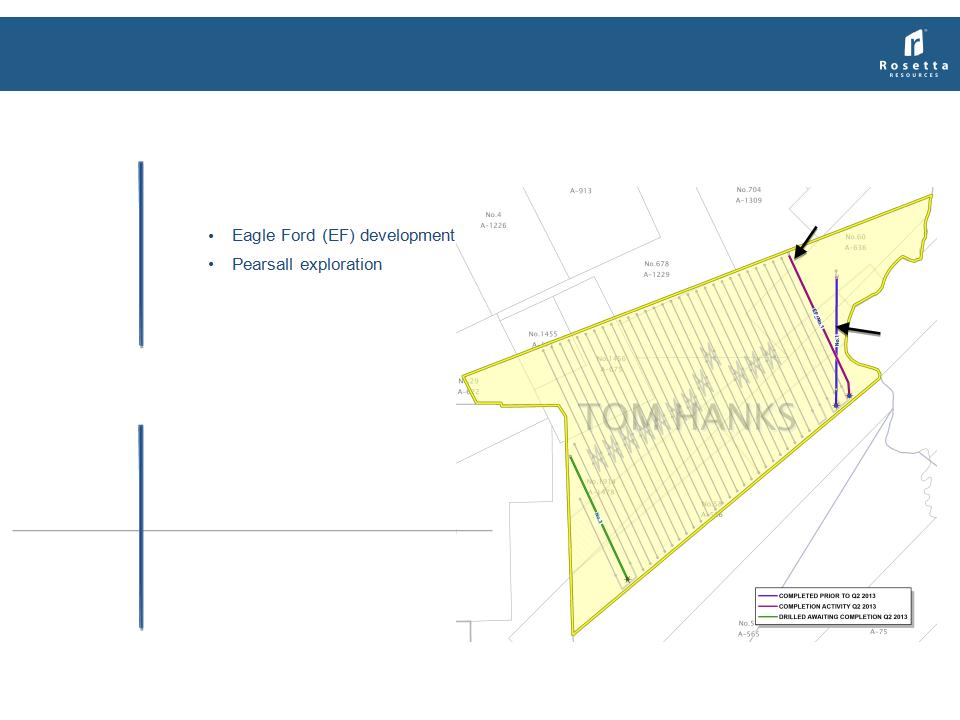

Tom Hanks

• 3,461 net acres in LaSalle County

• 2 gross total completions

• Well Costs $5.5 - $7.0 MM

• ~ 50-acre spacing (~400 feet apart)

Summary

6/30/2013

1 EF well drilled yet to be completed

2Q 2013: 1 EF completion

Eagle

Ford

• 1 completion - discovery well

• 7-day stabilized IP 657 Boe/d (91% oil)

