Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BRE PROPERTIES INC /MD/ | v355160_8k.htm |

1 BRE Properties, Inc. Aviara | Mercer Island, W A Q3 2013 Investor Presentation

2 BRE Properties, Inc.

3 BRE Properties, Inc. • Pure play West Coast apartment REIT in the nation’s leading markets for multifamily ownership – $5.6 billion total market capitalization – 21,126 homes (a) in Northern and Southern California; and Seattle – Long - term apartment fundamentals driven by demographic and societal trends provide favorable tailwind – Core markets characterized by: (1) expensive single - family housing; (2) high propensity to rent; and (3) long - term barriers to supply – 99% of portfolio in the nation’s top 25 largest MSAs for employment – Shorter lease term property type captures growth as the economy improves, even in a rising interest rate environment • Multiple sources for growth and value creation – D evelopment pipeline represents embedded growth and already generating strong results – Capital recycling strategy enhances returns from existing portfolio – Focus on o perational excellence to drive efficiencies and performance • Strong balance sheet and financial flexibility – Well - capitalized with significant financial flexibility – N o meaningful debt maturities until 2017 – No amounts outstanding under $750 million line of credit as of June 30, 2013 – Baa2/BBB/BBB+ senior unsecured ratings Investment Highlights (a) As of June 30, 2013, excludes 252 homes held in joint ventures.

4 BRE Properties, Inc. • Continued execution on current development pipeline – $870 million of development communities comprising 1,884 homes in core, in - fill locations scheduled to be delivered between Q4 2012 and Q4 2014 – Current pipeline already generating results: – Completed and delivered $150 million of $870 million in projects – Lawrence Station and Aviara have stabilized ahead of plan with rents tracking to or slightly ahead of pro forma trended rents – Maintain stable development program that is well - aligned with the company’s balance sheet • Recycle capital to accelerate portfolio upgrade strategy – Dispose of $350 to $400 million of slower growth communities to fund remaining capital requirements on the current development pipeline – Reinvest in existing core communities to improve quality and growth potential – Identify and reposition portfolio around target markets with highest value and growth potential – Continuously upgrade portfolio quality within existing core markets to generate sustainable, above - market average returns – Dispositions provide internally generated capital when shares are trading below NAV • Maintain strong balance sheet and significant financial flexibility – Maintain leverage within a range of 6.0x to 7.0x Debt/EBITDA – Long - term objective to operate below 6.0x Debt/EBITDA Strategic Plan Strategic Plan to Upgrade Long - term Growth Profile

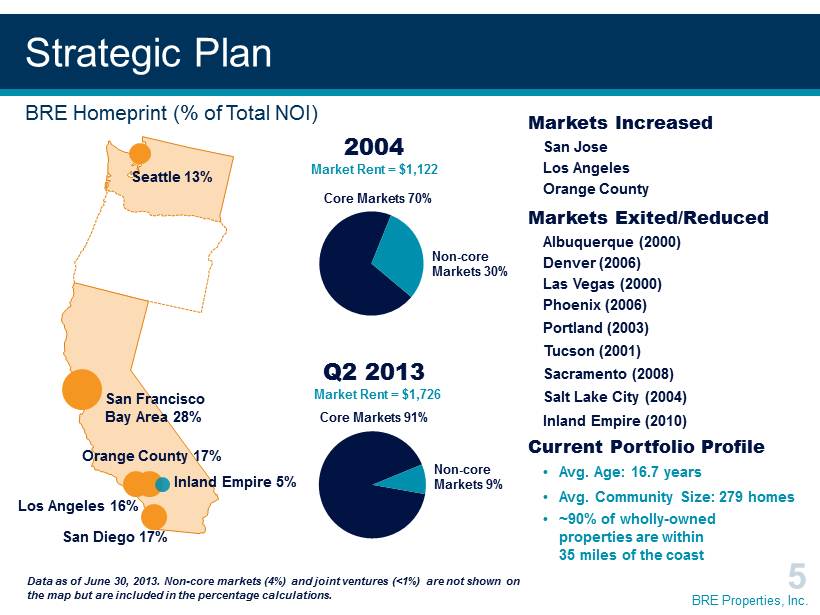

5 BRE Properties, Inc. Markets Increased San Jose Los Angeles Orange County Markets Exited/Reduced Albuquerque (2000) Denver (2006) Las Vegas (2000) Phoenix (2006) Portland (2003) Tucson (2001) Sacramento (2008) Salt Lake City (2004) Inland Empire (2010) Current Portfolio Profile • Avg. Age: 16.7 years • Avg. Community Size: 279 homes • ~90% of wholly - owned properties are within 35 miles of the coast Strategic Plan Core Markets 70% Non - core Markets 30% 2004 Q2 2013 Core Markets 91% Non - core Markets 9% Seattle 13% Inland Empire 5% Orange County 17% San Diego 17% Los Angeles 16% Data as of June 30, 2013. N on - core markets (4%) and joint ventures (<1%) are not shown on the map but are included in the percentage calculations. San Francisco Bay Area 28% BRE Homeprint (% of Total NOI) Market Rent = $1,122 Market Rent = $1,726

6 BRE Properties, Inc. GROWTH DRIVERS

7 BRE Properties, Inc. Growth Drivers Powerful Underlying Fundamentals Anchor Long - term Sector Performance Demand Supply Affordability • BRE core markets anchored by fast - growing industries, such as technology, defense and healthcare, which provide underpinnings for economic and employment growth • Job growth in BRE’s core markets forecasted to accelerate from 2.1% in 2013 to 2.5% in 2015, outpacing the nation • Rise in household formation as the economy recovers should boost apartment demand • Cost of home ownership in California’s coastal markets remains the highest in the nation • Homes are 80% less affordable in coastal California markets relative to other major metros in the U.S. • Homeownership rate in California is 1100 bps below the nation • Concentration in high barrier - to - entry markets insulates against supply increases and variability in supply • Multifamily supply is forecasted to return to levels consistent with historical averages • Supply in BRE’s core markets historically average 1.1% of total stock

