Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Real Goods Solar, Inc. | d595124d8k.htm |

Corporate Presentation

September 2013

NASDAQ:

RSOL

SERVING SOLAR SINCE 1978

Exhibit 99.1 |

This

presentation includes forward-looking statements relating to matters that are not

historical facts. Forward-looking statements may be identified by the use of words

such as "expect," "intend," "believe," "will," "should" or

comparable

terminology

or

by

discussions

of

strategy.

While

Real

Goods

Solar believes its assumptions and expectations underlying forward-looking

statements

are

reasonable,

there

can

be

no

assurance

that

actual

results

will not be materially different. Risks and uncertainties that could cause

materially different results include, among others, receiving shareholder

approval for the merger with Mercury Energy, Inc., successfully closing the

merger and other acquisitions, realizing synergies and other benefits from

the merger and other acquisitions, introduction of new products and

services, the possibility of negative economic conditions, and other risks

and uncertainties included in Real Goods Solar’s filings with the Securities

and Exchange Commission. Real Goods Solar assumes no duty to update

any forward-looking statements.

©

2013 Real Goods Solar. All Rights Reserved.

Important Cautions Regarding Forward Looking

Statements

2

SERVING

SOLAR

SINCE

1978

NASDAQ:RSOL |

SERVING

SOLAR

SINCE

1978

Key Stats: RSOL (NASDAQ)

3

Stock

Price

(9/5/2013)

$2.00

52 Week Low-High

$0.40 -

$7.17

Avg. Daily Vol. (3

mo.) 1,974,610

Shares

Outstanding

1

30.2M

Public Float, est.

18.3M

Insider Holdings

~26%

Institutional Holdings

~35%

Market Cap

$60.5M

Enterprise Value

$60.3M

EV/Revenue

(ttm)

0.7x

Net Revenue (ttm)

$90.6M

EPS

(ttm)

$(1.84)

Cash

(mrq)

$6.9M

Total Assets

(mrq)

$29.8M

Total Debt

(mrq)

$6.8M

Total Liabilities

(mrq)

$27.9M

Employees

~385

Data source: S&P Capital IQ

(ttm) –

trailing twelve months as of Jun. 30, 2013

(mrq) –

most recent quarter as of Jun. 30, 2013

1) Shares outstanding as of August 8, 2013

NASDAQ:RSOL |

NASDAQ:RSOL SERVING SOLAR SINCE 1978

Who We Are

Real Goods Solar

is one of the nation’s largest

and pioneering solar energy providers and

first public pure-play

We’ve installed well over 100 MW of solar

systems corresponding to 15,500+ residential,

commercial, government, and utility

installations nationwide

We offer a comprehensive end-to-end

solution for our customers to reduce their

utility costs while also reducing their carbon

footprint

Significant investments and process

improvements in the past 18 months have

created a highly scalable business model with

additional opportunity for margin capture

4 |

Longstanding

Commitment to the Sector and Deep Knowledge of Solar

*Currently

in

13

edition

with

over

500,000

sold.

1978

Real Goods Solar Trading Company opens first store; sold

the first solar panels in retail at over $100/W

1982

First Solar Living Source Book printed*

1986

Launched mail order catalog (95% customers off grid)

1991

Public offering directly to customers

1992

Launched National Tour of solar homes

1996

Opened Solar Living Center

2001

Merged with Gaiam

2003

Launched residential division

2008

IPO

2008 –

2009

Acquired Marin Solar, Carlson Solar, Independent Energy

Systems, Regrid Power

2011

Acquired Alteris –

became a major national residential and

commercial solar company

2012

Mid 2012, new CEO hired to address key challenges post

Alteris and to restore profitability and growth

2013

Company surpassed 15,500 installations corresponding to

well over 100MW of solar energy deployed since inception

August

2013

Completed Acquisition of assets of Syndicated Solar and

announced agreement to acquire Mercury Energy

5

th

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

SERVING SOLAR SINCE 1978

Solar represents an unlimited supply of

renewable energy

Solar has now become an attractive

investment

Not dependent on new construction

Strong state and federal mandates

Equipment costs trending lower while

technology is improving

Solar per kWh cost approaching or at grid

parity in key states (even with decreasing

incentives), as utility rates rise

Broader availability of consumer financing

Solar industry to see investment of $800

billion to

$1.2 trillion

over next decade ¹

Bright Future for Solar Power

Bright Future for Solar Power

6

Strong

Outlook

for

Growth

in

Solar

Power

(U.S., in Giga Watts -

GW)

2

NASDAQ:RSOL

SERVING SOLAR SINCE 1978

1.

