Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SAExploration Holdings, Inc. | v355174_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - SAExploration Holdings, Inc. | v355174_ex99-1.htm |

| EX-99.3 - EXHIBIT 99.3 - SAExploration Holdings, Inc. | v355174_ex99-3.htm |

September 2013 S AFETY . A CQUISITION . E XPERIENCE . NASDAQ: SAEX; SAEXW Exhibit 99.2

T HIS PRESENTATION INCLUDES CERTAIN FORWARD - LOOKING STATEMENTS , INCLUDING STATEMENTS REGARDING FUTURE FINANCIAL PERFORMANCE , FUTURE GROWTH AND FUTURE ACQUISITIONS . T HESE STATEMENTS ARE BASED ON SAE MANAGEMENTS ’ CURRENT EXPECTATIONS OR BELIEFS AND ARE SUBJECT TO UNCERTAINTY AND CHANGES IN CIRCUMSTANCES . A CTUAL RESULTS MAY VARY MATERIALLY FROM THOSE EXPRESSED OR IMPLIED BY THE STATEMENTS HEREIN DUE TO CHANGES IN ECONOMIC , BUSINESS , COMPETITIVE AND / OR REGULATORY FACTORS , AND OTHER RISKS AND UNCERTAINTIES AFFECTING THE OPERATION OF SAE’ S BUSINESS . T HESE RISKS , UNCERTAINTIES AND CONTINGENCIES INCLUDE : FLUCTUATIONS IN THE LEVELS OF EXPLORATION AND DEVELOPMENT ACTIVITY IN THE OIL AND GAS INDUSTRY ; THE VOLATILITY OF OIL AND NATURAL GAS PRICES ; DEPENDENCE UPON ENERGY INDUSTRY SPENDING ; DISRUPTIONS IN THE GLOBAL ECONOMY ; GLOBAL FACTORS INCLUDING POLITICAL AND MILITARY UNCERTAINTIES ; INDUSTRY COMPETITION ; DELAYS , REDUCTIONS OR CANCELLATIONS OF SERVICE CONTRACTS ; HIGH FIXED COSTS OF OPERATIONS ; OPERATIONAL DISRUPTIONS AND EXTERNAL FACTORS AFFECTING OUR CREWS SUCH AS WEATHER INTERRUPTIONS AND INABILITY TO OBTAIN LAND ACCESS RIGHTS OF WAY ; REDUCED UTILIZATION ; WHETHER IT ENTERS INTO TURNKEY OR TERM CONTRACTS ; CREW PRODUCTIVITY ; LIMITED NUMBER OF CUSTOMERS ; CREDIT RISK RELATED TO ITS CUSTOMERS ; THE AVAILABILITY OF CAPITAL RESOURCES ; ABILITY TO RETAIN KEY EXECUTIVES ; CURRENCY FLUCTUATIONS ; COURT DECISIONS AND REGULATORY RULINGS ; THE POTENTIAL DELISTING OF SAE’ S COMMON STOCK ON NASDAQ, PASSAGE OF NEW , OR INTERPRETATION OF EXISTING , ENVIRONMENTAL LAWS AND REGULATIONS ; AND OTHER FACTORS SET FORTH IN SAE’ S FILINGS WITH THE S ECURITIES AND E XCHANGE C OMMISSION . T HE INFORMATION SET FORTH HEREIN SHOULD BE READ IN LIGHT OF SUCH RISKS . SAE IS NOT UNDER ANY OBLIGATION TO , AND EXPRESSLY DISCLAIMS ANY OBLIGATION TO , UPDATE OR ALTER ITS FORWARD - LOOKING STATEMENTS , WHETHER AS A RESULT OF NEW INFORMATION , FUTURE EVENTS , CHANGES IN ASSUMPTIONS OR OTHERWISE . S AFE H ARBOR 2

