Attached files

| file | filename |

|---|---|

| EX-99.3 - EX 99.3 - Mexus Gold US | ex993.htm |

| EX-31.1 - EX 31.1 - Mexus Gold US | ex311.htm |

| EX-32.1 - EX 32.1 - Mexus Gold US | ex321.htm |

U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Amendment #3

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended March 31, 2012

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to _____________

Commission File Number: 000-52413

MEXUS GOLD US

(Name of small business issuer as specified in its charter)

|

Nevada

|

20-4092640

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

1805 N. Carson Street, Suite 150

Carson City, NV 89701

________________________________________________________________________

(Address of principal executive offices, including zip code)

|

|

Registrant’s telephone number, including area code: (916) 776-2166

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: common stock, $.001par value

___________________

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. No[X]

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. Yes [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

|

Non-accelerated filer [ ] (Do not check if smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates on June 21, 2012, based upon the $0.09 per share closing price for our common stock on the OTC Bulletin Board was $9,410,671.

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Exchange Act of 1934 after the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of June 21, 2012, there were 184,467,187 shares of our common stock were issued and outstanding.

DOCUMENTS INCORPORATE BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to securities holders for fiscal year ended December 24, 1980).

EXPLANATORY NOTE

The sole purpose of this Amendment No. 3 to the Annual Report on Form 10-K (the "Form 10-K") for the year ended March 31, 2012, is to amend Item # 1 and Item #15.

No other changes have been made to the Form 10-K. This Amendment No. 3 to the Form 10-K speaks as of the original filing date of the Form 10-K, does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the original Form 10-K.

PART I

Item 1. Business

Cautionary Statement Concerning Forward-Looking Statements

The following discussion and analysis should be read in conjunction with our audited consolidated financial statements and related notes included in this report. This report contains “forward-looking statements.” The statements contained in this report that are not historic in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “expects,” “anticipates,” “estimates,” “believes,” or “plans” or comparable terminology are forward-looking statements based on current expectations and assumptions.

Various risks and uncertainties could cause actual results to differ materially from those expressed in forward-looking statements. Factors that could cause actual results to differ from expectations include, but are not limited to, those set forth under the section “Risk Factors” set forth in this report.

The forward-looking events discussed in this report, the documents to which we refer you and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us. For these statements, we claim the protection of the “bespeaks caution” doctrine. All forward-looking statements in this document are based on information currently available to us as of the date of this report, and we assume no obligation to update any forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

The Company

Mexus Gold US is an exploration stage mining company engaged in the evaluation, acquisition, exploration and advancement of gold, silver and copper projects in the State of Sonora, Mexico and the Western United States. Mexus Gold US is dedicated to protect the environment, provide employment and education opportunities for the communities that it operates in.

Our President and CEO, Paul Thompson, brings over 40 years experience in mining and mining development to Mexus Gold US. Mr. Thompson is currently recruiting additional management personnel for its Mexico, Nevada, and submarine Cable Recovery operations to assist in growing the company.

Our executive offices are located at, 1805 N. Carson Street, #150, Carson City, Nevada 89701. Our telephone number is (916) 776 2166.

We were originally incorporated under the laws of the State of Colorado on June 22, 1990, as U.S.A. Connection, Inc. On October 28, 2009, we changed our domicile to Nevada and changed our name to Mexus Gold US to better reflect our new business operations. Our fiscal year end is March 31st.

Description of the Business of Mexus Gold US

Mexus Gold US is engaged in the evaluation, acquisition, exploration and advancement of gold exploration and development projects in the state of Nevada and Mexico, as well as, the salvage of precious metals from identifiable sources. Our main activities in the near future will be comprised of our mining operations in Nevada and Mexico and our cable salvage operations in Alaska and along the west coast of the United States.

Our mining opportunities located in the state of Nevada and the state of Sonora, Mexico will provide us with projects to recover gold, silver, copper and other precious metals. The cable salvage opportunity involves principally the recovery of copper and lead from abandoned cable previously utilized for communications purposes. Each of these opportunities are discussed further herein.

In addition, our management will look for opportunities to improve the value of the gold projects that we own or may acquire knowledge of or may acquire control through exploration drilling, introduction of technological innovations or acquisition with the goal of developing those properties into operating mines. We expect that emphasis on gold project acquisition and development will continue in the future.

Business Strategy

Our business plan was developed with the overriding goal of maximizing shareholder value through the exploration and development of our mineral properties, utilizing the extensive mining-related background and capabilities of our management and employees, and also through strategic partnerships. To achieve this goal, our business plan focuses on five strategic areas:

Lida Mining District, Nevada

We believe the Nevada properties represent the potential to provide the company with a viable project with the addition of additional geologic evaluation and the drilling of prospective areas. Our strategy for this project is to utilize geological data acquired through prior studies, confirm prior drilling results, expand the delineation of the possible ore body and identify reserves through our own geological evaluations.

Mexus Gold S.A. de C.V.

Effective March 31, 2011, we have acquired Mexus Gold S.A. de C.V. We begun funding the operations in Mexico and have begun shipping equipment to the mining sites. In addition, we have begun shipping raw materials from the mining areas for bulk processing and further analysis. We have also initiated an exploration drilling program to further identify the extent of the possible reserves now identified.

Cable Salvage Operation

We have determined that instituting a salvage operation offshore Alaska initially for the smaller diameter cable will provide us with the knowledge and experience to proceed forward with this project.

Other Exploration Properties

Our Other Exploration Properties comprise earlier-stage exploration properties. We are currently conducting a number of activities in connection with our earlier-stage exploration properties. During 2009, additional unpatented mining claims were staked in Esmeralda County, Nevada. The evaluation includes compilation of all geologic data and land information for the properties in a geological information system data base. We also staked additional claims in the State of Sonora, Mexico in areas of interest to the company.

