Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - II-VI INC | d596701dex21.htm |

| EX-99.1 - EX-99.1 - II-VI INC | d596701dex991.htm |

| EX-10.1 - EX-10.1 - II-VI INC | d596701dex101.htm |

| 8-K - FORM 8-K - II-VI INC | d596701d8k.htm |

1

II-VI Acquisition of

Semiconductor Laser Business

Investor Presentation

September 12, 2013

Exhibit 99.2 |

2

Forward Looking Statement Disclaimer

This presentation contains forward-looking statements based on certain assumptions and

contingencies that involve risks and uncertainties. The forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995

and relate to the Company's performance on a going-forward basis. The forward-looking statements in this

presentation involve risks and uncertainties, which could cause actual results, performance or trends

to differ materially from those expressed in the forward-looking statements herein or in

previous disclosures. The Company believes that all forward-looking statements made by it

have a reasonable basis, but there can be no assurance that management's expectations, beliefs or

projections as expressed in the forward-looking statements will actually occur or prove to be

correct. In addition to general industry and global economic conditions, factors that could

cause actual results to differ materially from those discussed in the forward- looking

statements in this presentation include, but are not limited to: (i) the failure of any one or more of the assumptions stated

above to prove to be correct; (ii) the risks relating to forward-looking statements and other

"Risk Factors" discussed in the Company's Annual Report on Form 10-K for the fiscal

year ended June 30, 2013 (iii) the purchasing patterns from customers and end-users; (iv)

the timely release of new products, and acceptance of such new products by the market; (v) the

introduction of new products by competitors and other competitive responses; (vi) the Company's

ability to devise and execute strategies to respond to market conditions; and/or (vii) the

Company’s ability to assimilate recently acquired businesses, and risks, costs and uncertainties

associated with such acquisitions. The Company disclaims any obligation to update information

contained in these forward-looking statements whether as a result of new information,

future events or developments, or otherwise. |

3

Agenda

•

Review of Today’s Announcement

•

Overview of the Semiconductor Laser Business acquired

•

Strategic Rationale and Fit with II-VI

•

Financial Impacts of the Transaction

•

Question and Answer Session |

4

Review of Today’s Announcement

•

We have completed the acquisition of the Switzerland-based Semiconductor

Laser business of Oclaro announced earlier today.

•

The transaction was valued at $115 million and, after deducting for retained

accounts receivable and holdbacks, the closing consideration paid was cash of

$92 million.

•

The business is currently expected to generate approximately $70

million in

revenues during the first 9.5 months of ownership by II-VI in FY14.

•

The acquisition is expected to become accretive to earnings during FY15.

•

The business will be included as a new fifth segment for financial reporting

purposes.

•

An option to acquire Oclaro’s amplifier and micro-optics business was

obtained. |

5

Switzerland-based

Gallium

Arsenide

Semiconductor

Laser

Business

Product family

Products

Market / application

Select customers

High

power

laser

(780nm

–

1060nm)

Material processing, industrial,

medical, printing

VCSEL

Computer mice, finger navigation,

optical interconnect, sensors

980nm pump

laser

(terrestrial and

submarine)

Optical amplifiers |

6

Technology Leadership

Innovation

•

Business originated at IBM Zurich

•

Continuous innovation in high power lasers and pump lasers

•

Rich patent portfolio (over 150 owned and licensed patents)

•

Over 70 engineers

World-class facility in

Zurich, Switzerland

Total size

116,600 sq ft / 10,800 m

2

(5 total floors, 3 production floors)

Cleanrooms

33,800 sq ft / 3,140 m

2

(mostly ISO class 7 on four floors)

Employees

Approximately 200 |

7

•

Strengthens II-VI’s existing portfolio of engineered materials

solutions. •

Broadens II-VI portfolio of differentiated components for high power laser

systems.

•

Establishes a semiconductor laser platform for II-VI.

•

Opens up new, large and rapidly growing addressable markets for II-VI.