C OMPANY O VERVIEW 3 H ISTORY • F OUNDED IN 2006 IN P ERU • R APID GROWTH THROUGH INTERNAL AND ACQUISITION - DRIVEN EXPANSION • D EEP INDUSTRY KNOWLEDGE WITH 85+ YEARS OF COMBINED EXECUTIVE EXPERIENCE • W ENT PUBLIC IN J UNE 2013 B LUE - CHIP C USTOMER BASE • R EDUCE CUSTOMERS ’ S EXPLORATION RISK WITH DEDICATION TO SAFETY AND EFFICIENCY • U TILIZE LOGISITICS EXPERTISE TO PROVIDE A FULL RANGE OF 2D, 3D AND 4D LAND AND SHALLOW WATER MARINE SEISMIC DATA SERVICES • N O SPECULATIVE SHOOTING - 100% OF REVENUE IS EARNED ON A FULLY - FUNDED , CONTRACTED BASIS • I NVEST IN LEADING - EDGE TECHNOLOGY - $65 MILLION IN NEW EQUIPMENT CAPEX (2011 - 2013) S TRATEGY • S PECIALIZES IN LOGISTICALLY - COMPLEX , CHALLENGING ENVIRONMENTS • F OCUSES ON N ORTH A MERICA , S OUTH A MERICA , AND S OUTHEAST A SIA • O PERATES IN MOST OF THE PROLIFIC OIL PRODUCING REGIONS IN THE WORLD G EOGRAPHY • A VG . CLIENT RELATIONSHIP OF 5 - 6 YEARS • L ARGEST T HREE CUSTOMERS ACCOUNTED FOR ~56% OF 2012 REVENUES

S ERVICE O VERVIEW » P ROGRAM D ESIGN ▪ 2 D, 3 D AND 4 D SURVEY DESIGN ▪ A LIGN PARAMETERS AND TECHNOLOGIES TO NEEDS , BUDGET AND PLAN » P LANNING & P ERMITTING ▪ E XTENSIVE EXPERIENCE IN HEAVILY CULTURED AREAS , LOGISTICALLY CHALLENGING LAND PROGRAMS , TRANSITION ZONES , AND SHALLOW WATER » C AMP S ERVICES ▪ S TREAMLINED PROCESSES FOR SETTING UP AND DISMANTLING FIELD CAMPS IN REMOTE AREAS » S URVEY AND L INE C UTTING ▪ U TILIZE LATEST TECHNOLOGIES ▪ S KILLED AT MANAGING SUBCONTRACTORS TO ENSURE PROJECT COMPLETION AND INTEGRITY » D RILLING ▪ S ENIOR STAFF WITH 50 + YEARS EXPERIENCE DRILLING FOR SEISMIC RECORDING IN SOME OF THE WORLD ’ S MOST CHALLENGING ENVIRONMENTS ▪ V ERSATILE , PORTABLE DRILLING EQUIPMENT » R ECORDING ▪ E MPLOY A VARIETY OF TECHNIQUES ( EXPLOSIVES , V IBROSEIS , AIR GUNS ) ▪ W IRELESS OR CABLE - BASED SYSTEMS , AND SINGLE OR MULTI - COMPONENT GEOPHONES » P ROCESSING ▪ E ND - TO - END DATA MANAGEMENT EXPEDITES DELIVERY 4

5 G LOBAL P RESENCE C ONTRACT R EVENUE B ACKLOG OF $285.0 MILLION AT J UNE 30, 2013 $123.0 MILLION OF NEW CONTRACTS ANNOUNCED IN Q2 2013 M AJORITY OF THESE PROJECTS WILL BEGIN IN Q3 2013 AND CONTINUE THROUGH Q1 2014

