Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LORILLARD, LLC | d592193d8k.htm |

1

1

September 3, 2013

Barclays Back-to-School

Consumer Conference

Exhibit 99.1 |

2

2

Chairman, President and Chief

Executive Officer

Murray S. Kessler |

3

Safe Harbor Disclaimer

Safe Harbor Disclaimer

You

are

cautioned

that

certain

statements

made

in

this

presentation

are

“forward-looking”

statements

within

the

meaning

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

include, without limitation, any statement that may project, indicate or imply future

results, events, performance or achievements, and may contain the words

“expect”, “intend”, “plan”, “anticipate”, “estimate”, “believe”, “will be”, “will continue”, “will likely result”, and

similar expressions. In addition, any statement that may be provided by management

concerning future financial performance (including future revenues, earnings or growth

rates), ongoing business strategies or prospects, and possible actions by Lorillard,

Inc. are also forward-looking statements as defined by the Act. Forward-looking

statements are based on current expectations and projections about future events and are inherently

subject to a variety of risks and uncertainties, many of which are beyond the control of

Lorillard, Inc., and could cause actual results to differ materially from those

anticipated or projected. Information describing factors that could cause actual results

to differ materially from those in forward-looking statements is available in

Lorillard, Inc.’s various filings with the Securities and Exchange Commission (“SEC”). These filings are available

from

the

SEC

over

the

Internet

or

on

hard

copy,

and

are,

in

some

cases,

available

from

Lorillard,

Inc.

as

well.

Forward-looking statements speak only as of the time they are made, and Lorillard, Inc.

expressly disclaims any obligation or undertaking to update these statements to reflect

any change in expectations or beliefs or any change in events, conditions or

circumstances on which any forward-looking statement is based. This

forward-looking statements disclaimer is only a brief summary of Lorillard, Inc.’s statutory forward-looking-statements

disclaimer. You are urged to read that disclaimer, which is included in Lorillard

Inc.’s Form 10-K and Form 10-Q filings with the SEC.

|

4

Regulation G Compliance

Regulation G Compliance

You are also reminded that during this presentation, certain non-GAAP financial measures,

such as Adjusted Earnings Per Share may be discussed. These measures should not

be considered an alternative to net income, or any other measure of financial

performance or liquidity presented in accordance

with

generally

accepted

accounting

principles

(GAAP).

These

measures

are

not

necessarily comparable to a similarly titled measure of another company. Please refer

to Appendix A for information that reconciles these measures with the most comparable

GAAP measures. |

5

Lorillard is the #3 Tobacco Company in the USA

Lorillard is the #3 Tobacco Company in the USA

With Very Strong Brands

With Very Strong Brands

Source: Lorillard proprietary retail database (“EXCEL”). As of full year

ended 12/31/2012. •

The

#2

U.S.

Cigarette

Brand

-

Newport

®

•

The

#1

U.S.

Menthol

Brand

-

Newport

•

The

#1

U.S.

electronic

cigarette

–

blu

eCigs

® |

6

In Cigarettes, Lorillard has Gained Market Share

In Cigarettes, Lorillard has Gained Market Share

For Eleven Consecutive Years

For Eleven Consecutive Years

Lorillard Retail Market Share of U.S. Cigarettes

Lorillard Retail Market Share of U.S. Cigarettes

Source: MSA, Inc. Excel retail database.

Source: MSA, Inc. Excel retail database. |

Driving a

Consistent Track Record of Superior Financial Results Driving a Consistent Track Record of

Superior Financial Results * Adjusted results. See Appendix A

for further discussion of adjustments. Source: Company filings.

7 |

8

Allowing The Company to Return Significant Cash to Shareholders

Allowing The Company to Return Significant Cash to Shareholders

+79%

Annualized Dividend Per Share

$713

$2,254

$3,615

$5,925

$7,310

Cumulative Cash Returned

In millions

More than $8 Billion Cash Returned to Investors Since Going Public

Source: Lorillard filings. Since Lorillard spin-off completed in June

2008. Dividend data adjusted to reflect 3-for-1 stock split effected January 15, 2013. |

9

And Ultimately Contributing To Significant Increases In

And Ultimately Contributing To Significant Increases In

Shareholder Value

Shareholder Value

2011

2012

Source: Bloomberg. As of August 27, 2013

Source: Bloomberg. As of August 27, 2013

Stock Price

P/E Ratio

Enterprise

Value (B)