Mergers and Acquisitions

We will routinely review merger and acquisition opportunities. An appropriate merger and acquisition opportunity must be accretive to the overall value of Mexus Gold US. Our primary focus will be on those opportunities involving precious metal production or near-term production with a secondary focus on other resource-based opportunities. Potential acquisition targets would include private and public companies or individual properties. Although our preference would be for candidates located in the United States and Mexico. Mexus Gold US will consider opportunities located in other countries where the geopolitical risk is acceptable.

Mining Operations

We classify our mineral properties into three categories: “Development Properties”, “Advanced Exploration Properties”, and “Other Exploration Properties”. Development Properties are properties where a decision to develop the property into a producing mine has been made. Advanced Exploration Properties are those properties where we retain a significant ownership interest or joint venture and where there has been sufficient drilling and analysis to identify and report proven and probable reserves or other mineralized material. We currently do not have a Development Property or Advanced Exploration Property. Other Exploration Properties are those that do not fall into the other categories. Please see below for information about our Other Exploration Properties.

Other Exploration Properties

Our Other Exploration Properties consist of the following:

Mining Properties located in the state of Nevada

Lida Mining District

The Lida Project is located in south central Nevada, approximately 20 miles south-west of Goldfield. The project area is accessed by proceeding 15 miles south of Goldfield along US Highway 95 to Lida Junction. Then by proceeding west along Nevada State Route 266 for 19 miles to the Lida, Nevada, the project site.

FIGURE 1 - LOCATION MAP

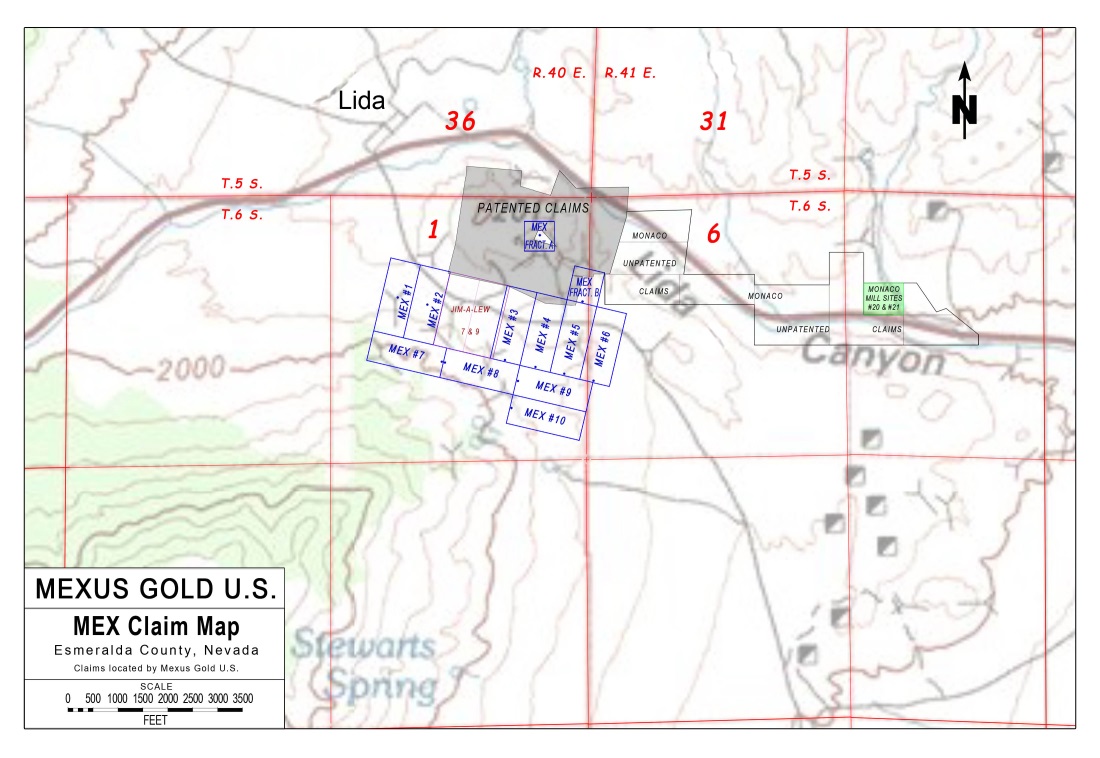

The Lida Project, located in Esmeralda County Nevada, consists of 2 components: the 1st component consists of two groups of leased patented claims: the Florida Group (Florida, Father Mother and Lenore, US Mineral Survey No. 3281) and the Wisconsin Group ( Wisconsin, Florida, King Solomon, Belle of Lida, Lucky Jim, Lucky Jack, Alhambra, Mountain View and Savana Fraction, US Mineral Survey No. 3388) totaling 174.503 acres. Also included in the lease are a total of approximately 230 acres of unpatented claims: Monaco Nos. 1 -10, Monaco Mill Site Nos. 20 & 21 and Jim-A-Lew Nos. 7 & 9. The lease includes the State of Nevada Certificate of Appropriation of Water No. 13630.(Figure 2)

The 2nd component consists of a total of 12 unpatented mining claims originally located by Mexus Gold US on November 24, 2009 (Mex Nos. 1 through 10 and Mex Fractions A & B) totaling approximately 210 acres. All of the named unpatented claims are considered to be valid by the Bureau of Land Management through Sept 2013.