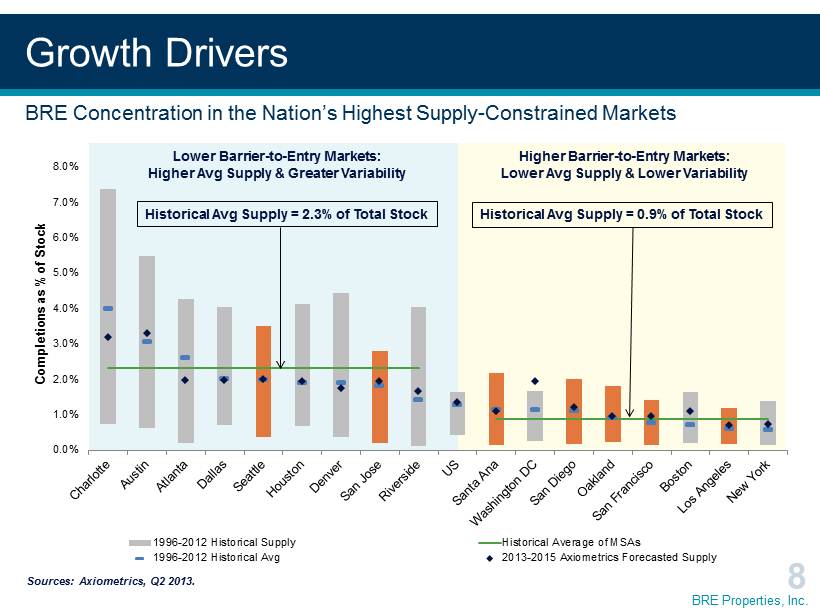

8 BRE Properties, Inc. 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Completions as % of Stock 1996-2012 Historical Supply Historical Average of MSAs 1996-2012 Historical Avg 2013-2015 Axiometrics Forecasted Supply Growth Drivers BRE Concentration in the Nation’s Highest Supply - Constrained Markets Sources: Axiometrics , Q2 2013. Lower Barrier - to - Entry Markets: Higher Avg Supply & Greater Variability Higher Barrier - to - Entry Markets: Lower Avg Supply & Lower Variability Historical Avg Supply = 2.3% of T otal Stock Historical Avg Supply = 0.9% of T otal Stock

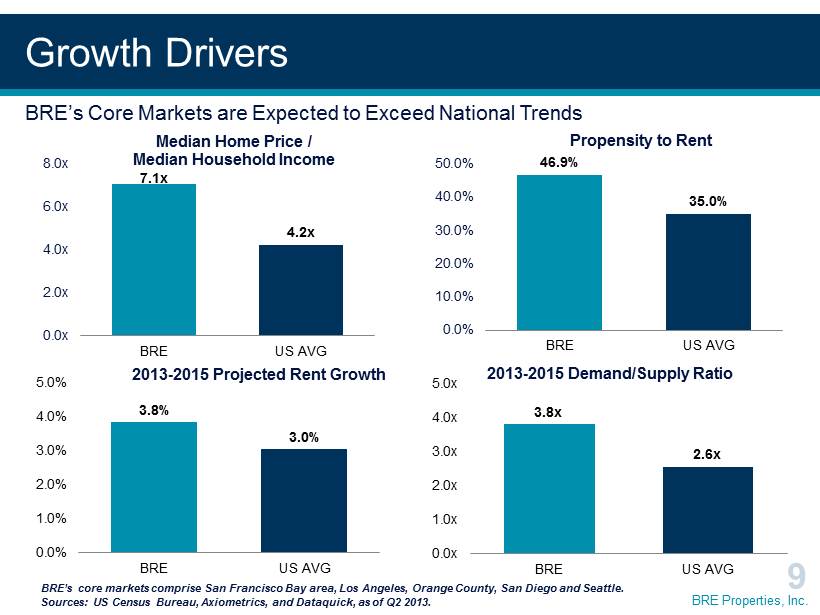

9 BRE Properties, Inc. Growth Drivers BRE’s core markets comprise San Francisco Bay area, Los Angeles, Orange County, San Diego and Seattle. Sources : US Census Bureau, Axiometrics, and Dataquick , as of Q2 2013. BRE’s Core Markets are Expected to Exceed National Trends 7.1x 4.2x 0.0x 2.0x 4.0x 6.0x 8.0x BRE US AVG Median Home Price / Median Household Income 3.8% 3.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% BRE US AVG 2013 - 2015 Projected Rent Growth 46.9% 35.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% BRE US AVG Propensity to Rent 3.8x 2.6x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x BRE US AVG 2013 - 2015 Demand/Supply Ratio

10 BRE Properties, Inc. 0.0% 1.0% 2.0% 3.0% 4.0% Axio 2014 - 2016 Forecasted Rent Growth California Demographics: Rental Housing Driven Sources: Bureau of Labor Statistics, Axiometrics , National Association of Realtors, and Moody’s economy.com. Growth Drivers 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 1950 1970 1990 2005 2007 2009 2011 Q2 2013 U.S. California Homeownership rate 1100 bps below U.S. U.S. 65.0% CA 54.0% Lowest h ome affordability in the nation BRE’s core markets expected to lead the nation in rent growth 0 50 100 150 200 250 300 NAR Affordability Index