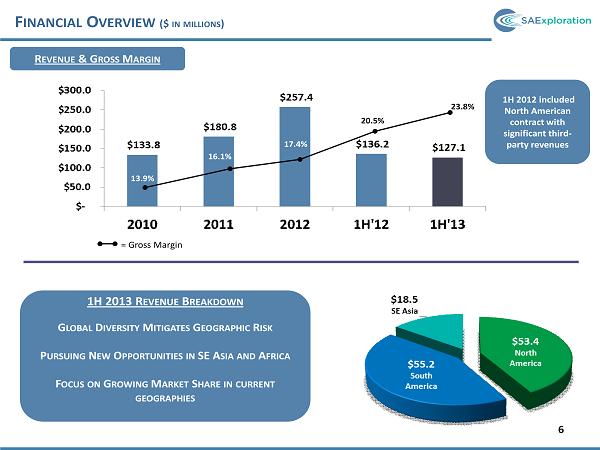

F INANCIAL O VERVIEW ($ IN MILLIONS ) 6 R EVENUE & G ROSS M ARGIN 1H 2013 R EVENUE B REAKDOWN G LOBAL D IVERSITY M ITIGATES G EOGRAPHIC R ISK P URSUING N EW O PPORTUNITIES IN SE A SIA AND A FRICA F OCUS ON G ROWING M ARKET S HARE IN CURRENT GEOGRAPHIES 1H 2012 included North American contract with significant third - party revenues = Gross Margin 13.9% 16.1% 17.4% 23.8% 20.5%

7 G LOBAL E&P S PEND VS . G LOBAL O IL P RODUCTION S OURCE : IEA, B ARCLAYS G LOBAL 2013 E&P S PENDING U PDATE O IL IS BECOMING INCREASINGLY DIFFICULT AND MORE EXPENSIVE TO LOCATE • G LOBAL O IL PRODUCTION FROM 1985 TO 2013 : INCREASE OF ~ 50% • G LOBAL E&P S PENDING FROM 1985 TO 2013 : I NCREASE OF ~ 690%

S EISMIC M ARKET O PPORTUNITY 16% < 4% 80% 12% 8% 40% 25 - 30% $644 B M ARKET $ 16 - 19 B M ARKET E XPLORATION G EOPHYSICS D EVELOPMENT 10 - 15% D ATA L IBRARY S ALES D ATA P ROCESSING L AND E QUIPMENT L AND A CQUISITION S ERVICES M ARINE E QUIPMENT M ARINE A CQUISITION S ERVICES S OURCE : ION G EOPHYSICAL O CTOBER 3, 2012 I NVESTOR P RESENTATION ; B ARCLAYS G LOBAL 2013 E&P S PENDING U PDATE W ORLDWIDE ANNUAL E&P CAPITAL SPENDING ESTIMATED A T ~ $644 BILLION S EISMIC INDUSTRY REPRESENTS A $16 TO $19 BILLION ANNUAL REVENUE OPPORTUNITY L AND ACQUISITION SERVICES SEGMENT OF THE SEISMIC MARKET REPRESENTS A $4.4 TO $5.3 BILLION ANNUAL MARKET 8

N ORTH A MERICAN M ARKET AND T RENDS • EXPANDED INTO N ORTH A MERICA IN 2011 AND IMMEDIATELY OBTAINED A SIGNIFICANT MARKET SHARE IN C ANADA AND A LASKA • N ORTH A MERICAN MARKET IS A STABILIZED AND SUSTAINED MARKET FOR 3D SEISMIC - I N MOST OF N ORTH A MERICA , THE HIGHER MARGIN 3D SEISMIC ACQUISITION IS THE STANDARD AS INTERNATIONAL OIL COMPANIES (IOC) AIM TO MAXIMIZE THE EFFICIENCY OF THEIR RESERVOIRS AND REDUCE EXPLORATION RISK • T AX CREDITS FOR EXPLORATION (40 - 60% REBATE FOR EVERY EXPLORATION DOLLAR SPENT ) IN A LASKA , INCLUDING THE A LASKA N ORTH S LOPE , IS INCENTIVIZING IOC TO INCREASE ACTIVITY IN THE REGION • E NTRANCE INTO A LASKA AND C ANADA OPTIMIZES SAE’ S RESOURCE UTILIZATION AND IS CONSISTENT WITH SAE’ S FOCUS ON LOGISTICALLY COMPLEX MARKETS H ISTORICAL R EVENUE ($MM) (1) (1) H ISTORICAL REVENUE STATISTICS ILLUSTRATED ABOVE DO NOT INCLUDE CORPORATE AND INTER - COMPANY ELIMINATIONS 9