FIGURE 2 - LIDA PROPERTY MAP

The patented claims are wholly owned by Nevada Pacific Rim, a Nevada Corporation as are the leased unpatented mining claims. The Mex Claims were located and are wholly owned by Mexus Gold US, also a Nevada Corporation. Nevada Corporations can locate and hold unpatented Mining Claims.

Mexus issued 250,000 shares of common stock to Nevada Pacific Rim upon signing this agreemen (21 Sept, 2009), which granted Mexus an 8 month option period. At the end of the option period, Mexus paid USD 75,000 to Nevada Pacific Rom and issued another 250,000 shares of common stock to Nevada Pacific Rim for a 6 month extension. Any production is subject to a 3% Net Smelter Royalty. A purchase price of USD 5,000,000.00 is set, with a minimum cash payment of USD 1,500,000.00. The balance can be issued in Mexus Gold US common stock.

Mexus has surface and mineral rights on the patented lands. Mexus has mineral rights only on the unpatented claims. In order for any mining work to begin on the unpatented lands, a Plan of Operation must be filed with the Bureau of Land Management.

The geology of the Lida Project area consists of a package of massive interbedded dolomites and limestone of the pre-Cambrian Deep Spring Formation, overlain by a Cambrian package consisting of massive limestones and dolomites. These packages are in turn overlaid by the Ordivician Palmetto Formation consisting of interbedded chert, siltstone and shale. All of the sedimentary units have been intruded by Jurassic to Tertiary aged stocks and dikes as well as being covered by volcanic flows and tuffs. Visually the intrusives range in composition from rhyolite to andesite.

The Lida Mining District is located along the NW trending Walker Lane structural zone. The Walker Lane localizes many deposits and mining districts, including: Goldfield, Tonopah, Candelaria, Borealis, Santa Fe, Rawhide, Yerington and possibly the Comstock Lode. It is also the locus of severe structural deformation.

The mineralization consists of mainly silver/gold veins, replacement deposits, and /or sediment hosted gold deposits. The exploited deposits were quartz and calcite veins which were oxidized near the surface. Primary mineralization appeared to be a complex sulfide deposit consisting mainly of galena with some hornsilver and free(?) gold. Total recorded early production was apparently only some 5,573 tons which was found in the geologic and mining report on Esmeralda County.

In the early 1970's, Hughes (The Summa Corporation) did some underground work and tried to develop an open pit. Both efforts were unsuccessful and exhausted the funds.

Historical work consists of a series of shafts and drifts throughout the properties. Access to these historical workings is variable with some of the shafts and adits being caved while others are in good condition. An unknown dollar amount has been expended upon this work. Future work will be undertaken to confirm the presence of reserves before commencing mining.

Only verbal summaries of some of the historical resource calculations are in the possession of mexus. The company does not have any assay maps or detailed calculations in hand. It is not known whether Nevada Pacific Rim has more data than what has been forwarded `to Mexus Gold US.

The "reserve" calculations were made by making assumptions which are no longer used in the mining industry and were questionable at the time the calculations were made and the report was written. One of the assumptions used was calculating a value per vertical foot based on properly taken channel sampling (based on written descriptions) of a limited face. The vertical distance used in the calculations was based on assumptions from the depth of historical workings (700 feet) in the Florida and adjacent mines. The width used in the calculations was generally limited and based on the length of the weighted channel sample.

A total of four intervals were channel sampled. The channel sample intervals were: 113 linear feet (30 channel samples, averaging 0.038 opt Au, 19.88 opt Ag), 13.5 linear feet (7 channel samples averaging trace Au, 44.524 opt Ag) and 29.4 linear feet (10 channel samples averaging 0.034 opt Au, 19.59 opt Ag). One drill hole yielded a weighted average of 15.20 opt Ag and 0.083 opt Au over the lowest 24 feet. As previously stated, there are no mine maps, assay maps or drill hole location maps in the company's possession, so it is impossible to evaluate the stated numbers. No information on the assay laboratory used was given. Consequently, no statements can be made regarding any resources or reserves on this property.

Due to these factors, the company is at the present time evaluating the resources quoted in the report and will make a final decision on how to proceed with the project.

Initially the work will be located on the patented lands, necessitating obtaining a Waste Water Disposal Permit from the Nevada Department of Environmental Quality and an Operating Permit from Esmeralda County, Such permits can usually be obtained within 90 days.

A preliminary budget of approximately USD 5,000,000.00 has been estimated for both exploration and possible extraction. Certain reserves have been cited as being present around the historical workings. These reserves have not yet been confirmed and will need to be confirmed by drilling before any extraction can commence.

In summary, Mexus intends to begin any work on the Patented Lands. By starting this way, Mexus will need an Operating Permit from Esmeralda County and a waste water discharge Permit from the Nevada Department of Environmental Protection (NDEP). Neither of these are difficult to obtain when following accepted practices, especially in Esmeralda County. In general, such permits can be had within 90 days.

Similar permits would be required for any drilling activity or other surface disturbances on the patented land. Drilling on the unpatented BLM lands would require filing of a Notice of Intent with the Bureau of Land Management for less than a 5 acre total disturbance.. The BLM has 30 days to comment on the Notice. Approval is generally automatic.

There are no known environmental liabilities from the historical work in the Lida Mining District.

Mining Properties Located in Mexico

The following properties are located in Mexico and owned by Mexus Gold S.A. de C.V., our wholly owned subsidiary:

Caborca Project

On January 5, 2011, Mexus Gold Mining S.A. de C.V. entered into a Purchase Agreement to purchase the Caborca Project. The Caborca Project consists of 7,400 acres (3,000 hectares) about 50 kilometers northwest of the City of Caborca, Sonora State, Mexico. The Caborca Project lies on claims filed by the owners of the Santa Elena Ranch, which controls the surface rights over the project claims. The claims lie near 112o 25' W, 31o 7.5" N. These claims were visited near the end of January, 2011. On or about July 11, 2011, we acquired five additional claims surrounding the Caborca Project consisting of approximately 1,000 additional acres.