Source Enerdata; McKinsey Global Solar Initiative 2. Source: http://www.seia.org/ - U.S. Solar Market Insight:

Year-in-review 2012 Report – Solar Energy Industries Association (SEIA)

and GTM Research |

Utility rates

rising in key Solar states: average cost per kWh up

~63%

to

~$0.13

from

1990

to

2011

High utility rates in key solar States:

average cost per kWh ranging from

$0.12-$0.33 in June 2013

Solar significantly reduces short and

long-term customer utility costs

with ROI as high as 30%+

Price of solar-PV modules expected

to drop 10% annually until 2020

Solar equipment manufacturing

capacity expected to double over

the next 3-5 years

Key Market Drivers: Rising Electric Bills &

Declining Solar-PV Module Prices

1)

Energy

Information

Administration

(EIA),

historical

data

for

CA,

CO,

NJ, NY & VT. Released Oct. 1, 2012. Next update Sept. 2013.

2)

EIA

Electricity Monthly Update, data for CA, MI, NY, DC, MD, NJ, CT,

RI, MA, NH, VT Released Aug. 22, 2013. Next update: Sept. 23, 2013.

3)

McKinsey Report: Solar Power: Darkest before dawn. April 2012.

7

Source: US Energy Information Administration

SERVING SOLAR SINCE 1978

Average Electric Utility

Rates in Key Solar States

Keep Rising….

…While Falling U.S. Solar-PV

Module Prices Makes Solar

More Affordable

$0.13

$2.76

$0.64

$0.08

Q1-09

Q1-10

Q1-11

Q1-12

Q1-13

1

2

3

NASDAQ:RSOL

Source: GTM Research and U.S. Solar Market Insight

3 |

SERVING SOLAR SINCE

1978 NASDAQ:RSOL

June 2013 vs. June 2012:

Cost of Electricity Rising in Key U.S. Solar States

8

Source: Energy Information Administration, Electricity Monthly Update. Released Aug. 22, 2013.

Next update: Sept. 23, 2013. Average electricity

costs across the U.S.

increased 3.2%

to

10.47

cents per kWh

25 States saw

average electricity

costs increase by

more than 3%

-9% -

-3%

-3% -

-1%

1% -

9%

9% -

30%

-1% -

1%

U.S. Electric Industry Percent Change in Average

Cents per kWh, June 2013 vs. June 2012 |

We Offer

Solutions Across Multiple Market Segments 9

More

than

15,500

Installations

Nationwide

–

More

than

100MW

Real Goods Solar

Utility

Commercial

Residential

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

Alteris

Renewables Acquisition of Alteris in Late 2011 Created a Strong

National Player with a Balanced Portfolio

10

SERVING

SOLAR

SINCE

1978

Northeast based

4,000+ installs

25+ MW

Primarily commercial

Very strong presence in

the education sector

Acquisition

successfully integrated

by late 2012

NASDAQ:RSOL |

Marquee

Customers 11

In addition to a strong residential track record, we have successfully provided solar

solutions to many key commercial customers across the country such as…

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

On Track for

Record Top & Bottom Line Growth in 2013

12

($ millions)

1) Guidance issued and only effective on 9/9/2013

Estimated revenue of

$115-120 million for

2013, excluding

Mercury

Pro forma 2013

revenue, with Mercury

of $132-137 million

$115-$120

$132-$137

2012 was a challenging year as

we completed the integration

of Alteris and addressed key

organizational issues

We expect to be EBITDA

positive for the second

half of 2013 and achieve

profitability in Q4

NASDAQ:RSOL

$12.1

$16.8

$18.9

$39.2

$64.3

$77.3

$109.3

$92.9

SERVING SOLAR SINCE 1978 |

We Have Made

Foundational Improvements to the Business in the Past 12 months Setting the Stage for the

Next Leg of Our Journey 13

New management quickly established and drove three corporate-wide priorities

•

Getting back on our historical growth performance and trajectory

•

Investing in project development and sales talent and capabilities

•

We increased commercial backlog by 91% at the end of Q2 2013 compared to the end of Q4

