Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Unilife Corp | d596289dex991.htm |

| 8-K - FORM 8-K - Unilife Corp | d596289d8k.htm |

Fiscal Year 2013

4 th

Quarter and Full Year Earnings Call

September 10, 2013

1

Exhibit 99.2 |

2

This

presentation contains forward looking statements under the safe harbor

provisions of the US securities laws. These forward-looking statements are based

on management’s beliefs and assumptions and on information currently

available to our management.

Our management believes that these forward-looking statements are reasonable

as and when made. However you should not place undue reliance on any such

forward looking statements as these are subject to risks and

uncertainties.

Please refer to our press releases and our SEC filings for more

information regarding the use of forward looking statements.

Cautionary Note Regarding Forward-Looking Statements |

Introductory

Comments by Unilife CEO Alan Shortall Signing of commercial supply contract with

Sanofi for use of Unifill Finesse with Lovenox

Minimum purchase of 150MM units per year

after four-year ramp program

Preparing to finalize several additional contracts

with other pharmaceutical companies relating to

devices across our proprietary portfolio

Additional upfront cash payments

Re-negotiating terms received for a large non-equity

based debt financing

3 |

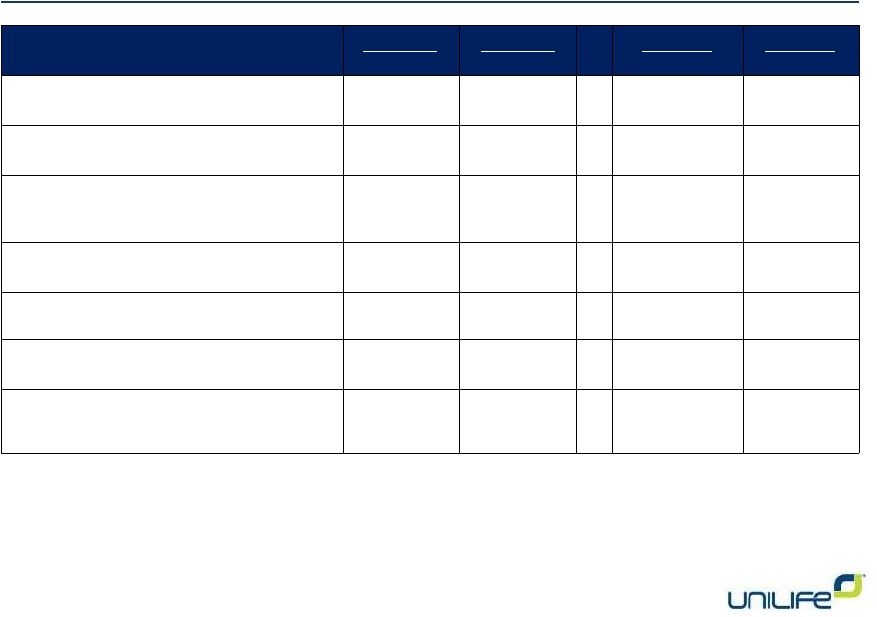

Lovenox®

Supply Contract –

Key Terms

Unilife Product

Sanofi Drug

Drug Area

Geographic Territory

Contract Period

Exclusivity

Minimum Volumes

Additional Payments

Other Terms

4

Unifill Finesse (customized product from Unifill platform)

Enoxaparin Sodium (Lovenox®

/ Clexane®)

Anti-thrombotics (low molecular weight heparin)

Global

Can extend up to 2024

Use of Unifill Finesse with anti-thrombotic drugs

Minimum of 150MM units per year (after four-year ramp

period after market entry) to maintain exclusivity

Up to $15MM ($5MM expected in CY2013)

Confidential between both parties for commercial

purposes and due to confidentiality clauses

Replaces and supersedes previously signed agreements |

Financial

Data 5

4Q 2013

4Q 2012

FY 2013

FY 2012

Revenues

$ 0.7M

$ 1.2M

$ 2.7M

$ 5.5M

Research & development

$ 6.5M

$ 6.9M

$ 21.7M

$ 23.1M

Selling, general & administrative

$ 10.3M

$ 7.1M

$ 32.4M

$ 27.7M

Net loss

$ 22.0M

$ 14.9M

$ 63.2M

$ 52.3M

Net loss per share –

diluted

$ 0.25

$ 0.21

$ 0.78

$ 0.78

Adjusted net loss

$ 9.9M

$ 11.0M

$ 38.0M

$ 37.7M

Adjusted net loss per share -

diluted

$ 0.11

$ 0.15

$ 0.47

$ 0.56 |

A Deep

Commercial Pipeline Driven by a Broad Product Portfolio Products are yet to be evaluated

by the FDA Unifill®

Unifill®

Select

EZMix™

EZMix™

Select

RITA™

Disposable Auto-Injector

LISA™

Reusable Auto-Injector

Precision-Therapy™

Flex-Therapy™

Depot-ject™

Ocu-ject™

Micro-ject™

Novel device for targeted organ

delivery (confidential)

Prefilled Syringes

For all prefilled biologics, drugs and vaccines

Reconstitution & Mixing

For all liquid or dry drug combination therapies

Auto-injectors

For all handheld patient self-injection therapies

Wearable Injectors

For long-duration or large-dose volume drugs that must

be worn on body during subcutaneous injection

Intraocular Delivery

For precise, accurate localized or targeted delivery of

drug depot or microliter doses to the eye

Specialized Devices

For the localized or targeted delivery of novel drugs

requiring extreme accuracy and precision

Selection of Products Within Platform

Technology Platform

6 |

7

Questions |