We have been unable to locate geologic maps of the area from the Government Geological Survey. However, pursuant to our investigation of the project, the claims were found to be underlain by an igneous complex. The rocks observed included many types of granitic rocks, exhibiting porphyrytic textures, gneissic and equigrannular textures. Quartz was variable. At times quartz "eyes" were observed, that is porphyrytic quartz which many workers consider to be indicative of a porphyry environment. In other localities, no quartz was evident. When no quartz was present, the rock was equigrannular. Quartz veining was evident throughout the claim group. A mine was developed along a major quartz vein, called the Julio 2 Mine with the vein being called the Julio Vein.

There are multiple exploration targets on the Caborca Project. The two most important are the quartz stockwork zone and the Julio vein system. The first target will be the quartz stockwork zone. At least four drill holes are expected to be drilled in this zone to test the mineral potential of this area. Additional holes will be completed to test the Julio vein system.

Ocho Hermanos – Guadalupe de Ures Project

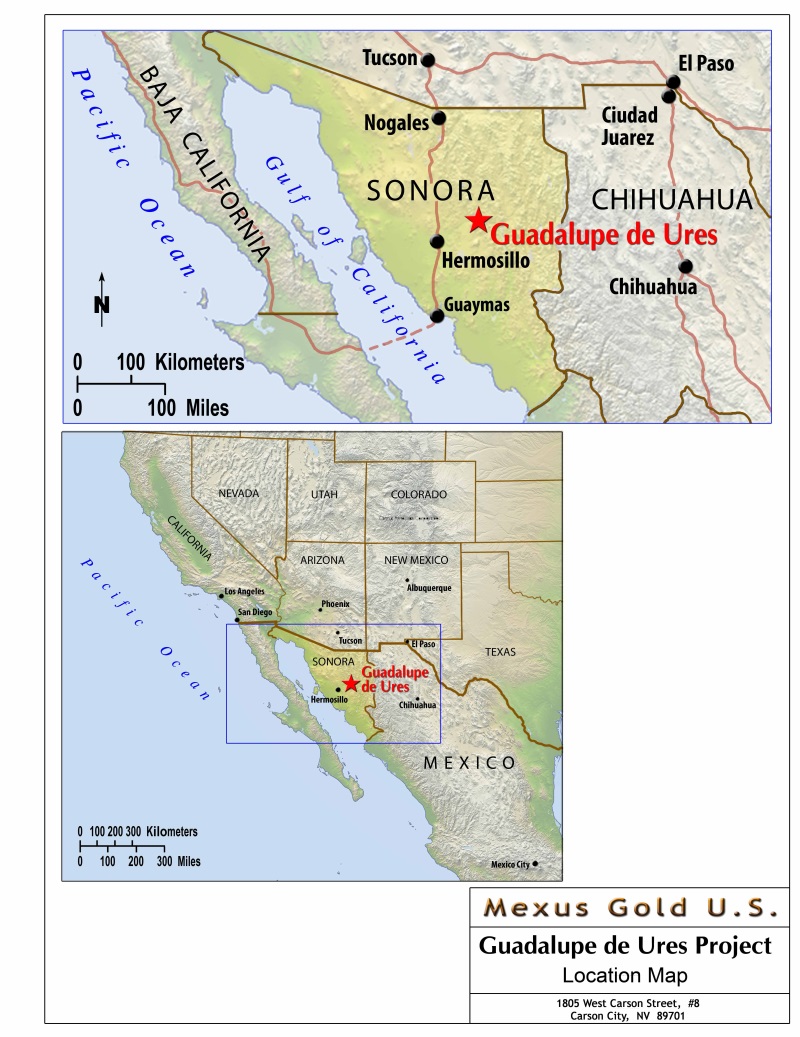

The Guadalupe de Ures Project is accessed from Hermosillo by driving via good paved road for 60 kilometers to the town of Guadalupe de Ures and then for 15 kilometers over dirt roads to the prospects. A base camp has been established near the town of Guadalupe de Ures using mainly trailers for accommodation, workshops and kitchen facilities.