11 BRE Properties, Inc. PORTFOLIO STRATEGY

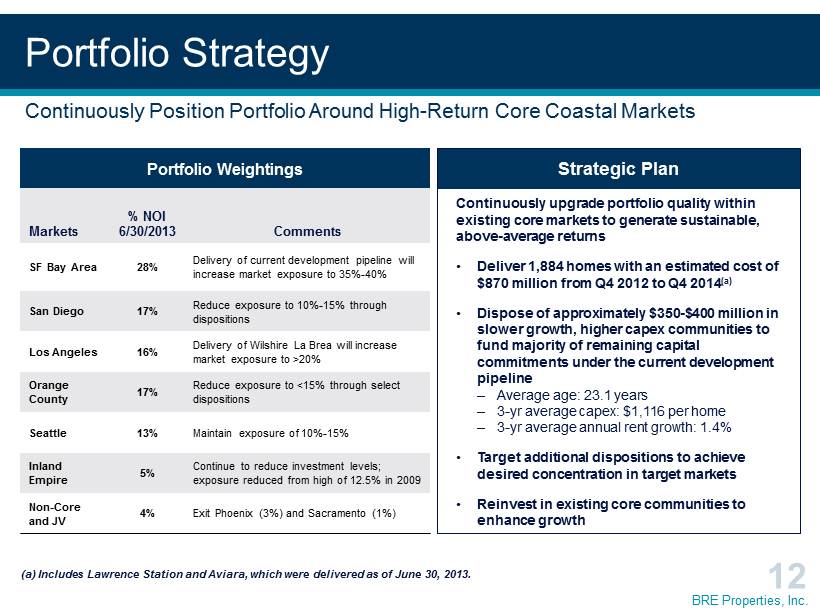

12 BRE Properties, Inc. Portfolio Strategy Continuously Position Portfolio Around High - Return Core Coastal Markets Portfolio Weightings Markets % NOI 6/30/2013 Comments SF Bay Area 28% Delivery of current development pipeline will i ncrease market exposure to 35% - 40% San Diego 17% Reduce exposure to 10% - 15% through dispositions Los Angeles 16% Delivery of Wilshire La Brea will increase market exposure to >20% Orange County 17% Reduce exposure to <15% through select dispositions Seattle 13% Maintain exposure of 10% - 15% Inland Empire 5% Continue to reduce investment levels; exposure reduced from high of 12.5% in 2009 Non - Core and JV 4% Exit Phoenix (3%) and Sacramento (1%) Continuously upgrade portfolio quality within existing core markets to generate sustainable, above - average returns • Deliver 1,884 homes with an estimated cost of $870 million from Q4 2012 to Q4 2014 (a) • Dispose of approximately $350 - $400 million in slower growth, higher capex communities to fund majority of remaining capital commitments under the current development pipeline – Average age: 23.1 years – 3 - yr average capex : $1,116 per home – 3 - yr average annual rent growth: 1.4% • Target additional dispositions to achieve desired concentration in target markets • Reinvest in existing core communities to enhance growth Strategic Plan (a) Includes Lawrence Station and Aviara, which were delivered as of June 30, 2013.

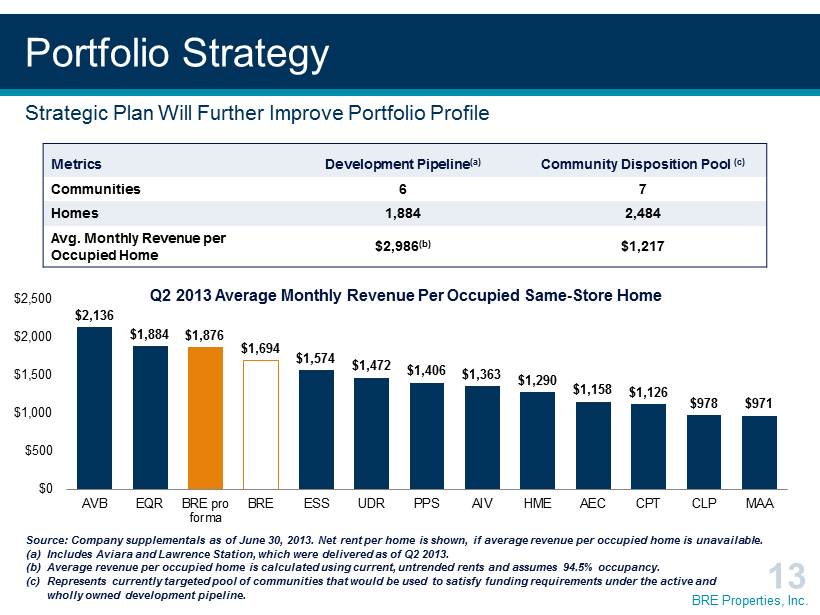

13 BRE Properties, Inc. $2,136 $1,884 $1,876 $1,694 $1,574 $1,472 $1,406 $1,363 $ 1,290 $ 1,158 $1,126 $978 $971 $0 $500 $1,000 $1,500 $2,000 $2,500 AVB EQR BRE pro forma BRE ESS UDR PPS AIV HME AEC CPT CLP MAA Portfolio Strategy Strategic Plan Will Further Improve Portfolio P rofile Source: Company supplementals as of June 30, 2013. Net rent per home is shown, if average revenue per occupied home is unavailable. (a) Includes Aviara and Lawrence Station, which were delivered as of Q2 2013. (b) Average revenue per occupied home is calculated using current, untrended rents and assumes 94.5% occupancy. (c) Represents currently targeted pool of communities that would be used to satisfy funding requirements under the active and wholly owned development pipeline. Q2 2013 Average Monthly Revenue Per Occupied Same - Store Home Metrics Development Pipeline (a) Community Disposition Pool (c) Communities 6 7 Homes 1,884 2,484 Avg. Monthly Revenue per Occupied Home $2,986 (b) $1,217

