Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GETTY REALTY CORP /MD/ | d596656d8k.htm |

GETTY REALTY CORP. PRESENTATION

Bank of America Merrill Lynch Global Real Estate Conference

September 2013

Exhibit 99.1 |

Forward Looking Statements

Certain

statements

in

this

Presentation

constitute

“forward-looking

statements”

within

the

meaning

of

the

federal

securities

laws.

Forward-looking

statements

are

statements

that

relate

to

management’s

expectations

or

beliefs,

future

plans

and

strategies,

future

financial

performance

and

similar

expressions

concerning

matters

that

are

not

historical

facts.

In

some

cases,

you

can

identify

forward-looking

statements

by

the

use

of

forward-looking

terminology

such

as

“may,”

“will,”

“should,”

“expects,”

“intends,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

or

“potential.”

Such

forward-looking

statements

reflect

current

views

with

respect

to

the

matters

referred

to

and

are

based

on

certain

assumptions

and

involve

known

and

unknown

risks,

uncertainties

and

other

important

factors,

many

of

which

are

beyond

the

Company’s

control,

that

could

cause

the

actual

results,

performance,

or

achievements

of

the

Company

to

differ

materially

from

any

future

results,

performance,

or

achievement

implied

by

such

forward-

looking

statements.

While

forward-looking

statements

reflect

the

Company’s

good

faith

beliefs,

assumptions

and

expectations,

they

are

not

guarantees

of

future

performance.

The

Company

does

not

undertake

any

obligation

to

publicly

update

or

revise

any

forward-

looking

statements

to

reflect

changes

in

underlying

assumptions

or

factors,

new

information,

data

or

methods,

future

events

or

other

changes.

For

a

further

discussion

of

these

and

other

factors

that

could

cause

the

Company’s

future

results

to

differ

materially

from

any

forward-looking

statements,

see

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2012

and

the

Company’s

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

June

30,

2013,

including,

in

particular,

the

section

entitled

“Risk

Factors”

contained

therein,

and

its

other

filings

with

the

SEC.

Unless

otherwise

noted

in

this

Presentation,

all

reported

financial

data

is

presented

as

of

the

quarter

ended

June

30,

2013,

and

all

portfolio

data

is

as

of

August

31,

2013.

The

information

contained

herein

has

been

prepared

from

public

and

non-public

sources

believed

to

be

reliable.

However,

the

Company

has

not

independently

verified

certain

of

the

information

contained

herein,

and

does

not

make

any

representation

or

warranty

as

to

the

accuracy

or

completeness

of

the

information

contained

in

this

Presentation.