FIGURE 3 - LOCATION MAP

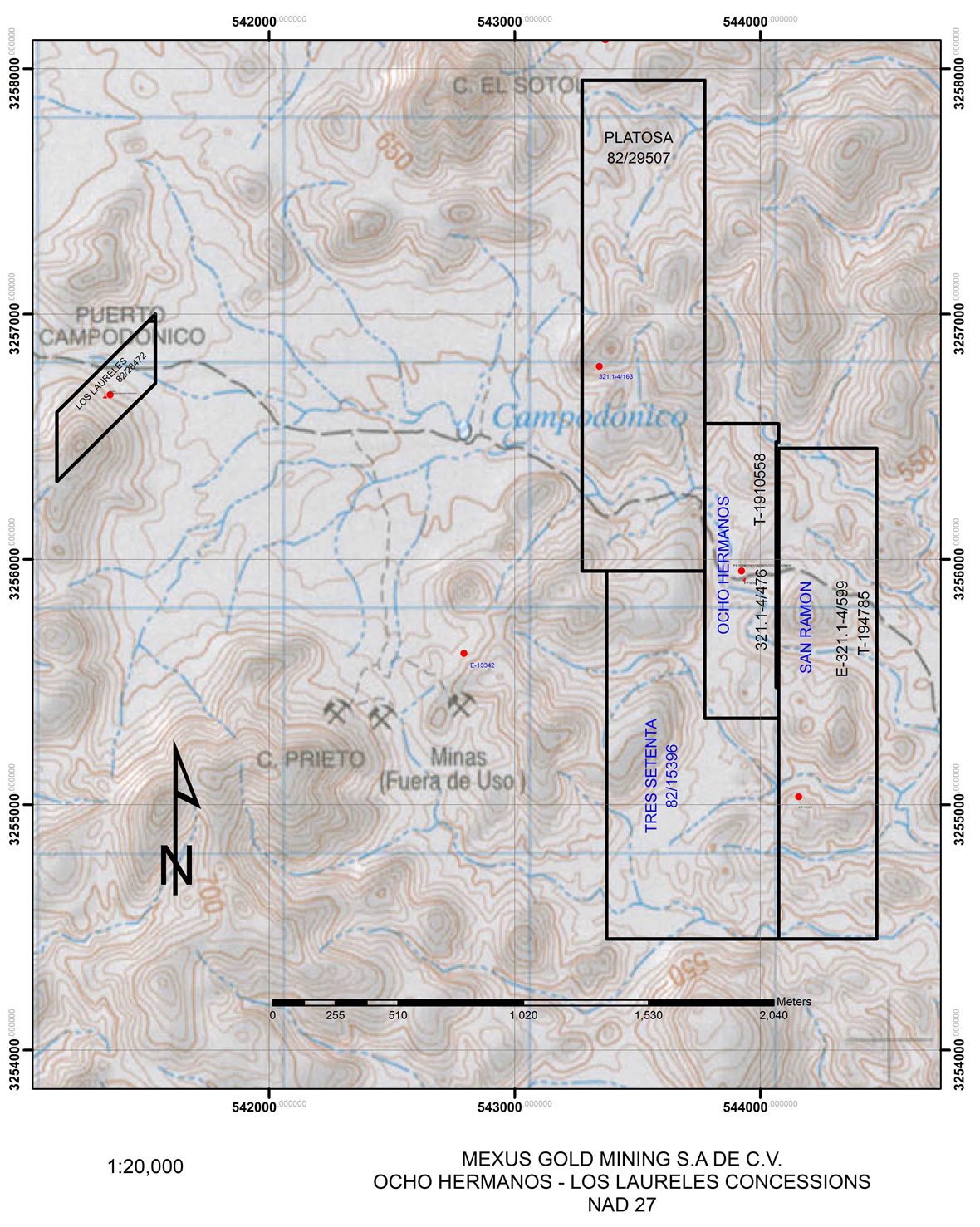

The Ocho Hermanos Project (also called the Guadalupe de Ures Project) consists of the “Ocho Hermanos” and "San Ramon" claims which are covered by the Sales and Production Contract dated the 4th day of July, 2009 between “Minerales Ruta Dorado de RL de CV” (seller) and “Mexus Gold Mining S.A. de C.V.”, a wholly owned subsidiary of Mexus Gold US (buyer). The Ocho Hermanos Claim consists of 34.9940 hectares (1 acre = 0.4047 hectares) or 86.4690 acres while the San Ramon Claim consists of 80 hectares (197.6773 acres).(Figure 4)

The term of the agreement is 5 years. During the term Mexus must pay 40% of the net revenue received for minerals produced to the seller. At the conclusion of the 5 years, the lease can be purchased for USD 50,000.

Minerales Ruta Dorado de RL de CV is a duly constituted Mexican Company and as such can hold mining claims in Mexico.

FIGURE 4 - OCHO HERMANOS

PROJECT AREA CLAIM MAP

Mexus did not perform any systematic sampling or any systematic drilling and because of this did not set up a formal QA/QC program. All of the samples were submitted to Certified Laboratories (ALS - Chemex in Hermosillo or American Assay in Reno, Nevada) which insert their own QA/QC samples/duplicates. Also the laboratories run duplicates and blanks from each batch fired The sequence of events so far are the following:

|

1.)

|

Mexus found a previously mined area with interesting values – Ocho Hermanos

|

|

2.)

|

Mexus began to submit characterization samples to the above noted assay laboratories, in order to determine the range of Au - Ag values present

|

|

3.)

|

Mexus then began an investigation into recovery options by using material taken from the areas with the better values

|

|

4.)

|

The above work was completed before any systematic exploration was done because if no recovery method could be found relatively quickly, the project would move more slowly

|

|

5.)