12.1

$11.8

$27

P/E Ratio

Enterprise

Value (B)

14.5

$18.1

Stock Price

$43

2013

More than $6 billion of value creation since 12/31/2010 |

10

The First Half of 2013 Has Been a Continuation of

The First Half of 2013 Has Been a Continuation of

Lorillard’s Industry-Leading Fundamentals

Lorillard’s Industry-Leading Fundamentals

Lorillard YTD 2013 performance through June 30 versus year ago

* Adjusted results. See Appendix A for further discussion of

adjustments. Source: Company filings. Operating

Income*

E.P.S.*

6.4%

9.0%

12.2%

0%

2%

4%

6%

8%

10%

12%

14%

YTD 2013 Change

Net Sales

(ex-FET) |

Pursuit of

Lorillard’s Strategic Vision Should Allow The Company to Continue Delivering Superior

Results Protect &

Grow The

Core

“To Responsibly Bring Newport Pleasure To All Adult Smokers”

* Double-digit shareholder return as measured by EPS growth and the dividend

yield. With a Goal of Consistently Delivering a Double-Digit

Shareholder Return* Over the Long-Term

11

Build Out

Processes and

Capabilities

Carefully

Pursue

Close-in

Adjacencies |

12

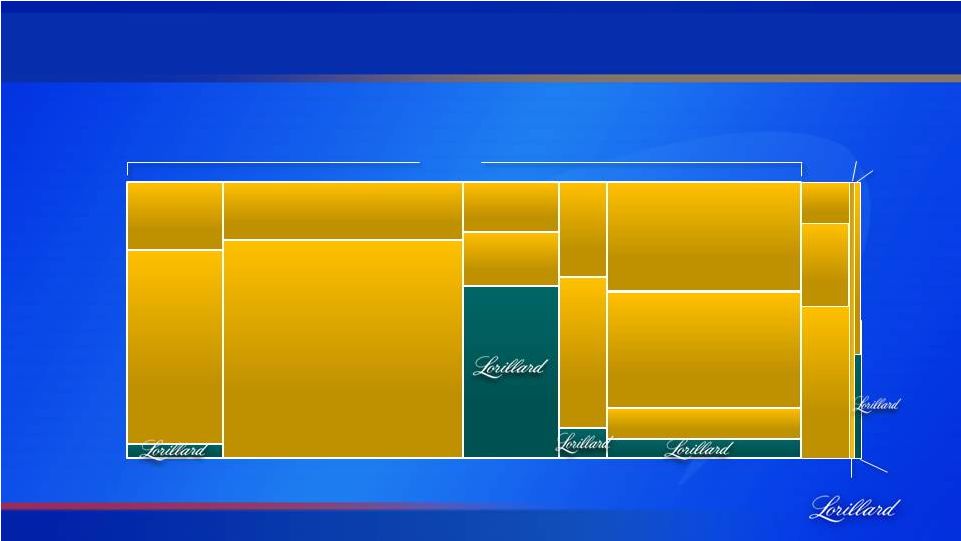

As The Company Uniquely has Numerous Close-In “White Space”

Growth Opportunities it is Pursuing, While Protecting its Core Franchise

2012 U.S. Tobacco Market Segmentation

100%

80%

60%

40%

20%

0%

NFF

Menthol

Discount

MST

0.2 %

8.8 %

90.5 %

15.1 B Packs/Cans

RJR

Altria

Altria

RJR

RJR

Altria

All Others

RJR

Altria

RJR

Altria

Others

RJR

Altria

0.5 %

Snus

Source: MSA, Inc. Excel retail database.

Non-Full Flavor Non-Menthol

Full-Flavor

Menthol

e-Cigs

Full-Flavor

Non-Menthol |

13

1.

Profitably maintain a stable Newport Full-Flavor franchise in the core through a

disciplined and focused approach

2.

Offset cigarette industry declines through close-in adjacency expansion

–

Geographic expansion of Newport promotions west of the Mississippi River

–

Product expansion into Non-Menthol (Red & Gold)

3.

Establish Lorillard as “first and best”

with blu eCigs in electronic cigarettes

4.

Defend Lorillard’s freedom to operate –

hold regulators to science-based decisions

5.