1 |

Investment Highlights

2

National portfolio with focus on growing and densely populated,

high barrier to entry markets

Stable cash flows supported by long-term, triple-net leases

Proven platform to pursue growth opportunities in sector with

large consolidation opportunity

At a positive inflection point in the Company’s evolution

Flexible balance sheet with low leverage

Upside opportunities created through rationalization of

transitional properties in existing portfolio

1

2

3

4

5

6 |

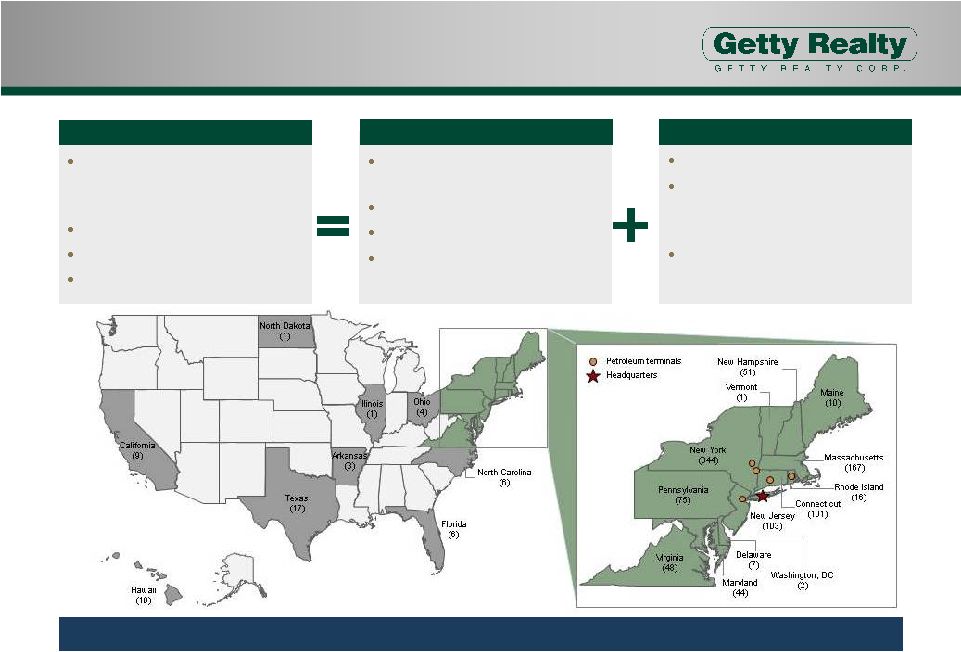

Leading National Portfolio with Future Upside

3

Long-term triple-net lease stability with future upside through transitional

properties 1,026 retail motor fuel/convenience

store properties, including five

terminals

898 owned properties (87.5%)

128 leased properties (12.5%)

21 states plus Washington, D.C.

Current Portfolio

20 tenants (662 properties) under long-

term, triple-net leases

89 single tenant triple-net leases

84% of core leases expire after 2022

Sites branded Getty, BP, Exxon, Mobil,

Shell, Chevron, Valero and Aloha

751 Core Properties

275 transitional properties

Successful releasing program focused

on attractive long-term, triple-net

leases

Proactively recycling capital from

property dispositions into accretive

investments

Future Upside |

Significant Presence in Markets with

“High Barriers to Entry”