Strategic Rationale and Fit with II-VI |

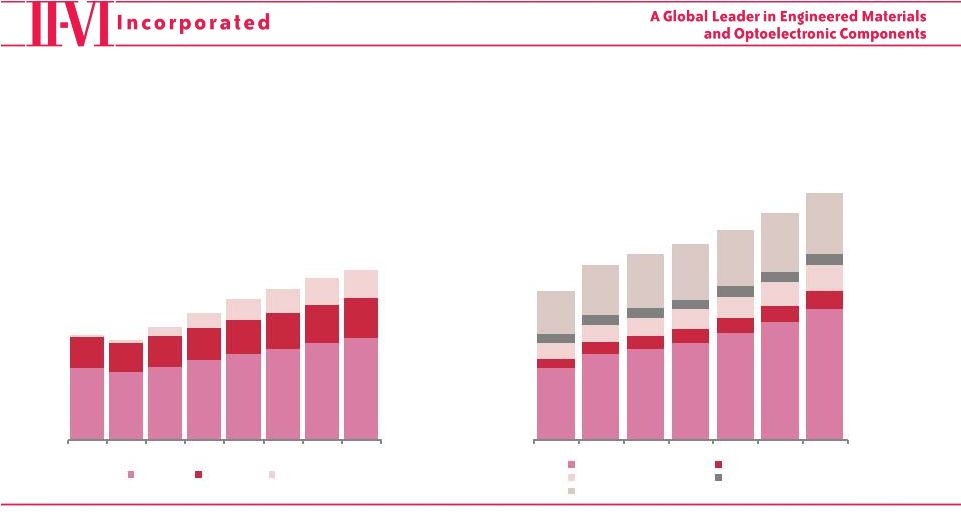

8

The Market Opportunity

CAGR = 9%

CAGR = 9%

CAGR = 8%

CAGR = 4%

CAGR = 4%

CAGR = 7%

CAGR = 5%

CAGR = 43%

Telecom pumps market (USD in millions)

Lasers market by application (USD in millions)

Source: Ovum-RHK 2013, Strategies unlimited 2013

$112

$106

$115

$125

$135

$143

$152

$160

$50

$46

$49

$51

$54

$57

$60

$63

$3

$5

$14

$24

$32

$38

$43

$45

$165

$157

$178

$200

$221

$238

$255

$268

2011

2012

2013

2014

2015

2016

2017

2018

Pump 980

Pump 1480

Pump 14xx

$1,959

$2,361

$2,488

$2,672

$2,939

$3,233

$3,608

$270

$330

$356

$389

$429

$468

$505

$441

$476

$503

$532

$578

$639

$709

$228

$260

$276

$273

$283

$297

$316

$1,204

$1,409

$1,500

$1,526

$1,575

$1,620

$1,677

$4,103

$4,835

$5,122

$5,392

$5,804

$6,256

$6,815

2010

2011

2012

2013

2014

2015

2016

Communications

Sensors

Medical

Micro Materials Proc.

Metal Materials Proc. |

9

Transaction Terms

Purchase price

•

$115

million valuation, consisting of:

•

$92

million in cash at closing

•

$15

million retained receivables

•

$6

million held back by II-VI for 15 months

•

$2 million held back by II-VI for potential working capital adjustments

Financing

•

Amended and restated credit facility with PNC Bank

•

$225 million revolving credit facility, $108 million drawn

•

$100 million unsecured term loan, fully drawn; quarterly payments of $5 million

beginning October 1, 2013

•

Interest

rate

of

L+0.75%

–

L+1.75% based on leverage ratio; currently at L+1.50%

Amplifier and micro-optics

option

•

II-VI paid $5

million for an exclusive option to acquire Oclaro’s amplifier and

micro-optics business •

30 days to exercise option

•

Option price retained by Oclaro if option is not exercised

|

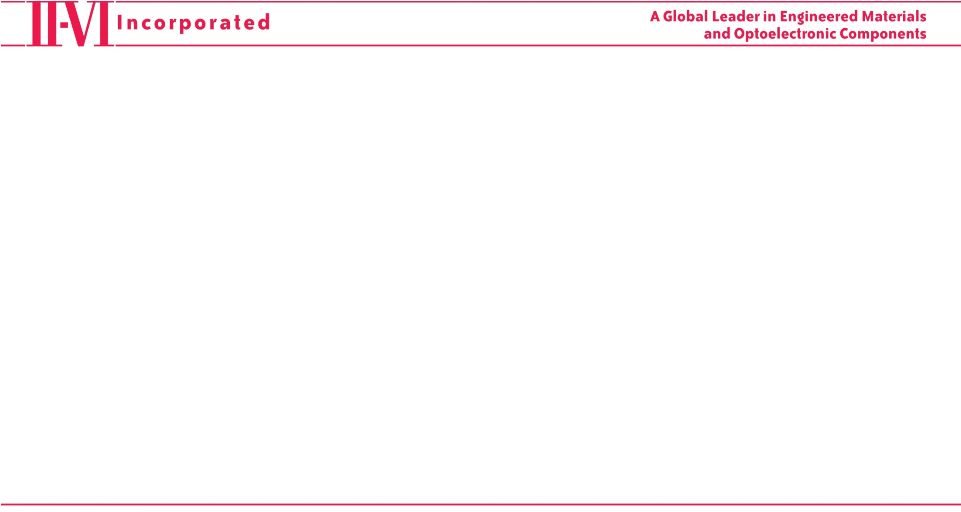

10

Earnings

•

Currently expected to be $0.08 to $0.12 dilutive to GAAP earnings per share in

FY2014 •

Includes transaction expenses estimated at $4 million or $0.06 EPS

•

Currently expected to be accretive beginning in FY2015

Leverage

Financial Impact

$111

$208

June 30, 2013

September 12, 2013

Credit facility borrowings |

11

Question and Answer Session

These comments and answers to certain questions contain forward

looking statements which are based on current expectations. Actual

results could differ materially. For information about factors that

could cause the actual results to differ materially, please refer to the

“Risk Factors”

section of our Annual Form 10-K for the fiscal year

ended June 30, 2013. Also, please refer to today’s Form 8-K filing

for additional details. |