Continue to reward shareholders with superior returns

Accordingly, Lorillard’s Strategic Priorities Are as Follows:

Accordingly, Lorillard’s Strategic Priorities Are as Follows: |

14

FF Menthol

Rest of Industry

Stability of Newport Full-Flavor Menthol in the Core is Job #1

Premium Full-Flavor Menthol, Core States

Premium Full-Flavor Menthol, Core States

Newport

Newport

All Other

All Other

Newport

All Other

Newport

All Other

74%

74%

73%

74%

Newport Share of

Premium Full-Flavor

Menthol Core States

5 Year CAGRs

2007 -

2012

-1.2%

-5.0%

Source: MSA, Inc. Excel retail database. Year-to-date 2013 as of August 17,

2013. 0%

20%

40%

60%

80%

100%

2010

2011

2012

2013 YTD |

15

Advertising

Advertising

Achieved Through Strong Brand-Building

Achieved Through Strong Brand-Building

Brand-Building Initiatives

Brand-Building Initiatives

Product

Product

Merchandising

Merchandising

•

Consistent 40-year

campaign

•

Distinctive & recognizable

•

Proven messaging

•

Iconic brand

•

Consumer preferred

•

Unique taste profile

•

32,000 new retail plans

•

New product visibility

•

Best relationships in

industry

61% Net Promoter Score |

16

Percentage of 2013 Menthol Volume Sold at Full Price*

Percentage of 2013 Menthol Volume Sold at Full Price*

* Source: MSA, Inc. Excel retail database, year-to-date through

8/17/2013. Full price is defined as within 50 cents per pack of the most

common retail price of the mainline brand. And Achieved Without Heavy Use of

Discounting And Achieved Without Heavy Use of Discounting |

17

1.

Profitably maintain a stable Newport Full-Flavor franchise in the core through a

disciplined and focused approach

2.

Offset cigarette industry declines through close-in adjacency expansion

–

Geographic expansion of Newport promotions west of the Mississippi River

–

Product expansion into Non-Menthol (Red & Gold)

3.

Establish Lorillard as “first and best”

with blu eCigs in electronic cigarettes

4.

Defend Lorillard’s freedom to operate –

hold regulators to science-based decisions

5.

Continue to reward shareholders with superior returns

Lorillard’s Strategic Priorities

Lorillard’s Strategic Priorities |

18

Results from geographic expansion strategy in the non-core

Newport

Total

Lorillard

Source: MSA, Inc. Excel retail database. Pre-period is 2009 change and

Post-period is 2012 change. Geographic Expansion of Promotions and Product Line

Geographic Expansion of Promotions and Product Line

Have Been Successful

Have Been Successful

-4.9%

5.5%

Volume Trends

4.3%

5.0%

Market Share

5.5%

7.3%

Pre

Post

-1.1%

18.6%

Pre

Post |

19

Source: MSA, Inc. Excel retail database.

As Has Lorillard’s Entry into Non-Menthol, First with

As Has Lorillard’s Entry into Non-Menthol, First with

Newport Red

Newport Red

Premium Non-Menthol Full Flavor

Premium Non-Menthol Full Flavor

Units by Brand

Units by Brand

•

0.9% retail market share

•

2.2 billion units in 2012

•

Pricing up more than 35%

since launch |

20

Non-Menthol Gold Represents an Even Bigger Opportunity

Non-Menthol Gold Represents an Even Bigger Opportunity

Sources: MSA, Inc. Excel Retail Database ; Newport 80mm Box Gold

Non-Menthol Product Test, January 2011; Newport Non-Menthol Gold Online

Packaging Test, August 2011; •

Recently authorized by FDA

•

Consumer-preferred taste

•

Consumer-preferred packaging

•

Priced in-line with Newport Red

Premium Non-Menthol Non-Full Flavor

Premium Non-Menthol Non-Full Flavor

Units by Brand

Units by Brand |

Shipments

Expected to Commence on October 4, 2013 21 |

1.

Profitably maintain a stable Newport Full-Flavor franchise in the core through a

disciplined and focused approach

2.

Offset cigarette industry declines through close-in adjacency expansion

–

Geographic expansion of Newport promotions west of the Mississippi River

–

Product expansion into Non-Menthol (Red & Gold)

3.

Establish Lorillard as “first and best”

with blu eCigs in electronic cigarettes

4.

Defend Lorillard’s freedom to operate –

hold regulators to science-based decisions

5.