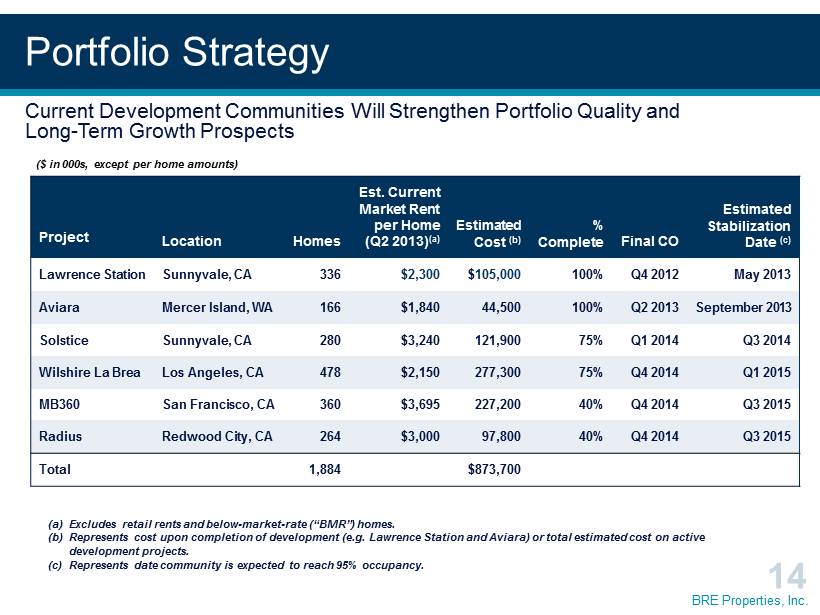

14 BRE Properties, Inc. Portfolio Strategy (a) Excludes retail rents and below - market - rate (“BMR”) homes. (b) Represents cost upon completion of development (e.g. Lawrence Station and Aviara ) or total estimated cost on active development projects. (c) Represents date community is expected to reach 95% occupancy. Project Location Homes Est. Current Market Rent per Home (Q2 2013) (a) Estimated Cost (b) % Complete Final CO Estimated Stabilization Date (c) Lawrence Station Sunnyvale, CA 336 $2,300 $ 105,000 100% Q4 2012 May 2013 Aviara Mercer Island, WA 166 $1,840 44,500 100% Q2 2013 September 2013 Solstice Sunnyvale, CA 280 $3,240 121,900 75% Q1 2014 Q3 2014 Wilshire La Brea Los Angeles, CA 478 $2,150 277,300 75% Q4 2014 Q1 2015 MB360 San Francisco, CA 360 $3,695 227,200 40% Q4 2014 Q3 2015 Radius Redwood City, CA 264 $3,000 97,800 40% Q4 2014 Q3 2015 Total 1,884 $873,700 ($ in 000s, except per home amounts) Current Development Communities Will Strengthen Portfolio Quality and Long - Term Growth Prospects

15 BRE Properties, Inc. Community Repositioning Initiatives Portfolio Strategy • Renovate / redevelop select assets to enhance value, extend useful life, and improve growth characteristics • Repositioning decisions driven by: – Asset submarket location, positioning and opportunity – Return on investment • Repositioning Value Creation – Higher rents + higher growth rate + lower operating expenses • Target returns of 7% – 10% • 11 communities totaling 3,663 homes currently under renovation with total estimated cost of approximately $100 million

16 BRE Properties, Inc. Portfolio Strategy • Since 2010, BRE has sold 10 wholly - owned, slower growth communities, totaling $ 368 million, or 2,876 homes with an average age of 24 years • YTD 2013, BRE has exited the Denver market and continues to trim exposure to Phoenix and select non - core submarkets in Southern California • The communities that have been sold underperformed same - store communities by a cumulative 580 bps over 3 years Capital Recycling Enhances Portfolio Growth (a) Represents reported same - store revenue growth, which includes the disposition properties. (b) Disposition Pool reflects 10 wholly - owned communities which were sold between 2010 and 2013. Disposition Pool Revenue Growth includes the annualized performance of disposition communities in each year through the year the community is sold. Analysis excludes JV dispositions. 2010 2011 2012 Same - Store Revenue Growth (a) (2.0%) 3.2% 5.5% Disposition Pool (b) Revenue Growth (1.7%) 1.6% 1.1% (Under)/ Overperformance of Disposition Pool 30 bps - 160 bps - 450 bps

17 BRE Properties, Inc. BALANCE SHEET MANAGEMENT

18 BRE Properties, Inc. Balance Sheet Management Source: Company data, as of June 30, 2013. (a) Interest includes GAAP interest and capitalized interest. (b) Fixed charges include GAAP interest, capitalized interest, preferred dividends and recurring cash amortization on secured deb t. Metric 6/30/2013 Debt - to - EBITDA Debt plus preferred stock - to - EBITDA 6.3x 6.5x Debt - to - total market capitalization Debt - to - gross assets 29.8% 38.6% Secured debt - to - gross assets 16.5% Unencumbered NOI / Total NOI 74% Interest coverage ratio (a) Fixed charge coverage ratio (b) 2.9x 2.8x Forward 36 month debt maturities as a % of total debt $67.0 million 4.0% Moody’s Standard and Poor’s Fitch Baa2 (stable) BBB (stable) BBB+ (stable) • Maintain a conservative, well - capitalized balance sheet – Operate with leverage in a range of 6.0x to 7.0x Debt/EBITDA – Long - term objective to operate below 6.0x Debt/EBITDA • Preserve financial flexibility – Focus on laddered maturities – Employ unsecured debt structure o 74% of NOI generated by unencumbered assets • Manage a simple, straight - forward capital structure – Benefits shareholders through enhanced transparency and lack of “complexity discounting” • Actively mitigate development risk Financial Principles