4

Limited Availability

of Suitable

Land

Prime Locations in

High Traffic

Areas

Increasingly

Restrictive

Zoning

Regulations

High replacement costs

Limited new development

Unique assets with ability to satisfy increased

demand for non-gas

uses

Mature neighborhoods

High daily traffic counts

Optimal corners with high visibility and easy

access

Close proximity to highway entrances or exit

ramps

Difficult and lengthy permitting process

Impractical to obtain the necessary permits to

construct a similar use site

Leading national portfolio with concentrations in high barrier to entry markets

in the Northeast and Mid-Atlantic regions |

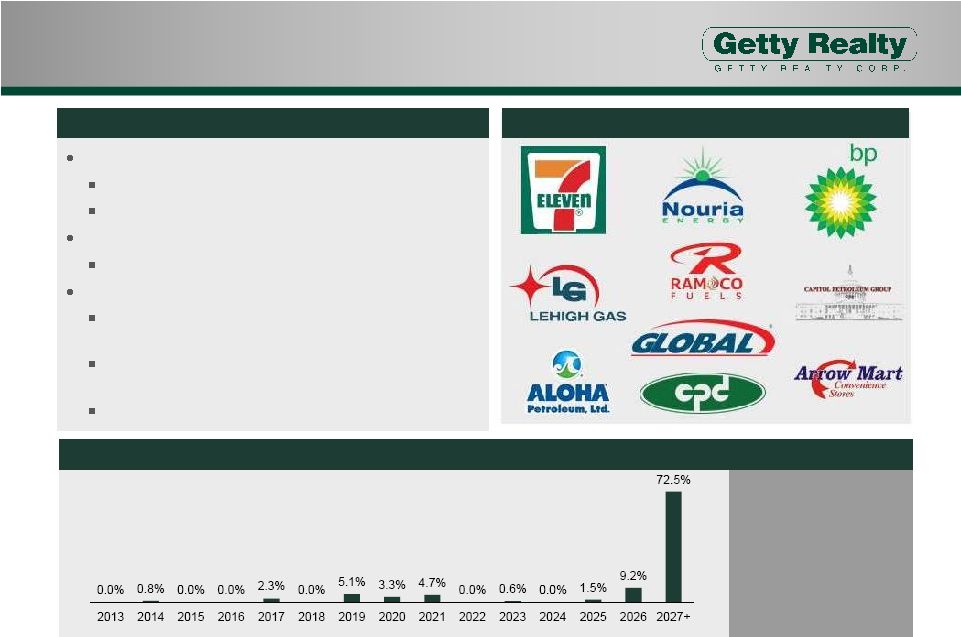

Sustainable Cash Flows Supported by

Long-Term Leases

5

Only 3% of leases

mature in next 5 years

and 17% in next

10 years

High Quality Tenant Base

Diversified tenant base

Prominent national and regional suppliers

2012 repositioning added 10 new high quality tenants

Compelling unit level economics

Rent coverage –

1.75x to 2.25x

Majority of triple-net leases have 15 year initial terms

Provisions for rent increases during initial term and

renewal periods

Unit level viability via station and tenant financial

performance

84% of core property leases expire after 2022

Highlights

Stable Long-Term Lease Structure

(1)

(1) Does not include single tenant triple-net leases or transitional properties

as their lease maturities vary. |

Incremental Upside in Transitional Properties

6

Proactive portfolio repositioning presents an opportunity to improve the cash flow

profile Disposition action plan:

Remaining properties being sold in a real estate auction or through regional

brokers De-tanked

sites

Restructuring of original unitary lease entered into in May 2012

~30 locations are entangled in an ongoing eviction action in CT Superior Appeals

Court Successfully amended lease in August 2013, including an agreement to

remove select properties NECG

Lease

Composed primarily of operating gas stations

Leasing action plan:

~50 properties being re-let to national and regional fuel distributors

Locations will be added to existing leases and Company will enter into new

triple-net leases with regional distributors

Disposition action plan:

~100 properties being sold in a real estate auction

Signed contracts of accepted offers on majority of these locations

Month to

Month

Licenses

Disposition action plan:

Remaining properties being sold in a real estate auction or through regional

brokers Terminals

84

157

5

29 |

Poised to Consolidate Fragmented Industry

7

More

than

150,000

properties

in

the

sector

(1)

Portfolio

dispositions

–

distributors,

MLP’s,

families

Consolidating

sector

–

approximately

60%

of

U.S.

stations

individually

owned

(1)

Debt

maturities

–

conduits,

majors,

banks

Mature, infill locations

Wide variety of formats

Convenience stores, repair bays, quick serve, quick

lube, etc.

Focus on fuel component to drive customer visits /

visibility

Gasoline, Diesel, Ethanol, CNG, LNG, other

Proven ability to source off-market

transactions not seen by others

Ability to integrate and assimilate

multi-unit portfolios

Capacity to operate in a

highly regulated industry

Established track-record of managing

and remediating environmental concerns

Actively seeking portfolio acquisitions through competitively priced and

innovatively structured capital allocation

Target Investments

Broad Market Opportunity

The Getty Competitive Advantage

(1)

Per NACS 2013 Retail Fuels Report. |

Accretive Acquisition of 36 Properties

8

$72.5 million acquisition of 36 properties in May 2013

Financed with debt and proceeds from the Company’s dispositions program (1031

exchanges) Tenants are subsidiaries of Capitol Petroleum Group, LLC, a

long-term tenant with which the Company has had a successful relationship

since 2009 New unitary triple-net leases having initial terms of 15 years

plus three renewal options Located in highly desirable markets

16 Mobil branded stations located in the New York metro area

20 stations (13 Exxon branded and 7 Shell branded) in the Washington, D.C.

Beltway Transaction Highlights

Illustrative Cash Flow Diagram (post-acquisition)

Getty

36 high-volume

properties

Capitol

Sub-lease

payments and

motor fuel sales

Sub-lease property

and supply motor

fuel

Thousands

of customers

Motor fuel, auto

service and

convenience

store

goods

Lease

Lease payments |

At

Positive Inflection Point In Company’s Evolution 9

Purchased 36 properties from Capitol Petroleum Group in May 2013

First portfolio acquisition since 2011

Refocusing efforts on accretive growth opportunities

Settled Lukoil litigation in July 2013

Realized approximately $32 million of initial proceeds from settlement in

August 2013

Additional proceeds may be realized from unsecured claims

Repositioning of Marketing Portfolio mostly complete

Upside remains in transitional properties from cost reductions and

recycling capital into new, high quality assets

Incurred $4.6 million of costs associated with transitional properties for the

first

six

months

of

2013

(1)