2012 •

Improving cash flow and liquidity

•

Much more disciplined management of working capital

•

Aggressive focus on lead-time reduction from origination to conversion

•

Strengthened

the

balance

sheet

with

net

proceeds

of

$8.4

million

from

private

placement

of equity

securities in June 2013; Q2 2013 ended and we expect Q3 2013 to end with zero drawn against

our $6.5 million line of credit

•

Reducing operating expenses and improving productivity

•

Improved key business processes in sales and operations

•

Eliminated resource redundancies and flattened the management structure

•

On a run-rate basis, we will exit Q3 2013 at $2 million lower opex than Q3 2012 while

having grown the business (over $8 million of annualized opex reduction)

Successfully completed the integration of Alteris and added top-notch management

talent in key areas

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

14

Source: GTM Research and SEIA, Q1 USSMI Report

State

California

6

Colorado

HQ +2

Connecticut

2

Missouri

1

New Jersey

1

New York

1

Rhode Island

1

Vermont

1

1

Total

17

US PV Installations

Office

Locations

Massachusetts

•

17 offices in key solar states

•

Installations in more than 30 states

We Are now Ready to Better Capture the Growth

Runway with a Stronger Foundation and Footprint |

We Offer Our

Customers a Comprehensive End-to-End Solution

15

Benefits of being a full

turnkey solar provider

Real Goods Solar operates as a turnkey solar solution provider in addition to its

extensive ‘EPC’

(Engineering, Procurement and Construction) capabilities.

•

Single point of contact simplifies communication for the

customers

•

Ensures quality and reduces risks

•

Project costs are well-defined and tightly-managed

•

Improved customer experience and confidence

Origination

Engineering

Construction

Operations/

Maintenance

Performance

Site evaluation

Financing

arrangements

•

Contracting

•

Engineering

Specification

•

Custom Design

•

Incentive

Processing

•

Product Selection

•

Permitting

•

Construction

•

Utility

Integration

•

System

Commissioning

•

Site Monitoring

•

Preventative

Maintenance

•

Warranty

Management

•

Customer &

Partner

Integration

•

Production

Guarantee

•

Optimize ROI

•

•

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

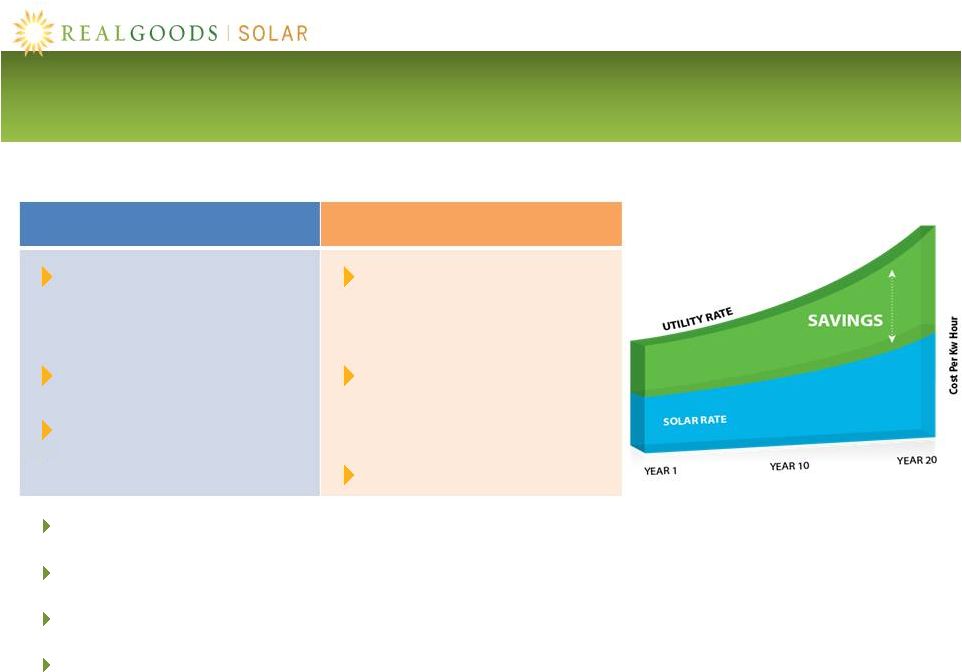

The Economics

are Compelling with Purchase or The Economics are Compelling with Purchase or

Lease of Solar Energy Systems

Lease of Solar Energy Systems

16

Purchase

Lease

Typical Payback in

seven years or less in

many geographies

Minimal risk

No money down

Power Purchase

Agreement

Fixed cost of

electricity for life of

system

Immediate savings

Investment in solar provides a natural hedge against rising energy prices

Monetize solar rebates and tax incentives: 30% Renewable Energy Tax Credit

Customers typically make purchase decisions based on reducing monthly utility bill