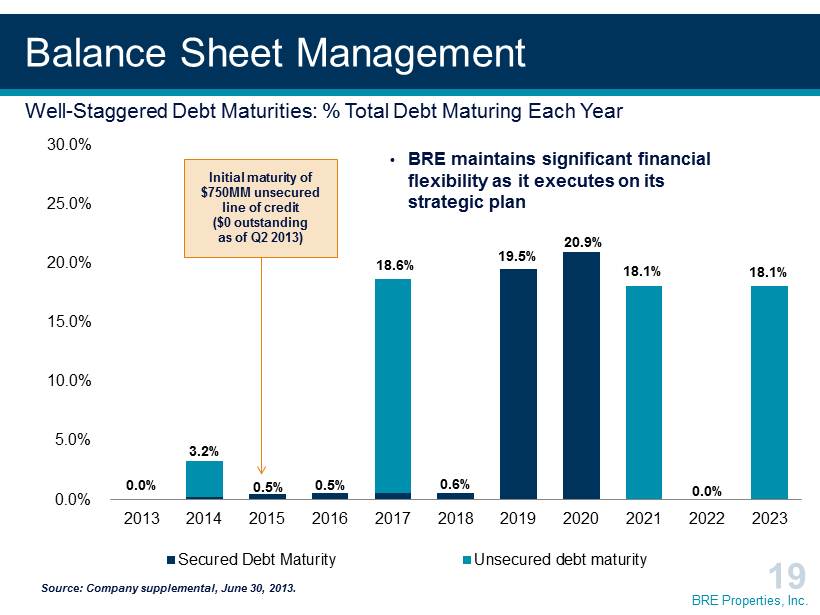

19 BRE Properties, Inc. 19.5% 20.9% 0.0% 3.2% 0.5% 0.5% 18.6% 0.6% 18.1% 0.0% 18.1% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Secured Debt Maturity Unsecured debt maturity • BRE maintains significant financial flexibility as it executes on its strategic plan Well - Staggered Debt Maturities: % Total Debt Maturing Each Year Balance Sheet Management Initial maturity of $750MM unsecured line of credit ($ 0 outstanding as of Q2 2013) Source: Company supplemental, June 30, 2013.

20 BRE Properties, Inc. • Pure play West Coast apartment REIT in the nation’s leading markets for multifamily ownership – $5.6 billion total market capitalization – 21,126 homes (a) in Northern and Southern California; and Seattle – Long - term apartment fundamentals driven by demographic and societal trends provide favorable tailwind – Core markets characterized by: (1) expensive single - family housing; (2) high propensity to rent; and (3) long - term barriers to supply – 99% of portfolio in the nation’s top 25 largest MSAs for employment – Shorter lease term property type captures growth as the economy improves, even in a rising interest rate environment • Multiple sources for growth and value creation – D evelopment pipeline represents embedded growth and already generating strong results – Capital recycling strategy enhances returns from existing portfolio – Focus on o perational excellence to drive efficiencies and performance • Strong balance sheet and financial flexibility – Well - capitalized with significant financial flexibility – N o meaningful debt maturities until 2017 – No amounts outstanding under $750 million line of credit as of June 30, 2013 – Baa2/BBB/BBB+ senior unsecured ratings Investment Highlights (a) As of June 30, 2013, excludes 252 homes held in joint ventures.

21 BRE Properties, Inc. APPENDIX

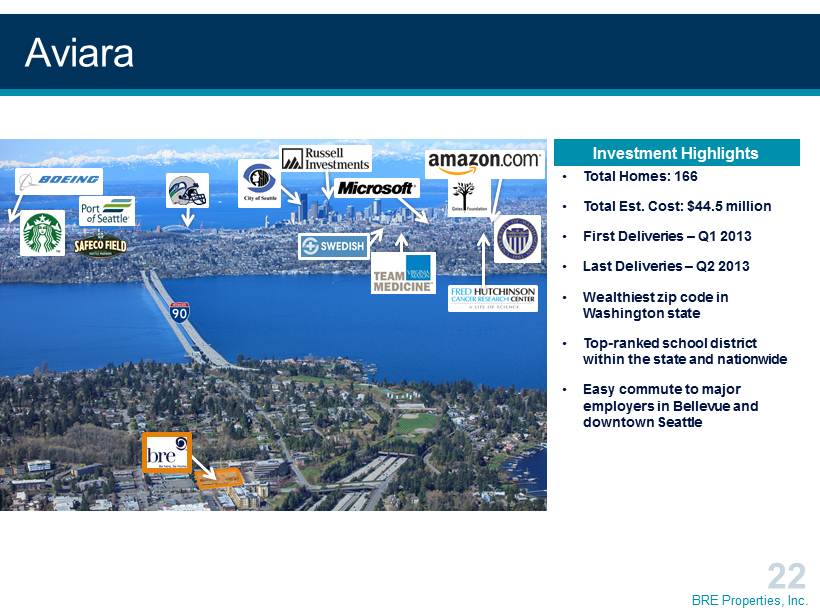

22 BRE Properties, Inc. Aviara • Total Homes: 166 • Total Est. Cost: $44.5 million • First Deliveries – Q1 2013 • Last Deliveries – Q2 2013 • Wealthiest zip code in Washington state • Top - ranked school district within the state and nationwide • Easy commute to major employers in Bellevue and downtown Seattle Investment Highlights