|

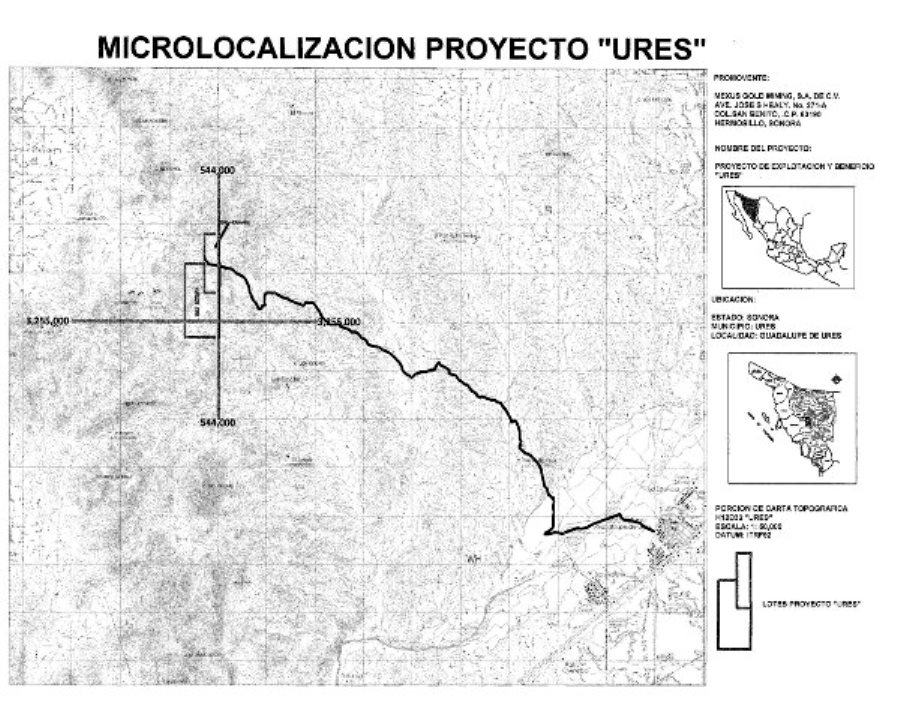

Because of the lead time involved, Mexus began work on an Environmental Impact Statement for the likely operational area (a total of 4 hectares to begin)

|

|

6.)

|

In order to complete the EIS, figures for estimated tonnages were submitted to cover the hoped for volume

|

|

7.)

|

To date, no suitable recovery method was found due primarily to the partial oxidation of the principally sulfide deposit

|

|

8.)

|

The Environmental Permits run for 35 years so there is time for further investigation

|

The main geologic feature of this project area is an apparent “manto” sulfide zone composed primarily of galena with some pyrite, arsenopyrite and possibly phyrrotite. Above this zone there is an oxide zone composed of iron and lead oxides. The sulfides themselves are partially oxidized. Reconnaissance and characterization samples taken indicated sporadically high gold and silver values. The deposit occurs in shallow water sediments (principally quartzites, with some limestone and shales) and can be best characterized as a skarn type deposit due to the presence of intrusive rocks within 1 kilometer.

Given the complex nature of the sulfide deposit and the partial oxidization of the material (indicated by the presence of yellow colored lead oxides), a satisfactory recovery method has not yet been found. Consequently, at this time, no further systematic work beyond the initial reconnaissance and characterization sampling has been completed. The entire project was essentially put on hold until a suitable recovery method is found, which is a continuing effort and at this time is being pursued by member of the faculty at the University of Sonora in Hermosillo. The faculty member teaches metallurgy and assay practices at the University. After a suitable recovery method has been identified, the process will need to be confirmed by a certified metallurgical testing laboratory.

The Environmental Permits detail all of the affected flora and fauna. The land is presently used for cattle grazing and the surface rights are owned by the community of Guadelupe de Ures. An agreement is in place with Mexus Gold Mining S.A. de C.V. for surface access and disturbance. The Environmental Permit concludes that no permanent damage or degradation of the present land use will result from the intended activity on the lands. At present, the Environmental Permits cover a total of 4 hectares - 3 hectares cover the initial site of the mineral as presently understood and 1 hectare is permitted for the erection of a suitable extraction plant.

No known contamination from past mining activities was found or is known to locals. The historic workings consisted of a few shallow adits and pits. In the course of obtaining the Environmental Permission the permit stipulated that properly lined ponds etc must be used to prevent any potential surface or ground water contamination from any proposed activities.

Only separation is proposed to be conducted on site if found to be possible, while final metal recovery will be conducted at a properly licensed and certified metal refining facility. Current efforts to find suitable recovery methods are being conducted off site in a University laboratory. Up sizing the process, if found, will be completed by a licensed, certified metallurgical laboratory.

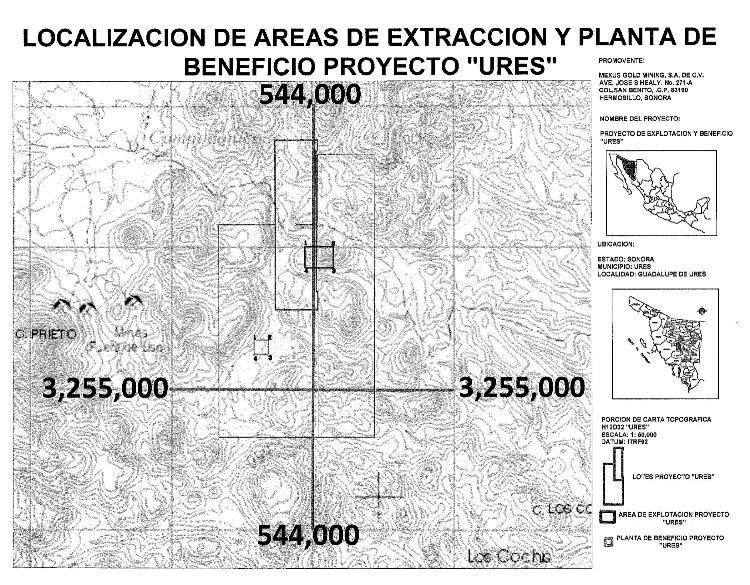

FIGURE 5- MICROLOCALIZACION PROYECTO “URES”

FIGURE 6 – LOCALIZACION DE AREAS DE EXTRACCION

FIGURE 7

PLANTA DE BENEFICIO

AREA DE EXTRACCION

370 Area

This zone is composed of a sedimentary sequence (limestone, quartzite, shale) intruded by dacite and diorite as well as rhyolite. The dacite exhibits argillic alterations as well as silicification (quartz veins). The entire area is well oxidized on the surface. This is an area of classic disseminated low grade gold and silver mineralization. Surface grab sample assays show 0.14 grams per ton to as high as 29.490 grams per ton gold. This area is an important area for potentially defining an open pit heap leach project.

