Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d598382d8k.htm |

ENCORE CAPITAL GROUP, INC.

THE 4TH ANNUAL CREDIT SUISSE SMALL/MID

CAP CONFERENCE

September 18, 2013

Exhibit 99.1 |

PROPRIETARY

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words

“will,” “may,”

“believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions, constitute “forward-looking statements”

within the meaning of the Private

Securities Litigation Reform Act of 1995 (the “Reform Act”).

These statements may

include, but are not limited to, statements regarding our future

operating results,

earnings per share, and growth.

For all “forward-looking statements,”

the Company

claims the protection of the safe harbor for forward-looking statements

contained in the Reform Act.

Such forward-looking statements involve risks, uncertainties and other

factors which may cause actual results, performance or achievements of the Company

and its subsidiaries to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in

the reports filed by the Company with the Securities and Exchange

Commission, including the most recent reports on Forms 10-K and

10-Q, as they may be amended from time to time. The Company disclaims

any intent or obligation to update these forward-looking statements.

|

PROPRIETARY

ENCORE IS A LEADING PLAYER IN THE CONSUMER DEBT BUYING

AND RECOVERY INDUSTRY

3

We deploy capital to acquire

delinquent consumer receivables...

... and generate predictable cash

flows over a multi-year time horizon

Total Cash

Collections

Portfolio

Purchase

Price

Illustrative cash collections

2-3x

Years

1-2

Years

3-4

Years

5-6

Years

7-8

1

in

7

American

consumers

have accounts with us

3.1

million

consumers

have

satisfied their obligations

$2.7

billion

in

estimated

remaining collections

27%

Adjusted

EBITDA

†

5-year

compound annual growth rate

3,530

employees

worldwide

$1

billion

collected

in

the

last

twelve months

†

Adjusted EBITDA is a non-GAAP number which the Company considers to be and

utilizes as a meaningful indicator of operating performance. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of this presentation.

|

PROPRIETARY

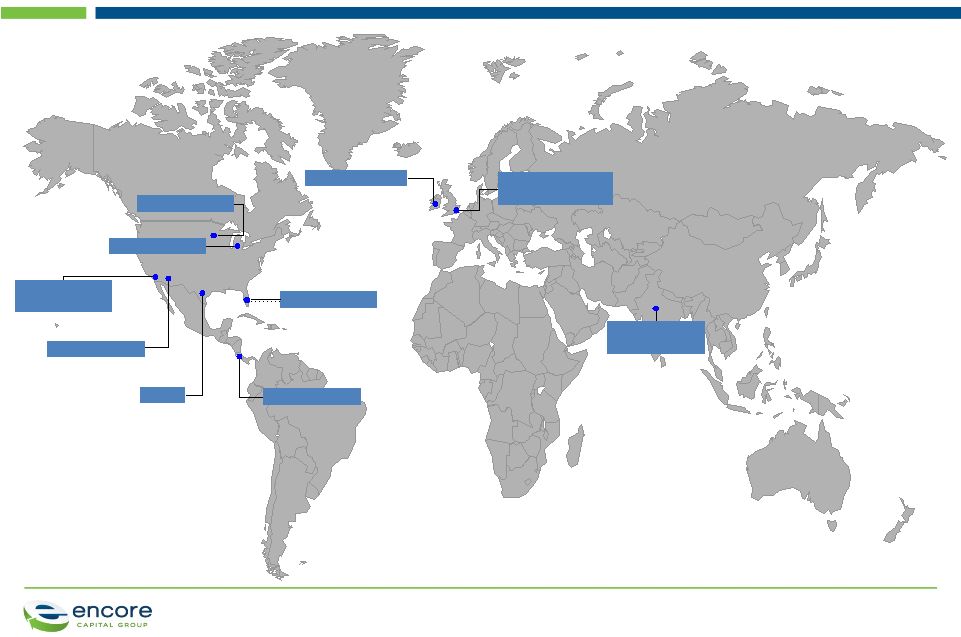

WITH A STRONG DOMESTIC AND INTERNATIONAL PRESENCE

4

St Cloud, MN

Phoenix, AZ

New Delhi, India

Call Center /

Technology Site

Call Center Site

Call Center Site

San Diego, CA

Headquarters /

Call Center Site

Call Center Site

Costa Rica

San Antonio, TX

Propel

Cabot HQ /

Call Center Sites

West Malling, UK

Stratford-upon-Avon, UK

Call Center Site

Dublin, Ireland

Tampa, FL

Call Center Site

Warren, MI

Call Center Site |

PROPRIETARY

Contingency

collection agency

Collection

time frame

•

4-6 months

Consumer

experience

Pressure

•

Artificial deadlines

•

Multiple

exchanges of

sensitive data

•

Counterproductive

incentives

Outcome

•

Consumer is

confused and

frustrated

ENCORE PROVIDES A PRINCIPLED AND ESSENTIAL SERVICE

5

•

84 months to

recover financially

Partnership

•

Create partnership

strategy and set goals

•

Tailor solutions to

individuals

•

Single point of contact

•

Maximizes repayment

likelihood, and

ensures fair treatment

Relationship is

transactional

•

Attempt to collect during

initial delinquency cycle

•

Consumer is “charged-

off”