Expected reduction in Getty Petroleum Marketing Inc. related bankruptcy

expenses

Incurred

$2.8

million

of

bankruptcy

and

litigation

costs

for

the

first

six

months

of

2013

(1)

Expense reductions and capital inflows from asset sales and Lukoil Settlement provide

capacity for growth while maintaining low leverage

(1) See the Company’s Quarterly Report on Form 10-Q for the quarter ended

June 30, 2013 for additional information. |

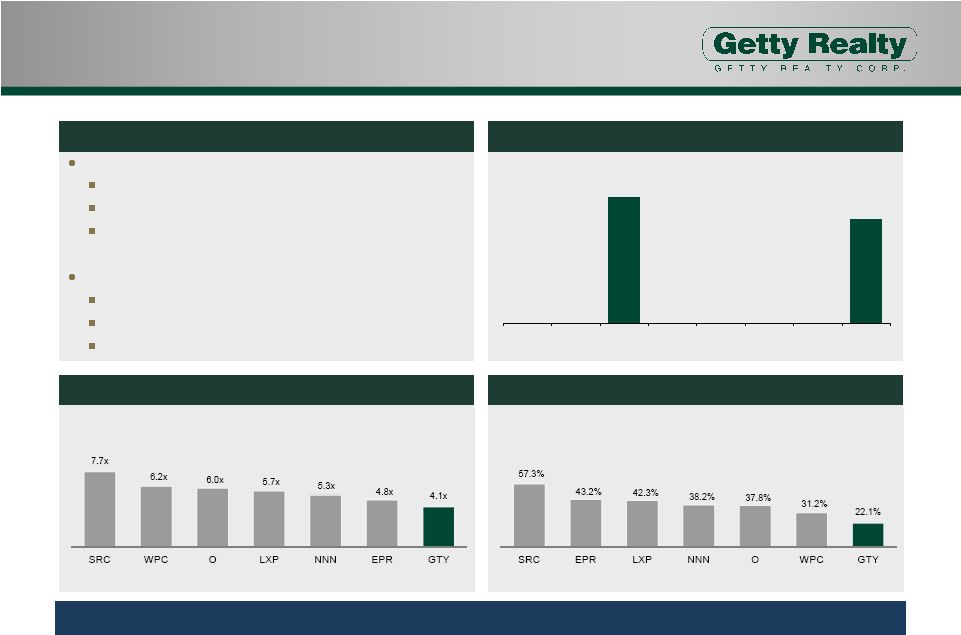

Flexible Balance Sheet with Low Leverage

10

$175 million senior secured credit facility

Matures in 2015 (plus one year option)

L+ 250-300 bps

No amortization requirements

$100 million secured debt private placement

Matures in 2021

Fixed rate: 6%

No amortization requirements

Debt / EBITDA

(2)

Leverage

/

Total

Market

Capitalization

(2)

Debt

Maturity

Schedule

(1)

Debt

Refinancing

in

February

2013

(1)

Low leverage and flexible balance sheet compared to REIT peers

$121

$100

2013

2014

2015

2016

2017

2018

2019

2020+

(1)

See the Company’s Quarterly Report on Form 10-Q for the quarter ended June

30, 2013 for additional information. (2)

Source: Wall Street research report dated 9/9/13.