El Scorpion Project Area

This area has several shear zones and veins which show copper and gold mineralization’s. Recent assays of an 84’ drill hole shows 1.750% per ton to .750% per ton of copper and 3.971 grams per ton to 0.072 grams per ton of gold. Another assay of rock sample from the area shows greater than 4.690% per ton copper. This land form distribution appears to be synonymous to the ideal porphyry deposit at Baja La Alumbrera, Argentina.

Los Laureles

Los Laureles is a vein type deposit mainly gold with some silver and copper. Recent assays from grab samples show gold values of 67.730 grams per ton gold, 38.4 grams per ton silver, 2,800 grams per ton copper.

As of the date of this Report, we have opened up old workings at the Los Laureles claim and have discovered a gold carrying vein running north and south into the mountain to the south.

Cable Salvage Operation

Our examination of the information provided to us and our accumulation of data has identified the most prospective area to begin our salvage operations is the near coast areas of Alaska. The initial recovery operations will be comprised of acquiring two and one-half inch diameter cable with a weight of eight and one-half pounds. We are satisfied that we will be able to comply with all permits and notifications to the appropriate governmental authorities regarding the salvage operations.

On July 8, 2010, the Company entered into a Project Management Agreement with Powercom Services, Inc., a Georgia corporation, to provide the necessary capital so Mexus can proceed with the first phase of our Cable Recovery in Alaskan waters.

Mexus President/CEO Paul Thompson along with Ken Setter, the person in charge of the Alaska sub-marine cable project for Mexus, just returned from a two week trip to Alaska to verify the cable locations in Alaska waters culminating in the execution of the contract which will fund Mexus through its first barge load sale of cable.

Mr. Ken Setter directed Mr. Thompson to several sites along the Pacific Coast of Alaska where we were able to identify the sub-marine cable. We were able to retrieve several sections for sampling purposes, and to test the Company’s new innovative way of retrieving cable from the bottom of the ocean. We believe the new cable pulling equipment will have the capability of pulling up to 10 miles per day or 475,200 pounds of cable per day.

The cable is composed of copper, lead, and steel all salvageable for scrap sales or processing for end user. Mexus is now ready to start equipping its 260’ barge located in Seattle, Washington with pulling equipment for the trip to Alaska where it will be able to start pulling cable at a point identified & marked by Messrs. Setters and Thompson on their recent trip.

On October 29, 2010, our tugboat, the "Caleb", and our 230 foot barge arrived in Ketchikan, Alaska. The boats are equipped with automated cable pulling equipment and underwater electrical equipment, magtonetor, underwater cable identifier, remote cameras and a high definition scanning sensor, and a cable left buoy marking system. As of the date of this report, we have begun cable pulling operations, weather permitting.

In addition, we have now located additional submarine cable in Washington State waters with our special survey equipment and we are awaiting cooperation from Washington State to pull the cable.

During the year, the Company began the first phase of its Cable Recovery Project in Alaskan waters. The cable which was recovered was smaller diameter cable which was excellent for testing the recovery equipment and vessels. The Company has re-evaluated the project and plans to conduct exploration activities in an attempt to identify larger cable. Should those activities identify any cable suitable for salvage operations, the Company would determine the proper title and ownership of the cable and once such title is determined act accordingly as to whether or not a recovery operation is warranted.

Employees

Mexus Gold US has no employees at this time. Consultants with specific skills are utilized to assist with various aspects of the requirements of activities such as project evaluation, property management, due diligence, acquisition initiatives, corporate governance and property management. If we complete our planned activation of the Nichols Property Exploration and Drilling Program, Cable Salvage Operations and operations of the Mexican mining properties, our total workforce will be approximately 30 persons. Mr. Paul D. Thompson is our sole officer and director.

Competition

Mexus Gold US competes with other mining companies in connection with the acquisition of gold properties. There is competition for the limited number of gold acquisition opportunities, some of which is with companies having substantially greater financial resources than Mexus Gold US. As a result, Mexus Gold US may have difficulty acquiring attractive gold projects at reasonable prices.

Management of Mexus Gold US believes that no single company has sufficient market power to affect the price or supply of gold in the world market.

Legal Proceedings

There are no legal proceedings to which Mexus Gold US or Mexus Gold S.A. de C.V. are a party or of which any of our properties are the subject thereof.

Property Interests, Mining Claims and Risk

Property Interests and Mining Claims

Our exploration activities are conducted in the state of Nevada. Mineral interests may be owned in this state by (a) the United States, (b) the state itself, or (c) private parties. Where prospective mineral properties are owned by private parties, or by the state, some type of property acquisition agreement is necessary in order for us to explore or develop such property. Generally, these agreements take the form of long term mineral leases under which we acquire the right to explore and develop the property in exchange for periodic cash payments during the exploration and development phase and a royalty, usually expressed as a percentage of gross production or net profits derived from the leased properties if and when mines on the properties are brought into production. Other forms of acquisition agreements are exploration agreements coupled with options to purchase and joint venture agreements. Where prospective mineral properties are held by the United States, mineral rights may be acquired through the location of unpatented mineral claims upon unappropriated federal land. If the statutory requirements for the location of a mining claim are met, the locator obtains a valid possessory right to develop and produce minerals from the claim. The right can be freely transferred and, provided that the locator is able to prove the discovery of locatable minerals on the claims, is protected against appropriation by the government without just compensation. The claim locator also acquires the right to obtain a patent or fee title to his claim from the federal government upon compliance with certain additional procedures.

Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities

not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. If the validity of a patented mining claim is challenged by the BLM or the U.S. Forest Service on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals located thereon. Such a challenge might be raised when a patent application is submitted or when the government seeks to include the land in an area to be dedicated to another use.

Reclamation

We may be required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and re-vegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts will be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Risk

Our success depends on our ability to recover precious metals, process them, and successfully sell them for more than the cost of production. The success of this process depends on the market prices of metals in relation to our costs of production. We may not always be able to generate a profit on the sale of gold or other minerals because we can only maintain a level of control over our costs and have no ability to control the market prices. The total cash costs of production at any location are frequently subject to great variation from year to year as a result of a number of factors, such as the changing composition of ore grade or mineralized material production, and metallurgy and exploration activities in response to the physical shape and location of the ore body or deposit. In addition costs are affected by the price of commodities, such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in production costs or a decrease in the price of gold or other minerals could adversely affect our ability to earn a profit on the sale of gold or other minerals. Our success depends on our ability to produce sufficient quantities of precious metals to recover our investment and operating costs.

Distribution Methods of the Products

The end product of our operations will usually be doré bars. Doré is an alloy consisting of gold, silver and other precious metals. Doré is sent to refiners to produce bullion that meets the required market standard of 99.95% pure gold. Under the terms of refining agreements we expect to execute, the doré bars are refined for a fee and our share of the refined gold, silver and other metals are credited to our account or delivered to our buyers who will then use the refined metals for fabrication or held for investment purposes.

General Market

The general market for gold has two principal categories, being fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and jewelry. The supply of gold consists of a combination of current production from mining and the draw-down of existing stocks of gold held by governments, financial institutions, industrial organizations and private individuals.

Patents, trademarks, licenses, franchises, concessions, royalty agreements or labor contracts, including duration;

We do not have any designs or equipment which are copyrighted, trademarked or patented.

Effect of existing or probable governmental regulations on the business

Government Regulation

Mining operations and exploration activities are subject to various national, state, provincial and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our exploration and other programs. We believe that Mexus Gold US is in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in the Nevada and United States and in any other jurisdiction in which we will operate. We are not aware of any current orders or directions relating to Mexus Gold US with respect to the foregoing laws and regulations.

Environmental Regulation

Our gold projects are subject to various federal and state laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. It is our policy to conduct business in a way that safeguards public health and the environment. We believe that the actions and operations of Mexus Gold US will be conducted in material compliance with applicable laws and regulations. Changes to current state or federal laws and regulations in Nevada, where we operate currently, or in jurisdictions where we may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

Research and Development

We do not foresee any immediate future research and development costs.

Costs and effects of compliance with environmental laws

Our gold projects are subject to various federal and state laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. It is our policy to conduct business in a way that safeguards public health and the environment. We believe that our operations are and will be conducted in material compliance with applicable laws and regulations. The economics of our current projects consider the costs and expenses associated with our compliance policy.

Changes to current state or federal laws and regulations in Nevada, where we operate currently, or in jurisdictions where we may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

Item 15. Exhibits, Financial Statement Schedules.

|

Statements

|

||||

|

Report of Independent Registered Public Accounting Firm

|

||||

|

Balance Sheets at March 31, 2012 and 2011

|

||||

|

Statements of Operations for the years ended March 31, 2012 and 2011and from September 18, 2009 to March 31, 2012

|

||||

|

Statement of Changes in Shareholders' Deficit for the years ended March 31, 2012 and 2011 and from September 18, 2009 to March 31, 2012

|

||||

|

Statements of Cash Flows for the years ended March 31, 2012 and 2011 and from September 18, 2009 to March 31, 2012

|

||||

|

Notes to Financial Statements

|

||||

|

Schedules

|

||||

|

All schedules are omitted because they are not applicable or the required information is shown in the Financial Statements or notes thereto.

|

||||

|

Exhibit

|

Form

|

Filing

|

Filed with

|

|

|

Exhibits

|

#

|

Type

|

Date

|

This Report

|

|

Articles of Incorporation filed with the Secretary of State of Colorado on June 22, 1990

|

3.1

|

10-SB

|

1/24/2007

|

|

|

Articles of Amendment to the Articles of Incorporation filed with the Secretary of State of Colorado on October 17, 2006

|

3.2

|

10-SB

|

1/24/2007

|

|

|

Articles of Amendment to Articles of Incorporation filed with the Secretary of State of the State of Colorado on January 25, 2007

|

3.3

|

10KSB

|

6/29/2007

|

|

|

Amended and Restated Bylaws dated December 30, 2005

|

3.3

|

10-SB

|

1/24/2007

|

|

|

Code of Ethics

|

14.1

|

10-KSB

|

6/29/2007

|

|

|

Certification of Paul D. Thompson, pursuant to Rule 13a-14(a)

|

31.1

|

X

|

||

|

Certification of Paul D. Thompson pursuant to 18 U.S.C Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

32.1

|

X

|

||

|

Caborca Concessions Site Map (Mexico)

|

99.1

|

10-K

|

6/102013

|

|

|

Mexus Gold Concessions Site Map (Nevada)

|

99.2

|

10-K

|

6/102013

|

|

|

Environmental Permits (Mexico)

|

99.3

|

X

|

||

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

MEXUS GOLD US

/s/ Paul D. Thompson

By: Paul D. Thompson

Its: President

Principle Accounting Officer

|

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant on the capacities and on the dates indicated.

|

Signatures

|

Title

|

Date

|

||

|

/s/ Paul D. Thompson

Paul D. Thompson

|

Chief Executive Officer

Chief Financial Officer

Principal Accounting Officer

President

Secretary

Director

|

September 12, 2013 |