by issuer on day

181 of cycle

•

No longer considered a

“customer”

by creditor

Original creditor |

PROPRIETARY

OUR BUSINESS PRINCIPLES ARE BUILT ON TREATING CONSUMERS

FAIRLY AND WITH RESPECT

6

Understanding

our consumers

•

Acknowledging limitations of our consumers’

household balance sheets to align recovery plans

•

Deploying specialized surveys to test consumer

satisfaction

Making focused

investments

•

Built specialized non-collections work groups to serve

consumer needs

•

Established Consumer Credit Research Institute to

better understand the financially stressed consumer

Improving

consumer

experience

•

Living the Consumer Bill of Rights

•

Creating resources and directing financially stressed

consumers to best external references

•

Founded Consumer Experience Council |

PROPRIETARY

ENCORE HAS DELIVERED A TRACK RECORD OF STRONG,

SUSTAINABLE FINANCIAL RESULTS

7

1. Cost to Collect is Adjusted Operating Expenses / Dollar Collected. See

Reconciliation of Adjusted Operating Expenses to GAAP Total Operating

Expenses at the end of this presentation. 2. Adjusted EBITDA is a

non-GAAP number which the Company considers to be and utilizes as a meaningful indicator of operating performance. See Reconciliation of Adjusted EBITDA to GAAP Net

Income at the end of this presentation. 3. Per Fully Diluted Share from Continuing

Operations Note:

Growth

rate

percentages

for

Cash

Collections,

Adjusted

EBITDA,

and

EPS

signify

compounded

annual

growth

rate

from

2007

-

2012

Strong business

fundamentals...

Cash Collections ($M)

12

948

11

761

10

604

09

487

08

398

07

355

+22%

Cost to Collect

1

(%)

12

40.4

11

42.2

10

43.7

09

47.6

08

50.2

07

51.5

-1100 BPS

...driving

profitable

growth

Adjusted EBITDA

2

($M)

12

577

11

444

10

343

09

260

08

205

07

175

+27%

Earnings Per Share

3

($)

+42%

12

3.04

11

2.36

10

1.89

09

1.28

08

0.55

07

0.52 |

PROPRIETARY

AND HAS CONTINUED TO BUILD UPON THIS PERFORMANCE WITH

STRONG RESULTS THIS YEAR

H1 2013

H1 2012

Increase/

(Decrease)

Collections

$549

$472

16%

Revenue

$301

$268

12%

Cost to collect

1

37.7%

38.9%

(120 bps)

Adjusted EBITDA

2

$352

$292

21%

Adjusted EPS

3

$1.70

$1.54

10%

8

1. Cost

to

Collect

is

Adjusted

Operating

Expenses

/

Dollar

Collected.

See

Reconciliation

of

Adjusted

Operating

Expenses

to

GAAP

Total

Operating

Expenses

at

the

end

of

this

presentation.

2.

Adjusted EBITDA is a non-GAAP number which the Company considers to be and

utilizes as a meaningful indicator of operating performance. See Reconciliation of Adjusted EBITDA to GAAP

Net Income at the end of this presentation. 3. See reconciliation of Adjusted EPS

to GAAP EPS at the end of this presentation. Year over year financial

results |

PROPRIETARY

Estimated Remaining Collections in core receivables

ENCORE HAS RAPIDLY GAINED SCALE AND POSITIONED ITSELF

FOR SUSTAINED GROWTH

9

($M) |

PROPRIETARY

THIS SCALE HAS BEEN CREATED BY MARKET LEADING INVESTMENTS

10

Capital deployed in core receivables |

PROPRIETARY

ENCORE HAS DELIVERED INDUSTRY LEADING TOTAL SHAREHOLDER

RETURN OVER THE PAST 5+ YEARS

11

Total Shareholder Return (Dec. 2007-

Aug. 2013)

2%

NASDAQ

Financial 100:

30%

Encore Capital:

8%

S&P SmallCap 600:

(%)