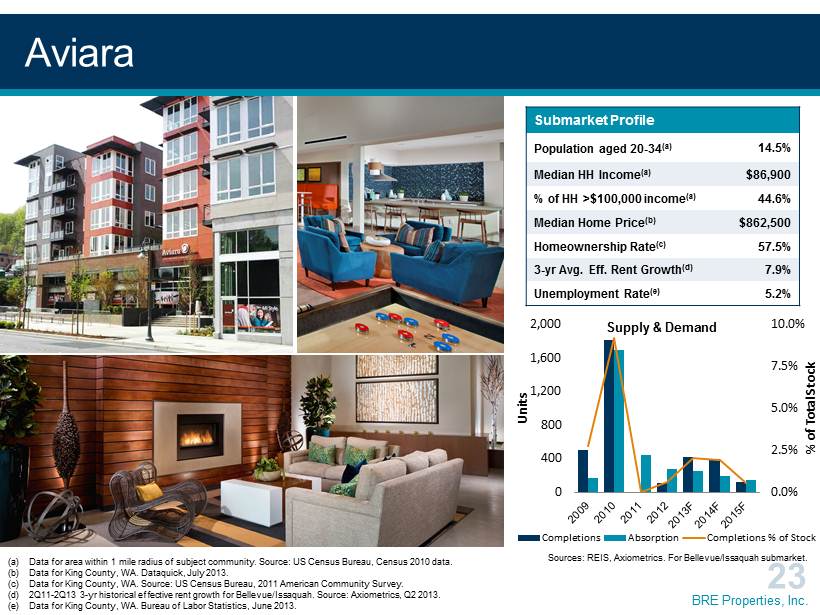

23 BRE Properties, Inc. Aviara Demographic Profile Submarket Profile Population aged 20 - 34 (a) 14.5% Median HH Income (a) $86,900 % of HH >$100,000 income (a) 44.6% Median Home Price (b) $862,500 Homeownership Rate (c) 57.5% 3 - yr Avg. Eff. Rent Growth (d) 7.9% Unemployment Rate (e) 5.2% (a) Data for area within 1 mile radius of subject community. Source: US Census Bureau, Census 2010 data. (b) Data for King County, WA. Dataquick , July 2013. (c) Data for King County, WA. Source: US Census Bureau, 2011 American Community Survey. (d) 2Q11 - 2Q13 3 - yr historical effective rent growth for Bellevue/Issaquah. Source: Axiometrics , Q2 2013. (e) Data for King County, WA. Bureau of Labor Statistics, June 2013. Supply & Demand Sources: REIS, Axiometrics . For Bellevue/Issaquah submarket. 0.0% 2.5% 5.0% 7.5% 10.0% 0 400 800 1,200 1,600 2,000 % of Total Stock Units Completions Absorption Completions % of Stock

24 BRE Properties, Inc. Solstice • Total Homes: 280 • Total Est. Cost: $121.9 million • First Deliveries – Q4 2013 • Last Deliveries – Q1 2014 • Adjacent to Sunnyvale Town Center (Macy’s, Target, 1.3mm sq. ft. retail and office, entertainment) • One block from Caltrain and recently redeveloped Historic Murphy Avenue (dining, shopping, entertainment) • Proximity to major employers in Silicon Valley and San Jose with Apple, Nokia, and Broadcom offices adjacent to subject site Investment Highlights

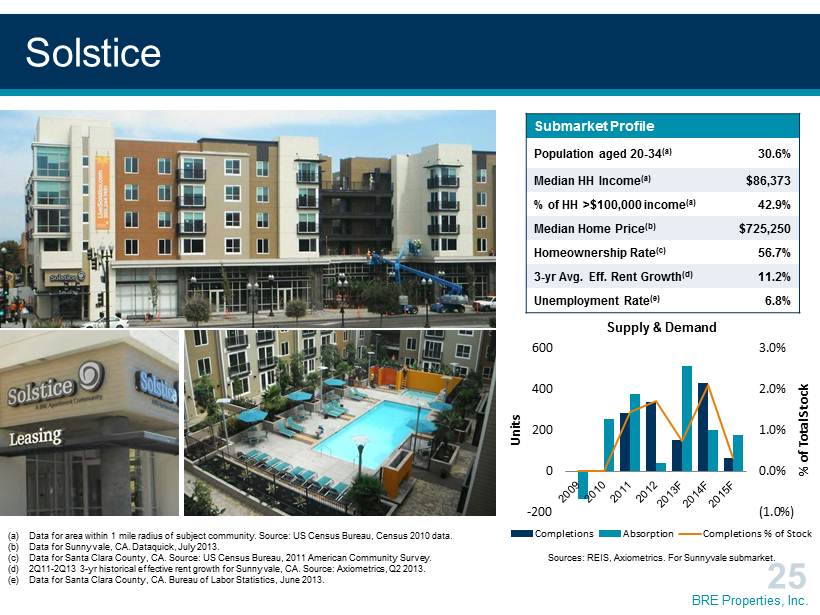

25 BRE Properties, Inc. Submarket Profile Population aged 20 - 34 (a) 30.6% Median HH Income (a) $86,373 % of HH >$100,000 income (a) 42.9% Median Home Price (b) $725,250 Homeownership Rate (c) 56.7% 3 - yr Avg. Eff. Rent Growth (d) 11.2% Unemployment Rate (e) 6.8% Solstice (a) Data for area within 1 mile radius of subject community. Source: US Census Bureau, Census 2010 data. (b) Data for Sunnyvale, CA. Dataquick , July 2013. (c) Data for Santa Clara County, CA. Source: US Census Bureau, 2011 American Community Survey. (d) 2Q11 - 2Q13 3 - yr historical effective rent growth for Sunnyvale, CA. Source: Axiometrics , Q2 2013. (e) Data for Santa Clara County, CA. Bureau of Labor Statistics, June 2013. Supply & Demand Sources: REIS, Axiometrics . For Sunnyvale submarket. (1.0%) 0.0% 1.0% 2.0% 3.0% -200 0 200 400 600 % of Total Stock Units Completions Absorption Completions % of Stock