• 56 net well locations remaining

• 1 well drilled awaiting completion

Pearsall

• 1 completion - exploration

• Un-stabilized test rate at 5 MMcf/d

• Gas content includes 1% H2S

Pearsall

Well

Eagle Ford

Well

24

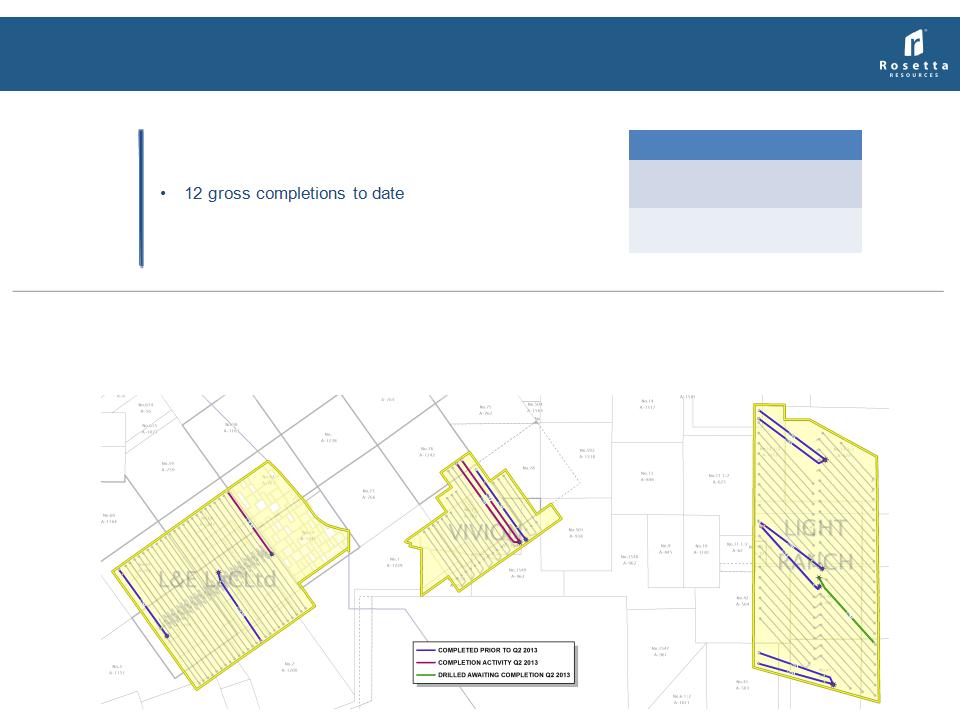

Summary

6/30/2013

Central Dimmit County Area

• 8,496 net acres located in Dimmit County

• 104 net well locations remaining

2Q 2013: Total 3 completions

|

Average Well Costs

|

|

|

Light Ranch

and Vivion

|

$5.5 - $6.0 MM

|

|

Lasseter &

Eppright

|

$6.5 - $7.0 MM

|

3 completions

2Q 2013: 1 completion

2Q 2013: 1 completion

Lasseter & Eppright

Light Ranch

6 total completions

1 well drilled yet to be completed

1 well drilled yet to be completed

Vivion

3 completions

2Q 2013: 2 completions

2Q 2013: 2 completions

25

|

|

Net acres

|

Drilling rig

activity |

Wells

completed |

Wells awaiting

completion |

Well Spacing

|

Remaining

locations |

Avg Cost /

Well ($M) |

Rig years

(16 wells/year) |

|

Gates Ranch

(75% NRI) |

26,230

|

2 - 3

|

119

|

18

|

55

|

313

|

$6.5 - $7.0

|

20

|

|

Briscoe Ranch

(81.3% NRI) |

3,545

|

1

|

4

|

19

|

50

|

64

|

$6.5 - $7.0

|

4

|

|

Central Dimmit1

(75 - 77% NRI) |

8,496

|

1

|

12

|

1

|

60

|

104

|

$5.5 - $7.0

|

7

|

|

Karnes Trough2

(75 - 80% NRI) |

1,902

|

-

|

19

|

6

|

60

|

0

|

$7.5 - $8.0

|

0

|

|

Tom Hanks

(77% NRI) |

3,461

|

0 - 1

|

1

|

1

|

50

|

56

|

$5.5 - $7.0

|

3

|

|

Lopez

(75% NRI) |

505

|

1

|

1

|

0

|

50

|

7

|

$7.5 - $8.0

|

1

|

|

Undelineated Acreage3

(75 - 77% NRI) |

6,754

|

0 - 1

|

0

|

0

|

50 - 70

|

47

|

$5.5 - $7.0

|

3

|

|

Encinal

(75 - 77% NRI) |

13,756

|

-

|

4

|

0

|

80

|

178

|

$6.5 - $7.0

|

11

|

|

Total Eagle Ford

|

64,650

|

5 - 6

|

160

|

45

|

50 - 80

|

769

|

$5.5 - $8.0

|

48

|

|

Years remaining

|

|

|

|

|

|

|

|

13

(60 wells per year)

|

Eagle Ford Inventory

+/- 770 net wells -- remaining as of 8/1/2013

+/- 770 net wells -- remaining as of 8/1/2013

1. Central Dimmit includes L&E, Vivion and Light Ranch

2. Karnes Trough area includes Dubose and Klotzman

3. Denotes roughly 6,800 net acres in the liquids window of the play

26

The current project inventory reflects our analysis on

reduced well spacing

reduced well spacing

50 to

55-acre

well spacing

(2Q12 Call)

65-acre

well spacing

(3Q11 Call)

100-acre

well spacing

(2009)

Completion pace of 60 wells per year

used as an example to show the true

“running room” of the portfolio

used as an example to show the true

“running room” of the portfolio

The current project inventory reflects our analysis on

reduced well spacing

reduced well spacing

65-acre

well spacing

(3Q11 Call)

100-acre

well spacing

(2009)

Completion pace of 60 wells per year

used as an example to show the true

“running room” of the portfolio

used as an example to show the true

“running room” of the portfolio

Upper

Eagle Ford

Potential

Eagle Ford

Potential

Upper Eagle Ford?

50 to

55-acre

well spacing

(2Q12 Call)

So, building on last year’s message, Rosetta’s Eagle Ford

development plan is leaving no stone unturned in our portfolio…

development plan is leaving no stone unturned in our portfolio…

29

• Focus on ongoing refinement of well spacing and well recoveries

• You rarely go wrong when you grow what you know in your own backyard!

• Be flexible, adjust to changing conditions

• Eagle Ford Shale is like Texas weather, it will change tomorrow

• Take risks and try something new

• You cannot make room for nay sayers in your organization

• Don’t be complacent - Test new ideas!

• Hidden value will stay hidden until you uncover it

But you ain’t seen nothing yet!