6%

Russell 2000: |

PROPRIETARY

New asset

classes

Bankrupt

accounts

Outsourcing

services

International

Secured

assets

Performing

assets

WE HAVE PURSUED DEALS AND INITIATIVES THAT ALIGN WITH

OUR CORE BUSINESS

12

Expand

geographically

Focus on

bankruptcy

Cover

different

type of debt |

PROPRIETARY

Largely satisfies our 2013

purchasing goals with

attractive returns

13

THE ASSET ACCEPTANCE DEAL IS WELL ALIGNED WITH OUR

STRATEGY AND ADDS $1 BILLION TO OUR ERC

Allows us to be selective in

purchases for the remainder

of the year

Able to leverage best

practices across the two

platforms to drive synergies |

PROPRIETARY

WE HAVE MADE SIGNIFICANT PROGRESS EXECUTING OUR PLANS

FOR PROPEL

14

Our plan

Existing

market

•

Working to penetrate the

80% of the Texas market

that doesn't use tax lien

transfers

1

What we've delivered

•

Developed & implemented

model for direct mailing

•

Started outbound calling

w/existing Encore facilities

New

markets

•

Lobbying to introduce

legislation in other states

that will create new markets

2

•

Successfully worked with

Nevada to pass legislation

•

Advancing legislative push

to other states

•

Purchased tax lien

certificates in three states

New

opportunities

•

Exploring alternative tax lien

models that will allow us to

expand into new markets

3 |

PROPRIETARY

Market leader in U.K. debt management

•

Over 14 years of collections growth

•

Operations in Great Britain and Ireland

Specializes in higher balance, “semi-

performing”

(i.e., paying) accounts

•

Favorable repayment characteristics

Key statistics as of June 30, 2013:

•

£8.4B face-value of debt acquired for

£761M

•

Statutory ERC of £1,043M

•

3.8M customer accounts

•

2013 H1 collections of £81M

•

2013 H1 capital deployment of

£84M

CABOT IS THE LEADING PURCHASER OF DEBT IN THE U.K.

15

Leverage

Encore's

operations

and know-

how

•

Enhance collections by

leveraging Encore's efficient

operations, including our

operations in India

•

Leverage Encore's experience

in secondary and tertiary debt

to pursue new investments in

the U.K.

•

Leverage Encore’s favorable

financing to fund growth

Leverage

Encore's

analytics

•

Deploy Encore's superior

analytical capabilities to the

Cabot platform

•

Focus on improving account

segmentation and specialized

collection strategies |

PROPRIETARY

WE ARE WELL POSITIONED TO MAINTAIN OUR MOMENTUM AND

CONTINUE DELIVERING TOP QUARTILE TSR

16

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

•

Specialized call

centers

•

Efficient international

operations

•

Internal legal

platform

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

•

Consumer

intelligence

•

Data driven,

predictive modeling

•

Portfolio valuation at

consumer level

•

Consumer Credit

Research Institute

Superior

Analytics

1

•

Uniquely scalable

platform

•

Strategic investment

opportunities in

geographic and

paper type

adjacencies

Extendable

Business Model

4 |

PROPRIETARY

17

APPENDIX |

PROPRIETARY

RECONCILIATION OF ADJUSTED EBITDA

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note: The periods 3/31/07 through 12/31/08 have been adjusted to

reflect the retrospective application of ASC 470-20. All periods have been

adjusted to show discontinued ACG operations. PROPRIETARY

18 |

PROPRIETARY

RECONCILIATION OF ADJUSTED EPS TO GAAP EPS

Six Months Ended June 30,

2013

2012

$

Per Diluted

Share

$

Per Diluted

Share

Net income from continuing operations

30,460

$1.24

37,096

$1.44

Adjustments:

Convertible notes non-cash interest and issuance

cost amortization, net of tax

1,000

$0.04

Acquisition related legal and advisory fees, net of

tax

4,980

$0.20

2,567

$0.10

Acquisition related integration and severance

costs, and consulting fees, net of tax

3,304

$0.13

Acquisition related other expenses, net of tax

2,198

$0.09

Adjusted income from continuing operations

41,942

$1.70

39,663

$1.54

19 |

PROPRIETARY

RECONCILIATION OF ADJUSTED OPERATING EXPENSES

2007

2008

2009

2010

2011

2012

H1

2012

H1

2013

GAAP total operating expenses, as

reported

$201,849

$216,900

249,782

$269,952

$328,566

$401,696

$194,203

$232,110

Adjustments:

Ascension Operating Costs

(14,801)

(13,369)

(13,218)

Stock-based compensation

expense

(4,287)

(3,564)

(4,384)

(6,010)

(7,709)

(8,794)

(4,805)

(5,180)

Tax lien business segment

operating expenses

(5,681)

(1,513)

(6,526)

Acquisition related legal and

advisory fees

(4,263)

(4,263)

(8,224)

Acquisition related integration and

severance costs, and consulting

fees

(5,455)

Adjusted operating expenses

$182,761

$199,967

$232,180

$263,942

$320,857

$382,958

$183,622

$206,725

20

Reconciliation of Adjusted Operating Cost to GAAP Operating Expenses

(Unaudited, In Thousands) |