26 BRE Properties, Inc. Wilshire La Brea 3 rd Street Office, Restaurant, and Retail Wilshire Corridor: 6.9MM Sqft Office 1.7MM Sqft Retail 5,988 Employees Century City Westwood Samsung Mobile Building: Various talent management and entertainment companies Future subway stop The Grove Wilshire La Brea (under construction) 5600 Wilshire • Total Homes: 478 • Total Retail: 40,000 sq. ft. • Total Est. Cost: $277.3 million • First Deliveries – Q4 2013 • Last Home Deliveries – Q4 2014 • High density urban infill site at one of the busiest intersections in L.A. • Adjacent to future site of a Metro subway station • The Miracle Mile has one of the lowest office vacancy rates in the city • Neighborhood transformation over the past eight years • Close proximity to Century City, Hollywood and Downtown L.A . Investment Highlights

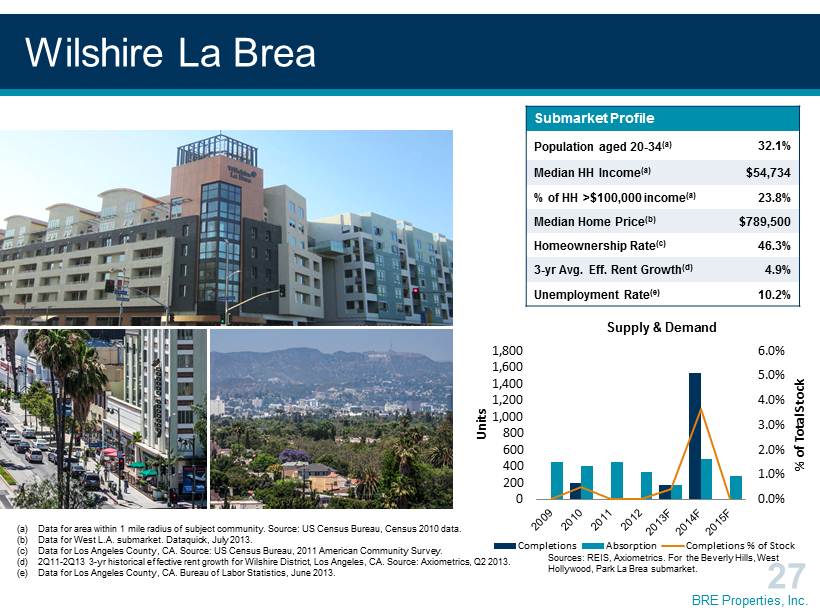

27 BRE Properties, Inc. Submarket Profile Population aged 20 - 34 (a) 32.1% Median HH Income (a) $54,734 % of HH >$100,000 income (a) 23.8% Median Home Price (b) $789,500 Homeownership Rate (c) 46.3% 3 - yr Avg. Eff. Rent Growth (d) 4.9% Unemployment Rate (e) 10.2% Wilshire La Brea (a) Data for area within 1 mile radius of subject community. Source: US Census Bureau, Census 2010 data. (b) Data for West L.A. submarket. Dataquick , July 2013. (c) Data for Los Angeles County, CA. Source: US Census Bureau, 2011 American Community Survey. (d) 2Q11 - 2Q13 3 - yr historical effective rent growth for Wilshire District, Los Angeles, CA. Source: Axiometrics , Q2 2013. (e) Data for Los Angeles County, CA. Bureau of Labor Statistics, June 2013. Supply & Demand Sources: REIS, Axiometrics . For the Beverly Hills, West Hollywood, Park La Brea submarket. 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 % of Total Stock Units Completions Absorption Completions % of Stock

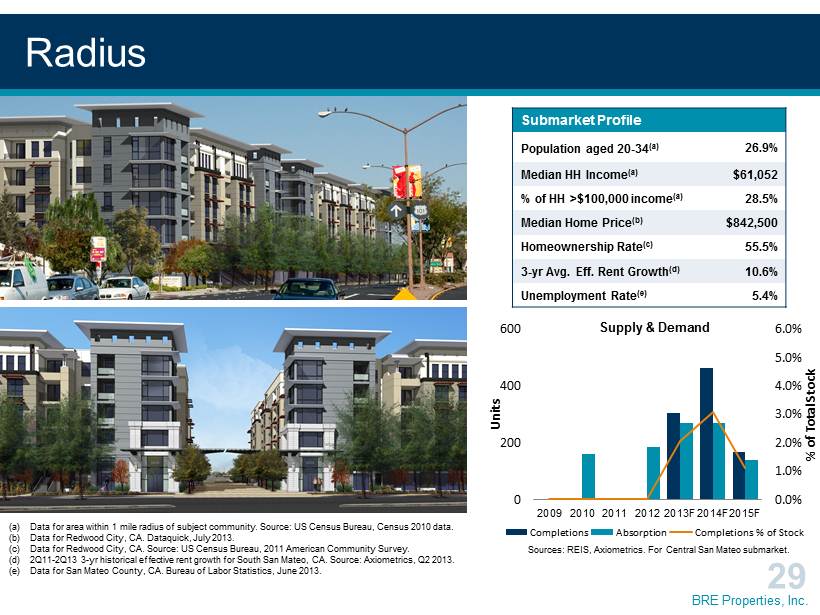

28 BRE Properties, Inc. Radius • Total Homes: 264 • Total Est. Cost: $97.8 million • First Deliveries – Q2 2014 • Last Deliveries – Q4 2014 • Located mid - peninsula with easy access to major employment centers of San Francisco and Silicon Valley • Concentration of large technology, bio - tech, healthcare and research employers within 5 mile radius • Proximity to US101, Caltrain , SFO International Airport • Walking distance of dining, shopping and entertainment venues in downtown Redwood City Investment Highlights