Continue to reward shareholders with superior returns

Lorillard’s Strategic Priorities

22 |

•

Category estimated at $1 billion

with 100% annual market growth

•

Awareness = ~100%

•

Trial = 43%

•

Repeat Usage = 26%

•

~1% impact on cigarettes

•

Gives Lorillard a major seat in the

harm reduction debate

Lorillard’s Acquisition of blu eCigs Gives the Company

A Head-Start in an Emerging New Category

Sources: Wells Fargo/Nielsen estimates, research note dated 7/26/2013;

Lorillard Adult Tobacco User Survey; May 2013 (n=523)

23 |

•

National retail roll-out –

110,000+ outlets currently

•

National TV and print

advertising campaign ($40

MM 2013 marketing spend)

•

Product enhancements &

quality controls

•

Increased manufacturing

capacity & inventory

Lorillard Has Been Focused on Being First and Best

24 |

Brand-Building is the Top Priority

Stephen Dorff

Jenny McCarthy

25 |

26

Old Pack

New Pack

MSRP

$59.99

$34.99

Size

Cigarette pack

Slim as a smart phone

Battery

Pack charge indicator

Pack & cig charge indicator

Retailer margin

~20%

~30%

Lorillard Believes that Rechargeables are the Key to Long-Term

Profitability and Achieving Margins Comparable to Cigarettes |

Source:

MSA, Inc. Excel retail database for electronic cigarettes, as of July 31, 2013. * blu eCigs internal estimates.

~10% Market Share*

~12,000 Retail

Outlets

Quarterly blu eCigs Retail Market Share

40%+ Market Share

~110,000 Retail

Outlets

Through These Efforts, blu eCigs has Emerged as

The #1 e-Cig Company

50%

40%

30%

20%

10%

0%

Q2 2012

Q3 2012

Q4 2012

YTD 2013

44%

34%

15%

*

10%

*

EPS Accretive in Year 1

27 |

28

1.

Profitably maintain a stable Newport Full-Flavor franchise in the core through a

disciplined and focused approach

2.

Offset cigarette industry declines through close-in adjacency expansion

–

Geographic expansion of Newport promotions west of the Mississippi River

–

Product expansion into Non-Menthol (Red & Gold)

3.

Establish Lorillard as “first and best”

with blu eCigs in electronic cigarettes

4.

Defend Lorillard’s freedom to operate –

hold regulators to science-based decisions

5.

Continue to reward shareholders with superior returns

Lorillard’s Strategic Priorities |

•

FDA’s PSE is Fundamentally Flawed

–

Lack of transparency in FDA’s selection and weighting of studies

–

FDA’s conclusions often based on strained interpretations of data

not supported by suitable evidence

–

FDA

inappropriately

uses

“association”

instead

of

causation

–

FDA appears to ignore the most critical peer review comments

–

FDA relies upon unpublished and non-peer reviewed studies

Scientific evidence does not

support a finding that

a product standard related to menthol would be

“appropriate for public health”

Lorillard’s Position on Menthol is Based on Science

29 |

Lorillard Agrees

with Comments from the CTP Director “As a regulatory agency, we can only go as far

as the regulatory science will take us.”

“The bottom line is we need more information.”

Mitch Zeller, Director, FDA Center for Tobacco Products

-

New York Times, July 23, 2013

30 |

•

60-Day comment period runs through September 23, 2013

•

Lorillard will submit its review of the menthol science

•

There is no deadline or timeline for FDA to determine what

regulatory actions, if any, are appropriate

•

FDA-NIH funded PATH Studies may provide additional information

on menthol over the next several years

•

We continue to believe that FDA’s evaluation of menthol in

cigarettes will be a very long process

•

Lorillard is fully prepared to respond to any FDA action on

menthol

FDA’s Menthol Evaluation Going Forward

Lorillard Intends to Hold Regulators to a Science-Based Decision

31 |

32

1.

Profitably maintain a stable Newport Full-Flavor franchise in the core through a

disciplined and focused approach

2.

Offset cigarette industry declines through close-in adjacency expansion

–

Geographic expansion of Newport promotions west of the Mississippi River

–

Product expansion into Non-Menthol (Red & Gold)

3.

Establish Lorillard as “first and best”

with blu eCigs in electronic cigarettes

4.

Defend Lorillard’s freedom to operate –

hold regulators to science-based decisions

5.