|

Investment Highlights

11

National portfolio with focus on growing and densely populated,

high barrier to entry markets

Stable cash flows supported by long-term, triple-net leases

Proven platform to pursue growth opportunities in sector with

large consolidation opportunity

At a positive inflection point in the Company’s evolution

Flexible balance sheet with low leverage

Upside opportunities created through rationalization of

transitional properties in existing portfolio

1

2

3

4

5

6 |

APPENDIX |

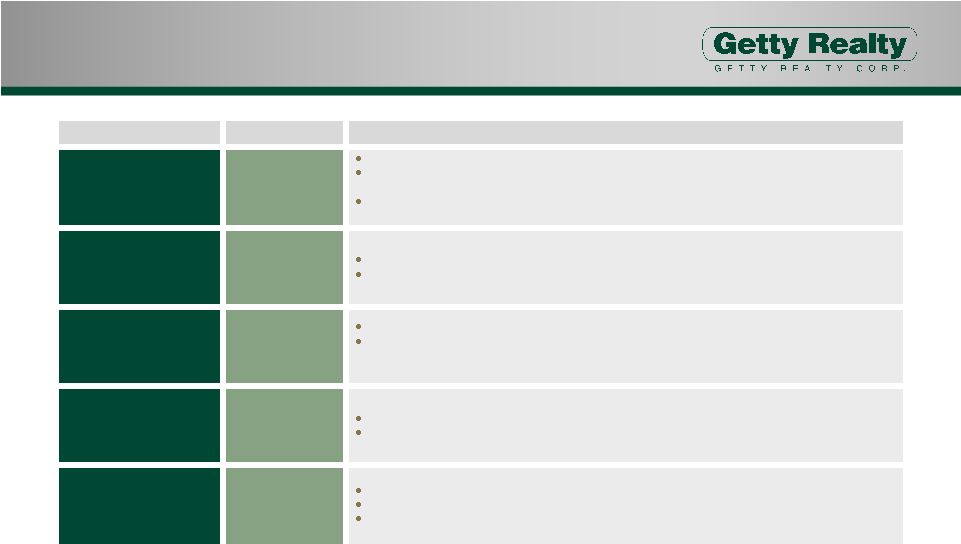

Senior Management

13

Name / Title

Years at Getty

Biography

David Driscoll

Chief Executive Officer,

President, Director

6

President and Chief Executive Officer since 2010

Director of Getty since May 2007 and Lead Independent Director from April 2008

until February 2010

Previously a Managing Director of Morgan Joseph & Co. Inc. and Co-head of

ING Barings Americas Equity Capital Markets and Global Head of Lodging and

Real Estate Kevin Shea

Executive

Vice President

29

Executive Vice President since May 2004 and, prior to that, Vice

President since 2001

Joined in 1984

Thomas Stirnweis

Vice President &

Chief Financial Officer

25

Vice President and Chief Financial Officer since 2003

Previously a Manager of Financial Reporting and Analysis at Getty Petroleum

Marketing, Inc. (“GPMI”)

Joshua Dicker

Senior Vice President,

General Counsel

& Secretary

5

Vice President since February 2009 and General Counsel and Secretary since

2008 Previously a Partner at Arent Fox LLP specializing in corporate and

transactional matters Chris Constant

Vice President, Director of

Planning & Treasurer

3

Vice President since 2013 and Treasurer since 2011

Joined in 2010 as Director of Planning and Corporate Development

Previously Vice President of Morgan Joseph & Co. Inc.; Began career at ING

Barings |

Board of Directors

14

Name / Title

Years at Getty

Biography

Leo Liebowitz

Chairman

58

Chairman of the Board since May 1971 and Chief Executive Officer

from 1985 -

2010

Served as President from May 1971 until May 2004

Co-founded the predecessor business in 1955

Milton Cooper

Executive Chairman,

Kimco Realty Corporation

42

Executive Chairman of Kimco Realty Corporation

Chairman and CEO of Kimco from its IPO in 1991 to 2009 and Director and President

of Kimco prior thereto

Phillip Coviello

Fmr. Partner,

Latham & Watkins, LLP

17

Director of Kimco since 2008

Previously a Partner in Latham & Watkins LLP for 18 years

David Driscoll

Chief Executive Officer,

President, Director

6

President and Chief Executive Officer since 2010

Director of Getty since May 2007 and Lead Independent Director from April 2008

until February 2010

Previously a Managing Director of Morgan Joseph & Co. Inc. and Co-head of

ING Barings Americas Equity Capital Markets and Global Head of Lodging and

Real Estate Richard Montag

Fmr. Director,

FNC Realty Corporation

GPMI

3

Elected to serve as a Director by the current Board (annual meeting on May 20,

2010) Previously Director of FNC Realty Corporation from 2004 until 2005 and

Getty Petroleum Marketing, Inc. from 1997 until 2000

Howard Safenowitz

President,

Safenowitz Family Corp.

15

Lead Independent Director since February 25, 2010

President of Safenowitz Family Corp., an investment firm, since June 1997

Previously a Director of Getty Petroleum Marketing, Inc. from December 1998 until

December 2000 |