Corporate programs to reduce carbon footprint are also emerging as strong enablers

NASDAQ:RSOL

SERVING

SOLAR

SINCE

1978

ROI as good as 20%-30% |

Industry is

still immature and very fragmented

Most players in the

downstream have limited

financial strength and with no

real value creation option

Real Goods Solar has the

platform to pursue highly

selective acquisitions to

strategically accelerate

growth and to increase the

overall depth, breadth, and

performance of the company

In Addition to Organic Growth, Selective Acquisition

will be a Strong Source of Value Creation

17

Real Goods Solar a leading installer

among more than 2,000 nationwide ¹

Source: GTM Research “Five Residential PV Installers to Watch in 2013, U.S. PV

Leaderboard.” 1) Company estimate.

NASDAQ:RSOL

SERVING

SOLAR

SINCE

1978

U.S. Residential Solar Installers 2012

Market Share |

Acquisition of

Syndicated Solar Strengthens Residential Division

18

18

NASDAQ:RSOL

SERVING SOLAR SINCE 1978

Syndicated Solar

Expanded footprint to Missouri and

enhanced presence in Colorado and

California

Added 40+ employees mostly in the

front-end

Rapid growth over past few years

through:

•

Efficient residential sales processes

•

Highly scalable and nimble business

model

•

Integrated software tools

Revenue up 192% from $2.5 million in

2011 to $7.3 million in 2012 |

Mercury Solar

Systems Based in Port Chester, New York, one of the

region’s top solar companies

Adds sales and operational talent and

complementary geographies

Commercial and residential customers across

Northeast, totaling nearly 2,000 solar

installations

•

Installed 50+ MWs of solar projects that

have cumulatively generated $250+ million

in revenues

Signed definitive agreement to acquire

Mercury for 7.9 million shares of consideration

subject to certain customary adjustments

Upon closing, Mercury will add 50+ employees

and ~$10 million of cash and no debt

Expected Mercury Solar Systems Acquisition to Expand

Northeast Commercial & Residential Capabilities

19

3,588kW -

Manalapan, NY

1,288 kW -

Robbinsville, NJ

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

35-year

Track Record: Longer than any other major player

Substantial market Depth and Breadth:

strong residential and commercial

capabilities with deep knowledge of key verticals

Highly

Integrated:

end-to-end

capabilities

all

the

way

from

lead

generation

and

project development to design, construction, commissioning, and O&M

Nationwide

Presence:

able

to

deliver

cost-effective

solar

solutions

to

homeowners

and businesses in multiple states

Low Risk Business Model:

broad geographic spread and diversified client base

(across different segments and geographical markets)

Strong Consumer Brand:

well recognized, opens doors

Opportunity

for

Margin

Expansion:

SG&A

productivity

and

project

finance

Leadership Depth and Talent:

senior team with a proven track record

High Potential for Investor Value Creation:

through organic growth and through

selective acquisitions and against a backdrop of highly undervalued stock compared

to peers

Our Competitive Advantages and Key

Takeaways

20

NASDAQ:RSOL

SERVING

SOLAR

SINCE

1978 |

Contact Us

NASDAQ: RSOL

RealGoodsSolar.com

Real Goods Solar, Inc.

833 West South Boulder Road

Louisville, CO 80027

Tel 303.222.8400

Kam Mofid, CEO

Tony DiPaolo, CFO

Investor Relations

Liolios Group, Inc.

Ron Both

Tel 949.574.3860

RSOL@liolios.com

21

SERVING SOLAR SINCE 1978

NASDAQ:RSOL |

Appendix

22

SERVING SOLAR SINCE 1978

NASDAQ:RSOL |

NASDAQ:RSOL SERVING SOLAR SINCE 1978

Pro Forma Income Statement June 30, 2013

23

June 30, 2013 -

6 months ended

Real Goods Solar

Mercury

Pro Forma Combined

Revenue

37,458

7,677

45,135

Cost of revenue

28,099

5,592

33,691

Gross Profit

9,359

2,085

11,444

Selling and operating

12,317

2,834

14,902

General and administrative

3,579

748

4,327

Total operating expenses

15,896

3,582

19,229

Loss from operations

(6,537)