Continue to reward shareholders with superior returns

Lorillard’s Strategic Priorities |

Industry

Leading

Fundamentals

Lean

Cost

Structure

Focus on

Returning

Cash to

Shareholders

Consistent Delivery of a Double Digit

Total Shareholder Return* Over the Long-Term

Lorillard Formula for Success is Unchanged

* Double-digit shareholder return as measured by EPS growth and the dividend

yield. 33 |

2010

2011

2012

2013-

1H

Leverage

1.0 X

1.3X

1.6 X

1.8 X

Long-Term Debt

$1.77 B

$2.60 B

$3.11 B

$3.57 B

Shares Repurchased (millions)

27.0

46.7

14.8

7.7

Dividend Payout

63%

66%

73%

nm

Weighted Average Interest Rate on Debt

6.2%

5.7%

5.2%

5.0%

*

See Appendix A for further discussion of leverage.

Continually Improving Capital Structure

34 |

Consistently

Rewarding Shareholders with Superior Returns 35

Source: Bloomberg. From Carolina Group IPO on 1/31/2002 through 8/27/2013.

|

36

1.

Delivering superior results over the long-term

2.

Core cigarette business still has running room

3.

e-Cigarettes are a significant growth opportunity

4.

Lorillard believes that science does not support

disproportionate regulation of menthol cigarettes

5.

As always, the Company is focused on rewarding shareholders

Summary

Summary |

Questions

Questions

Murray S. Kessler

Murray S. Kessler

Chairman, President and Chief Executive Officer

Chairman, President and Chief Executive Officer

David H. Taylor

David H. Taylor

Executive Vice President and Chief Financial Officer

37 |

38

Appendix A

Appendix A

Regulation G Reconciliations

Regulation G Reconciliations

Year ended December 31, 2011

Operating

Income

Diluted EPS

E-Cigarette Segment

Operating Income

Reported (GAAP) results

$1,892

$2.66

N/A

GAAP results include the following:

1)

Impact of RAI mark-to-market adjustments on Lorillard’s

tobacco settlement expense included in cost of

sales (25)

(0.03)

N/A

Adjusted (Non-GAAP) results

$1,867

$2.63

N/A

Year ended December 31, 2012

Operating

Income

Diluted EPS

E-Cigarette Segment

Operating Income

Reported (GAAP) results

$1,878

$2.81

$1

GAAP results include the following:

1)

Impact of RAI mark-to-market pension accounting adjustments on

Lorillard’s tobacco settlement expense included in cost of sales

(8)

(0.01)

-

2)

Impact of RJRT adjustments to its 2001-2005 operating income and

restructuring charges on Lorillard’s tobacco settlement expense

included in cost of sales

7

0.01

3)

Expenses incurred in conjunction with the acquisition of blu eCigs

6

0.01

1

Adjusted (Non-GAAP) results

$1,883

$2.82

$2

Reconciliation

of

Reported

(GAAP)

to

Adjusted

(Non-GAAP)

Results

(Amounts in millions, except per share data) (Unaudited) |

39

Appendix A (cont.)

Appendix A (cont.)

Regulation G Reconciliations

Regulation G Reconciliations

Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results

(Amounts in millions, except per share data) (Unaudited)

Six Months Ended June 30, 2013

Operating

Income

Diluted

EPS

E-Cigarette

Segment

Operating

Income

Reported (GAAP) results

$1.101

$1.69

$9

GAAP results include the following:

1)

Favorable impact of the reduction in Lorillard's MSA

payment s as a result of the settlement to resolve certain

MSA payment disputes approved by the arbitration panel

in March 2013 included as an offset to tobacco

settlement expense in cost of sales

(154)

(0.25)

-

1)

Estimated costs to comply with or otherwise resolve the

U.S. Government Case judgment included in selling,

general and administrative expenses

20

0.03

-

Adjusted (Non-GAAP) results

$967

$1.47

$9 |

40

Appendix A (cont.)

Appendix A (cont.)

Regulation G Reconciliations

Regulation G Reconciliations

Leverage Ratios

Leverage Ratios

2010

2011

2012

2013 -

Q1

2013 -

Q2

Adjusted operating income

$1,725

$1,867

$1,883

$1,883

(1)

$1,883

(1)

Depreciation and amortization

35

37

39

39

39

Earnings before interest, taxes, depreciation and

amortization (B)

$1,760

$1,904

$1,922

$1,922

$1,922

Long-term debt

$1,769

$2,595

$3,111

$3,101

$3,571

Fair value of interest rate swap

(69)

(95)

(111)

(101)

(71)

Long-term debt, net of fair value of interest rate swap (A)

$1,700

$2,500

$3,000

$3,000

$3,500

Leverage (A/B)

1.0

1.3

1.6

1.6

1.8

(1) Estimated based on 2012 Adjusted operating income.

|

41

|