S OUTH A MERICAN M ARKET AND T RENDS • IOC S THROUGHOUT S OUTH A MERICA SEEK EXPERIENCED SEISMIC PROVIDERS WITH COMPLEX ENVIRONMENT KNOW - HOW , STRONG QHSE RECORDS AND EXCELLENT RELATIONS WITH LOCAL COMMUNITIES - SAE HAS A STRONG QHSE RECORD - SAE HAS NUMEROUS PERSONNEL DEVOTED TO BUILDING STRONG COMMUNITY AND GOVERNMENT RELATIONS • S TABILIZING POLITICAL ENVIRONMENTS PROVIDE CONFIDENCE AND HIGH GROWTH POTENTIAL TO THESE MARKETS • S OUTH A MERICAN COUNTRIES CONTINUE TO EXPAND AND DEVELOP ; DEMANDING SIGNIFICANTLY MORE ENERGY TO FUEL THIS GROWTH - SAE IS TAKING ADVANTAGE OF THIS GROWTH BY EXPANDING INTO B RAZIL AND CONTINUING TO GROW IN C OLOMBIA , P ERU AND B OLIVIA • T HE S OUTH A MERICAN MARKET HELPS OPTIMIZE SAE’ S EQUIPMENT UTILIZATION BY OFFSETTING N ORTH A MERICAN AND S OUTH A MERICAN OPERATING SEASONS H ISTORICAL R EVENUE ($MM) (1) 10 (1) H ISTORICAL REVENUE STATISTICS ILLUSTRATED ABOVE DO NOT INCLUDE CORPORATE AND INTER - COMPANY ELIMINATIONS

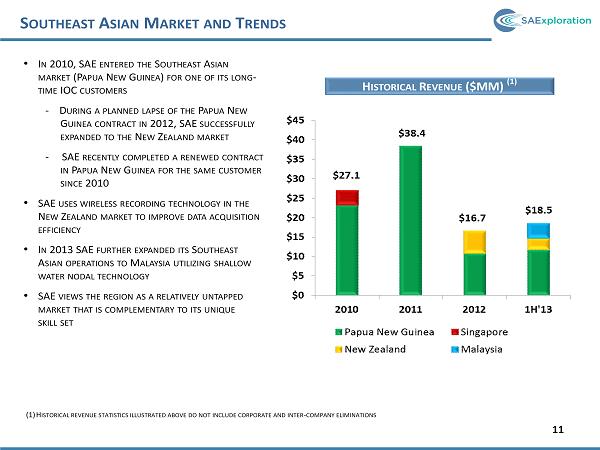

S OUTHEAST A SIAN M ARKET AND T RENDS • I N 2010, SAE ENTERED THE S OUTHEAST A SIAN MARKET (P APUA N EW G UINEA ) FOR ONE OF ITS LONG - TIME IOC CUSTOMERS - D URING A PLANNED LAPSE OF THE P APUA N EW G UINEA CONTRACT IN 2012, SAE SUCCESSFULLY EXPANDED TO THE N EW Z EALAND MARKET - SAE RECENTLY COMPLETED A RENEWED CONTRACT IN P APUA N EW G UINEA FOR THE SAME CUSTOMER SINCE 2010 • SAE USES WIRELESS RECORDING TECHNOLOGY IN THE N EW Z EALAND MARKET TO IMPROVE DATA ACQUISITION EFFICIENCY • I N 2013 SAE FURTHER EXPANDED ITS S OUTHEAST A SIAN OPERATIONS TO M ALAYSIA UTILIZING SHALLOW WATER NODAL TECHNOLOGY • SAE VIEWS THE REGION AS A RELATIVELY UNTAPPED MARKET THAT IS COMPLEMENTARY TO ITS UNIQUE SKILL SET 11 H ISTORICAL R EVENUE ($MM) (1) (1) H ISTORICAL REVENUE STATISTICS ILLUSTRATED ABOVE DO NOT INCLUDE CORPORATE AND INTER - COMPANY ELIMINATIONS