29 BRE Properties, Inc. Radius Submarket Profile Population aged 20 - 34 (a) 26.9% Median HH Income (a) $61,052 % of HH >$100,000 income (a) 28.5% Median Home Price (b) $842,500 Homeownership Rate (c) 55.5% 3 - yr Avg. Eff. Rent Growth (d) 10.6% Unemployment Rate (e) 5.4% (a) Data for area within 1 mile radius of subject community. Source: US Census Bureau, Census 2010 data. (b) Data for Redwood City, CA. Dataquick , July 2013. (c) Data for Redwood City, CA. Source: US Census Bureau, 2011 American Community Survey. (d) 2Q11 - 2Q13 3 - yr historical effective rent growth for South San Mateo, CA. Source: Axiometrics , Q2 2013. (e) Data for San Mateo County, CA. Bureau of Labor Statistics, June 2013. Supply & Demand Sources: REIS, Axiometrics . For Central San Mateo submarket. 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 0 200 400 600 2009 2010 2011 2012 2013F 2014F 2015F % of Total Stock Units Completions Absorption Completions % of Stock

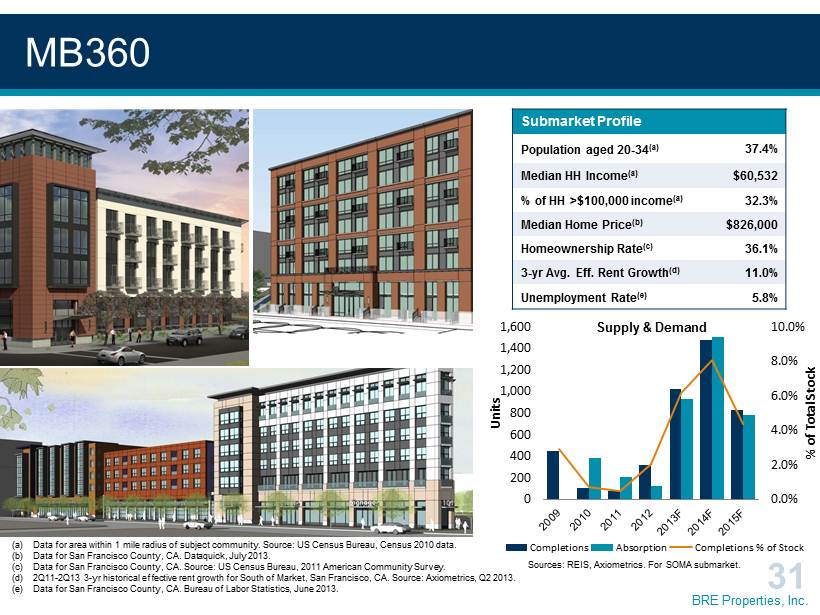

30 BRE Properties, Inc. MB360 (a) Data for San Francisco downtown financial district and Mission Bay submarkets. Source: Cushman and Wakefield. Convention Center (n ew ) BRE BLOCK 5 BRE BLOCK 11 • Total Homes: 360 • Total Retail: 17,000 sq. ft. (block 5) • Total Est. Cost: $227.2 million • First Deliveries – Q2 2014 • Last Home Deliveries – Q4 2014 • Proximity to Cal - train, municipal bus lines, and I - 280 • Walking distance to CBD and SOMA, major centers of high - paying, knowledge - based jobs • Urban amenities – SF Giants ballpark, restaurants, retail, entertainment, parks • High barrier - to - entry submarket for development Downtown Financial District and Mission Bay (a) : 67.3MM Sqft Office 231,765 Jobs Investment Highlights

31 BRE Properties, Inc. MB360 Submarket Profile Population aged 20 - 34 (a) 37.4% Median HH Income (a) $60,532 % of HH >$100,000 income (a) 32.3% Median Home Price (b) $826,000 Homeownership Rate (c) 36.1% 3 - yr Avg. Eff. Rent Growth (d) 11.0% Unemployment Rate (e) 5.8% (a) Data for area within 1 mile radius of subject community. Source: US Census Bureau, Census 2010 data. (b) Data for San Francisco County, CA. Dataquick , July 2013. (c) Data for San Francisco County, CA. Source: US Census Bureau, 2011 American Community Survey. (d) 2Q11 - 2Q13 3 - yr historical effective rent growth for South of Market, San Francisco, CA. Source: Axiometrics , Q2 2013. (e) Data for San Francisco County, CA. Bureau of Labor Statistics, June 2013. BRE BLOCK 5 BRE BLOCK 11 Supply & Demand Sources: REIS, Axiometrics . For SOMA submarket. 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 0 200 400 600 800 1,000 1,200 1,400 1,600 % of Total Stock Units Completions Absorption Completions % of Stock

32 BRE Properties, Inc. “ Safe Harbo r” Statement under the Private Securities Litigation Reform Act of 1995 : Except for the historical information contained herein, this presentation contains forward - looking statements regarding Company and property performance and financial and economic trends, and is based on the Company’s current expectations and judgment . Actual results could vary materially depending on risks and uncertainties inherent to general and local real estate conditions, competitive factors specific to markets in which BRE operates, legislative or other regulatory decisions, future interest rate levels or capital markets conditions . The Company assumes no responsibility to update this information . For more details, please refer to the Company’s SEC filings, including its most recent Annual Report on Form 10 - K and quarterly reports on Form 10 - Q . Safe Harbor Statement