(1,497)

(7,785)

Interest and other expense

164

5

169

Earnings (loss) before income taxes

(6,701)

(1,502)

(7,954)

Income tax expense (benefit)

-

-

-

Net earnings (loss)

(6,701)

(1,502)

(7,954)

Net earnings (loss) per common share

Basic

(0.25)

(0.23)

Diluted

(0.25)

(0.23)

Weighted-average common shares outstanding

Basic

27,253

35,153

Diluted

27,253

35,153 |

Pro Forma Balance Sheet

June 30, 2013 24

Costs in excess of billings on uncompleted contracts Billings in excess of

costs on uncompleted contracts

Real Goods Solar

Mercury

Pro Forma Combined

Assets

Current assets

Cash and cash equivalents

6,859

11,507

17,416

Accounts receivable , net

10,194

979

11,173

2,749

1,386

4,135

Inventory, net

4,697

1,154

5,851

Other current assets

1,710

1,194

2,904

Total current assets

26,209

16,220

41,479

Property and Equipment

3,596

695

4,291

Goodwill and intangibles, net

-

3,681

9,262

Notes receivable, net

-

160

160

Deferred tax assets

-

4,163

-

Other assets

-

125

125

Total assets

29,805

25,044

55,317

Liabilities and Stockholders' Equity

Current Liabilities

Accounts payable

10,183

3,199

13,382

Accrued liabilities

3,315

1,250

4,565

2,474

479

2,953

Related party debt

3,600

-

3,600

Other current liabilities

776

421

1,197

Total current liabilities

20,348

5,349

25,697

Related party debt

3,150

-

3,150

Common stock warrant liability

3,702

-

3,702

Other liabilities

696

3,676

696

Total liabilities

27,896

9,025

33,245

Stockholders' equity

Common stock

3

22

11

Preferred stock

-

14,219

-

Additional paid in capital

86,870

27,009

107,975

Accumulated deficit

(84,964)

(25,231)

(85,914)

Total stockholders' equity

1,909

16,019

22,072

Total liabilities and stockholders' equity

29,805

25,044

55,317

NASDAQ:RSOL

SERVING SOLAR SINCE 1978 |

SERVING SOLAR SINCE 1978

Additional

Information

About

the

Pending

Acquisition

of

Mercury

Energy,

Inc.

Important Disclosure

25

NASDAQ:RSOL

This communication does not constitute an offer to sell or the solicitation of an offer to buy

any securities or a solicitation of any vote or approval. The transaction described

herein will be submitted to the shareholders of each of Real Goods Solar and Mercury for approval. Real

Goods Solar has filed with the Securities and Exchange Commission a registration statement on

Form S-4 containing a joint proxy statement/prospectus of Real Goods Solar and

Mercury as well as other relevant documents in connection with the transaction.

SHAREHOLDERS ARE URGED TO READ IN THEIR ENTIRETY THE REGISTRATION STATEMENT AND JOINT PROXY

STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SECURITIES AND EXCHANGE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REAL GOODS

SOLAR, MERCURY AND THE PROPOSED TRANSACTION.

A free copy of the registration statement and joint proxy statement/prospectus as well as

other filings containing information about Real Goods Solar and Mercury, may be

obtained at the SEC’s website (www.sec.gov). These documents may also be obtained, free of charge, from

the investor relations section of Real Goods Solar’s website (www.RealGoodsSolar.com) or

by directing a request to 833 W. South Boulder Road, Louisville, Colorado 80027,

Attention: Secretary, Real Goods Solar, Inc., heidi.french@realgoods.com or (303) 222-8430.

Real Goods Solar and its directors and executive officers may be deemed to be participants in

the solicitation of proxies from the shareholders of Real Goods Solar in connection

with the transaction. Information about Real Goods Solar’s directors and executive officers is

set forth in Real Goods Solar’s Amendment No. 1 to Annual Report on Form 10-K/A for

the year ended December 31, 2012, as filed with the Securities and Exchange Commission

on April 30, 2013. Additional information regarding the interests of those participants and other

persons who may be deemed participants in the transaction may be obtained by reading the joint

proxy statement/prospectus regarding the transaction when it becomes available. Free

copies of these documents may be obtained as described above.

This document shall not constitute an offer to sell or the solicitation of an offer to buy or

subscribe for any securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act

of 1933, as amended.

|