G ROWTH S TRATEGIES 2012 12 C ONTINUED E XPANSION INTO L OGISTICALLY C OMPLEX M ARKETS AROUND THE W ORLD A TTRACT AND R ETAIN THE BEST MANAGERS AND CREW - LEVEL PERSONNEL IN THE INDUSTRY U TILIZATION OF N EW A CQUISITION T ECHNOLOGIES IN G LOBAL M ARKETS M AXIMIZE A SSET U TILIZATION AND R ESOURCE E FFICIENCIES R EDUCE C USTOMER E XPLORATION R ISK BY P ROVIDING I NDUSTRY - L EADING QHSE AND F OCUS ON C OMMUNITY R ELATIONS

C ONTACT 13 D EVIN S ULLIVAN S ENIOR V ICE P RESIDENT (212) 836 - 9608 DSULLIVAN @ EQUITYNY . COM T HOMAS M EI A SSOCIATE (212) 836 - 9614 TMEI @ EQUITYNY . COM B RENT W HITELEY C HIEF F INANCIAL O FFICER AND G ENERAL C OUNSEL 713 - 816 - 6392 BWHITELEY @ SAEXPLORATION . COM

A PPENDIX • E XECUTIVE M ANAGEMENT • S ECOND Q UARTER 2013 F INANCIAL R EVIEW • EBITDA R ECONCILIATION 14

E XECUTIVE M ANAGEMENT Y EARS E XPERIENCE 35 + J EFF H ASTINGS C HAIRMAN ▪ P RESIDENT AND O WNER OF F AIRWEATHER G EOPHYSICAL , WHICH SUCCESSFULLY MAINTAINED A SIGNIFICANT MARKET SHARE OF A LASKAN SEISMIC MARKET DURING EACH YEAR OF OPERATION ▪ F OLLOWING THE ACQUISITION OF F AIRWEATHER G EOPHYSICAL BY V ERITAS DGC IN 2000 , M R . H ASTINGS RETAINED HIS ROLE AS H EAD OF THE A LASKAN D IVISION FOR V ERITAS AND THEN CGGV ERITAS FOLLOWING ITS ACQUISITION OF V ERITAS DGC . ▪ M R . H ASTINGS WAS INSTRUMENTAL IN ASSISTING SAE IN SUCCESSFULLY EXPANDING ITS OPERATIONS ON A LASKA ’ S C OOK I NLET AND N ORTH S LOPE B RIAN B EATTY P RESIDENT AND CEO ▪ F OUNDED SAE IN 2006 AFTER ESTABLISHING AND MAINTAINING V ERITAS DGC’ S S OUTH A MERICAN OPERATIONS , WHERE HE RAN OPERATIONS FOR OVER 15 YEARS ▪ B EGAN CAREER IN SEISMIC FIELD MANAGEMENT IN 1980 WITH V ERITAS DGC ▪ S UCCESSFULLY LED SAE’ S EXPANSION INTO C ANADA THROUGH ITS ACQUISITION OF D ATUM E XPLORATION 30 + B RENT W HITELEY CFO AND G ENERAL C OUNSEL ▪ J OINED SAE IN 2011 IN THE ROLE OF COO AND G ENERAL C OUNSEL , LATER TRANSITIONING TO THE ROLE OF CFO AND G ENERAL C OUNSEL ▪ F OLLOWING OVER 10 YEARS IN PRIVATE LAW PRACTICE , M R . W HITELEY JOINED V ERITAS DGC AS ITS A SSISTANT G ENERAL C OUNSEL . M R . W HITELEY OBTAINED HIS MBA IN 2006 AND ASSUMED THE ROLE OF G ENERAL C OUNSEL — A MERICAS FOR CGGV ERITAS AND THEN ASSUMED THE S ENIOR VP ROLE RUNNING THE OPERATIONS FOR CGGV ERITAS ’ L AND A CQUISITION BUSINESS IN THE A MERICAS . 20 + 15

S ECOND Q UARTER 2013 F INANCIAL R EVIEW ($ IN MILLIONS ) 16 Q2 2013 Q2 2012 Revenue (1) $42.4 $74.4 Gross profit $10.2 $13.0 Gross profit excluding depreciation (2) $13.7 $15.8 Gross margin 24.2% 17.4% Gross margin excluding depreciation (2) 32.2% 21.2% Net (loss) income ($0.2) $5.1 Net income excluding merger costs (3) $0.3 $5.1 EBITDA $7.6 $9.0 6/30/2013 12/31/2012 Cash & equivalents $28.5 $15.7 Working capital $50.4 $27.7 Long - term debt $90.9 $78.5 Stockholders’ Equity $36.5 $24.1 1) 2Q 2012 revenues included North American contract with significant third - party revenues 2) Excludes direct operating expenses, including depreciation of $3.4 M and $2.8 M in Q2 2013 and Q2 2012, respectively 3) Excludes one - time costs of $0.6M related to June 2013 merger with Trio Merger Corp.

EBITDA R ECONCILIATION : T HREE AND S IX M ONTHS 2013 AND 2012 17 (Unaudited) (In thousands) (1) Excludes $472,000 and $1,092,000 of amortization of loan issuance costs which are included in depreciation and amortization in the three and six month periods ended June 30, 2013. (2) Principally debt-related third-party costs, merger costs, and one-time severance costs related to the reduction of staff in Colombia. Three Months Ended Six Months Ended June 30, June 30, 2013 2012 2013 2012 Net (loss) income $ (245) $ 5,073 $ 5,617 $ 12,826 Depreciation and amortization 4,155 2,973 8,550 5,756 Interest expense, net 2,955 (1) 471 5,720 (1) 839 Provision (benefit) for income taxes (1,117) 483 1,248 1,917 Non-recurring major expense 1,841 (2) - 1,841 (2) - Modified EBITDA $ 7,589 $ 9,000 $ 22,976 $ 21,338 Modified EBITDA (arrived at by taking earnings before interest, taxes, depreciation and amortization, and non - recurring expenses ) is not derived in accordance with generally accepted accounting principles (“GAAP”). EBITDA is a key metric SAE uses in evaluating its financi al performance. EBITDA is considered a non - GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933, a s amended. SAE considers EBITDA important in evaluating its financial performance on a consistent basis across various periods. Due to the s ign ificance of non - cash and non - recurring items, EBITDA enables SAE’s Board of Directors and management to monitor and evaluate the business on a consis tent basis. SAE uses EBITDA as a primary measure, among others, to analyze and evaluate financial and strategic planning decisions regarding fut ure operating investments and potential acquisitions. The presentation of EBITDA should not be construed as an inference that SAE’s future res ults will be unaffected by unusual or non - recurring items or by non - cash items, such as non - cash compensation. EBITDA should be considered i n addition to, rather than as a substitute for, pre - tax income, net income and cash flows from operating activities.

EBITDA R ECONCILIATION : FY 2010 - 2012 18 Modified EBITDA (arrived at by taking earnings before interest, taxes, depreciation and amortization, and non - recurring expenses ) is not derived in accordance with generally accepted accounting principles (“GAAP”). EBITDA is a key metric SAE uses in evaluating its financi al performance. EBITDA is considered a non - GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933, a s amended. SAE considers EBITDA important in evaluating its financial performance on a consistent basis across various periods. Due to the s ign ificance of non - cash and non - recurring items, EBITDA enables SAE’s Board of Directors and management to monitor and evaluate the business on a consis tent basis. SAE uses EBITDA as a primary measure, among others, to analyze and evaluate financial and strategic planning decisions regarding fut ure operating investments and potential acquisitions. The presentation of EBITDA should not be construed as an inference that SAE’s future res ults will be unaffected by unusual or non - recurring items or by non - cash items, such as non - cash compensation. EBITDA should be considered i n addition to, rather than as a substitute for, pre - tax income, net income and cash flows from operating activities. Net Income $ 9,985 $ 9,508 $ 5,821 Depreciation and amortization 12,470 4,110 3,493 Interest expense, net 3,573 (1) 624 674 Income tax expense 1,444 3,319 4,500 Non-recurring major expense 3,437 (2) 964 (3) -0- Modified EBITDA $ 30,909 $ 18,525 $ 14,488 December 31, (1) Excludes $213,000 of amortization of loan issuance costs which are included in depreciation and amortization in December 2012. (2) Principally the cost associated with deferred financing costs and fee for early payment of debt. (3) Principally the costs related to contemplated acquisitions. (in thousands) 2012 2011 2010